Fantastic Tips About Individual Income Statement

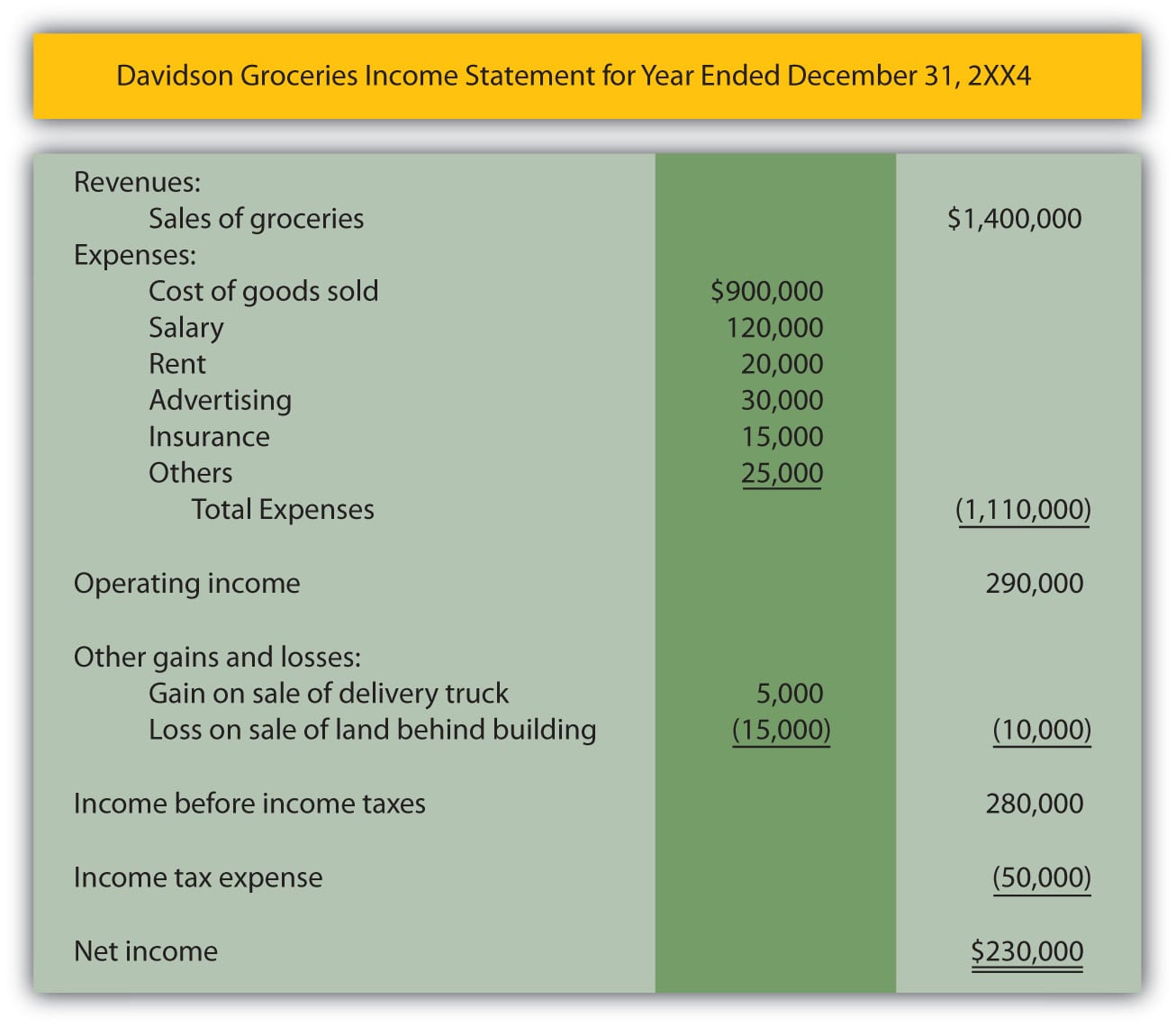

Revenue, expenses, gains, and losses.

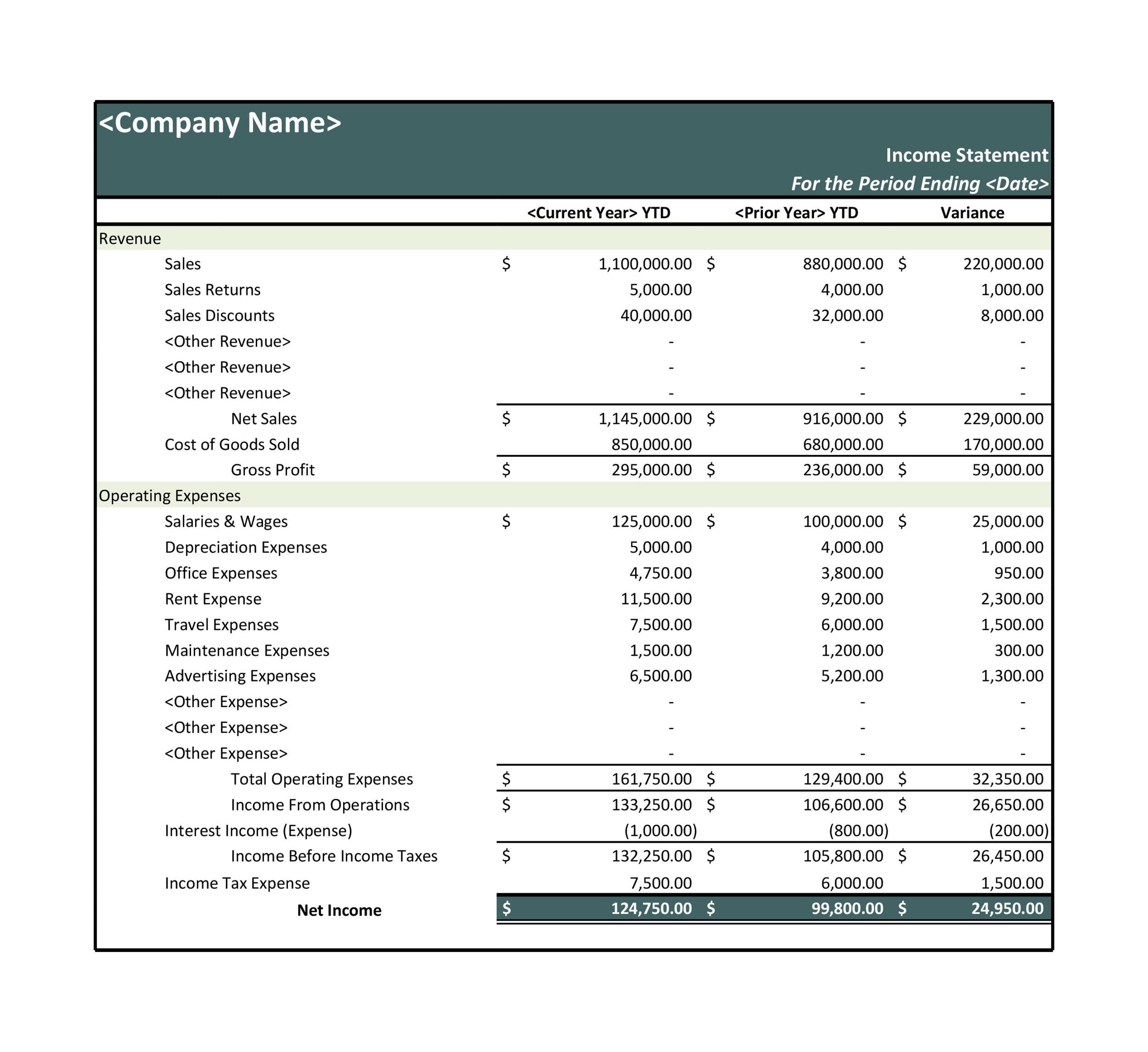

Individual income statement. Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. It is easy to understand and interpret. Deputy prime minister and minister for finance, mr.

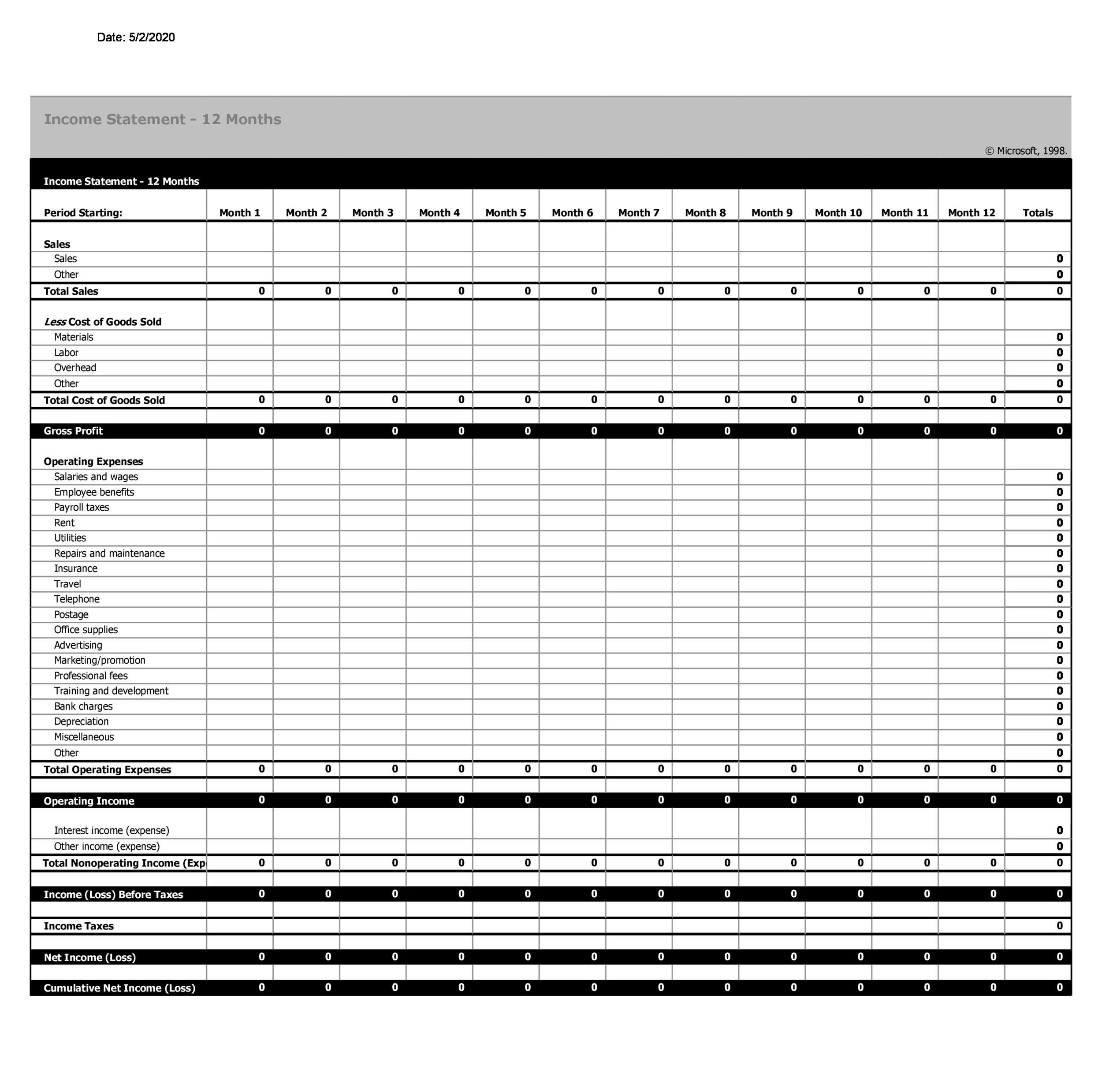

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows. An income statement compares revenue to expenses to determine profit or loss. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs.

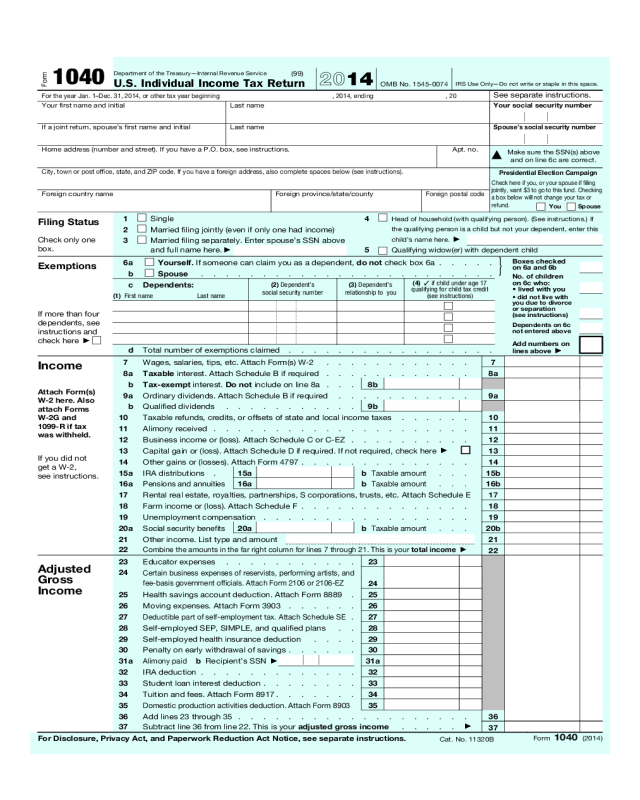

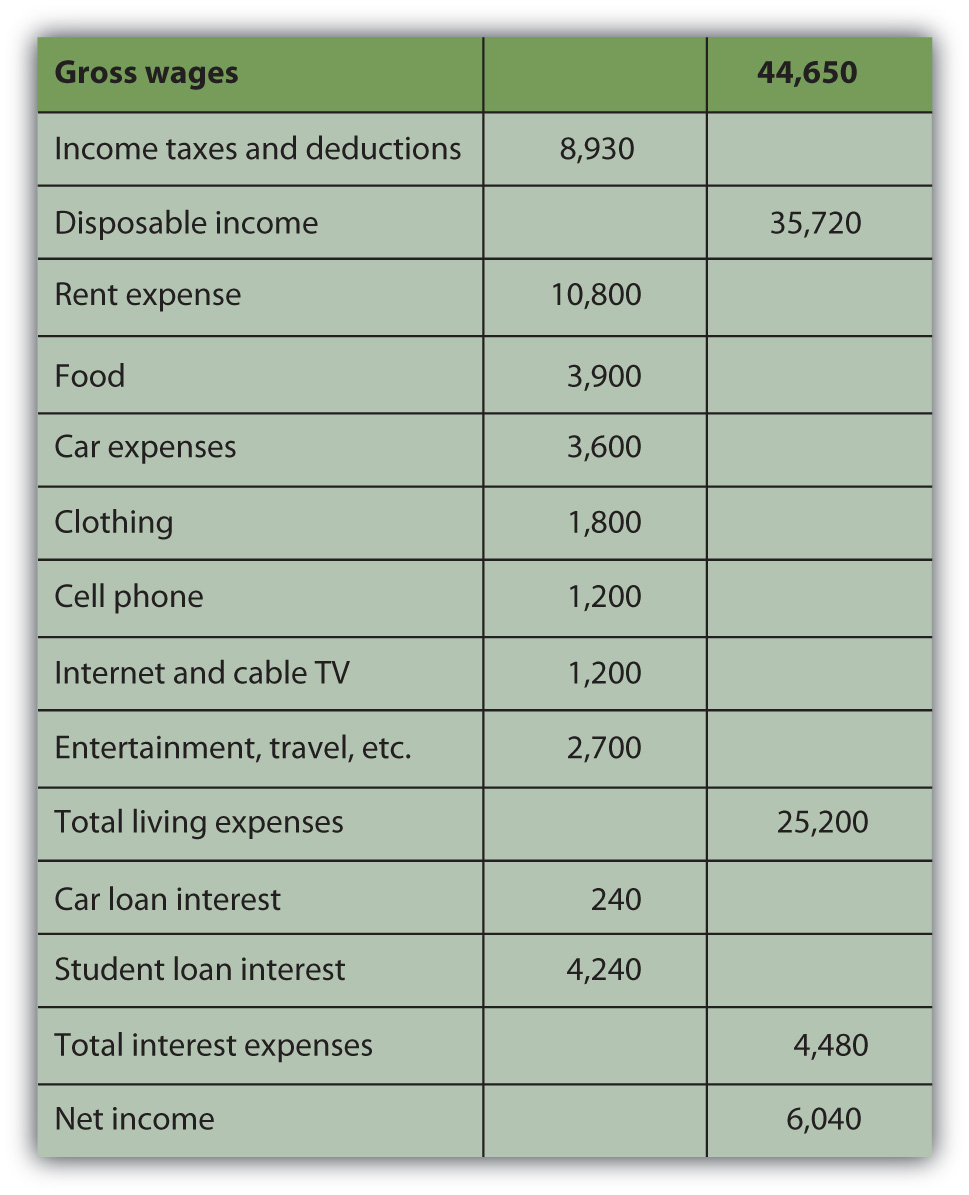

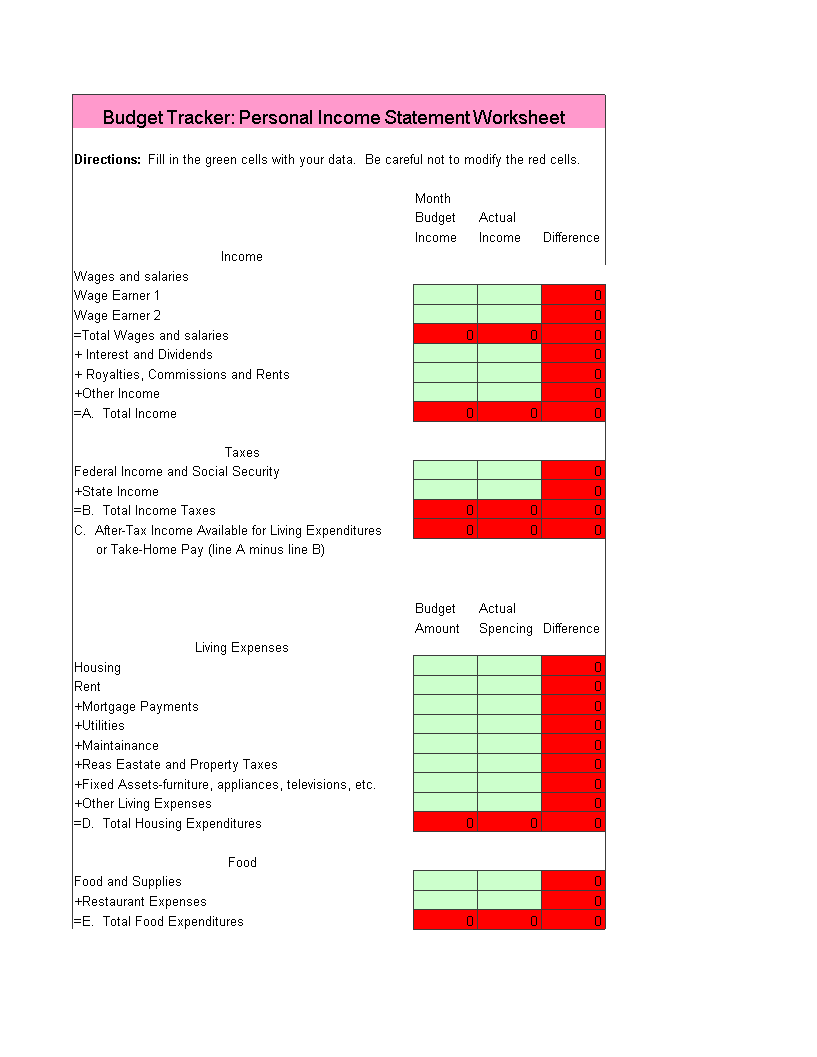

It is one of three major financial statements required by gaap (generally accepted accounting principles). This personal financial statement also contains all the living expenses that you might incur over time such as rent, utility payments, and mortgage payments. Other revenues include federal reserve earnings, excise taxes, and

Understanding personal finance statement template. Abc company income statement tax year 2020. If you don't want to create a mygov and link to the ato you can phone us on 13 28 61 to get a copy of your income statement.

The exemption amount of $3,200 begins to be phased out if the federal adjusted gross income (agi) is more than $100,000 ($150,000 for joint taxpayers). Some countries in europe are considering changing their top personal. An income statement is a financial statement that shows you the company’s income and expenditures.

The income statement focuses on four key items: What is an income statement? Many key fundamental ratios use information from the income statement.

What is an income statement? Lawrence wong, delivered the budget statement for the financial year 2024. Run the income statement to view your income, expenses and profit for the selected report period.

The expense category has the heads. What is the income statement? A personal income financial statement lists income from various sources (salaries, dividends, and profits from bonds or stocks).

Sales on credit) or cash vs. About the income statement run or view the report customize your report use common formats what's next? Court of appeals for the fifth circuit.

For comparison, the average combined state and federal top income tax rate for the 50 u.s. It shows whether a company has made a profit or loss during that period. It is a very simple format and has a few line items.