Amazing Tips About Warranty Expenses Are Reported On The Income Statement As

Accounting accounting questions and answers the balance of the estimated warranty llablity account on january 1, 2022 was $19,000.

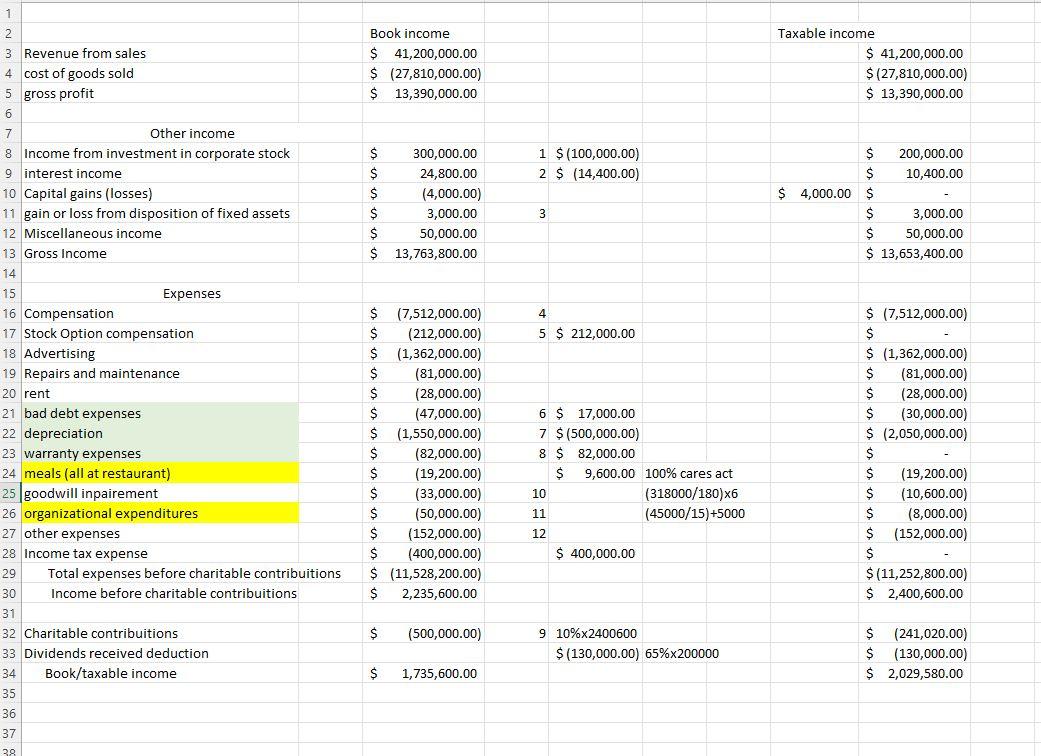

Warranty expenses are reported on the income statement as. When warranty claims are actually paid, there is no impact to the income statement. Units sold, the percentage that will be replaced within the warranty period, and the cost of replacement. The accounting treatment varies depending upon the type of warranty.

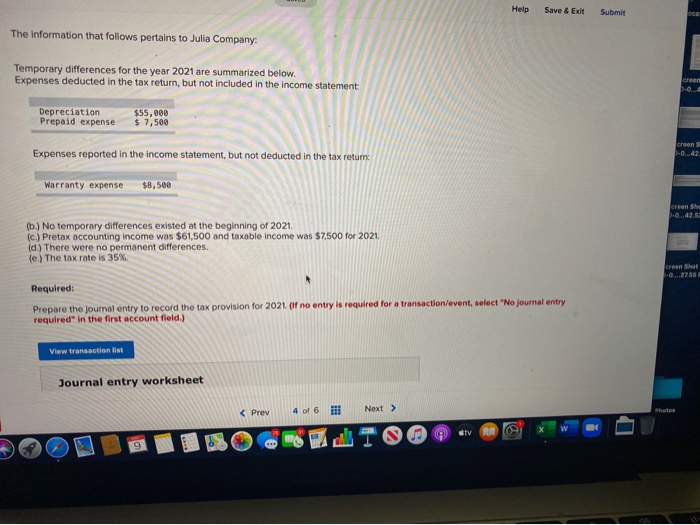

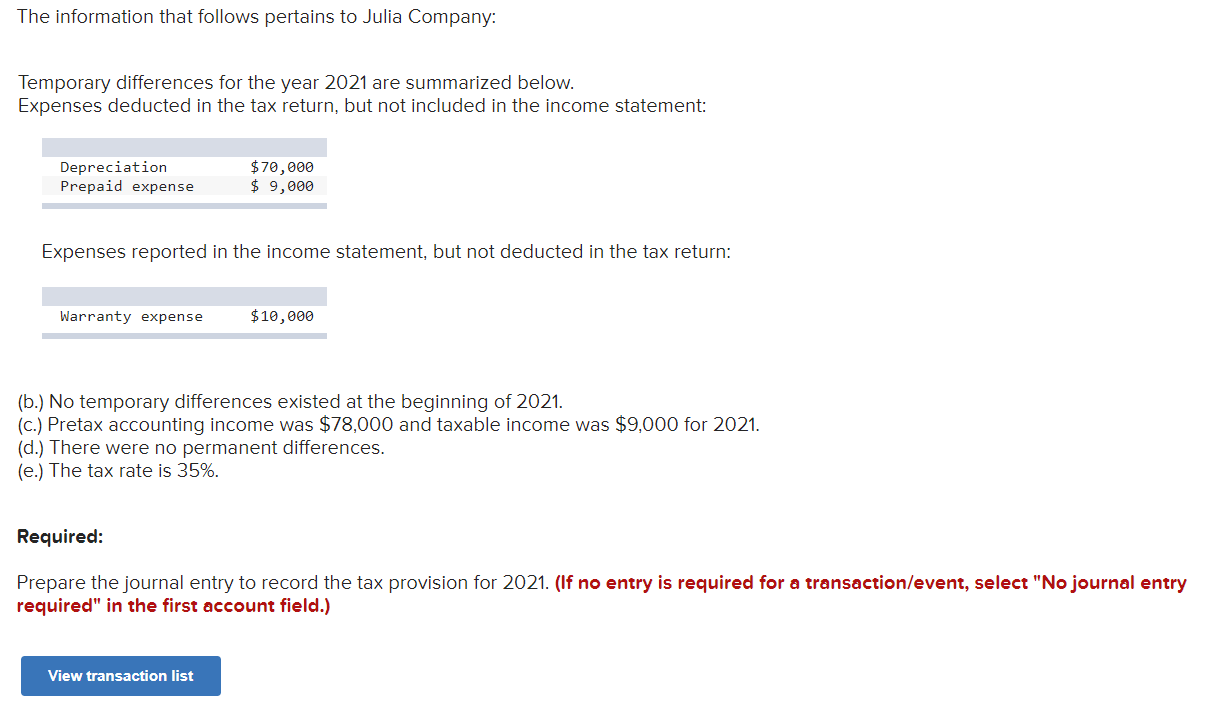

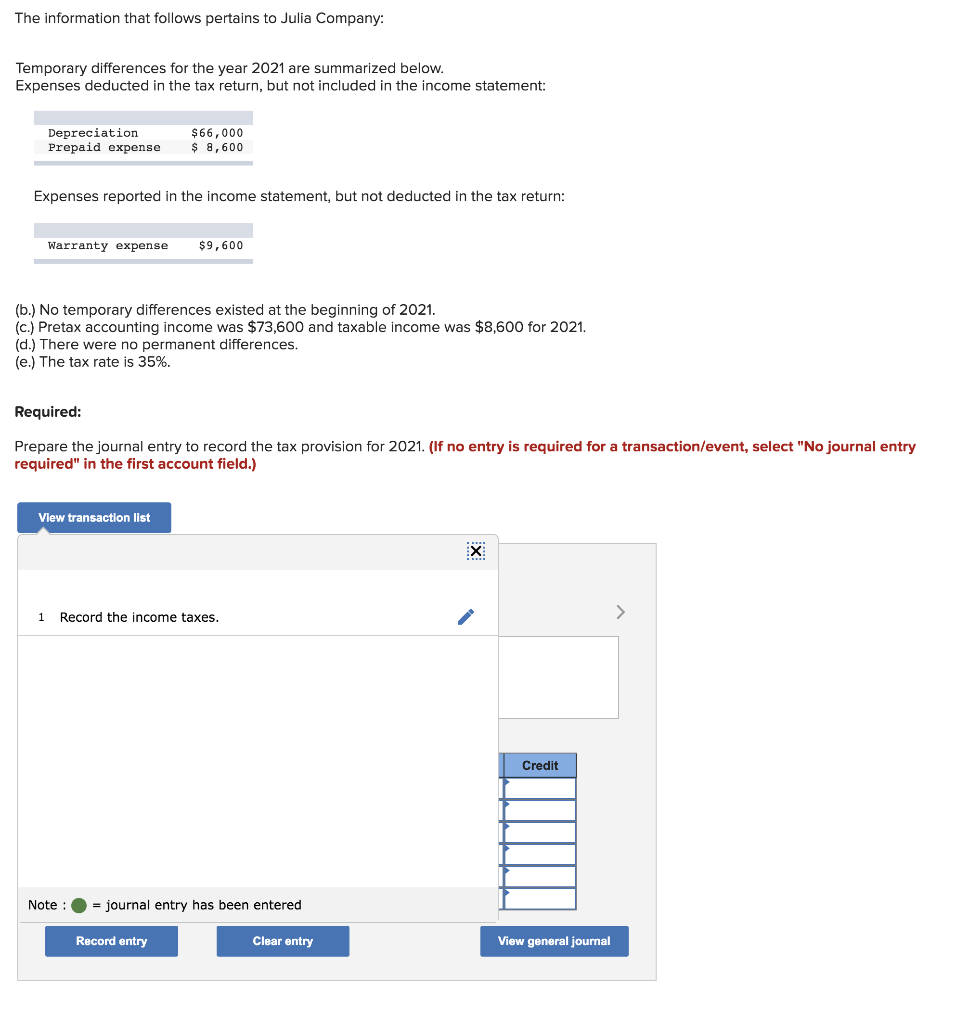

Warranty expense is recognized in the income statement when incurred, but warranty expense is deducted on the tax return when the warranty work is completed. Note that the expected future cost to repair or replace is matched. Warranty expense definition the expense associated with a commitment to repair or replace a product for a specified period of time.

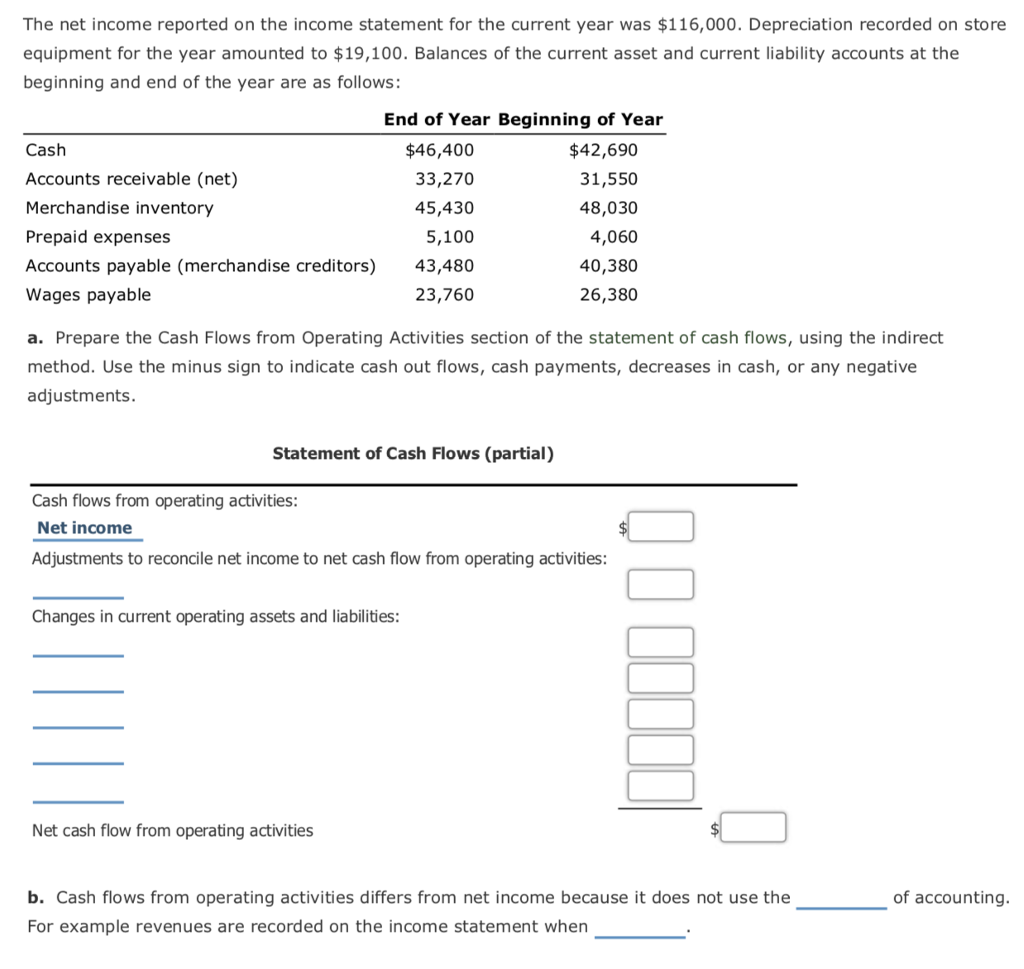

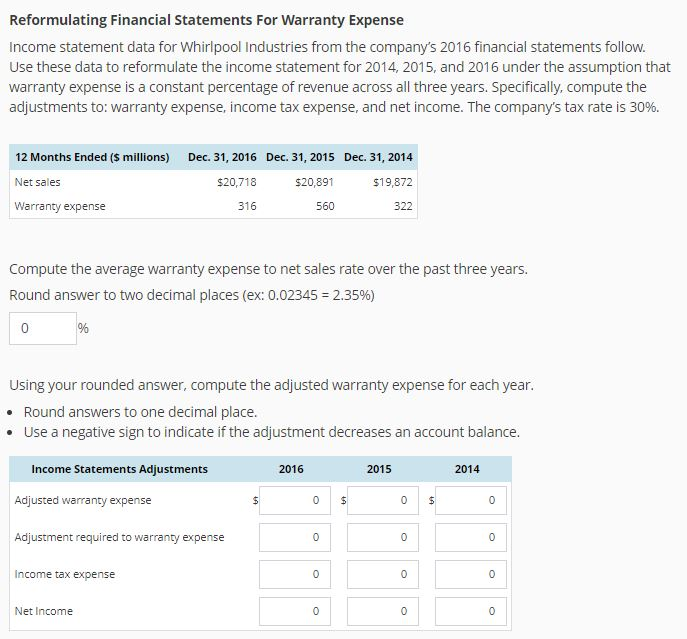

Warranty expense, income statement and statement of cash flows From an accounting perspective, according to the financial accounting standards board (fasb), warranty expenses should be recognized when they are probable and can be estimated. So, if a company estimates that warranty claims are.

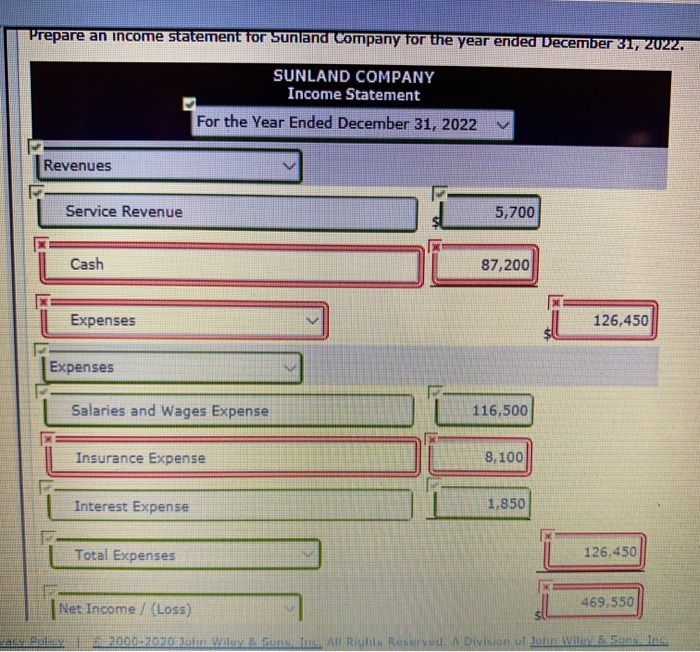

Part of cost of goods sold d. To record the warranty expense, we need to know three things: Warranty expenses are reported on the income statement as a.

While recording the event in the financial statements, the company will debit (charge) the warranty expense account and. Thus, the income statement is impacted by the full amount of warranty expense when a sale is recorded, even if there are no warranty claims in that period. The impact is only to the balance sheet.

As an example, general electric reported on its december 31, 2008, balance sheet a liability for product warranties totaling over $1.68 billion. Accounting for these costs is essential for. 200, actual warranty expenditures 50, the income tax rate is 30%.

Part of cost of goods sold. Warranty expenses are reported on the income statement as a. In accounting for warranties, cash rebates, the collectability of receivables and other similar contingencies, the likelihood of loss is not an issue.

Part of cost of goods sold. O part of cost of goods sold. That is certainly not a minor.

That is certainly not a. What is the warranty expense on an income statement? As an example, stanley black and decker reported on its december 31, 2022, balance sheet a liability for product warranties totaling over $99 million.

The expense should be reported on the. Warranty expenses are reported on the income statement as a. Warranty expenses are reported on the income statement as o administrative expenses.

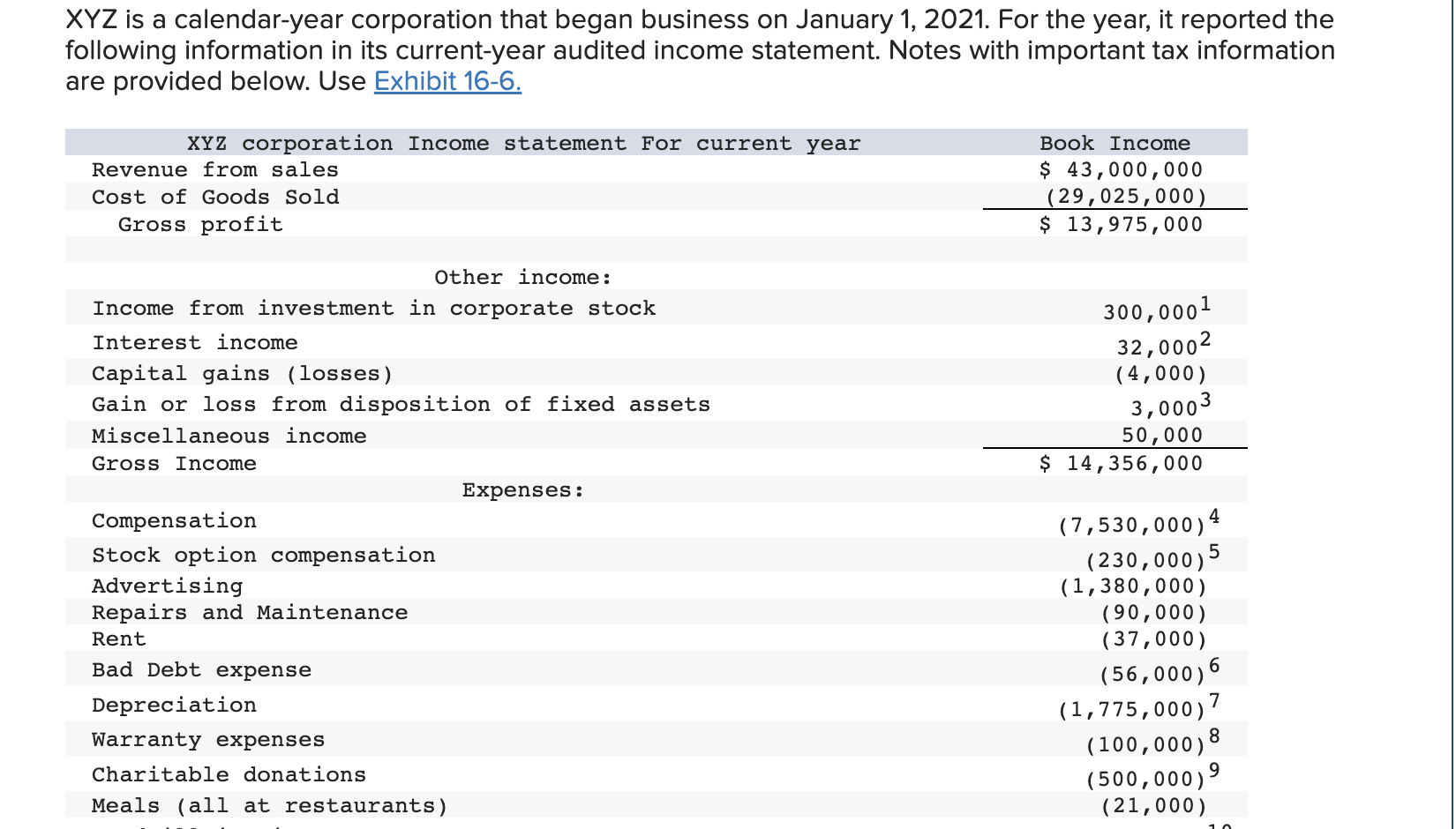

![[Solved] XYZ is a calendaryear corporation that b SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1546/8/7/2/6425c33674234a3f1546855269420.jpg)