Brilliant Info About Treatment Of Accrued Income In Cash Flow Statement

This article considers the statement of cash flows of which it assumes no prior knowledge.

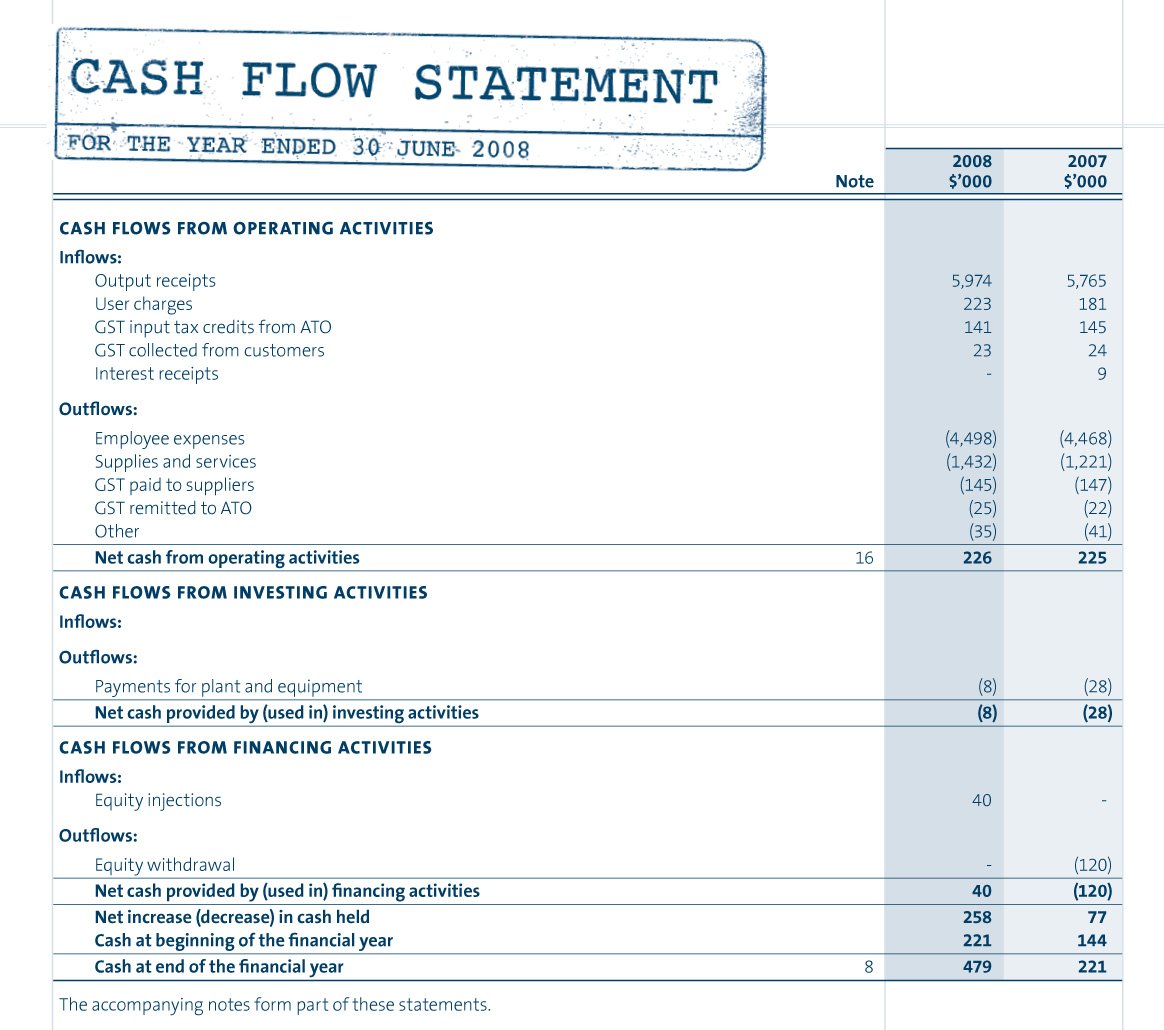

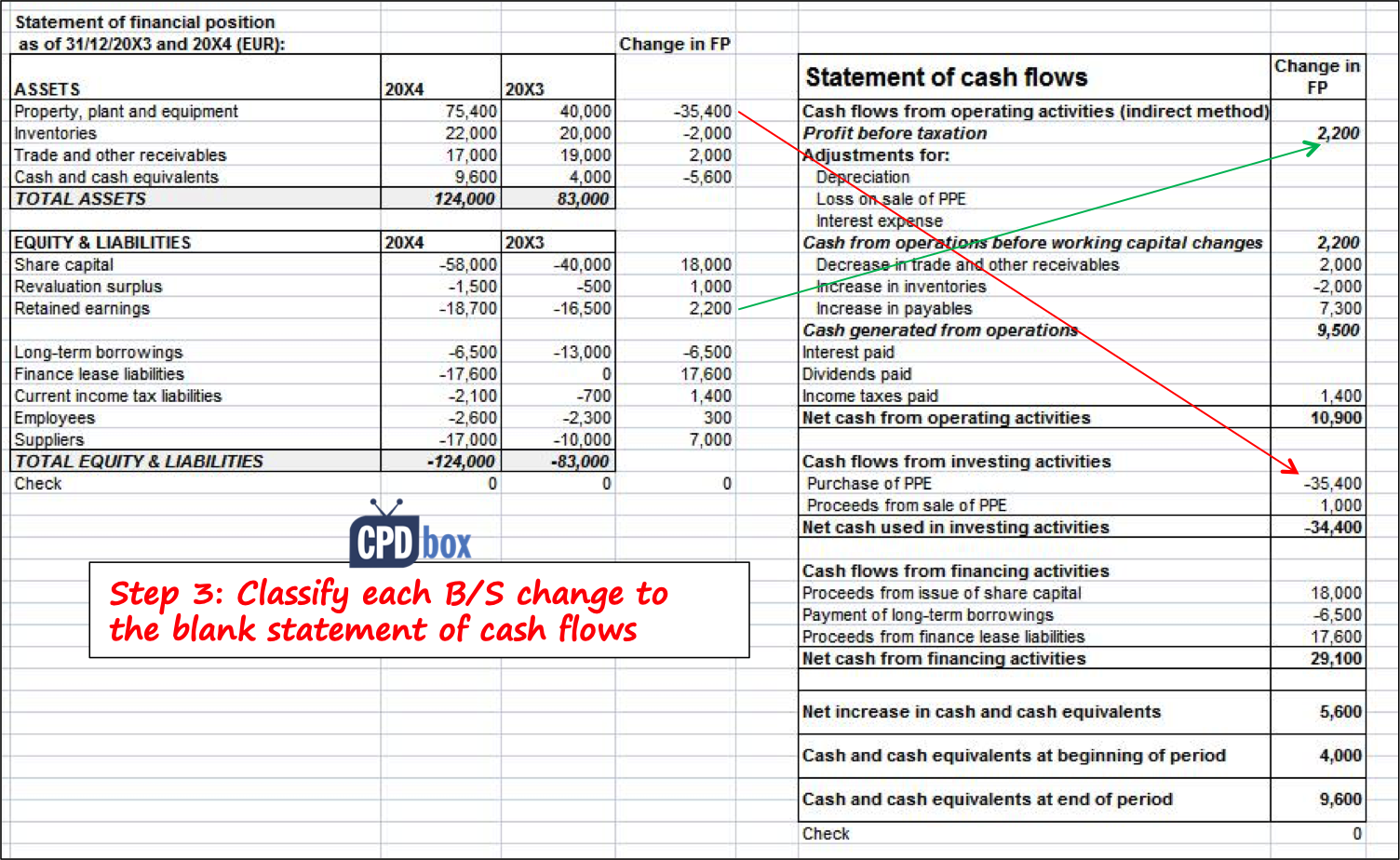

Treatment of accrued income in cash flow statement. In summary, we can make the adjustments for the increase or decrease in prepaid expenses on cash flow statement by deducting the increased amount or adding the decreased. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Using the indirect method, operating net cash.

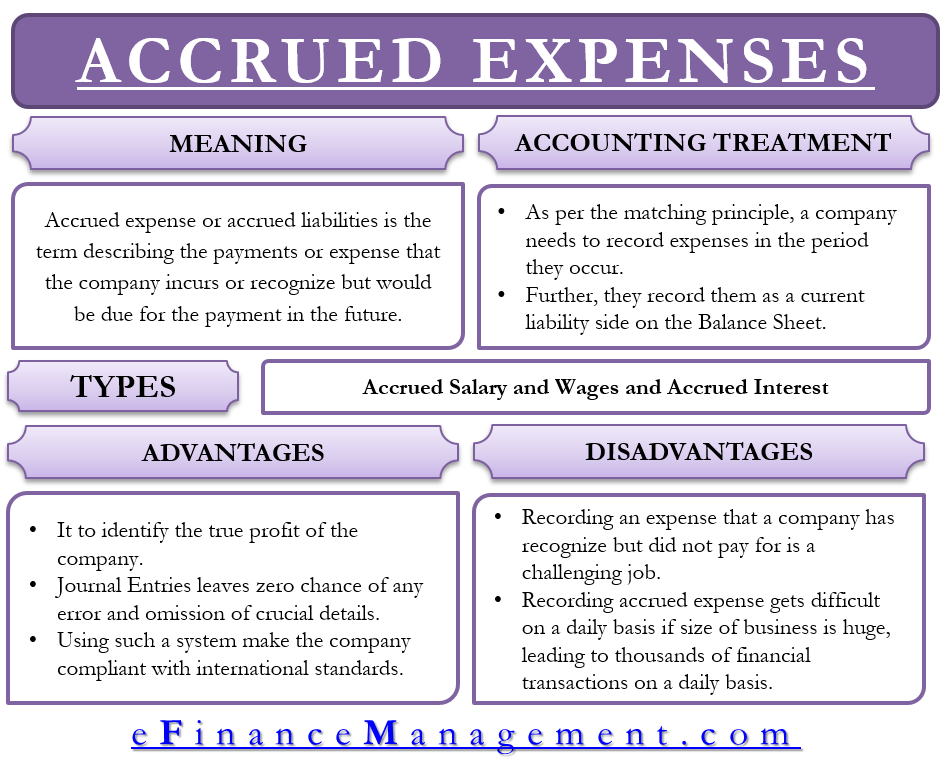

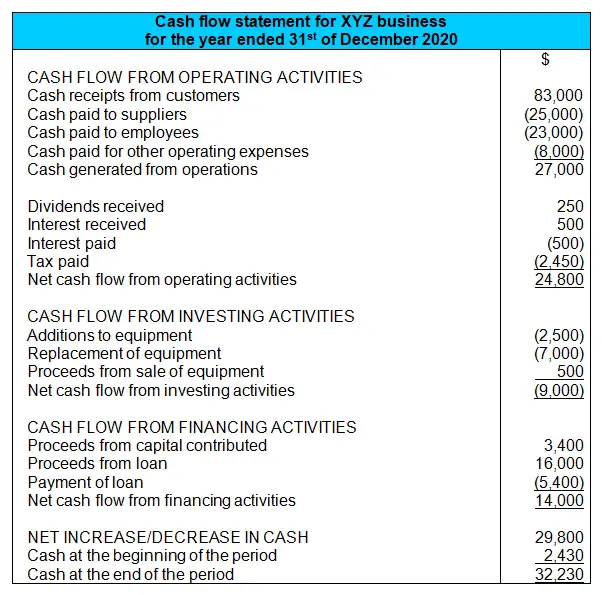

Accrued income arises where income has been earned in the accounting period but has not yet been received. The statement of cash flows is governed by ias 7, which mandates the classification of cash flows into operating, investing, and financing activities in a manner that is most. The problem of managing cash using the income statement and balance sheet happens since most businesses use accrual accounting to keep track of their business.

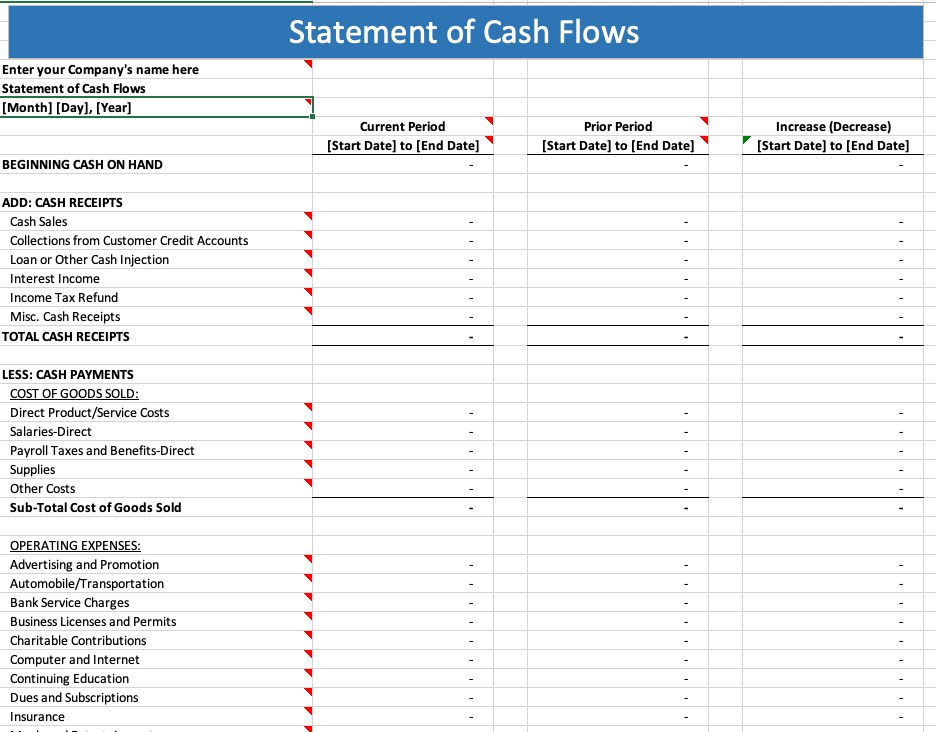

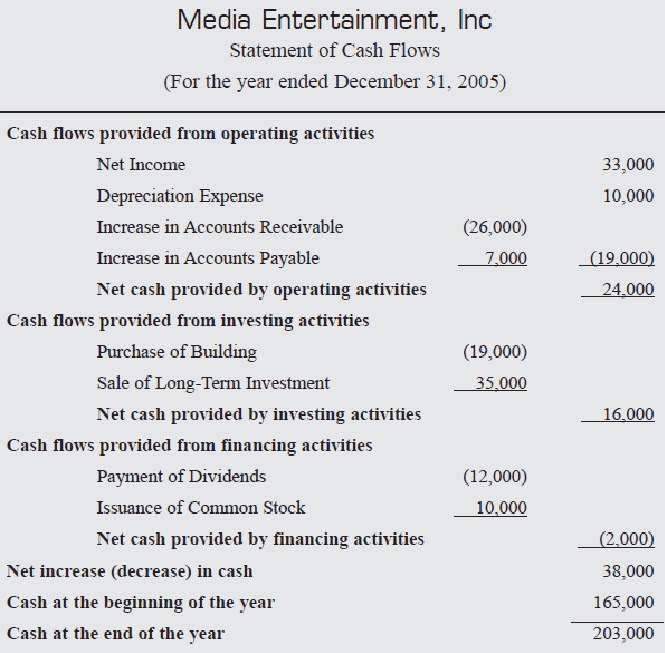

Determine net cash flows from operating activities. Accounting standards codification (asc) 230, statement of cash flows, addresses the presentation of the statement of cash flows. The statement of cash flows is prepared by following these steps:

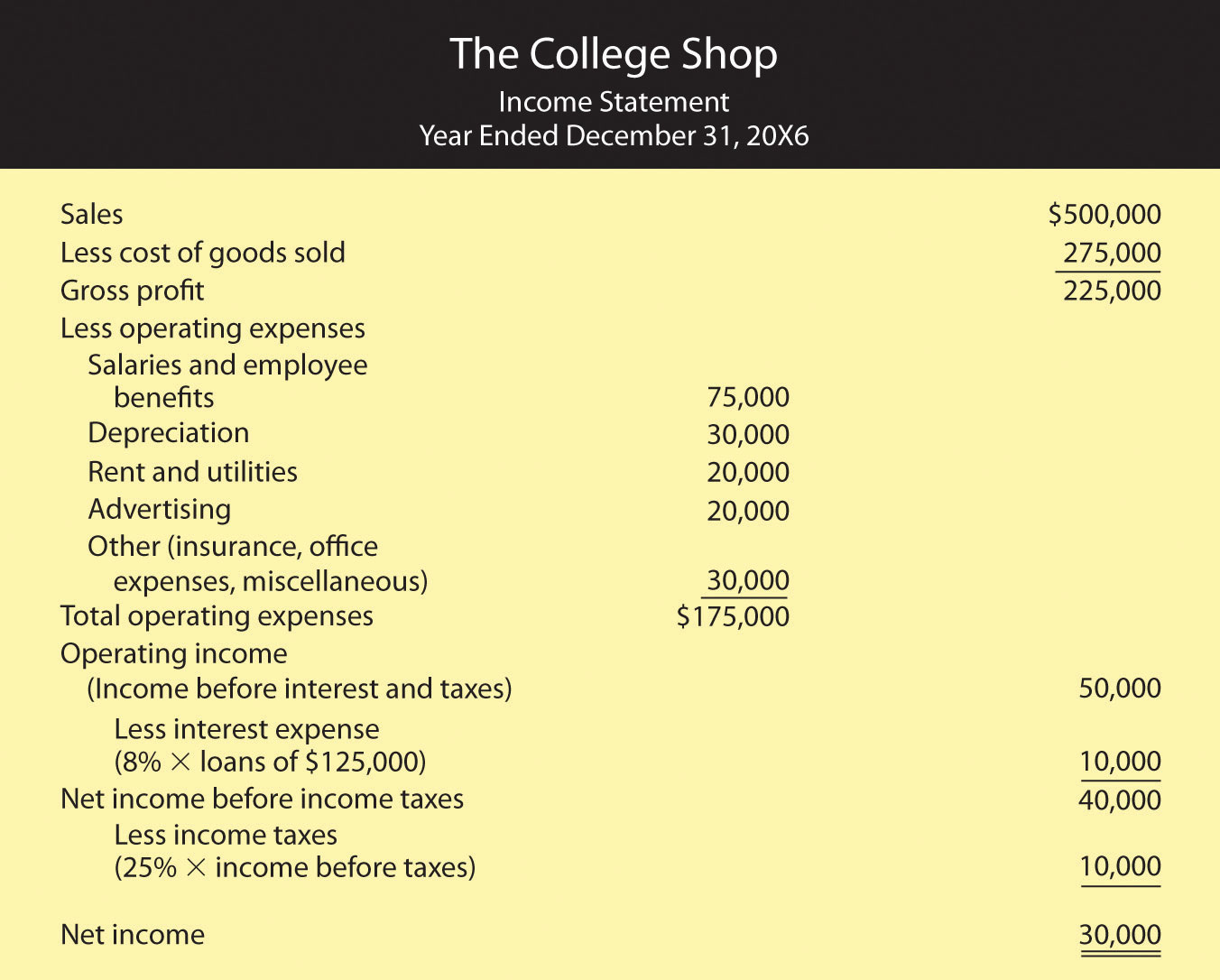

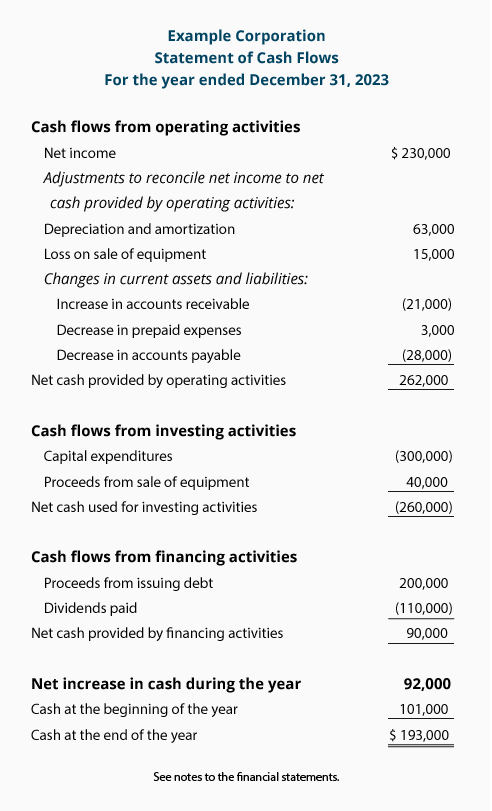

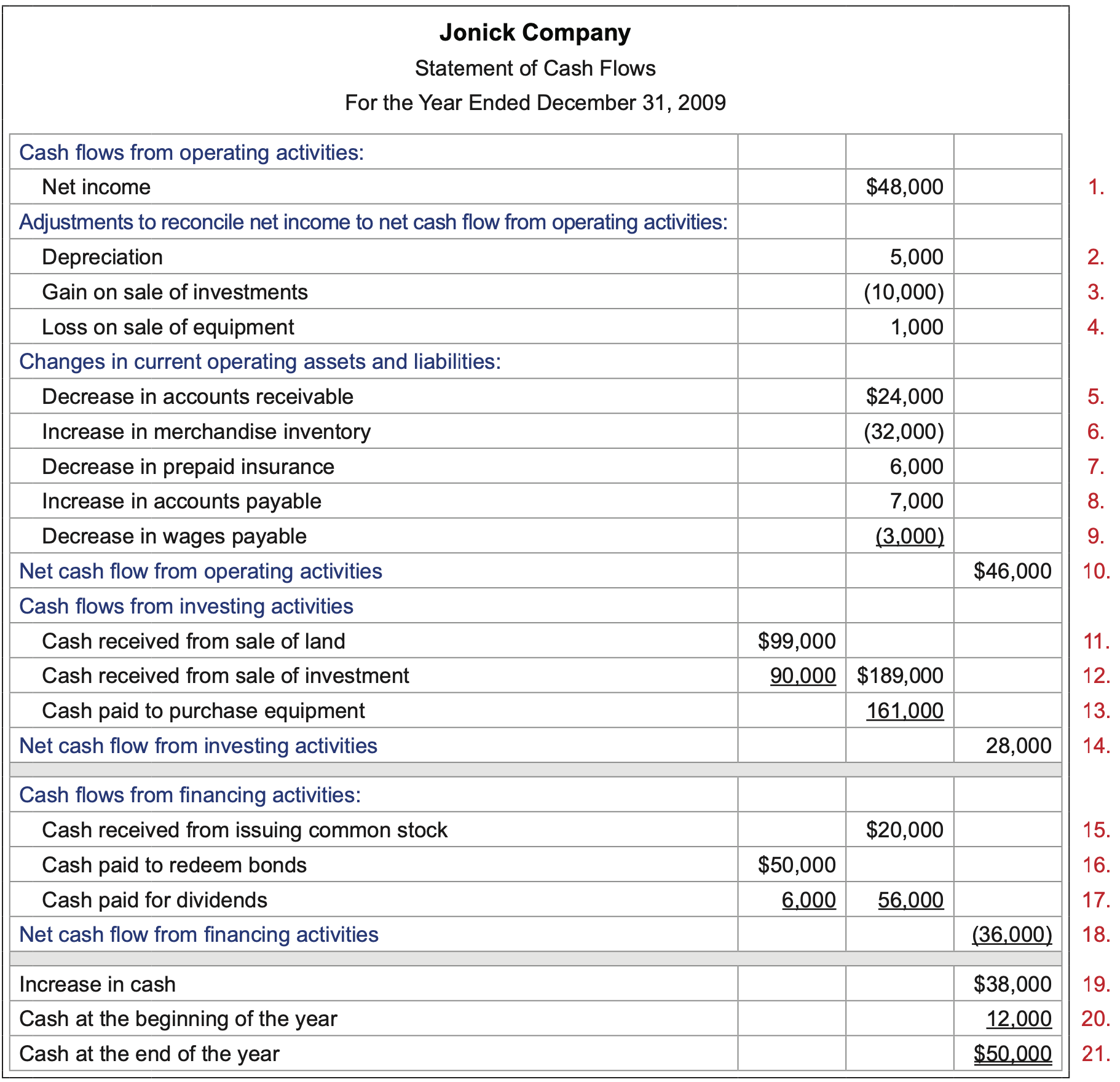

Now, to bridge the gap between the income statement and balance sheet we will show the decrease of this accrued liability in the cash flow statement since the effect wasn’t shown on the income statement. So we would take the net income, and work from there. A reminder the indirect method is working from the bottom of the income statement and adjusting it to the cash basis.

Changes in accrued liabilities absolutely affect cash flow, but not in the way you might expect. It is relevant to the fa (financial accounting) and fr. Remember, under accrual accounting, transactions are recorded when they occur, not necessarily when cash moves.

To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230. A statement of cash flows allows users to assess the ability of an entity to: An accrued wage is incurred and recognized on the income statement per the matching principle—in spite of the fact that the employees have not actually been.

A company has an accrued utility expense of $6,000 for the. In this case, it is necessary to record the extra income in. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

Accrued revenues and accrued expenses themselves have no impact on cash flow because neither cash nor cash equivalents have exchanged hands. Thus, the income statement does not provide all the. Accrued liabilities can temporarily affect cash flow by the amount.

The indirect method reports cash flows from operating activities into categories such as: Because the income often is reported before it has been received, it can be difficult for an organization to know if and. Cash flow statement:

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)