Fantastic Info About Difference Between Trial Balance And Profit Loss Account

The figures in the trial balance will usually be the amounts paid in the period, and they need adjusting for outstanding amounts and amounts paid which relate to other periods to.

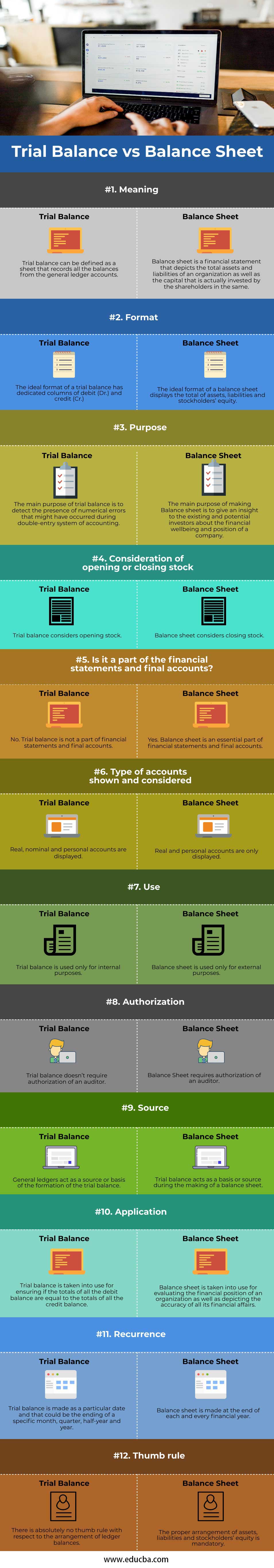

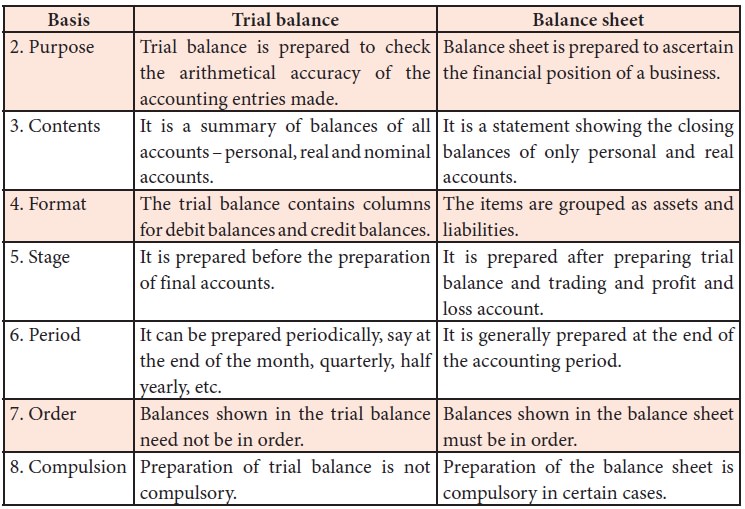

Difference between trial balance and profit and loss account. The key difference between balance sheet and profit and loss statement in general, the balance sheet is prepared at the end of the financial year, at one particular date. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business.

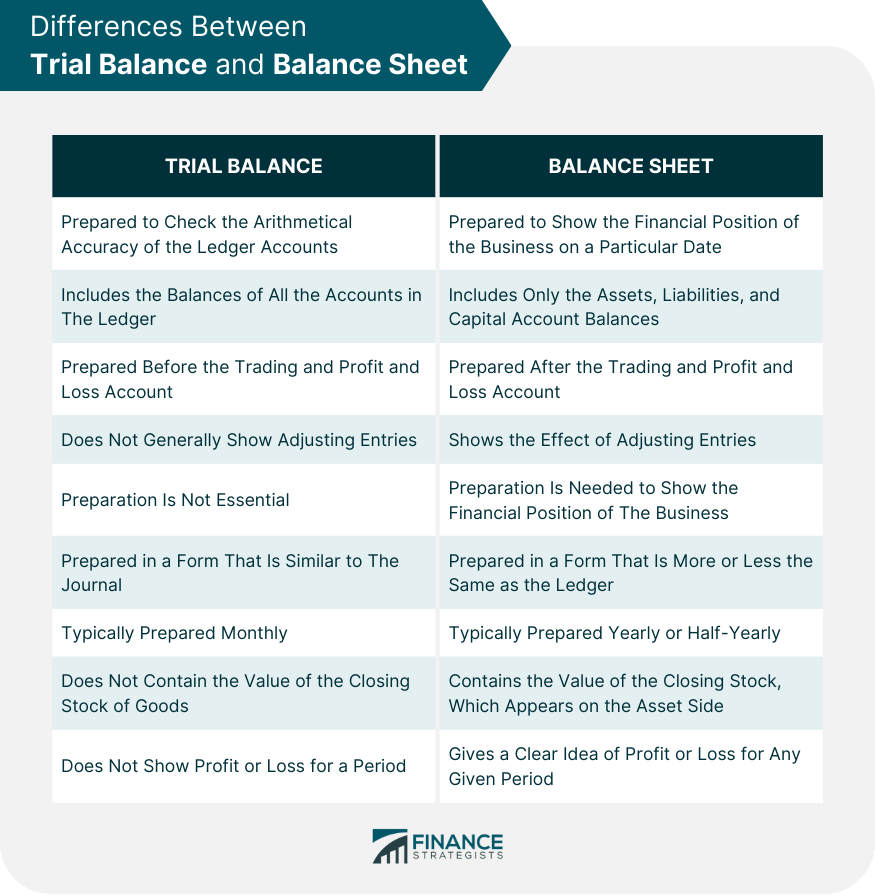

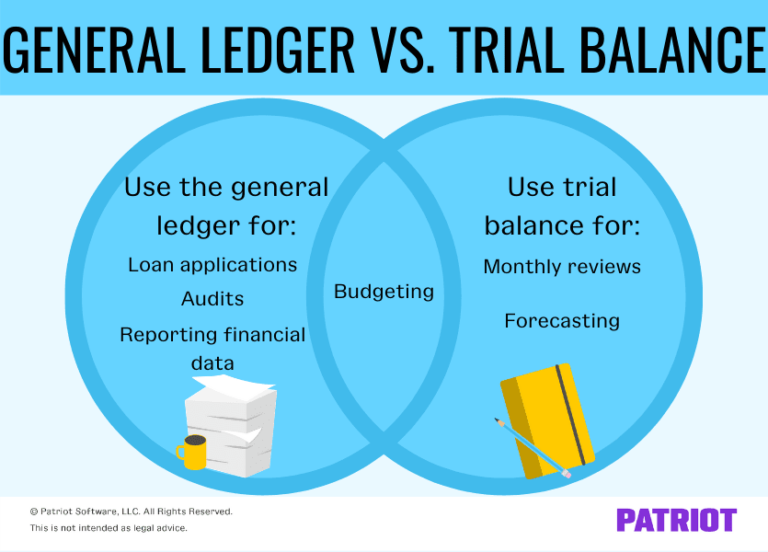

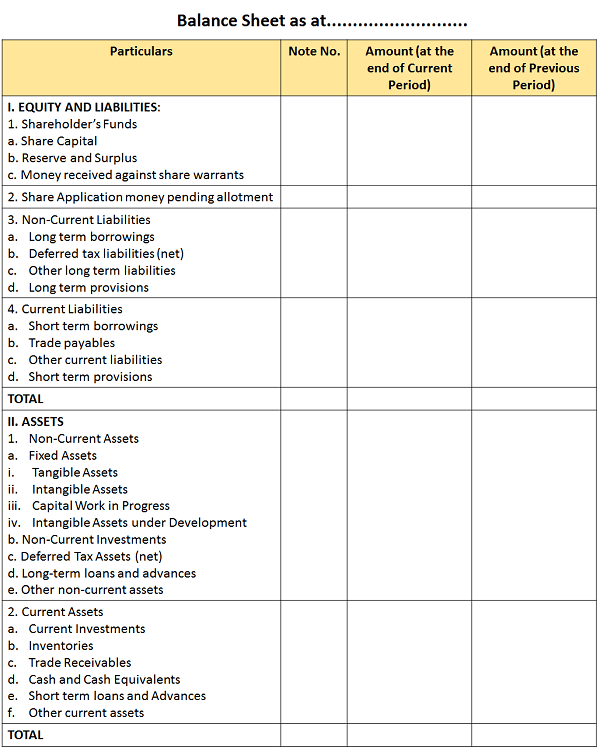

What is trial balance vs balance sheet vs profit and loss? Trial balance presents the balances of all. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

The accounts reflected on a trial balance are related. Despite their common origins, there are key. A balance sheet is that trial balance is the report of accounting in which ending balances of different general ledger of the.

In simple terms, a profit and loss account is a summary of an organisation’s expenses and revenues and ultimately calculates the net figure of the. This article is a ready reckoner for all the students to learn the difference between the balance sheet and profit & loss account. A trial balance is a report that is used internally within the company, while the balance sheet is usually.

The profit and loss account and the balance sheet are two of the most important financial reports companies and investors rely on. Definition of trial balance a trial balance is an internal report that remains in the accounting. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

The key difference between trial balance vs. A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given. The balance sheet is also referred to as the statement of financial position.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Profit & loss account is prepared after the preparation of trading account, with the help of trial balance. On the other hand, the profit and loss account tends to be prepared for a particular time period.

It is the foundation stone of all account statements and the connecting bridge between the profit and loss account, books of accounts, and the balance sheet. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Balance sheet is a statement that a company prepares every year to present the assets, liabilities and equity on a particular date.

The balance of trading account is transferred to this account, which acts. Q1 what is the purpose of preparing a trial balance?

![Difference between Trial Balance and Balance Sheet [With PDF] Trial](https://everythingaboutaccounting.info/wp-content/uploads/2021/03/Difference-between-Trial-Balance-and-Balance-Sheet-1-1024x536.png)