Amazing Tips About Operating Lease Income Statement

The lease payments will be shown as operating costs on the income statement of xyz corp.

Operating lease income statement. Operating leases are usually for short term rentals, and the rental period is normally only for a small part of the assets. An exception to this is where the lease payments increase over time. For operating leases, lessees will recognize a single total lease expense.

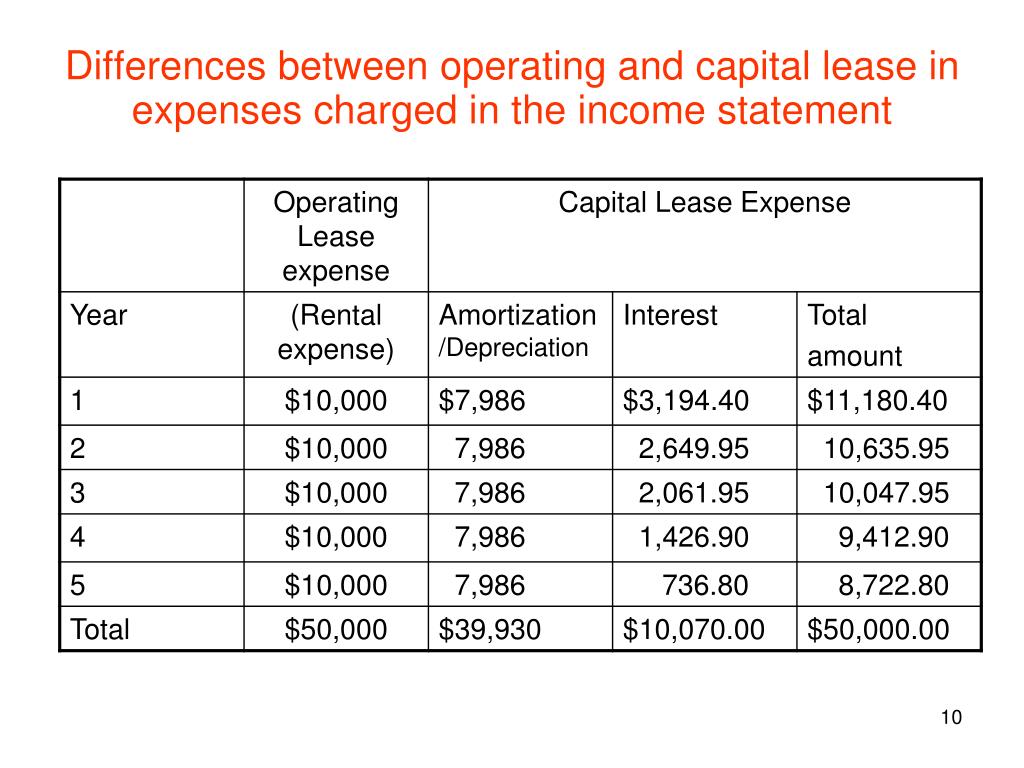

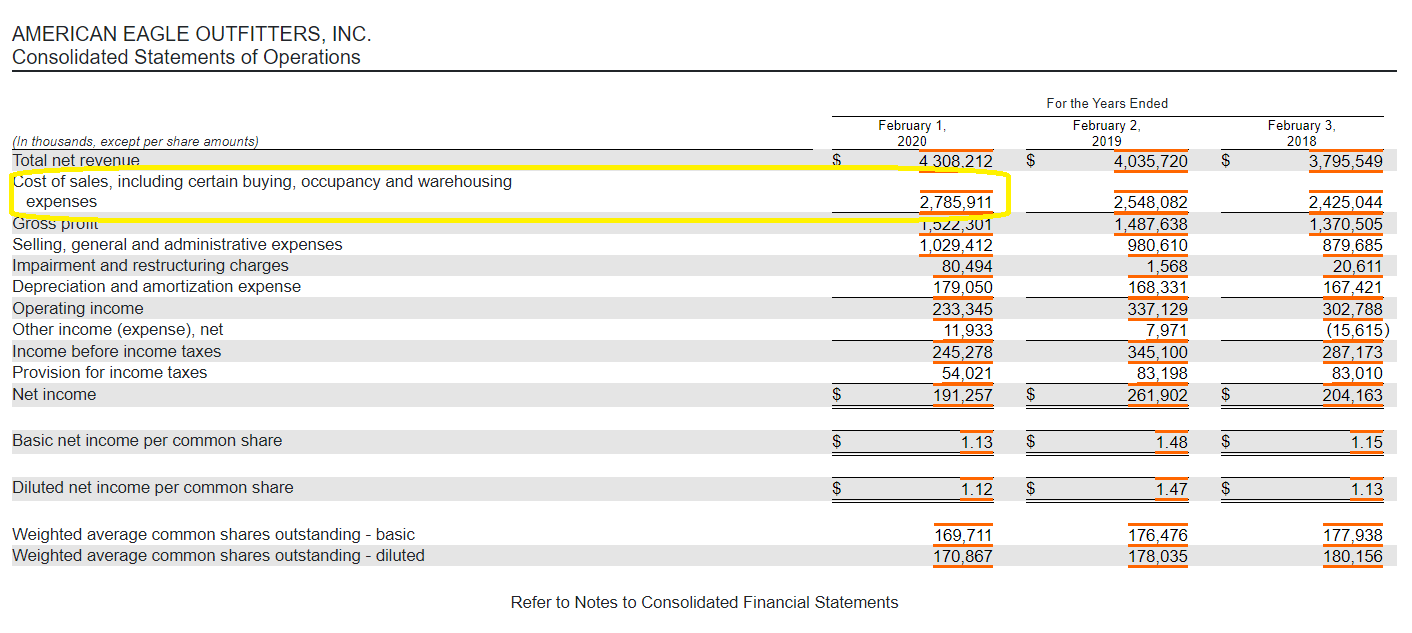

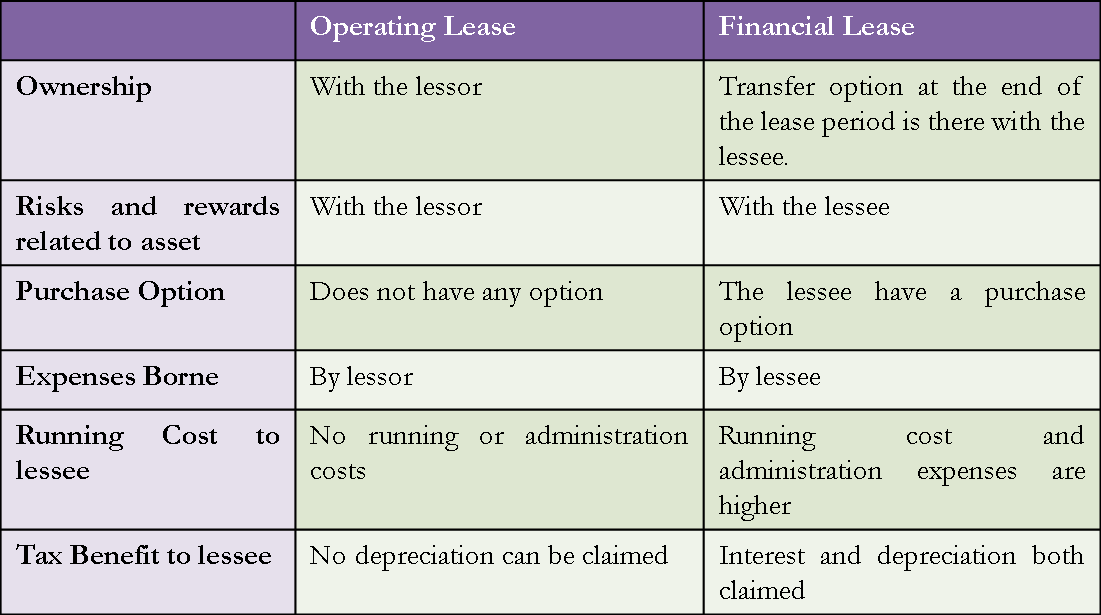

The primary difference between finance and operating leases is how the lease is recognized on the income statement. Under an operating lease, a single lease cost, generally allocated on a straight line basis over the lease term, is presented in the income statement. If you have an operating lease, you record the payments you make to the lessor as a lease expense on the income statement, along with amortization.

Lendlease holds a 38% economic interest in the military housing asset management income stream and 100% interest in development and construction management rights. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Aum of $14b related to military housing shown on a 100% basis within residential.

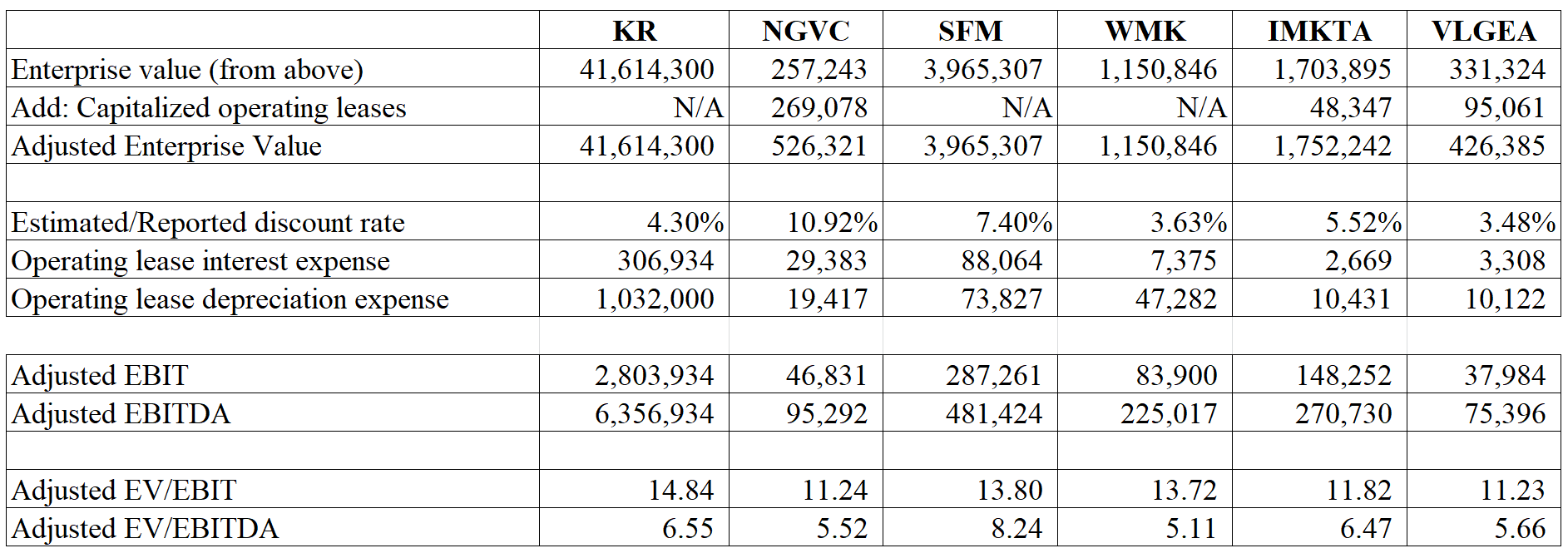

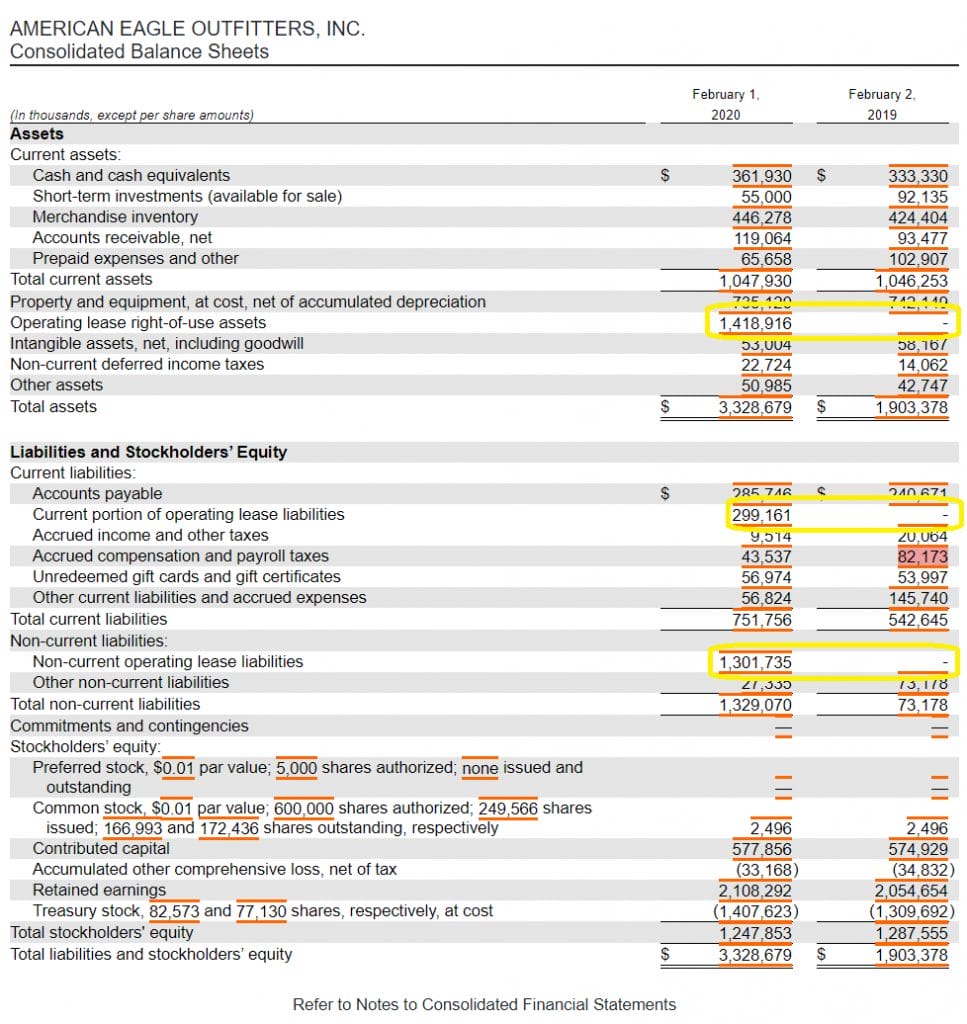

Lease criteria are operating leases. If there is no existing bond rating, a “synthetic” bond rating can. The lease standard has very little impact on either the balance sheet amounts reported or the associated ratios.

It is the new normal for lease accounting around the world. On the asc 842 effective date, determine the total payments remaining step 5: The two most common types of leases in accounting are operating and finance (or capital) leases.

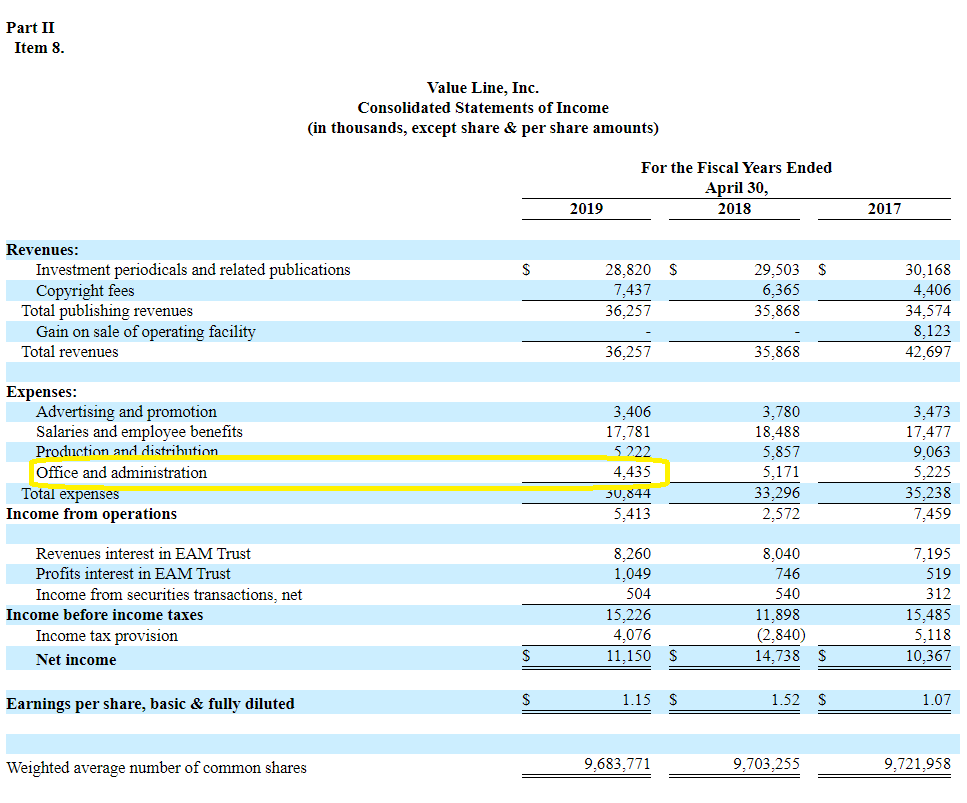

For financing leases, lessees will recognize amortization of the rou asset separately from interest on the lease liability. Let’s turn to the income statement next—which is good for seeing how operating expenses have affected the bottom line in the past. A finance lease is a contract that permits the use of an.

Operating lease accounting refers to the accounting methodology used for leasing agreements where the lessor retains the ownership of the leased asset. Finance leases and operating leases under ifrs 10:29: Operating leases in the income statement.

Determine the lease term under asc 840 step 2: Ifrs 16 leases has now been successfully adopted by companies reporting under ifrs® standards. The accounting for easements, certain technical corrections, targeted improvements to the transition provisions, a lessor’s separation of lease and nonlease components, and practical expedients.

Gaap treatment of operating leases 14:20: No asset or liability will be recorded on the balance sheet. Although finance and operating leases have similarities, reporting and recognition requirements differ, as outlined below:

Present the underlying assets subject to an operating lease in accordance with other accounting standards; Determine the total lease payments under gaap step 3: The primary accounting differences between a finance lease and an operating lease are that under a finance lease, reported amounts of debt and.