Fun Info About Difference Between Trial Balance And Adjusted

Background dynamic knee valgus (dkv) accompanied by poor balance is the cause of anterior cruciate ligament (acl) injury in athletes, and the identification and correction of these factors are always of interest to researchers.

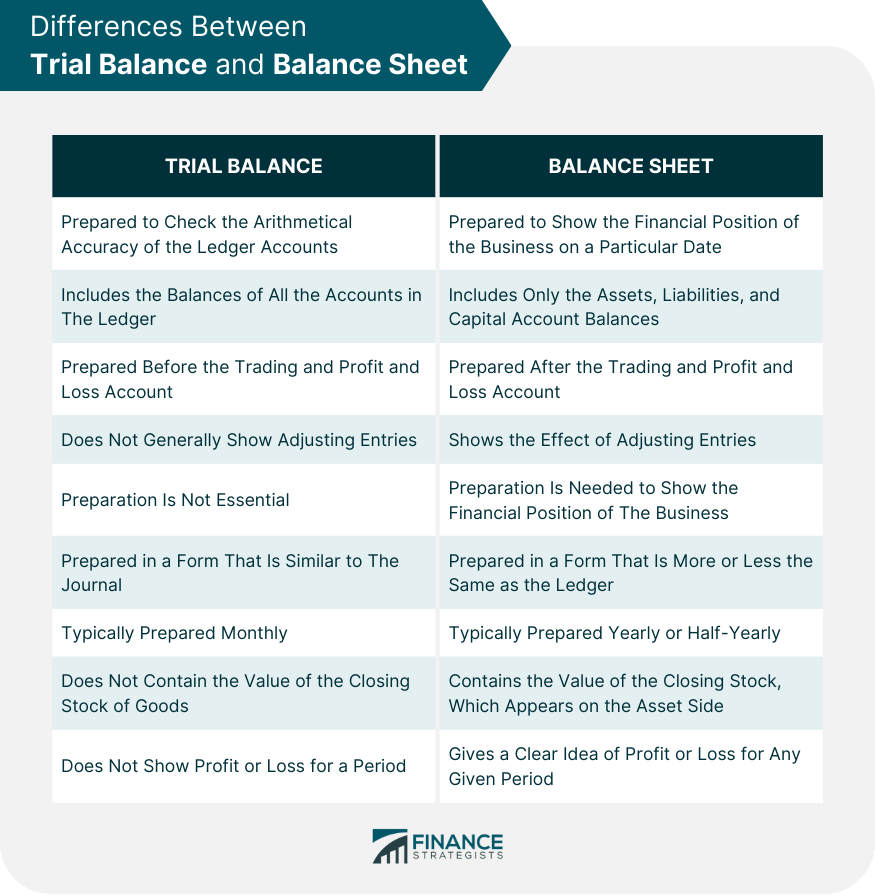

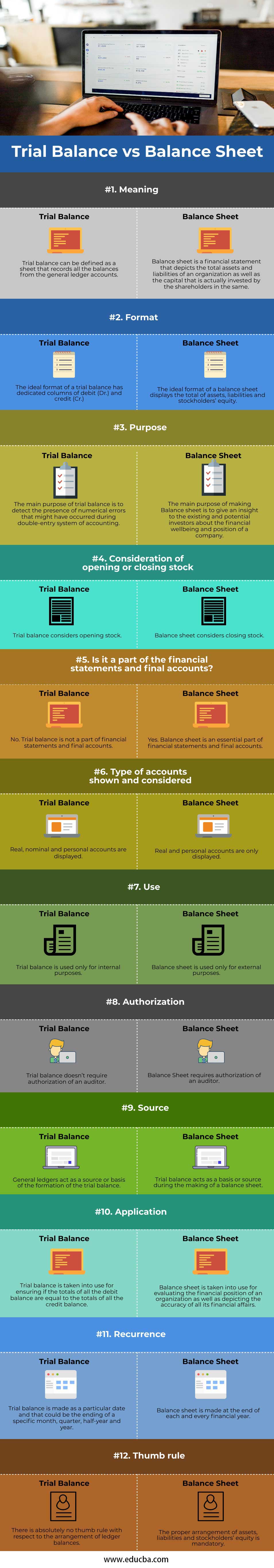

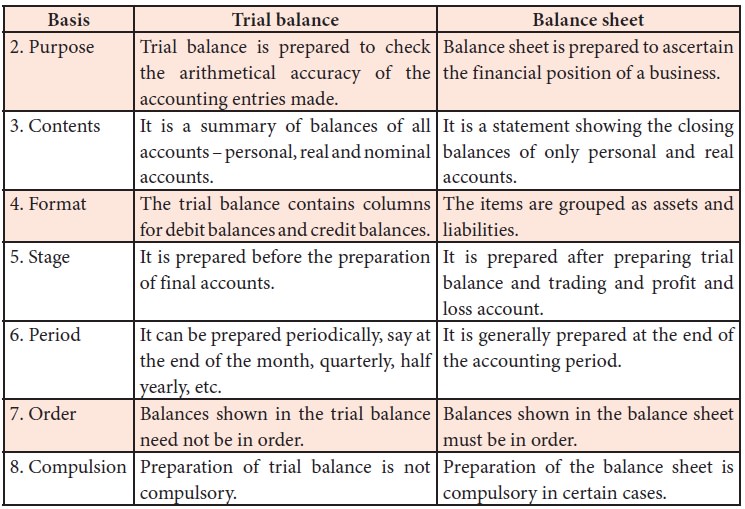

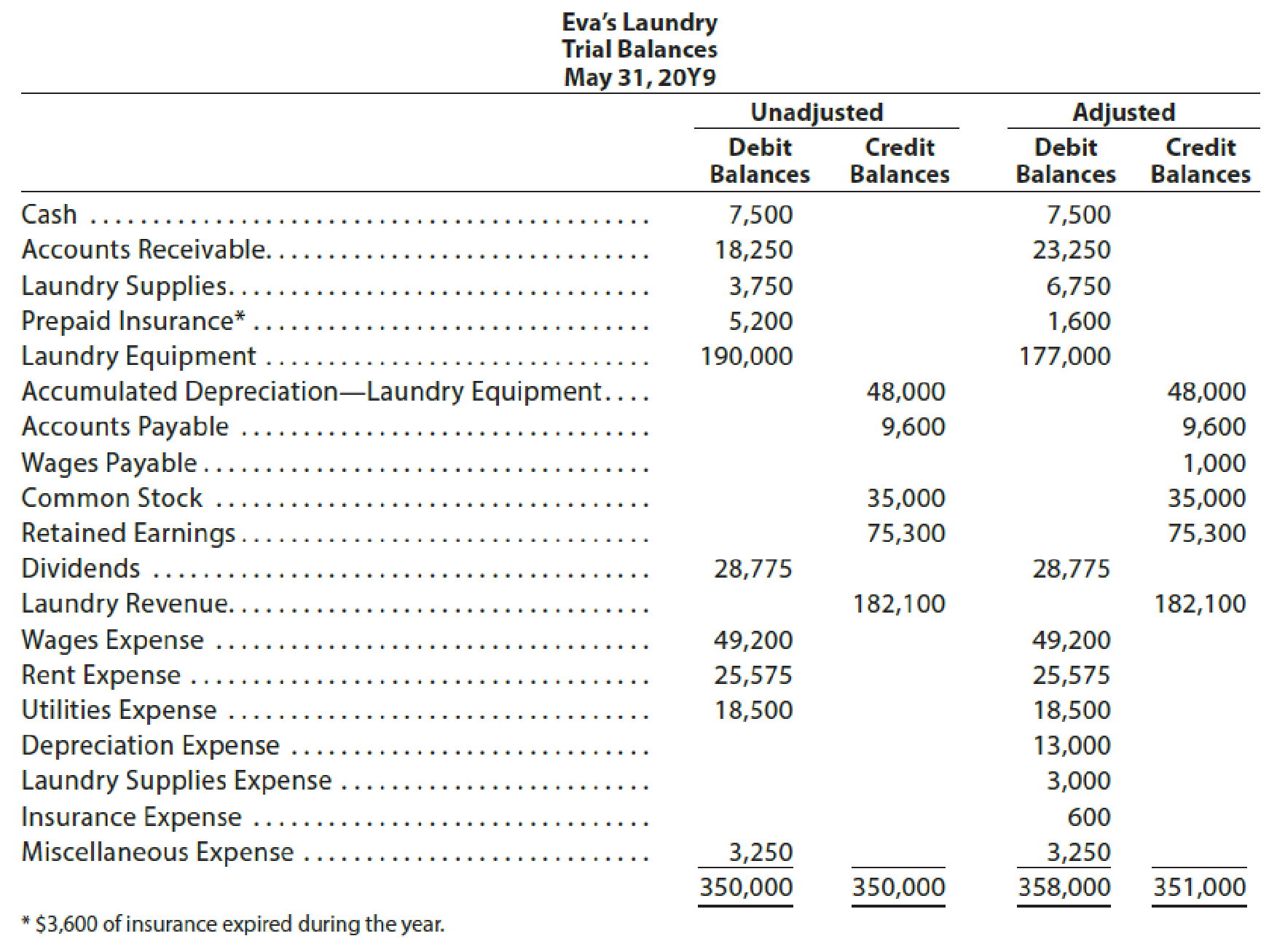

Difference between trial balance and adjusted trial balance. An unadjusted trial balance is the initial list of balances of all ledger accounts, whereas an adjusted trial balance is a list of balances after necessary adjustments have been made. Finally, if some adjusting entries were entered, it must be reflected on a trial balance. Key takeaways a trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct.

An adjusted trial balance lists the ending balances in all accounts after adjusting entries have been prepared. Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements. A trial balance is an accounting statement that aggregates all ledger balances into equal debit and credit account column totals.

However, an adjusted trial balance requires corrections and adjustments for missing entries. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. An unadjusted trial balance is a summary of the general ledger accounts before making any adjustments while the finished product is the adjusted trial balance.

The adjusted trial balance is a list of accounts and their balances after adjusting entries have been posted. What is the difference between balance sheet and trial balance? Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Both these types of trial balances come from the same bookkeeping records. Balance sheet vs trial balance balance sheet 1.

The accrual of expenses that were incurred but were not yet recorded the accrual of revenues that were earned but were not yet recorded the deferral of a. Adjusted trial balance is a list that shows all general. What is an adjusted trial balance?

Comparing an unadjusted and adjusted trial balance. The difference between unadjusted and adjusted trial balance has been detailed below: The adjusted trial balance is used to prepare financial statements.

Adjusted trial balance is the trial balance compiled after considering adjustment entries at the close of the. What is the procedure for preparing a trial balance? Adjusted trial balance definition.

The adjusted trial balance is not a financial statement, but the adjusted account balances will be reported on the financial statements. 2.an unadjusted trial balance is basically used before all the adjustments will be made. Adjusting entries typically affect one income statement (revenue or expense) and one balance sheet (asset.

Adjusting entries that will result in a difference between the unadjusted trial balance and the adjusted trial balance include the following: What is a trial balance? It is a statement that shows a detailed listing of assets, liabilities, and capital demonstrating the financial condition of a company on a given date.

![Difference between Trial Balance and Balance Sheet [With PDF] Trial](https://everythingaboutaccounting.info/wp-content/uploads/2021/03/Difference-between-Trial-Balance-and-Balance-Sheet-1-1024x536.png)