Underrated Ideas Of Info About Capital Contribution Balance Sheet

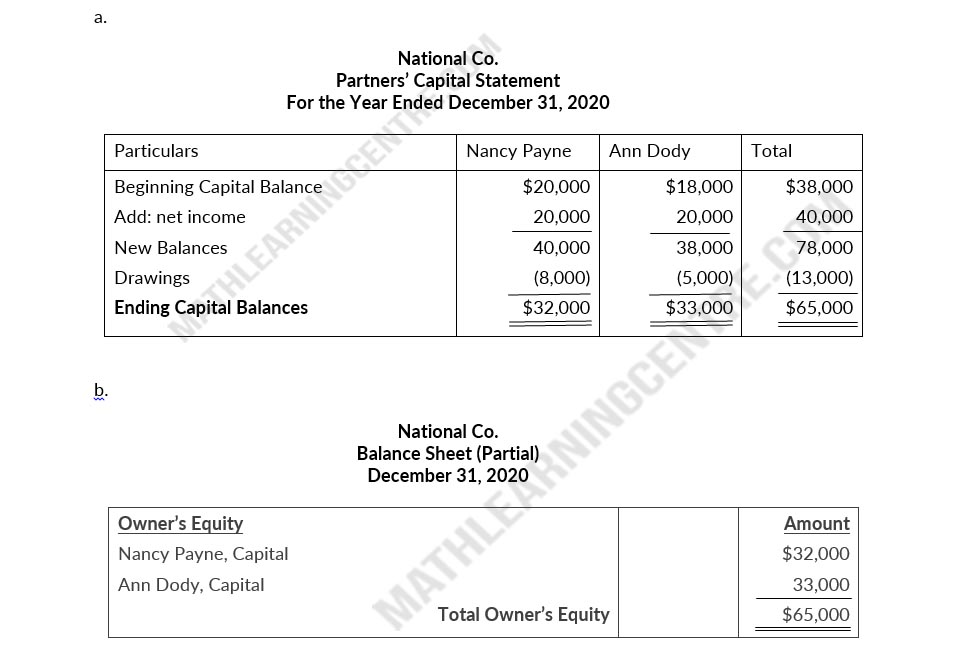

If you are a partnership, your main equity account will be member capital.

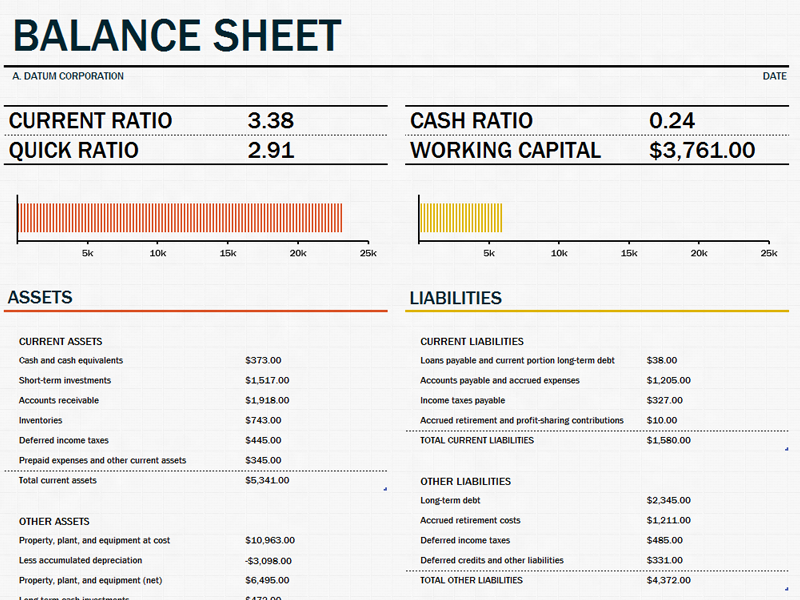

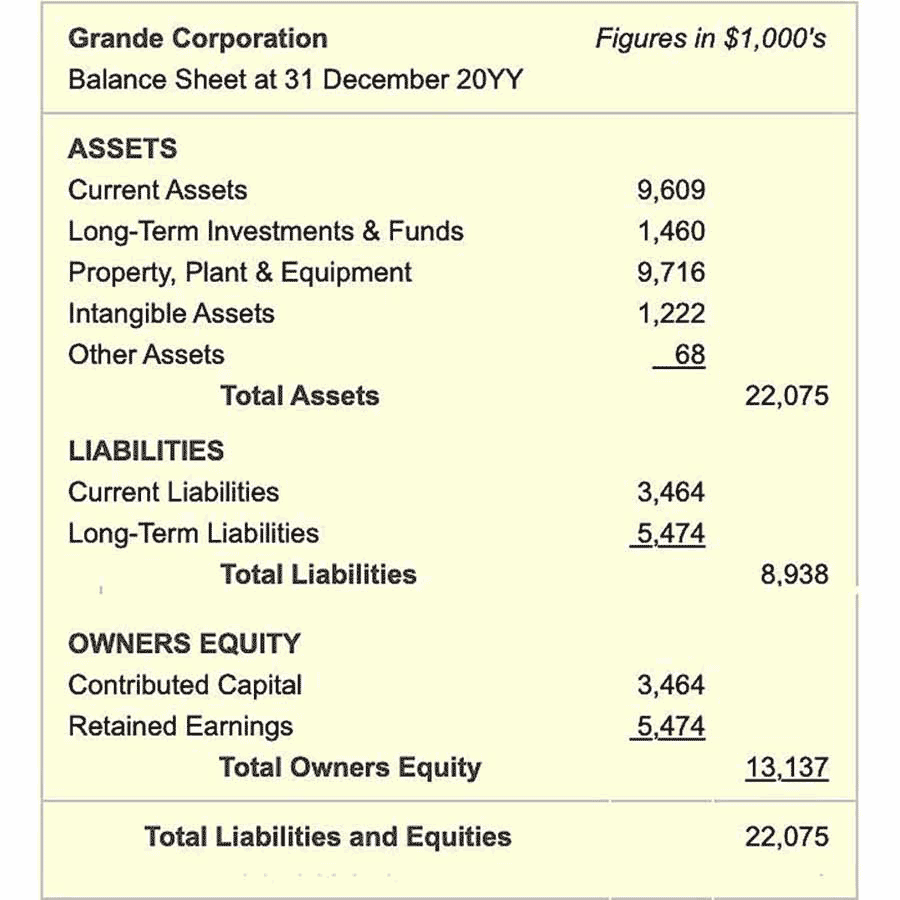

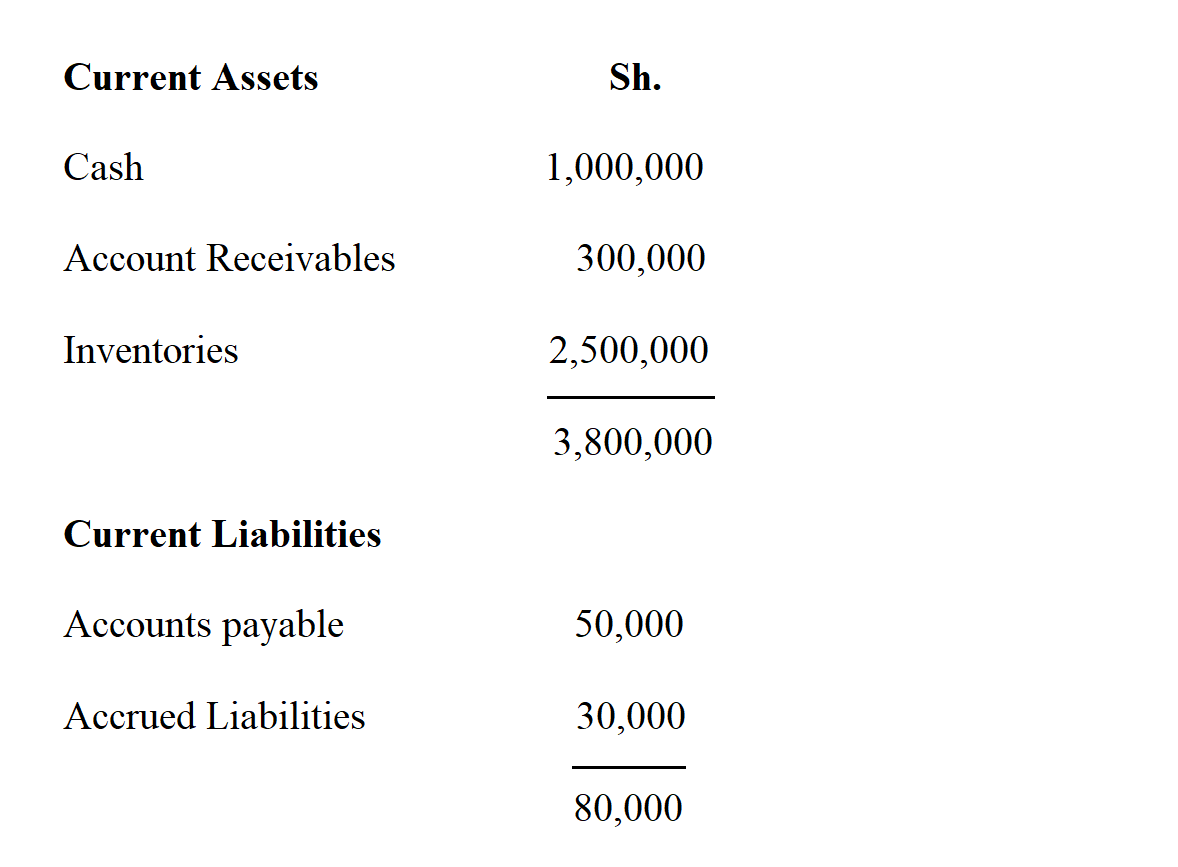

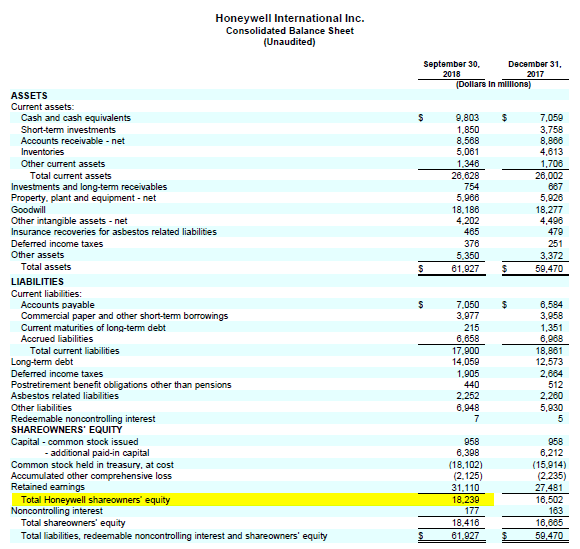

Capital contribution balance sheet. Contributed capital is the amount of money shareholders have invested in the company in exchange for ownership rights. Therefore, these amounts are reported on the balance sheet in the equity section. In short, the balance sheet is a financial statement that provides a.

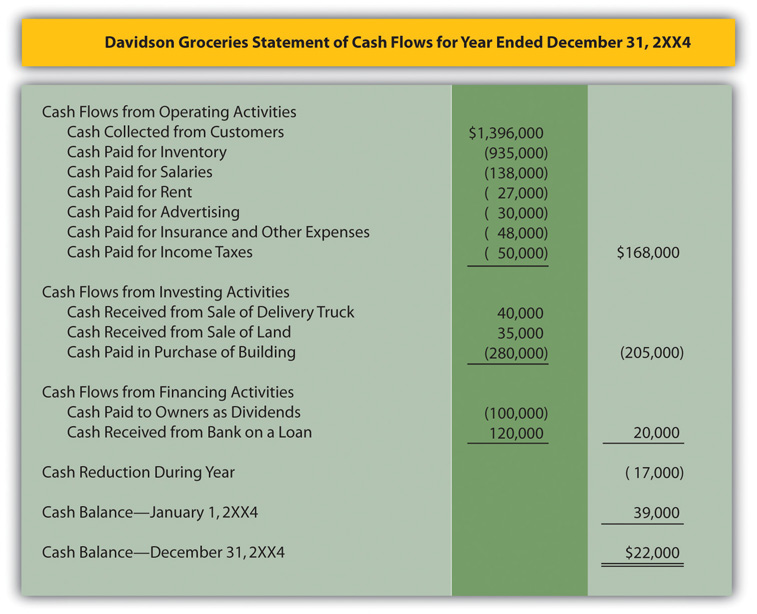

You should record the contribution as a credit to capital contributions and a debit to cash. Still, it will be split into two different accounts: Because it represents shareholder funds, a capital contribution will be found on the bottom half of a company’s balance sheet, usually as a separate line item headed “capital contribution” or “capital contribution reserve”.

What is the process of contributed capital? So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. In a company's balance sheet, the shareholders' equity section will include the contribution of capital or contributed capital.

Then you put £200 back into the cash register: Fact sheets published by the irs in 2023. Each member's capital account records the initial contribution and any additional contributions made during the year.

When a company is first created, if its only asset is the cash invested by the shareholders, the balance sheet is balanced with cash on the left and share capital on. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. Common stocks issued and premiums paid for these stocks combined to make the.

Understanding the different types of capital and how to calculate them can help you properly manage your company's finances. On the balance sheet, the contributed capital contains two separate accounts: On the stockholders’ equity section of the balance sheet, the reporting for contributed capital includes two separate accounts:

A company’s balance sheet will generally show capital contributions made to it as an item of shareholders’ funds separate from paid up share capital. They increase the company's equity, or investment, amount. Within the equity section of your balance sheet there are three main areas:

What is share capital? Cash register £200,00 as a private deposit £200,00. We will recognize the car value of $ 40,000 into the balance sheet.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. As fixed assets age, they begin to lose their value. It also indicates the price shareholders have paid for their stake or position in the company.

Capital contributions are funds provided to the company by a partner or owner. It is vital for a new company issuing stock to understand the concept of contributed capital for accounting and taxation purposes. Once you have put money into the llc, your capital contribution and the contributions of other members are shown in the llc's balance sheet as an equity (ownership) account.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)