Real Info About Unearned Revenue Cash Flow Statement

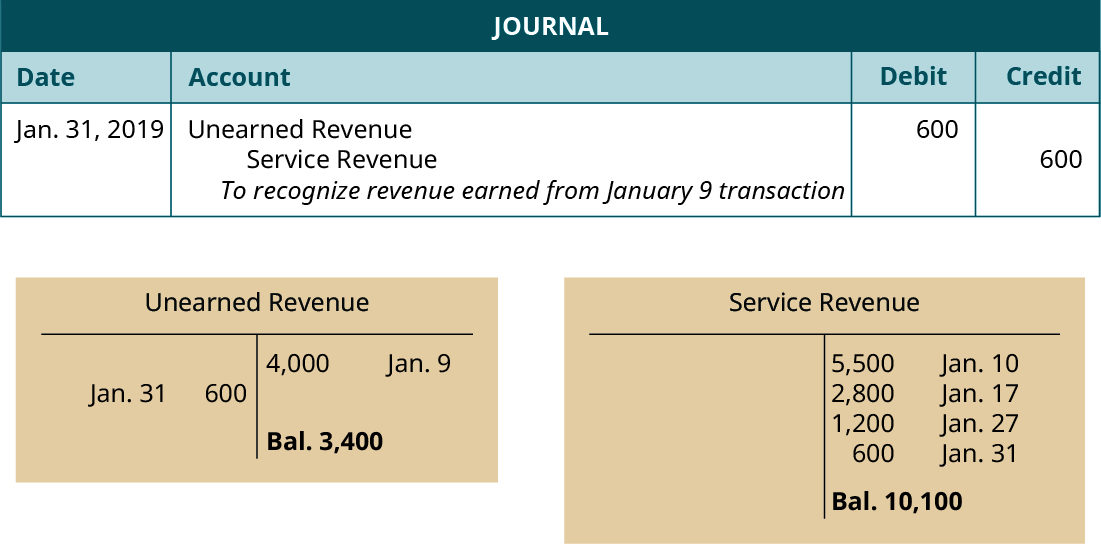

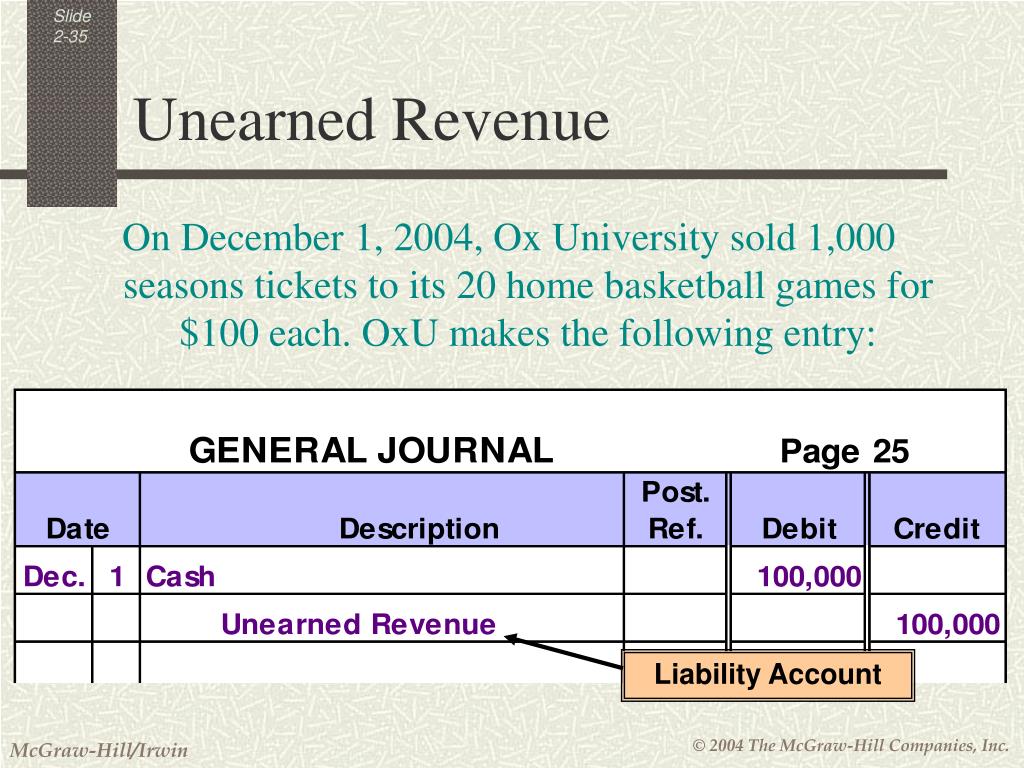

When your company receives a customer deposit or prepayment on a sale, that payment occurs in advance of the actual sale and is therefore considered unearned.

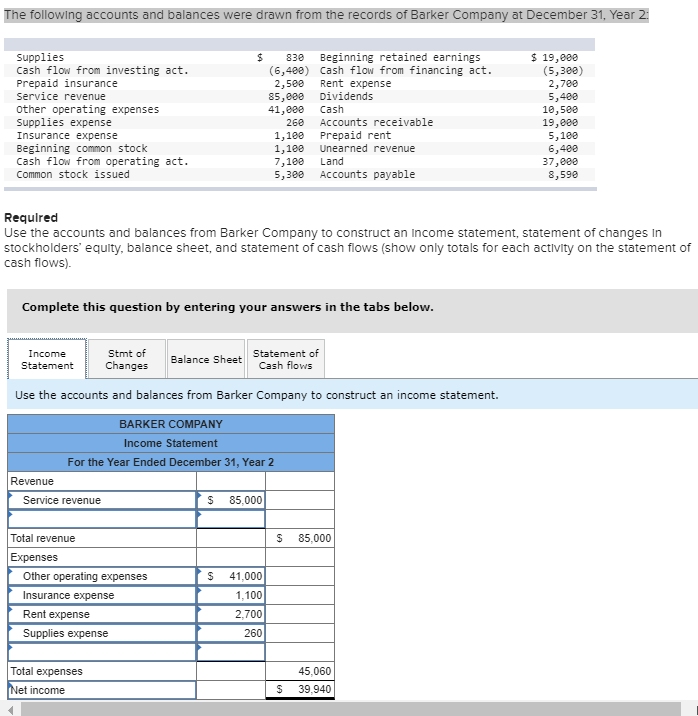

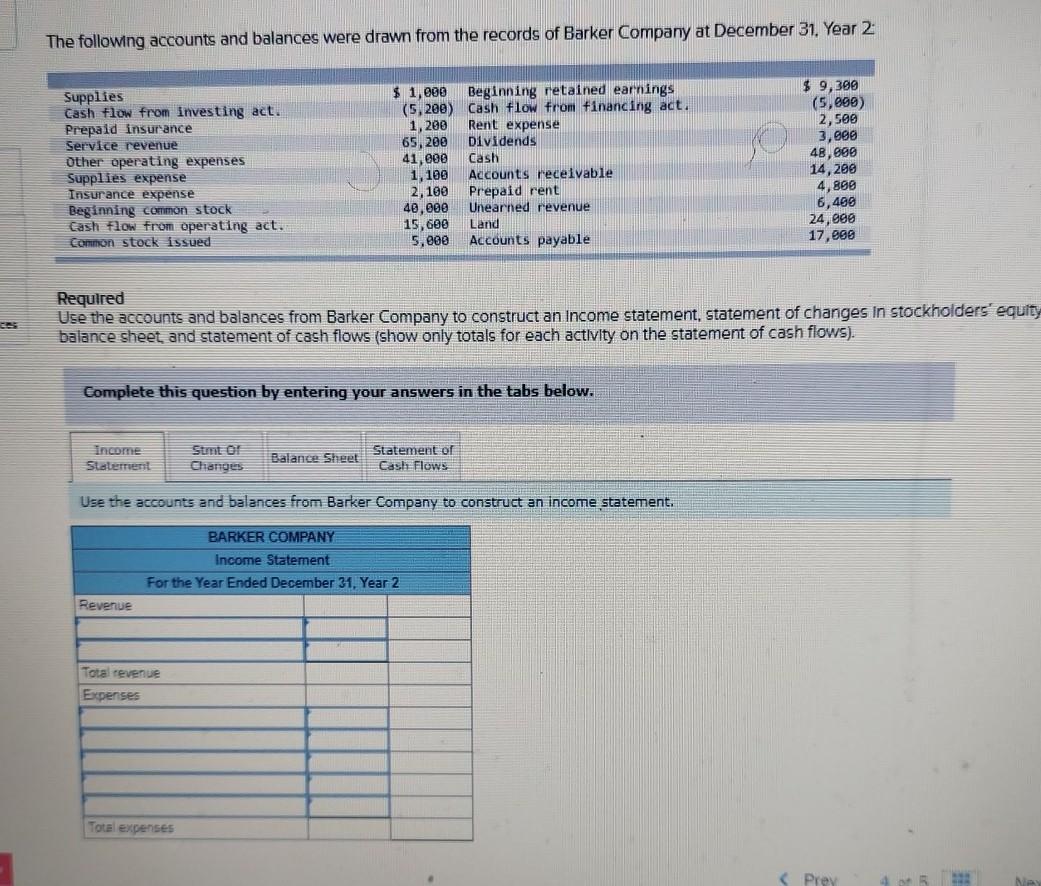

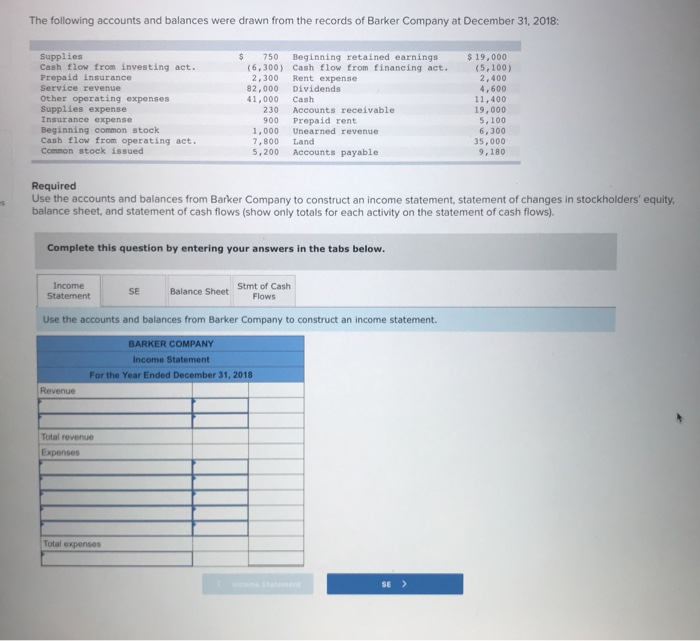

Unearned revenue cash flow statement. You can easily show this by recording unearned. Revenue is the money a company earns from the sale of its products and. An increase in unearned revenue increases the cash flow whereas a decrease in unearned revenue decreases the cash flow.

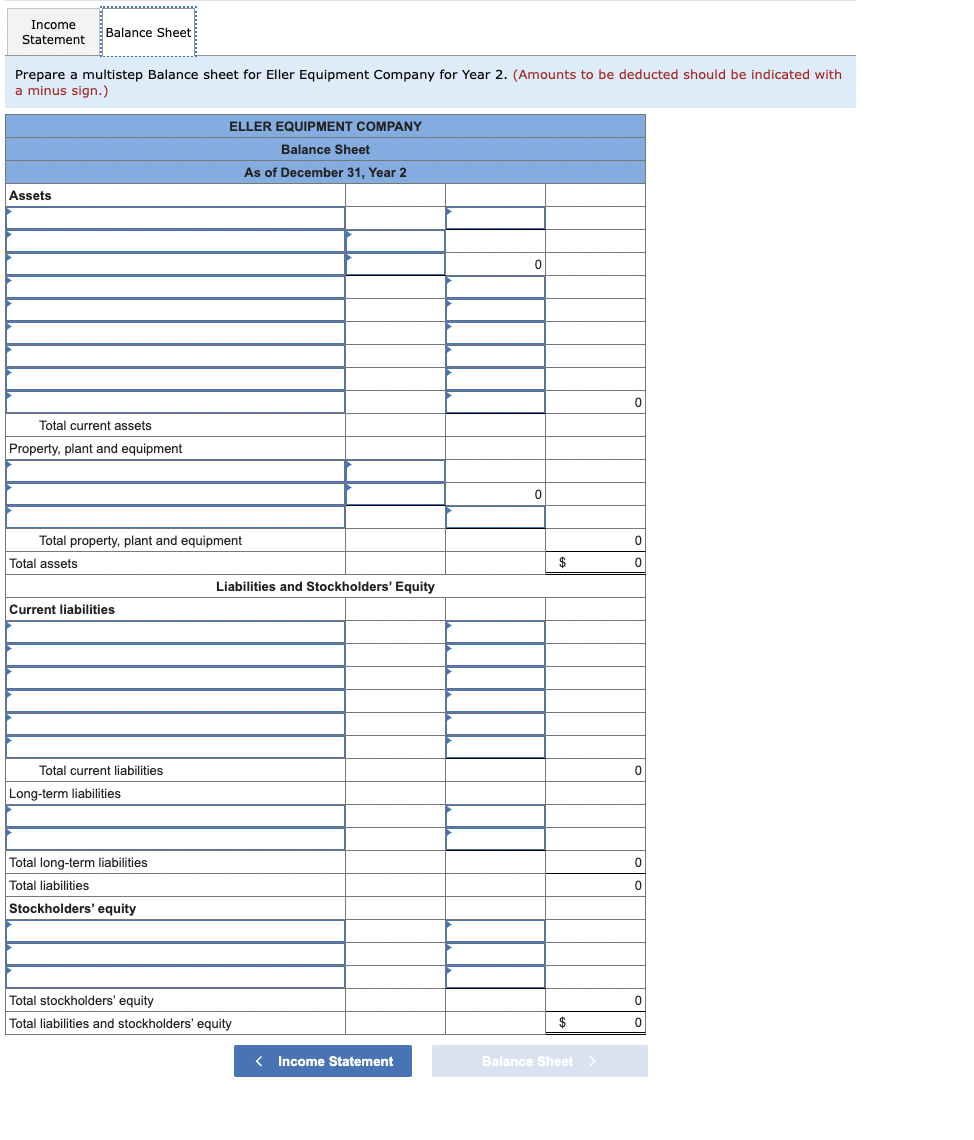

By understanding your collection probability, you can provide investors and board members with financial data that isn’t misleading. Updated may 23, 2021 reviewed by margaret james how are cash flow and revenue different? Balance sheet unearned revenue shows up in two places on the balance sheet.

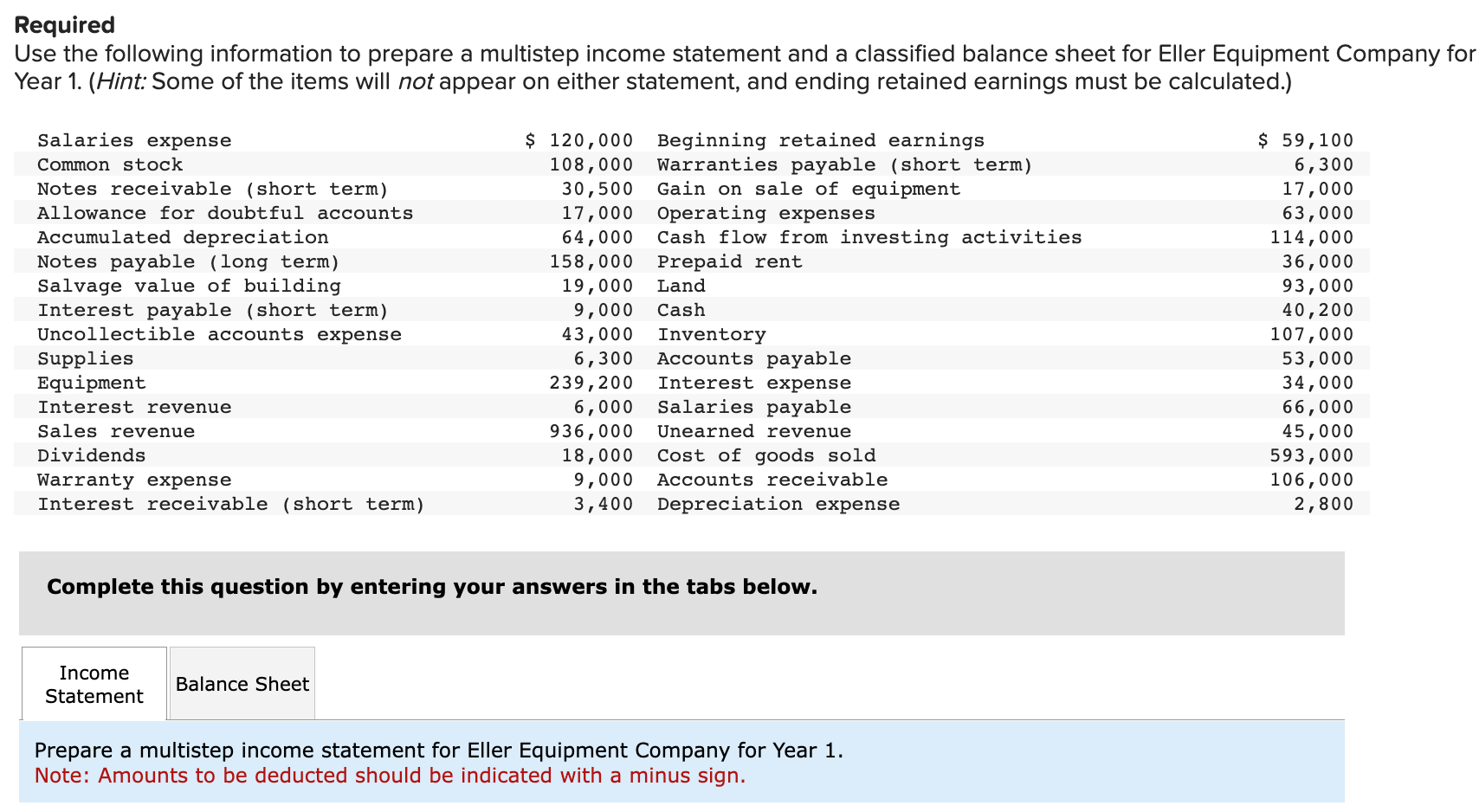

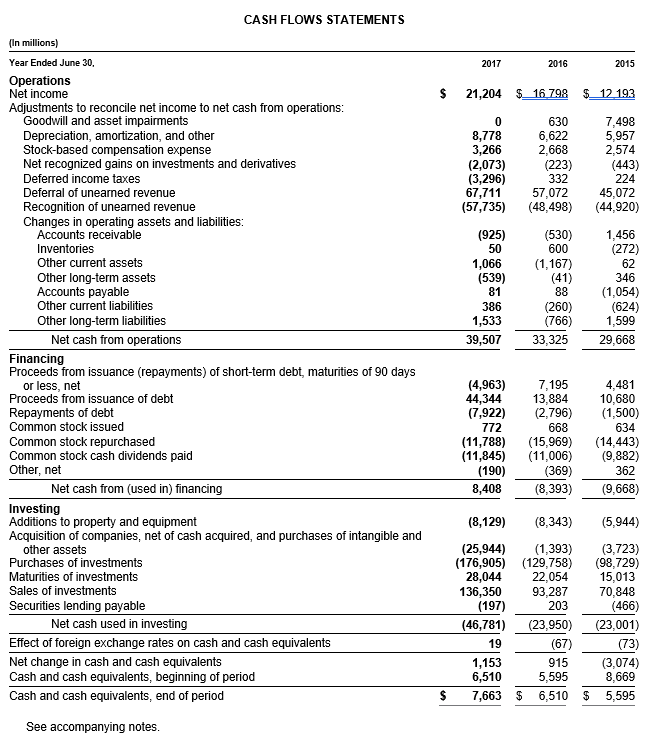

Effect of unearned revenue on statement of cash flow: The statement of cash flows can be prepared using two methods: Both methods organize cash flows into three activities:

It can help a company pay for its operations without relying solely on capital. The unearned revenue of services is when the money is paid, but the service is not performed yet. Many might think that unearned revenue would complicate the process of preparing the cash flow statement, since the money is in the bank, obviously affecting “cash flow,”.

This is because the revenue received ends up on the income. Usually, this unearned revenue on the balance sheet balance sheeta balance sheet is one of the financial statements of a company that presents the shareholders' equity,. First, since you have received.

What you need to know ☰ how cube works sync data, gain insights, and analyze business performance right in excel, google sheets, or the cube. Unearned revenue refers to the compensation or payment received by an individual or an organization for products or services that are yet to be. Effects of unearned revenue on statement of cash flow.

Unearned revenue on financial statements 1. As we discussed above, unearned revenue is an advance payment received. How is deferred revenue reflected on the cash flow statement?

Several types of businesses use unearned revenue to increase their cash flow. The direct method and the indirect method. 6 rows as the unearned revenue is the current liability, the impact on cash flow statement is the.

As already mentioned, unearned revenue results in an influx of cash flow as it is essentially an advanced payment.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)