Beautiful Info About Sba Form 413 Example

Small business administration uses to assess the creditworthiness and repayment ability of its loan.

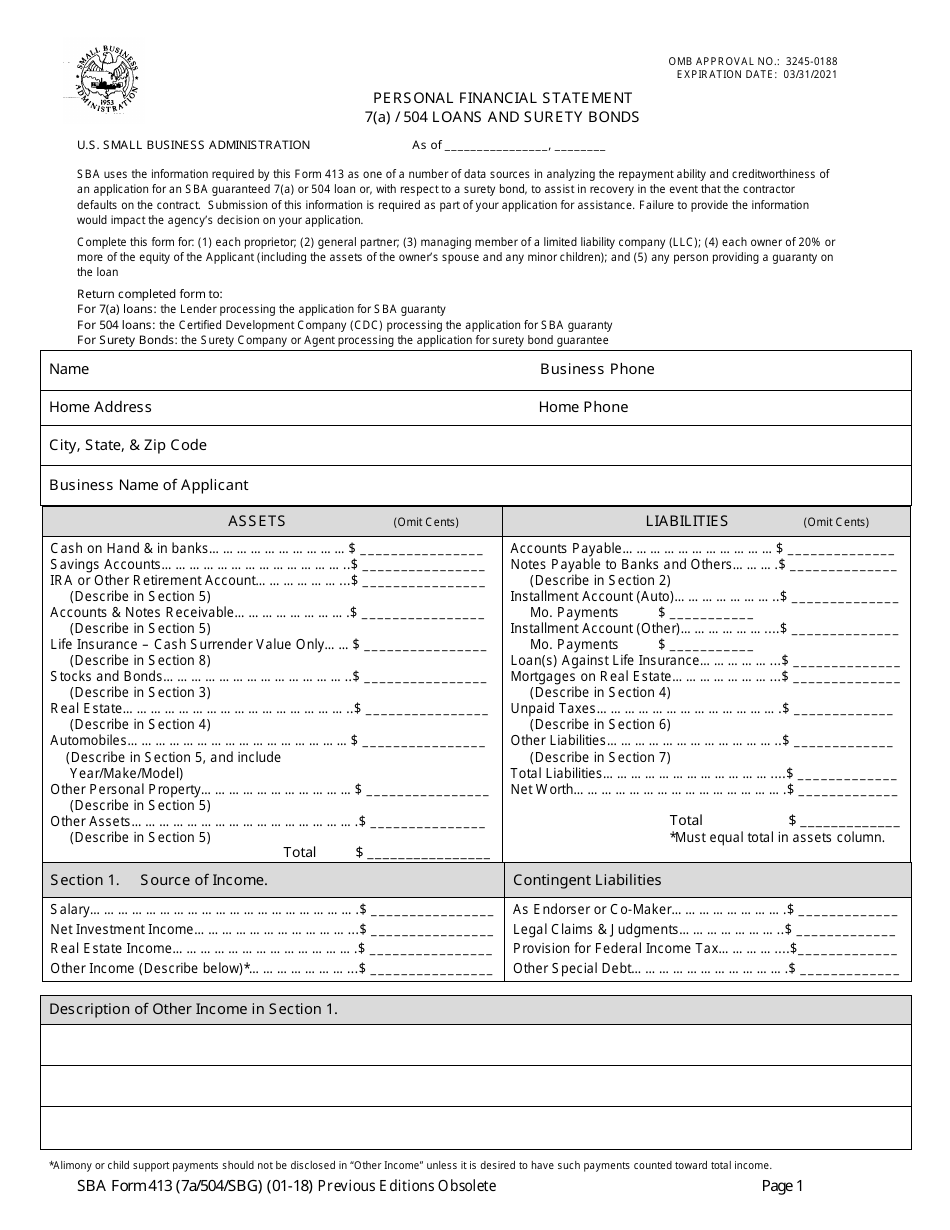

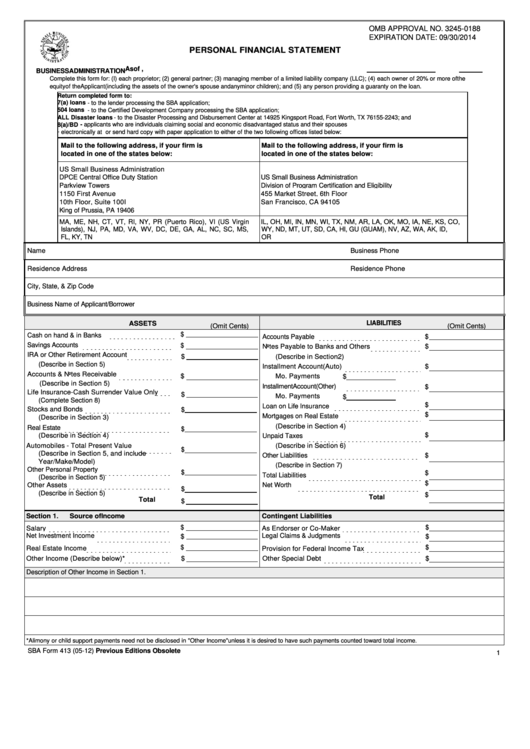

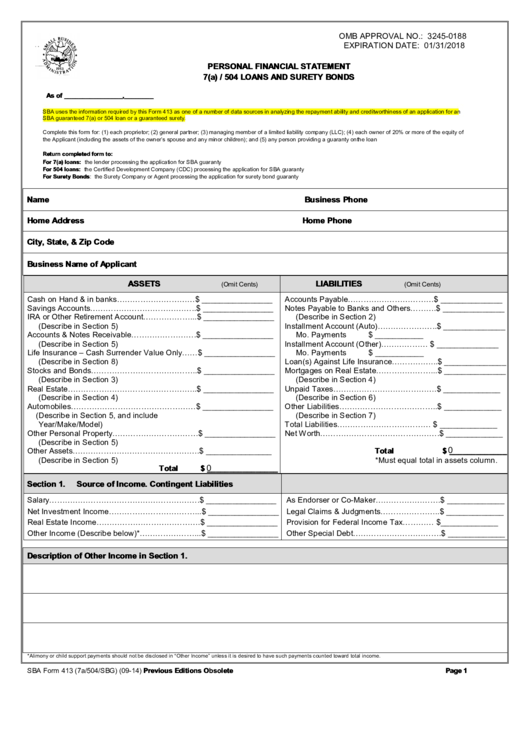

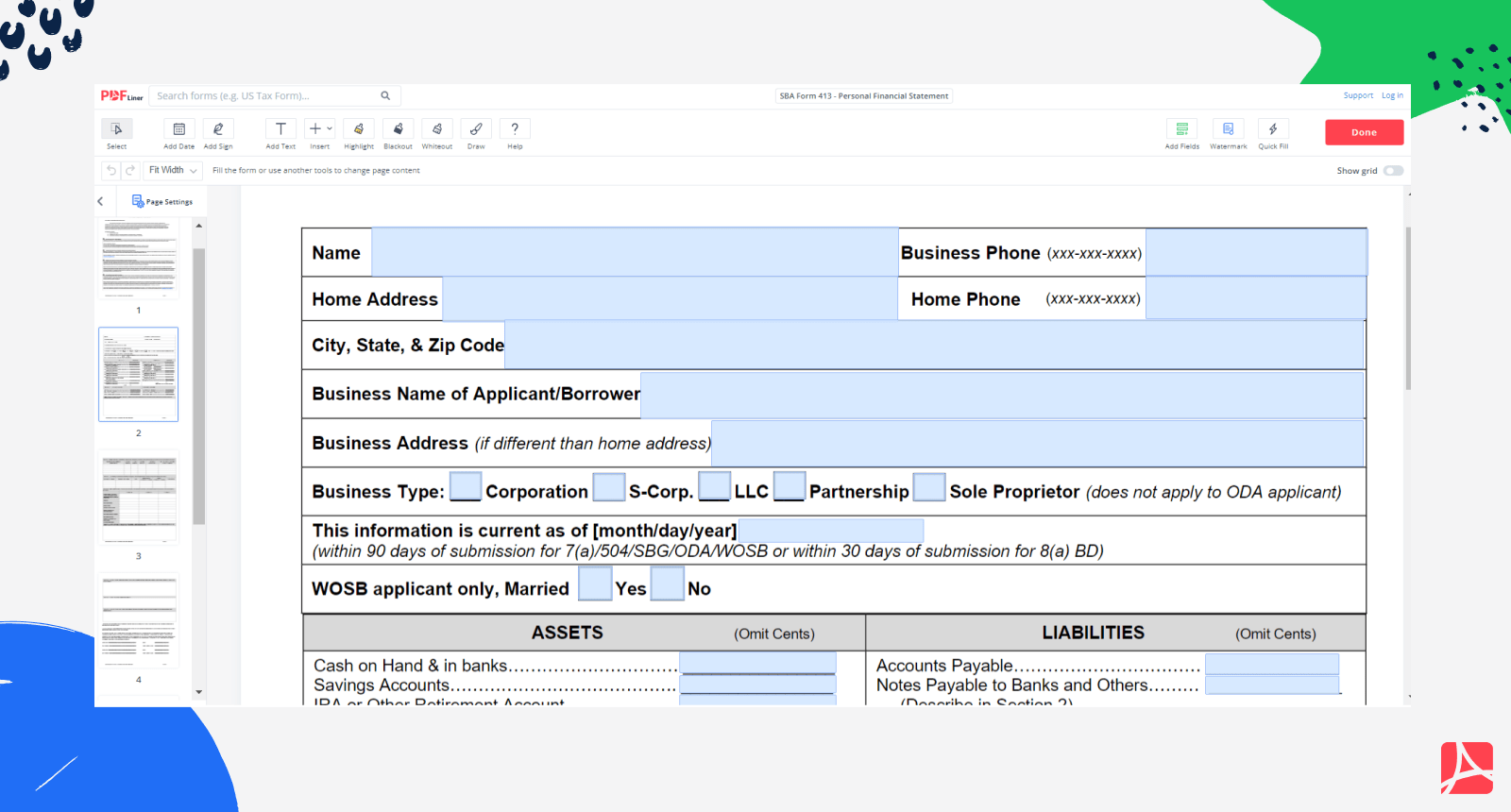

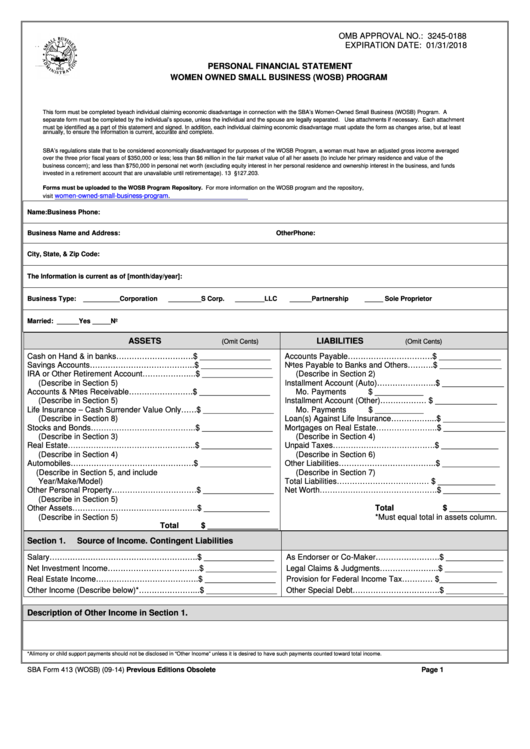

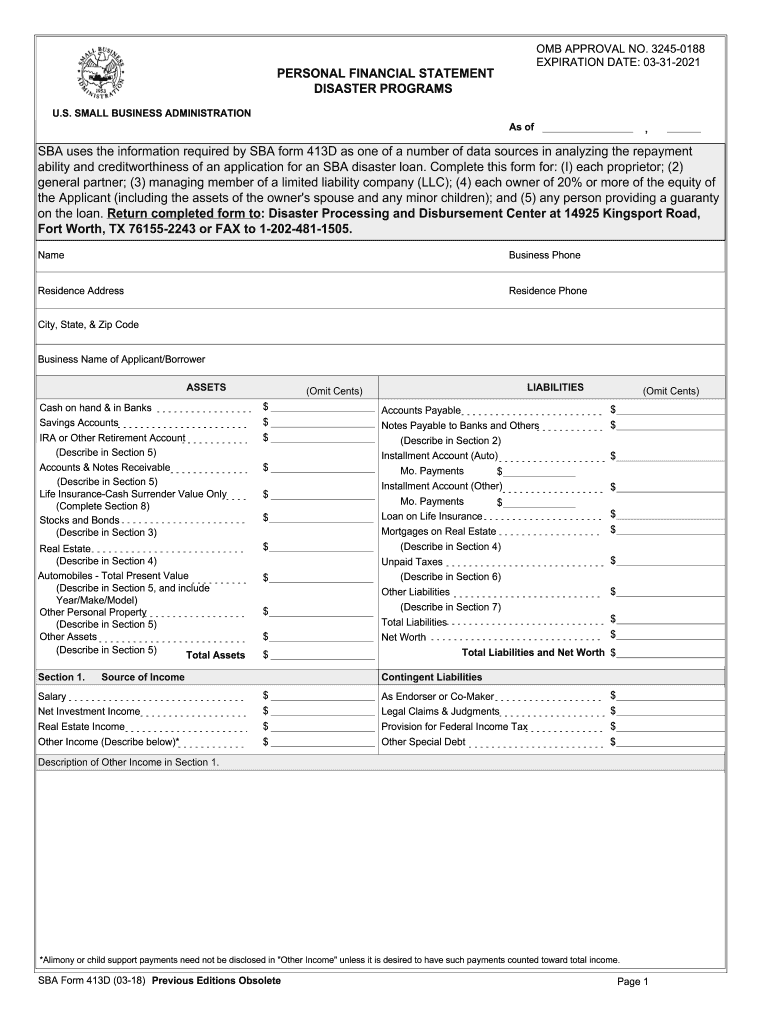

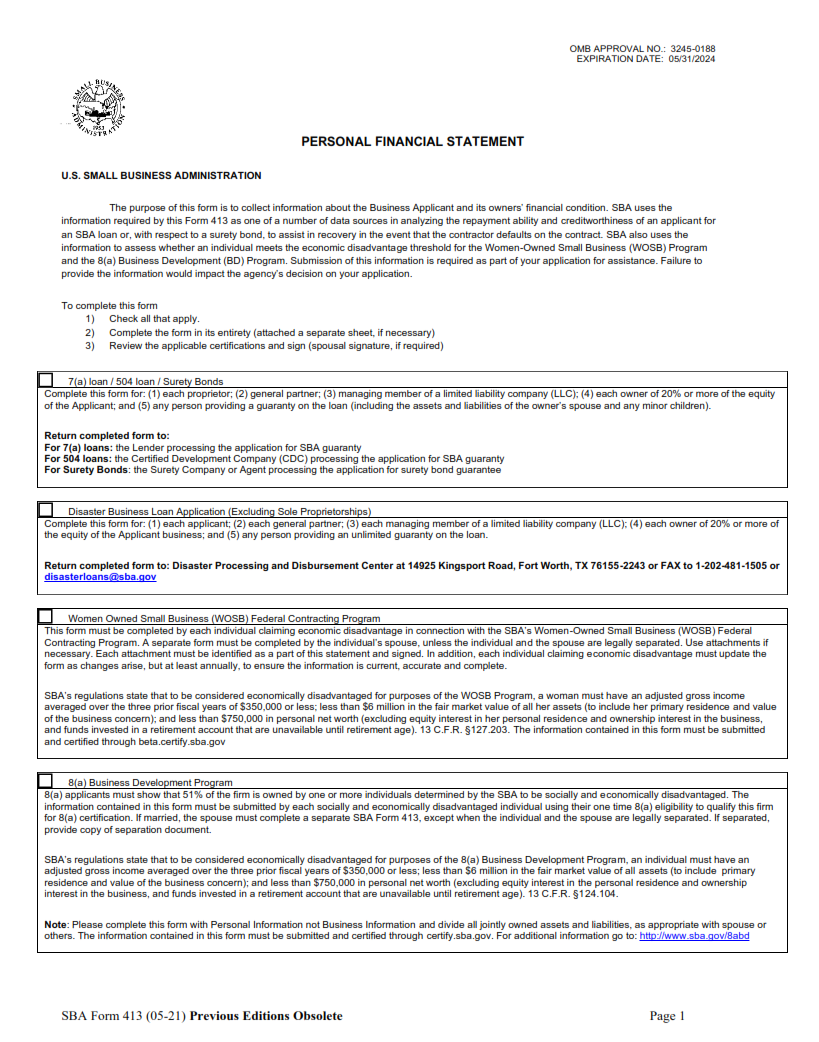

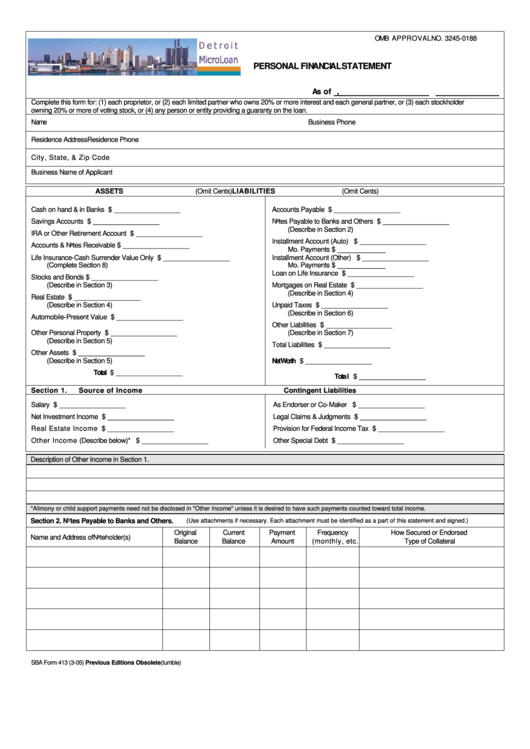

Sba form 413 example. (1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person or entity providing a guaranty o n. If the customer were to cash in the warrantee, how much would you pay out? Sba form 413, also known as the personal financial statement, is an essential document for those seeking an sba loan.

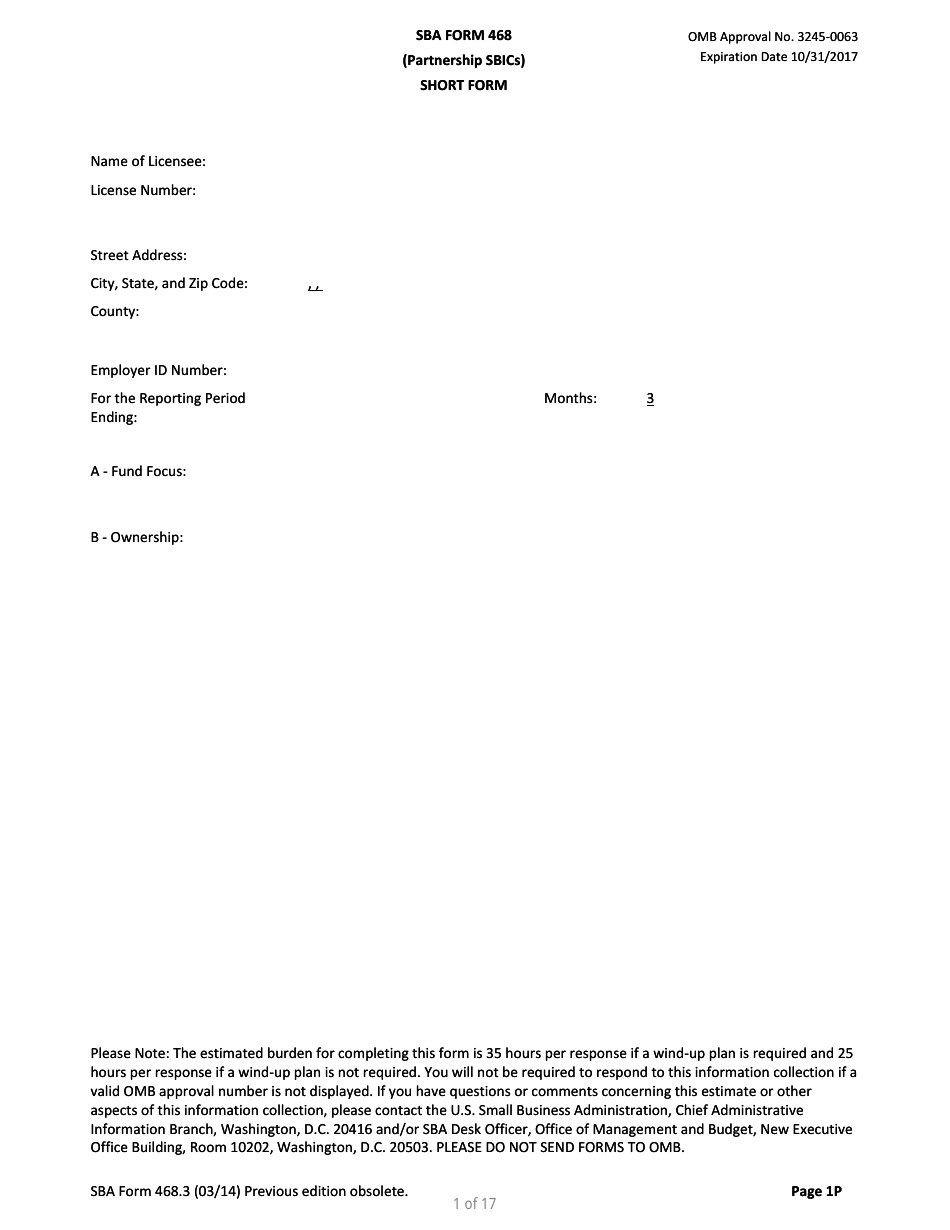

Small business administration (sba) is announcing the issuance of sba form 413 (7a/504/sbg/oda/wosb/8a), personal financial statement. Most common uses the sba form 413 is commonly used by all sba 7 (a) or sba 504 loan applicants. In this video, i show you exactly how to fill out the pfs to perfection and avoid the back and forth frustrations.

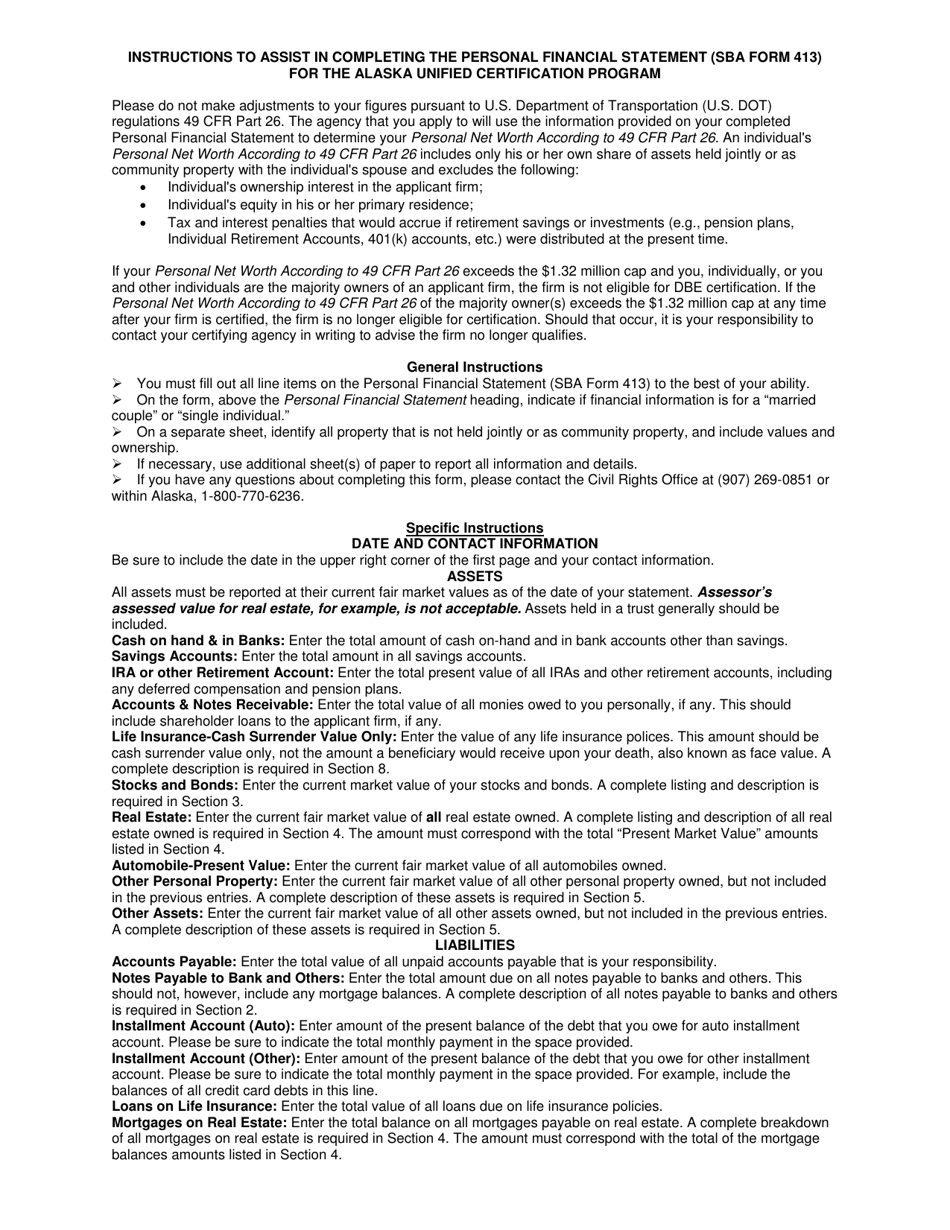

The sba uses form 413 as a way to assess your creditworthiness and ability to repay an sba 7 (a) or sba 504 loan. Notes payable to banks and others (page 2) section 3: Each of the following people must complete sba form 413:

What is sba form 413? The sba reviews your personal financial information to determine your ability to repay the requested loan. Sba form 413, formally titled “personal financial statement,” is a document that the u.s.

Specifically, we’ll answer these questions and more: Sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. The small business administration and approved lenders use this form to help determine borrowers’ creditworthiness and ability to repay the loan.

An example is a pending lawsuit—if you were to lose the suit, how much would you have to pay? These loans often have more favorable rates and longer repayment terms than other business financing options and are. Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract.

Why does the sba require form 413? Key takeaways form 413 is a key piece of most sba loan applications. Checking and savings account statements individual retirement account (ira), 401 (k), and other retirement account statements

Supplemental tables are included for each of the following sections of sba form 413: Another common example is a product warrantee you provide to customers when they buy bigger ticket items. The financial information you will need includes:

What is sba form 413? The small business administration (sba) requires form 413, the personal financial statement, for most sba loans, such as the eidl loan, 7 (a) loan, and 504 loan. One of the first documents a small business owner must provide to their lender.

Sba form 413 is a personal financial statement that provides lenders with an overview of your current financial situation, allowing them to analyze your assets and liabilities. What is sba form 413? In this article, we discuss how the sba uses form 413, address frequent.