Out Of This World Info About Non Controlling Interest Financial Statements

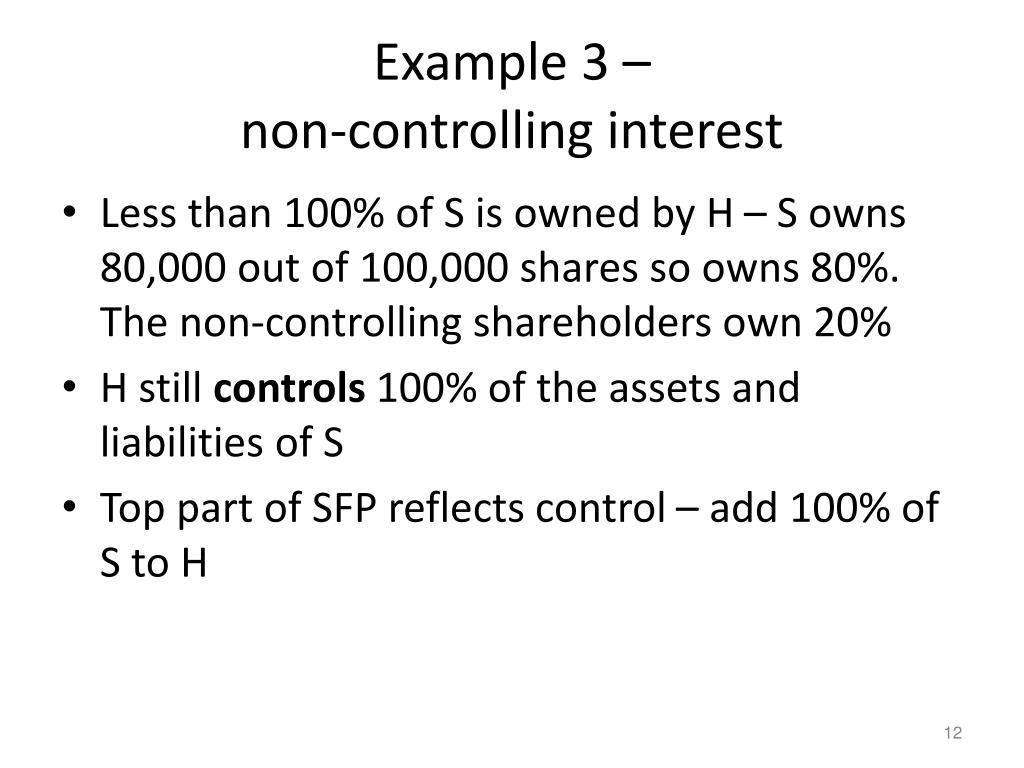

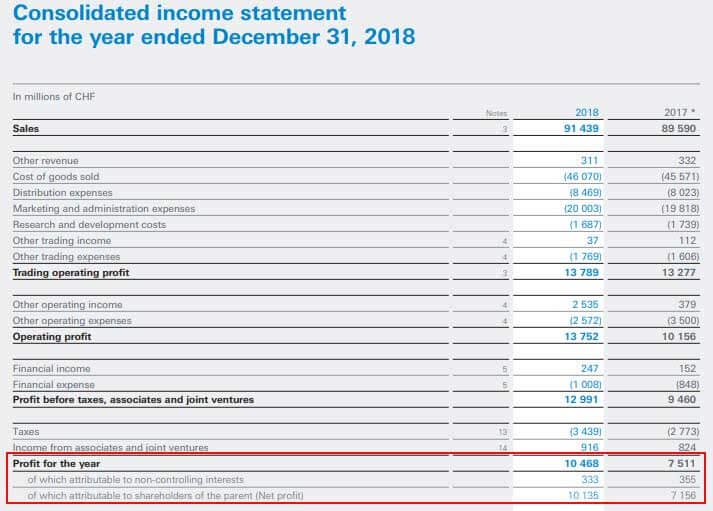

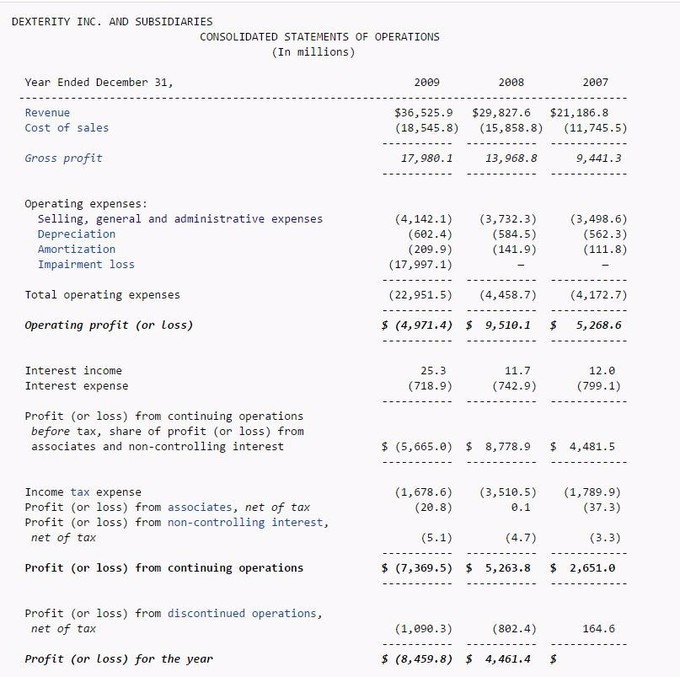

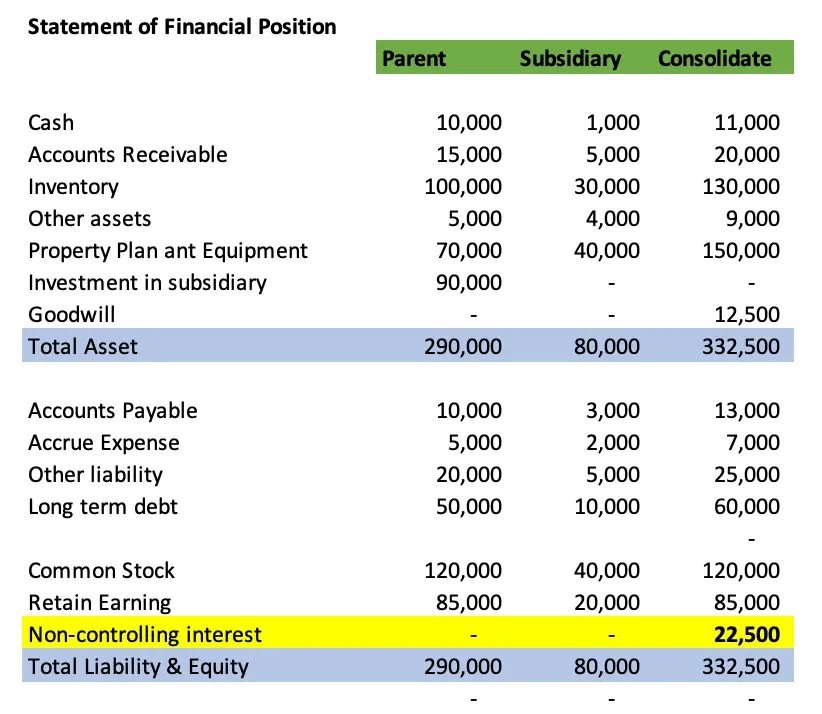

In other words, company a will claim 100% of company b’s revenues and expenses and assets and liabilities.

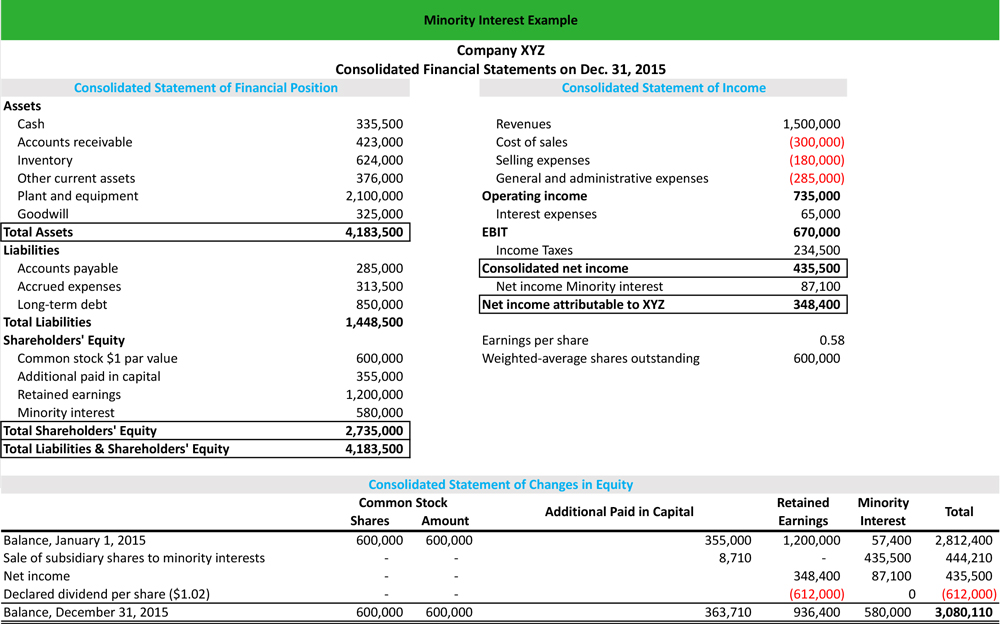

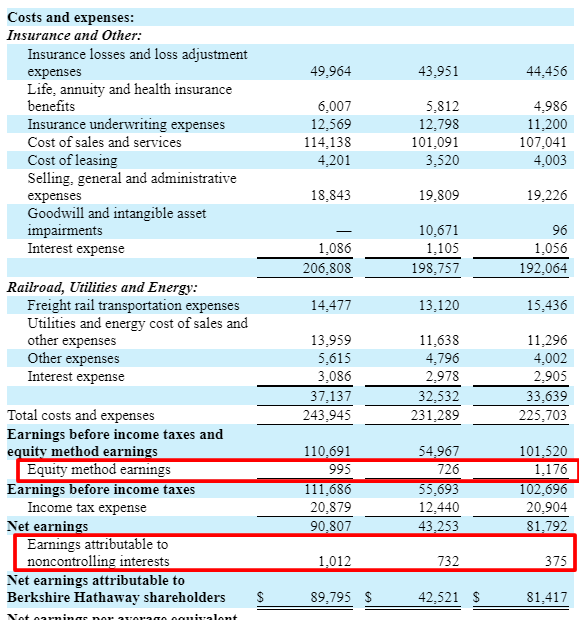

Non controlling interest financial statements. Company a will fully consolidate its financials with company b. Reporting entities should present any noncontrolling interest (nci) as a separate component of stockholders' equity, distinct from the equity attributable to the controlling. When a parent company (“parent co.”) owns at least 50% of another company (“sub co.”), the noncontrolling interest represents the portion the parent does not own:

Shares held by company a: Nci can be created in. The shift to the term “noncontrolling interest” will emphasize a parent’s substantive control over a subsidiary rather than a simple ownership percentage and will more usefully.

It is calculated using the direct interest on the balance sheet of p. The investor’s returns can be only positive, only negative or both positive and negative. Although only one investor can control an investee, more than one party can share in.

As an example, assume company a owns 75% of company b:

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)