Sensational Info About Goodwill Balance Sheet

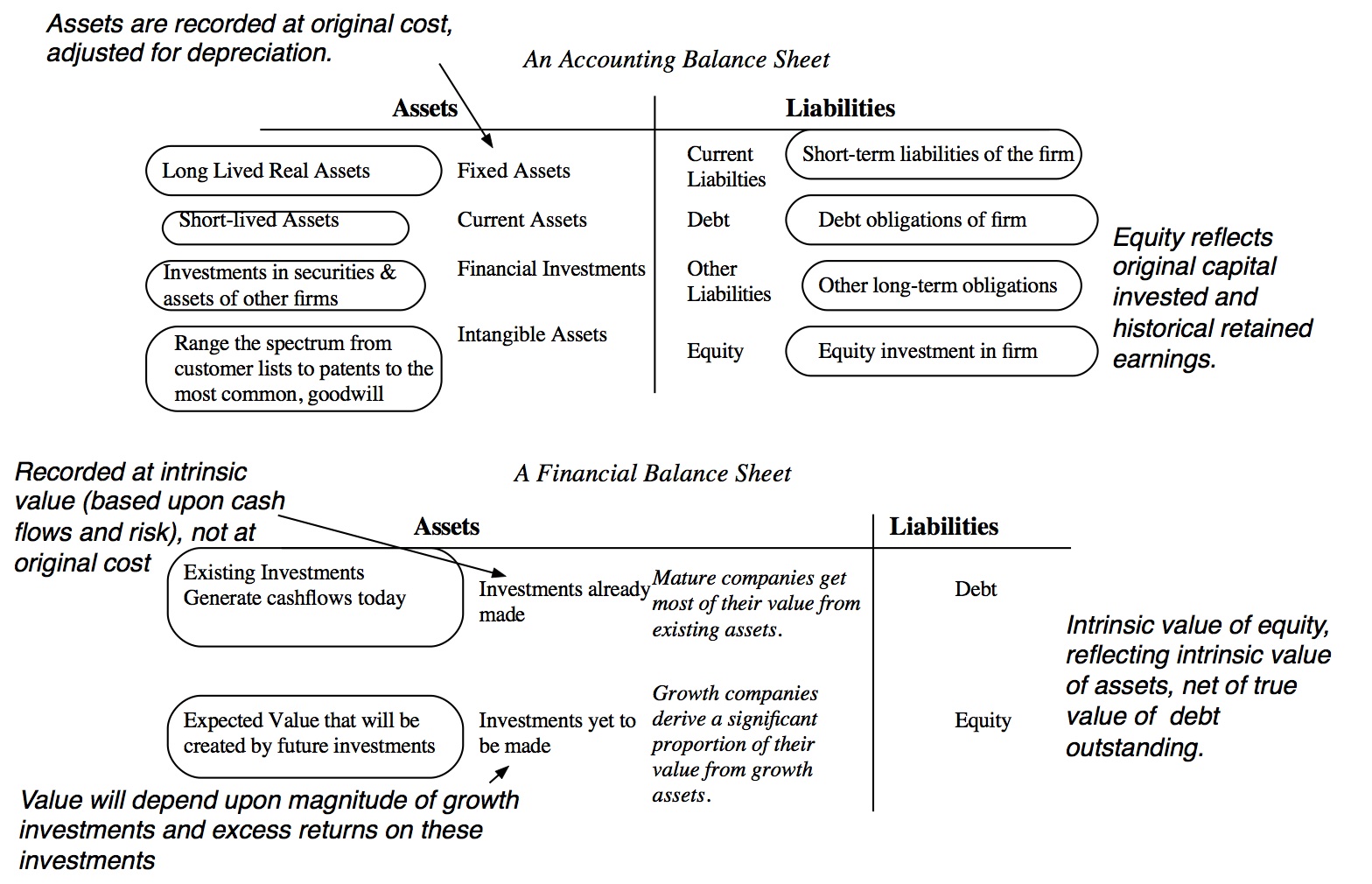

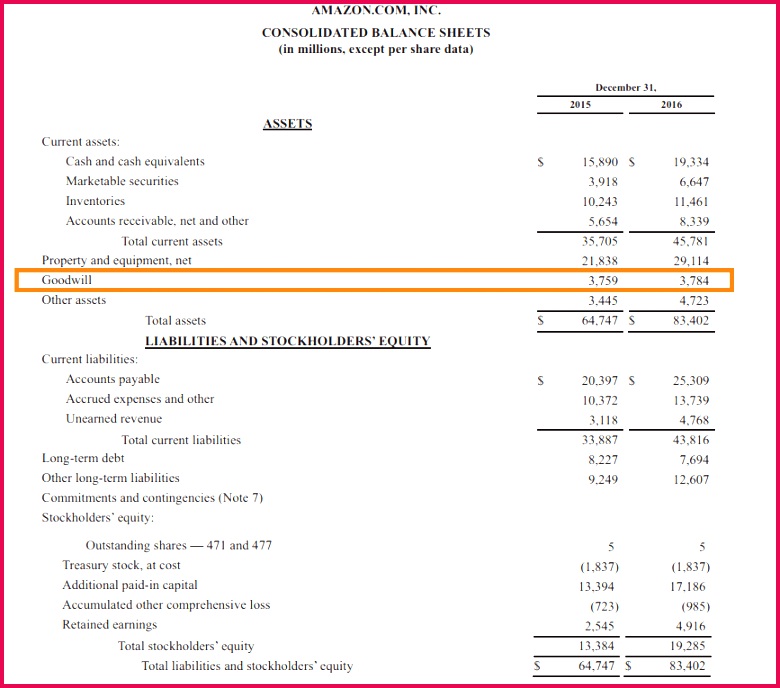

It is classified as an intangible asset on the balance sheet, since it can neither be seen nor touched.

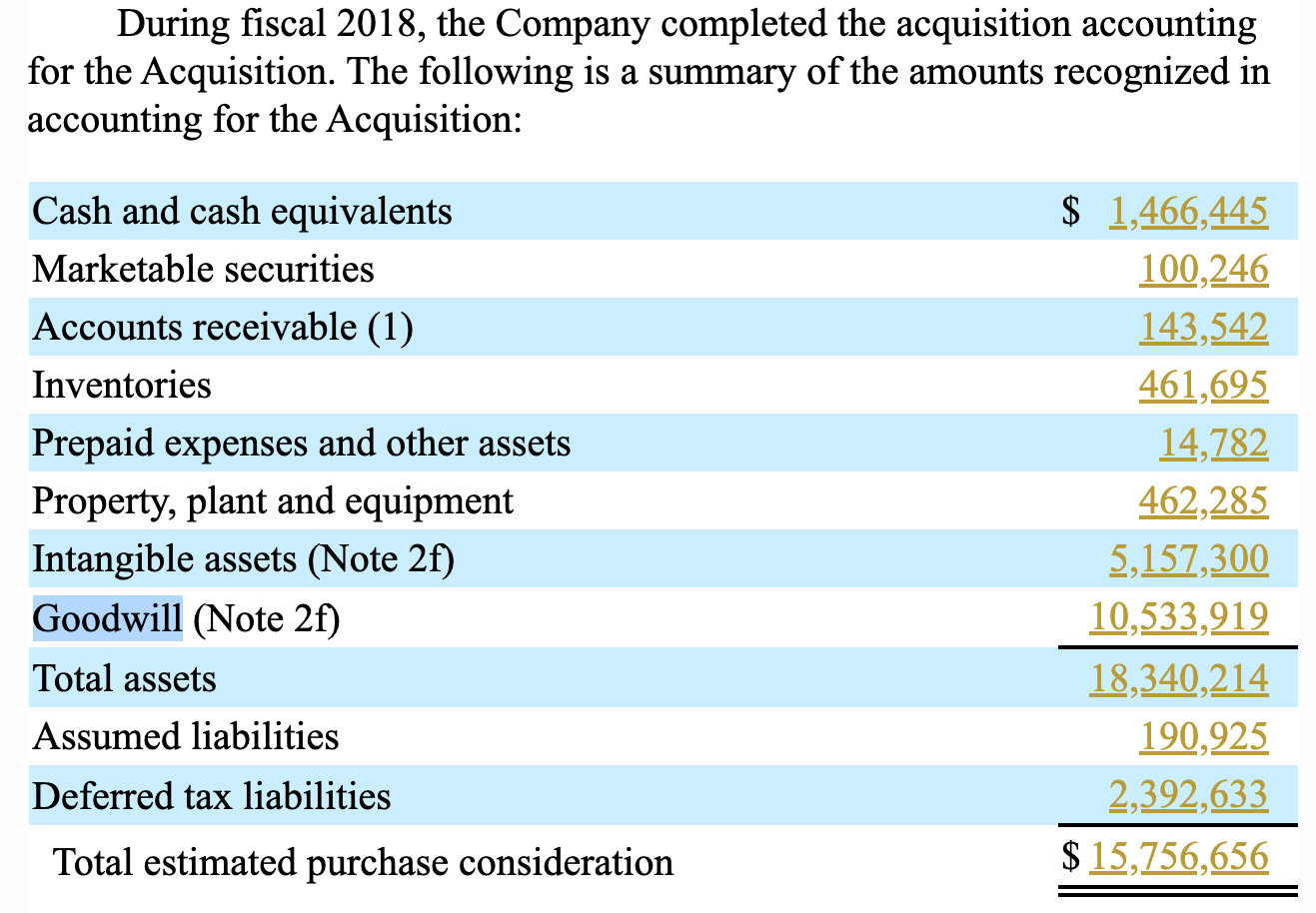

Goodwill balance sheet. But the market value is $15,000,000. Goodwill impairments are instances in which the value of assets declines after being purchased by an acquiring company. The valuation exercise requires a detailed analysis of each of the drivers of bank profitability.

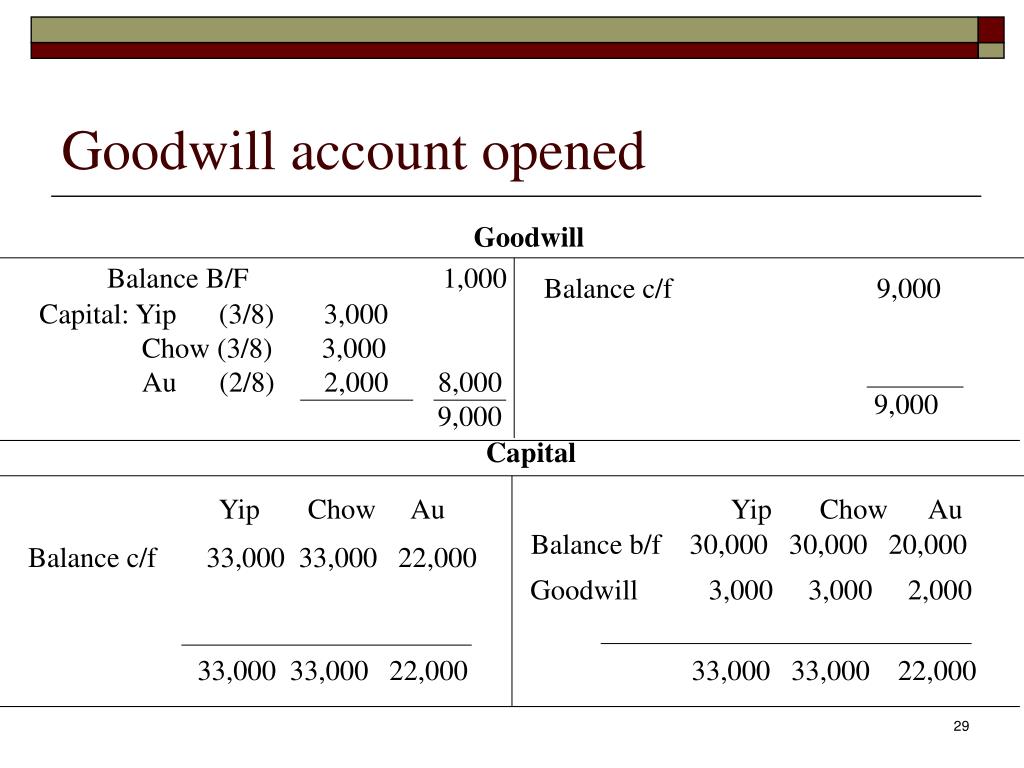

So, for instance, imagine that the book value of a company being sold is $10,000,000. Since goodwill is an intangible asset, it is recorded on the balance sheet as a noncurrent asset. Goodwill is an intangible asset linked to a company combination in accounting.

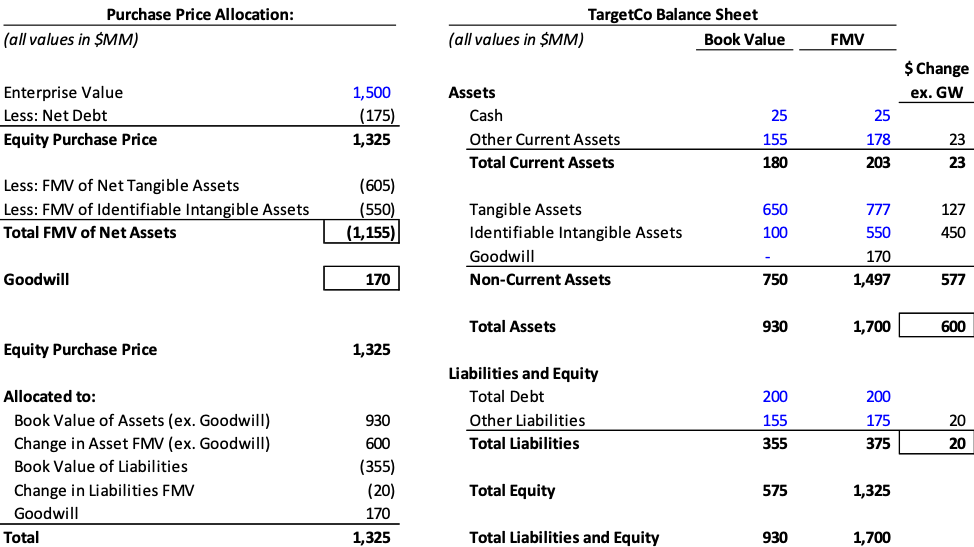

The calculation of goodwill follows a simple formula: Read more about the corporate balance sheet. Test the goodwill account for impairment each year.

How goodwill is written down. $400,000 determine the purchase price of the company the first step is to determine the purchase price of the company. When a company earns a rate of return that is greater than the fair value of the tangible and intangible assets combined, the excess income is considered goodwill for the company.

When testing goodwill for impairment, banks are required to assess the carrying value of a significant balance sheet asset by applying the discipline of fair value measurement. Goodwill is listed as an intangible asset on the acquirer’s balance sheet when one company pays a premium to acquire another. Individual intangible conditions that may contribute to goodwill are hard to recognize and, if recognized, cannot be appreciated separately.

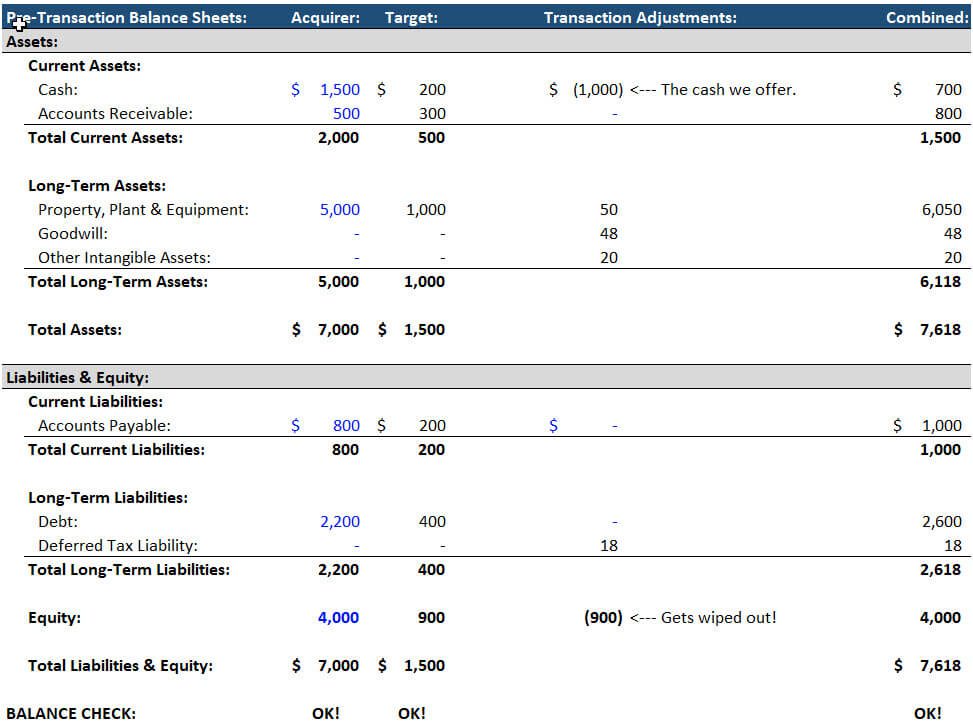

Gaap and ifrs, goodwill is never amortized, because it is considered to have an indefinite useful life. The acquiring company adds goodwill to the balance sheet for $5,000,000. Prior to 2002, goodwill was.

Goodwill is an intangible asset account on the balance sheet. This series of entries adds the $800,000 in assets to the books, adds the $200,000 in goodwill, and subtracts $1 million in cash from the books to reflect cash leaving to fund the purchase. To record goodwill on a balance sheet, the acquirer must list it as an intangible asset under the “assets” section.

It comes in a variety of forms, including reputation, brand, domain names,. Or, more simply: Calculate the market value of the company's assets:

Suppose abc company has $100,000 in fair market assets and $50,000 in liabilities. This accounting record is referred to as recognizing the value of goodwill. $1,000,000 market value of its assets:

Goodwill reflects a company's reputation, customer relationships, brand recognition, and other factors contributing to its ability to generate future earnings. The goodwill formula calculates the value of the goodwill by subtracting the fair value of net identifiable assets of the company to be purchased from the total purchase price; Answer the goodwill calculation would include deferred consideration of $188,679 being $200,000 x 1/1.06 1.