Unique Info About P&l Statement Quickbooks

By quickbooks• 198•updated 4 days ago.

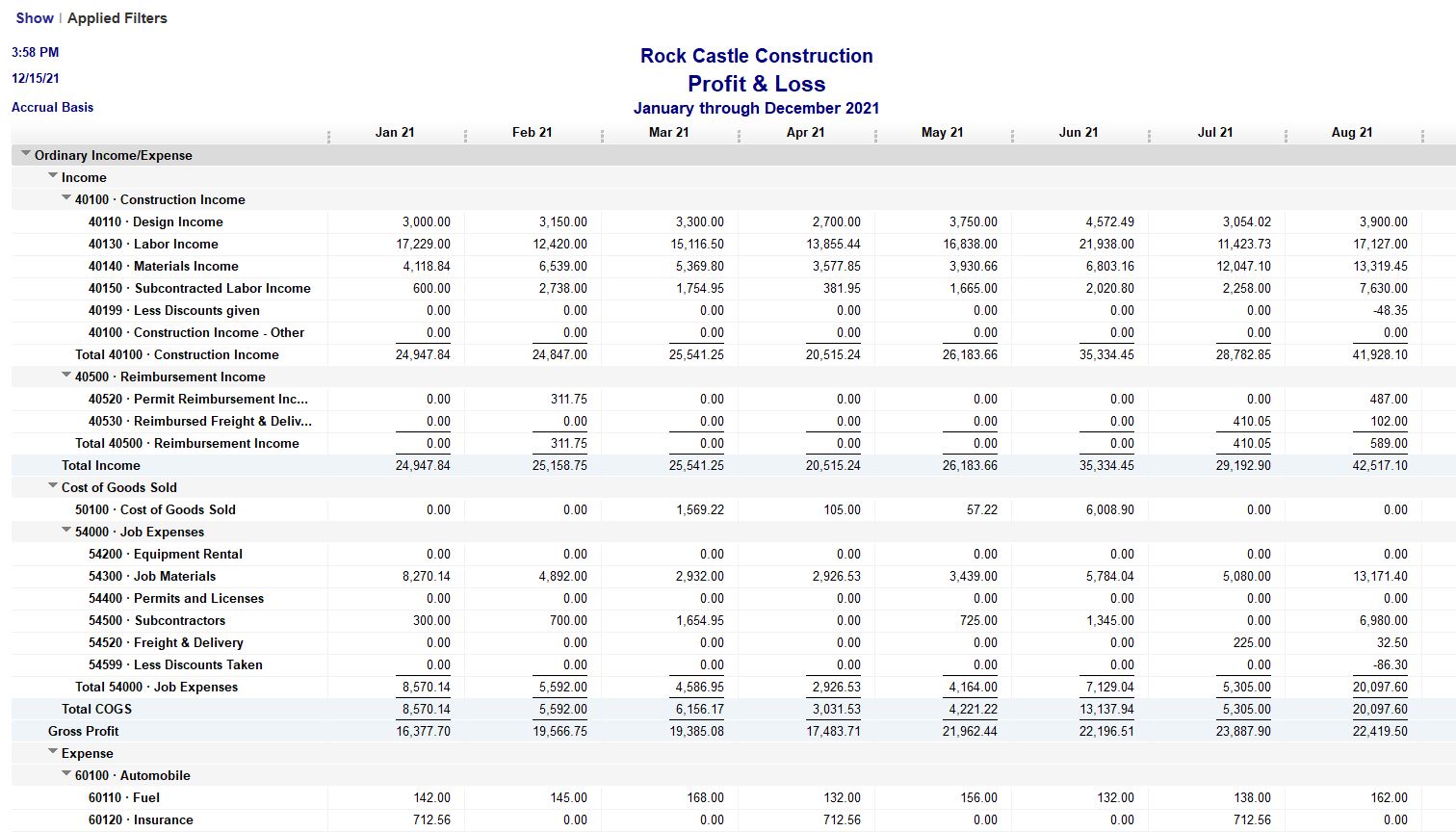

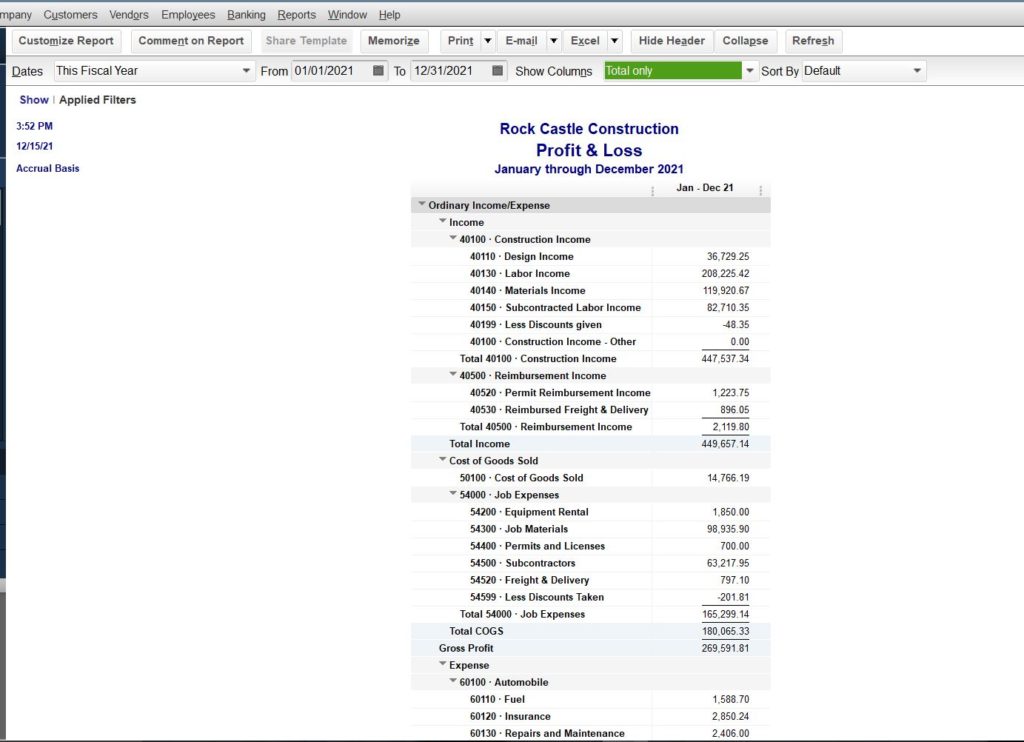

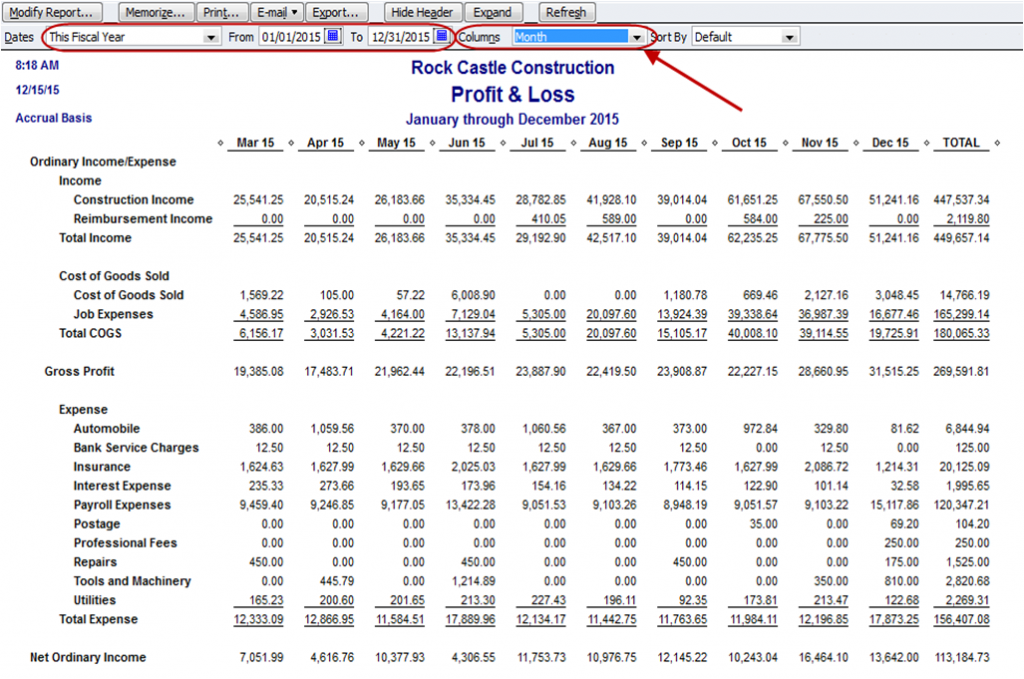

P&l statement quickbooks. Business owners use the p&l to assess the company's profitability—how much money a company makes. Use profit and loss comparison reports to compare your income and expenses for different time periods. Create a quickbooks account step 2:

Hi there, @john. Is there a way to do this, i did figure out how to attach my fuel costs but cant seem to get the other two. In this article, you’ll learn how to run a profit and loss (p&l) statement in quickbooks online.

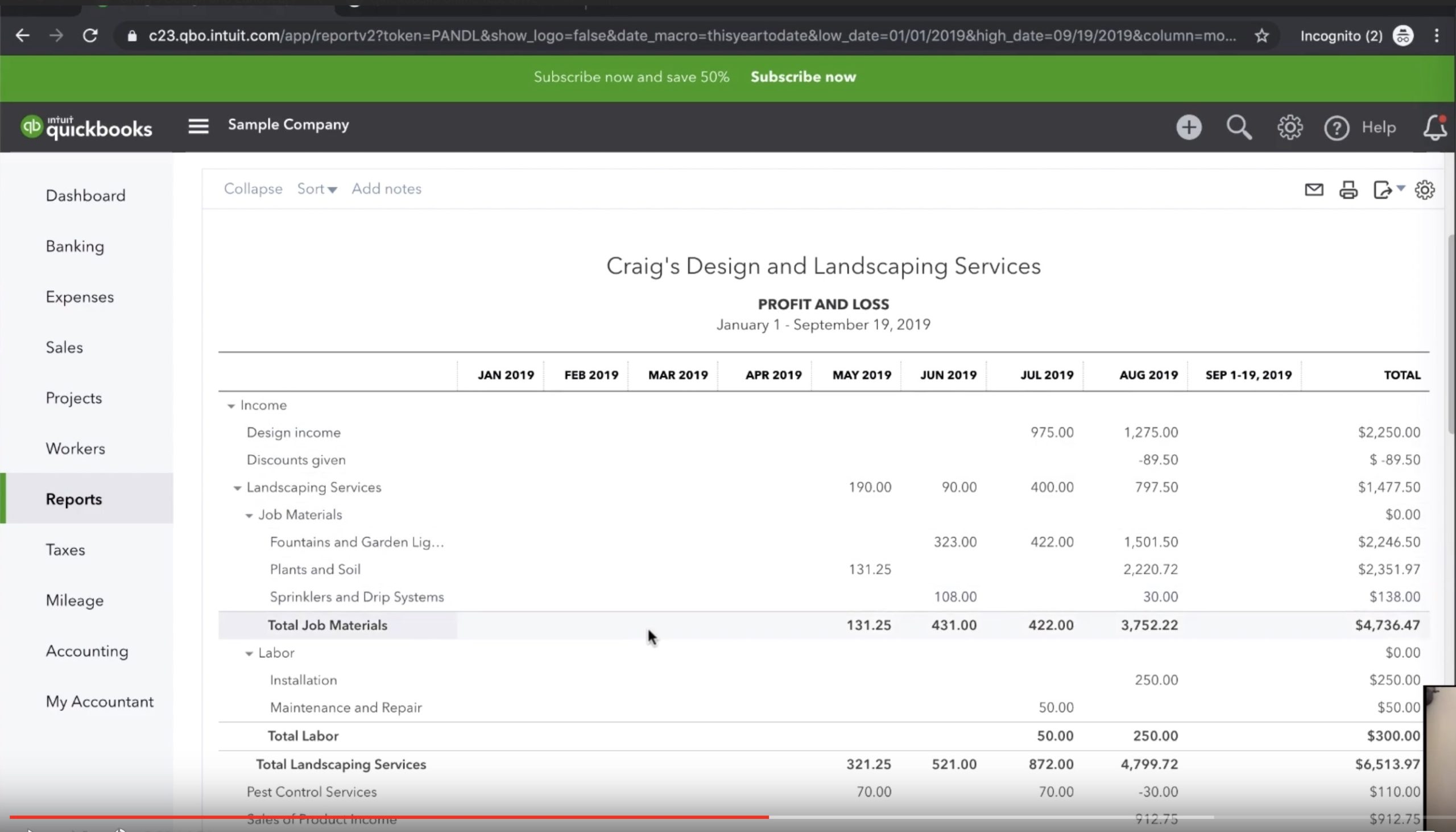

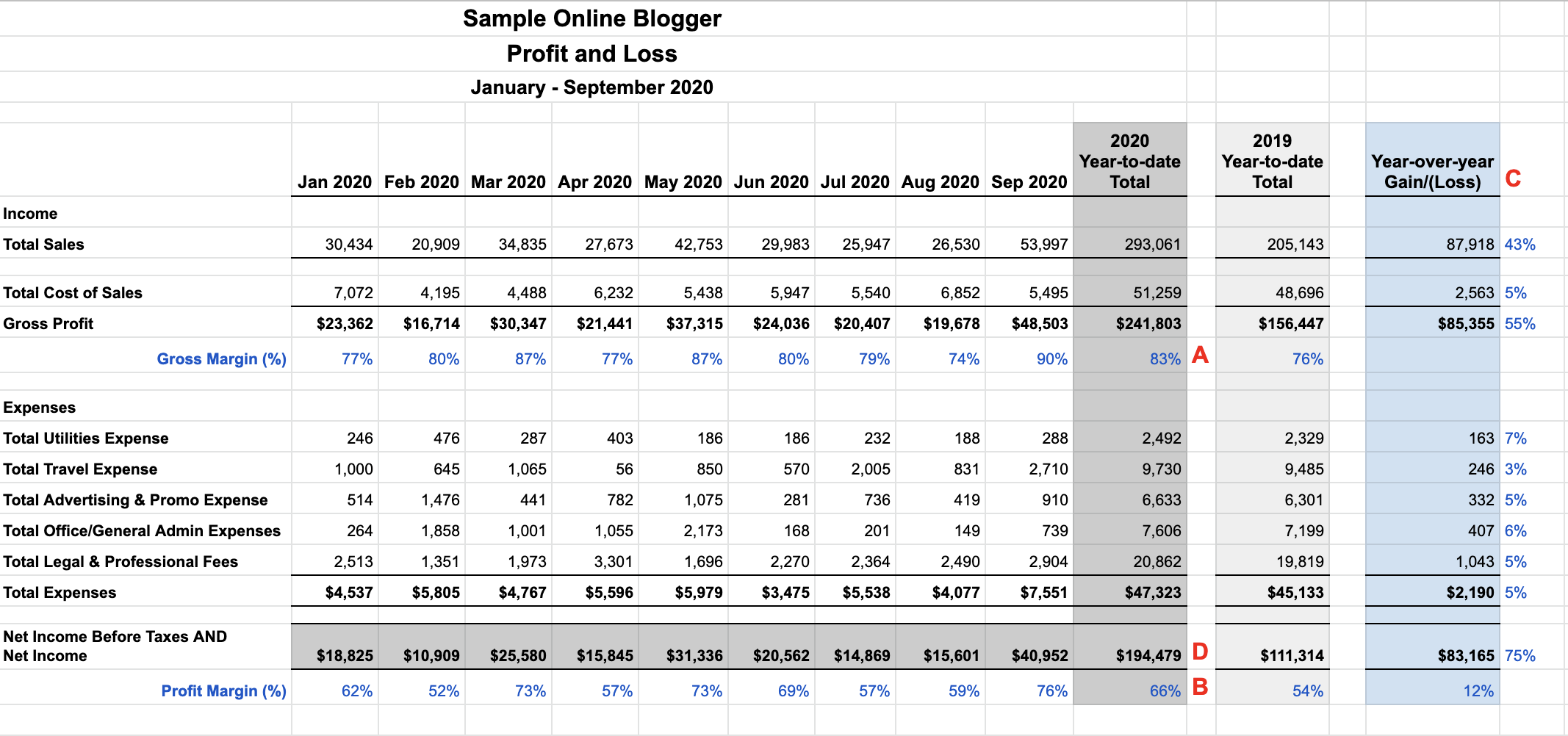

Scroll down to the for my accountant section. And i'll be happy to guide you. The video walks you through how to create your profit and loss statement in quickbooks by quarter (or whatever time period you want) for a year on 1 page.

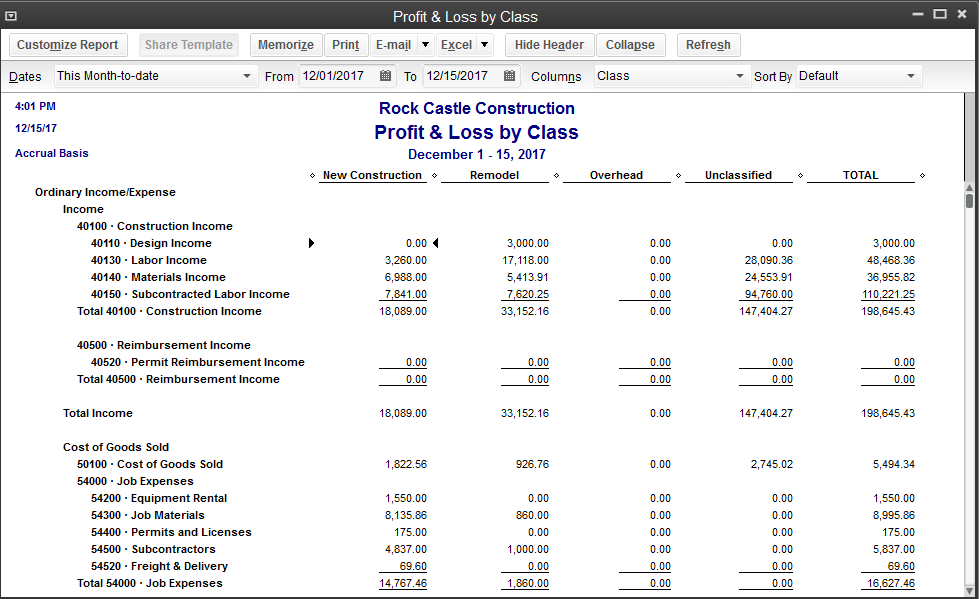

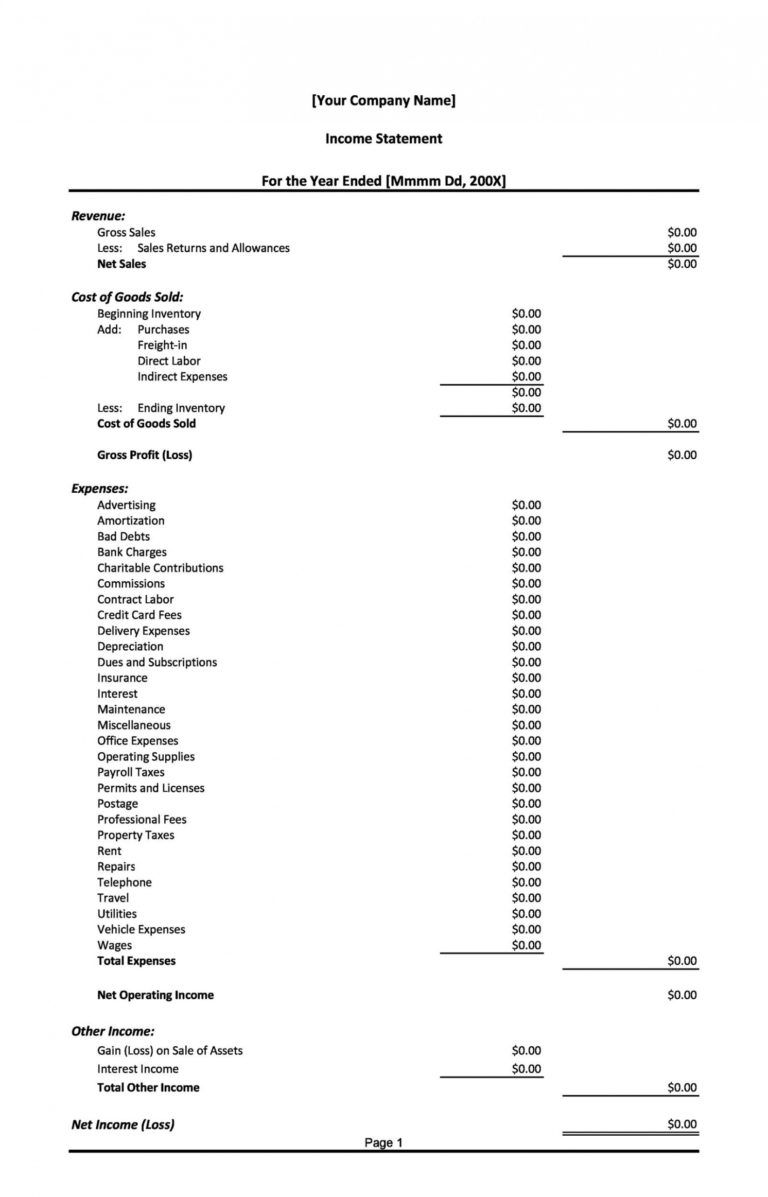

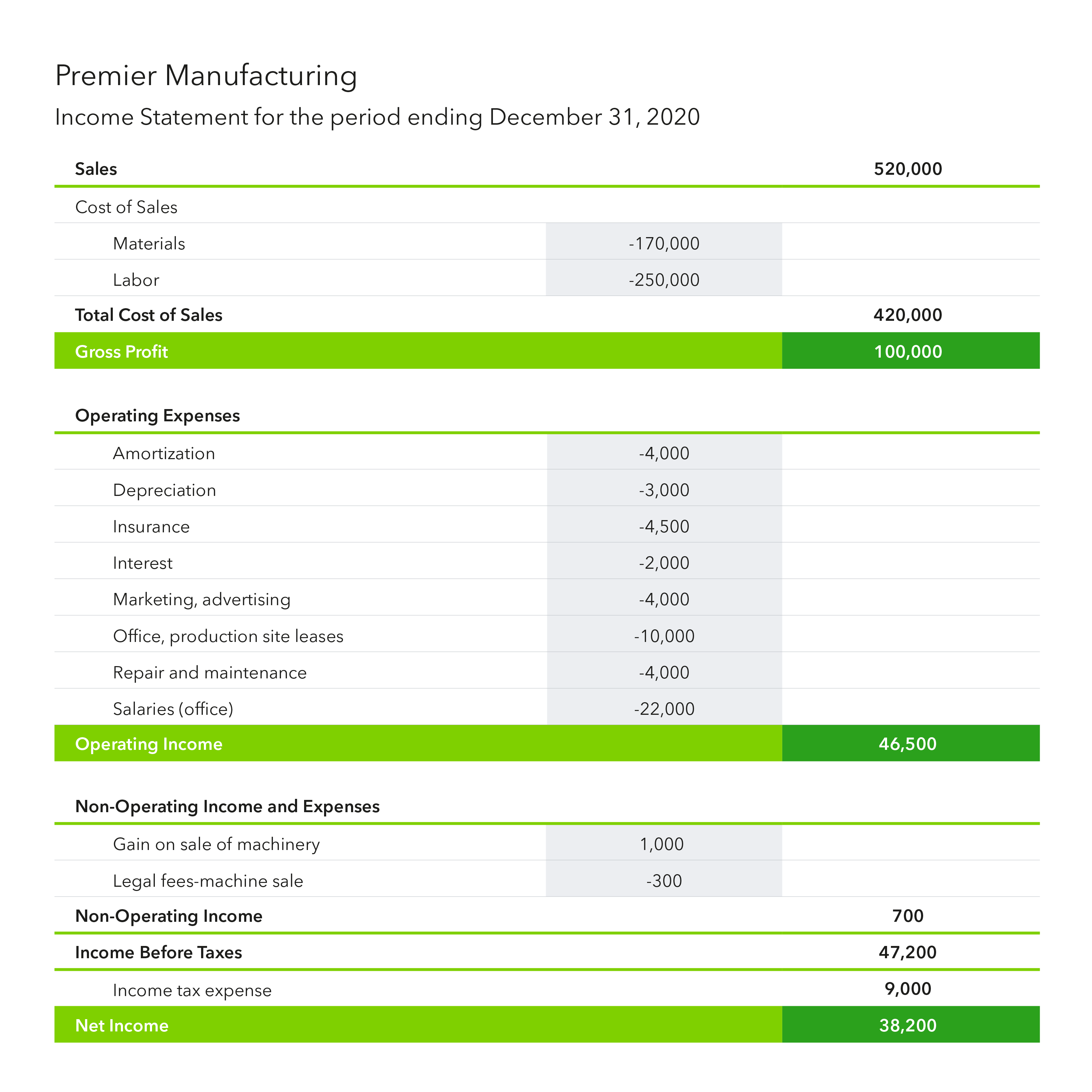

Choose your income statement report format; Select the transaction list by date report. The profit & loss statement provides a summary of your revenue minus expenses for a specific period of time, such as a month, a quarter, or a year.

Find the income statement in quickbooks; Set the date range of the report. It's a straightforward presentation of.

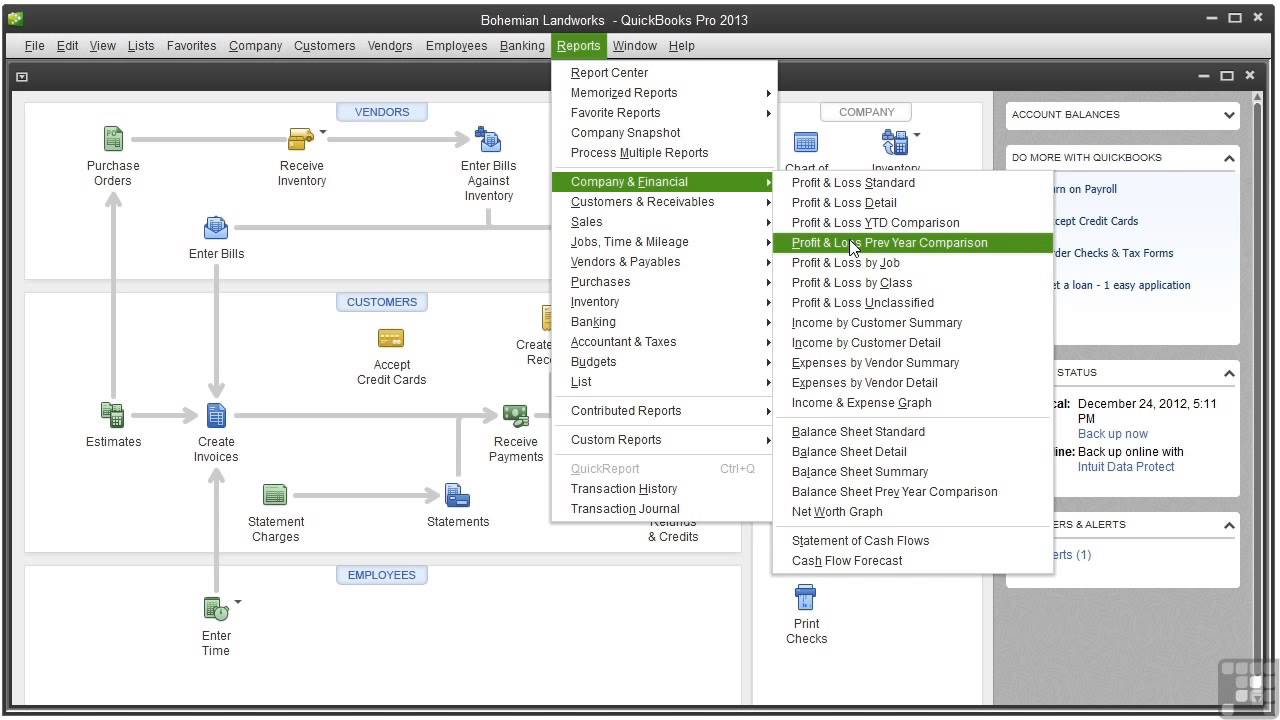

In this guide, we’ll walk through how a profit and loss statement works, what it can tell you, and how to create one easily. What to do if you see unapplied cash bill payment expense on your profit and loss. Customize your profit and loss statement in quickbooks step 5:

Profit and loss statement. A profit and loss (p&l) statement is a type of financial report that summarizes your company’s revenue, expenses and net income or losses over a particular period of time. In this video, our certified public bookkeeper, tasha yao walks you through creating balance sheet and profit and loss reports in quickbooks.

You can compare your performance this week, month, or year to other timeframes. A p&l report, also called an income statement, consists of income, expenses, and net profit over a specific period. Print, email, or download your report conclusion.

How to run a profit and loss report (p&l) in quickbooks online (2021) ⬇⬇⬇⬇ click 'show more' to expand ⬇⬇⬇⬇ as a small business owner, it's important to understand your financial. It displays a detailed report of all your income and expense transactions grouped per account. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

Select the profit and loss detail report under the business overview section. The income statement, also called the profit and loss statement, is used to calculate profits by comparing revenue to expenses. Also, you can view the general ledger report.

![[QODBCDesktop] How to run a Profit and Loss By Class Report in QODBC](https://support.flexquarters.com/esupport/newimages/ProfitAndLossByClass/step3.png)

![[QODBCDesktop] How to run a Profit and Loss Standard Report in QODBC](https://support.flexquarters.com/esupport/oneadmin/_files/Image/Screen Dump Upload Folder/ProfitandLossStd1.JPG)