Great Tips About Most Important Financial Ratios For Banks

5 major pillars of financial ratios.

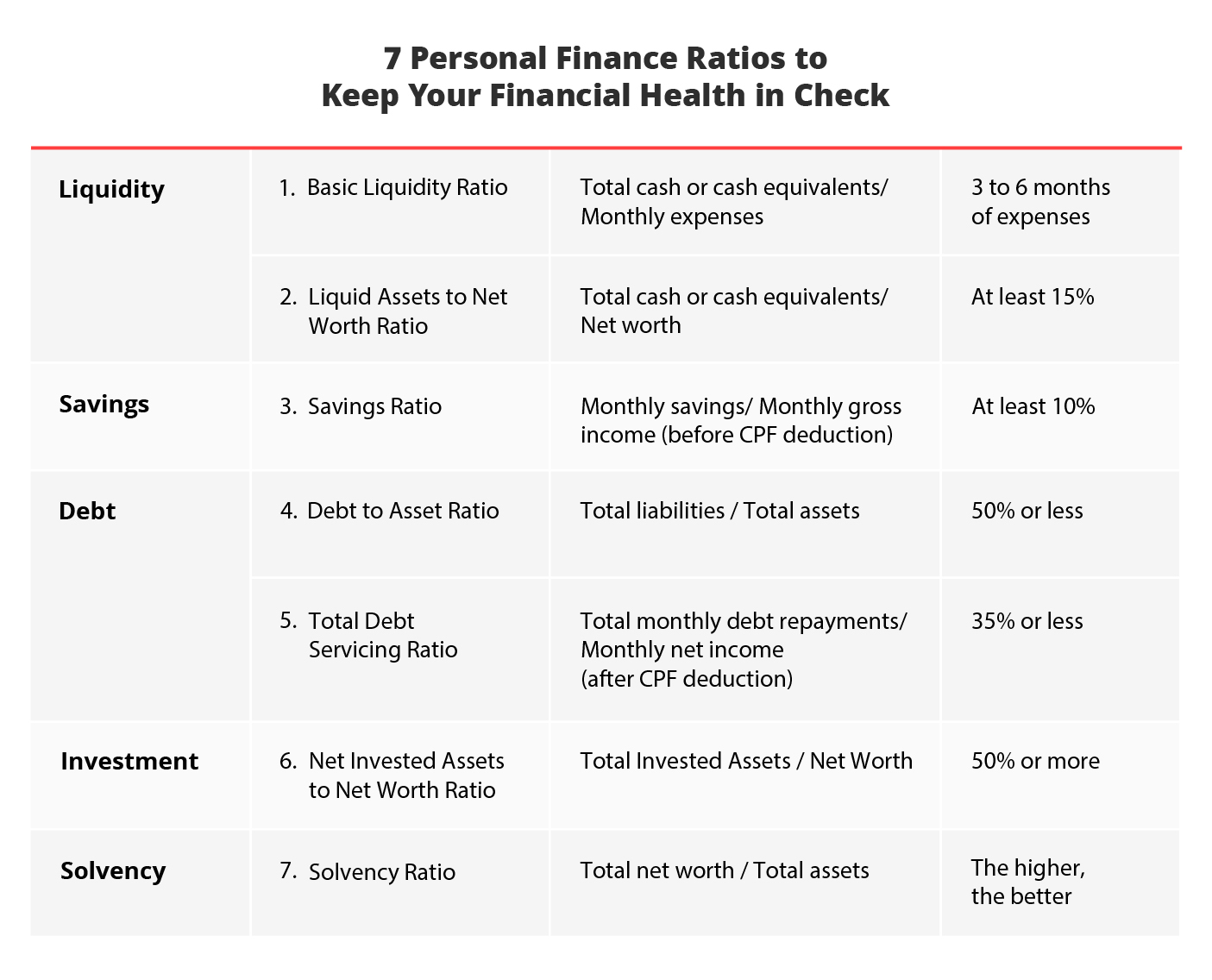

Most important financial ratios for banks. The term liquidity refers to how easily a company can turn assets into. Key financial ratios to analyze retail banks the retail banking industry. Helps measure company’s debt 2.

As you can see there are 15 ratios beneath these categories. You can find the p/b ratio by knowing two things: This is one of the most frequently used types of financial ratios, giving a quick indicator of business liquidity.

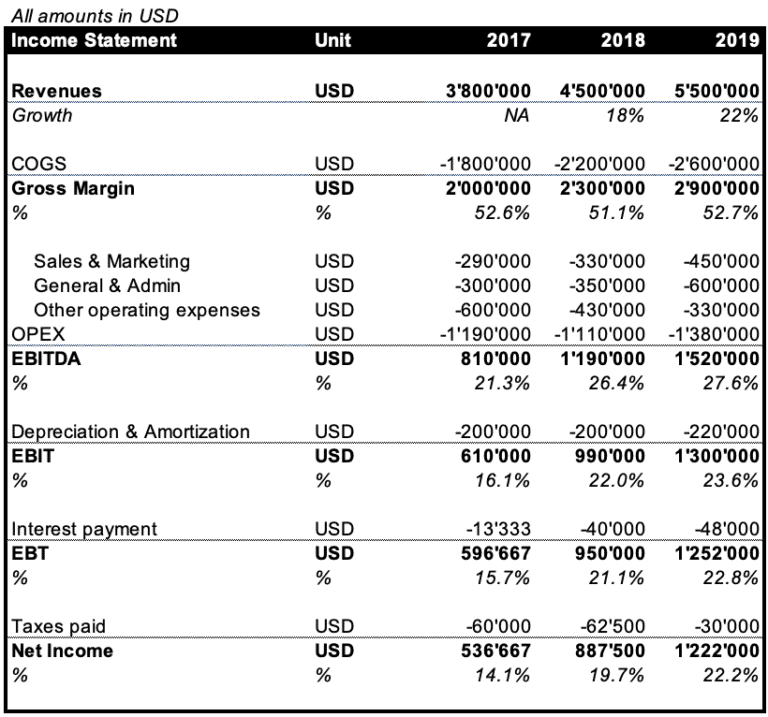

Cash flow ratios cash flow is important for every business. Financial ratios are grouped into the following categories: Uses and users of financial ratio analysis.

A higher ratio usually means that a sizable proportion of the loans given out are not generating income and hence, are carrying a higher level of risk for the bank. The critical ratios for the banking industry 2.1 net interest margin. The gnpa ratios of 5 indian banks are:

Analysis of financial ratios serves two. Corporate finance financial ratios financial ratios to analyze investment banks by sean ross updated july 21, 2021 reviewed by chip stapleton it can be tricky for the average investor to. Here’s a breakdown of important financial ratios, and why they’re so useful.

There are several key financial ratios that can be used to analyze retail banks: 2.2 the loan to assets ratio. A book value is the value of an asset that is entered in a company’s books.

Helps measure company’s efficiency in using its resources 3. A simple version of how banks work is they get money from their depositors and pay them. When analyzing banks, there are several important financial ratios unique to banks to compute when analyzing their solvency and financial strength.

Similar to companies in other sectors, banks have specific ratios to measure profitability and efficiency that are designed to suit their unique business operations. Price, profitability, liquidity, debt, and efficiency. Analysts look at net interest margin income and other fundamentals to value bank shares.

Before we dive into the top 10 financial ratios, let’s first discuss the five major categories of ratios: Yield on earning assets indicates how well assets are performing by looking at how much income they bring in. Helps understand company’s ability to repay short.

Typically, ratios are not examined alone, but are looked at in combination with other performance indicators. Market capitalization and book value. Working capital ratio assessing the health of a company in which you want to invest involves measuring its liquidity.