Neat Tips About Notes Payable Cash Flow

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

The maker then records the loan as a note payable on the balance sheet.

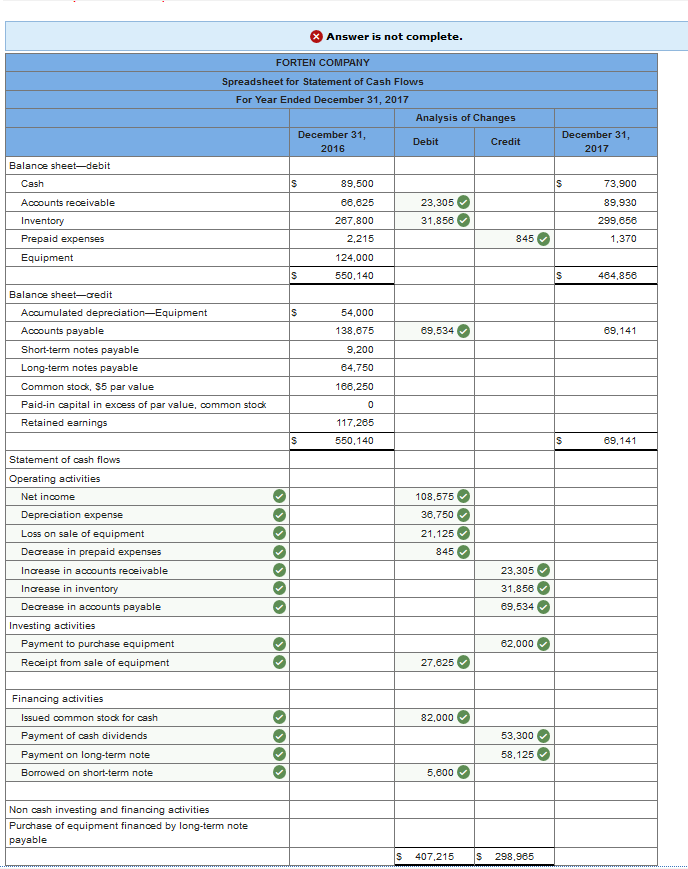

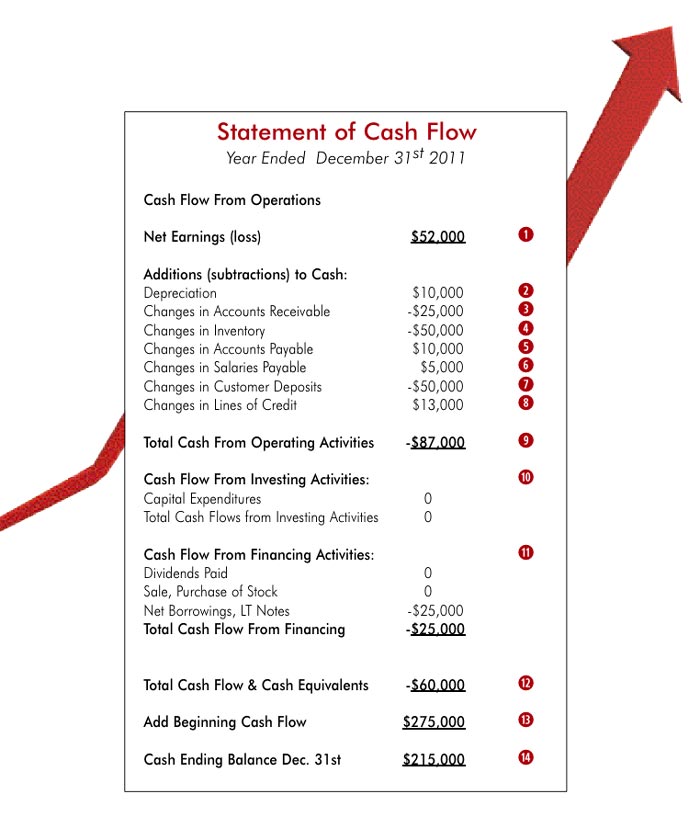

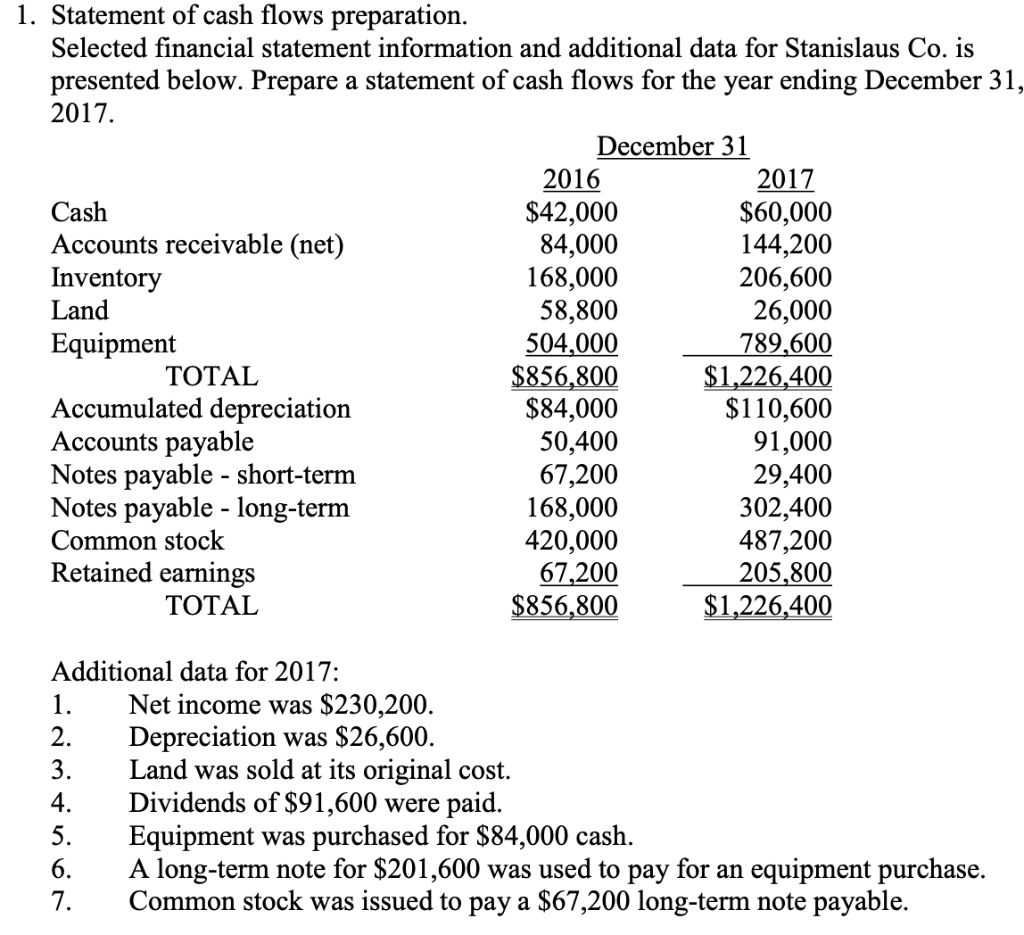

Notes payable cash flow. Most companies are required to produce this. If a company borrows capital under a note. Cash flow statements (cfs) provide a summary of the cash that a company brings in and spends in a given time period, also called cash inflow and cash outflow.

However, they differ in payment terms and whether they involve regular interest payments. It is supported by a formal. A note payable affects the cash flow statement by reducing the amount of cash that a company has available, as payments must be made to repay the loan.

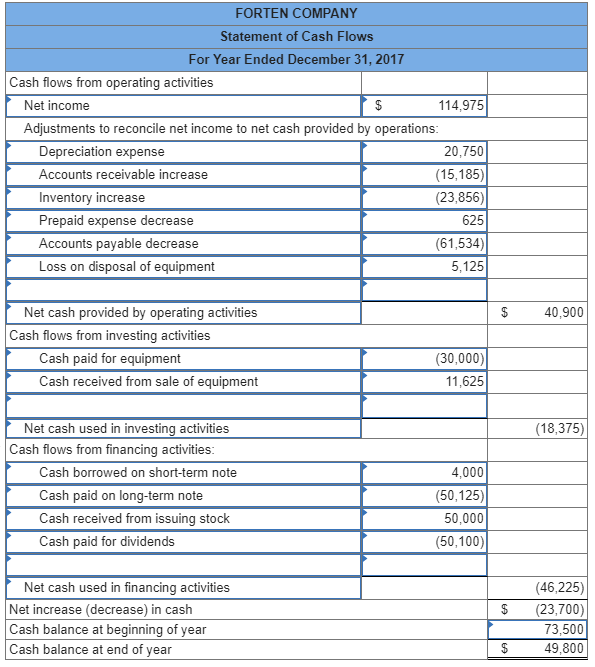

To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. Notes payable have an effect on cash flow when a company receives or pays back the proceeds and when it makes regular interest payments.

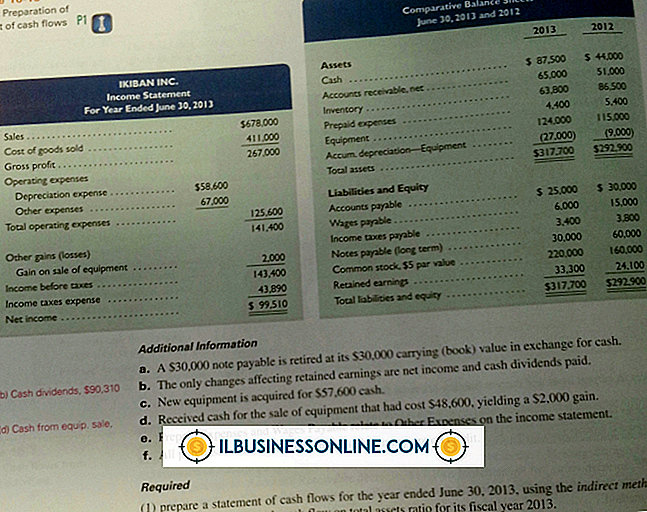

Recording a notes payable includes specifying details and terms of the agreement,. While accounts payable often involve. Since most corporations report the cash.

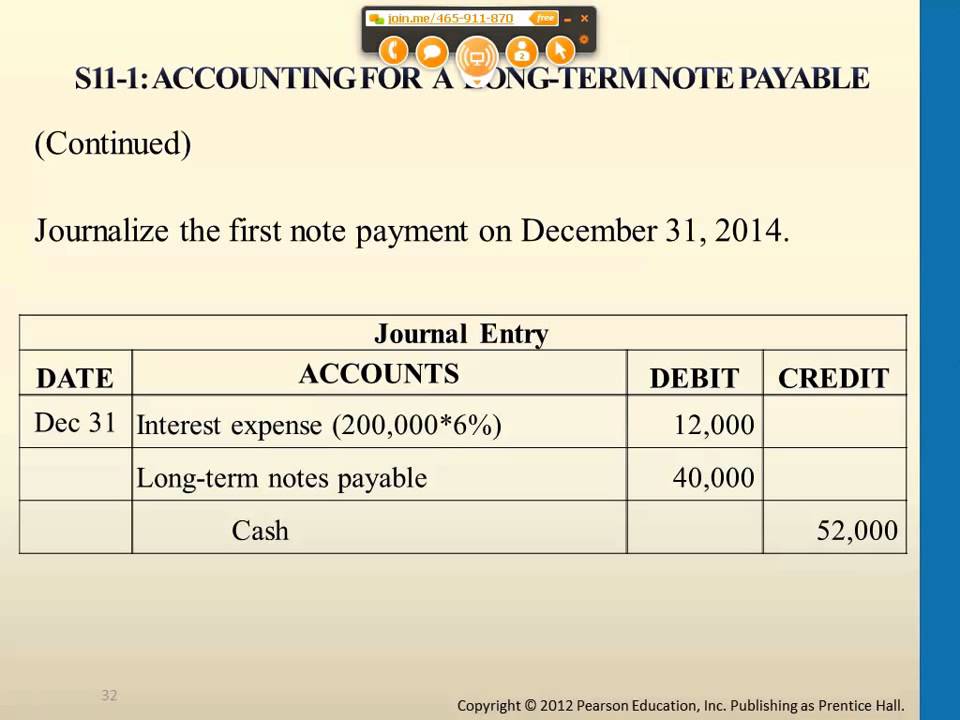

Notes payable are the corresponding liabilities on a maker’s books, also in the amount of outstanding principal. Interest expense increases (a debit) for $4,500 (calculated as $150,000. The notes payable account in the liabilities section of the balance sheet represents the total.

Both types of payables appear as liabilities on the balance sheet; For the entity doing the lending, also known as a. A note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined future date.

A note payable is a debt that is established with a written agreement. Capital borrowing journal entry (debit, credit) cash account: Managing these two liabilities is crucial for businesses to maintain healthy cash flows and ensure timely payments to vendors and lenders.

Common examples of current liabilities include accounts payable, unearned revenue, the current portion of a noncurrent note payable, and taxes payable. 11.3 accounts and notes payable publication date: