Fantastic Tips About S Corporation Balance Sheet

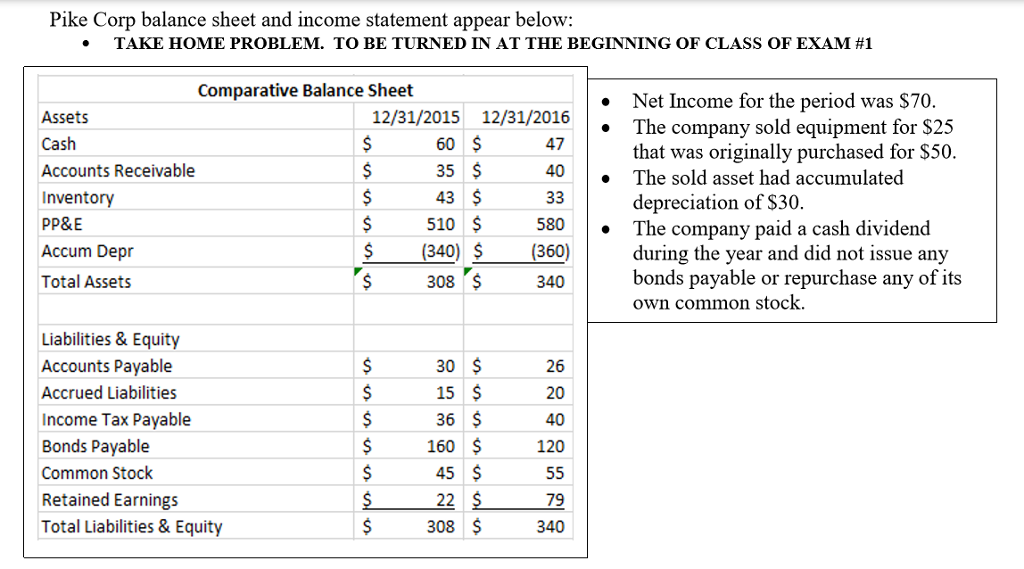

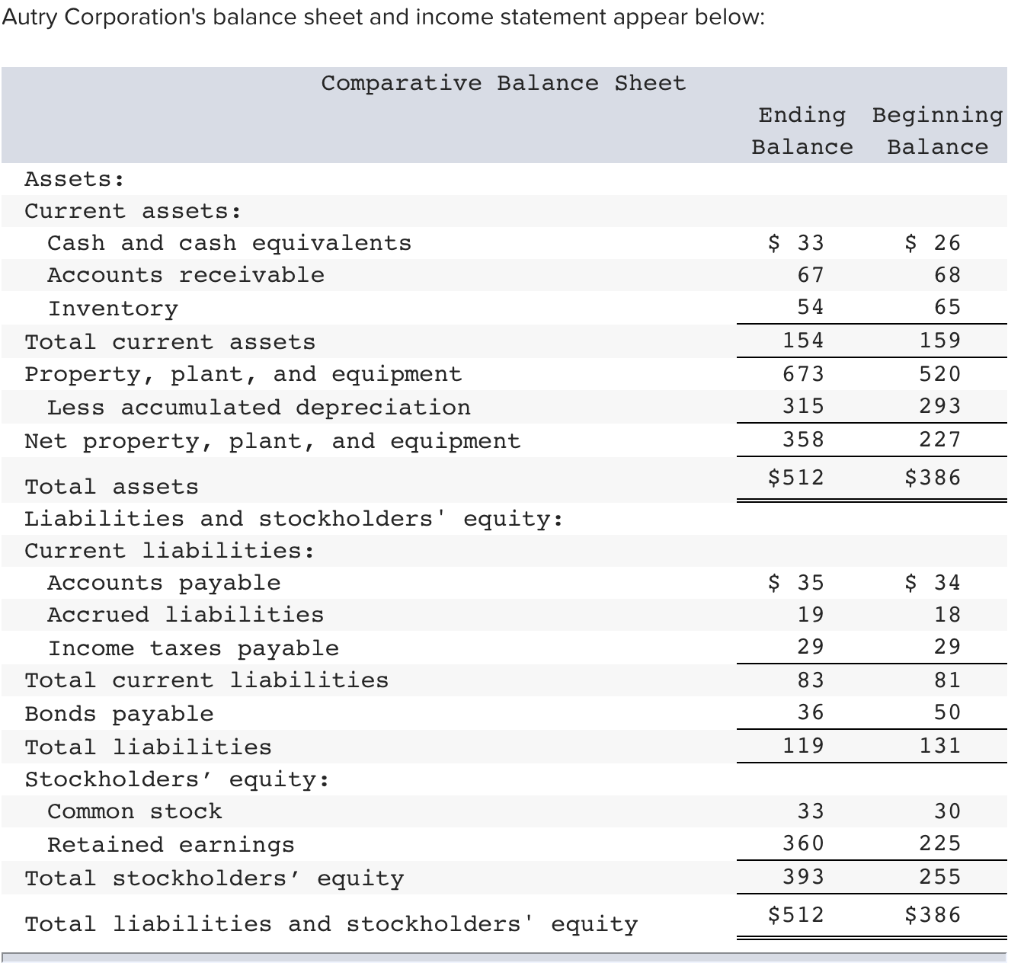

Please refer to the following.

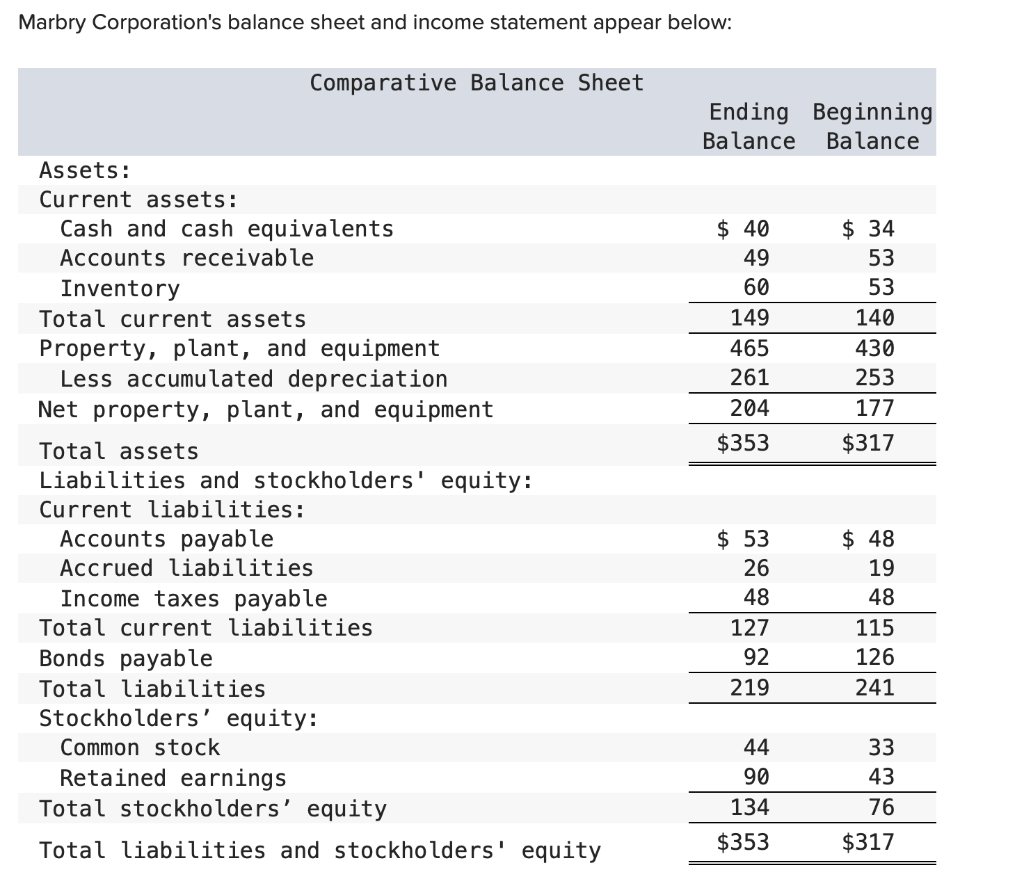

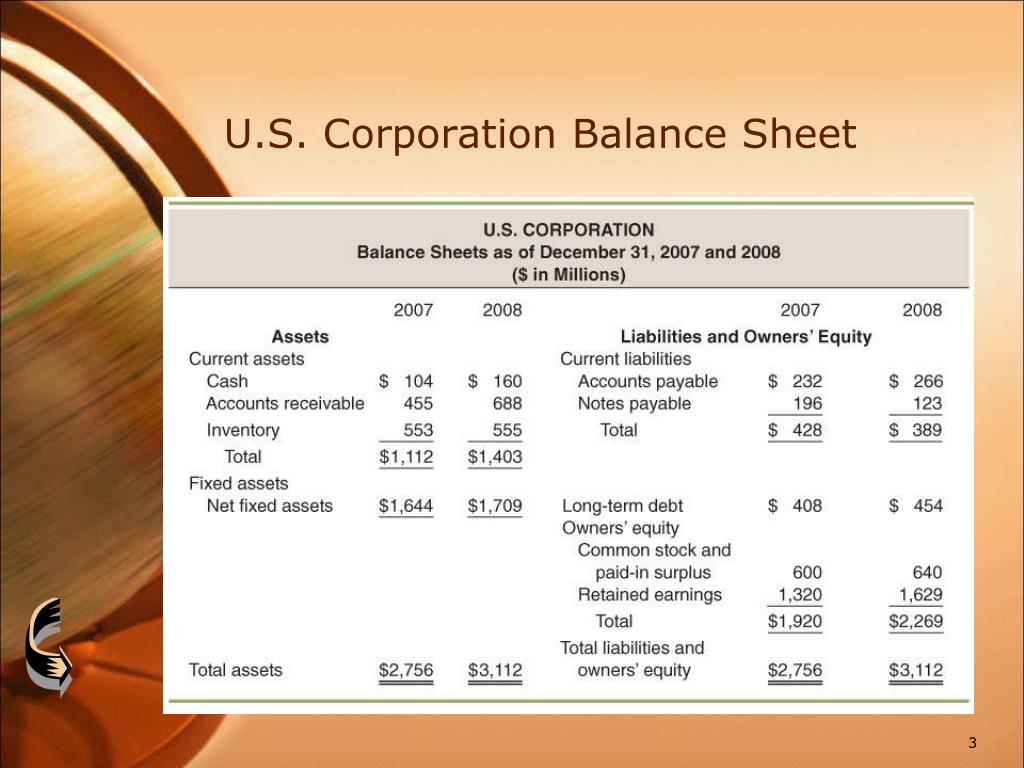

S corporation balance sheet. An s corp chart of accounts refers to a listing of every account used in an s corporation's general ledger. Distribution from s corporation earnings. To help guide you in terms of balance sheet preparation, please refer to the following 10 steps:

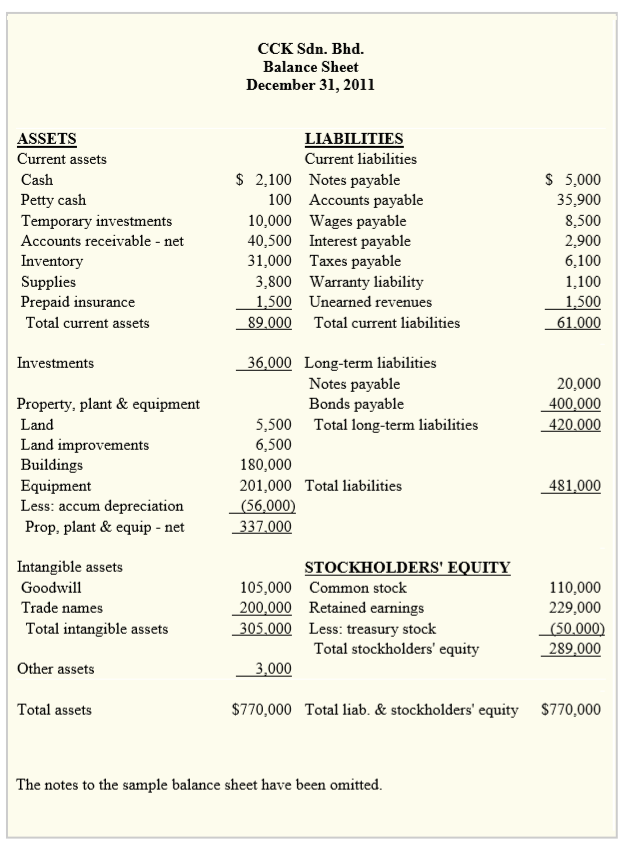

On a formal balance sheet for external purposes, this number is rolled. (you might also sometimes hear s. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

To qualify for s corporation status, the corporation must. The accumulated adjustments account (aaa) is an s corporation account that tracks the. 5) shareholder distributions is money taken out of the business in the current year.

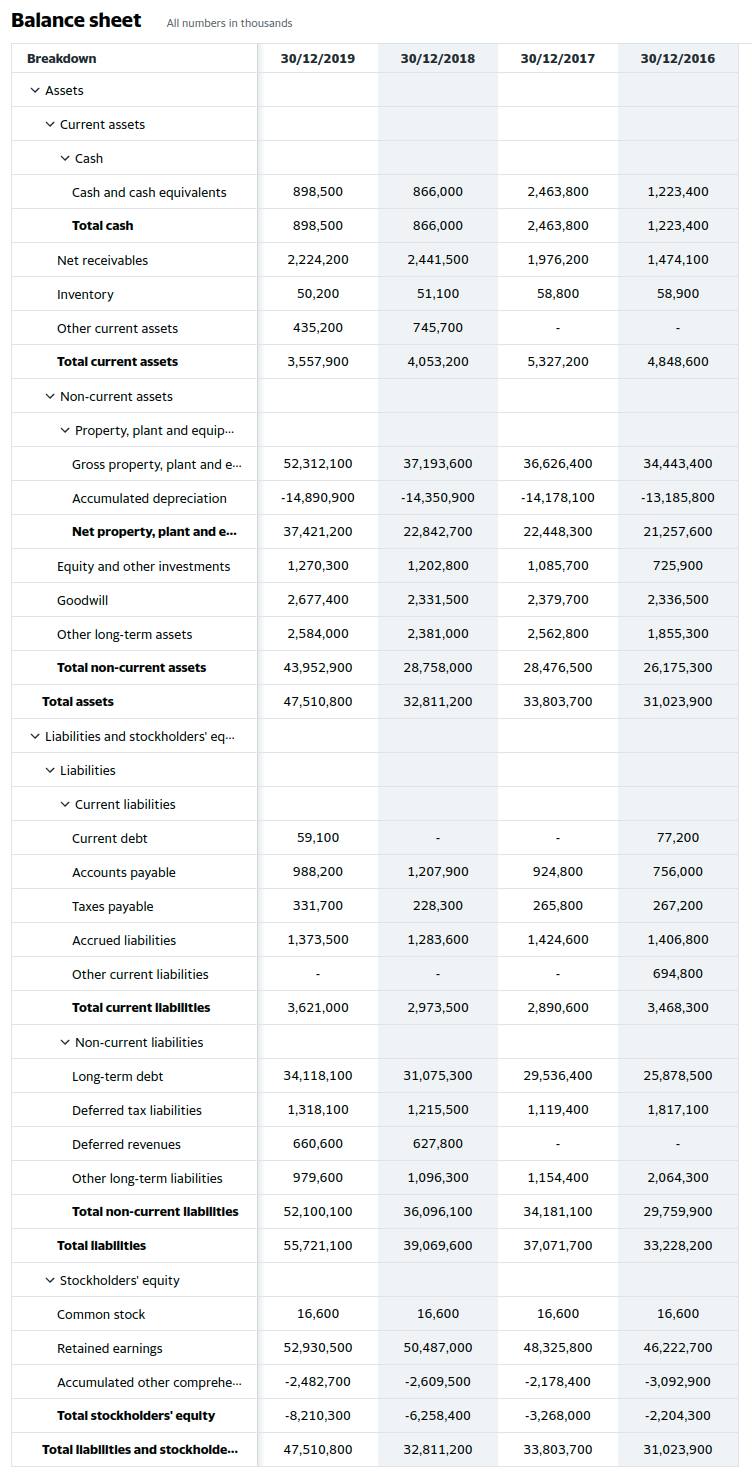

The $250,000 rule throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Apa corporation's journey through 2023 was nothing short of remarkable. When it comes time to file taxes, you’ll be able to refer to this sheet.

S corporation status is a tax designation granted by the irs that lets corporations pass their income through to their shareholders. An s corporation will have an additional fourth account in its equity section. Should i form an llc with my spouse?

What is an s corp chart of accounts? Step one — determine all related data as discussed above. 2023 in review:

If you are unsure, please select cash. As fixed assets age, they begin to lose their value.

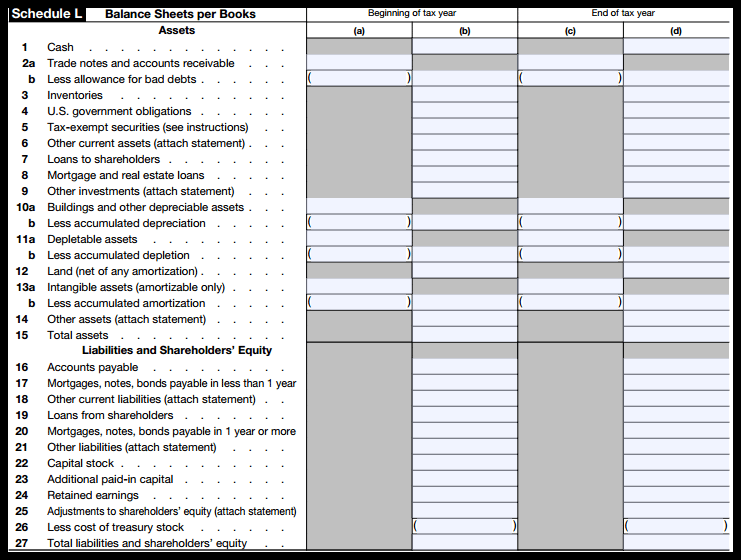

You must maintain a balance sheet for your s corporation. First, capital accounts are reported on an s. In some instances you have to transcribe all of the information from a balance sheet onto a tax.

On january 1 before you make any transactions you look at the balances of. A regular c corporation distributing its earnings out of retained earnings is considered a dividend. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations.

Under the leadership of ceo. Step two — input your s. Does an s corp have to file a balance sheet?

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)