Heartwarming Tips About Cash Flow Statement Net Profit Before Tax

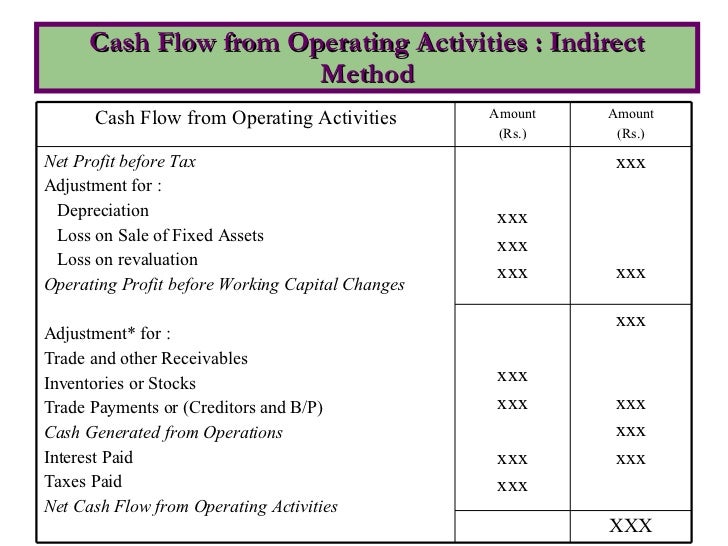

Alternatively, the indirect method starts with profit before tax rather than a cash receipt.

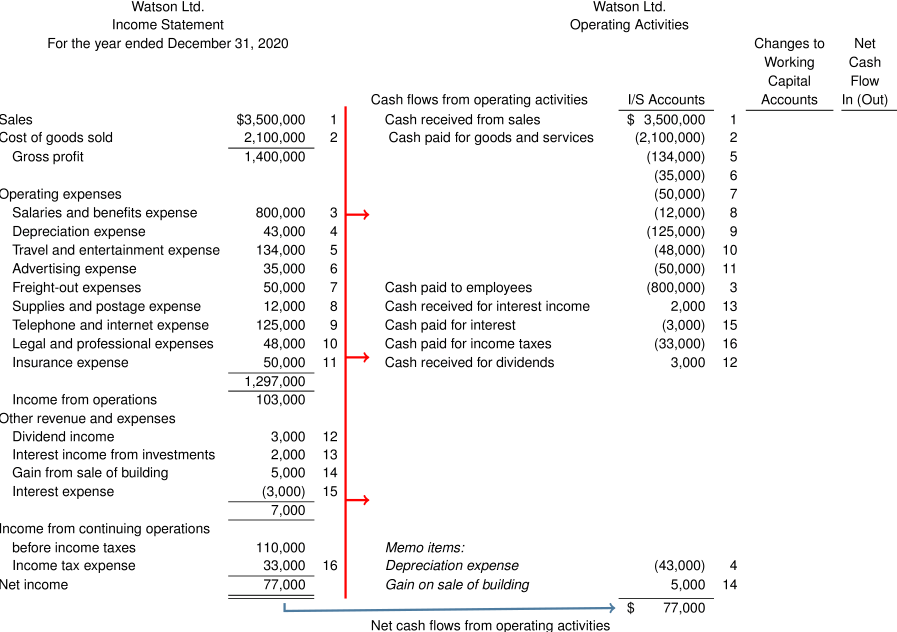

Cash flow statement net profit before tax. 1 the need for a statement of cash flows profit and liquidity the accounting concepts of accruals and matching are used tocompute a profit figure which shows the additional. Key differences ebitda vs. To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230.

Provision for taxation (current year). Cash flows from operating activities. Profit before tax is also known as earnings before tax.

It explains how to calculate net profit before tax and extraordinary items with example. Net operating income (noi) = effective gross income (egi). It is a measure of a company’s profitability before it pays its income tax.

It provides investors and company owners with useful financial data regarding the business’ operating performance. Here’s a look inside donald trump’s $355 million civil fraud verdict. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

We use the operating profit before tax, but after. Investors with information about cash inflows and outflows and the resulting change in cash and. Taxes on income ( 300) profit.

This is the 4th video in the series of cash flow statement. The profit before tax is then reconciled to the cash that it has generated. Ebitda indicates the profit of the company before paying the expenses, taxes, depreciation, and amortization, while.

A statement of cash flows provides. A new york judge has ordered donald trump and his companies to pay $355 million. The given amount of provision for taxation is added to calculate net profit before tax and extraordinary items.

The essentials—cash flow statements. Now, we have all the required calculations to come to the profit before tax value. Start with earnings before interest and tax (ebit) calculate the hypothetical tax bill the company would have if.

The same amount is deducted as tax paid as the.

![[2] Cash Flow Statement [AS PER AS 3] Calculation of Net Profit](https://i.ytimg.com/vi/ggLTWmkeotM/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)