The Secret Of Info About Owners Equity In Sole Proprietorship

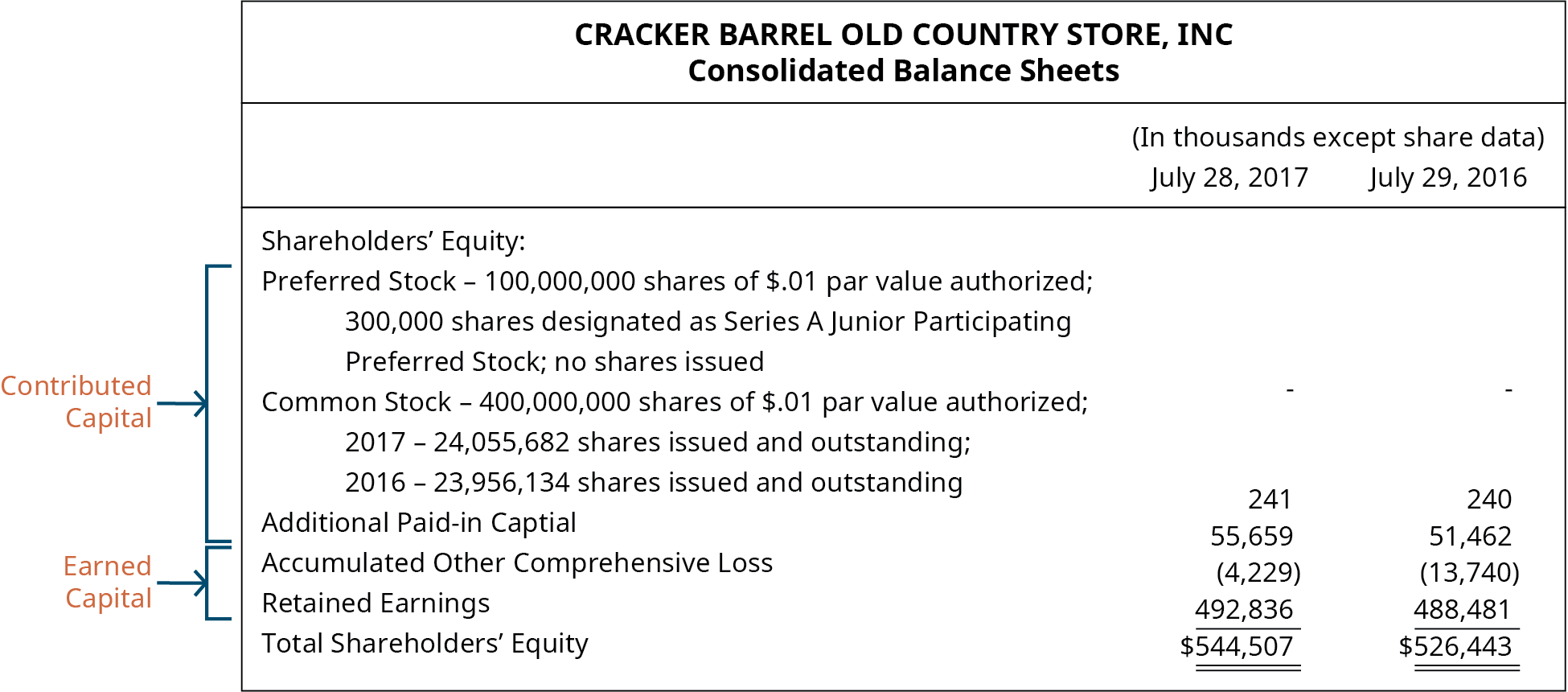

While “owners’ equity” is used for all three types of business organizations (corporations, partnerships, and sole proprietorships), only sole proprietorships name the balance sheet account “owner’s equity” as the entire equity of the company belongs to the sole owner.

Owners equity in sole proprietorship. Again, the most appropriate source of information in preparing financial statements would be the adjusted trial balance. A sole proprietorship is an unincorporated business that has just one owner who pays personal income tax on profits earned from the business. This applies to you, regardless of if your business is a sole proprietorship, partnership, or corporation.

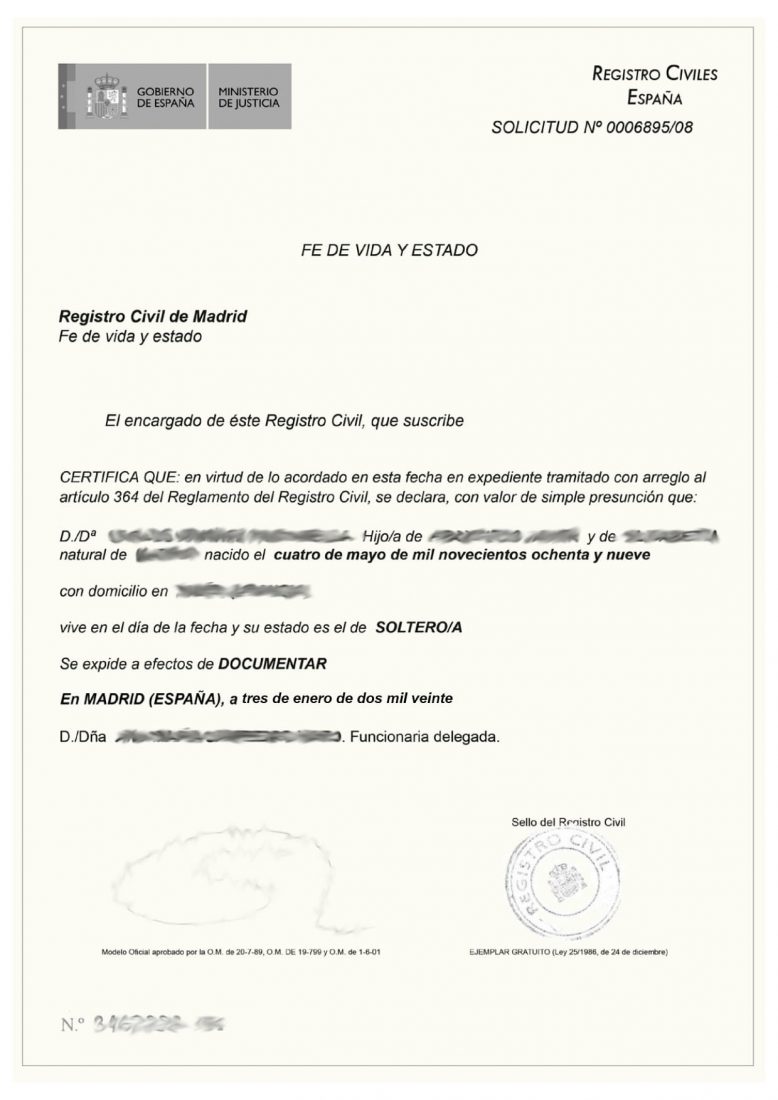

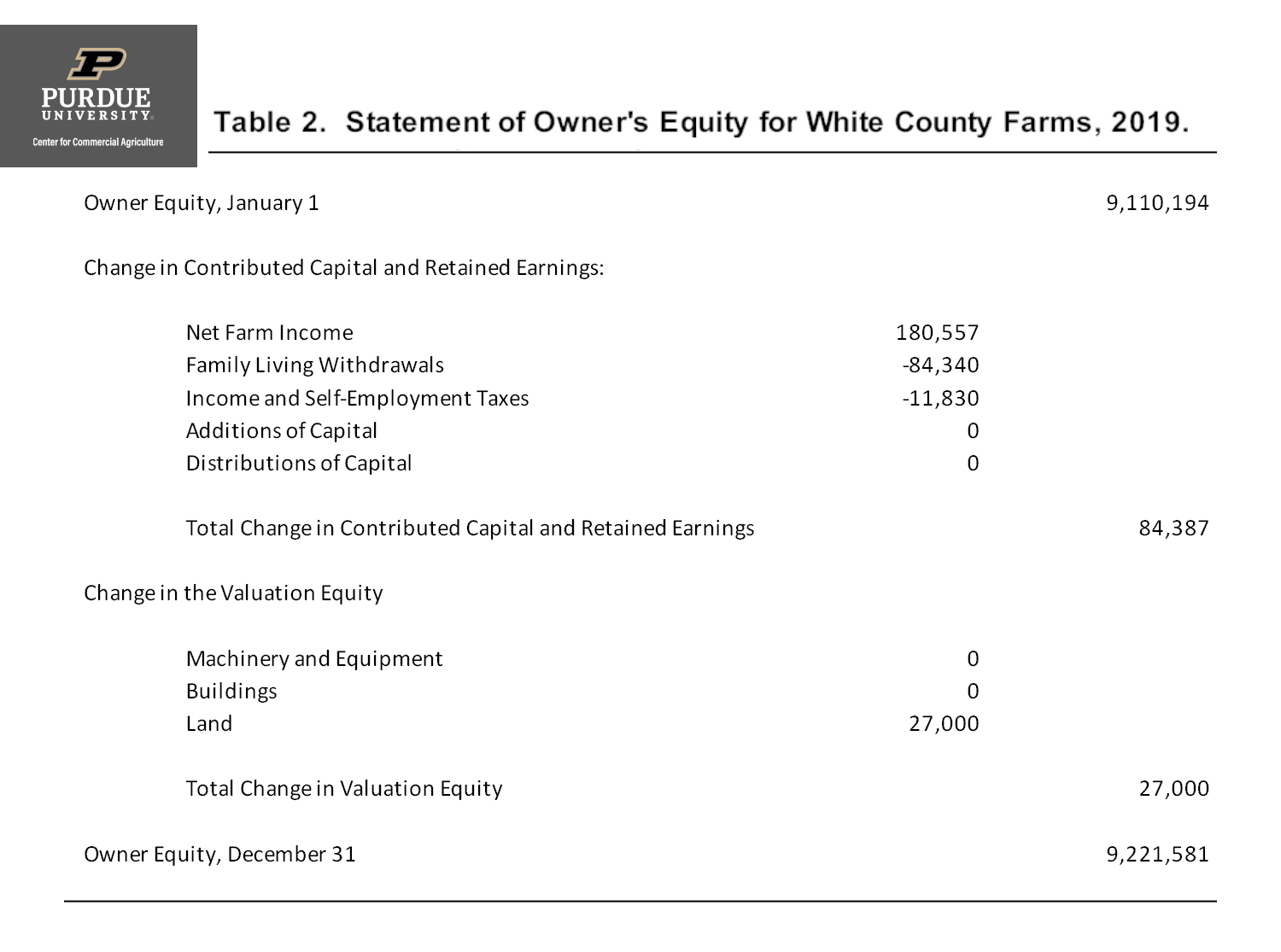

Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the net income (or minus the net. For a sole proprietor, equity is called owner’s equity. Sole proprietor with this form you will learn the major causes of the change in the owner's equity section of a sole proprietorship's balance sheet.

The company’s assets (resources), minus liabilities (what the company owes others), is equal to the total net worth of the company, also known as owner’s equity. Here is a sample statement of owner's equity of a service type sole proprietorship business, carter printing services. The risks involved with sole proprietorships include unlimited personal liability and a limited life for the business.

What are the main components of owner’s equity? Statement of owner's equity example. The owner’s capital account and owner’s draw account.

All amounts are assumed and simplified for illustration purposes. Equity can be calculated by subtracting total liabilities from total assets. Assume that the company started the year 2021 with $100,000 capital.

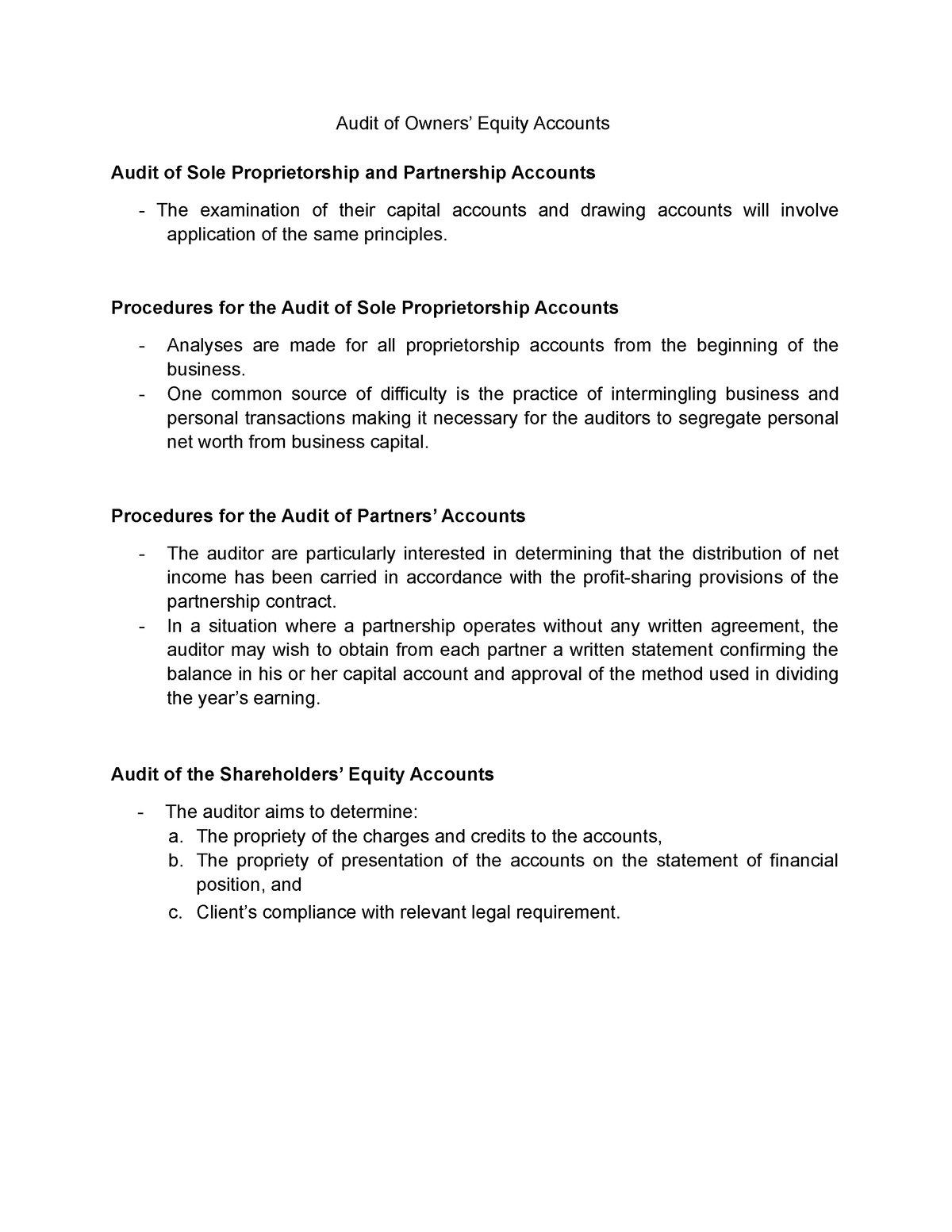

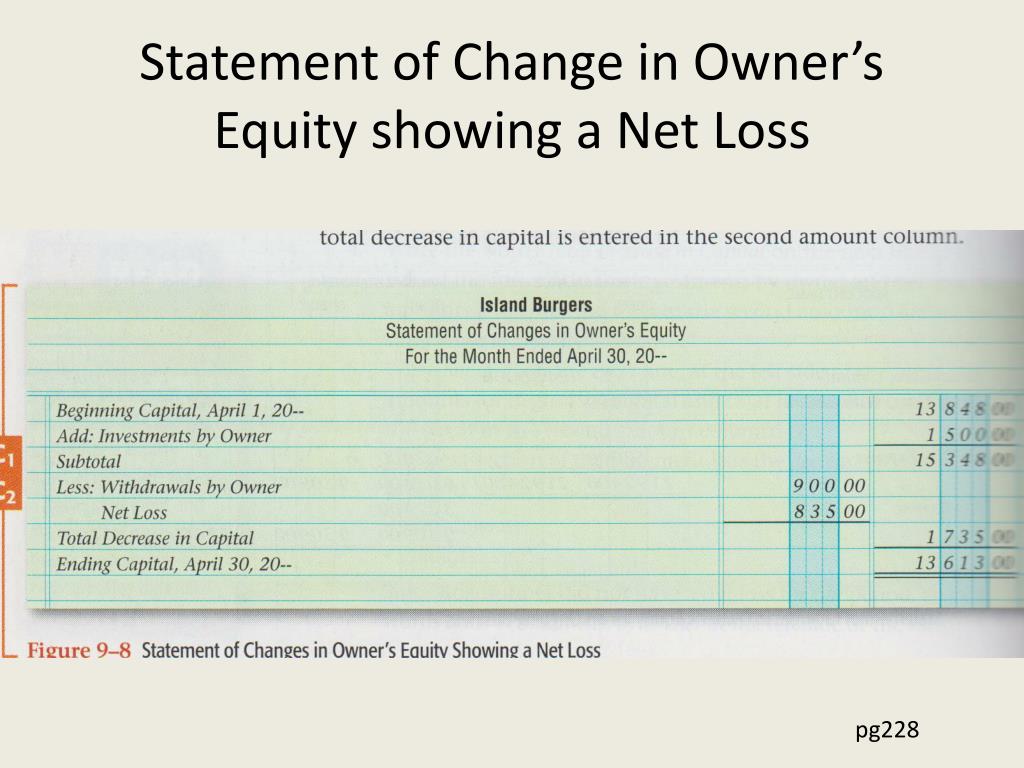

The statement of owner's equity portrays changes in the capital balance of a business over a reporting period. Owner’s equity is defined as the proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders (if it is a corporation ). The amount of owner’s equity was determined on the statement of owner’s equity in the previous step ($16,850).

Investments by owners and distributions to owners are two activities that impact the value of the organization (increase and decrease, respectively). The company’s assets (resources), minus liabilities (what the company owes others), is equal to the total net worth of the company, also known as owner’s equity. The elements of the financial statements shown on the statement of owner’s equity include investments by owners as well as distributions to owners.

This is attributable to one, or multiple owners, depending on how the company is owned. In the balance sheet of a sole proprietorship, owners' equity refers to the sum total of the following transactions: Also, owner’s equity can be considered the residual value of a company’s assets after liabilities are paid.

As a reminder, the balance sheet has three major sections: There are typically two accounts listed: Can you think of another way to confirm the amount of owner’s equity?

This is attributable to one, or multiple owners, depending upon how the company is owned. The result is the ending balance in the capital account. Assets = liabilities + owner's equity.