Can’t-Miss Takeaways Of Tips About Form 16 And 26as

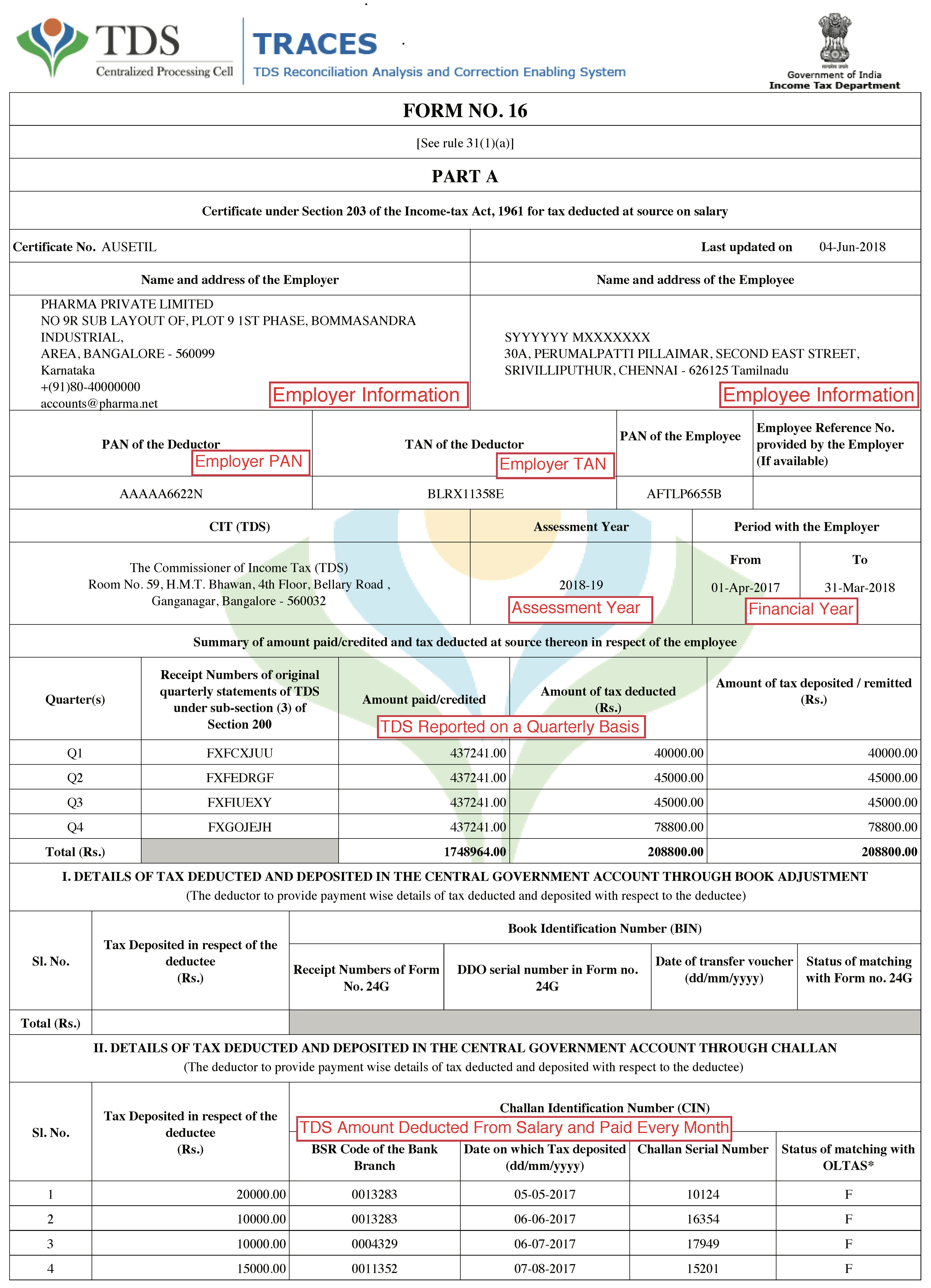

Form 26as reflects only the tds details mentioned in form 16.

Form 16 and form 26as. However, with the deadline approaching fast, an. Can be verified online in the traces to check if the deductions by the employer are reflected in. Why should you compare form 26as with form 16 before filing your income tax return (itr)?

As we have seen above, form 16 and form 16a are used by the employer for tds deduction. Usually, it could be institutions or banks from. Tds certificate (form 16/16a) vs.

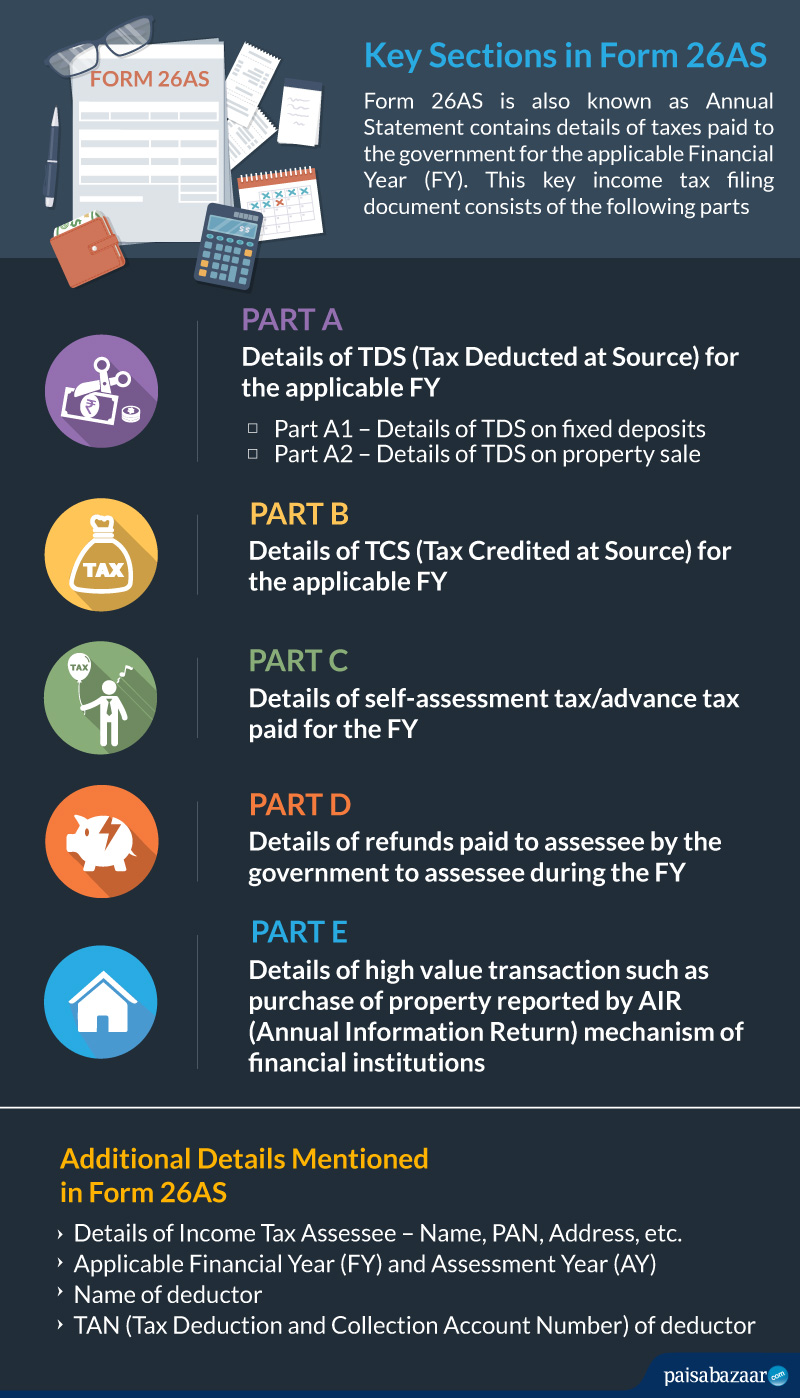

Is there a connection? Mismatch in the income figure may raise an inquiry from the income. This form documents the records regarding the details related to tax deducted at source by different people.

This is where form 26as comes into the picture. Ensure that you have received the correct. The employer is not obligated to provide this form if an employee does not fall.

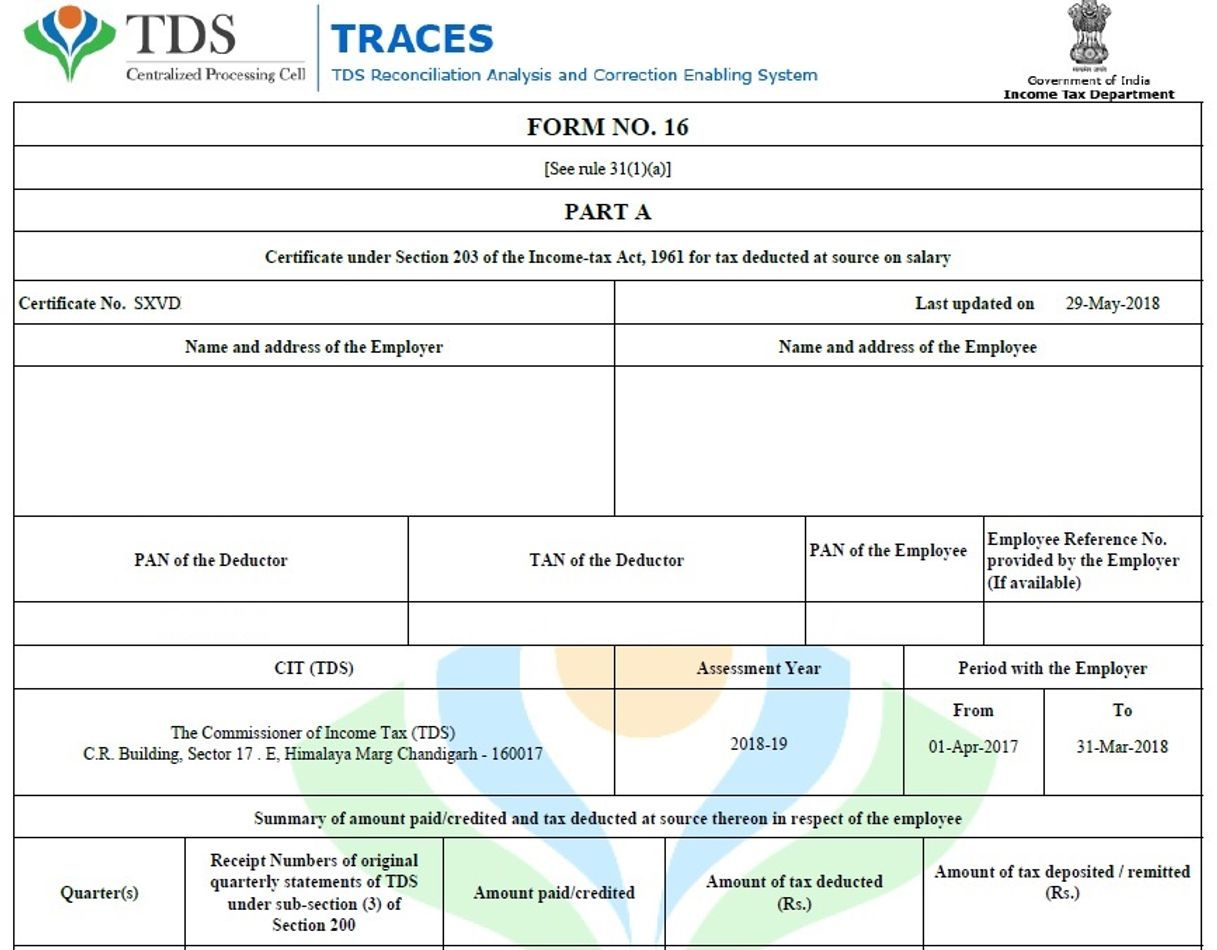

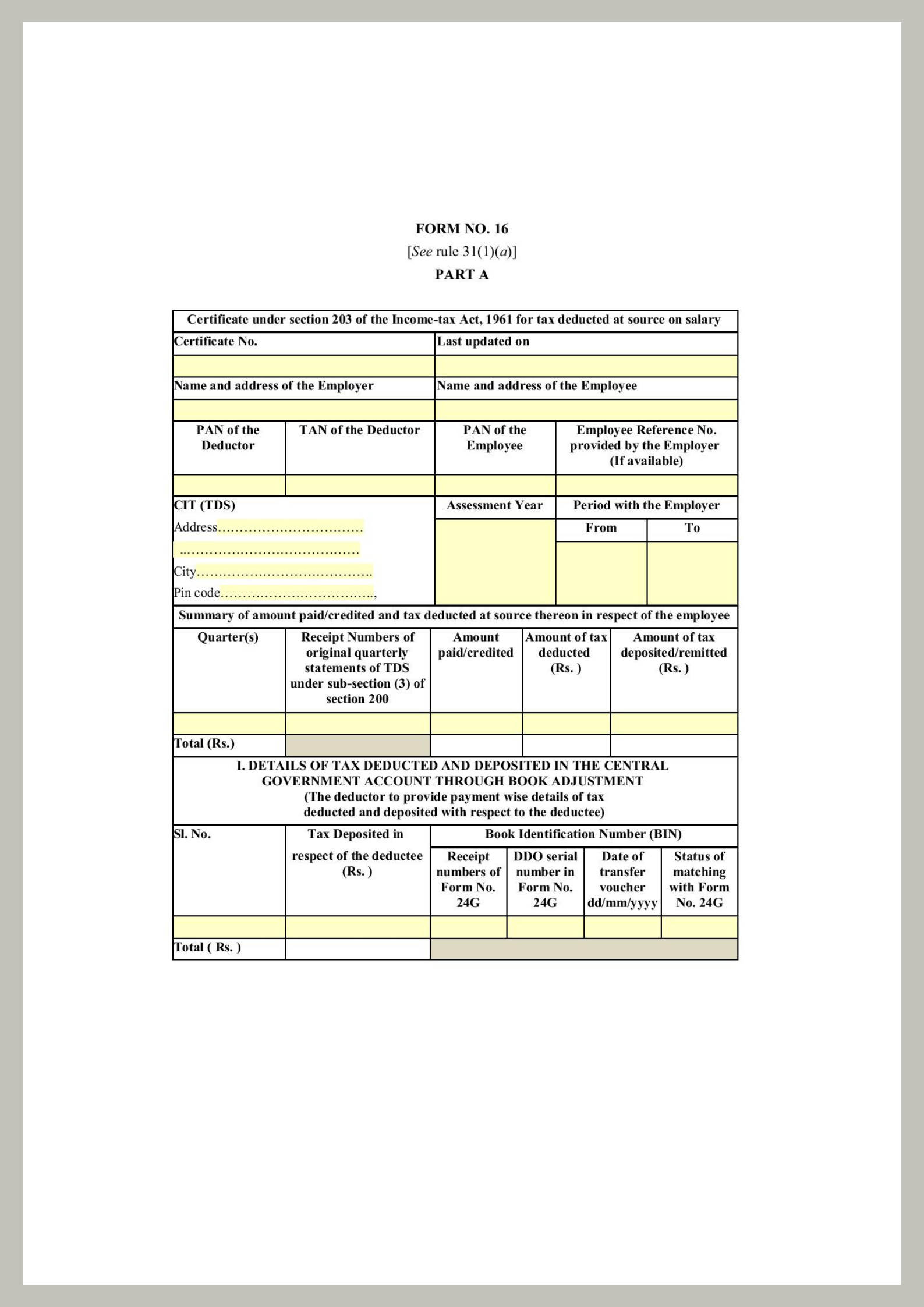

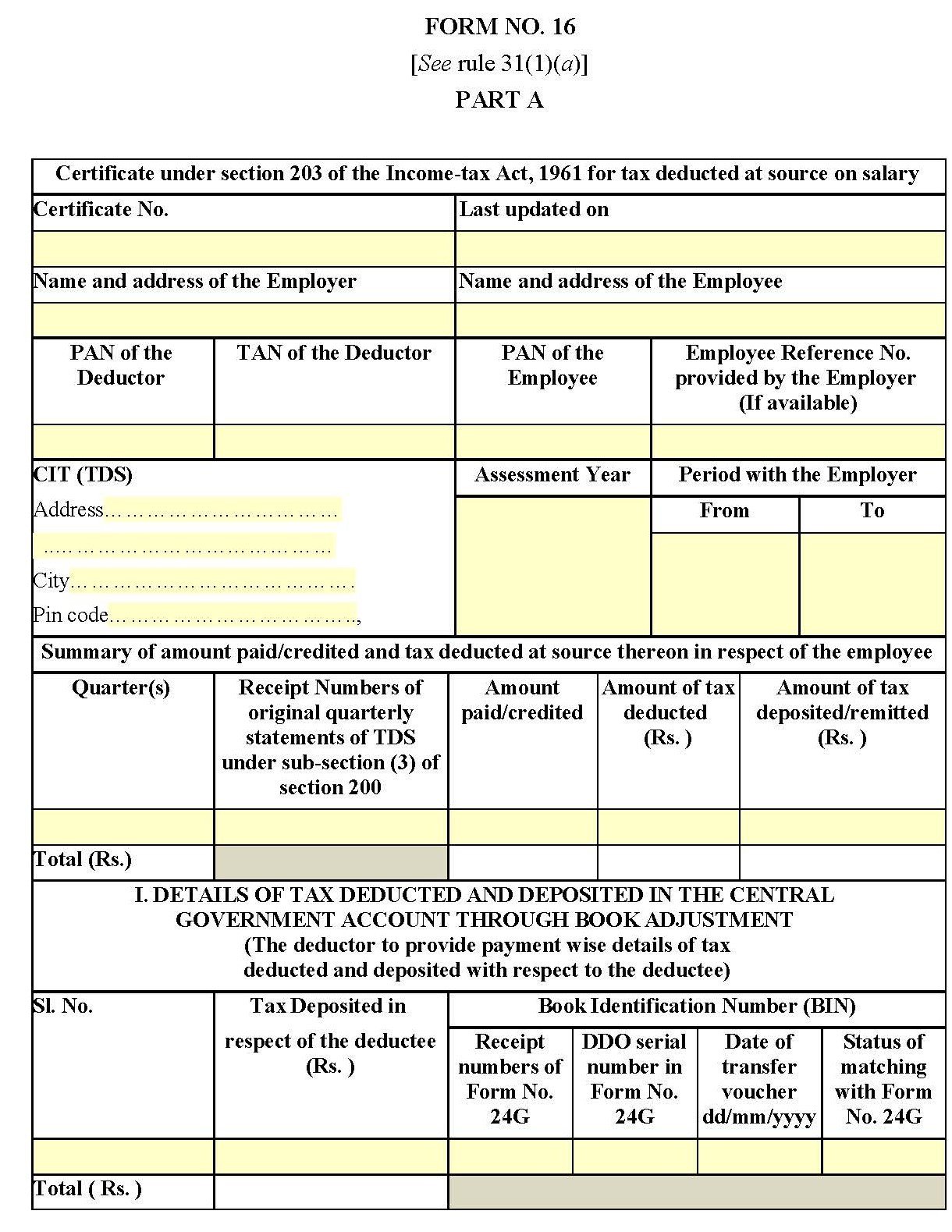

One of the key bits of information available from form 16 part a is a detailed record of the tds deposits made. Form 16 or 16a are provided by employer to employee as a proof of tax deduction. So, tds deductions that are given in form 16 / form.

Form 26as is a consolidated tax. Enter the captcha code and click on proceed. step 4: At the end of the financial year, tax payers file their income tax returns (itr).

Every salaried individual who falls under the taxable bracket is permitted for form 16. The form 26as contains details of tax deducted on behalf of the taxpayer (you) by deductors (employer, bank etc.). Steps to verify validity of form 16:

Tds certificates such as form 16/form 16a are important documents that can help an individual to file itr easily. However, there can also be a mismatch in the income details as per form 16 and form 26as. Log in to your account using your pan.

Between forms 16 and 26as. The first step in the income tax return filing process is to gather all the required documents. If you are a salaried employee, your employer will give you.

Difference between form 16 and. Waiting for the final updates minimizes the chances of mismatches between form 16 and form 26as. Information on the tax that deductors (employer, bank, etc.) have taken out for taxpayers is included on form.