What Everybody Ought To Know About Depreciation Entry In Profit And Loss Account

In the world of taxes for trades, professions, or vocations, not al.

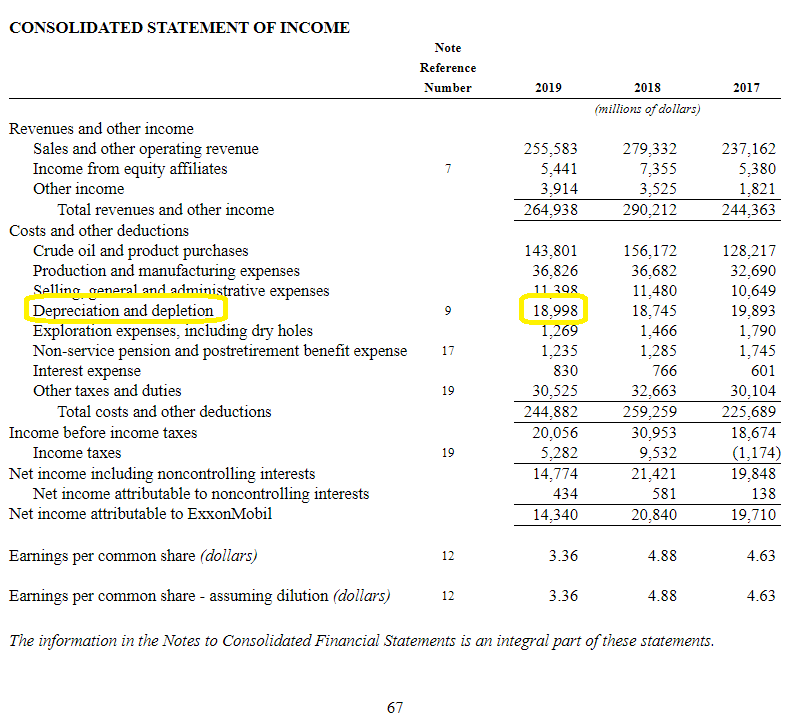

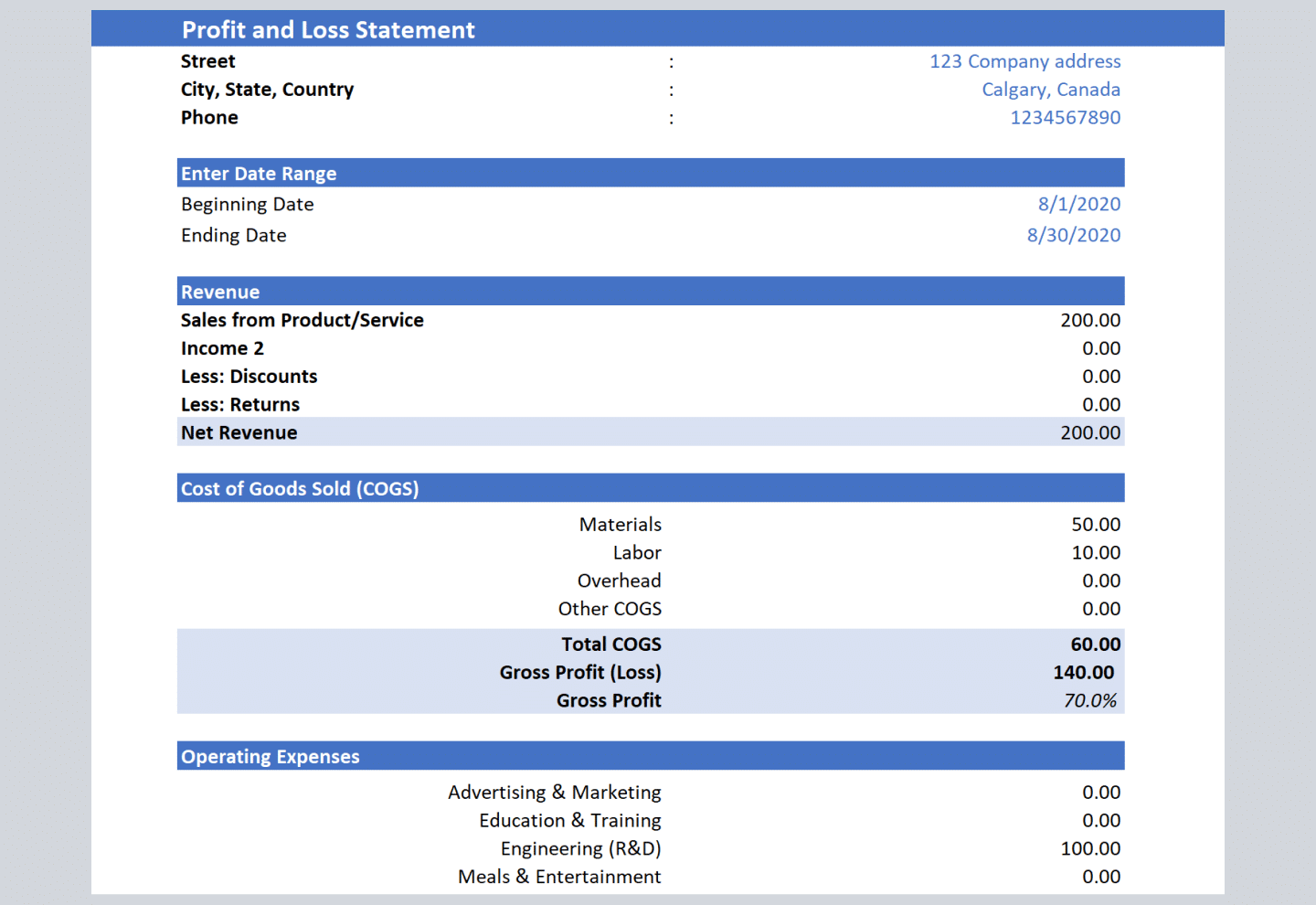

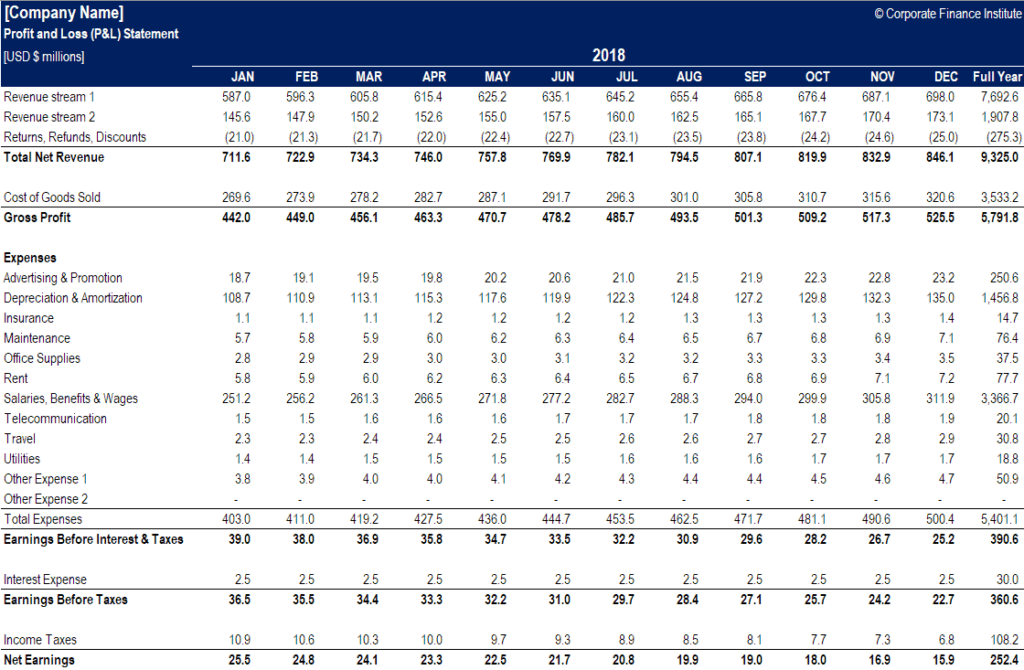

Depreciation entry in profit and loss account. It states that this cost should be. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Depreciation expense is an income statement item.

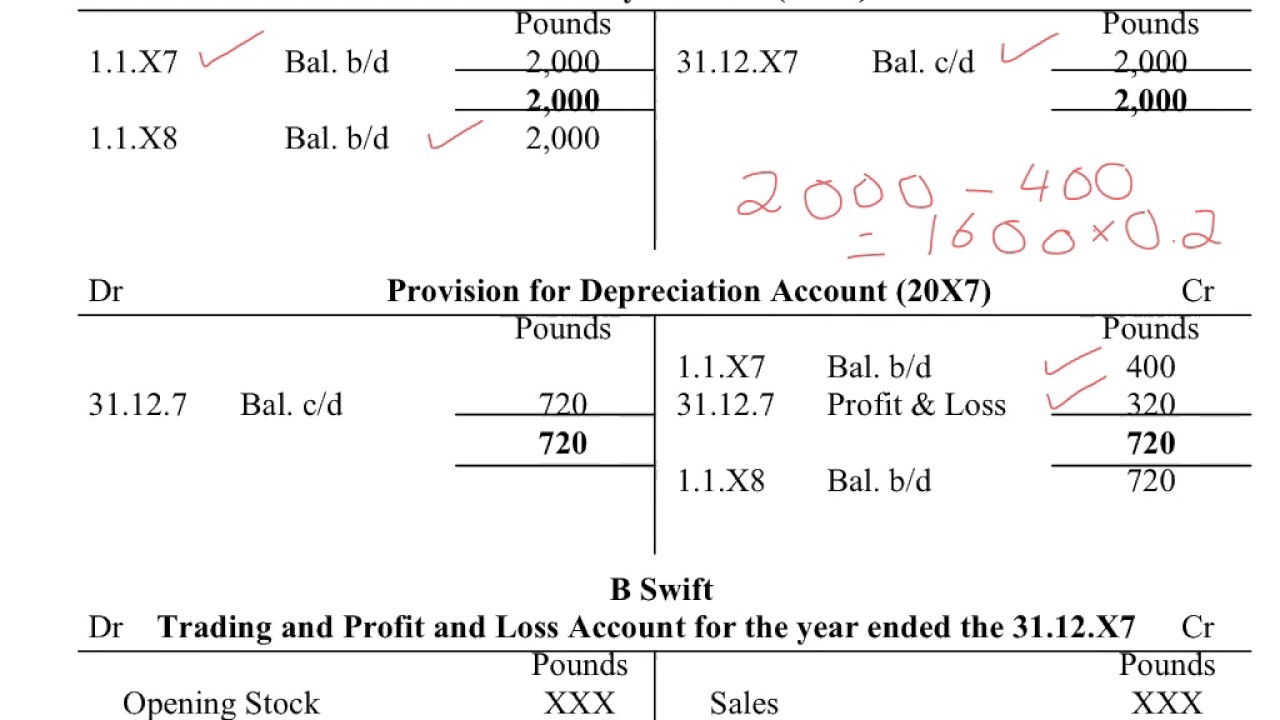

In the company accounts, the balance sheet would include the asset at its cost of £2k. Profit and loss account is made to ascertain annual profit or loss of business. Trading account used to find the gross profit/loss of the business for an accounting period:

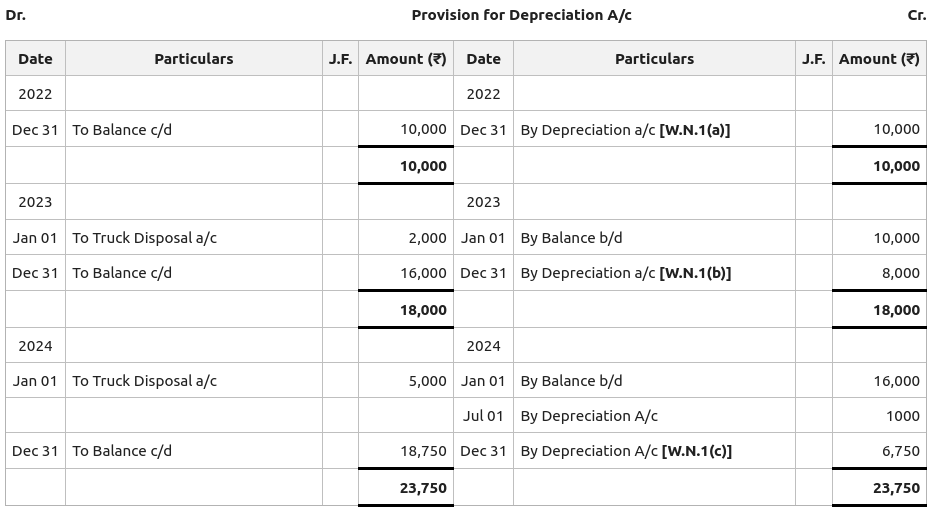

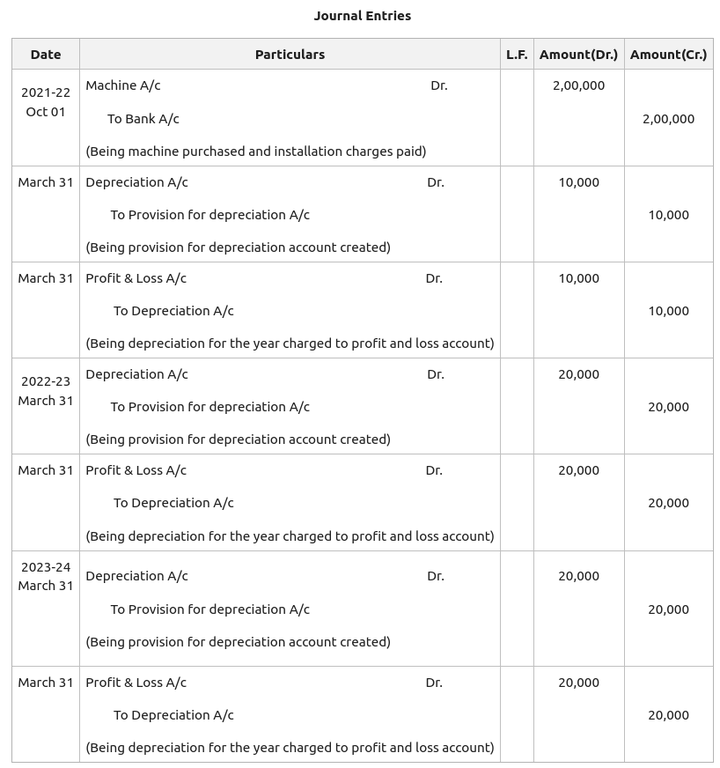

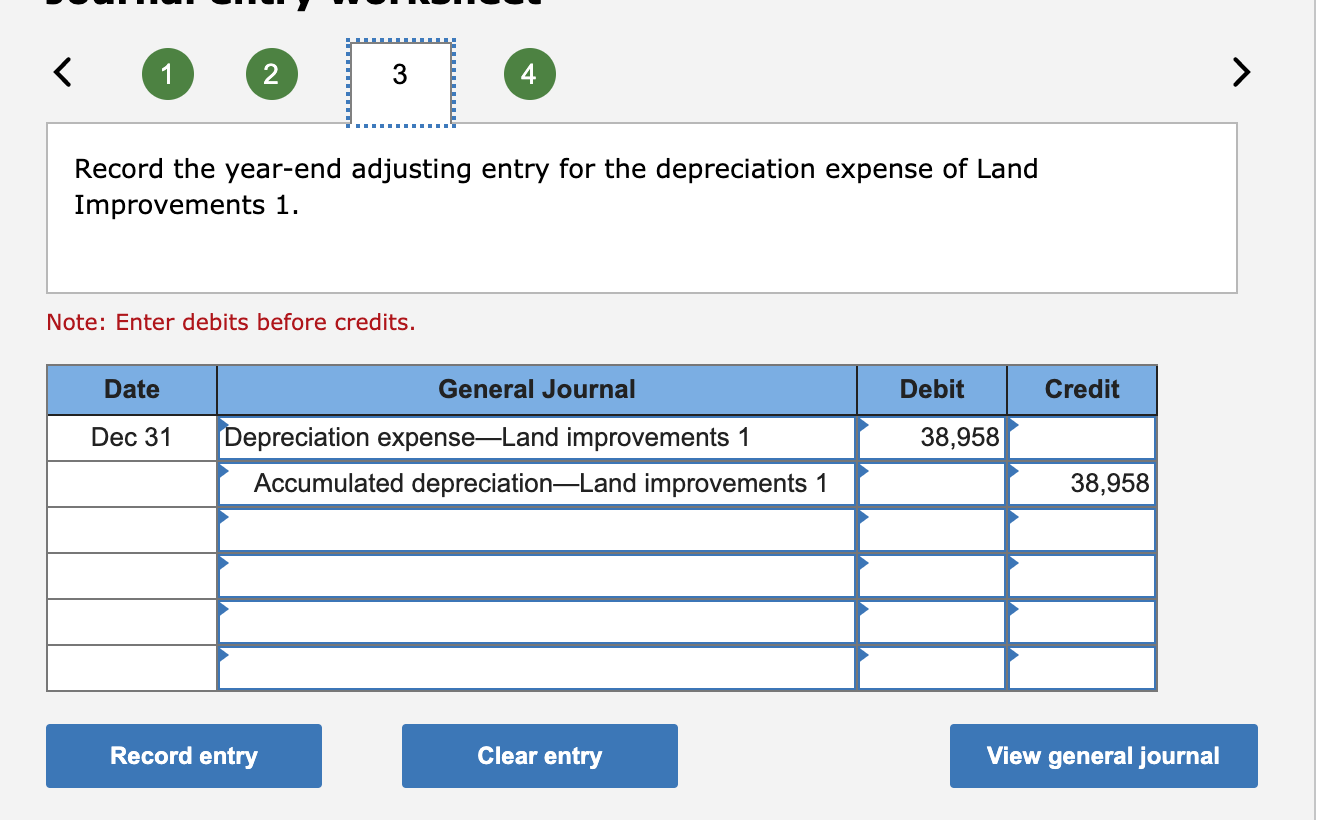

The basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which appears in the balance sheet as a contra account that. It is accounted for when companies record the loss in value of their fixed assets through depreciation. Depreciation as an expense (cost of doing business) to understand how profitable your business is, you need to know all your costs.

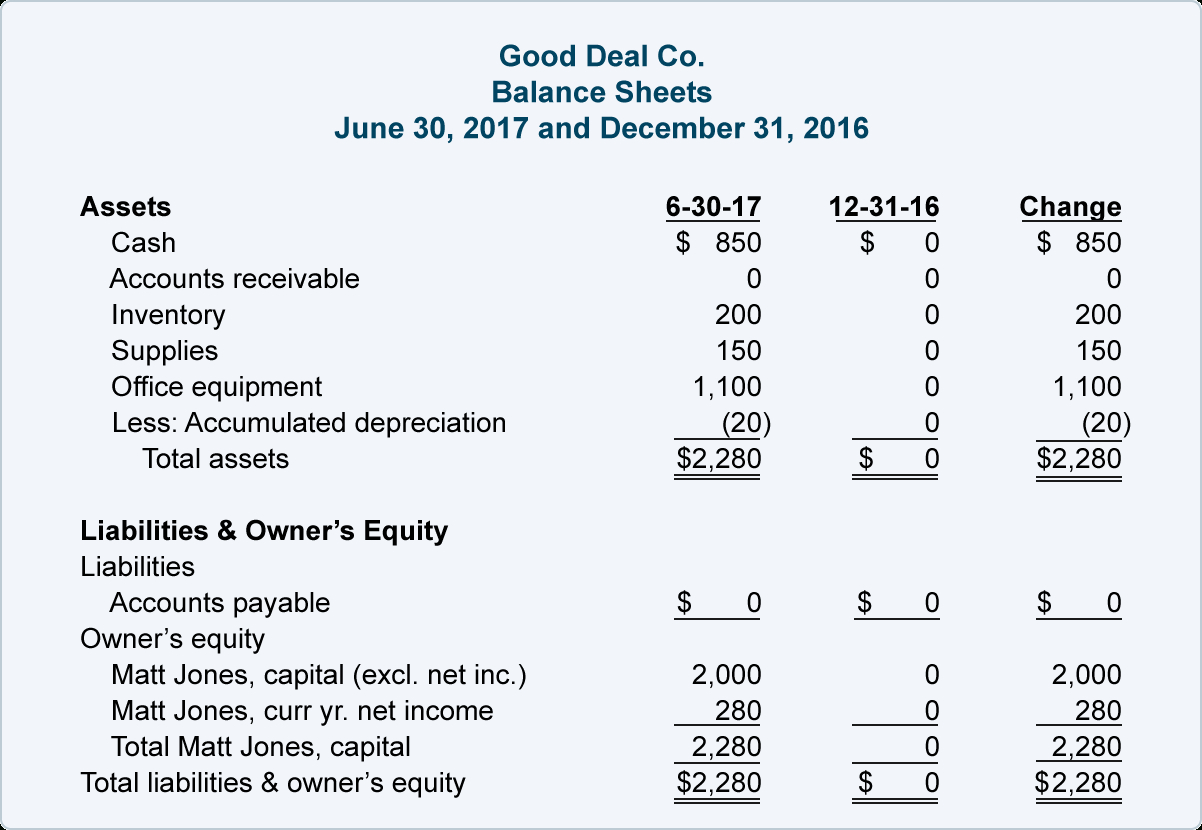

The double entry to close the depreciation account and transfer to the profit and loss account is carried out as follows: Depreciable assets mainly fixed assets. Depreciation account is taken to the profit and loss account and the asset at its reduced value is shown in the balance sheet.

If the above entry was passed before. The balance sheet shows what the business has and what the business. The appropriate journal entry to record equipment depreciation expense would consist of a debit to depreciation expense and a credit to which of the following accounts?

Depreciation is one of those costs. The $39,000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. The depreciation expense account, being a nominal account, is closed at the end of each financial year by transferring its balance to the profit and loss account.

Only indirect expenses are shown in this account. All the items of revenue and expenses. The carrying amount of the plant and.

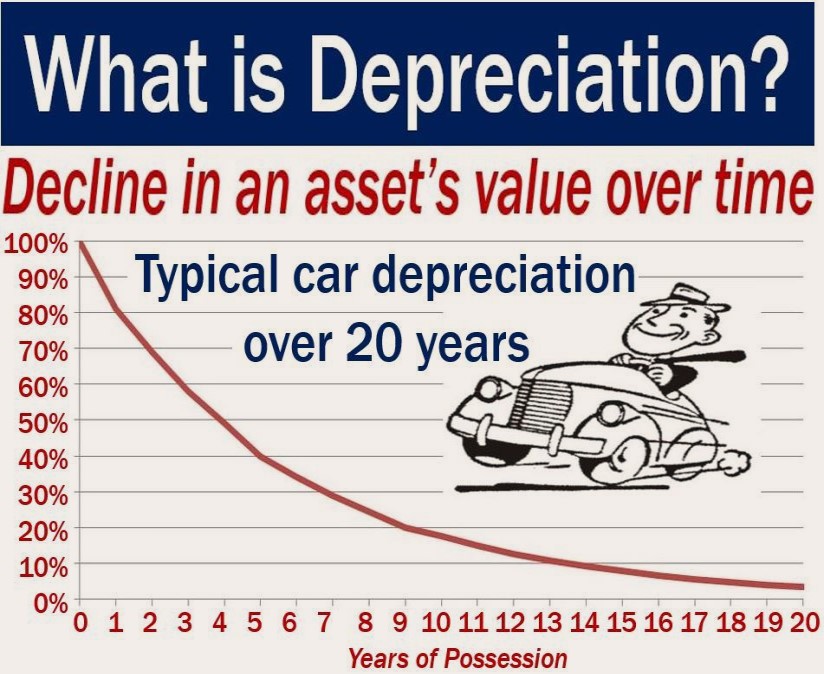

It is charged every year and deducted. Depreciation in accounting is the systematic process of allocating the cost of an asset (fixed assets) over its estimated useful life. In other words, depreciation spreads out the cost of an.

The profit and loss account reports sales, expenditure and profit during a given period. Depreciation is an accounting entry that represents the reduction of an asset's cost over its useful life. Closing entries for profit & loss account:

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)