Fun Info About Income Statement Ratios Balance Sheet Figure

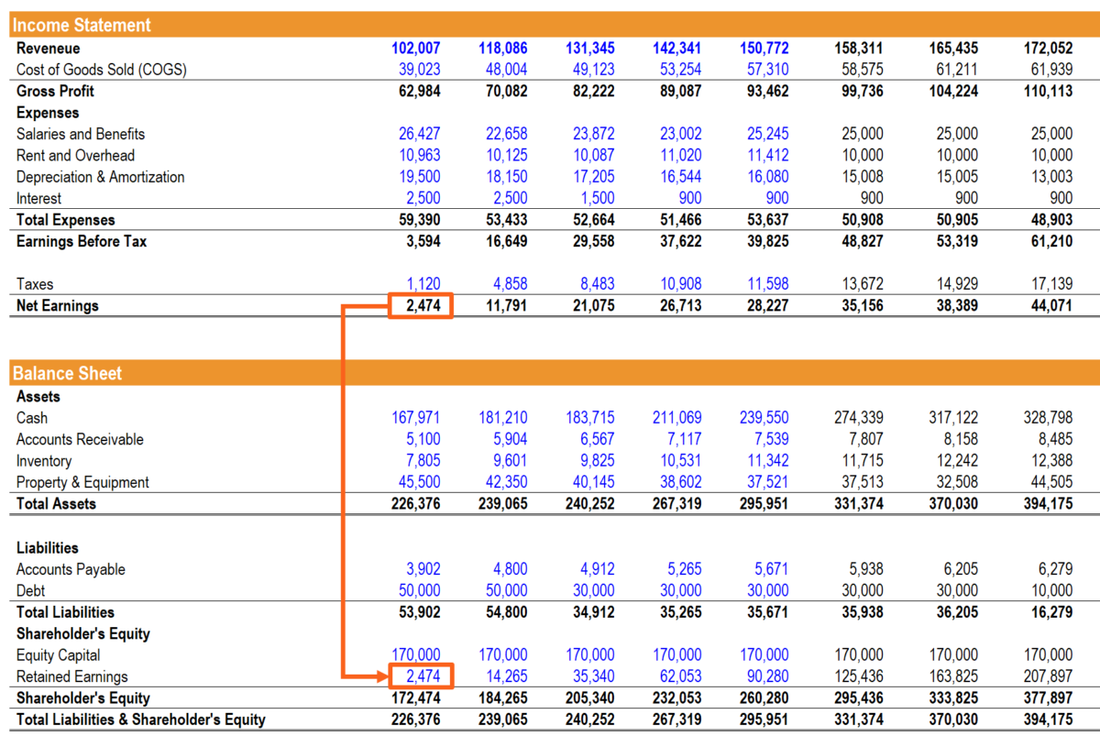

If any of you like to track your net worth, with debts and assets (like your house), then that is exactly like a company’s balance sheet.

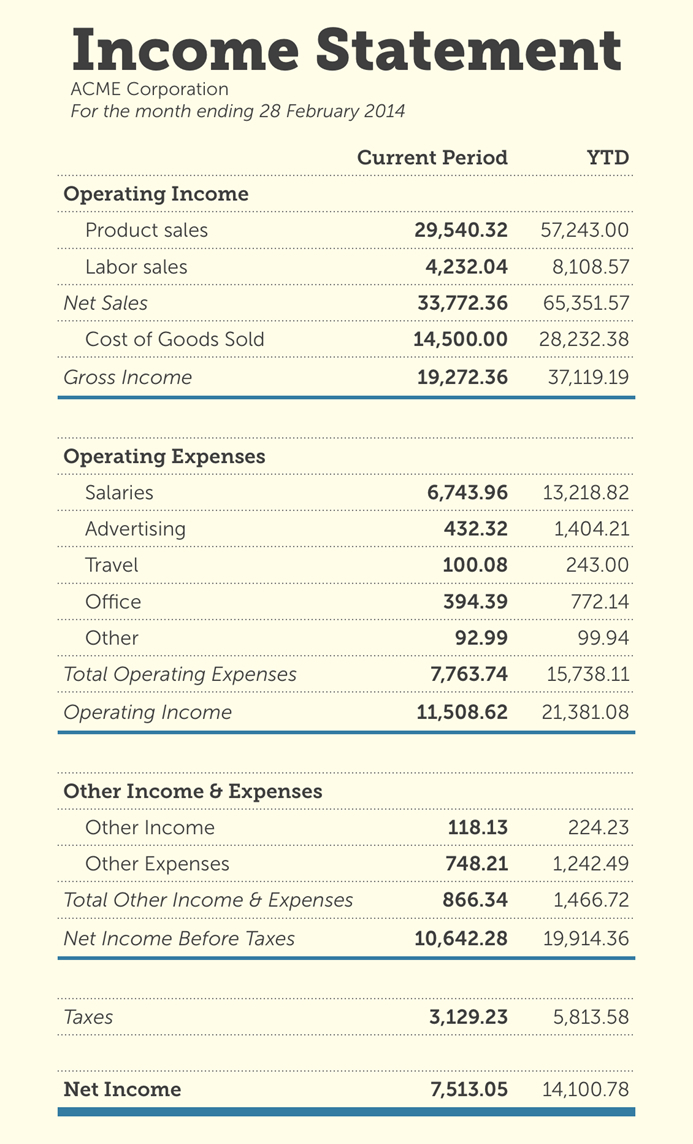

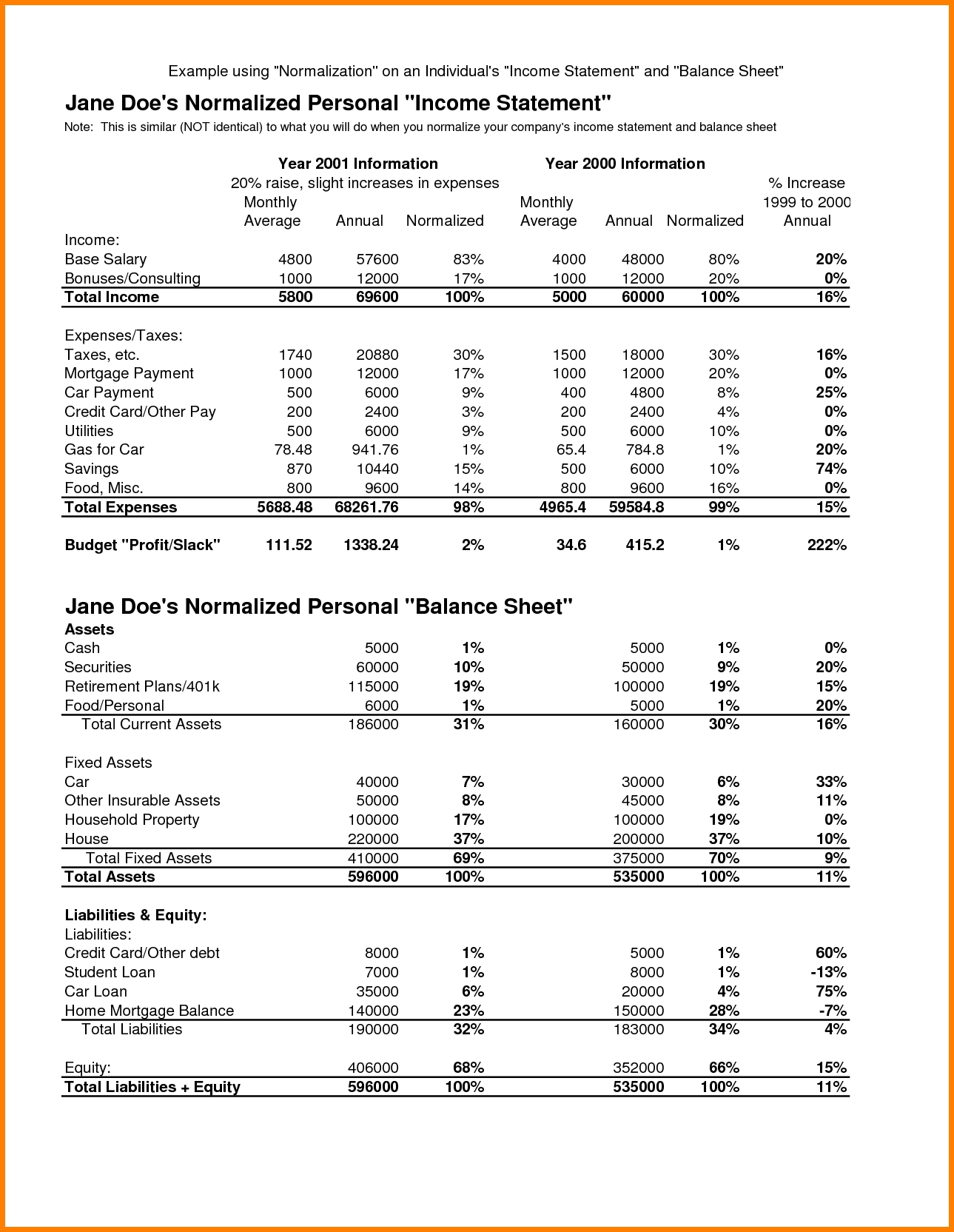

Income statement ratios balance sheet figure. The income statement vs. Liquidity ratios show the ability to turn assets into cash quickly. In this case, the statement of owner’s equity uses the net income (or net loss) amount from the income statement (net income, $5,800).

When the company earns money and keeps it, it gets added to the balance sheet. Ratio #6 gross margin (gross profit percentage) ratio #7 profit margin ratio #8 earnings per share ratio. Ratio analysis is a way of creating a context by.

If both sides do not tally the final total, you will need to run through the figures to spot where the discrepancy arises. An income statement tallies income and expenses; The balance sheet shows the cumulative effect of the income statement over time.

Here is a quick reference for the key differences between the balance sheet and income statement, summarizing what we’ve. It is just like your bank balance. Financial ratios using amounts from the balance sheet and income statement financial ratio using amounts from the statement of cash flows calculating the ratios using amounts from the balance sheet you will be using the following balance sheet to calculate the first group of financial ratios:

These ratios aid to analyze the company’s performance in the market within a stipulated time. Differentiate between expenses and payables. Financial ratios using amounts from the balance sheet and income statement.

There are three types of ratios derived from the balance sheet: During the period close process, all temporary accounts are closed to the income summary account, which is then closed to. The statement uses the final number from the financial statement previously completed.

The balance sheet while the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. Balance sheet vs income statement basics the easiest way i can describe each statement is by relating them to your personal finances. Solvency ratios show the ability to pay off debts.

The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed. A balance sheet, on the other hand, records assets, liabilities, and equity. Michael logan companies produce three major financial statements that reflect their business activities and profitability for each accounting period.

Let’s create a balance sheet for cheesy chuck’s for june 30. Calculate balance sheet ratios with the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: Ratio #10 receivables turnover ratio.

The income and cash flow statements explain the changes in the balance sheet over time. The amount that remains with you after covering all expenses in this overview, we recall that the balance sheet’s total must be equivalent to the total liabilities and the equity. Definition and example of income statement formulas