Top Notch Tips About Selling And Administrative Expenses Income Statement

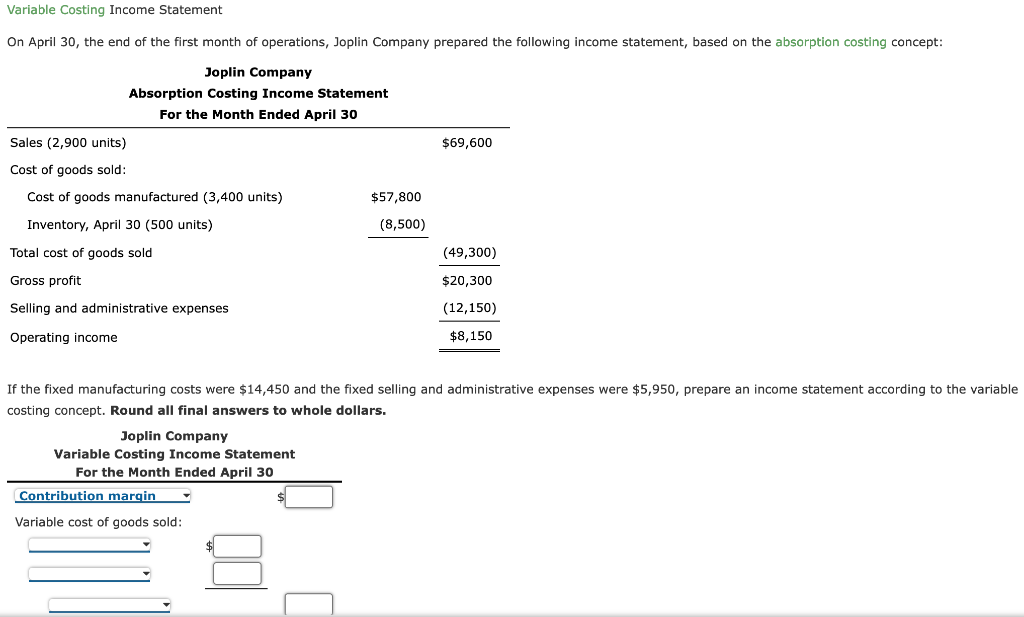

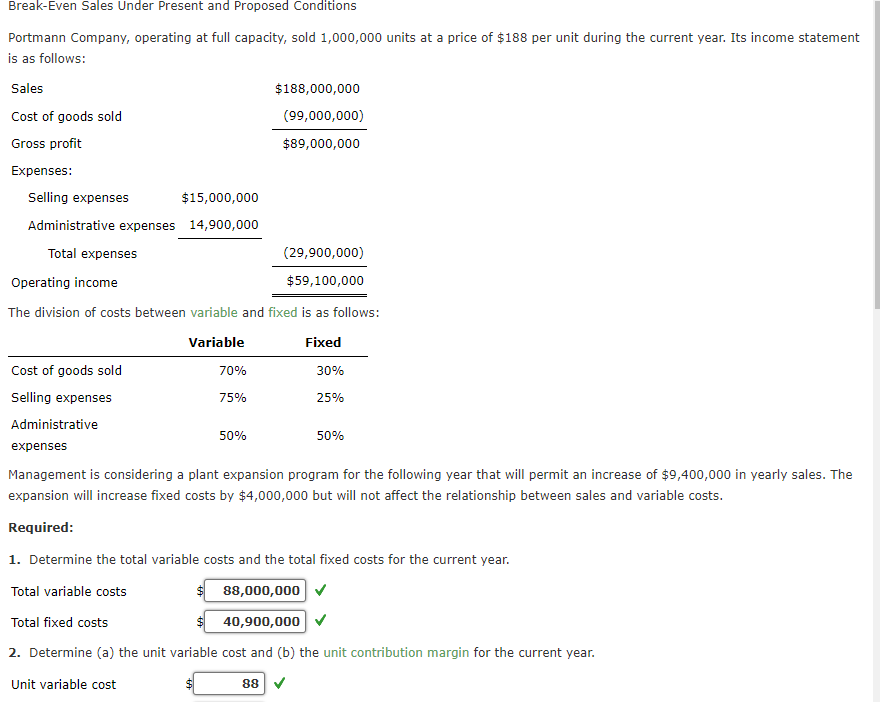

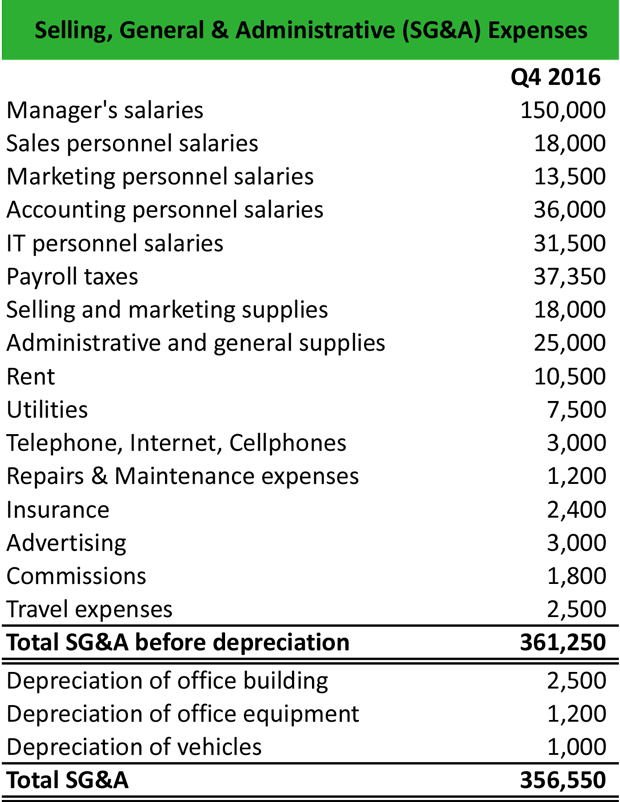

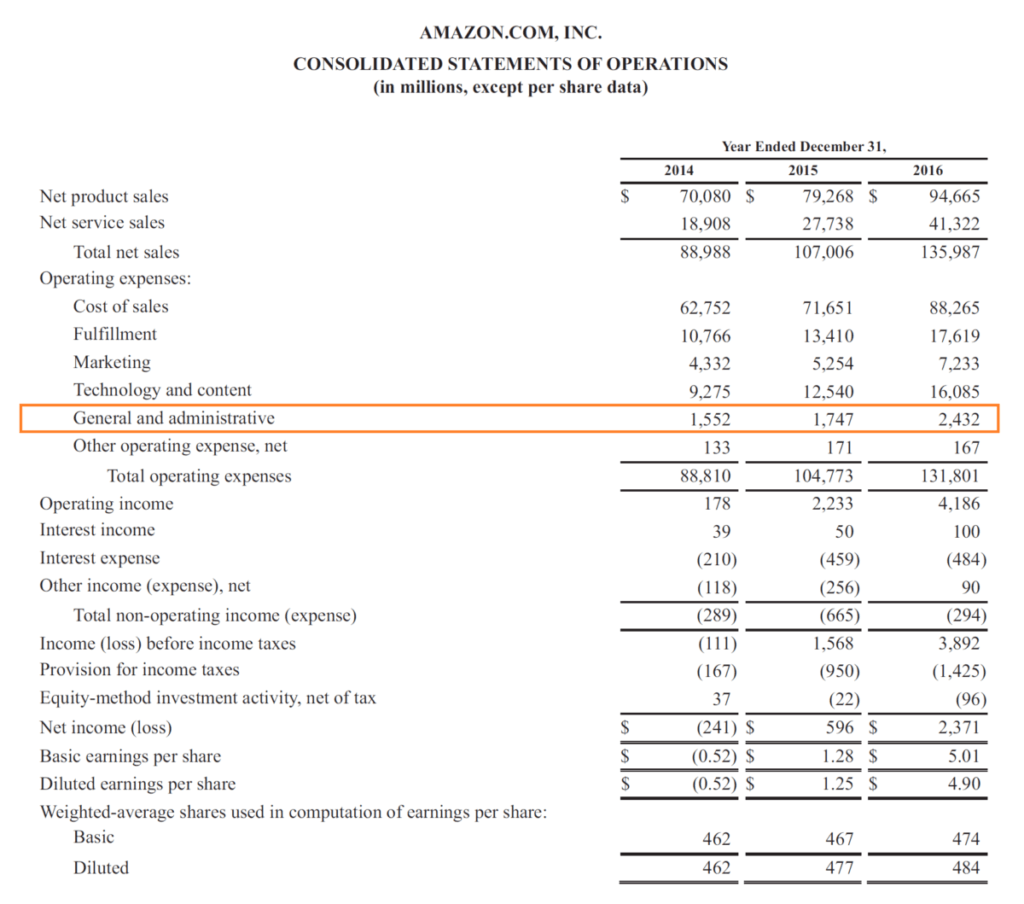

The category of selling, general, and administrative expenses (sg&a) in a company's income statement includes all general and.

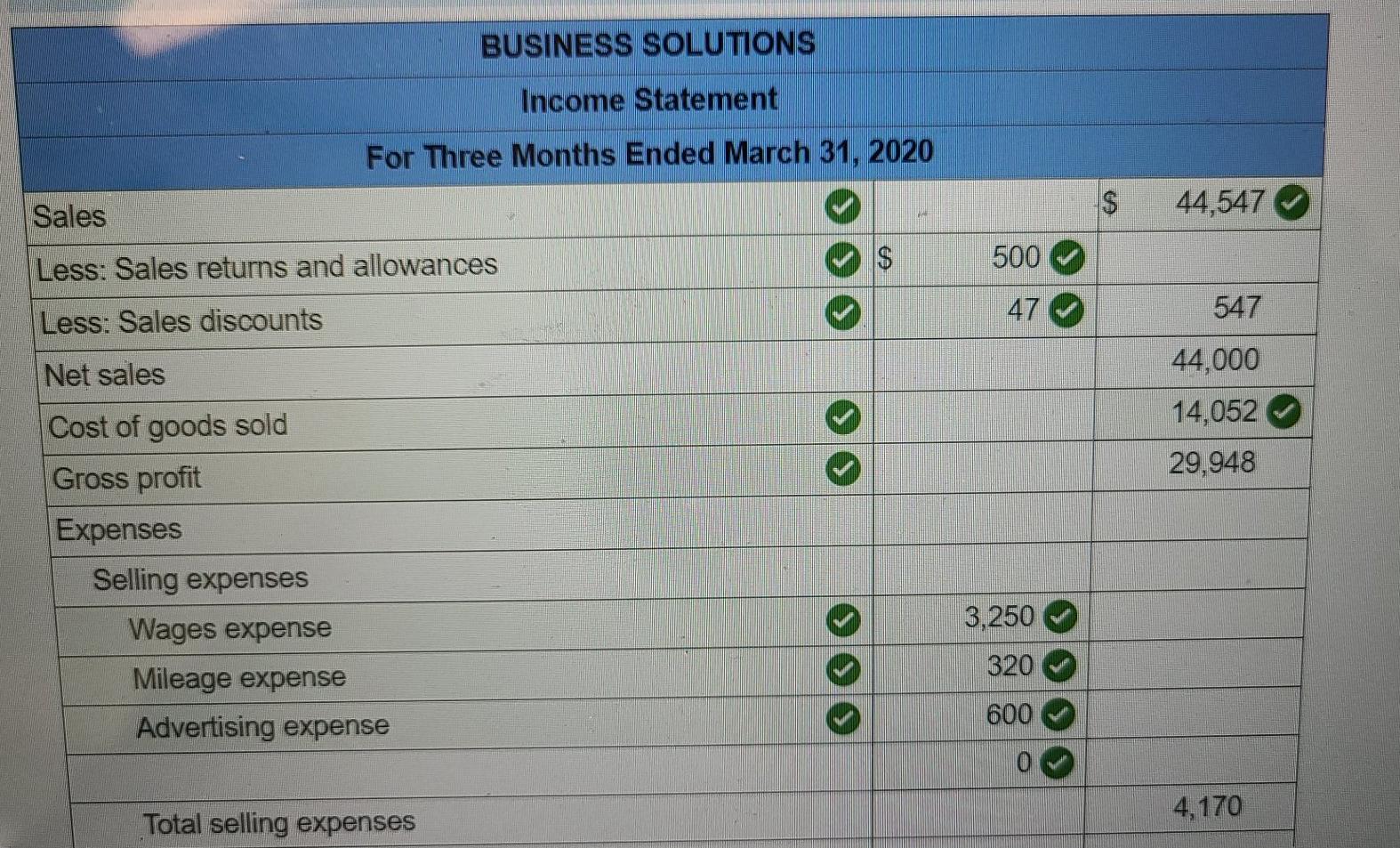

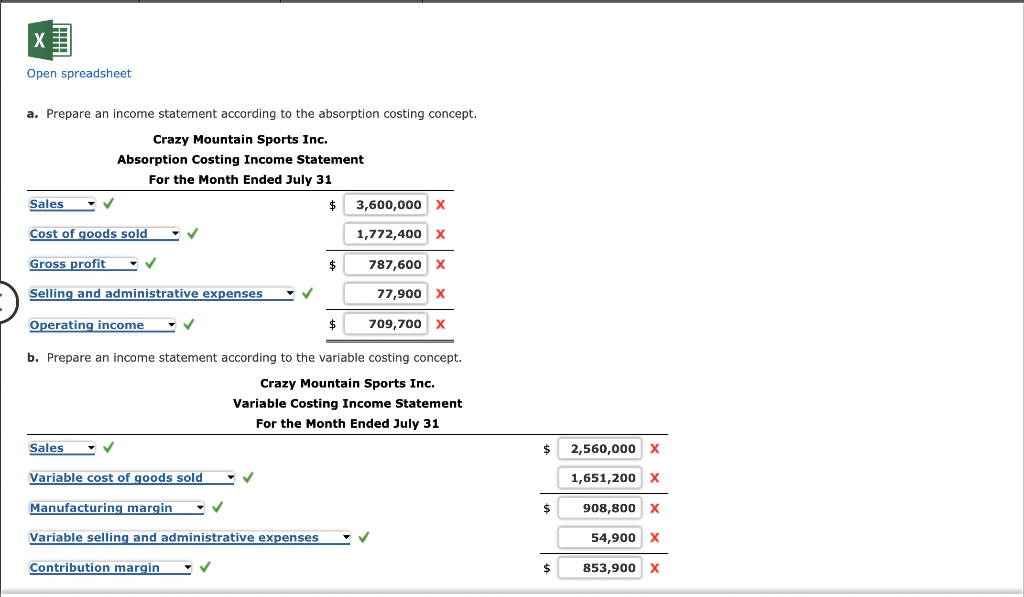

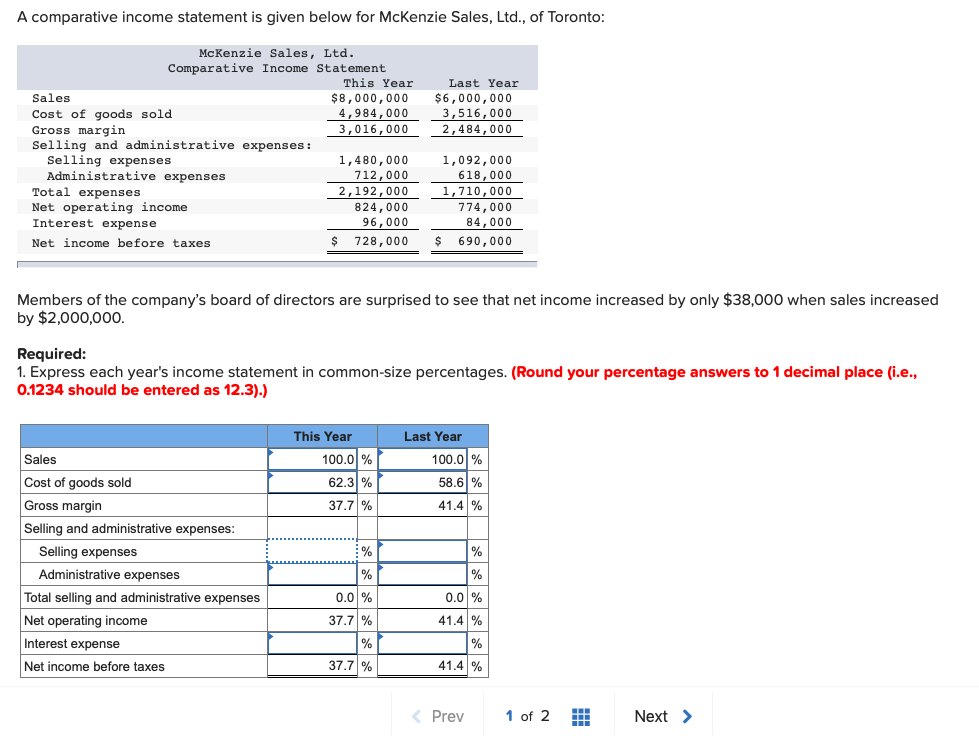

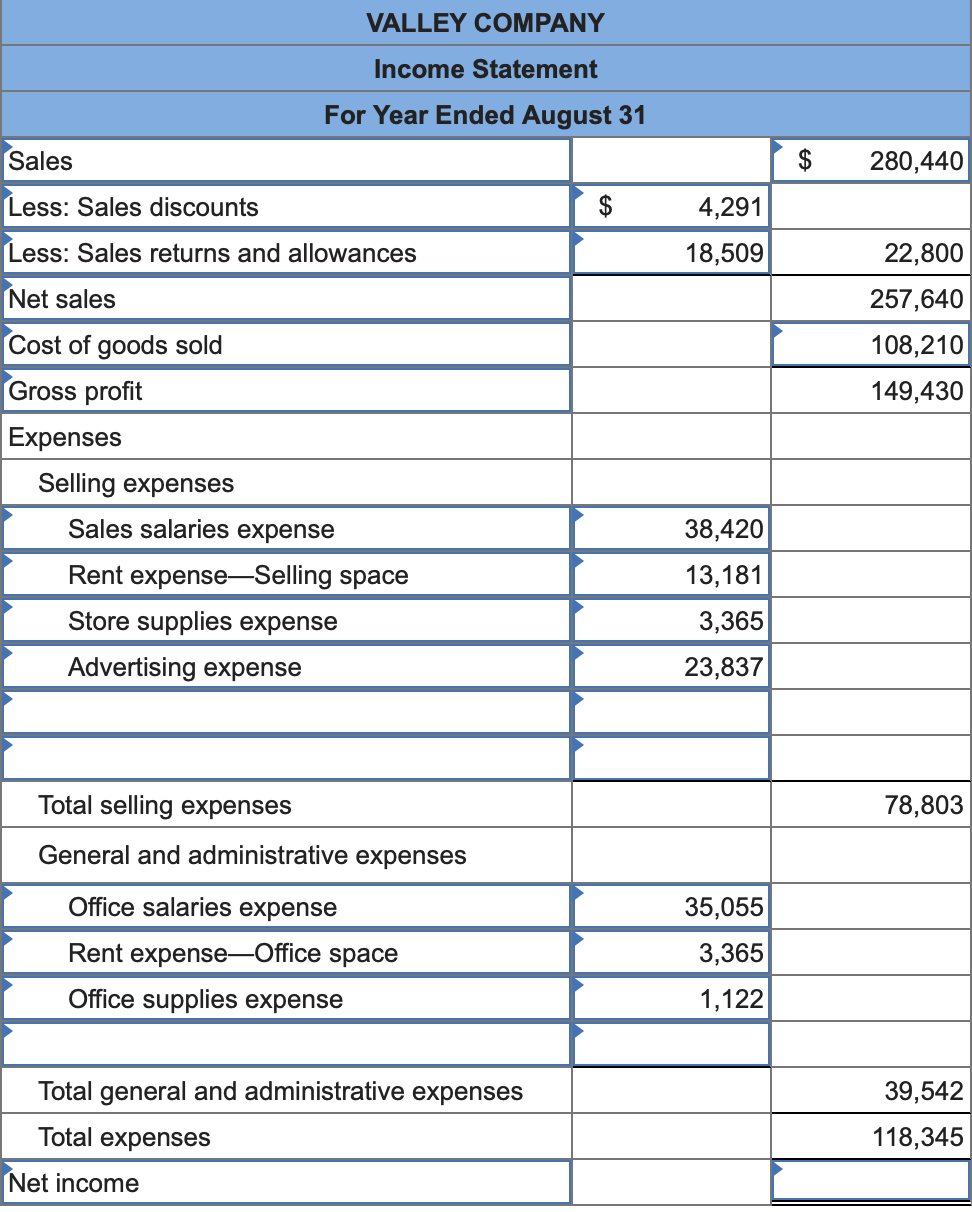

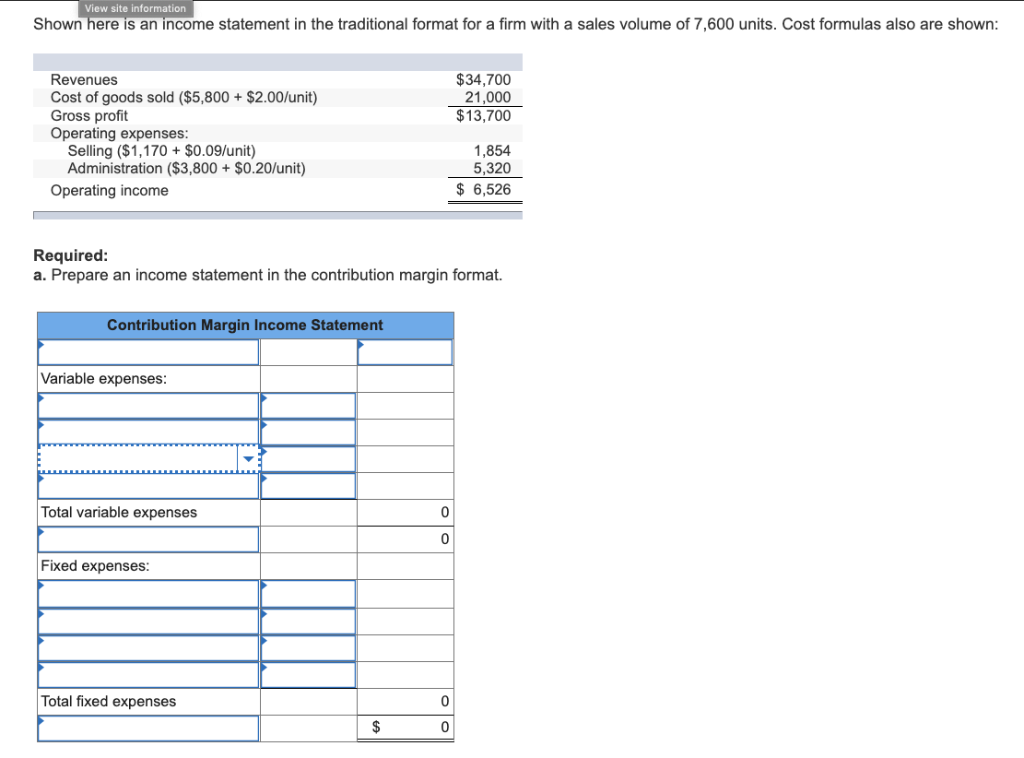

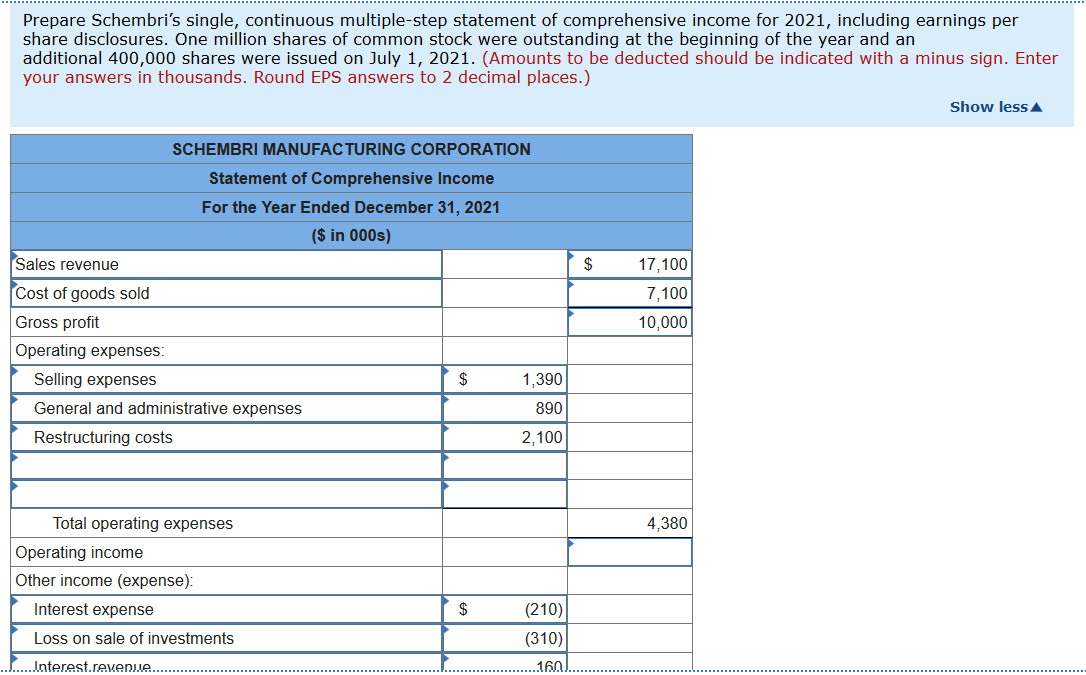

Selling and administrative expenses income statement. Selling, general, and administrative expenses are reported in a company’s income statement and represent any overheads included in a company’s core operating. Advertising costs are generally presented as part of selling, general, and administrative (sg&a) expenses in a reporting entity’s income statement. By kimberlee leonard updated november 26, 2018 selling and administrative expenses are both part of the selling, general and administrative.

Administration expenses definition in accounting, administration expenses are listed on the income statement as operating expenses. Gross margin is an essential indicator of your income statement. A line for selling, general, and administrative (sg&a) expenses appears on a company's income statement.

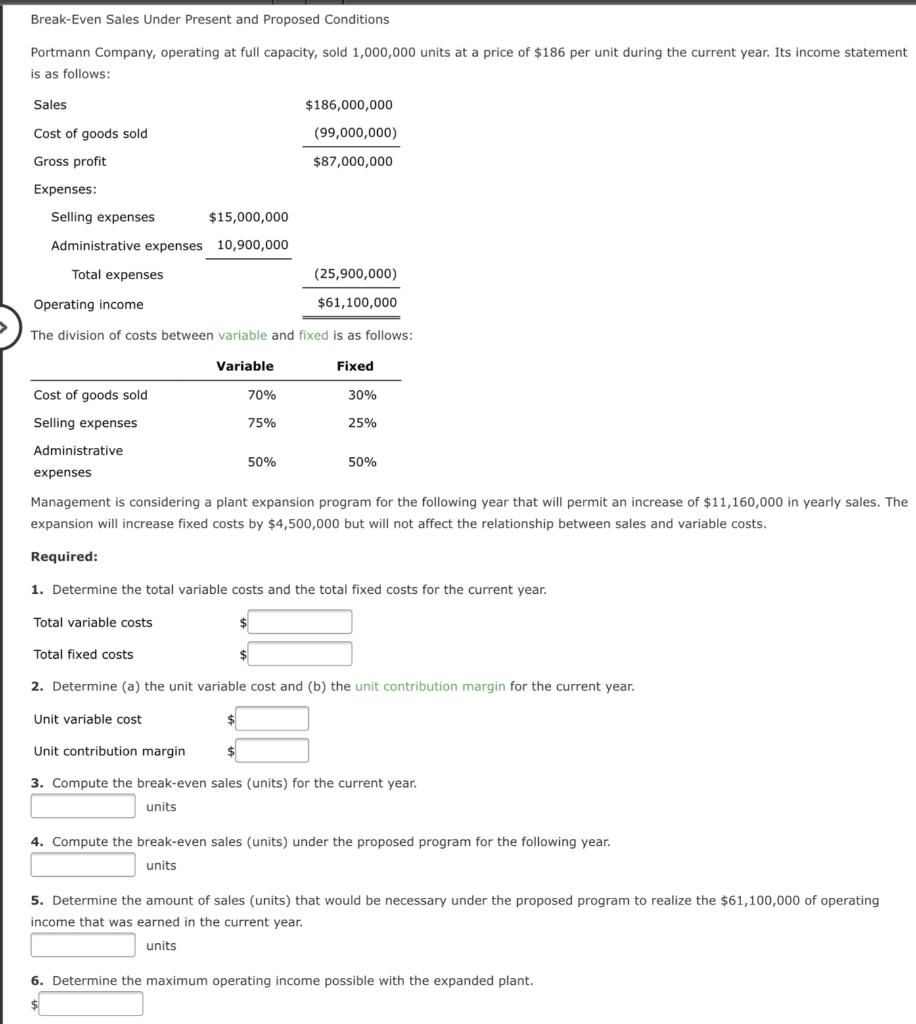

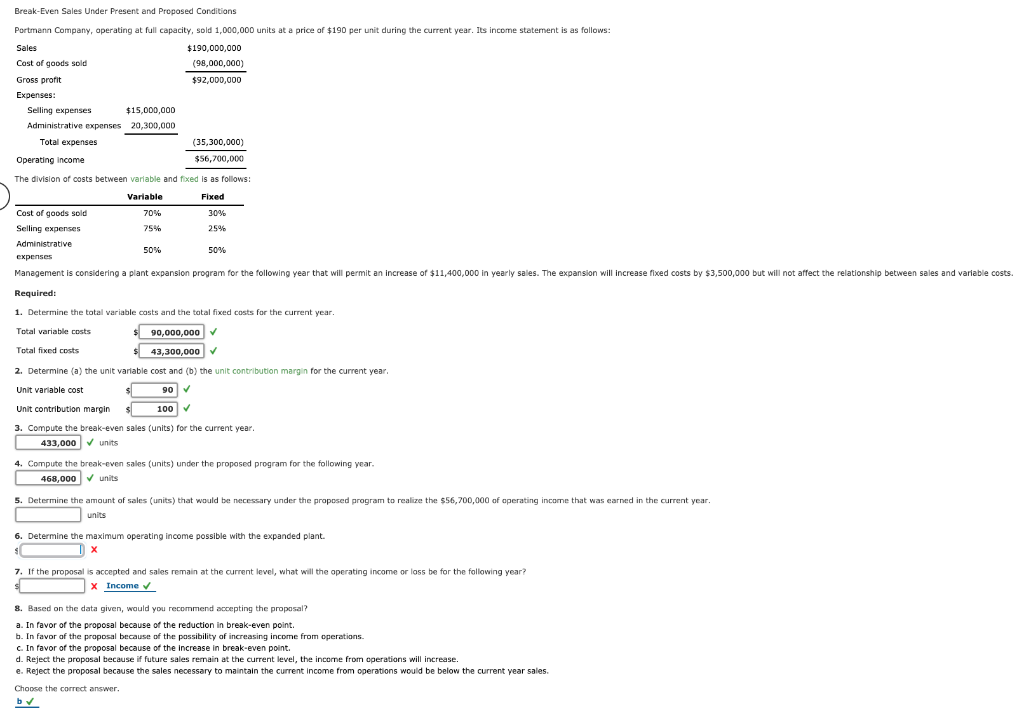

They include rent and utilities, marketing and. Managers should not only calculate selling and administrative expenses, but also analyze them selling and administrative expenses are typically a huge line. From payroll expenses to selling, general, and administrative.

Total operating expenses = selling expenses + administrative expenses. Operating expenses—also known as selling, general and administrative expenses (sg&a)—are the costs of doing business. Learn how to categorize sg&a expenses.

These are the costs it incurs trying to produce.