Favorite Tips About Impairment Loss Double Entry

Impairment is an accounting principle that describes a permanent reduction in the value of a company's asset, normally a fixed asset.

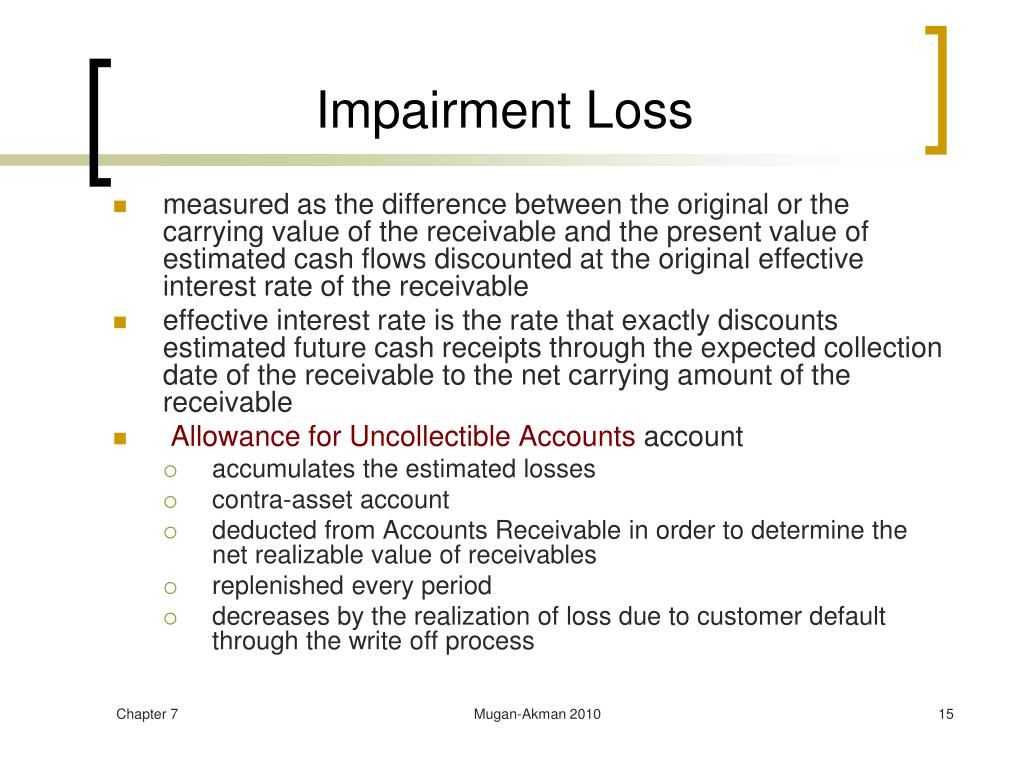

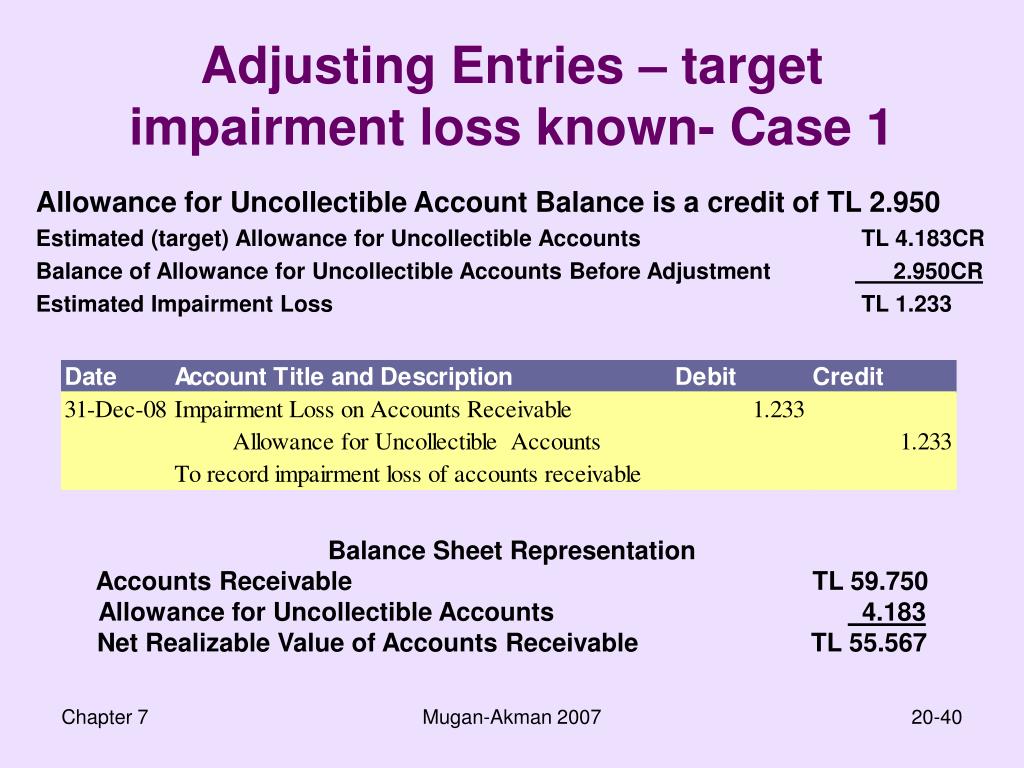

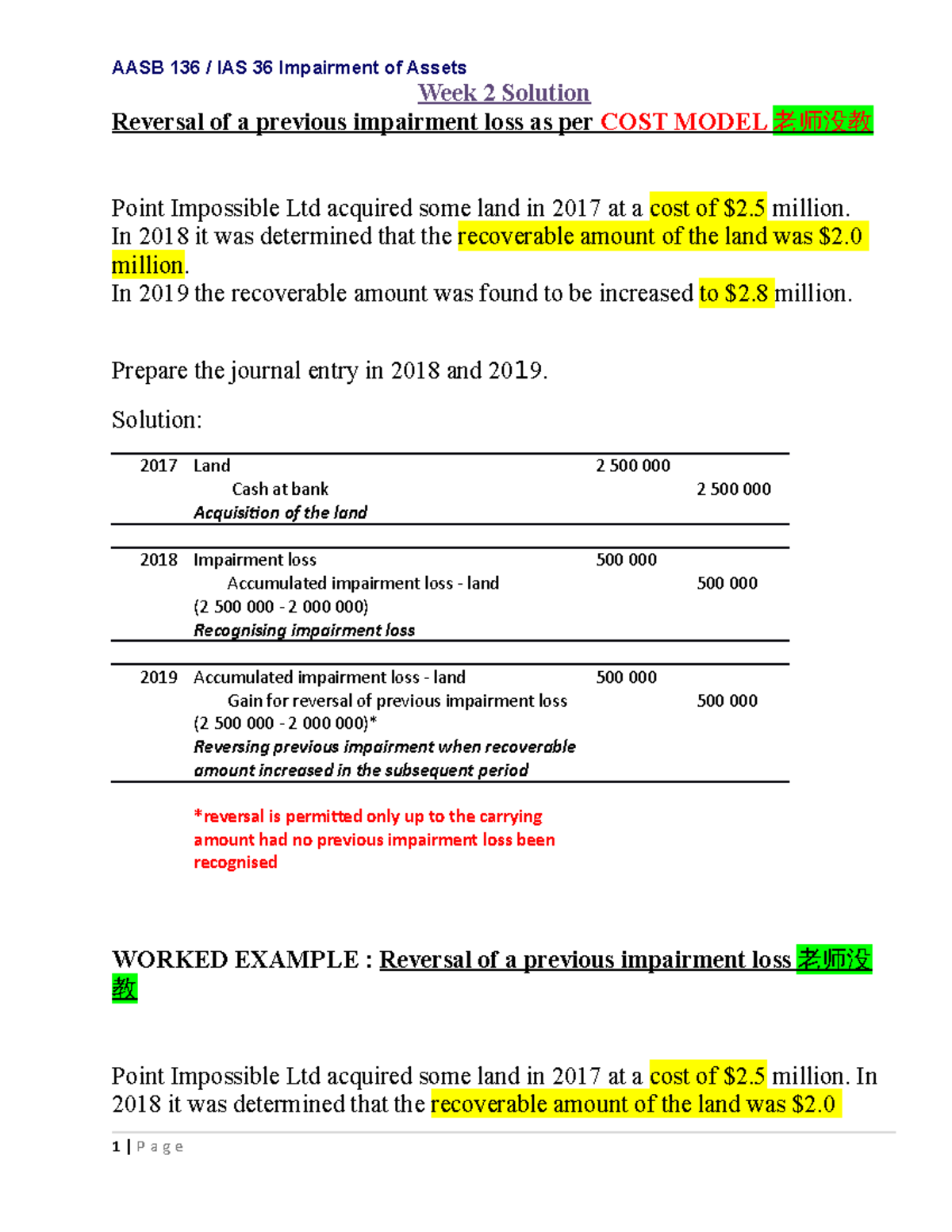

Impairment loss double entry. The write down of inventory journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double. Impairment loss is recognized immediately in p&l (unless the asset is carried at revalued amount) thus, entries would be: If a financial asset is deemed to be impaired, then this will impact on its carrying amount and future cash flows and so this article considers the principles on which the impairment of.

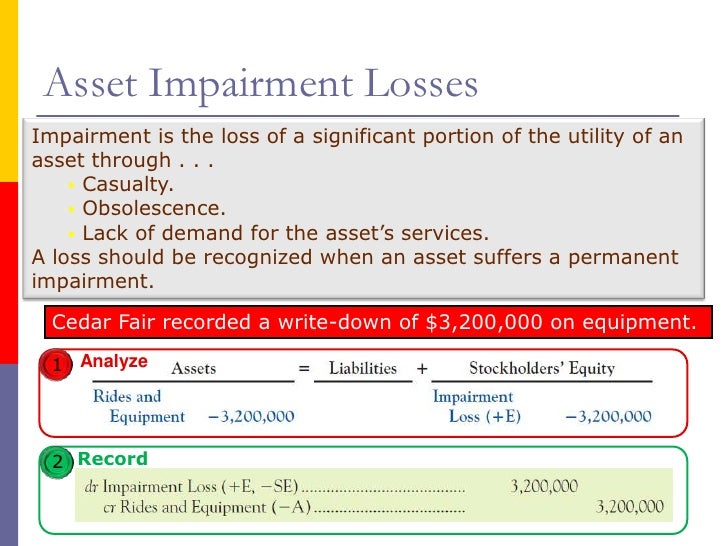

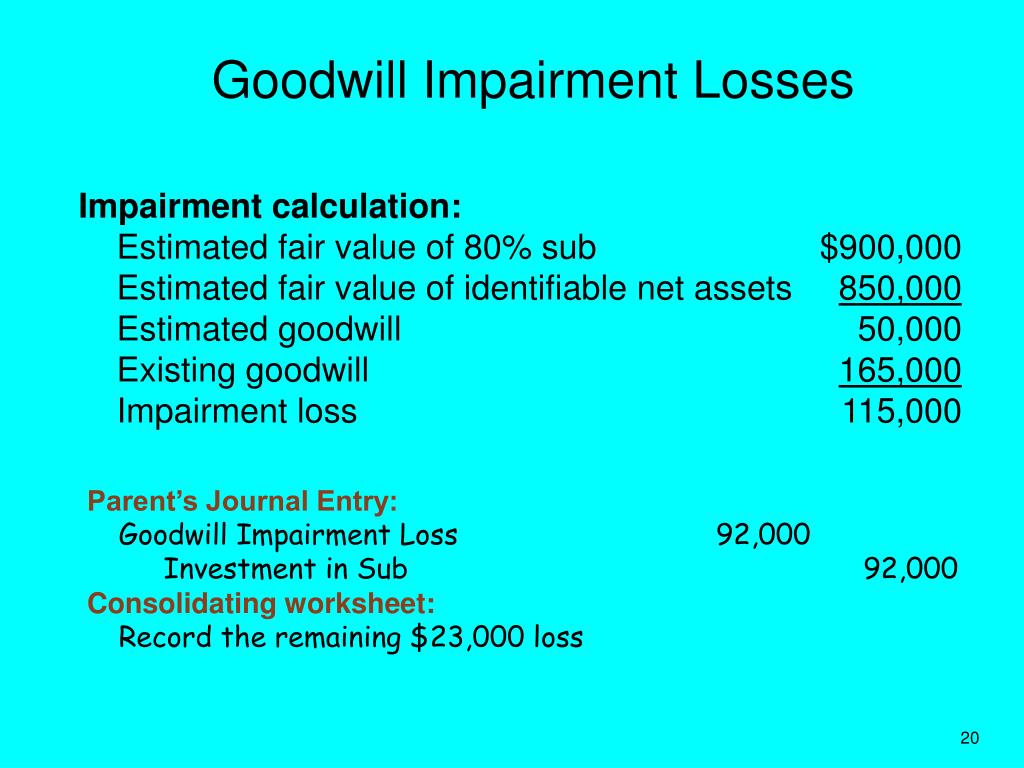

In this journal entry, the goodwill which is an intangible asset on the balance sheet of the company abc will. Based on the report from a technical expert, the impairment loss is $ 50 million. Can calculate the impairment loss.

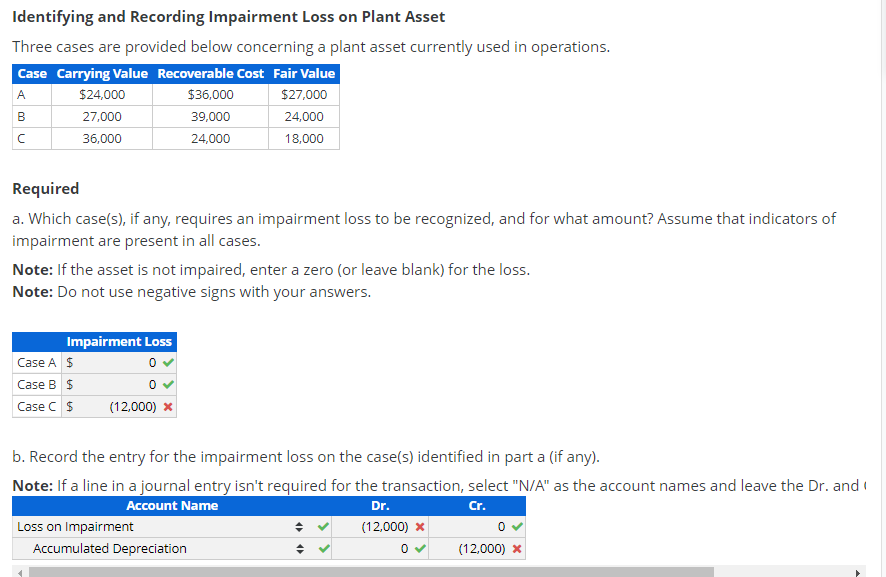

In this case, the company abc needs to make the fixed asset impairment journal entry for the impairment loss of $50,000 due to obsolescence of its machine as below: Impairment loss journal entry. Then records the impairment loss.

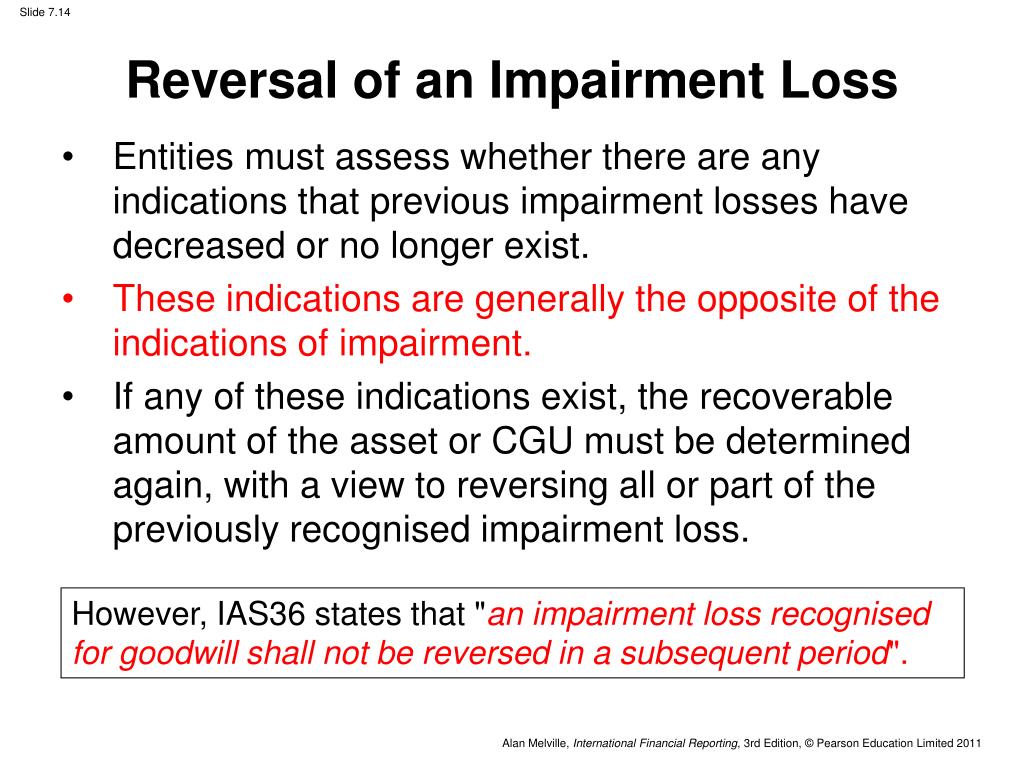

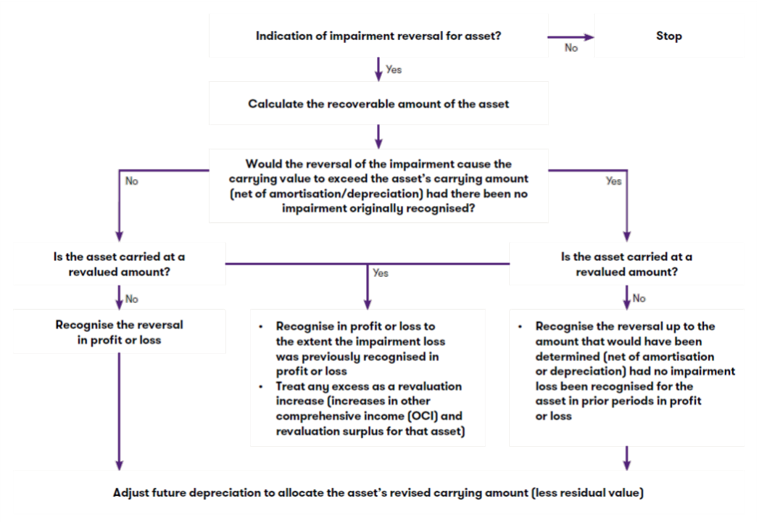

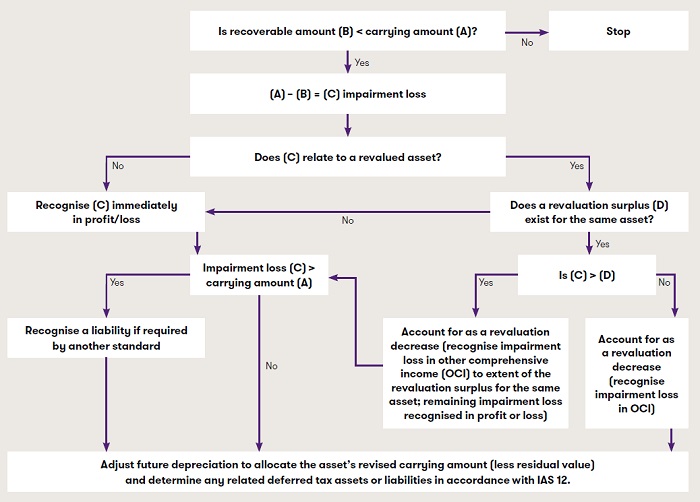

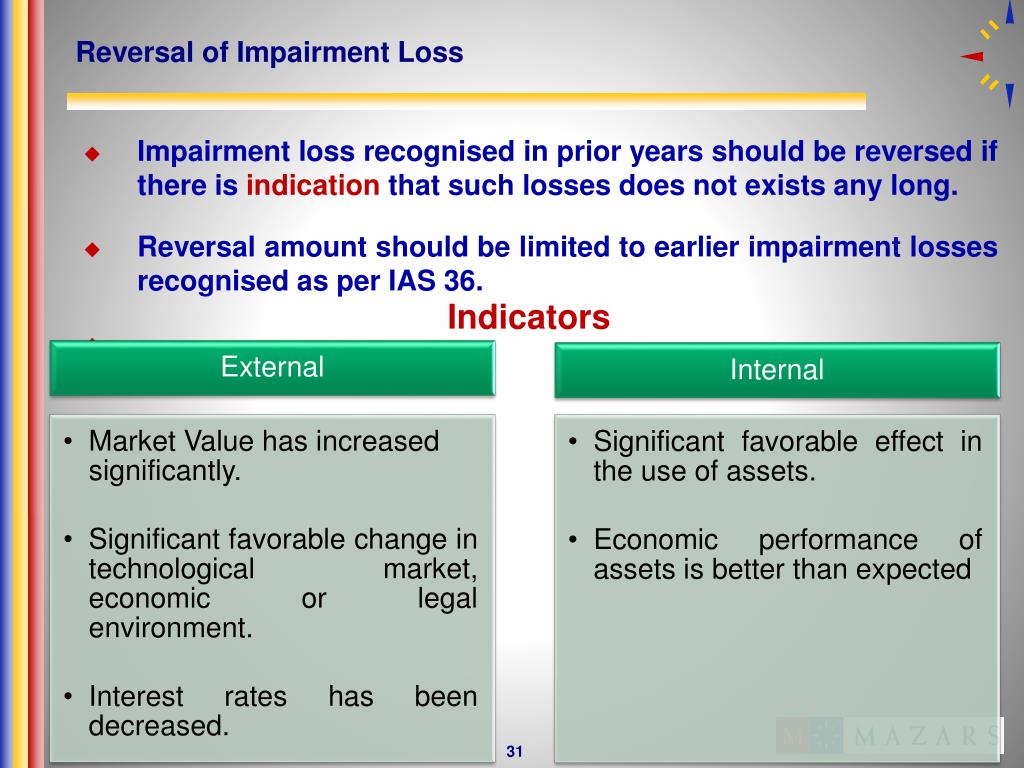

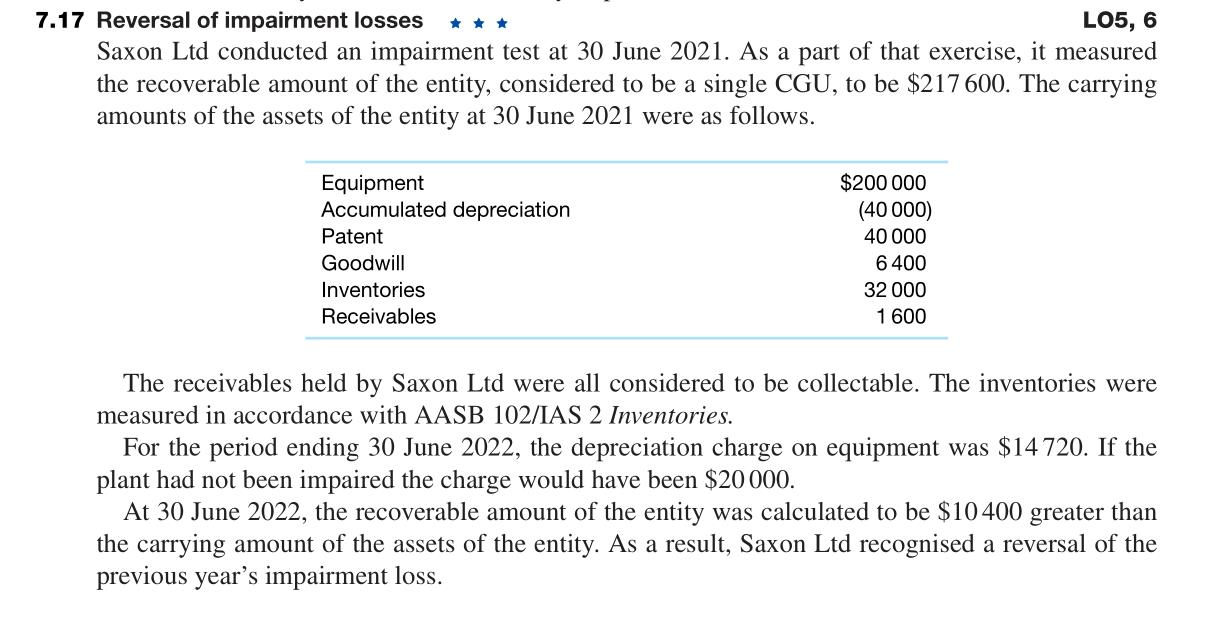

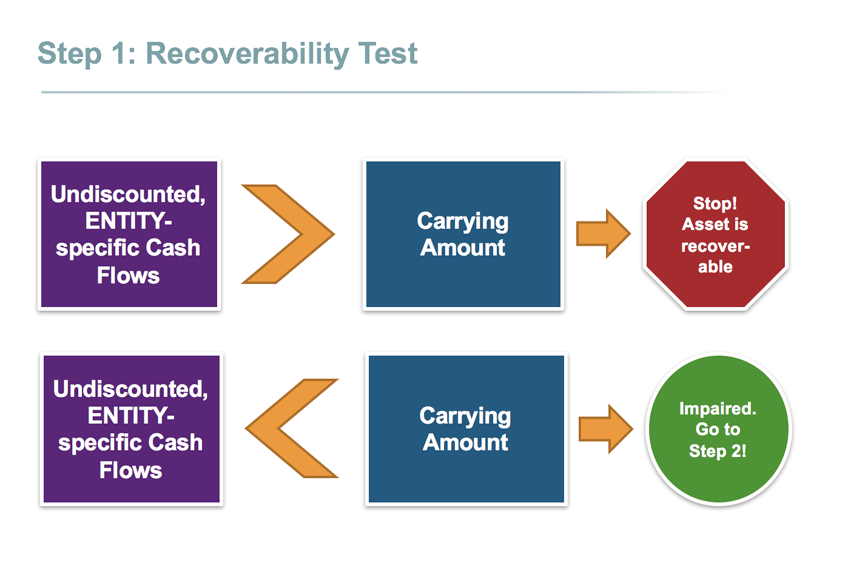

The entity to recognise an impairment loss. Section 1 introduction the principle of ias 36 impairment of assetssection 7is that assets must be carried at no more than their recoverable amount. When testing for impairment, the.

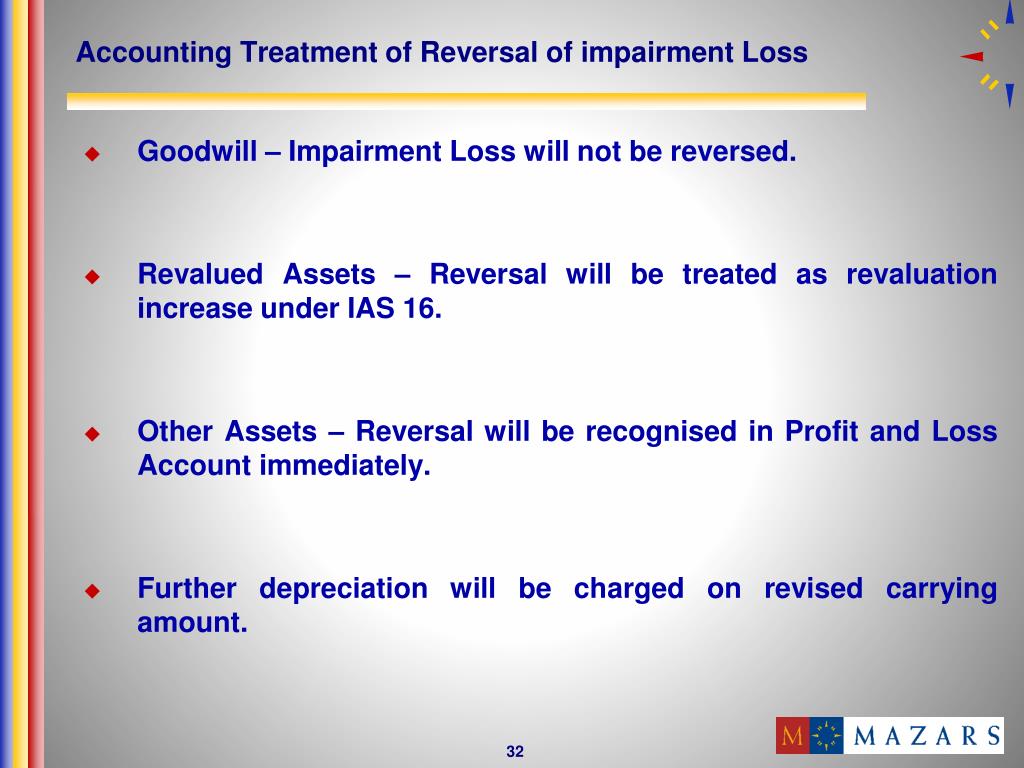

This loss will be as below. An impairment loss is recognised immediately in profit or loss (or in comprehensive income if it is a revaluation decrease under ias 16 or ias 38). Physical damage to the asset, a permanent reduction in market value, legal issues against the asset, and early asset.

When an asset is impaired, a journal entry must be recorded to reflect the loss on the company’s financial statements. Recognising an impairment loss for cgus. So we need to reduce the balance of fixed assets (machinery) by $ 50 million and record.

Dr impairment losses a/c (p&l. An impairment loss must be recognised for a cgu when the recoverable amount of the unit is less than its.