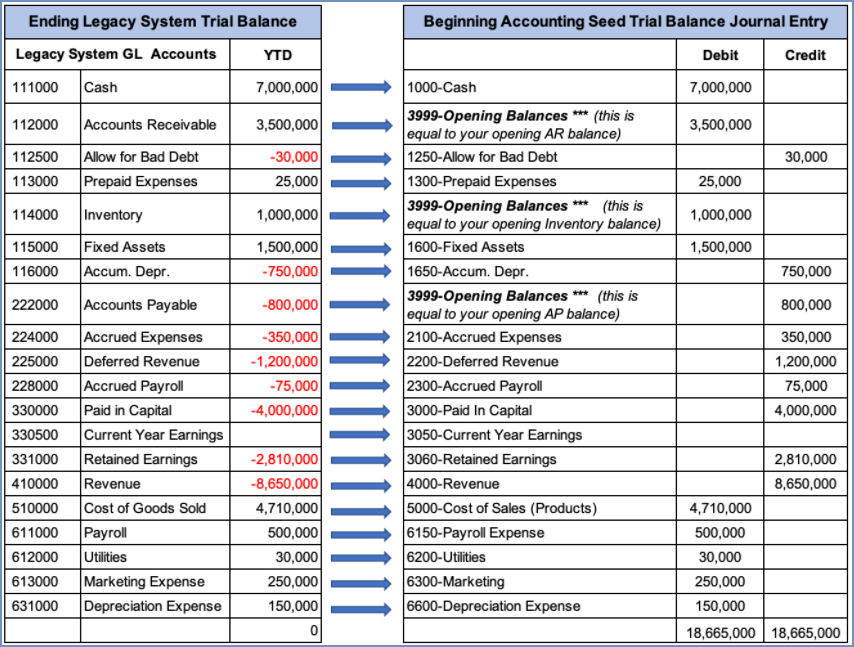

Great Tips About Opening Stock Entry In Trial Balance

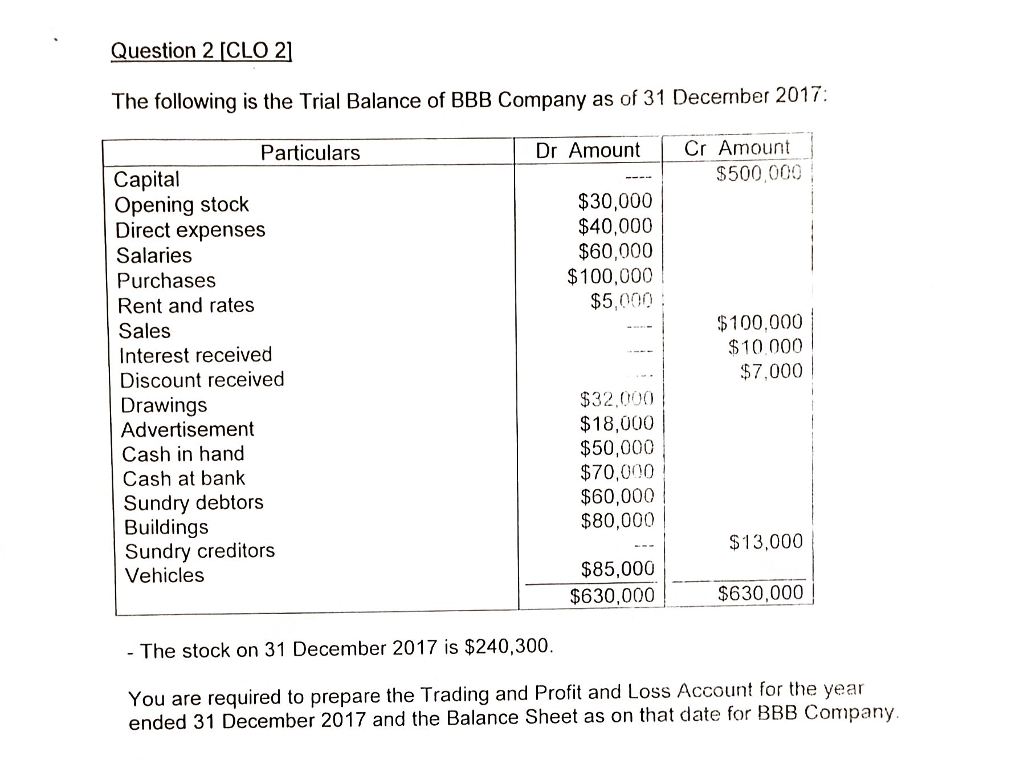

The opening stock (last year’s unsold purchases) will appear on the opening trial balance on the debit side and will be classified as current assets.

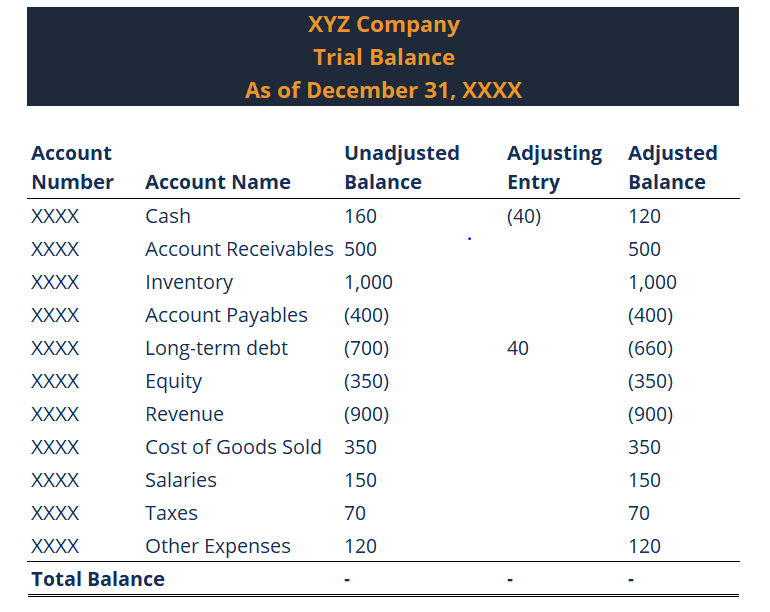

Opening stock entry in trial balance. You are preparing a trial balance after the closing entries are complete. Accounting and journal entry for closing stock is posted at the end of an accounting year. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

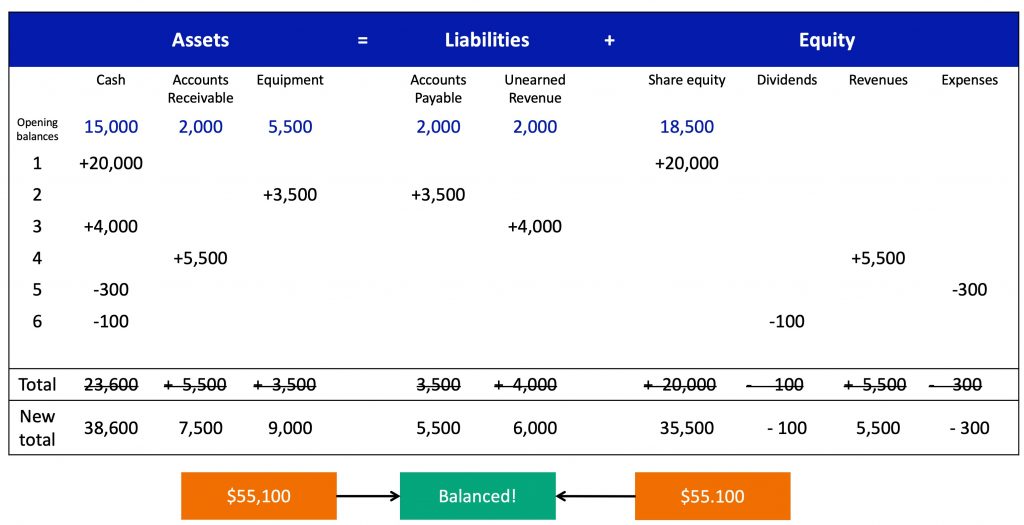

Sneha there are two types of stock i.e. The opening balance entry is as follows. Closing stock is the leftover balance out of goods which were purchased during an accounting period.

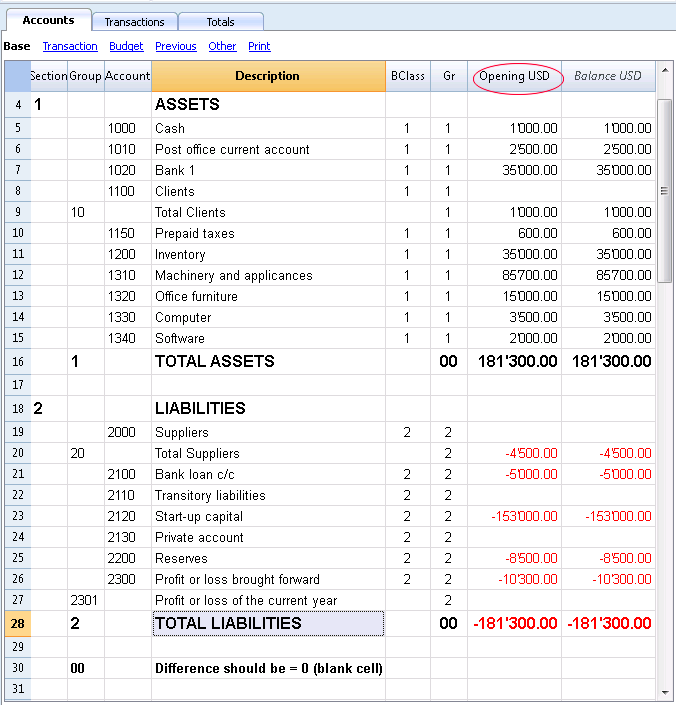

The opening trial balance. The ledger account behind the adjustment causes problems for some candidates. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the. Opening stock is part of trial balance while, closing stock is part of adjustment. Then click on the blue + button to open the journal entry form.

To prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. This is how the inventory account will look at the time the trial balance is being prepared. If not cost of goods sold,.

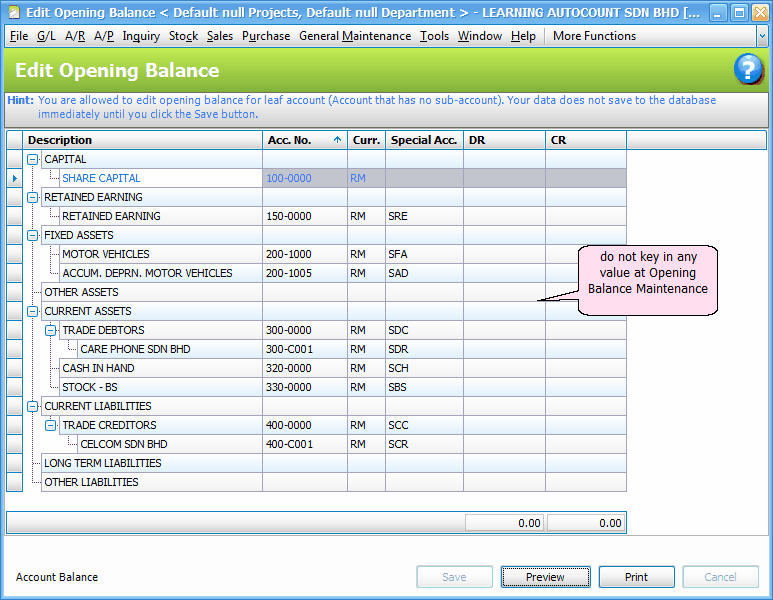

Create a journal entry. The opening balance is usually that balance which is brought forward at the beginning of an accounting year from the end of a previous accounting year. Extended tb in order to.

Closing stock is valued at cost or market value whichever is lower. First navigate to the journal entry page. To enter the figure use the o/bal button on the nominal record, this posts the opposite entry to the.

Opening stock and closing stock. Set the entry type as. First we journal your opening stock value from the balance sheet, 1001, to the profit and loss, 5200.

Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. The formula for calculating opening stock is as follows: Will opening stock appear in the trial balance?

This is done to determine that debits. Opening stock always appears in the trial balance, and the amount is recorded in its debit column. If you do not have this figure you must obtain it.