Simple Tips About Which Of The Following Is Not A Cash Outflow

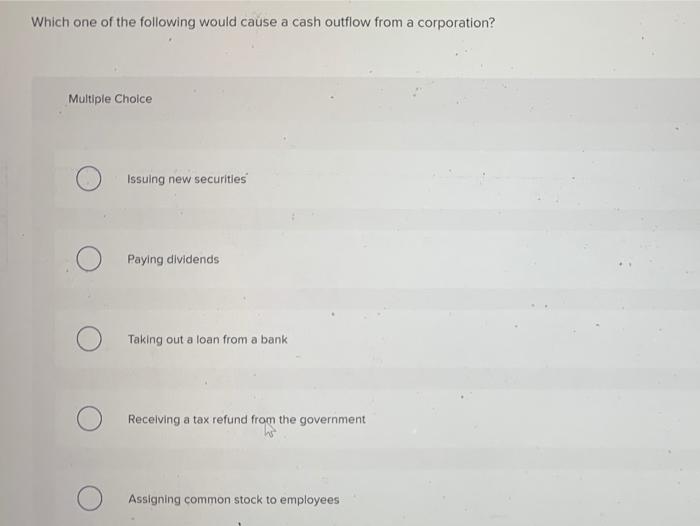

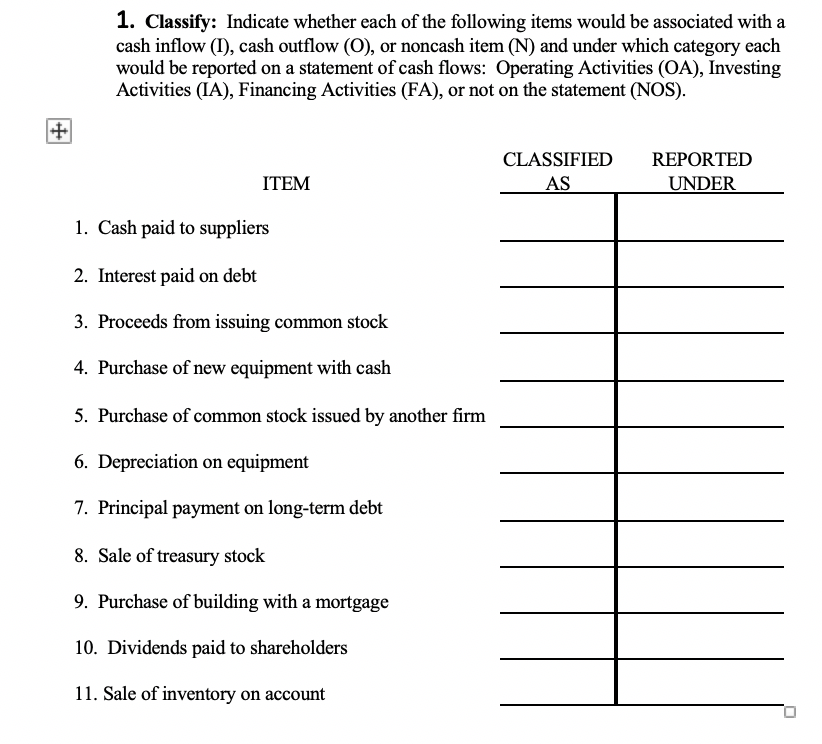

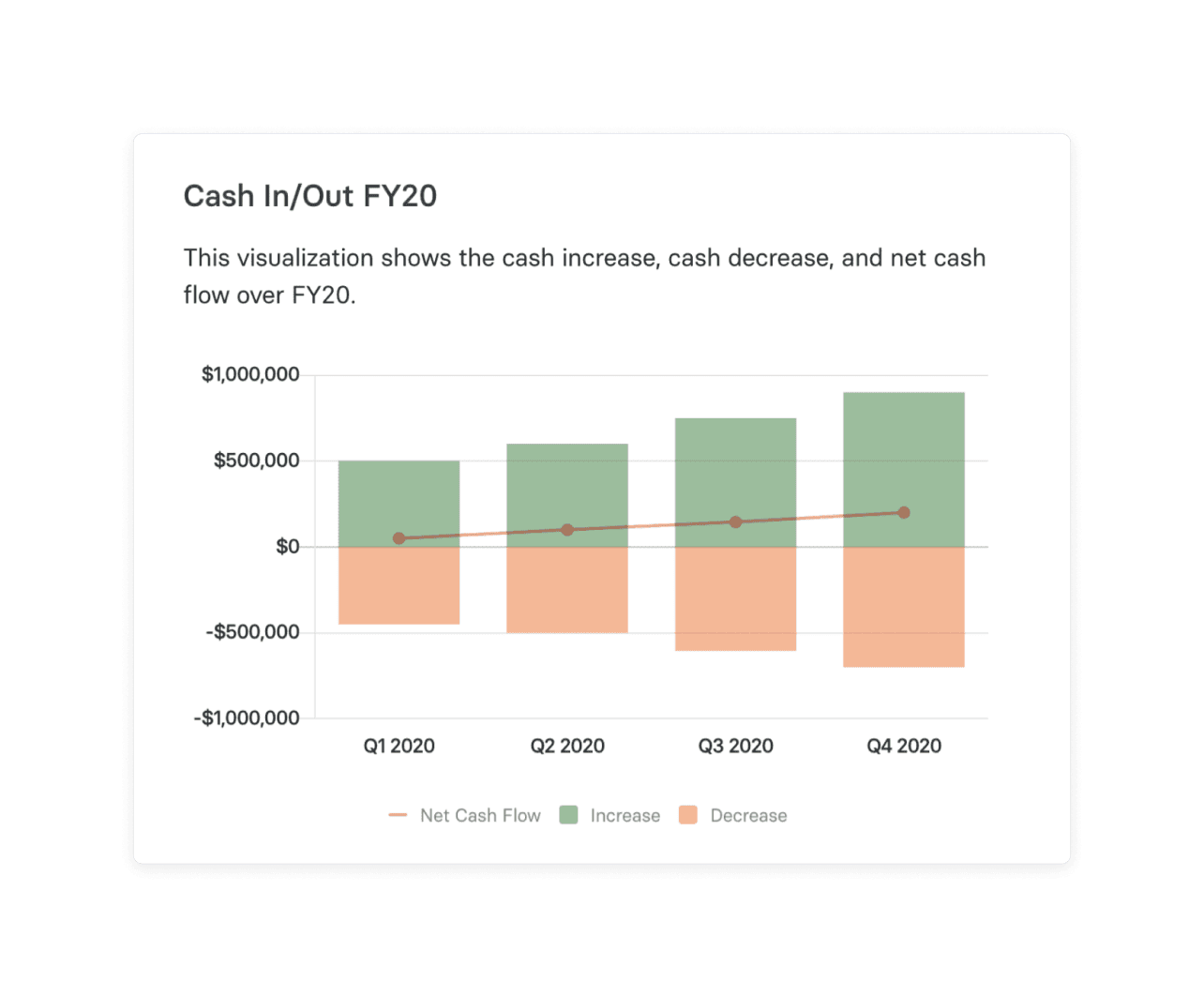

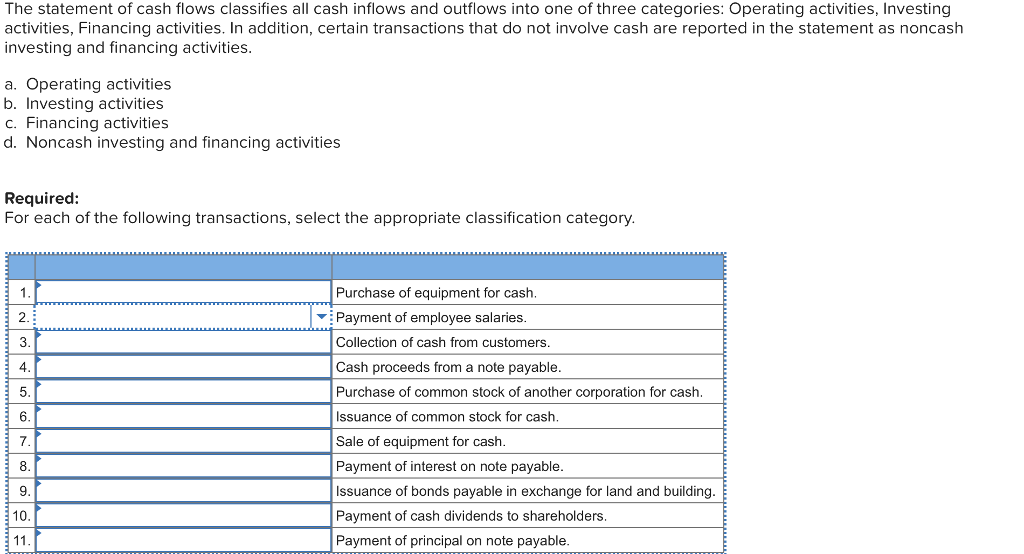

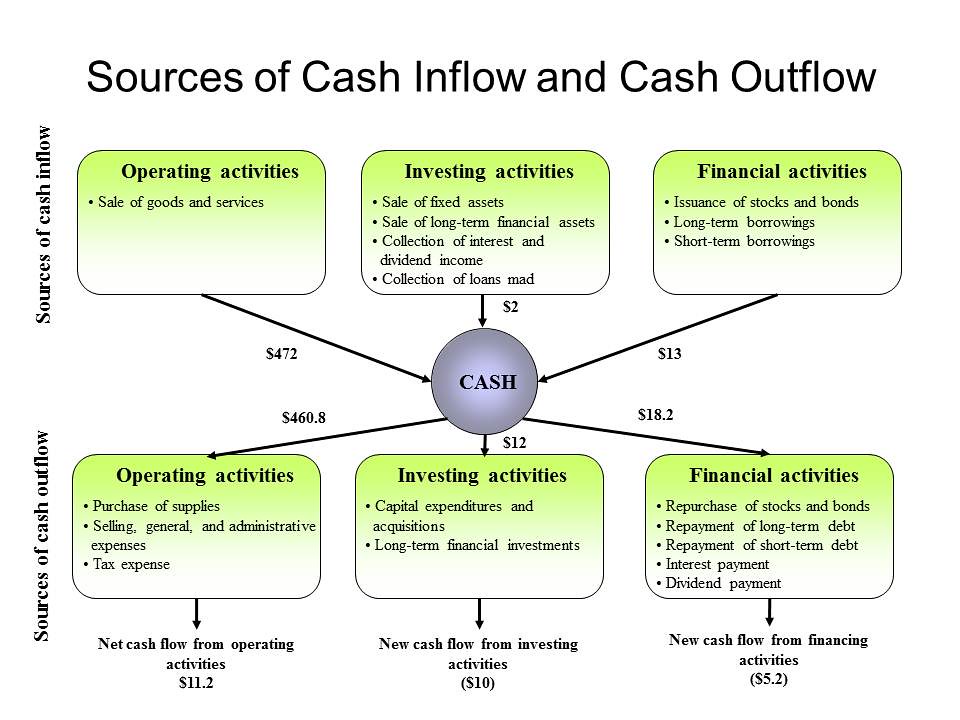

The reasons for these cash payments fall into one of the following classifications:

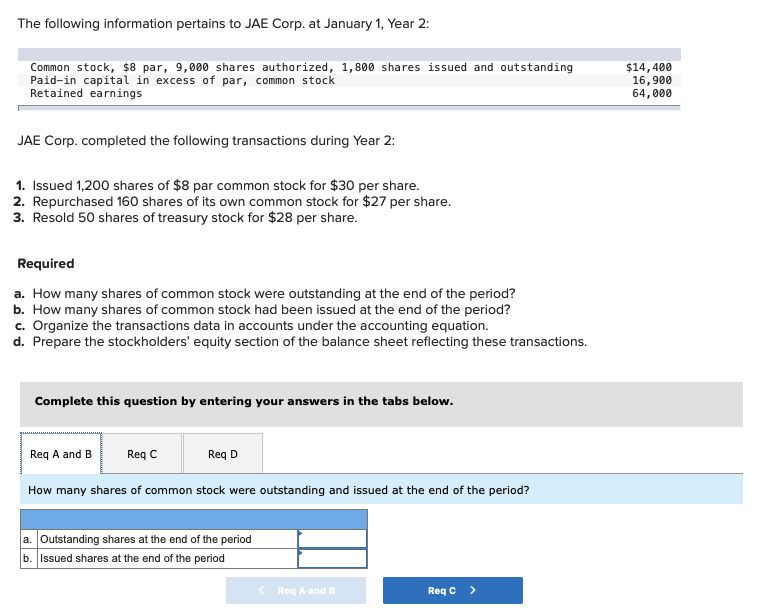

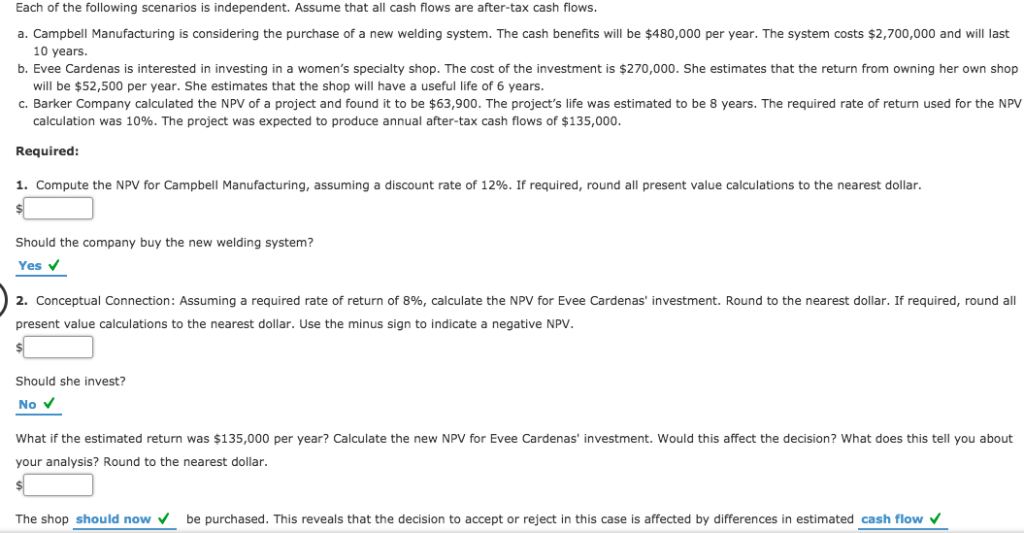

Which of the following is not a cash outflow. Study with quizlet and memorize flashcards containing terms like incremental cash flows from a project =, which of the following is not one of the categories for a project's. To learn more commerce related. A cash outflow refers to the movement of money from a business due to various expenses.

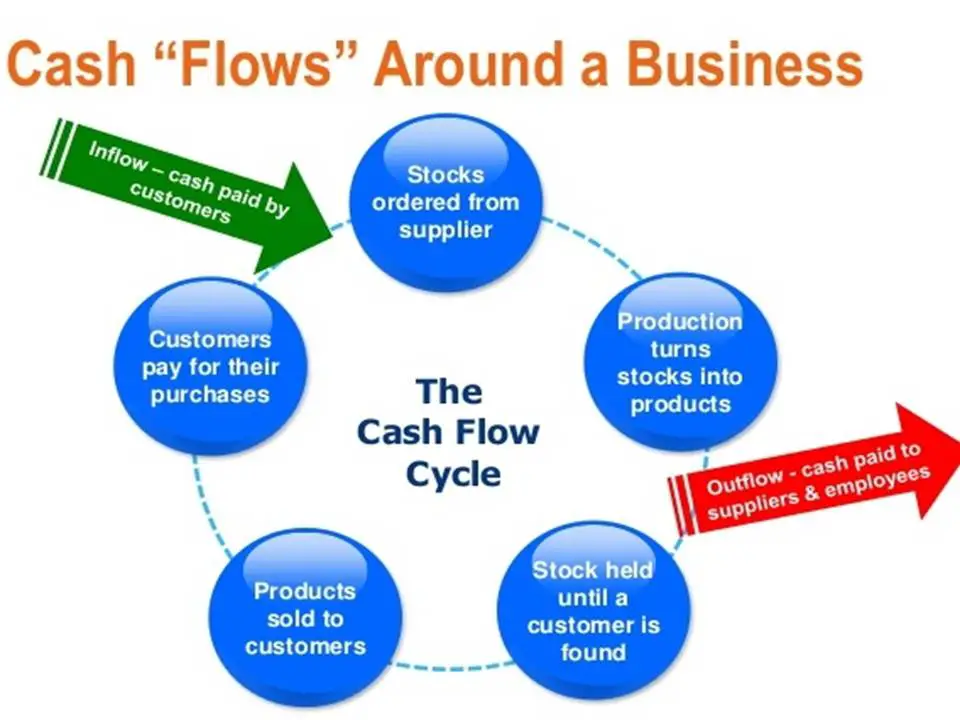

Option (d) increase in creditors. Cash inflow is the cash you’re bringing into your business, while cash outflow is the money that’s being distributed by your business. What is cash outflow?

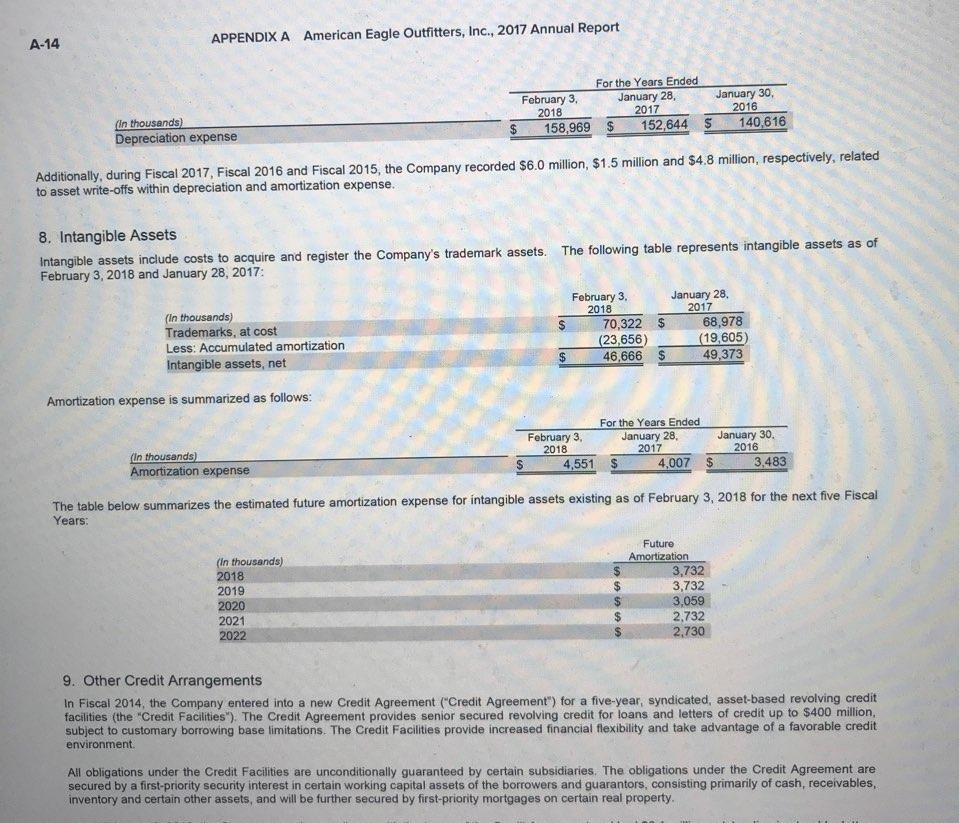

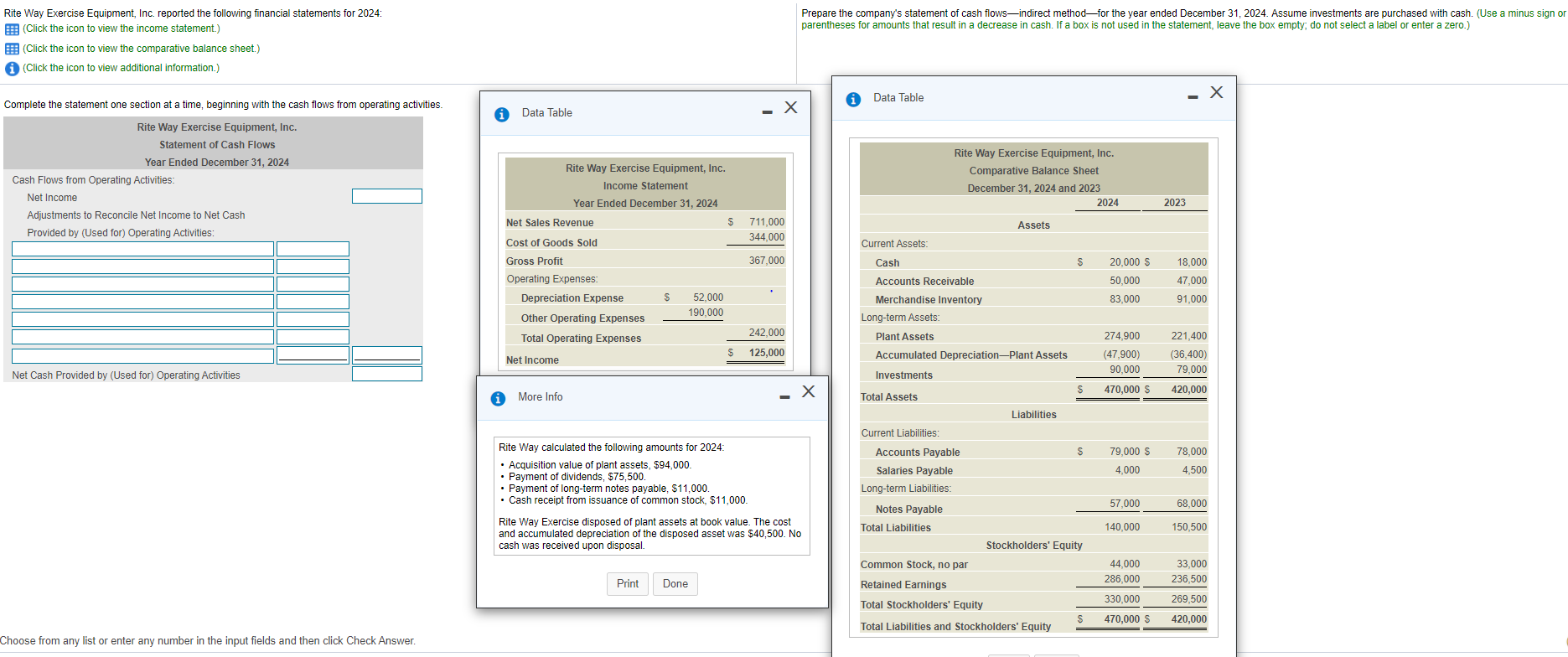

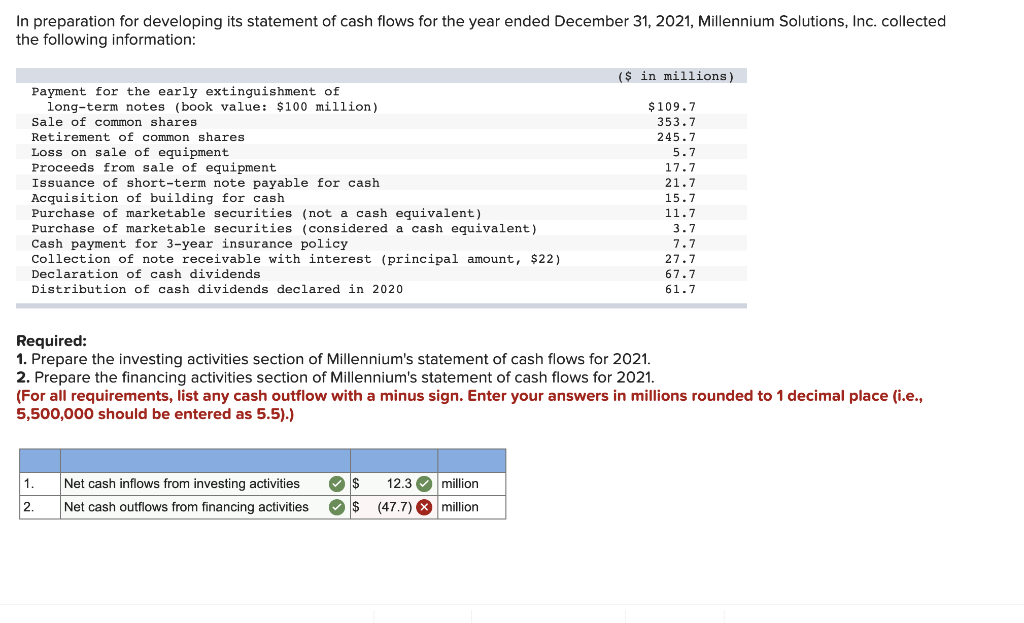

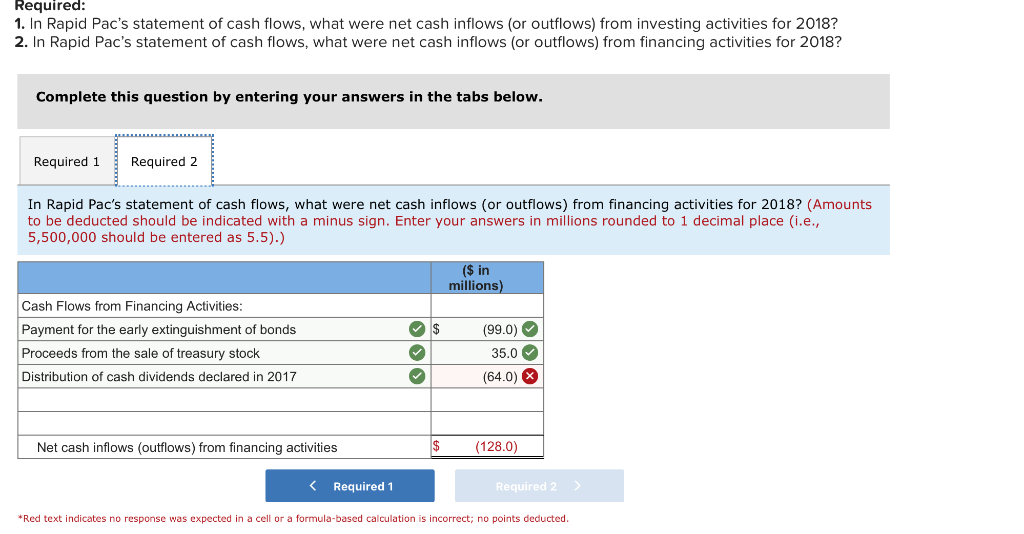

According to the financial accounting standards board (fasb), which of the following is a cash flow from a financing activity? A company may be required to seek. Cash inflow from sale of property, plant, and equipment c.

Cash outflow results from expense or investments. Solution verified by toppr cash outflow is the amount of cash that a business disburses. If the cash outflow of a business is greater than the cash inflow, then the.

Which of the following is not a typical cash flow under investing activities? Which of the following is not a cash outflow? Among the given options, an increase in creditors is not a cash outflow.

These expenses are categorized in the cash flow statement. Types of cash outflows cash outflows can be classified into three categories, which are as follows: The objectives of cash flow.

Among the given options, a decrease in creditors is not a cash inflow. In most cases, the term “outflow”. The opposite of cash outflow is cash inflow, which refers to the money coming into a business.

Cash outflow on purchases is calculated by. Study with quizlet and memorize flashcards containing terms like the capital budgeting methods that focus on cash flows rather than incremental operating income are. Salvage value of equipment when project is complete.

Cash outflow from operating activities: Which of the following is not a cash outflow for the firm? Cash inflow from receipt of loans b.

(i) cash sales of goods. Option (c) decrease in creditors. Classify the following activities into cash flows under (a) operating (b) investing (c) financing:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)