Brilliant Strategies Of Info About Balance Sheet Total Liabilities And Equity

Graph and download economic data for balance sheet:

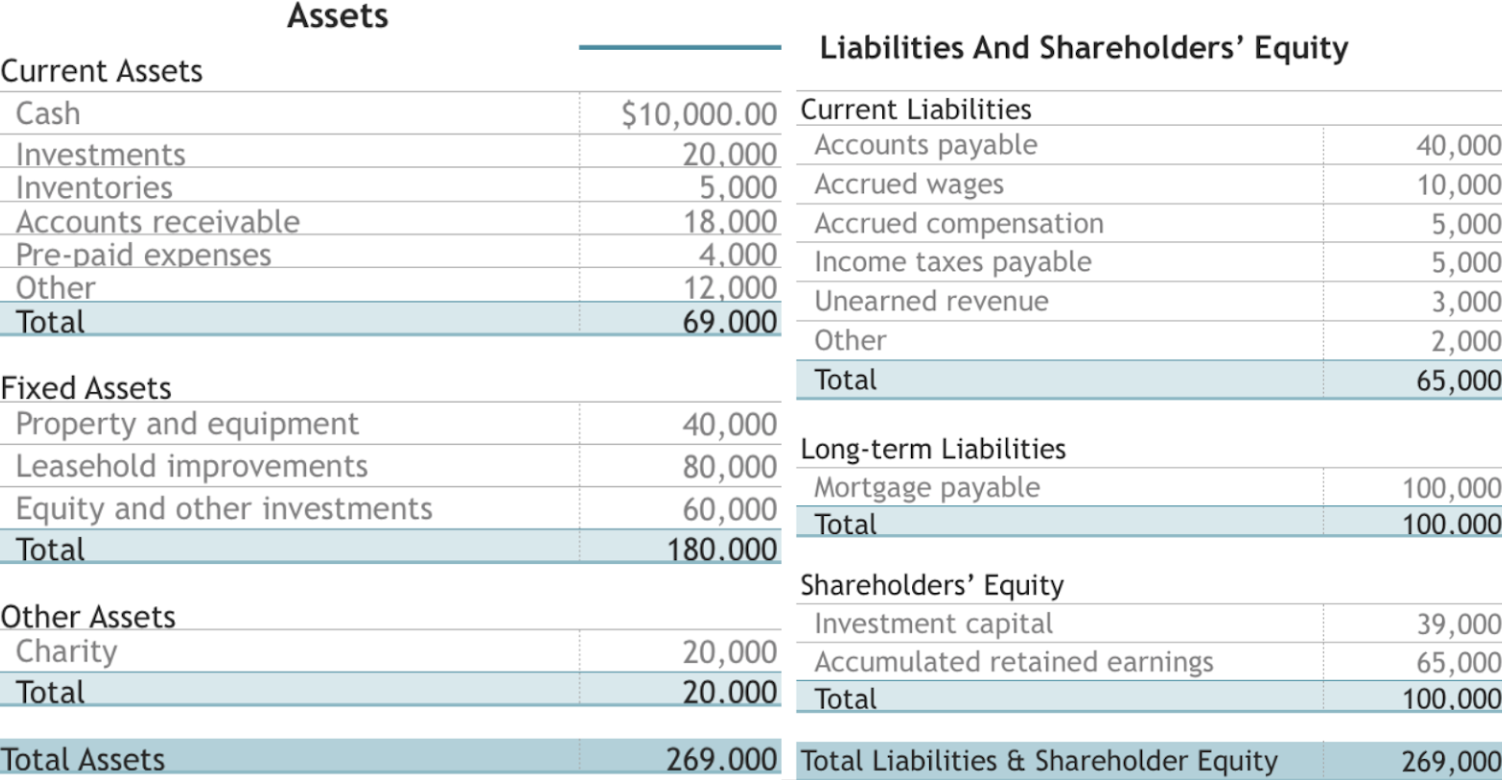

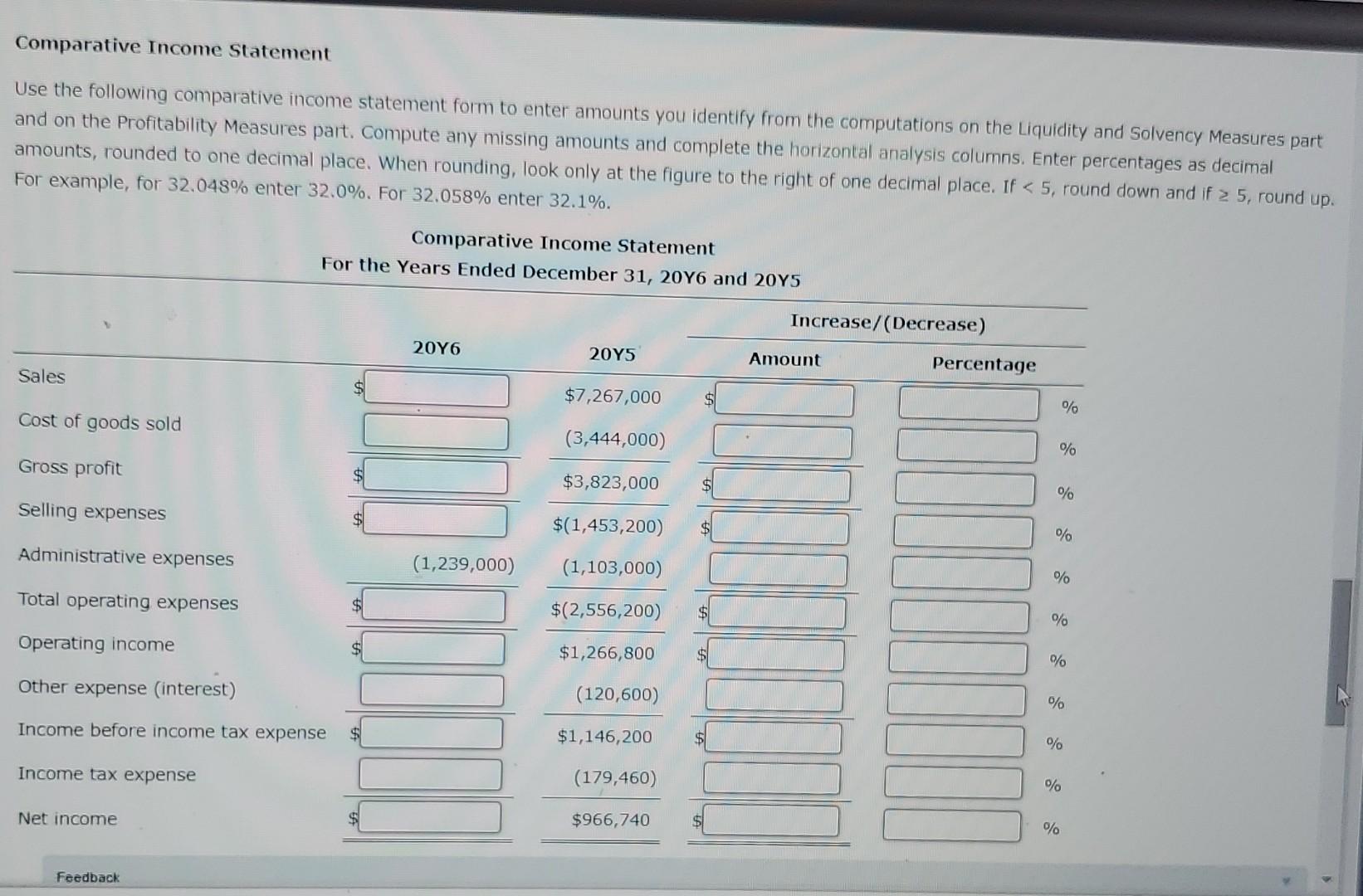

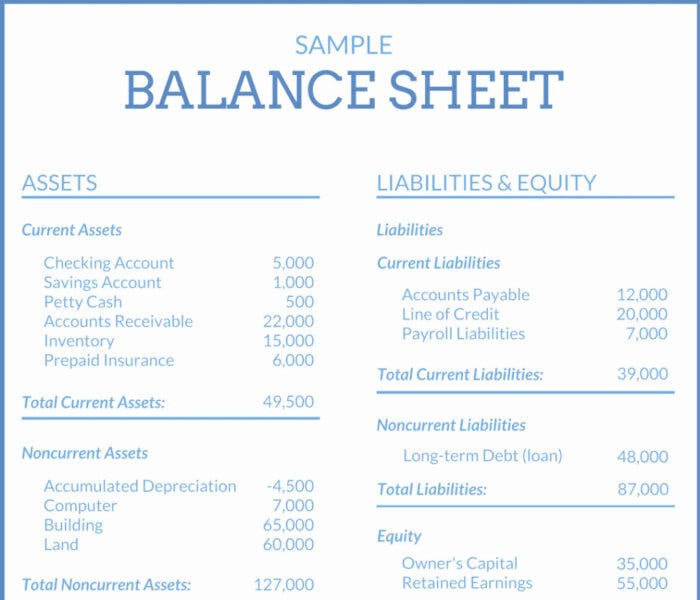

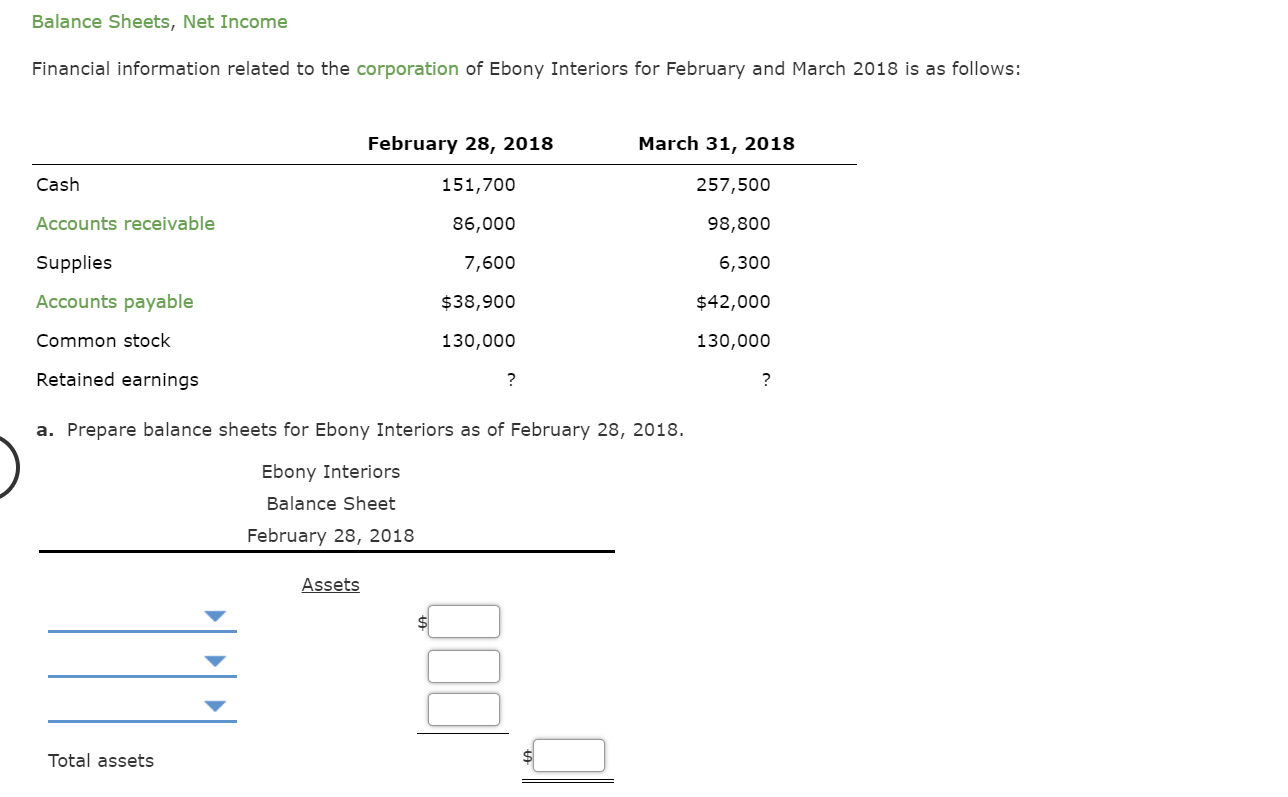

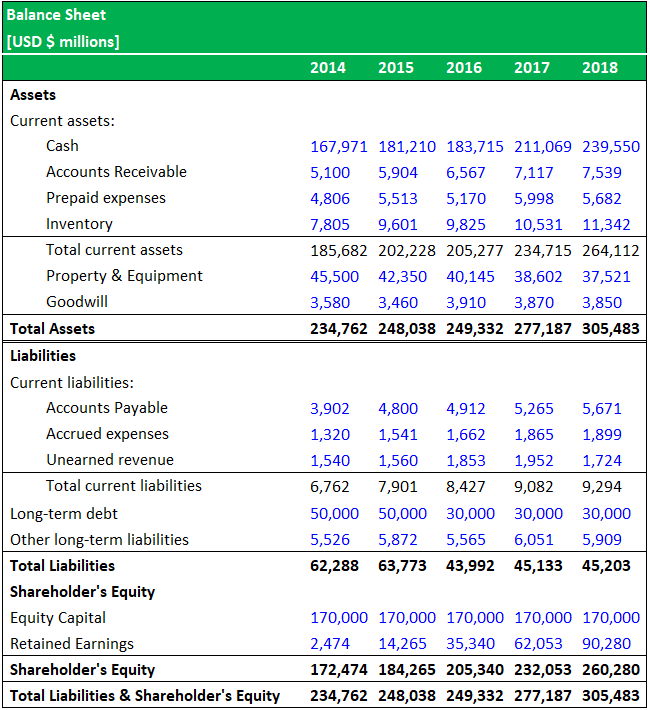

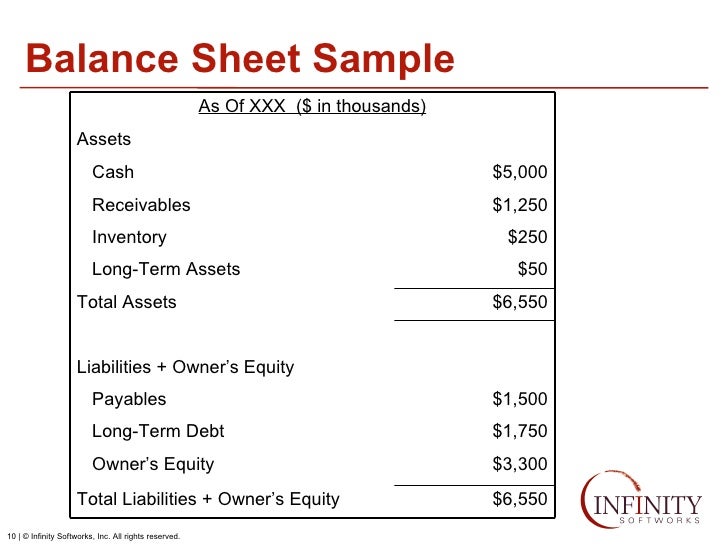

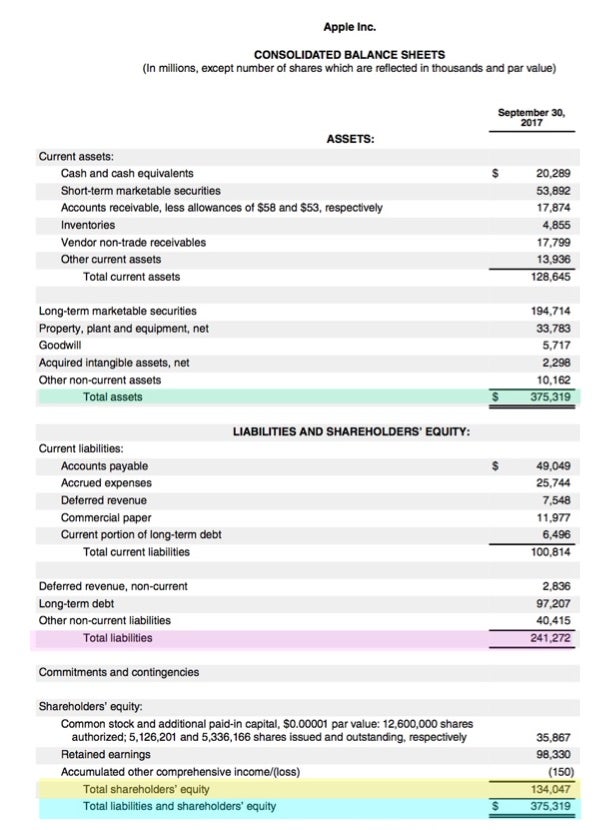

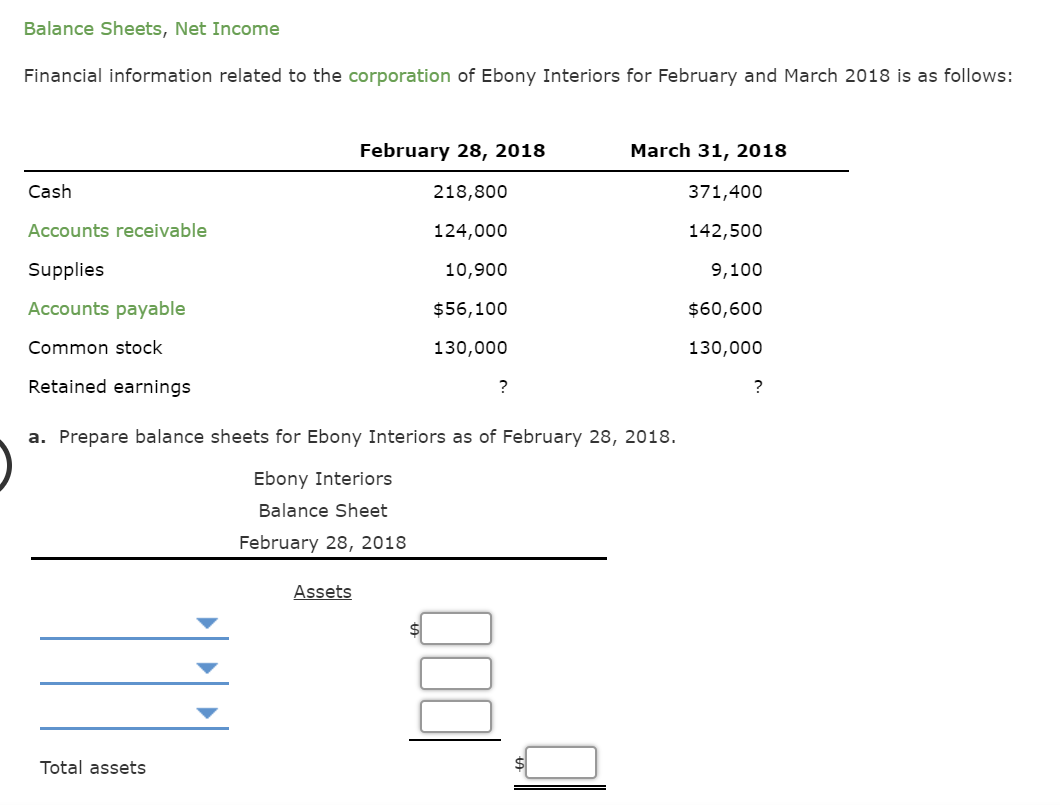

Balance sheet total liabilities and equity. If prepared correctly, the total assets on the balance sheet. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Prepare a balance sheet.

It can also be referred to as a statement of net worth or a statement of financial position. Below liabilities on the balance sheet, you'll find equity, the amount owed to the owners of the company. The balance sheet as of december 31, 2018, for delicious desserts, inc., a fictitious bakery, is illustrated in table 14.1.

A =l+e a = l + e. You’ve already calculated owner’s equity on the statement of owner’s equity as $17,350, so now let’s account for the assets and liabilities. For the balance sheet to balance, total assets should equal the total of liabilities and shareholders' equity.

Below, we’ll break down each term in the simplest way possible, how they relate to each other, and why they’re relevant to your finances. And it only reflects profit to the extent that it affects shareholders’ equity. The balance sheet highlights the financial position of a company at a particular point in time (generally the last day of its fiscal year).

The balance sheet doesn’t show cash movements in and out of the business during a trading period. Common or preferred stock are types of. To create a balance sheet, assets should equal liabilities plus equity (assets = liabilities + equity).

This is probably where you come in as an investor. Total assets = liabilities + owner’s equity. Assets = liabilities + equity.

Total liabilities and equity: Cash & short term investments: Graph and download economic data for balance sheet:

Initially, a spreadsheet for each category can help you keep tabs on these key numbers. But what do these words really mean? The three main categories of.

At the very bottom of the balance sheet, you will see totals for assets and liabilities plus equity. The balance sheet shows the accounting equation: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

A single balance sheet doesn’t tell you how a company’s financial position has changed. November 25, 2019 accountants use the words assets, “liabilities” and “equity” a lot. This typically means they can either be sold or used by the company to make products or provide services that can be sold.

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

![[Solved] Required a. For the balance sheet, identify how](https://media.cheggcdn.com/media/1fa/1fa88419-d3af-4dc0-ae82-cc7695ce9b66/phpfl6iz4)