Beautiful Tips About Cash Flow P&l Balance Sheet

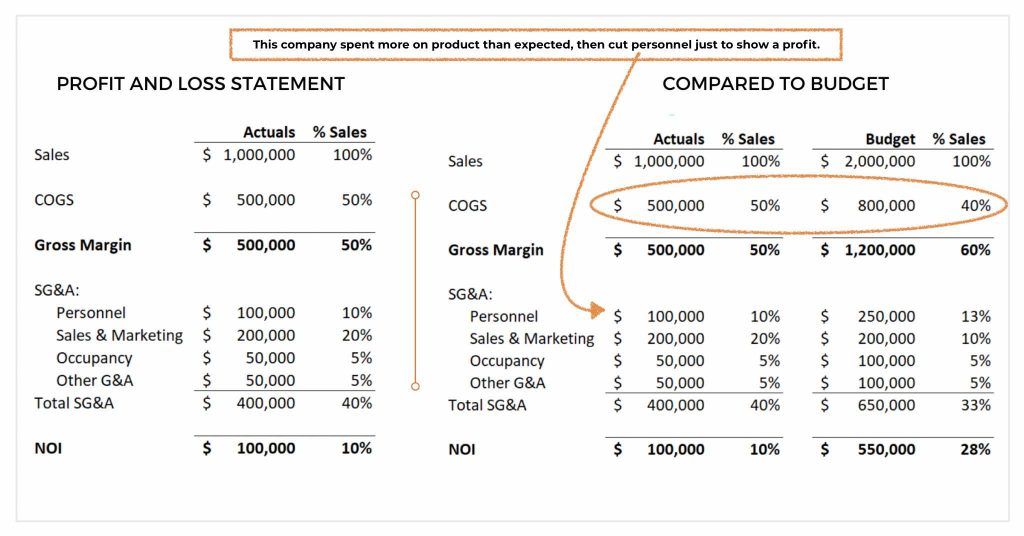

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

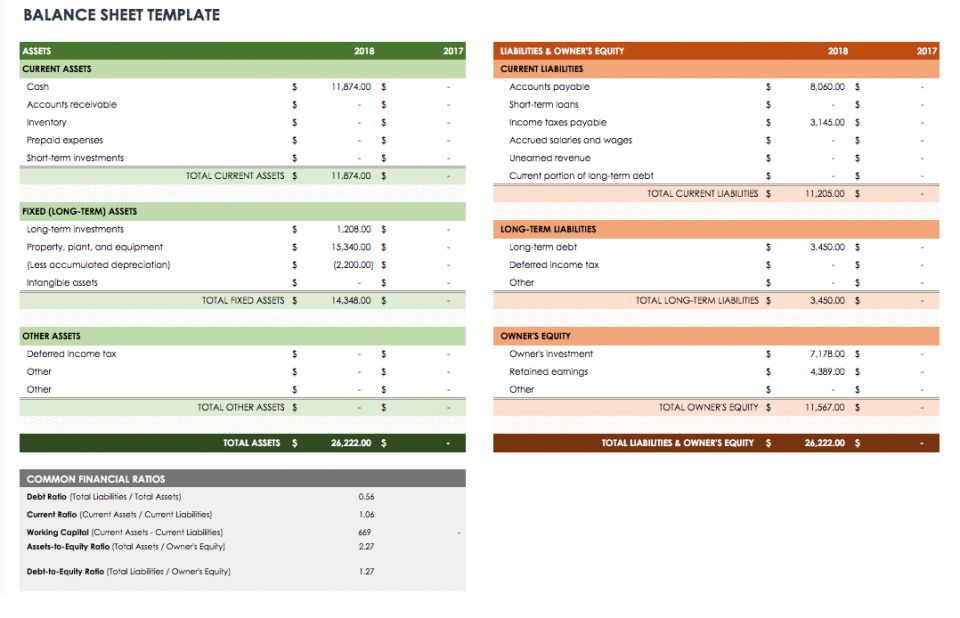

Cash flow p&l balance sheet. The p&l statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or statement of cash flows). Such statements provide an ongoing record of a company's. A business may own its building and the land around it.

What is the profit and loss statement (p&l)? The income statement, also known as the profit and loss or p&l statement. It is a snapshot of the organization’s financial position.

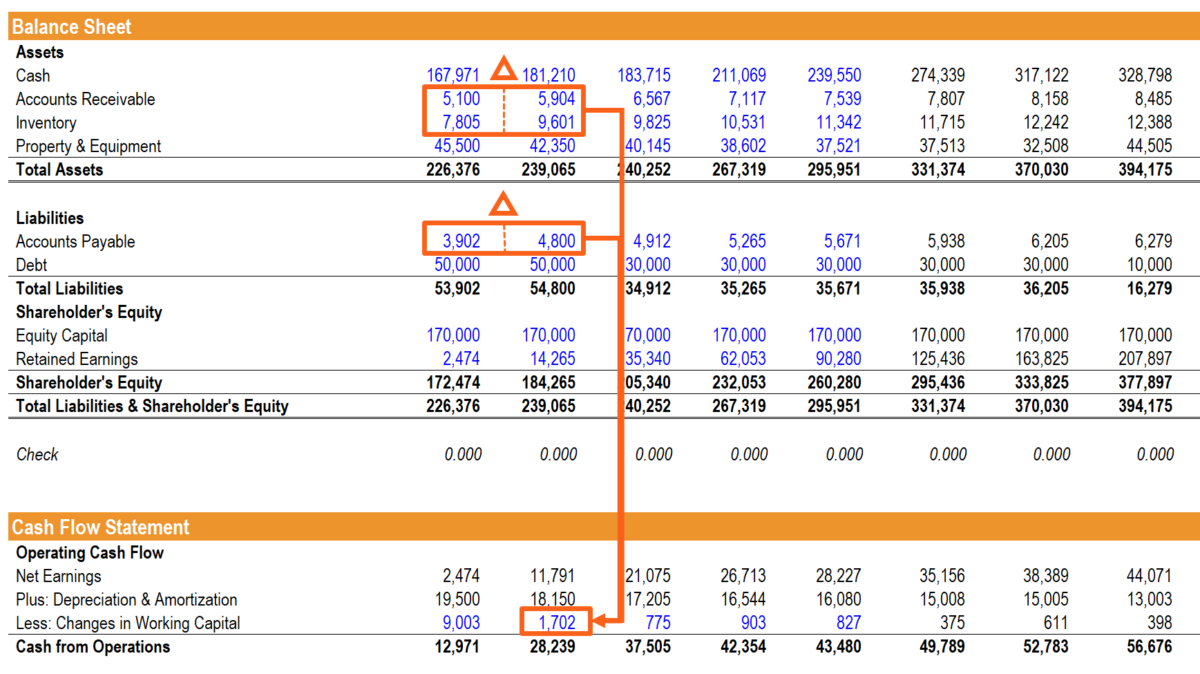

The connection between balance sheet, p&l statement and cash flow statement 00:04:34 8. Land is not depreciated on a balance sheet, but buildings are. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement.

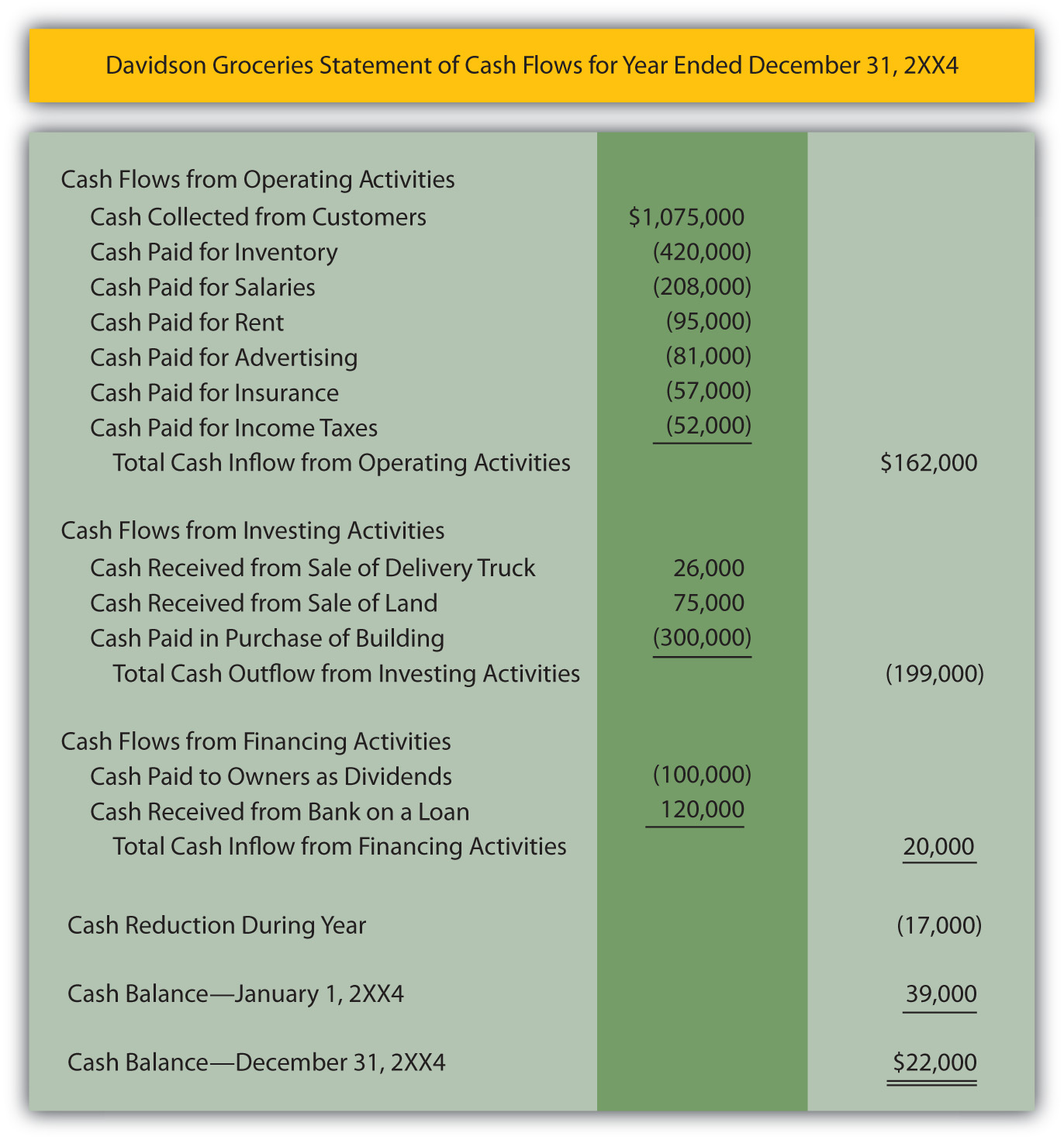

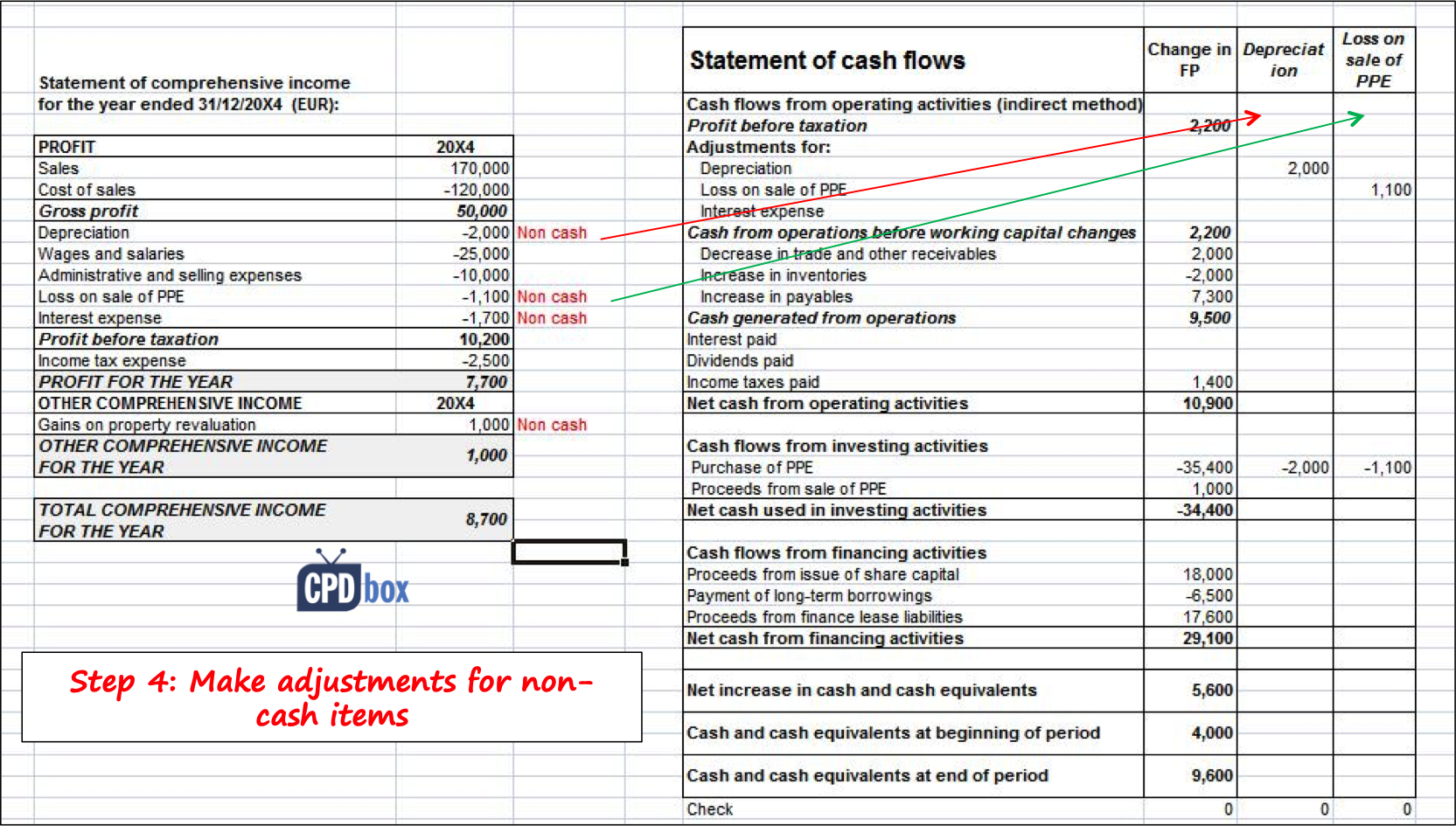

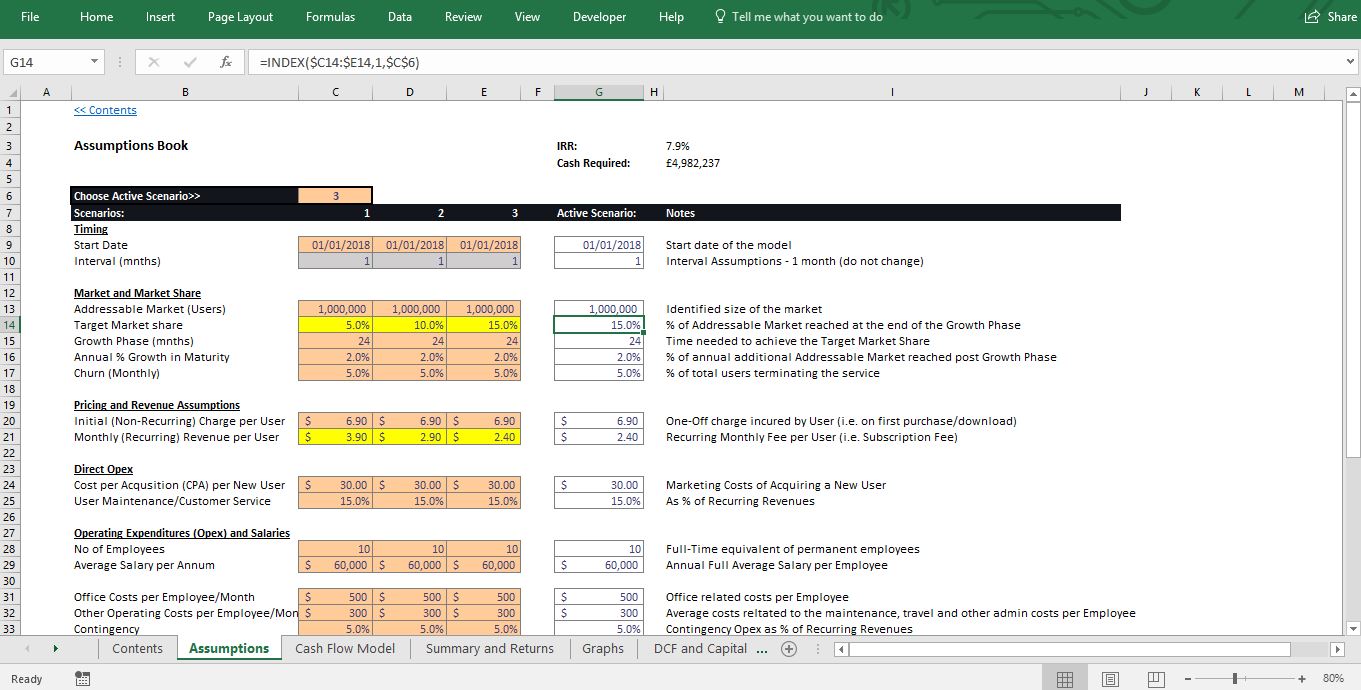

The three financial statements are the income statement, the balance sheet, and the cash flow statement. The financial ratio analysis 00:16:48 9. However, heavy investing can reduce your cash.

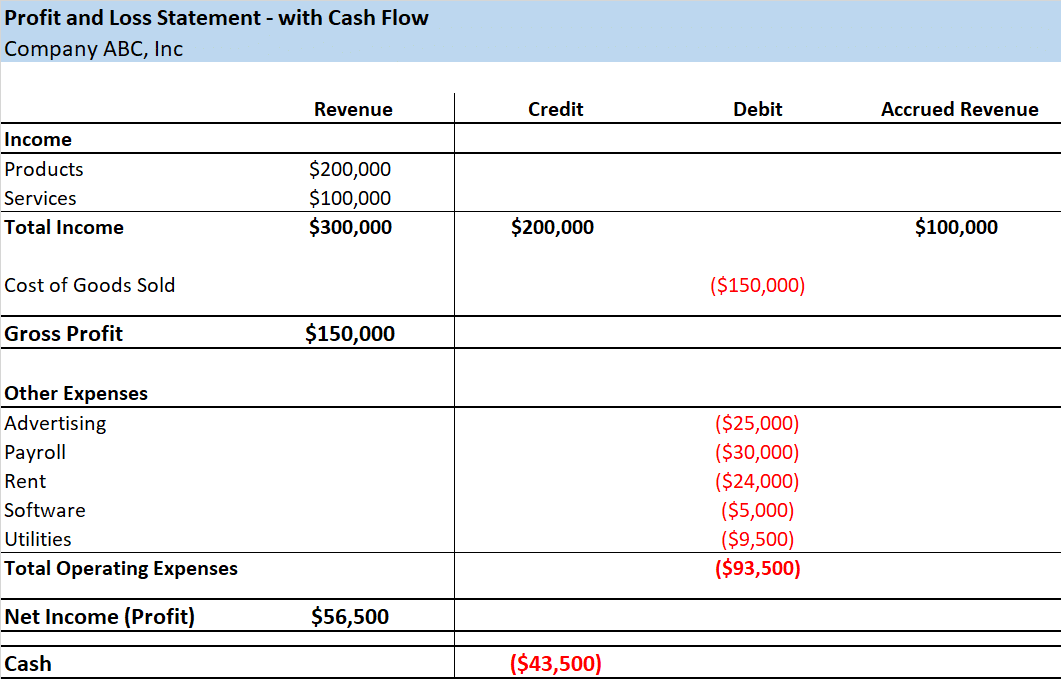

It summarizes profit and loss performance for the accounting perio d, covering items such as income, costs, expenses, cash flows, among other things. Find the net profit from the income statement. Calculate the total of the changes in the operating, investing, and financing activities.

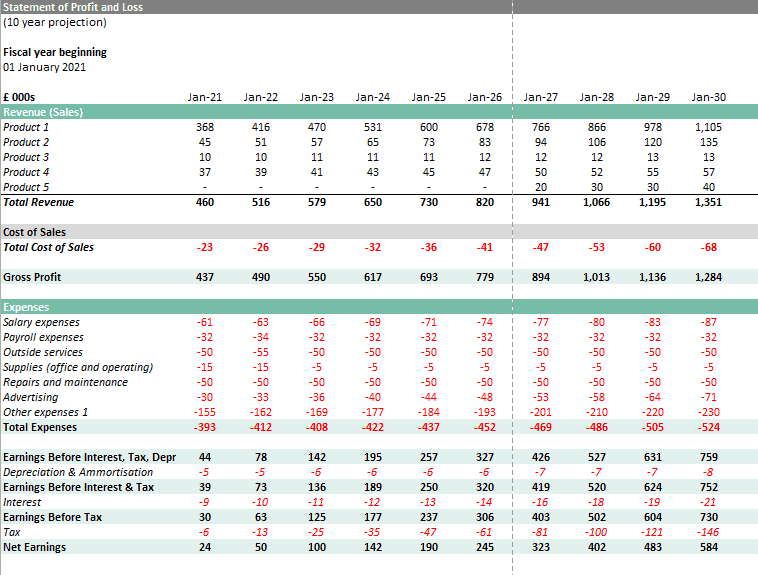

The pro forma income (p&l) and cash flow statements. The balance sheet shows balances as of a specific date. These three statements are interconnected and changes in one can affect.

The balance sheet that was discussed earlier in this lesson provides a snapshot in time of the financial health of a firm or the valuation (again, at a snapshot in time) of a specific investment project. In particular, the p&l statement shows the operating performance of the company as well as the costs and expenses that impact its profit margins. Together, alongside the cash flow statement (cfs) and balance sheet , the p&l statement provides a detailed depiction of the financial state of a company.

Make adjustments for non cash transactions. Here is a quick refresher for those who have long since discarded the accounting text and rely on others for day to day financial decisions: The p&l, balance sheet, and cash flow statements are three interrelated parts.

The p&l feeds net income on the liabilities and equity side of the balance sheet. Find the cash and cash equivalent at the beginning and end of the reporting period. It made $55.4 billion in cash flow from operations and $4.1 billion from asset sales, and then spent $23.4 billion on capital expenditures for a total of $36.1 billion in free cash flow, of which.

Quick note on relative valuation 00:03:32 10. However, with the sharp increase in free cash flow generation, cash & equivalents on the balance sheet have jumped considerably. A huge number of line items that can be chosen as needed and the instructions to work it out.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)