Spectacular Tips About Pro Forma Cash Flow Statement Example

Here’s a historical example of a pro forma income statement, courtesy of tesla inc.'s (tsla) unaudited pro forma condensed and consolidated income statement for the year ended dec.

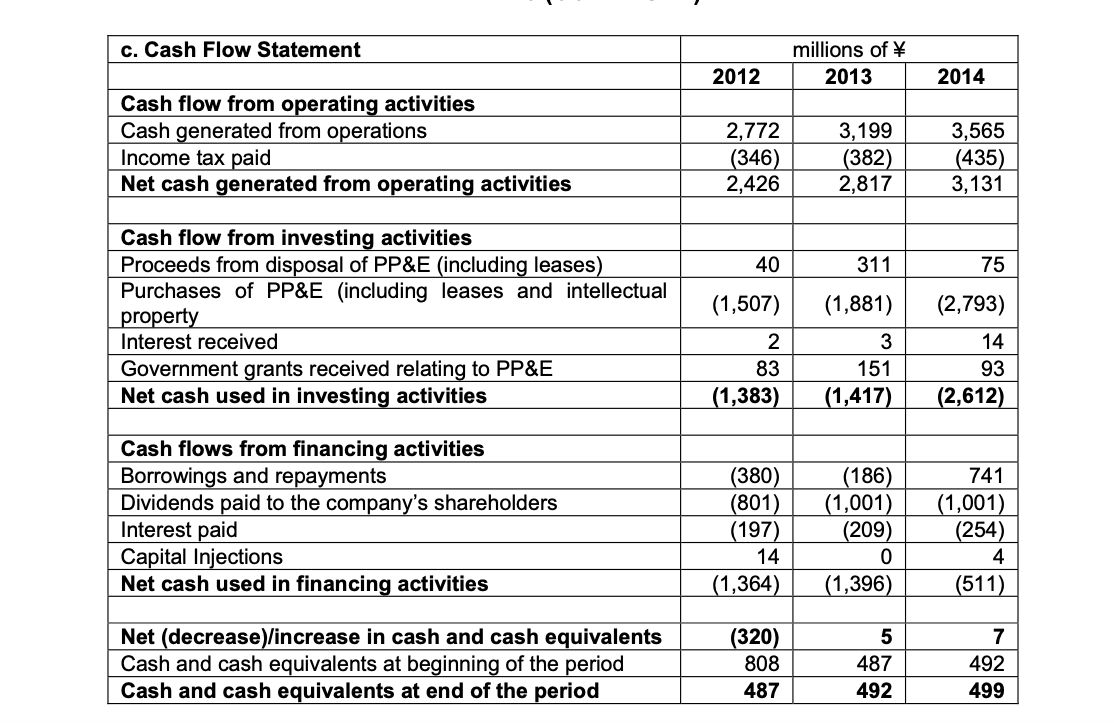

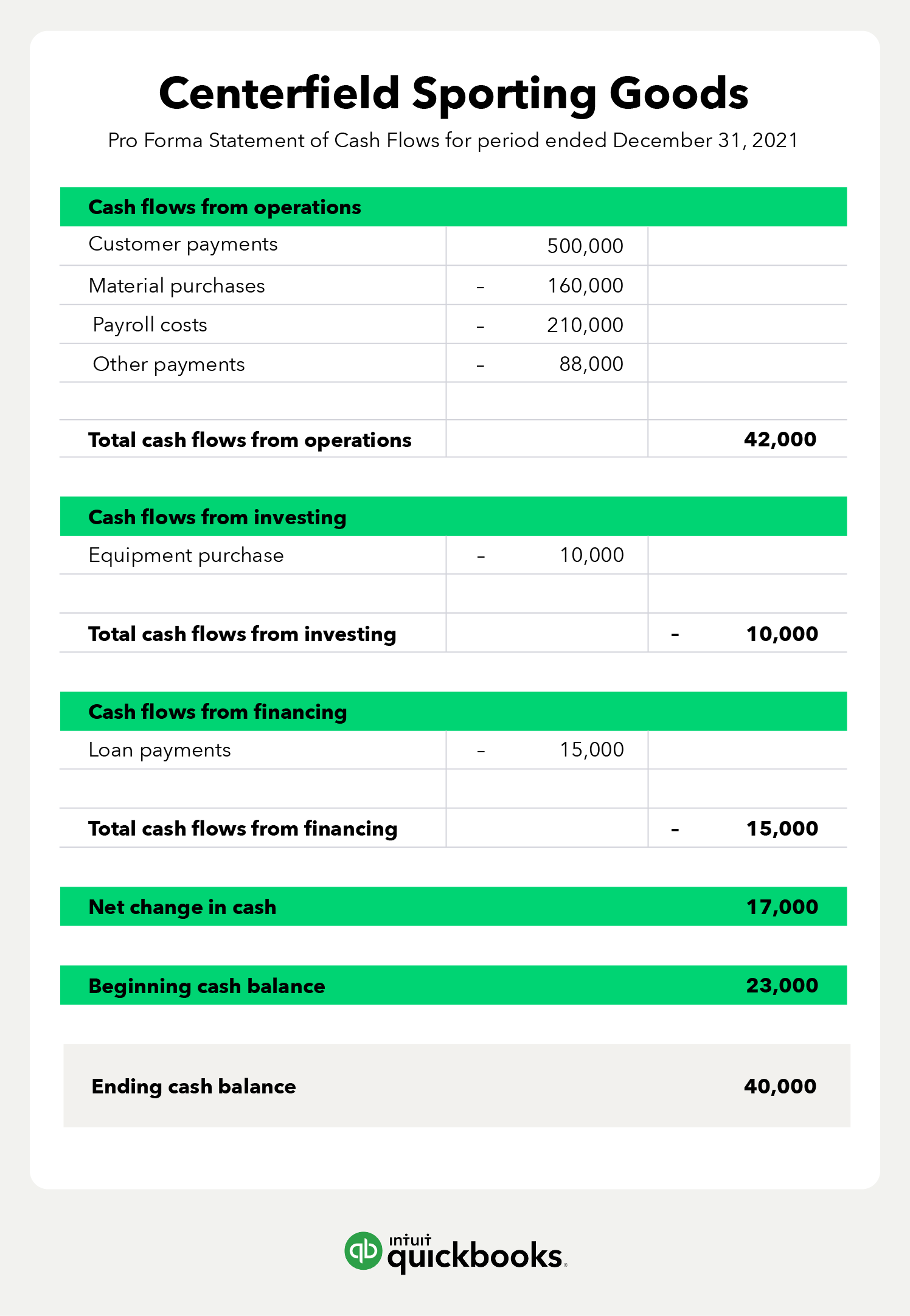

Pro forma cash flow statement example. Businesses can also create pro forma balance sheets and income statements, and a pro forma cash flow statement helps validate them. Cash flows from operating activities. Increase in trade and other receivables ( 500) decrease in inventories.

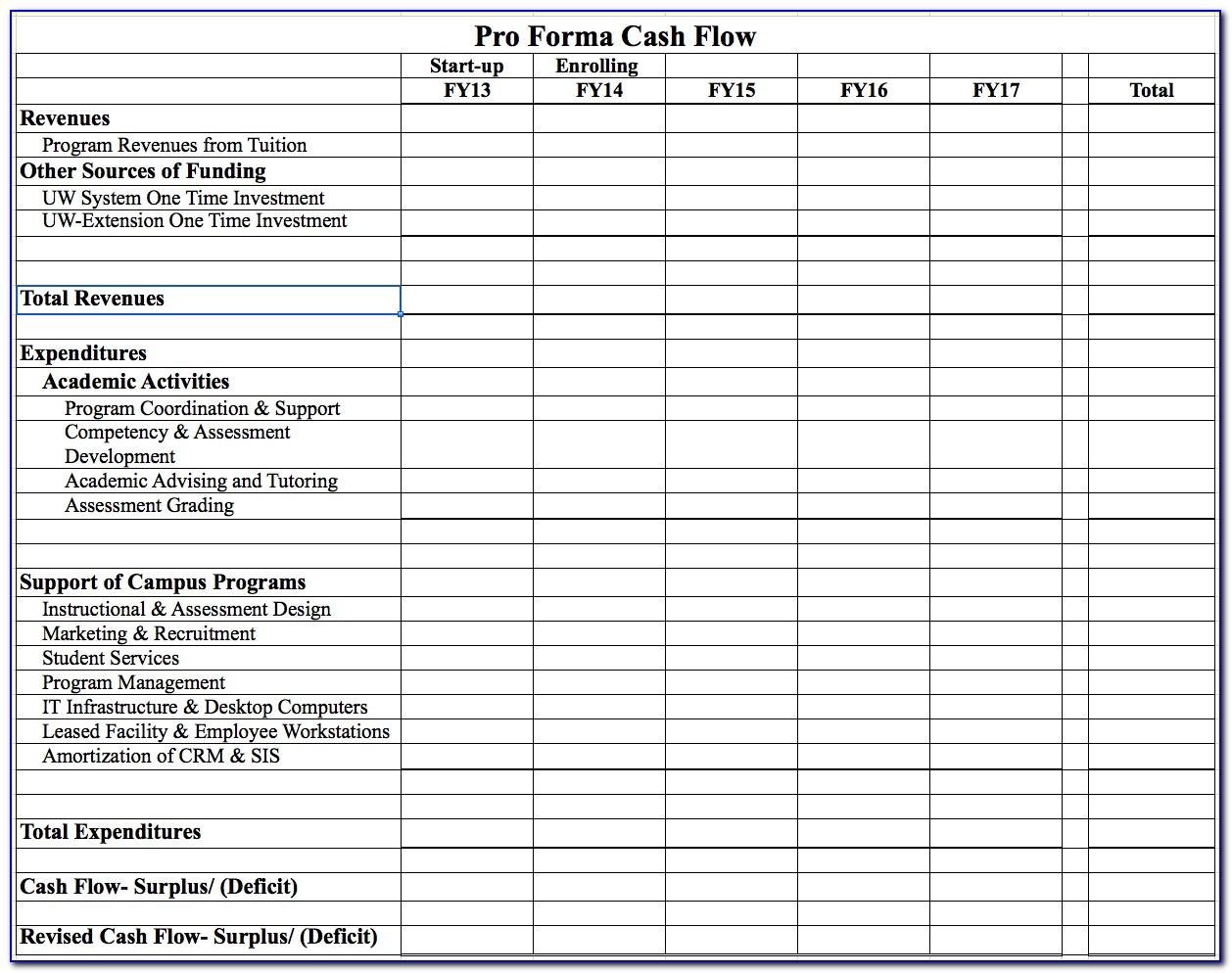

Produce a statement to look at how that debt would impact cash flow over a certain period. Budgeting financial forecasting and modeling the statement of cash flows types of pro forma cash flow forecasting methods a pro forma cash flow is constructing using several methods, each covering a different period of time. Pro forma statements demonstrate to investors and lenders that a company is worth investing in.

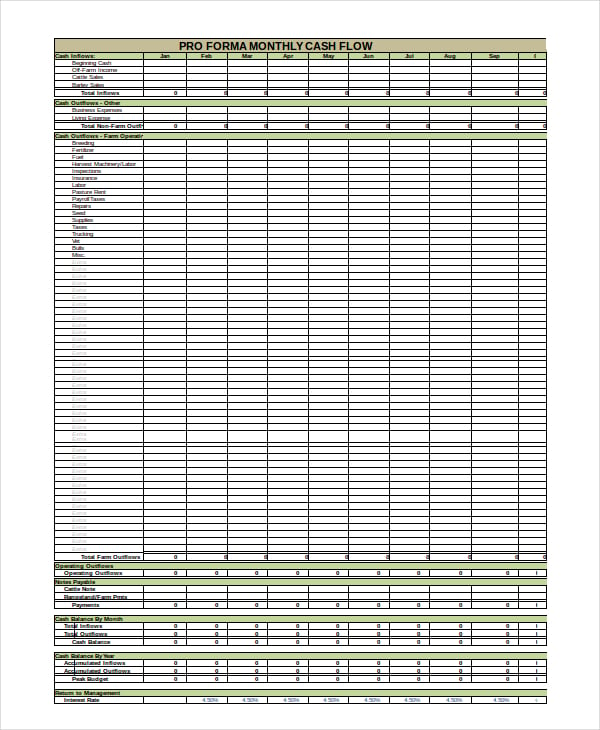

Identify the beginning cash balance. Cash flow statements whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. In this case, west coast shoe will begin february with $95,000.

Pro forma cash flow: Pro forma cash flow example. As we go through the various parts of the pro forma, it will be useful to refer to a numerical example, to keep things a little less abstract.

Insights, examples, and how to create them by james durrenberger, cpa* | february 6, 2020 it would be nice to peer into the future. Let’s understand by pro forma statement example. The pro forma income statement, for instance, estimates future revenues and expenses, offering a preview of potential profitability.

Another type of pro forma document is a pro forma cash flow that shows both you and potential investors the outflows and inflows of your company’s financial results within a set period that you determine. Pro forma cash flow statements help in business planning and control. Example 5 year annual cash flow statement

Identify cash inflow from financing. Below is an example pro forma statement of cash flows in lloyd’s preliminary results 2020. As in, “what if my business got a $50,000 loan next year?”

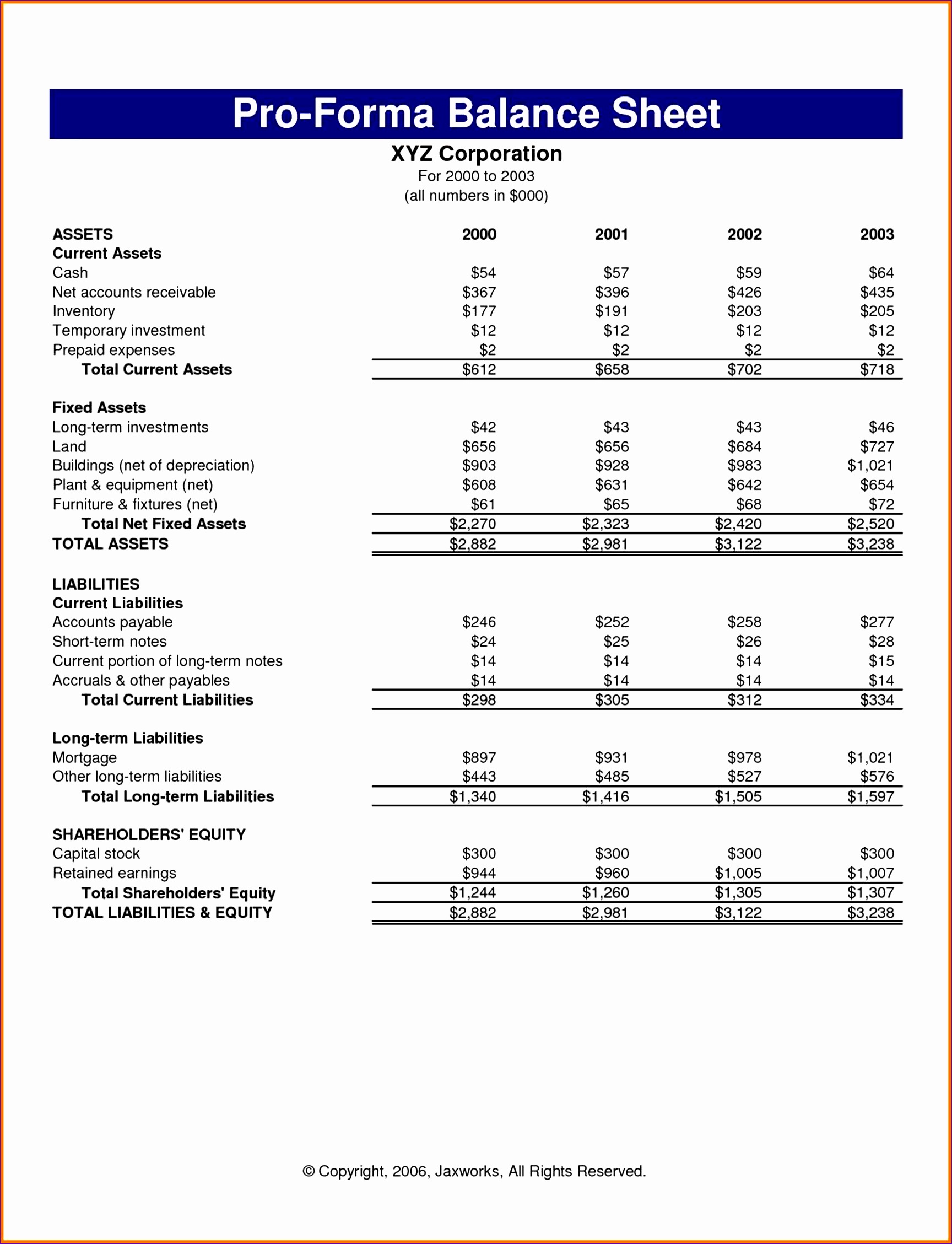

What may happen if a business receives a $150,000 loan? Different types of pro forma cash flows. The pro forma balance sheet, on the other hand, predicts future assets, liabilities, and equity.

Imagine a company named ekvira which manufactures table fans that want to create a pro forma cash flow statement and using these they just wanna know how much they will have cash on hand by the end of the next month. For example, if you are considering refinancing your debt, or if your business is trying to set a new tax rate, you can use the pro forma financial statements to determine the impact of your decision on your business and plan for the future. For example, it may project insufficient cash flow.

Pro forma statements look like regular statements, except they’re based on what ifs, not real financial results. Pro forma cash flow statements; The true value of pro forma statements goes beyond the numbers they show.