Exemplary Info About Deferred Tax Balance

Ias® 12 defines a dtl as being the amount of income tax payable in the future periods in respect of a taxable temporary difference.

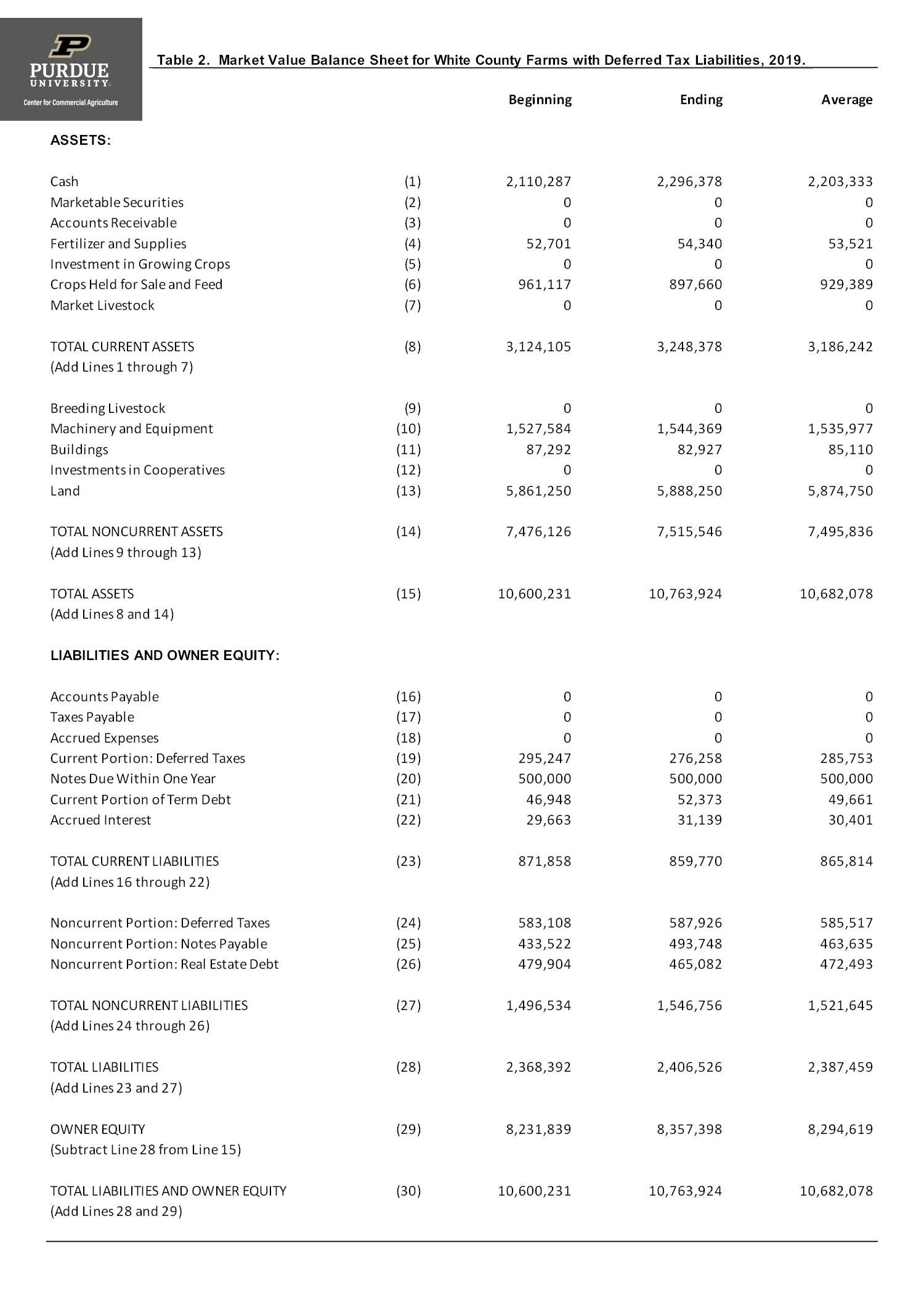

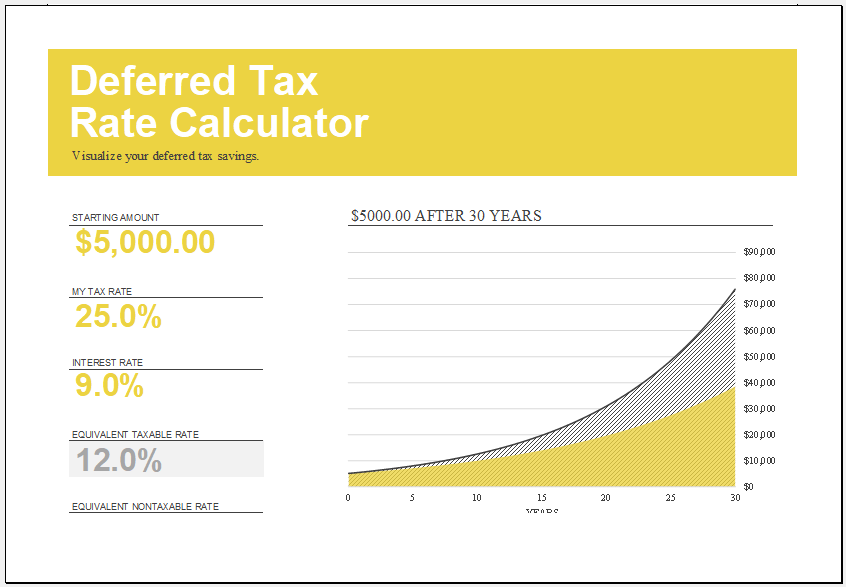

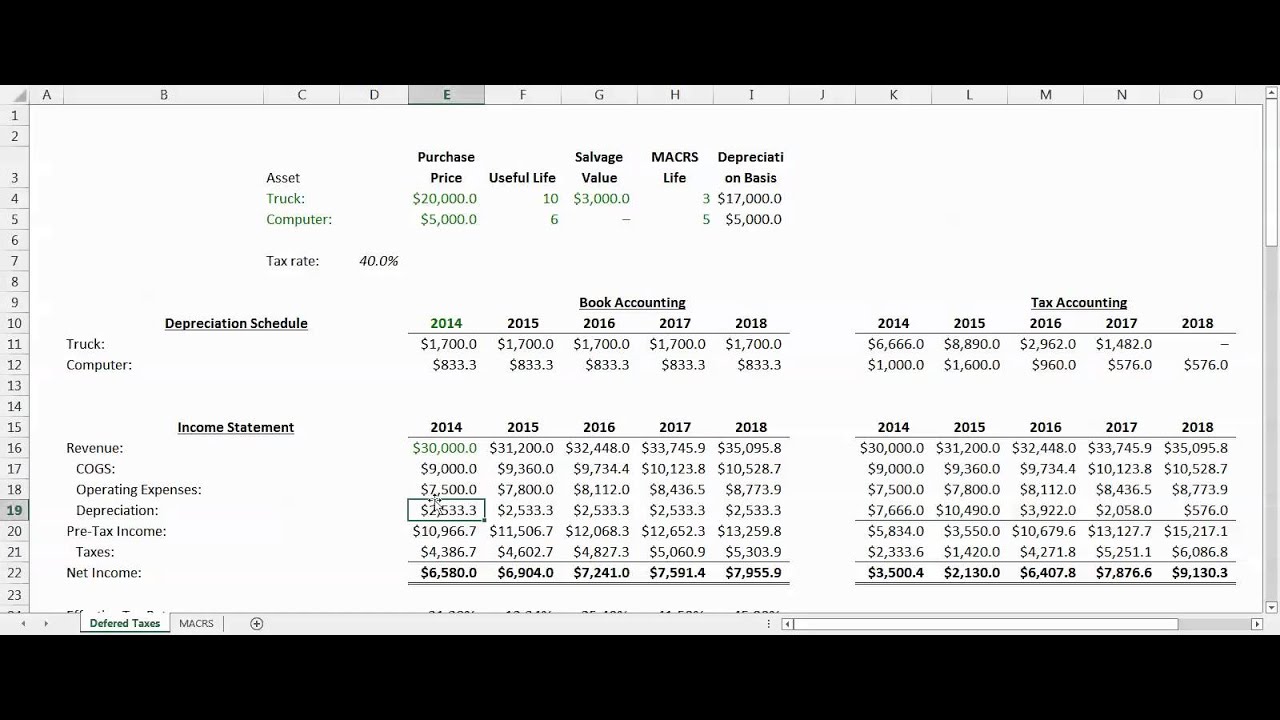

Deferred tax balance. The double entry bookkeeping journal to post the deferred tax liability would be as follows: Balanced budget while still making alberta look appealing to investors and canadians. Going off the prior depreciation example, the deferred tax liability (dtl) recorded on the balance sheet is calculated as the difference between the value of pp&e under book accounting and tax accounting in each period multiplied by the tax rate.

An increase in deferred tax liabilities or a decrease in deferred tax assets is a source of cash. By contrast, deferred tax liability is underpaid tax which must later be repaid. The tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400 at the tax rate of 25% is the deferred tax of 350.

A deferred tax liability (dtl) is listed on the balance sheet that shows taxes that are payable in the future. Tax authorities charge taxes based on tax laws, and the two often differ. The deferred tax liability on a company balance sheet represents a future tax payment that the company is obligated to pay in the future.

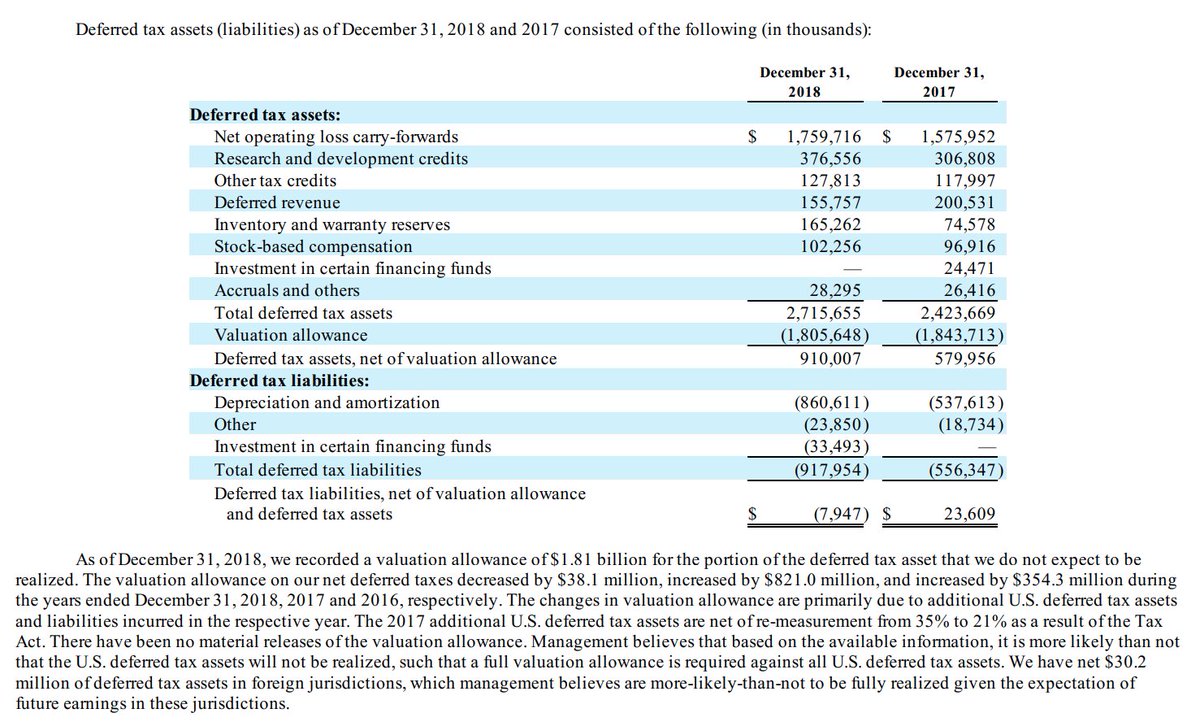

Overview of the guide 1 section 1: Fundamentally, deferred tax balances represent the future tax impacts of recovering or otherwise consuming assets (e.g., by depreciating the asset) and settling liabilities (e.g., by cash settlement of the obligations) at the respective book values. During every tax period, your company’s deferred tax assets must be calculated.

This article will consider the aspects of deferred tax that are relevant to fr. The basics deferred tax is accounted for in accordance with ias ® 12, income taxes. Exceptions to paying taxes on cd interest.

This heritage fund idea is potentially a really big deal, he said. Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. Here is a write up on all about dtl/dta, how it’s calculated and certain specific.

Deferred tax asset in balance sheet. The term ‘substantively enacted’ is defined in the glossary to frs 102 as follows: A deferred tax asset represents a reduction in future tax liability and is reported on the balance sheet.

When the amount is less than the estimated tax, an entry is placed on the balance sheet in the form of a liability. Companies calculate book profits using a particular accounting method; Frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws that have been enacted or substantively enacted by the balance sheet date and which are expected to apply to the reversal of the timing difference.

The effect arises when taxes are either not paid or overpaid. Deferred tax (dt) refers to the difference between tax amount arrived at from the book profits recorded by a company and the taxable income. Deferred tax typically refers to liabilities, wherein the amount entered on the balance sheet is payable at a future time.

It is calculated as the company's anticipated tax. However, deferred tax can also apply in the opposite sense. Allocating the deferred tax charge or credit 12 section 3:

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/Deferredtaxliability_rev-2b13fcdb2894415092ae4171dac657df.jpg)