Out Of This World Tips About Prepayments Are Shown In The Balance Sheet As

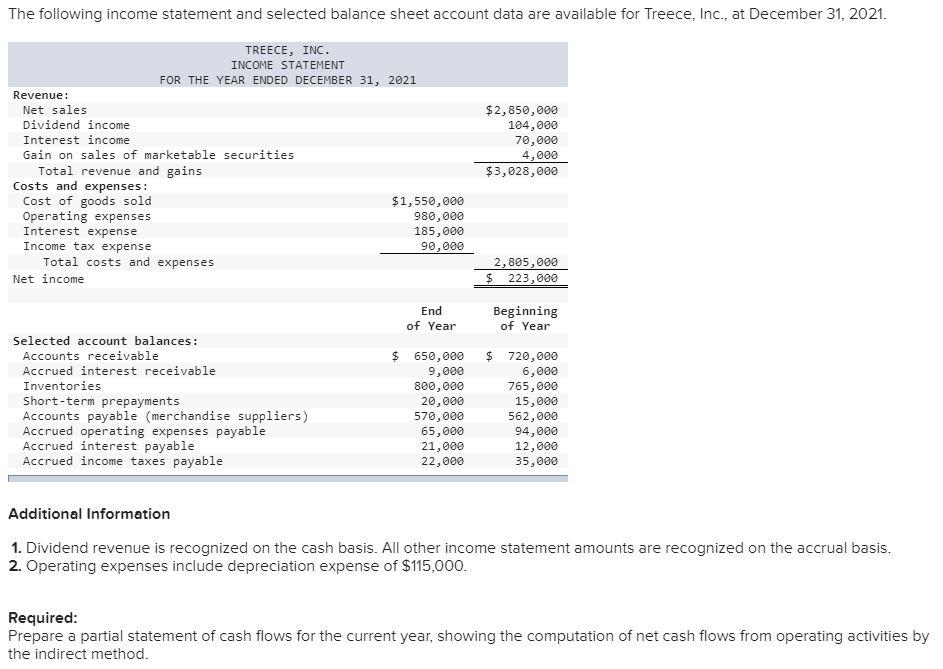

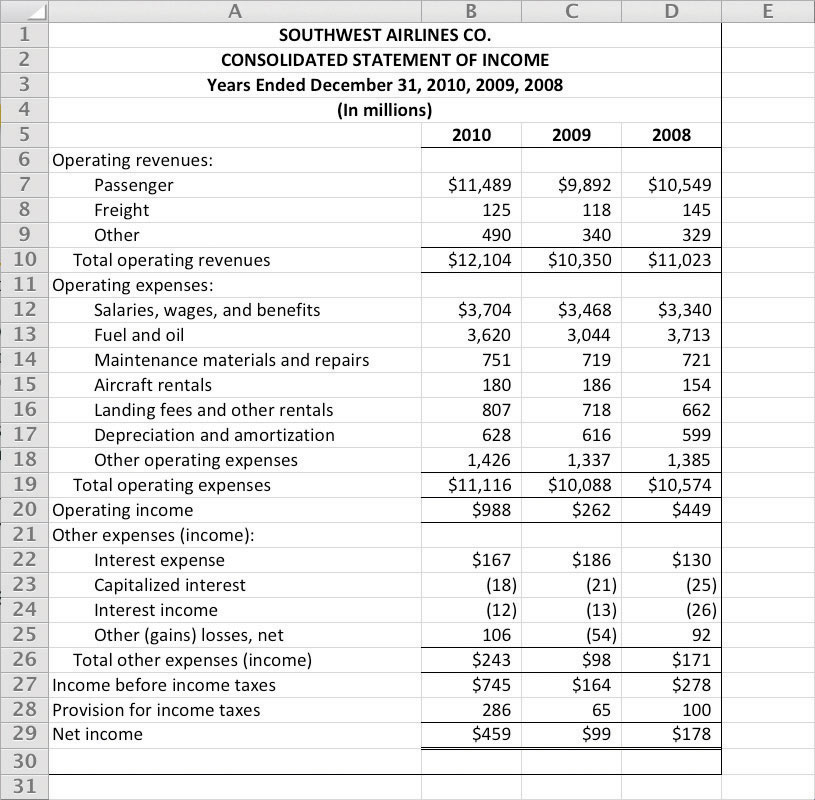

As the economic benefits from such resources are.

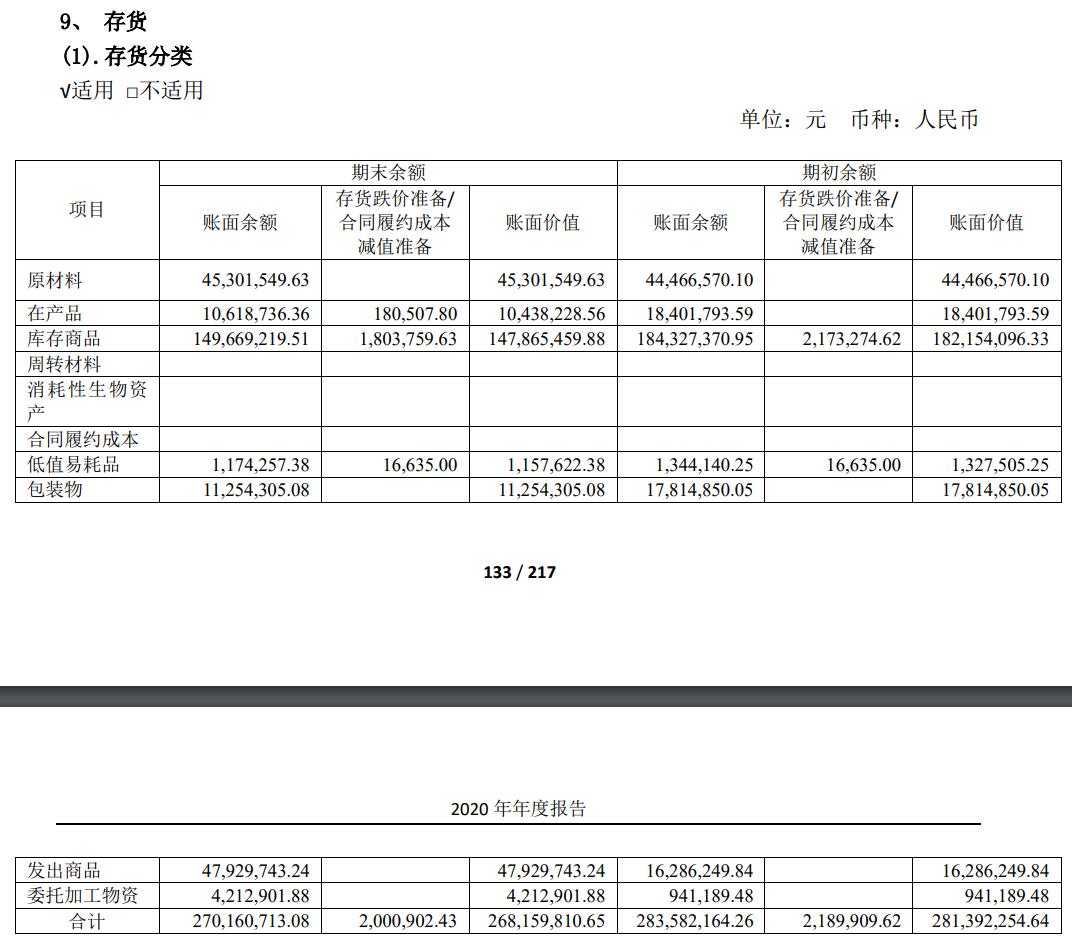

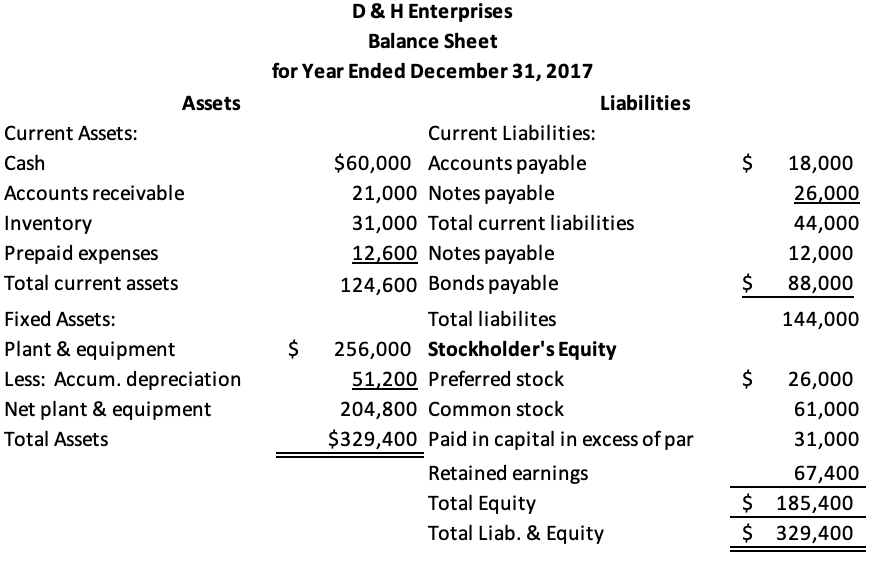

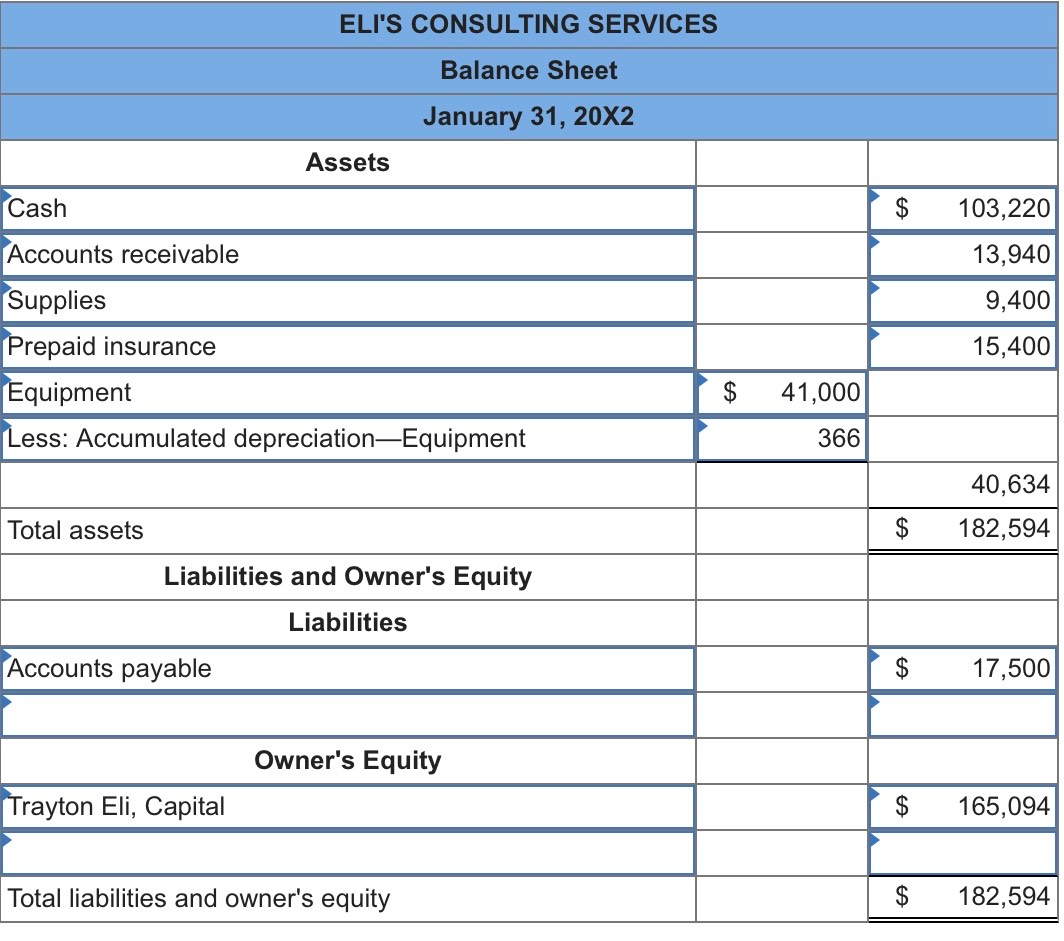

Prepayments are shown in the balance sheet as. The prepaid expense is shown on the assets side of the. How to find prepaid expenses on the balance sheet? A prepaid expense is first categorized as a current asset on the company's balance sheet.

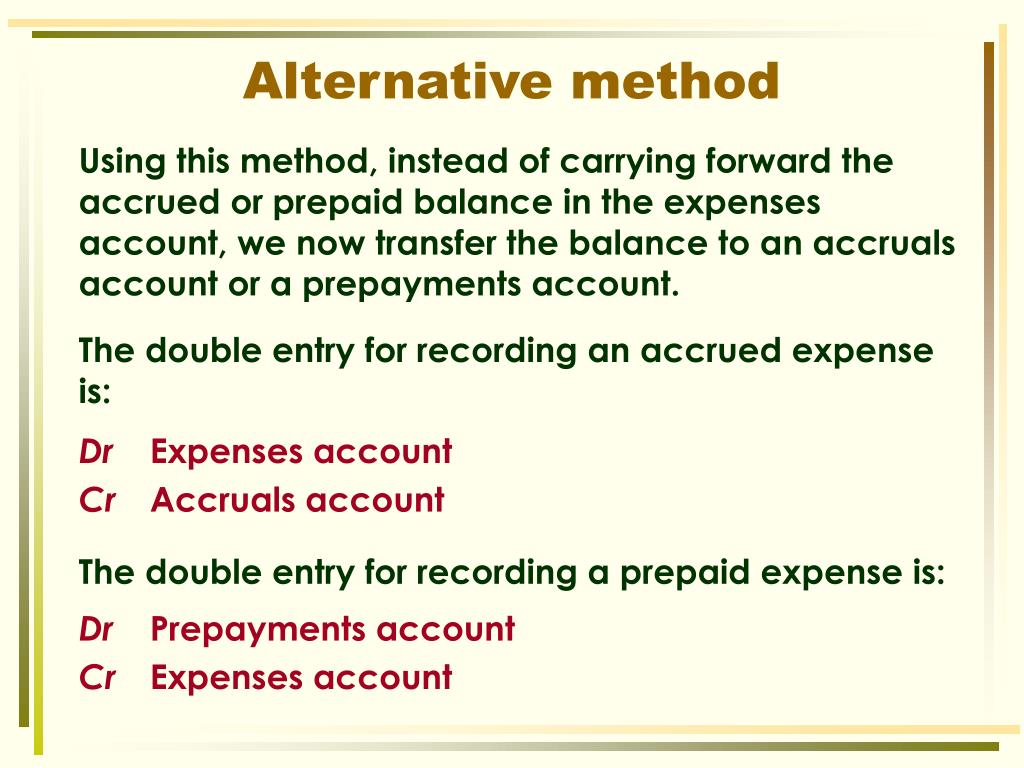

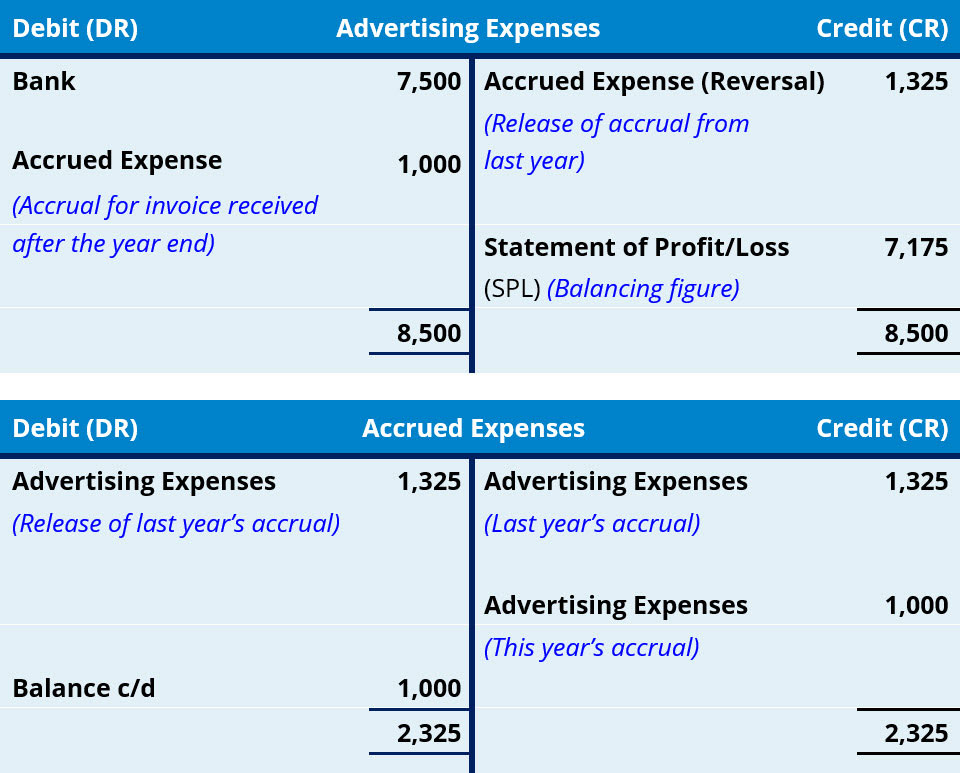

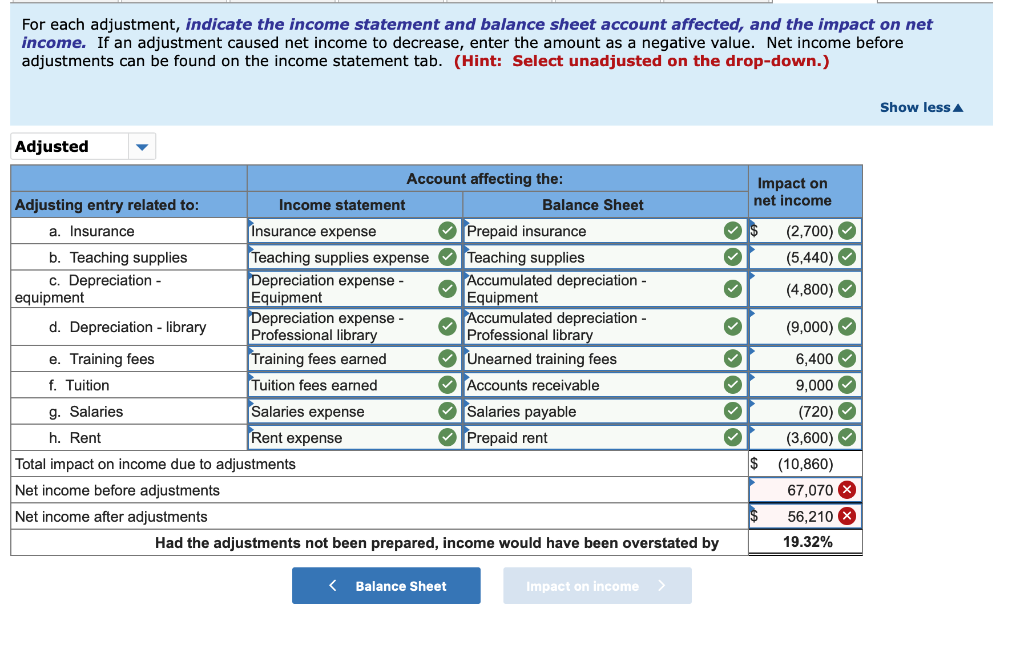

Prepayment is an accounting term referred to the types of expenses not incurred yet but for which payment is made in advance. This prepaid rent of 4,500 is shown in the trial balance as follows: Illustrate the process of adjusting for accruals and prepayments in preparing financial statements.

These things are often classified as current. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Here’s more information on the meaning of prepayments and how to include prepayments in the balance sheet.

It might be easy to remember that the accrued expense and prepayment are shown on the balance sheet as in the reverse position as the accrued expense is the current liability. Bookkeeping guidebook accounting for prepayments we will address the accounting for prepayments from the perspectives of both the buyer and the seller. Benefits still unexpired at the year end will be shown as a current asset in the balance sheet of the business.

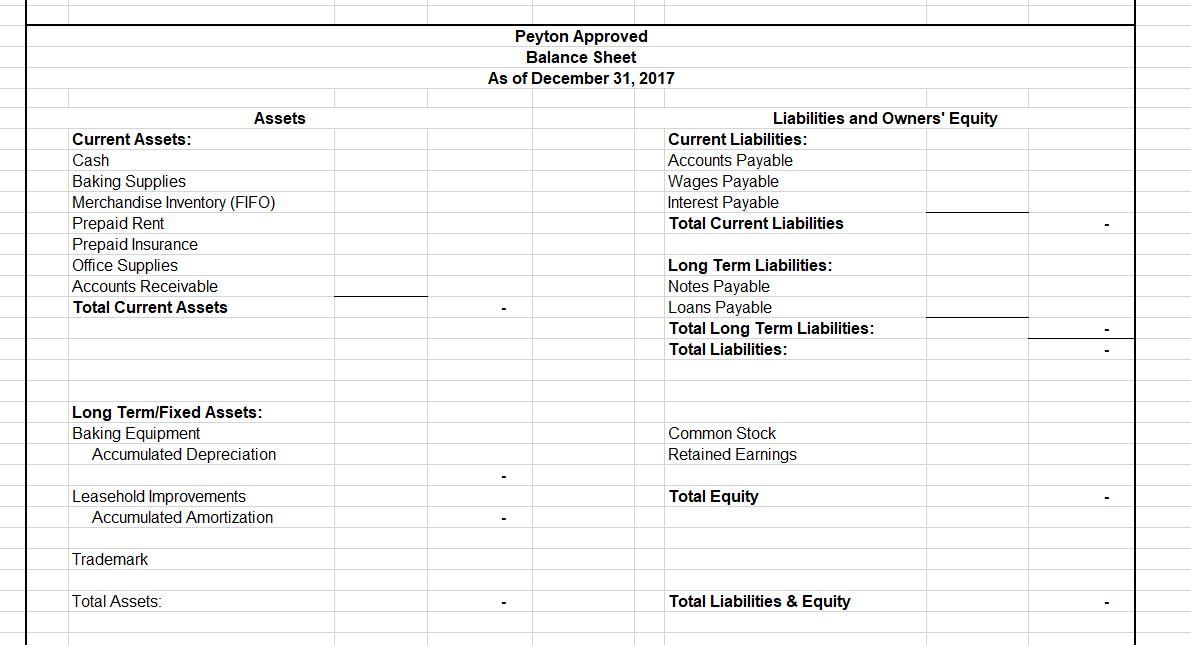

Initially, they are recorded as assets on the balance sheet. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepayments therefore differ from debtors in that they relate to.

A payment for an expense or income that was paid/received in a previous financial period but relates to an expense/income incurred in the current. 1 accruals basis of accounting Prepayments are when a business pays for certain expenses in advance, but the benefit is received in a later period.

Trial balance as of 31st march, yyyy note if the prepaid expenses are already shown in the trial balance it. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. For example, a company can list $6,000 as a current asset under the.

A buyer records a prepayment as an asset, whereas the seller records it as a liability. The gaap matching principle prevents expenses from being recorded. The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet.

How is prepayment appears in balance sheet. Refer to the first example of prepaid rent. Some of these examples are given below:

Prepaid expenses are payments made in advance for goods or services that will be received in the future. A prepayment is shown in your business balance sheet as a current asset.