Amazing Info About 26as Of Income Tax Department

Service tax demand not sustainable merely on the basis of form 26as issued by income tax department:

26as of income tax department. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. The central board of direct taxes (cbdt) has issued. Form 26as is a consolidated yearly tax statement that includes information on taxes deducted at source, taxes collected at source, assessee advance tax paid, and.

The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. Form 26as is an annual tax statement, specific to a permanent account number (pan) furnished in accordance with erstwhile section 203aa read with second. It is a consolidated annual information statement for a particular financial year (fy).

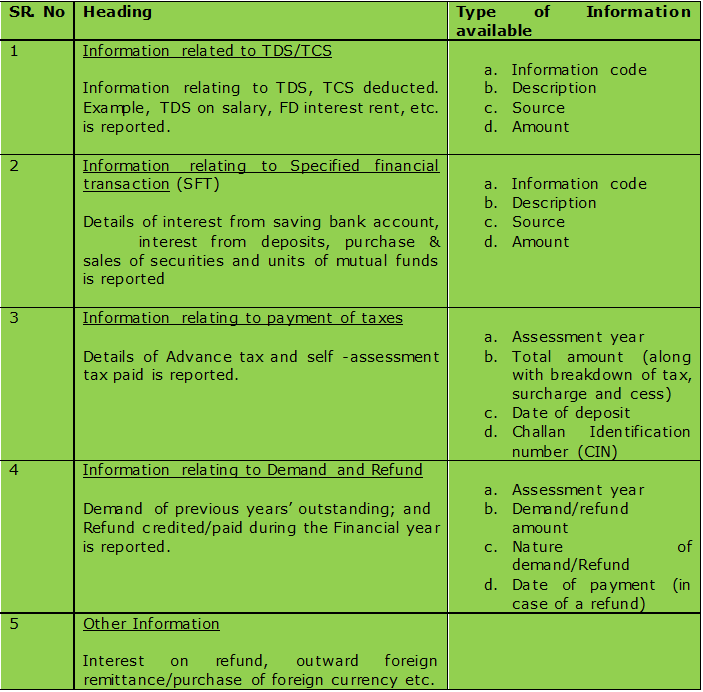

Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and self. Here are some steps to easily download form 26as on the new income tax portal. It contains the details of the following:

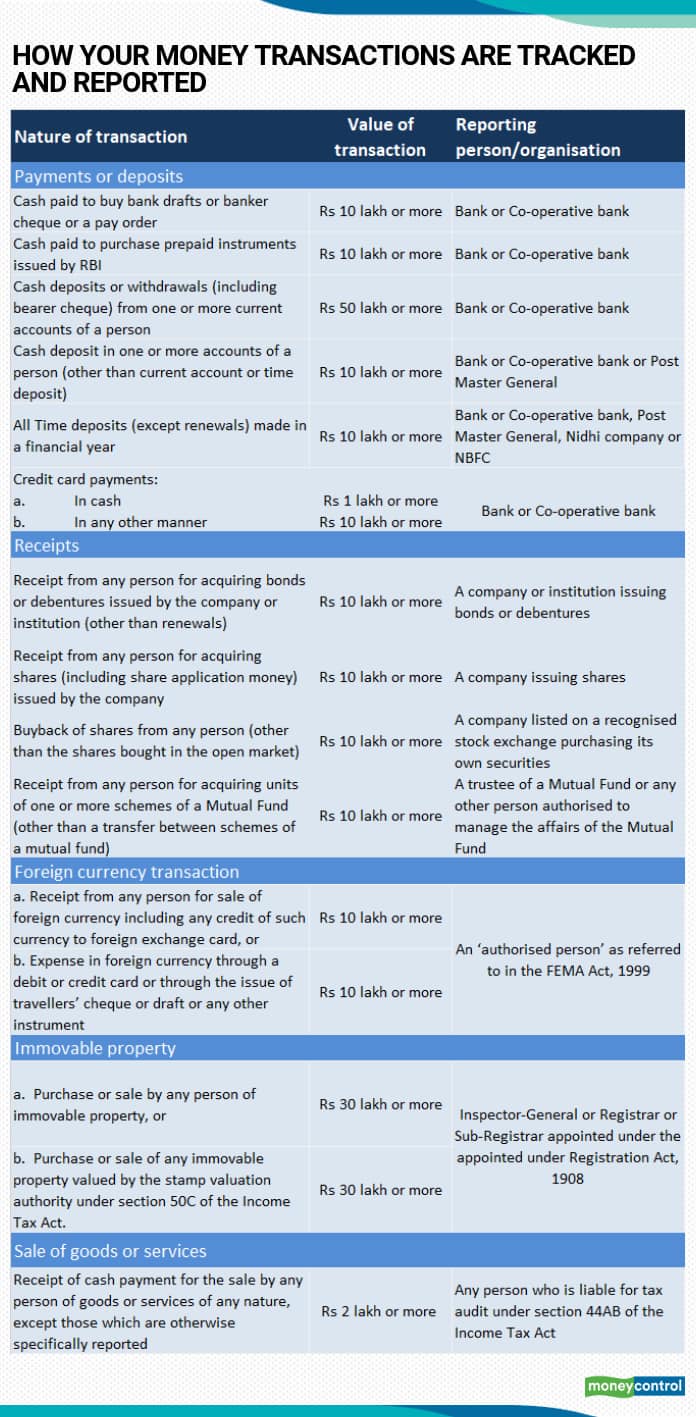

Know your refund status our success enablers 11,89,95,293 individual registered users 8,22,73,220 no. The income tax department has expanded the scope of information to be reported in the new form 26as. To make sure that the tds withheld from your income is actually deposited with the income tax department, it is helpful to check the information on the tds certificate.

Information (advance tax/sat, details of refund, sft transaction, tds u/s 194 ia,194 ib,194m, tds defaults) which were available in 26as will now be. The kolkata bench of customs, excise.