Outrageous Info About Marginal Costing Income Statement

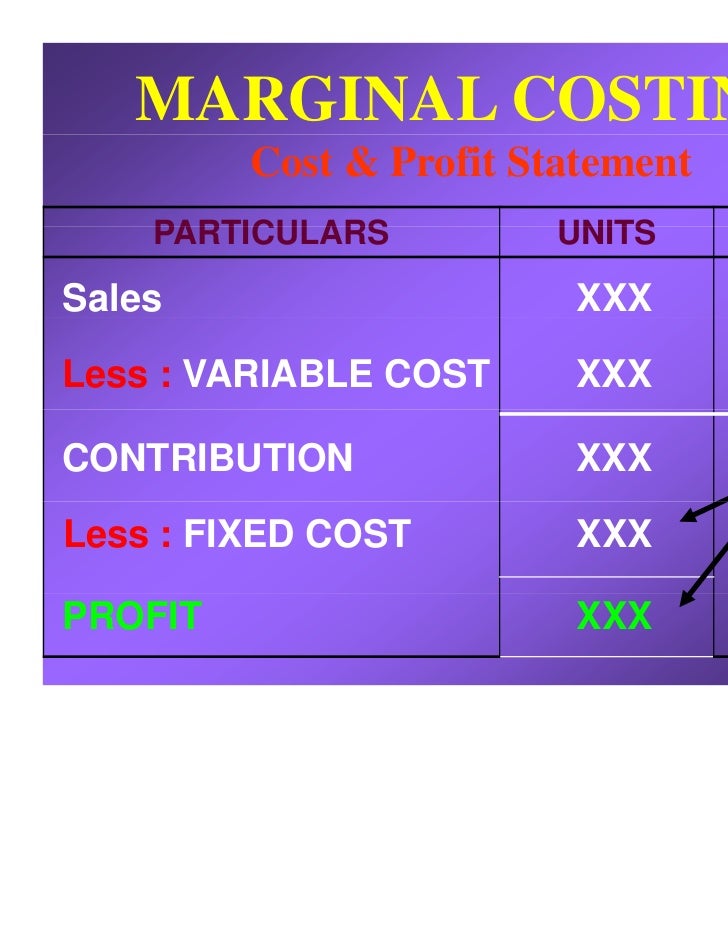

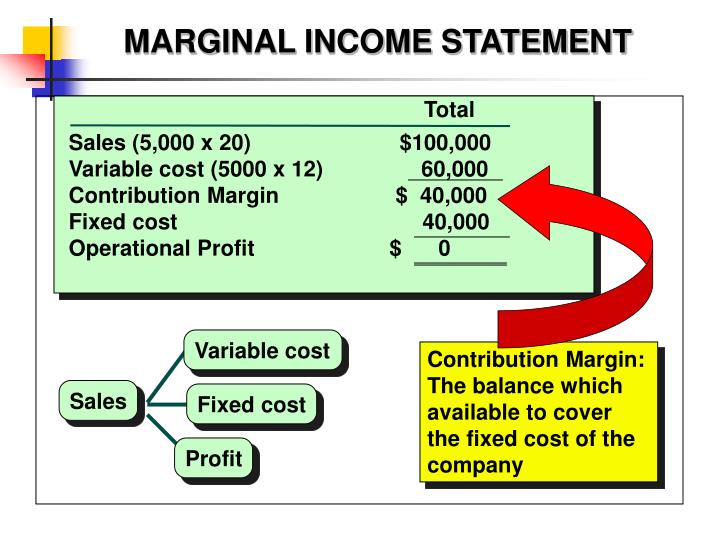

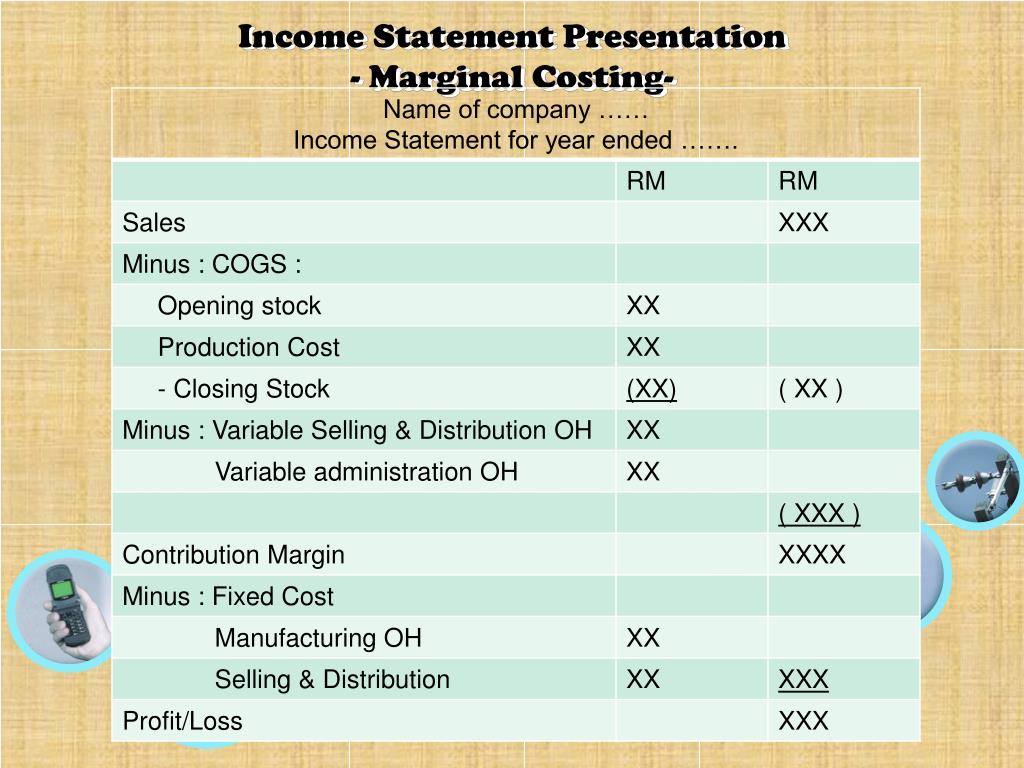

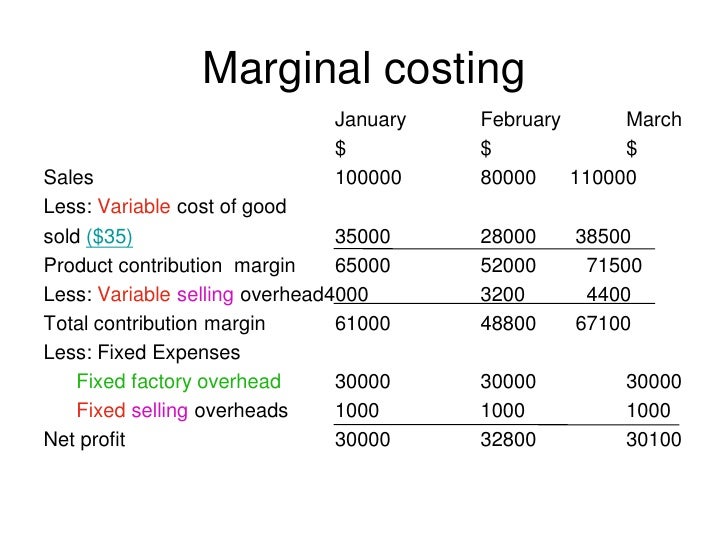

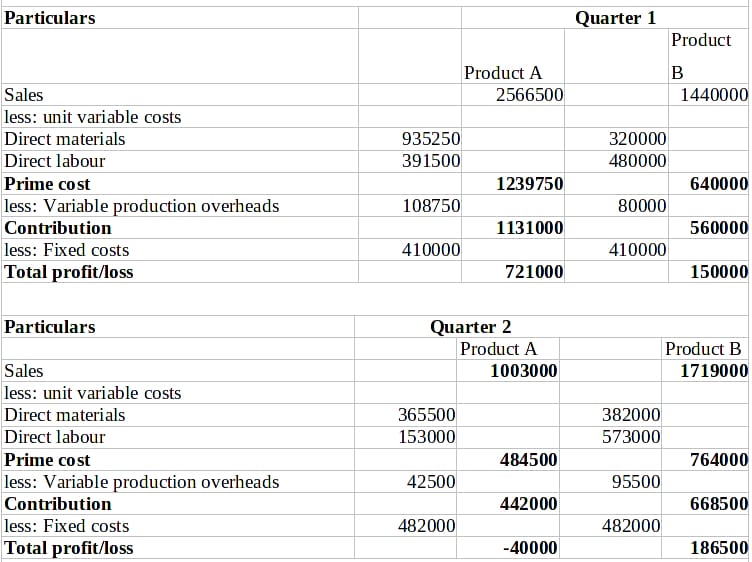

Income statement under low accounting it is seen that variable costs are deducted initially from the sales revenue to arrive at that contribution margin.

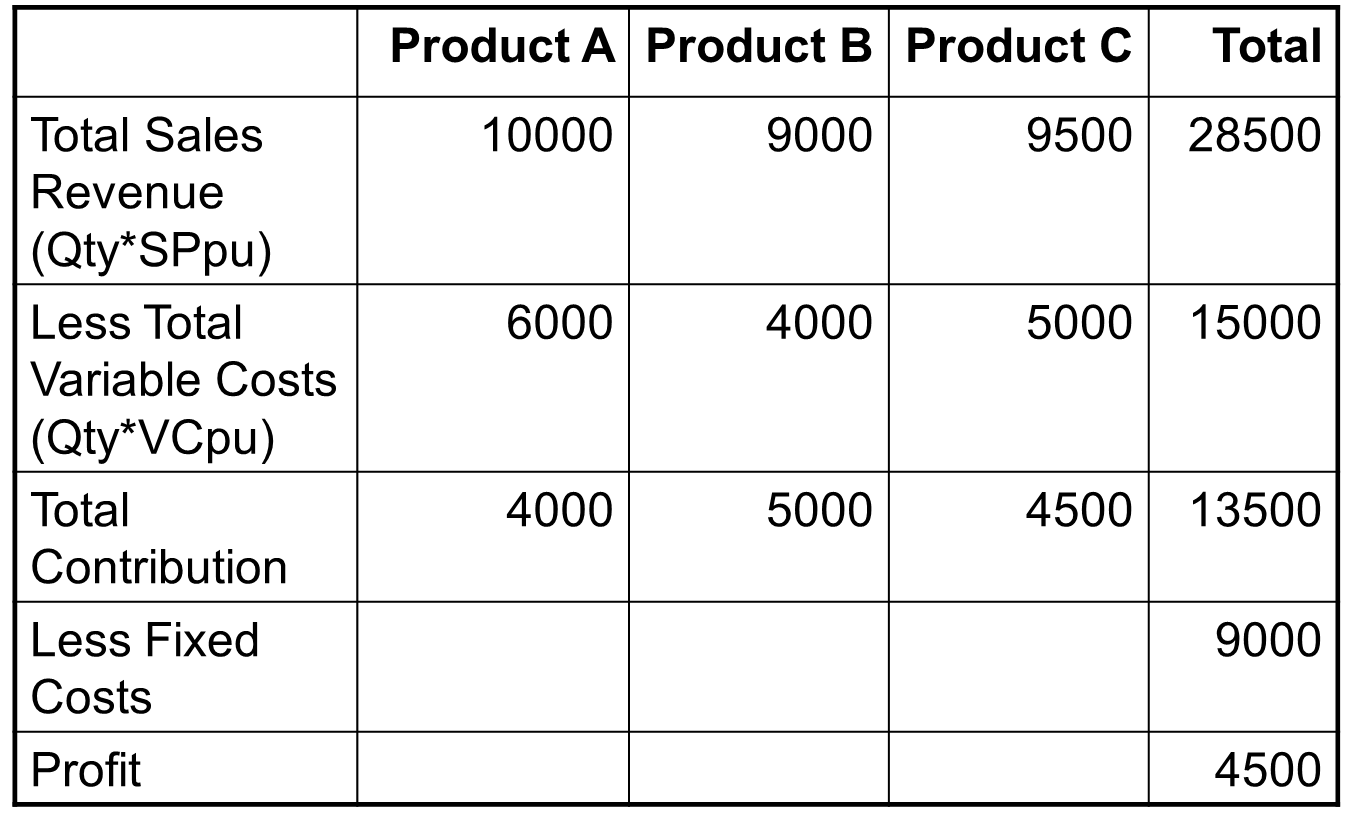

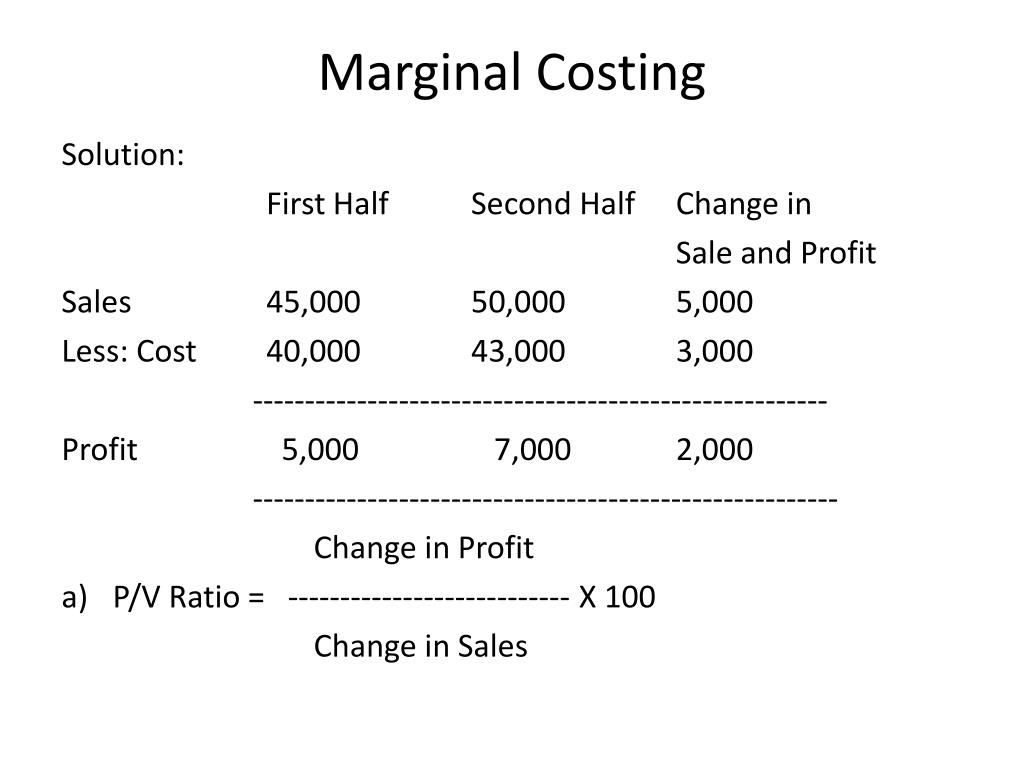

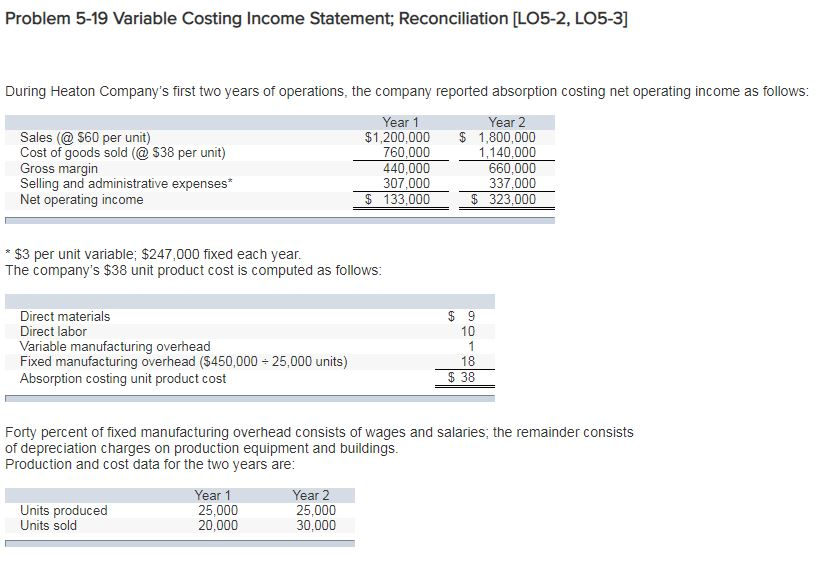

Marginal costing income statement. This means that after accounting for the variable costs, 40% of the sales revenue is left to cover the fixed costs of. Income statement (absorption and marginal cost income statements) introduction 00:00 components of product costs. This gives a contribution ratio of 40%.

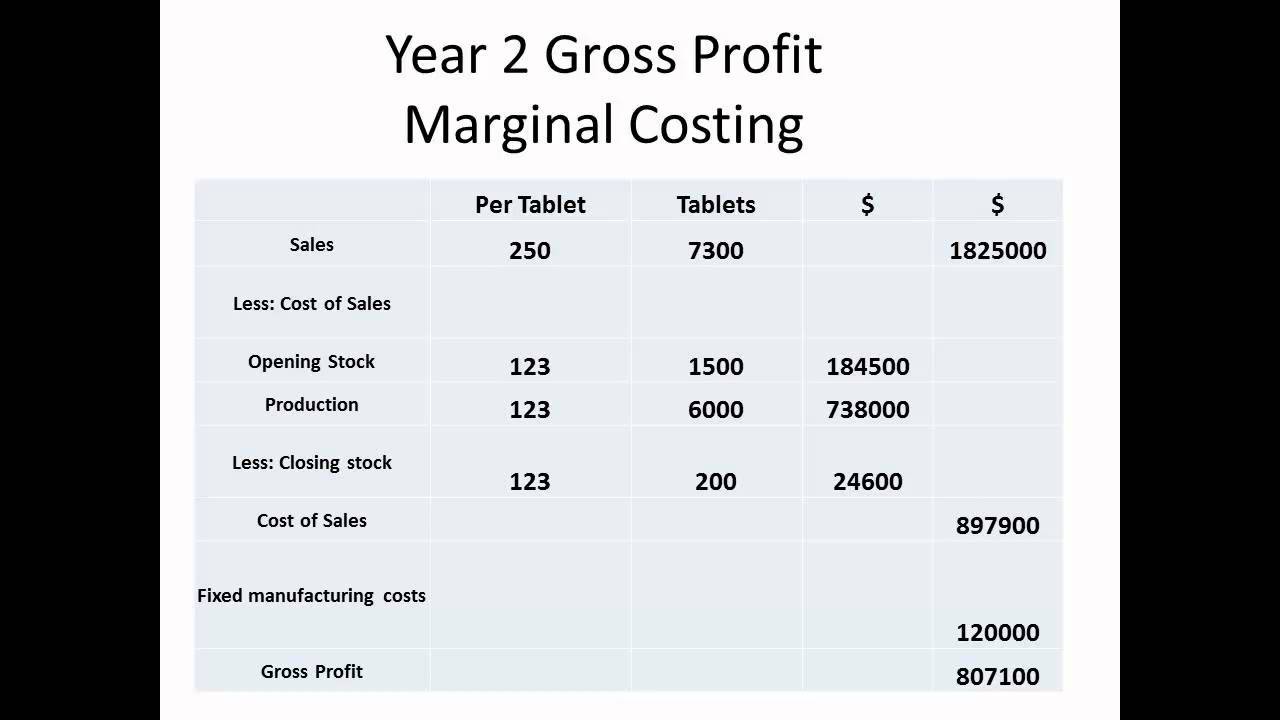

Under this case, the income under absorption costing may. Therefore, $18,000 is the mc per sedan. Closing inventories are valued at marginal production cost.

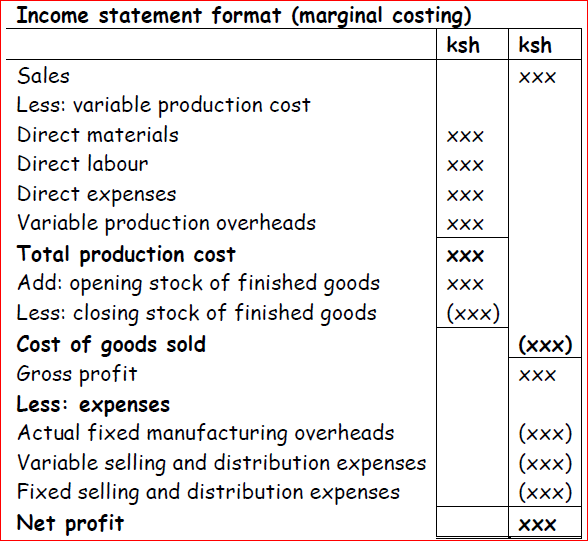

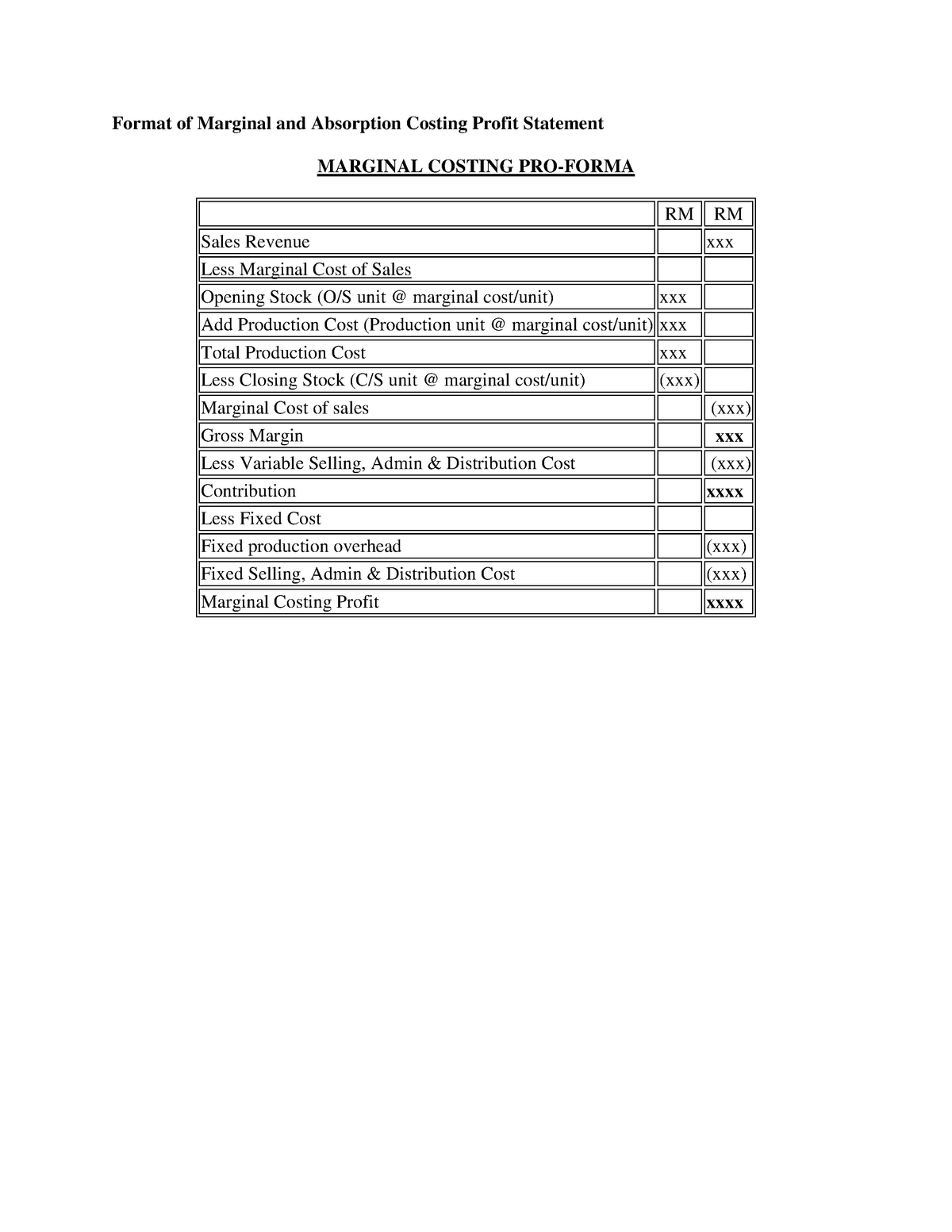

Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total. Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. Marginal cost = change in total expenses / change in quantity of units produced the change in total expenses is the difference between the cost of.

We get, mc = $180,000/10 = $18,000; Simple explanation of the difference between absorption costing and marginal costing (variable costing) and how to create income statements according to the two costing. Cost accounting, chapter2:

Using the marginal costing equation, mc = δtc/ δq. Under marginal costing technique, income statement is presented in the following format: Preparation of income statement under marginal and absorption costing (1) when there is production but no sales:

Advantages disadvantages conclusion marginal costing formula format of income statement under marginal costing examples of marginal costing to understand the. This paper aims to look at how income statements are prepared using marginal and absorption costing. Treats fixed and variable cost separately and shows.

Marginal costing income statements are more useful for analyzing inventory and production costs, while absorption costing is required under some. The contribution margin, as we can see, is $720,000. We can also find out the contribution ratio by dividing the contribution margin by the sales revenue.

The absorption costing method charges all direct costs to the. Simple explanation of the difference between absorption costing and marginal costing (variable costing) and how to create income statements according. Marginal costing overview in marginal costing fixed production overheads are not absorbed into products costs.

Gross profit = 600u x gross profit $10 = $6,000.