Can’t-Miss Takeaways Of Tips About Ifrs Ias 1

In addition, companies may need to provide new disclosures for liabilities subject to covenants.

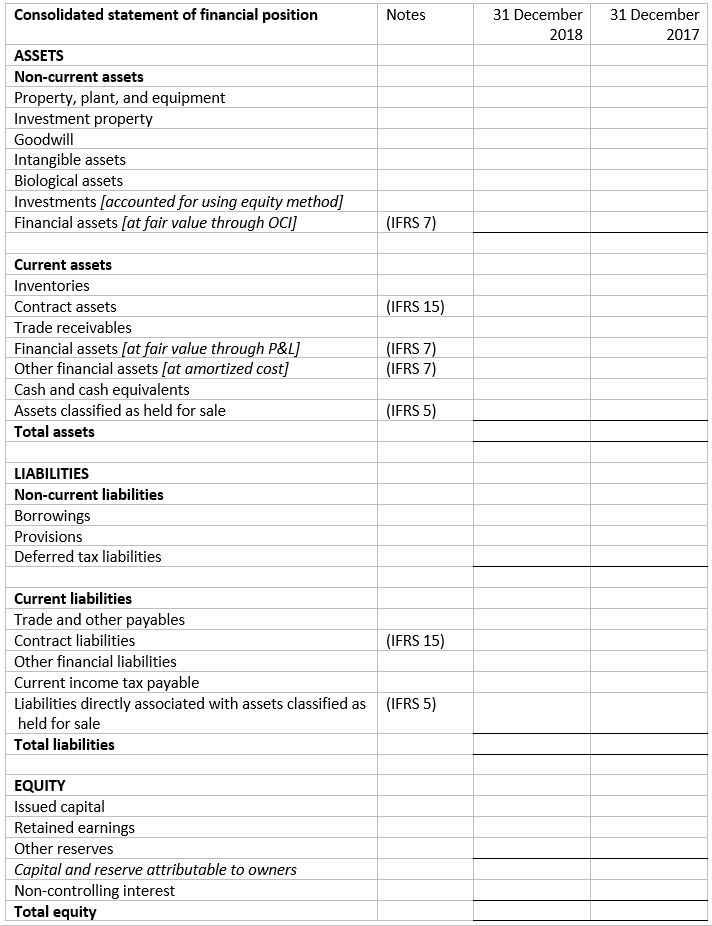

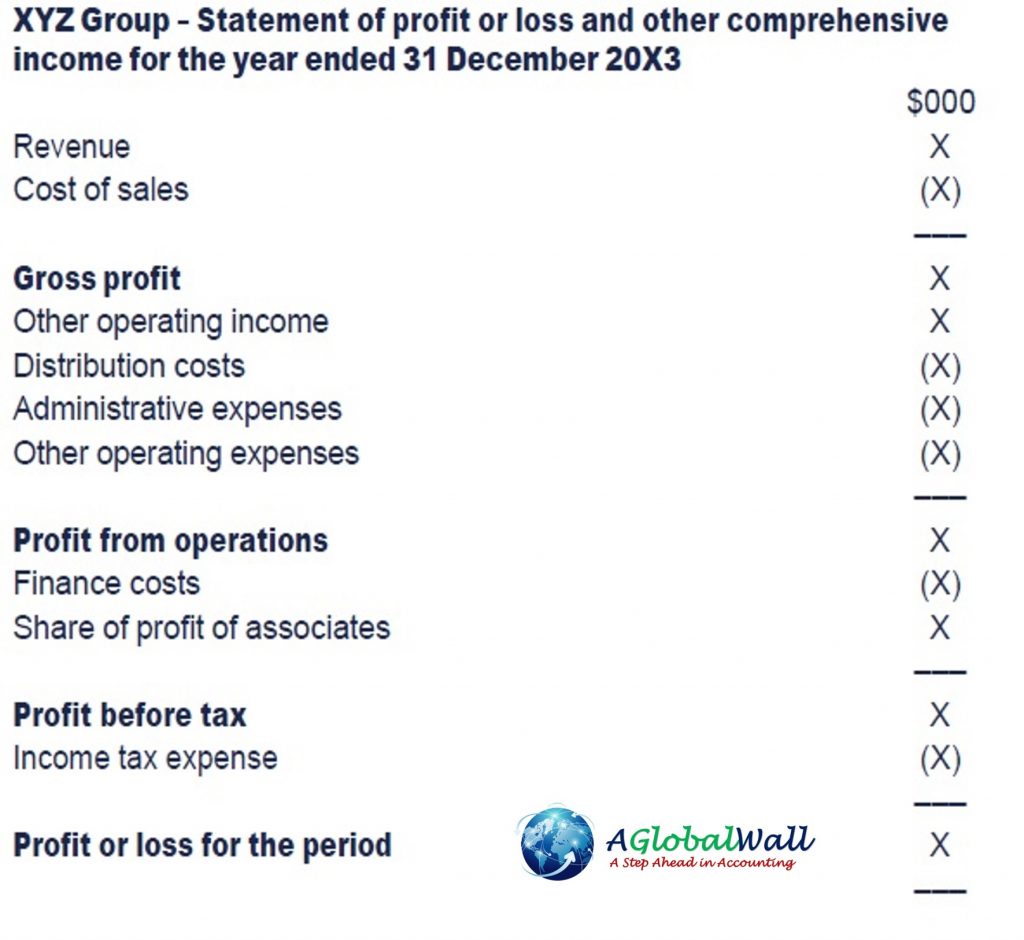

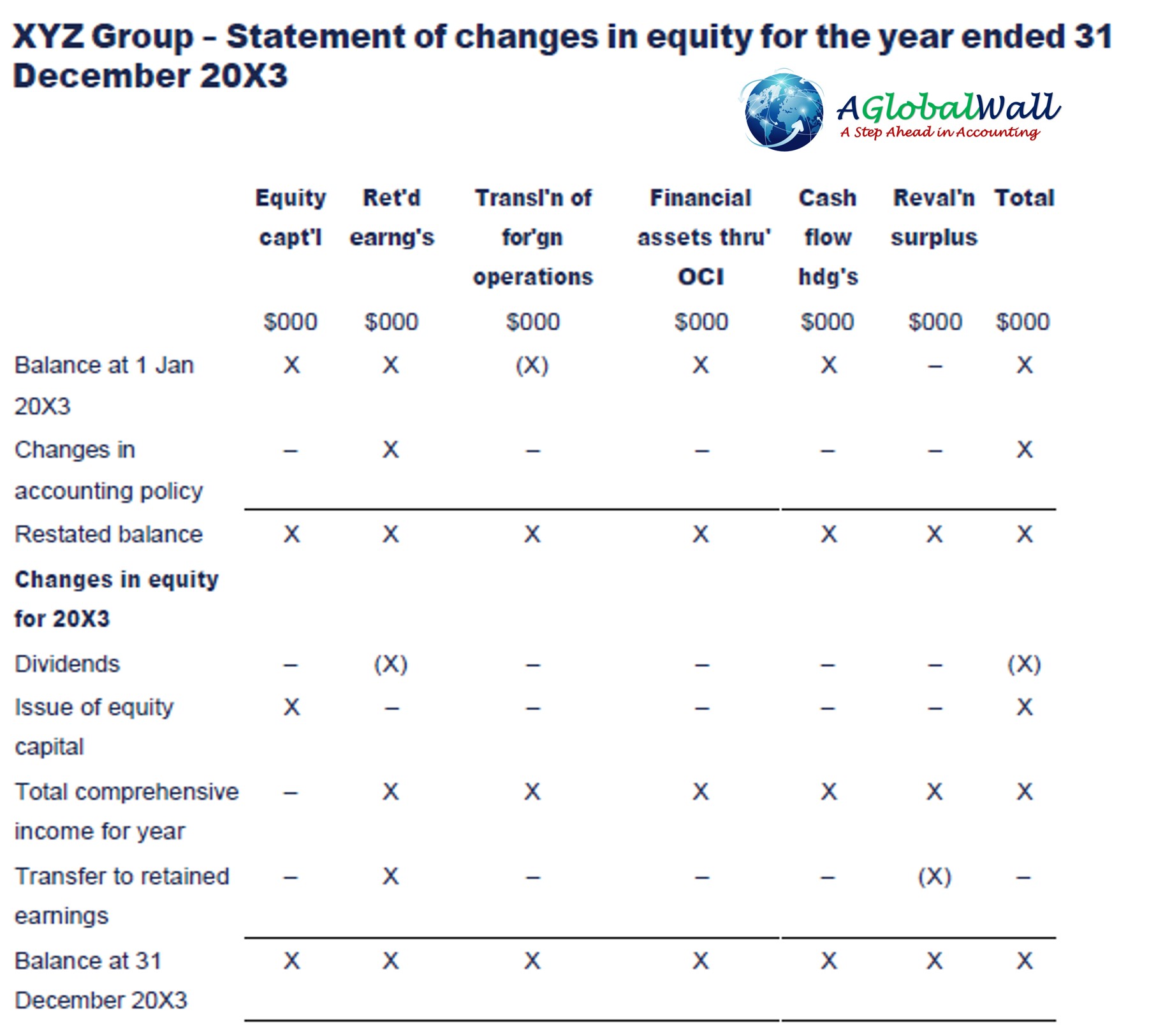

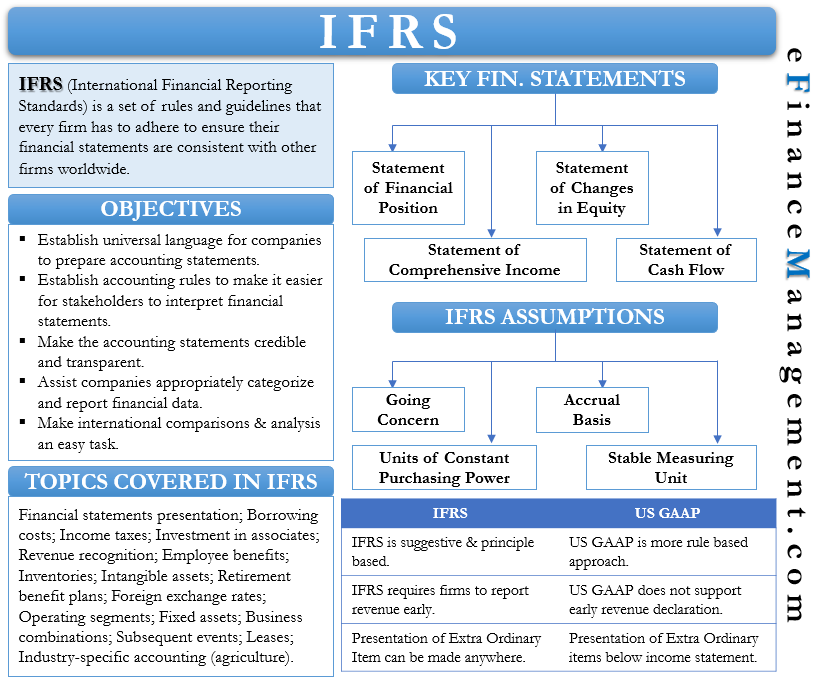

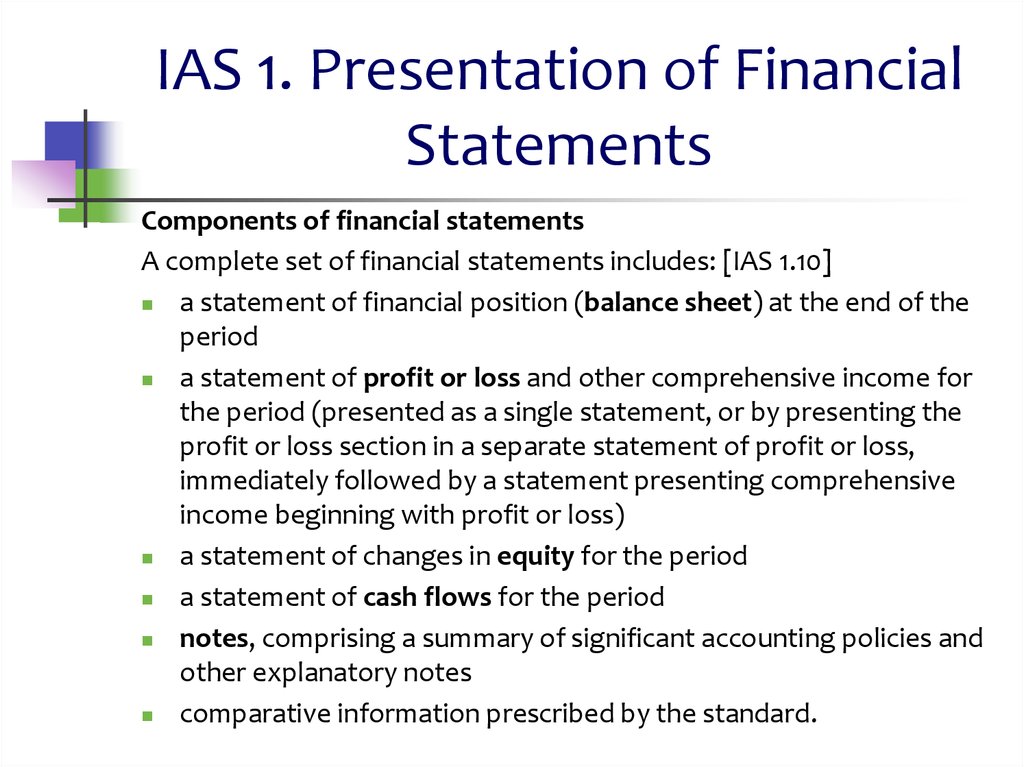

Ifrs ias 1. It defines complete set of general purpose financial statements that contains 5 components: Ias 1 applies to all general purpose financial statements that are prepared and presented in accordance with international financial reporting standards (ifrss). International accounting standard 1 ias 1 presentation of financial statements:

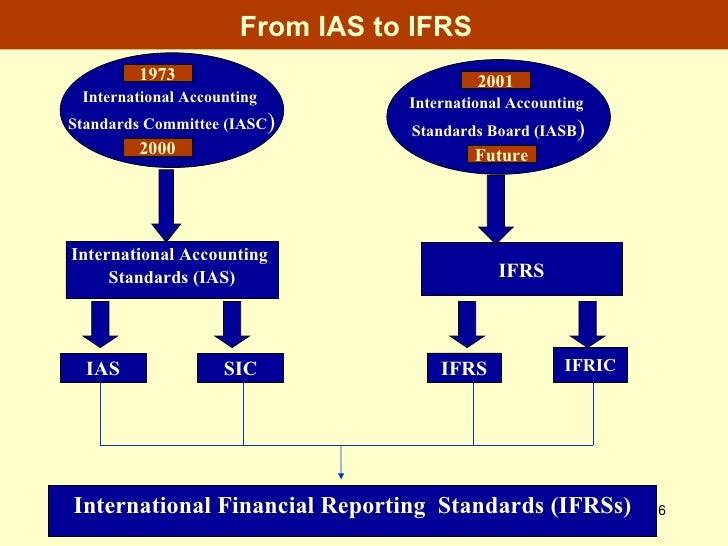

However, the decrease shall be recognised in other comprehensive income to the extent of any credit balance existing in the. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes). Links to summaries, analysis, history and resources for ifrs sustainability disclosure standards (ifrs sds), international financial reporting standards (ifrs) and international accounting standards (ias), ifric interpretations, sic interpretations and other pronouncements issued by the international accounting standards board (iasb).

Ias 1 — presentation of financial statements ifrs practice statement 'making materiality judgements' this ifrs in focus outlines the amendments to ias 1 and ifrs practice statement 2 titled 'disclosure of accounting policies', published by the iasb in february 2021. Ias 1 presentation of financial statements in april 2001 the international accounting standards board (board) adopted ias 1 presentation of financial statements, which had originally been issued by the international accounting standards committee in. Paragraph 31] the decrease shall be recognised in profit or loss.

Ifrs s1 sets out overall requirements with the objective to require an entity to disclose infor. Ias 8 accounting policies, changes in accounting estimates and errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance. The iasb is supported by technical staff and a range of advisory bodies.

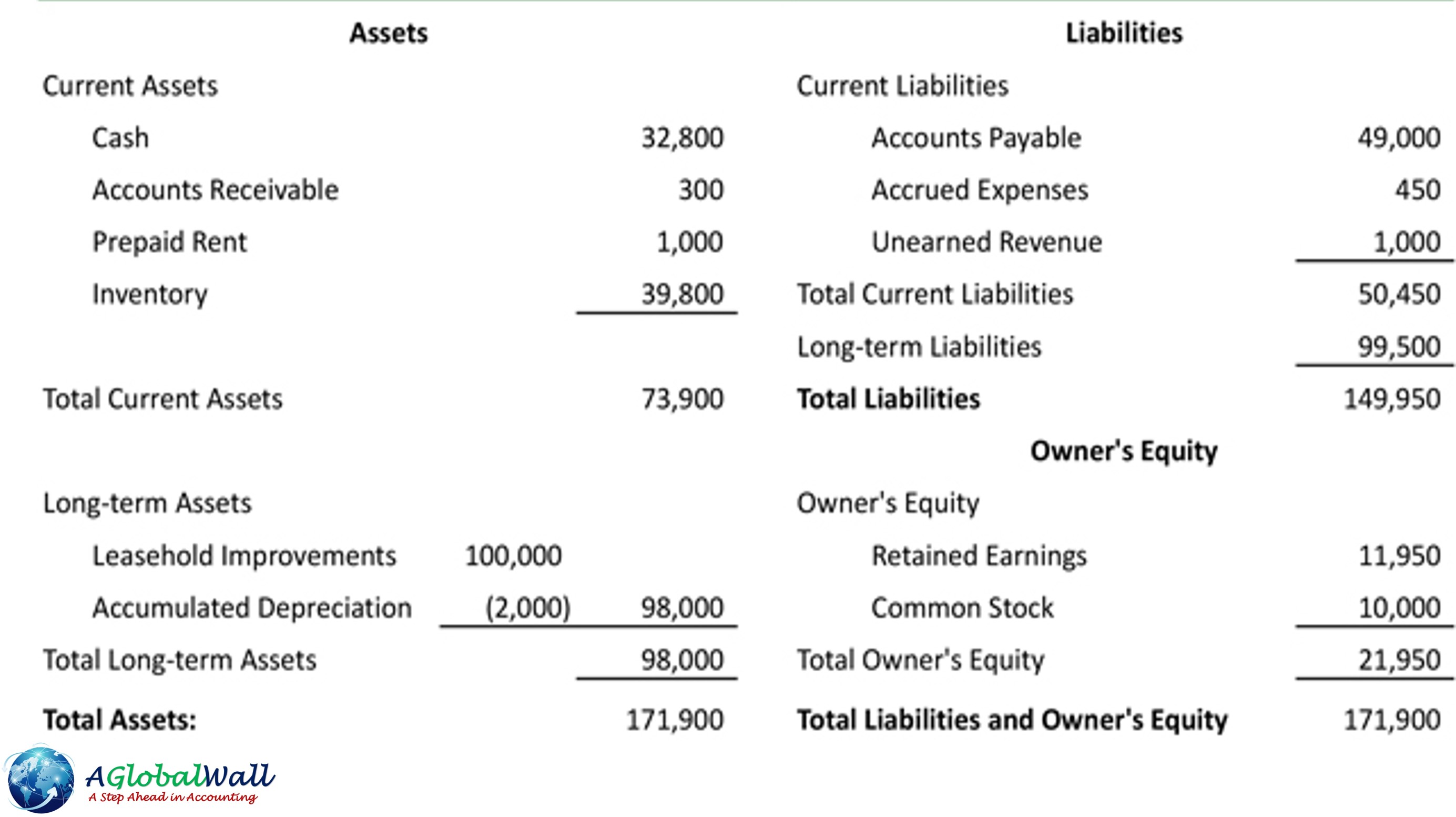

Entities must choose between ‘function of expense method’ and ‘nature of expense method’ to present Ias 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. Ias 1 should be read in the context of its objective and the basis for conclusions, the preface to ifrs standards and the conceptual framework for financial reporting.

In news you will find recent news announcements regarding the standard, including meetings about projects which might affect the standard. Disclosure of material accounting policy information, among. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes).

While the iaasb remains framework neutral when developing the isas, it considers financial reporting framework developments that may affect the isas, such as changes to the international financial reporting standards (ifrs). 1 january 2009 what it does: Ias 1 has been revised to incorporate a new definition of “material” and ias 8 has been revised to refer to this new definition in ias 1.

Ias 1.108 example ifrs 1.ig10 disclosure: The amendments are effective for annual reporting periods beginning on or after january. In about you will find a brief summary and the history of the standard, alongside related active and completed projects and other related information.

It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Ias 1 presentation of financial statements (as revised in 2007) amended the terminology used throughout ifrs standards, including ifrs 1. The amendments will apply from 1 january 2024.

Ifrs 1 requires an entity that is adopting ifrs standards for the first time to prepare a complete set of financial statements covering its first ifrs reporting period and the preceding year. The entity uses the same accounting policies throughout all periods presented in its first ifrs financial statements. Summary 2020 share watch on overview of ias 1 issued:

![[PDF] Comparison of IAS 39 and IFRS 9 The Analysis of Replacement](https://d3i71xaburhd42.cloudfront.net/67b3ca92d6a9916b419602abe09bd860d20fc48b/3-Table1-1.png)

:max_bytes(150000):strip_icc()/IFRS_Final_4194858-00f3f3a4c8334cc1aa13b29e692935db.jpg)