Exemplary Info About Understanding The Cash Flow Statement

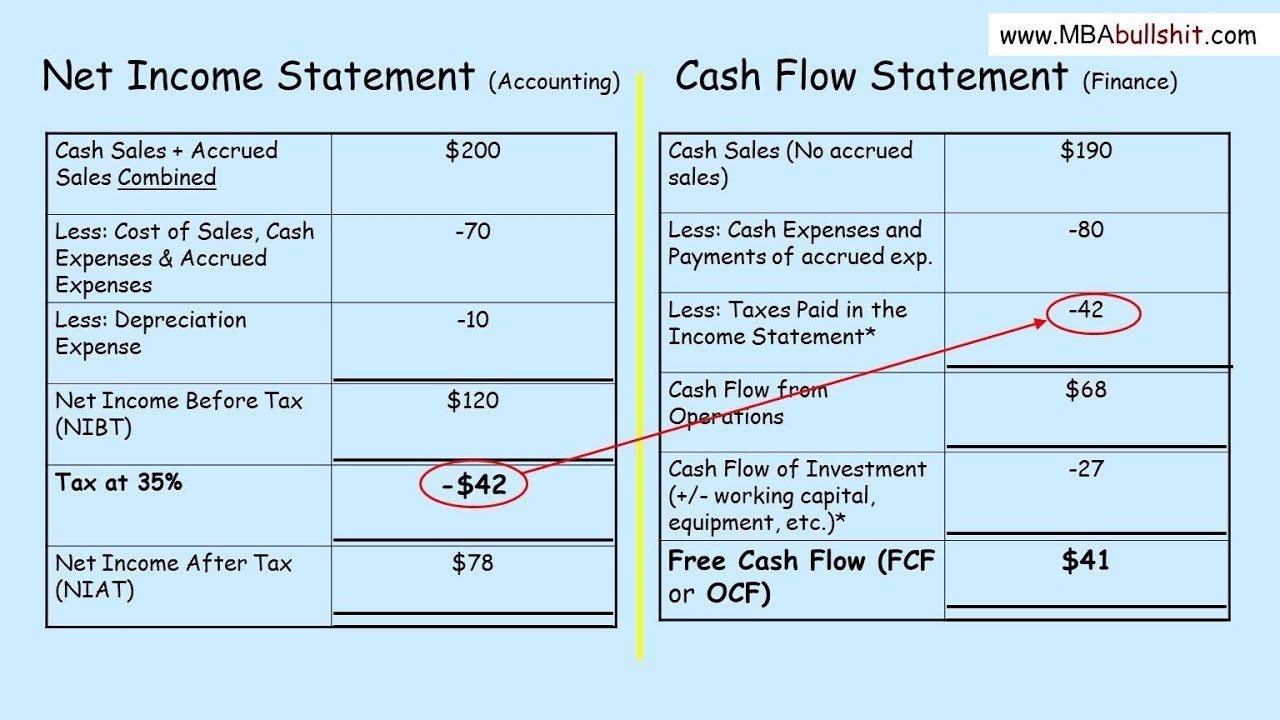

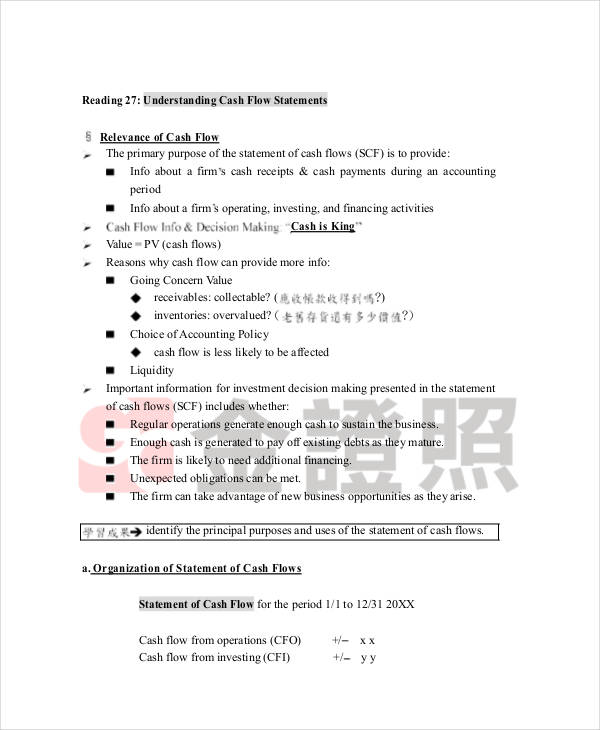

The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period.

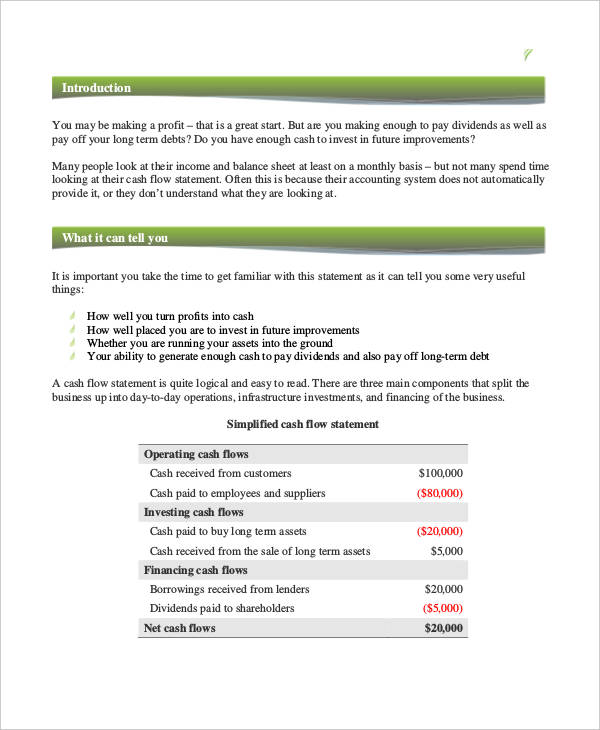

Understanding the cash flow statement. The cash flow statement gives us a picture of the company’s actual cash position. A document showing the timing of all cash going in and out of the business over a particular period of time. Key takeaways from this chapter.

Understanding the statement of cash flows by: A cash flow statement provides an overview of the money entering and leaving your business, providing essential insight into operations and helping inform. The cash flow statement is a standardized document that clarifies the state of a company's cash flow at a point in time.

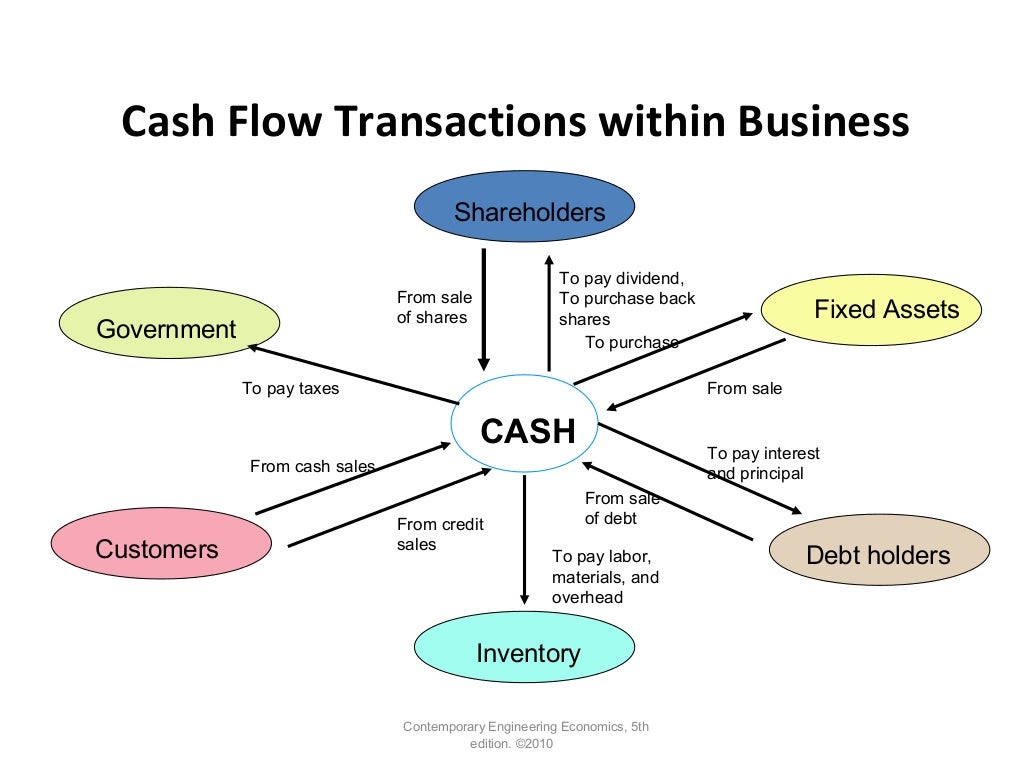

For positive cash flows, and to provide a. A legitimate company has three main. The cash flow statement is a financial document that gives a snapshot of the company’s cash flow, that is cash and cash equivalents flowing in and out of a company.

There are three primary components of the cash flow statement format, including: Cash flow generated by delivering goods and services, including. The sum of cash and cash.

The cash flow statement is a financial statement that reports a company's sources and use of cash over time. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of. Peter wilson describes the purpose, preparation, and uses of the statement of cash flows.

A cash flow statement looks at three components of core operations, investing, and financing in order to come to the final conclusion. The cash flow statement or statement of cash flows measures the sources of a company's cash and its uses of cash over a specific period of time. The purpose of a cash flow statementis to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)