Supreme Info About Cash Flow Indirect Method Example

For instance, assume that sales are stated at $100,000 on an accrual basis.

Cash flow indirect method example. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Under the accrual method of accounting, revenue is recognized when earned, not necessarily when cash is received. In the direct method, on the other hand, the cash flow is calculated directly from the individual cash flows.

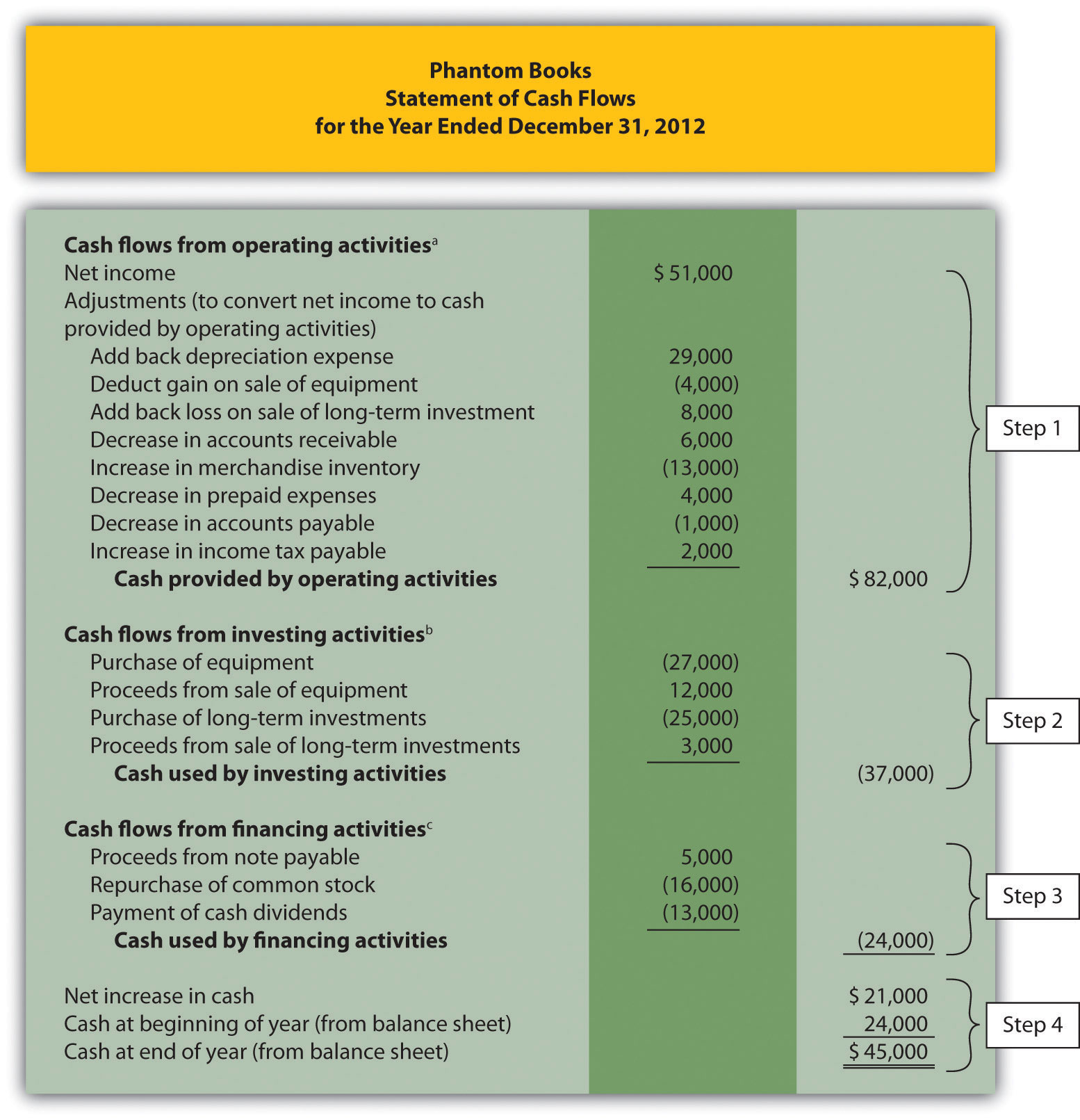

Below is an example of an indirect method cash flow statement. Definitions and examples evans kimatu updated march 10, 2023 businesses monitor various metrics when reporting financial statements and tracking how much money they spend and earn. Normally, two methods are used to prepare statement cash flows.

If a customer buys a $500 widget on credit,. Begin with net income from the income statement. Cash flows from operating activities.

Cash flows from investing activities sale of property: In the presentation format, cash flows are divided into the following general classifications: It might be helpful to look at an example of what the indirect method actually looks like.

Add back noncash expenses, such as depreciation, amortization, and depletion. Definitions and examples direct vs. Cash flows from operating activities.

The statement of cash flows is prepared by following these steps: You are required to prepare indirect method cash flow statement. A cash flow statement contains three sections;

Investment income ( 500) interest expense. To understand how to calculate the cash flow from operations using the indirect method, you need to first be aware of all the inputs used to calculate it. News career development direct vs.

The direct method converts each item on the income statement to a cash basis. The format of the indirect method appears in the following example. The american institute of certified public accountants reports that approximately 98% of all companies choose the indirect method of cash flows.

Increase/(decrease) cash flows from operations net income: Example and preparation. As you can see, the operating section always lists net income first followed by the adjustments for expenses, gains, losses, asset accounts, and liability accounts respectively.

The following example shows the format of the cash flows from operating activities section of cash flows statement prepared using indirect method: There are two ways to prepare the cash flow statements. Example of the indirect method.