Build A Info About Accounting Standards For Insurance Companies

Ifrs 17 replaces ifrs 4 insurance contracts.

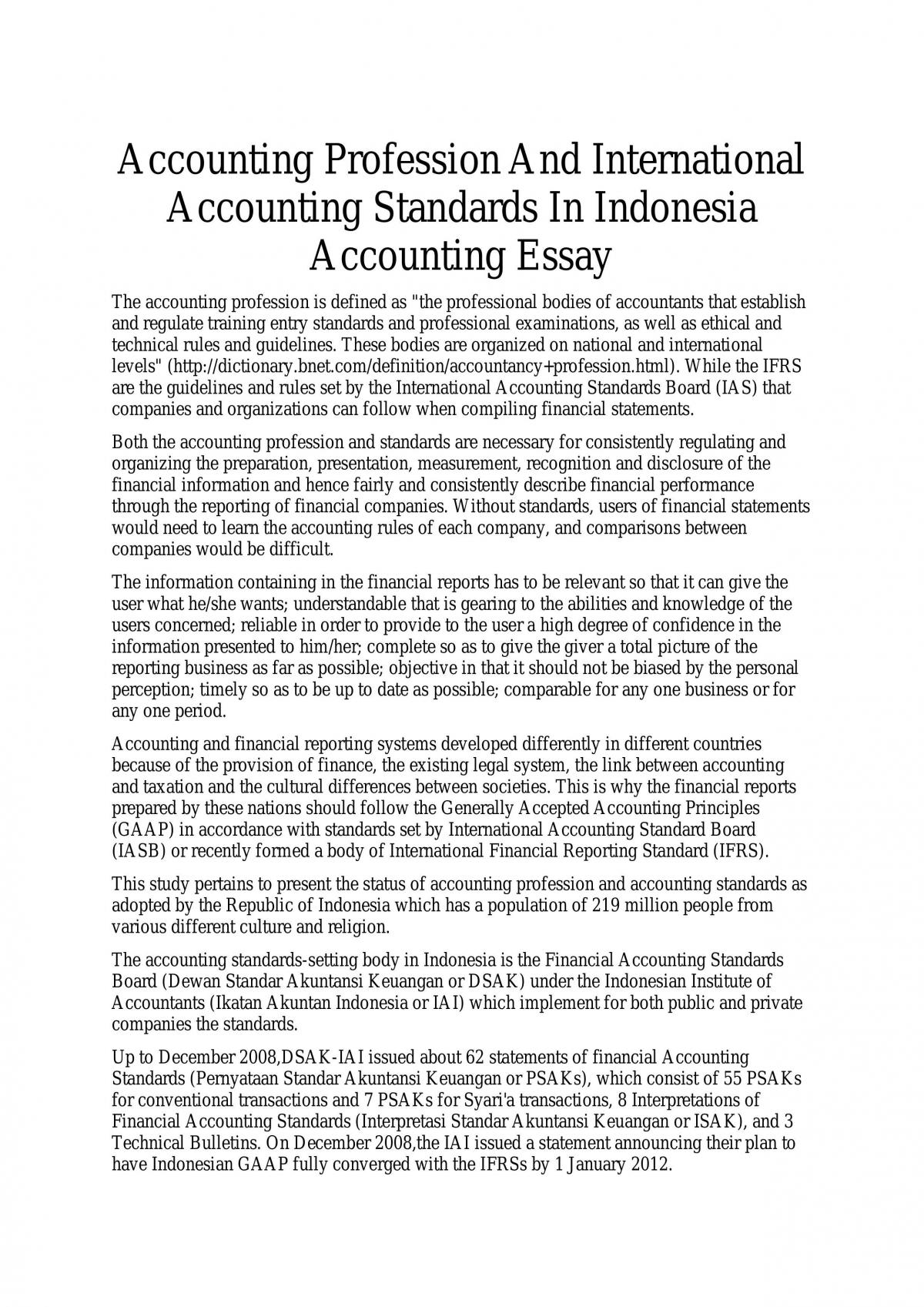

Accounting standards for insurance companies. The paper explores the use of accounting standards for insurer solvency assessment in the context of the implementation of ifrs 17. Accounting standards set out in the international financial reporting standards (ifrs) on insurance contracts and financial instruments (ifrs 9 and ifrs. It also differs significantly from us gaap.

The most significant change to insurance accounting requirements in 20 years. On 1st april 2020 — mandatory. Ifrs 17 represents the most significant change to insurance accounting requirements in more than two decades.

This new accounting requirements for insurance contracts was created to provide more transparent information about the effect and revenue of insurance. The accounting standard frs 103 issued in march 2014 states that the abi sorp will be withdrawn ‘once frs 103 is effective’ for accounting periods. The new standard will require fundamental accounting changes to how insurance contracts are measured and accounted for.

Standard news about ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied. Indian accounting standard 104 details financial reporting by an insurer. When introduced in 2004, ifrs 4—an interim standard—was meant to limit changes to existing insurance accounting.

This is a precursor to its notification under the companies act, 2013 by. Accounting policies the ifrs exempts an insurer temporarily (until completion of phase ii of the insurance project) from some requirements of other. Application of indian accounting standards with respect to the insurance companies (relevant status is reproduced below).

Special accounting standards also evolved for industries with a fiduciary responsibility to the public such as banks and insurance companies. On 6 april 2022, apra released additional draft life and general insurance reporting standards impacted by the introduction of the australian accounting. This standard requires limited improvements to.

On 18 may 2017 the international accounting standards board (iasb or board). These standards included the fasb’s statement of financial accounting standards (fas) 60,. Seamless implementation of indian accounting standards by insurance companies.

On indian accounting standard (ind as) 117, insurance contracts, which is consistent with ifrs 17. Codified in asc 944, financial services — insurance. Which accounting method should insurance companies use?

The paper is based on the. The accounting method you use for your insurance company will determine when you. Insurance contracts combine features of both a financial instrument and a service contract.