Awe-Inspiring Examples Of Info About Common Size Income

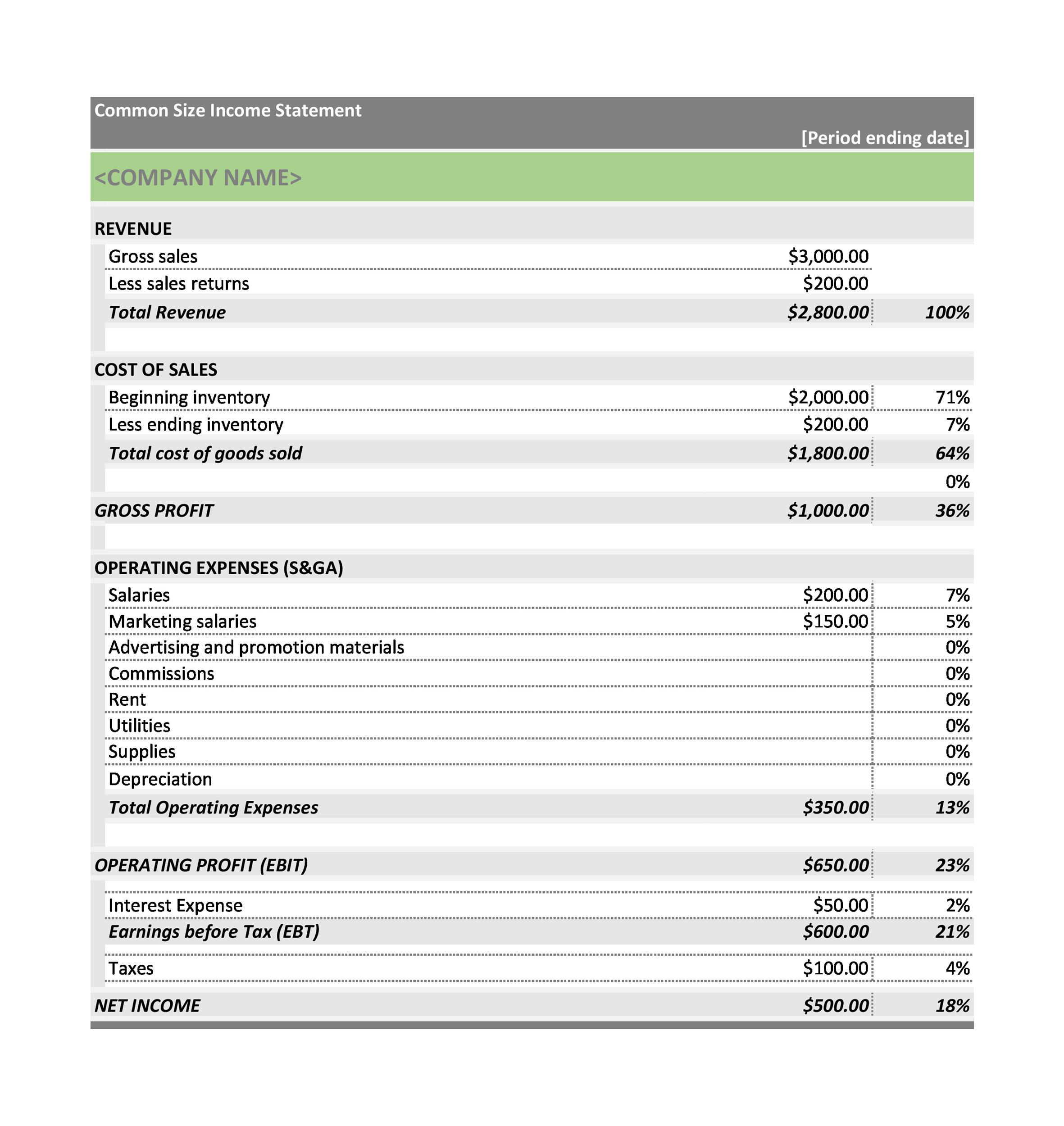

Therefore, the calculation of each line item.

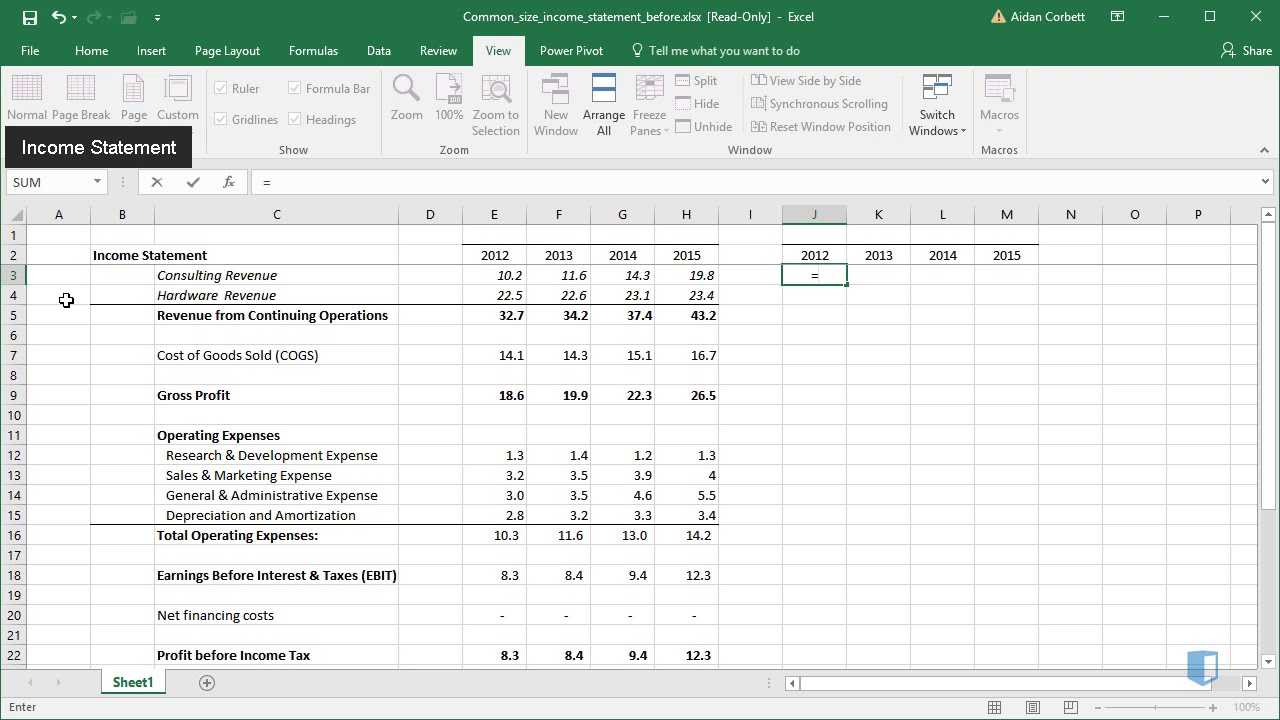

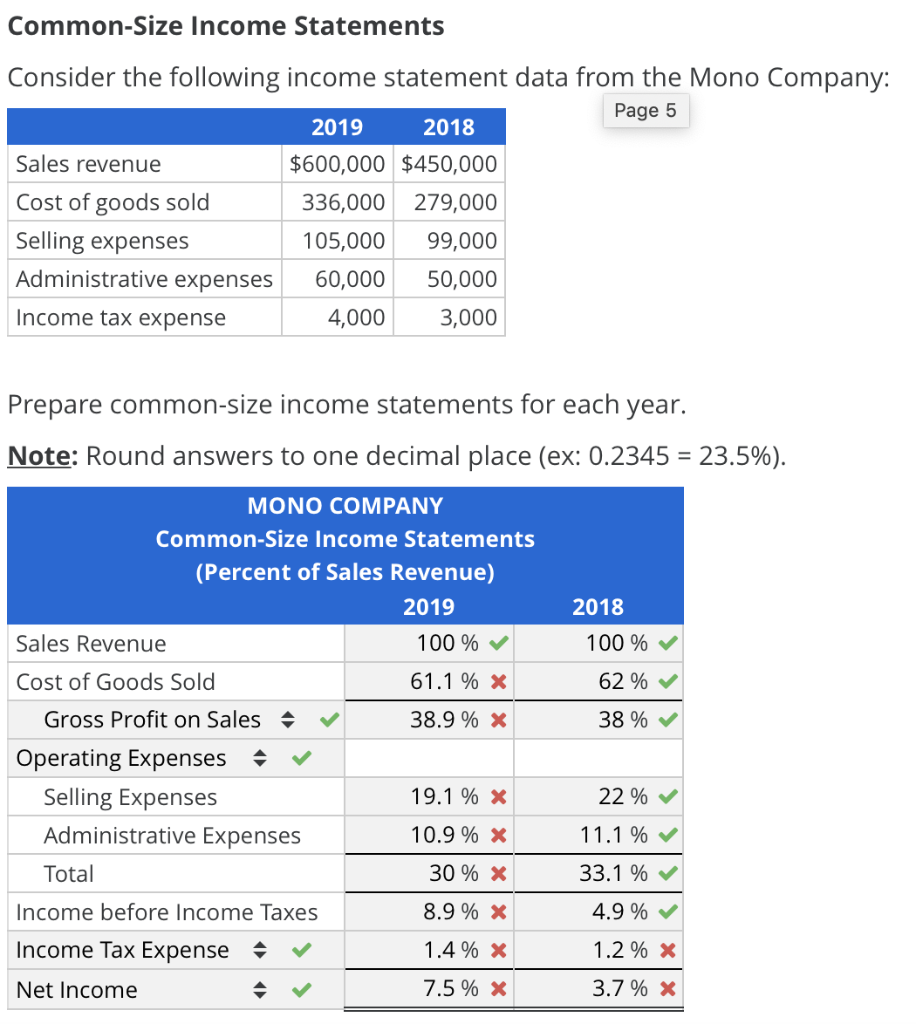

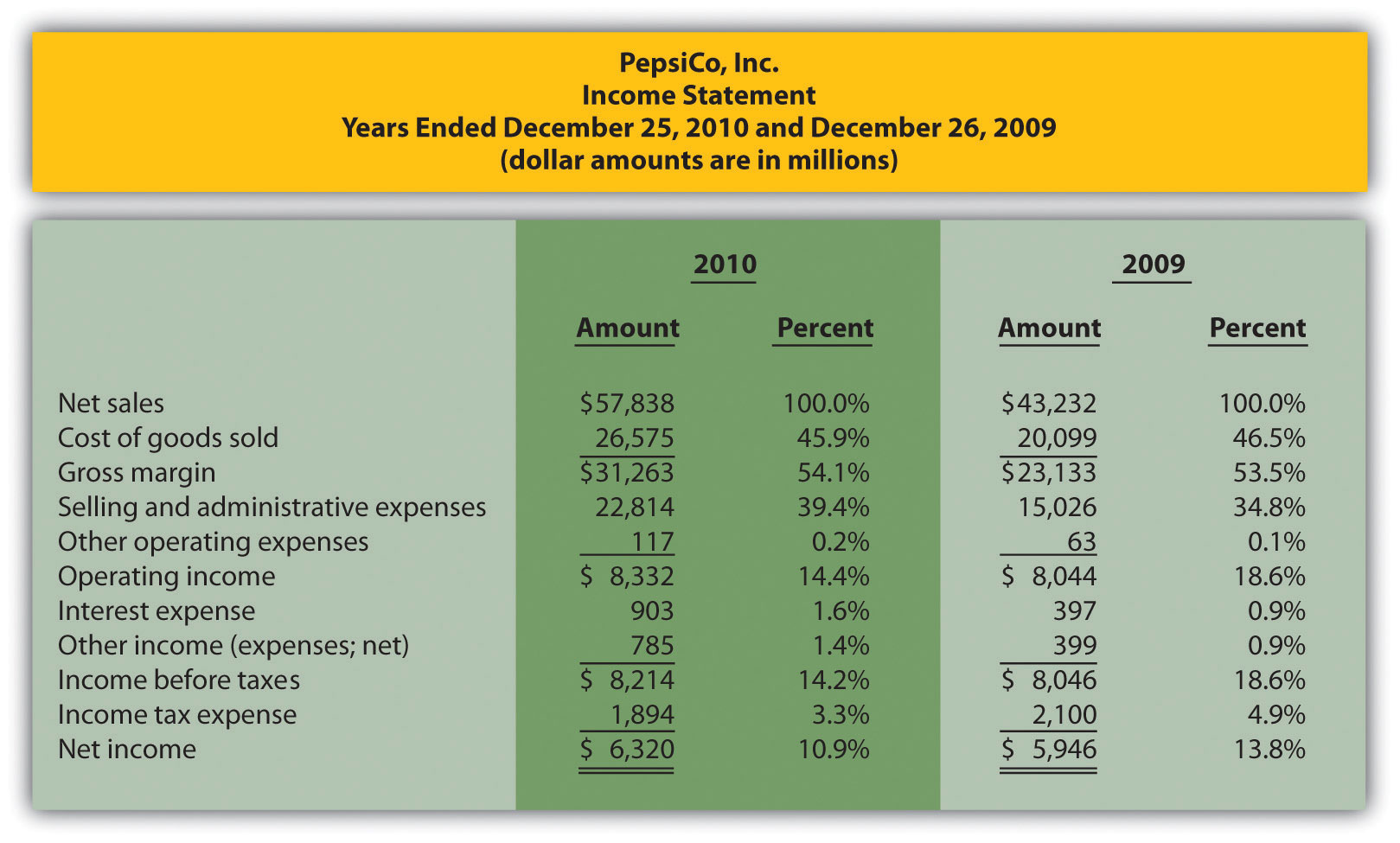

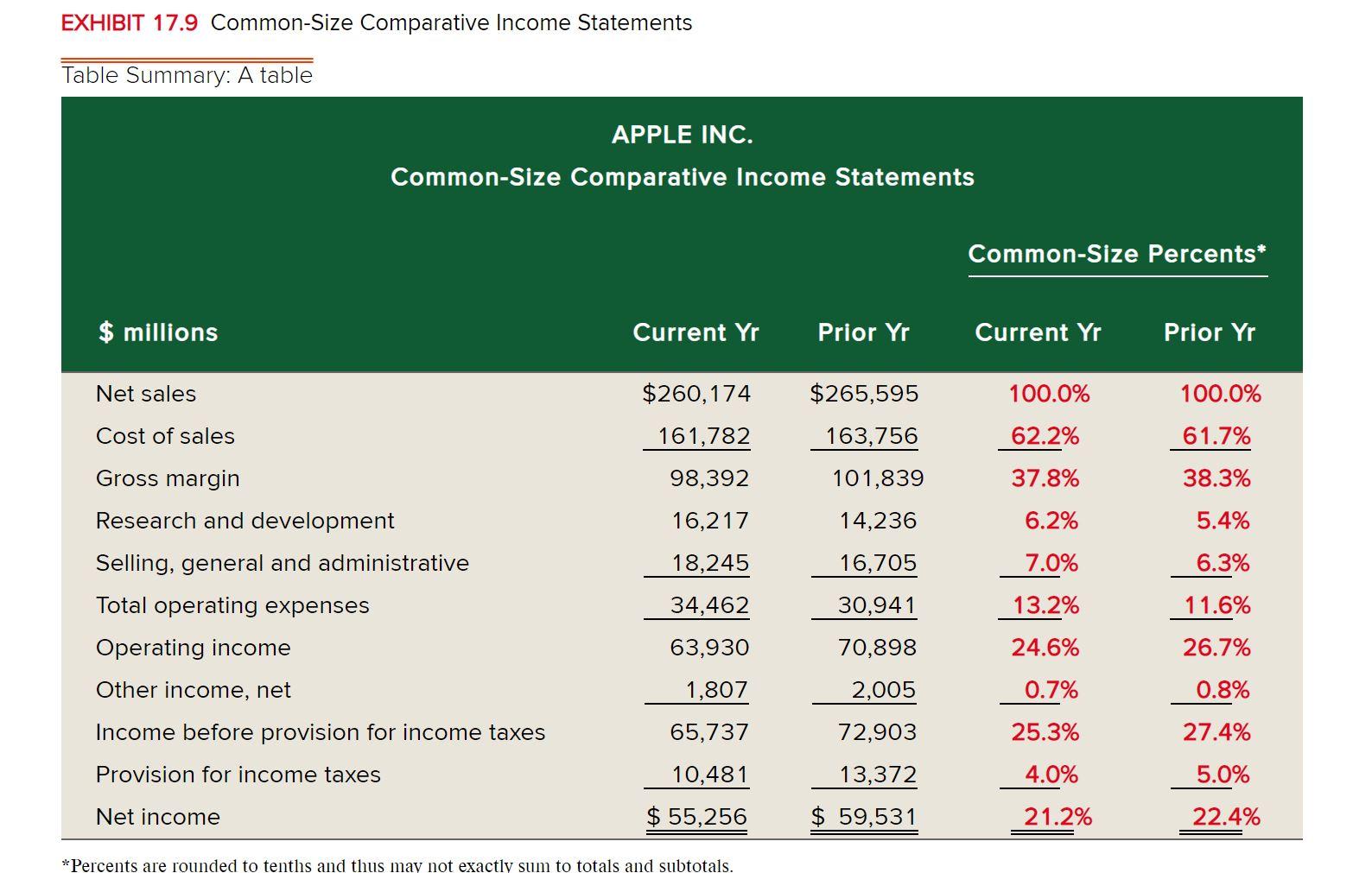

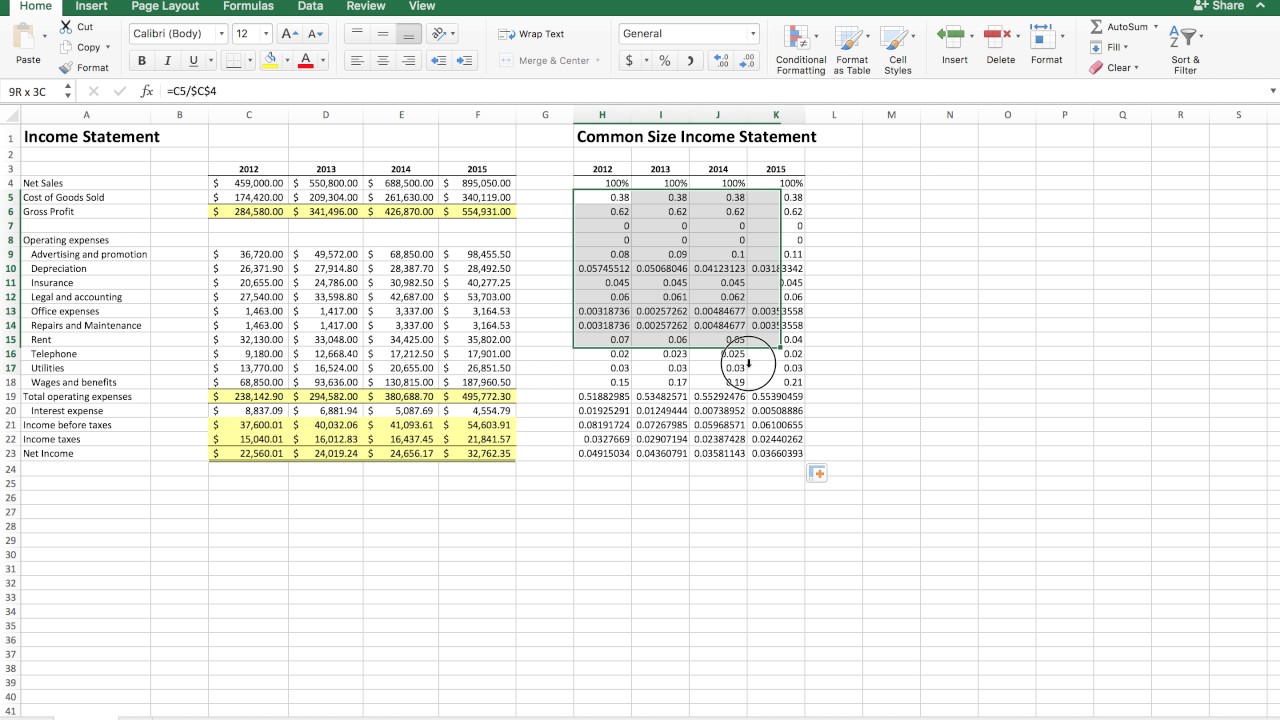

Common size income. Updated may 3, 2021 the practice of common sizing financial statements allows you to compare two companies that are of different sizes. It is used for vertical analysis, in which each line item in a financial statement is represented as a percentage of a base figure within the statement. Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year.

What is a common size income. (amount / base amount) and multiply by 100 to get a percentage. Common size income statement:

A common size income statement is a financial document that presents a company's revenues revenue refers to the total income generated by a business from. A statement that shows the percentage relation of each income/expense to the revenue from operations (net sales), is known. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of revenue or sales.

Common size income statement this is one type of common size statement where the sales is taken as the base for all calculations. Net profit margin = (net profit/total revenue) *. 7 rows a common size income statement is the presentation of a company’s income and expenses in.

A common size income statement is the presentation of a company’s income and expenses in percentage terms instead of dollar amounts. Pengertian analisis common size. Expressing each item on the income statement as a percentage rather than in.

Last editeddec 2020 — 2 min read. While they don’t tell you.

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)