Outrageous Info About Manufacturing Account Income Statement Format

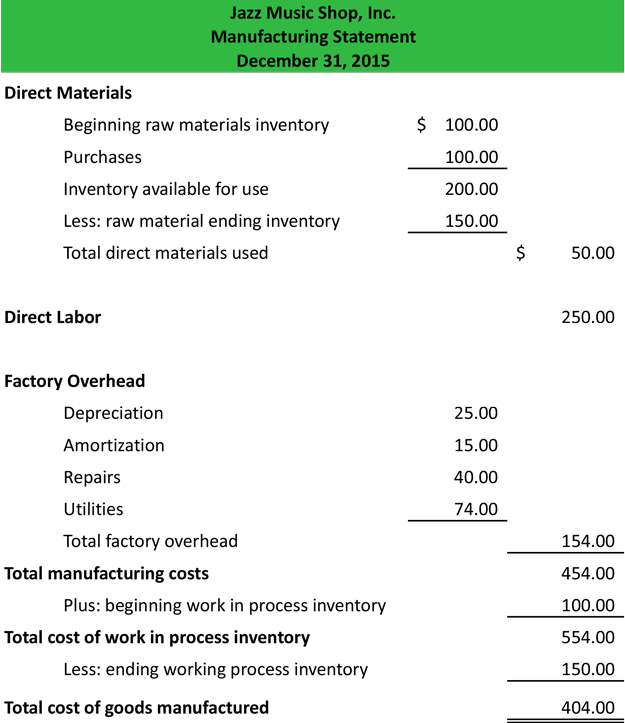

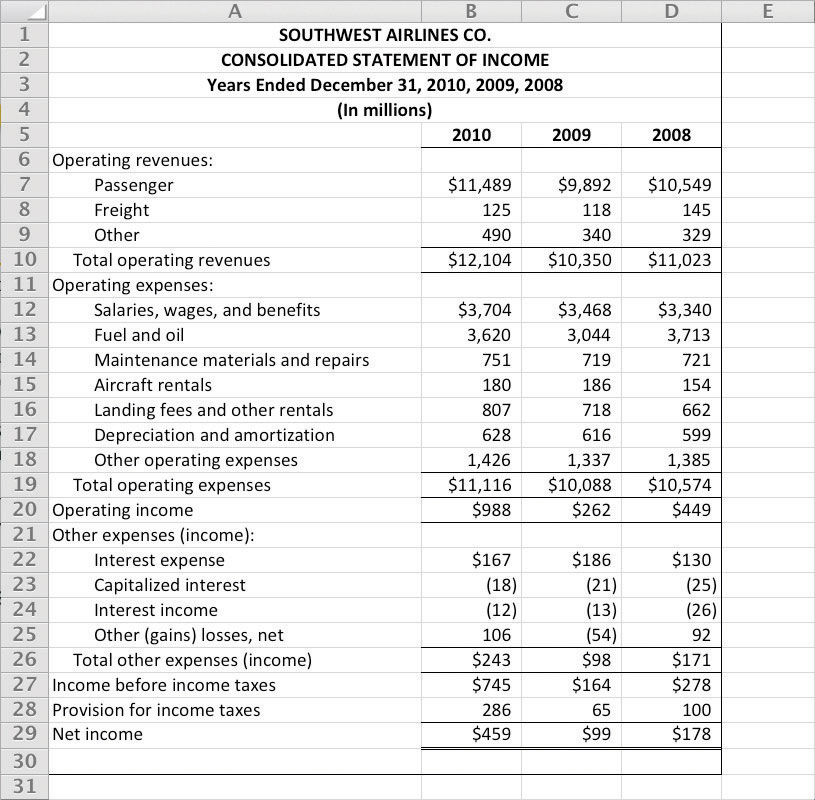

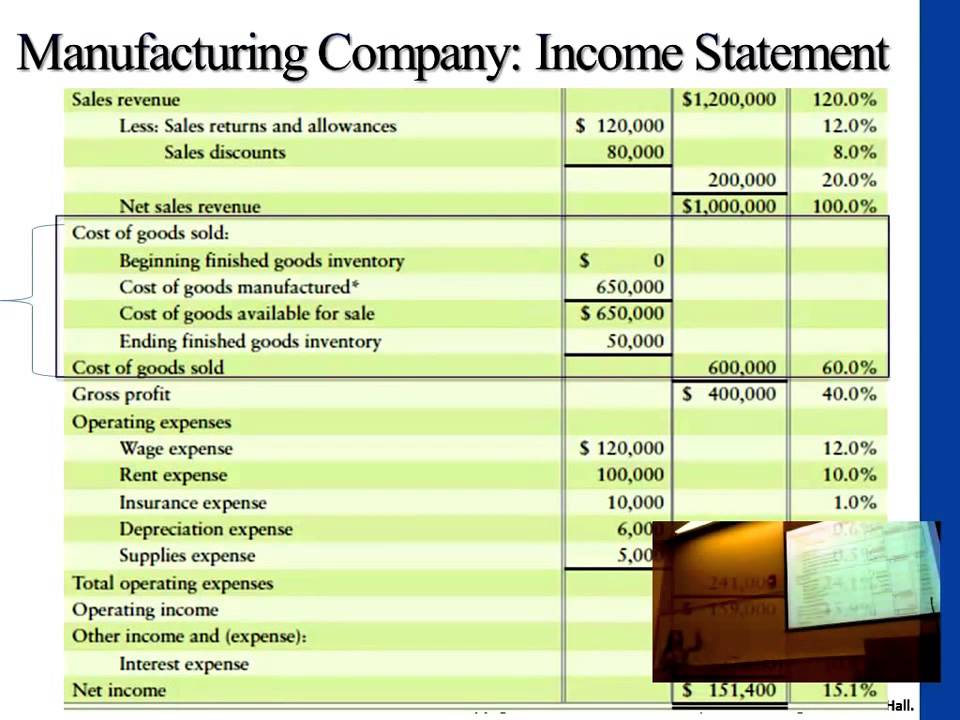

Once you have completed these calculations, the income statement for a manufacturing company is exactly the same at the income statement for a merchandising company.

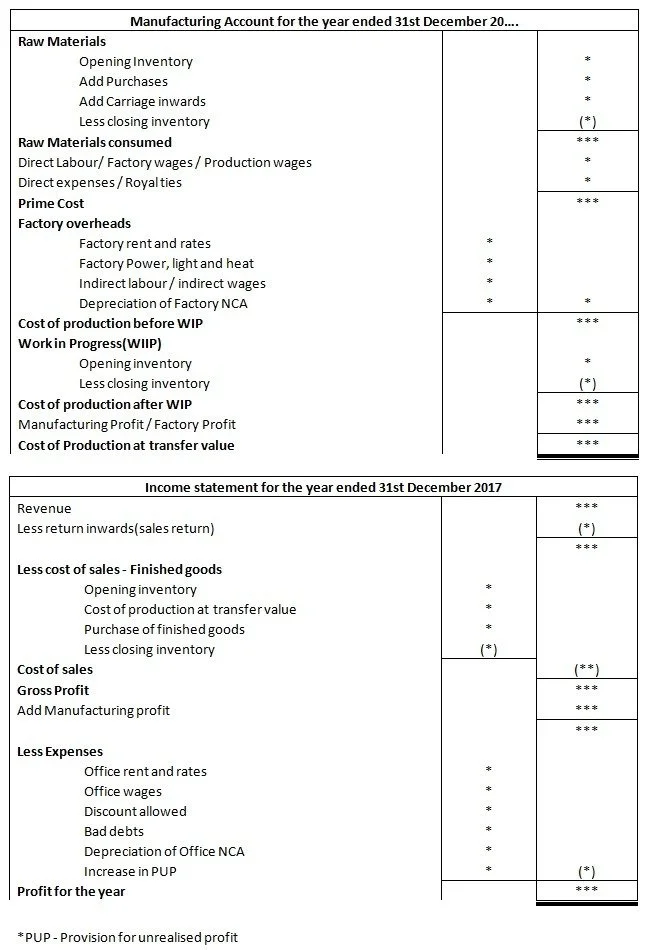

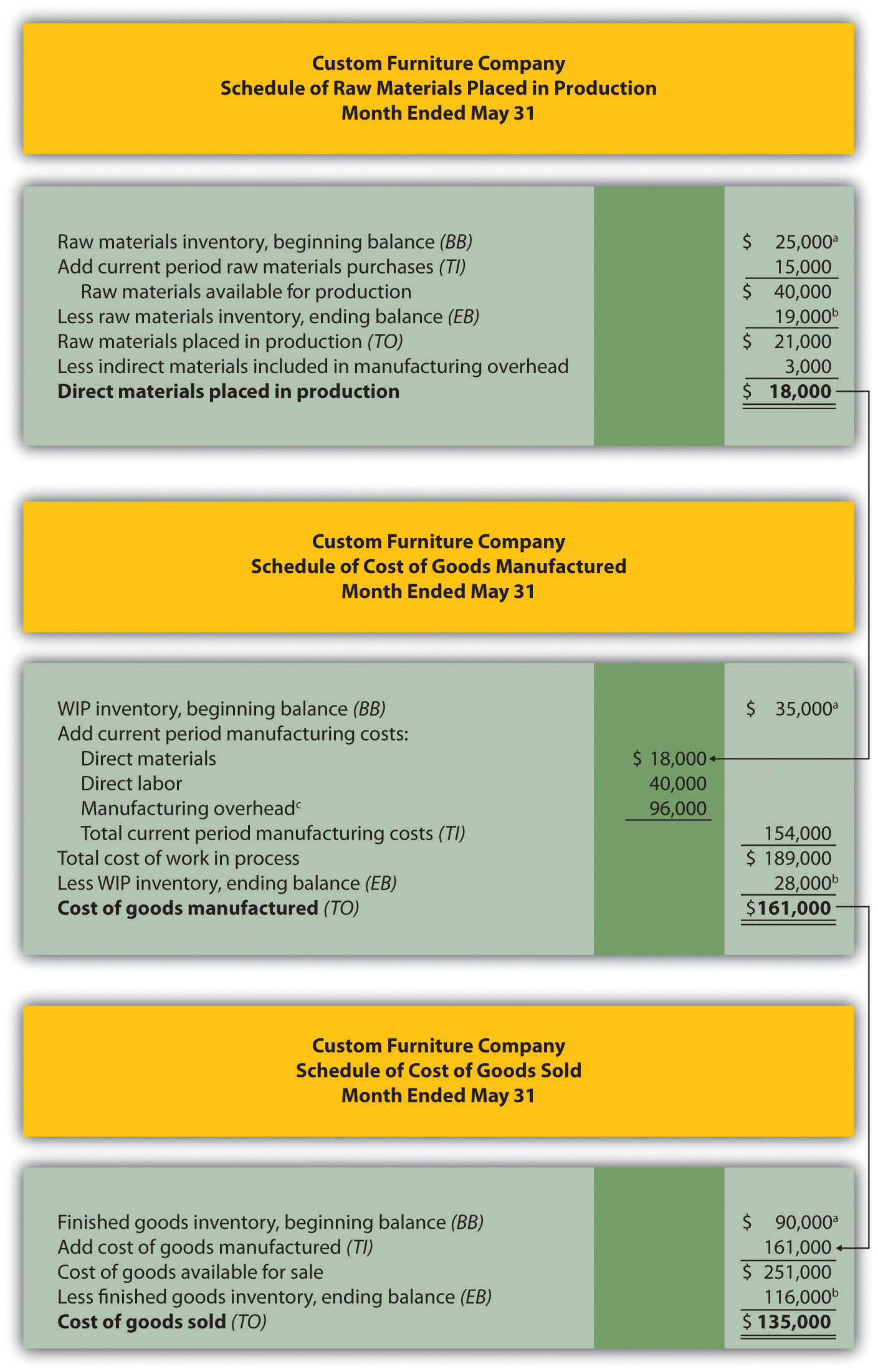

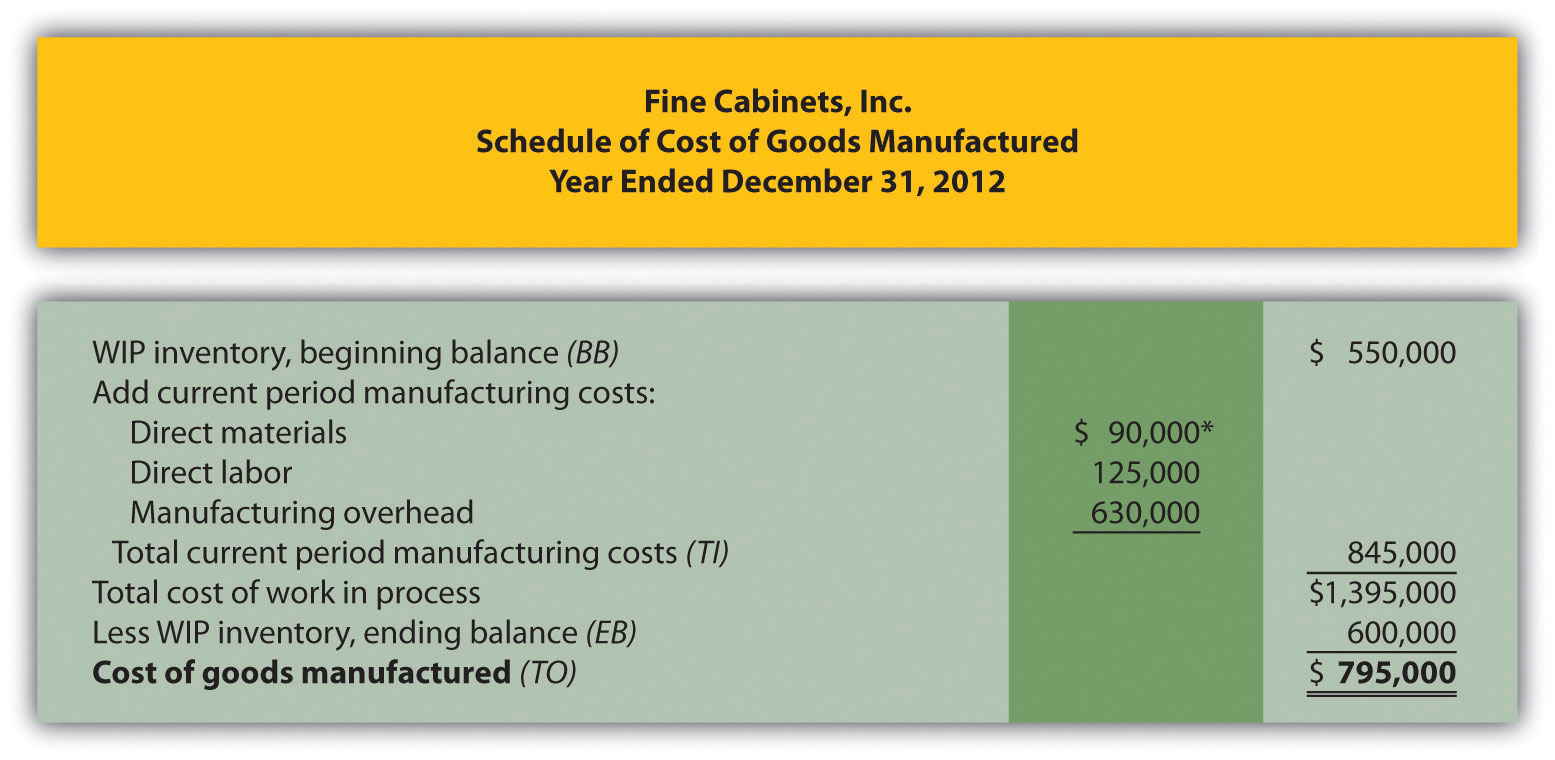

Manufacturing account income statement format. Accountants need all these amounts—raw materials placed in production, cost of goods manufactured, and cost of goods sold —to prepare an income statement for a manufacturing company. The same design also helps to determine the cost of goods sold. The main aim of accounting is to arrange accounting data in order to ascertain the amount of profit or loss of an entity.

We describe how to calculate these amounts using three formal schedules in the following order: What are income statements for manufacturing companies? There are two ways of presenting an income statement.

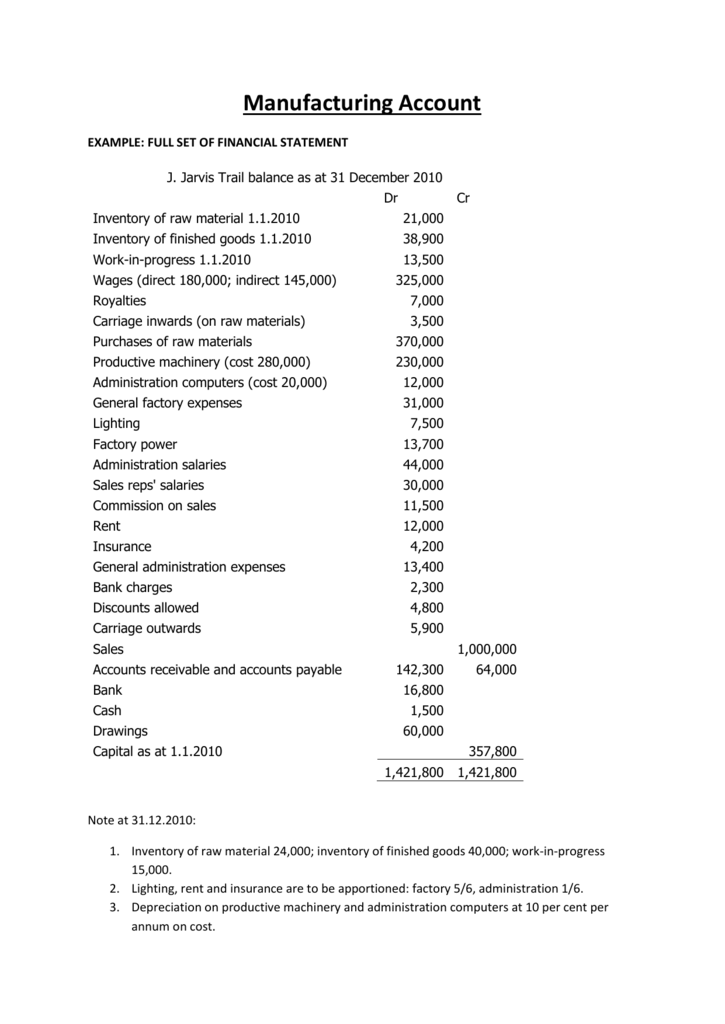

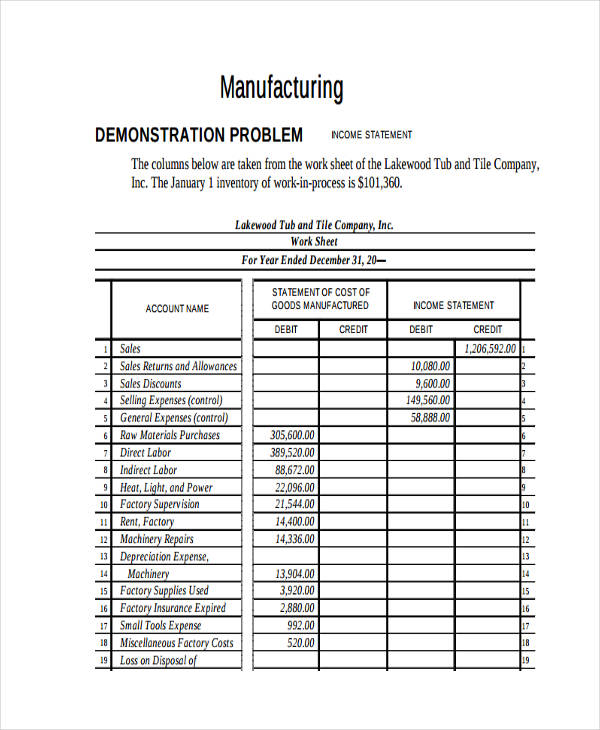

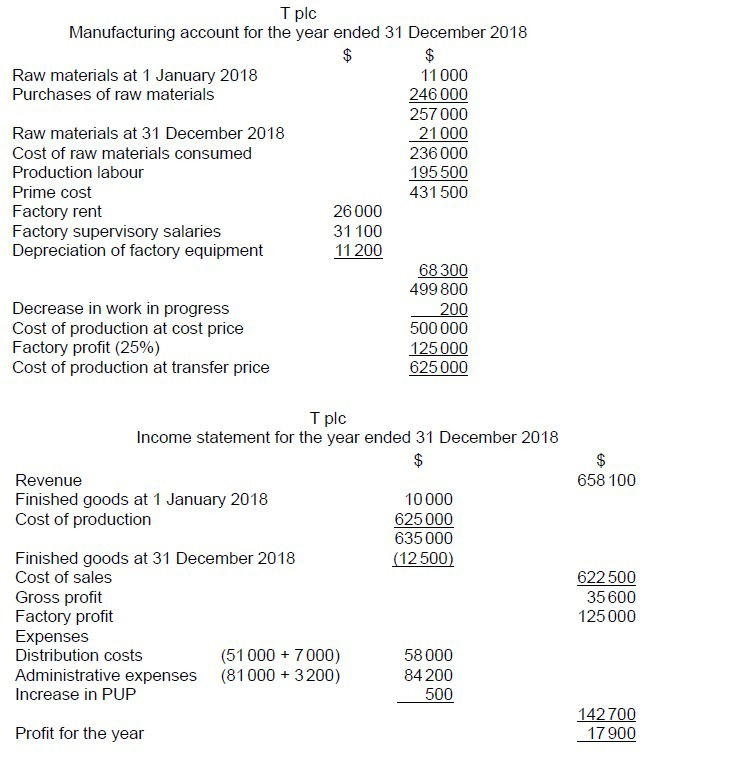

Home > income statement basics > assembly statement format manufacturing account format the manufacture account is an account in the general ledger which is used to accumulation all the manufacturing costs of goods completed by a business during an accounting period. Manufacturing account for the year ended… points to remember: Let's take a look at how each would look like.

In calculating cost of goods sold, only the finished goods inventory account is used, as shown. Both statements use cost of goods sold to calculate gross profit, then subtract selling and administrative expenses (or operating expenses) to arrive at operating income. (d) factory power rs.2,500 advertisements:

= mark up × cost of production. + beginning raw material inventory. Learning objective describe how to prepare an income statement for a manufacturing company.

To prepare a manufacturing income statement, follow the same format used by other companies. Here are the following reasons why the manufacturing account format pdf is different from other types of financial statements: The majority of the income statement remains consistent across business types, with only a few accounts changing and rearranging for manufacturing companies.

Manufacturing business owners generally use the manufacturing account format to keep track of expenses incurred during the production of goods. The manufacturing cost of goods completed for an accounting period is calculated using the cost of goods manufactured formula as follows. Chrome_reader_mode enter reader mode.

In the absence of ledger balances like inventories, quantity manufactured etc, we need to calculate the figures for inventories, sales, etc. Your reporting period is the specific timeframe the income statement covers. Chrome_reader_mode input reader play.

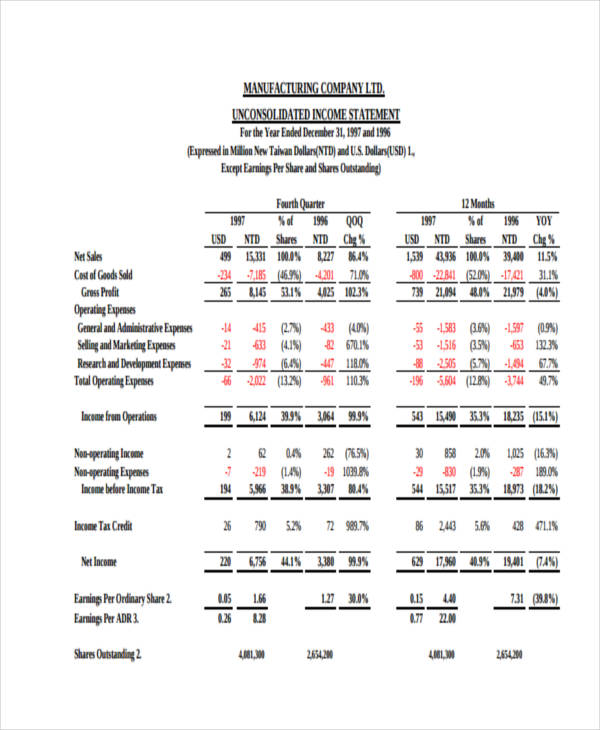

Waleed khan textiles manufacturing account for the year ended dec 31, 2022 $ $ The accounting process and income statement for service companies are relatively simple. Accountants need all these amounts—raw materials placed in production, cost of goods manufactured, and cost of goods sold—to prepare an income statement for a manufacturing company.

Companies that provide services, such as ernst & young (accounting) and accenture llp (consulting), do not sell goods and therefore have no inventory. Financial statements for manufacturing sector. A manufacturing company must use a proper income statement format to appreciate gross profit and net income reports properly.