Stunning Tips About Formula For Profit After Tax

For example, let’s assume an.

Formula for profit after tax. Calculate the nopat: The formula of pat can describe as below: Ubl profit jumps.

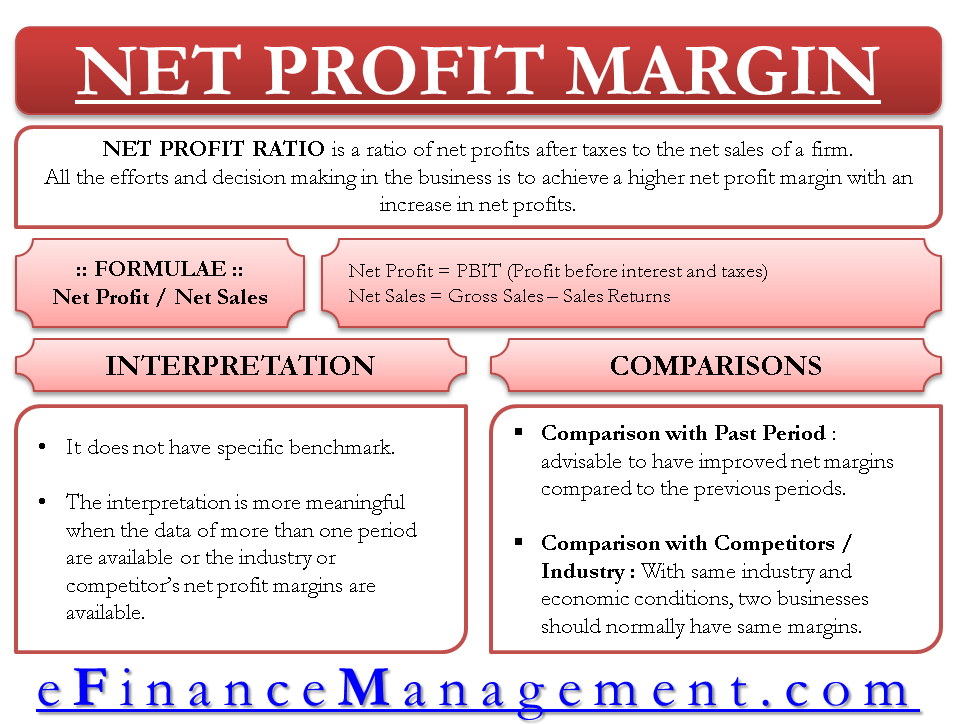

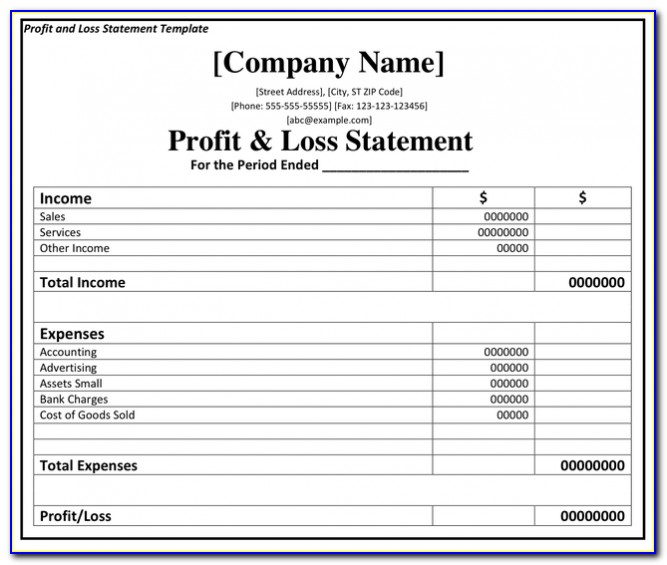

In other words, the after tax profit margin ratio. This amount is the final, residual amount of. If you have categories of raw data, you can calculate your nopat using excel.

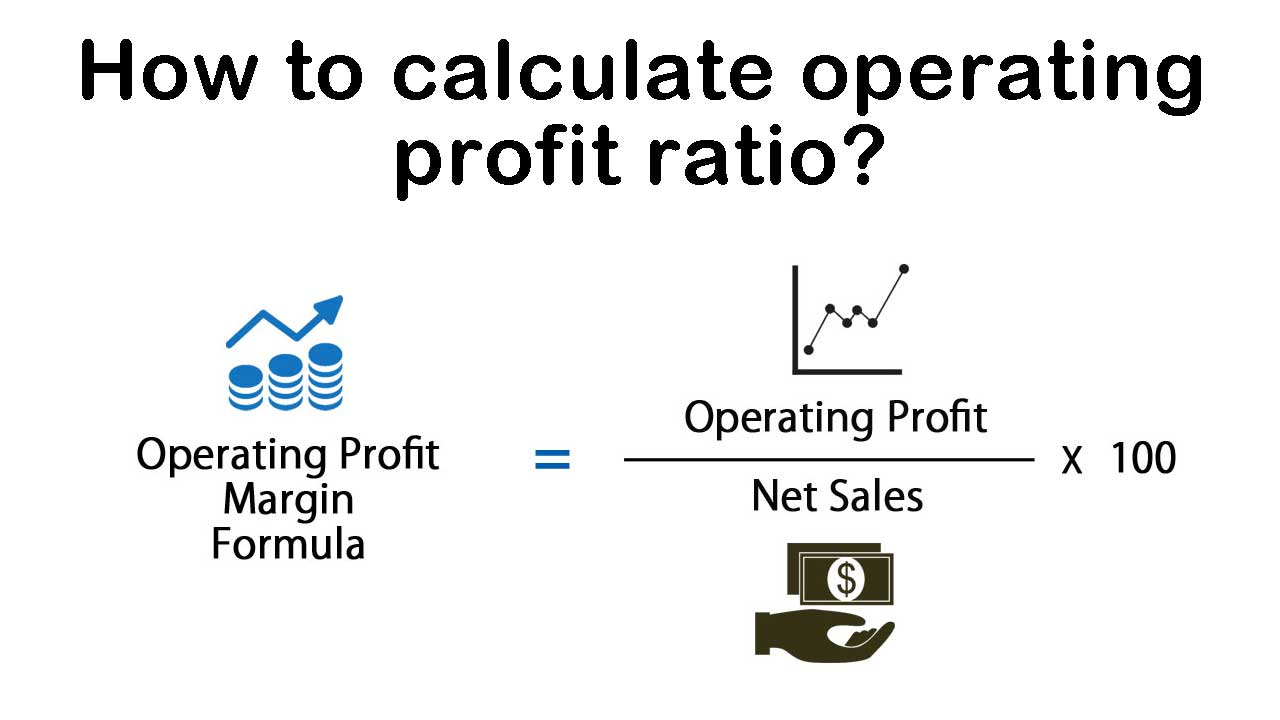

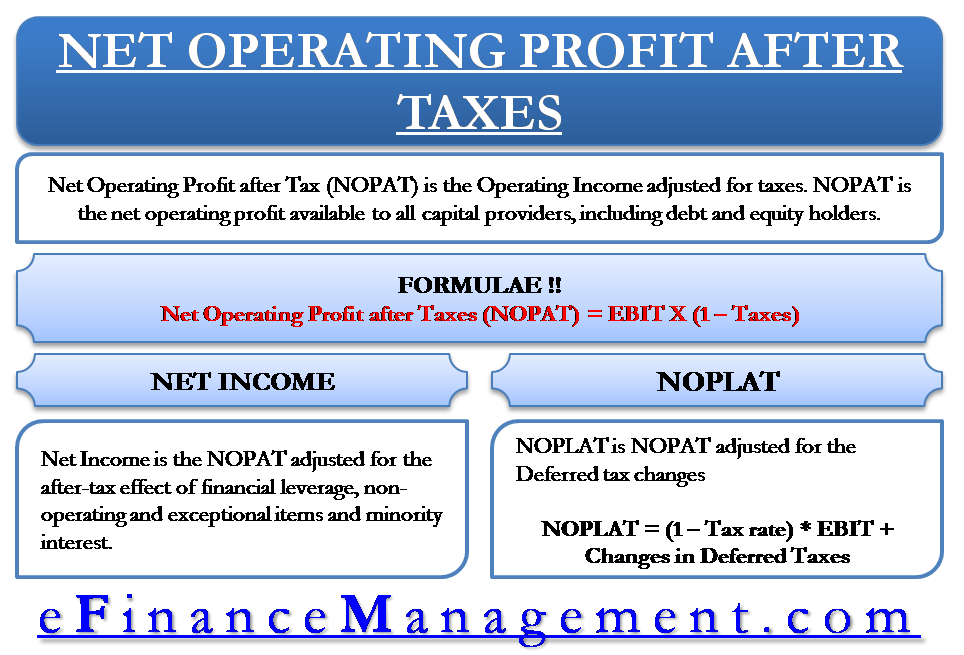

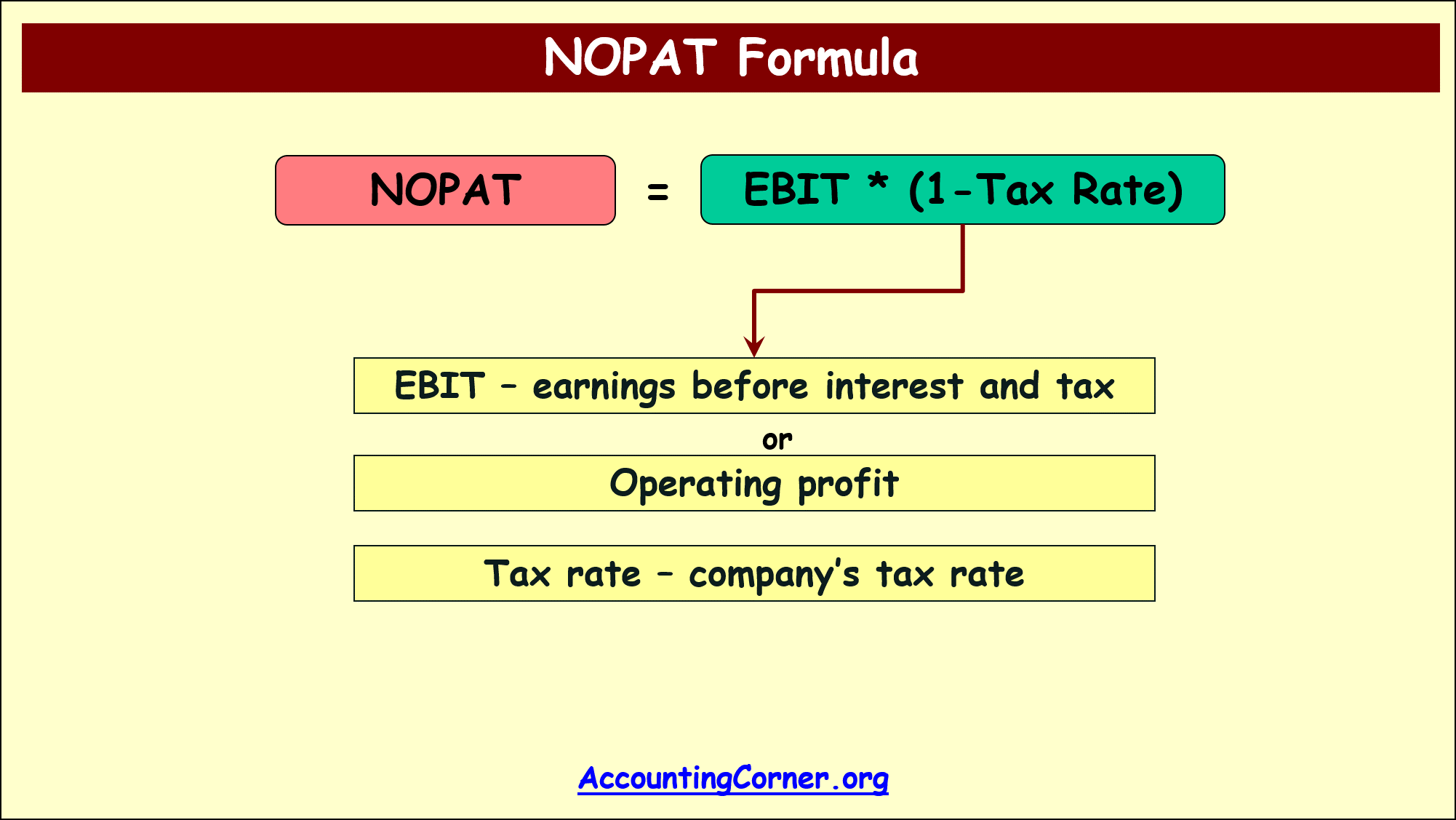

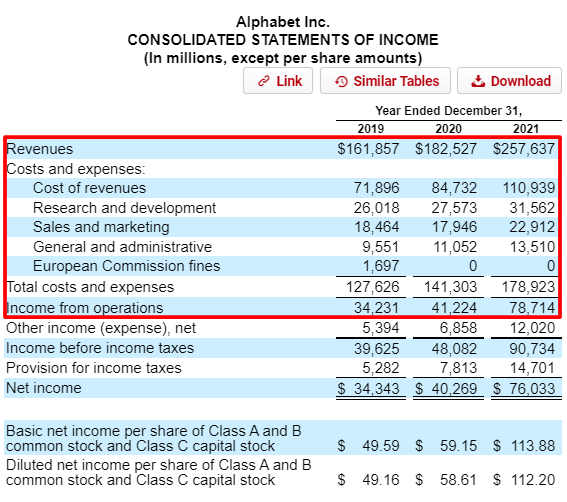

We can apply the values to our variables and calculate net operating profit after tax: Profit after tax (pat) is calculated by taking a company’s earnings before taxes and subtracting the total tax expense. Nopat= 120,000 × (1−0.2) so, your company’s net profit after tax is $96,000.

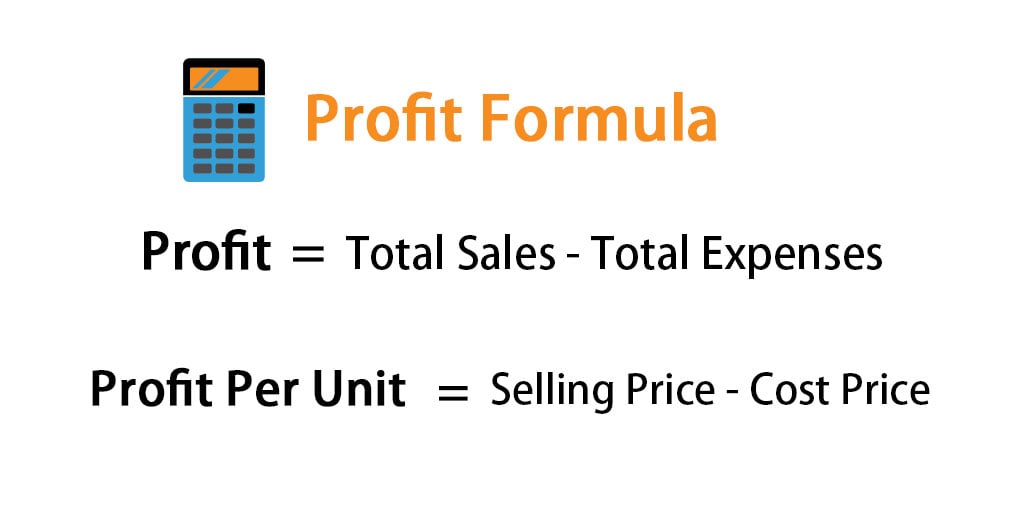

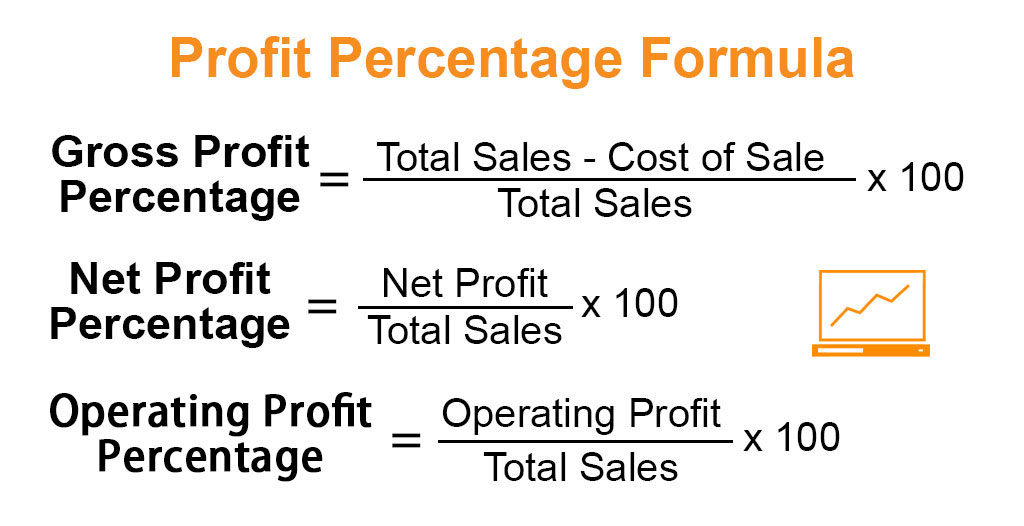

Your transition profit after overlap relief will be spread over 5 years, starting. The formula to calculate profit after tax is as follows: The after tax profit margin ratio expresses the company's net income or earnings as a percent of the company's net sales.

Multiply the two items together, and the result is the net. Operating income = 60,000. The formula to calculate profit after tax (pat) is given below.

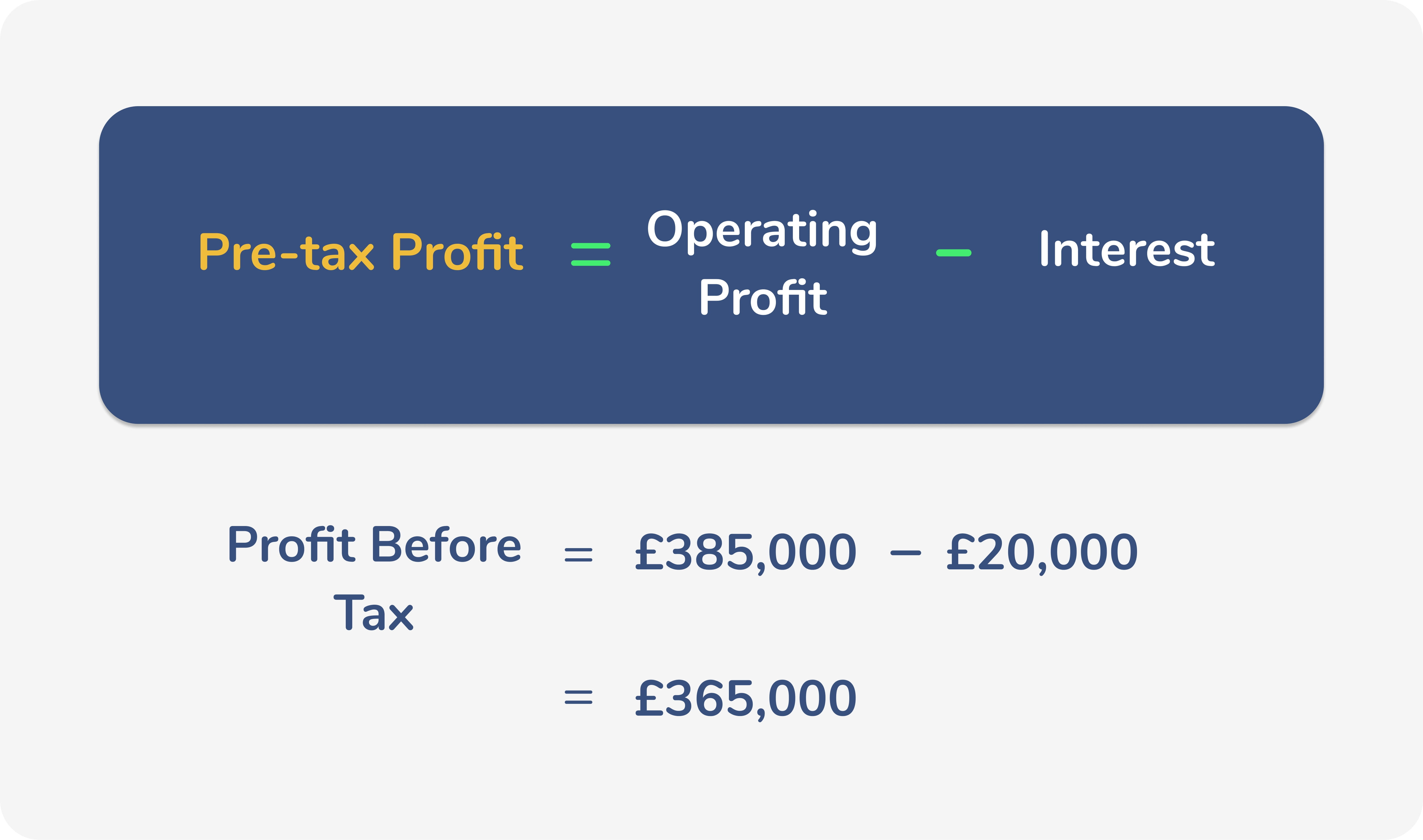

The formula for calculating operating profit is as follows: In this case, the net operating. Save upto rs 46,800 in tax under section 80 c we are rated ~ 6.7 crore registered consumers 51 insurance partners 3.4 crore policies sold zero tax on maturity amount.

Calculating net profit after tax involves using operating income and the result of your tax rate equation. Work out how much of your transition profit after overlap relief to tax in 2023 to 2024. How is profit after tax calculated?

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)