Top Notch Info About When Is A Trial Balance Prepared

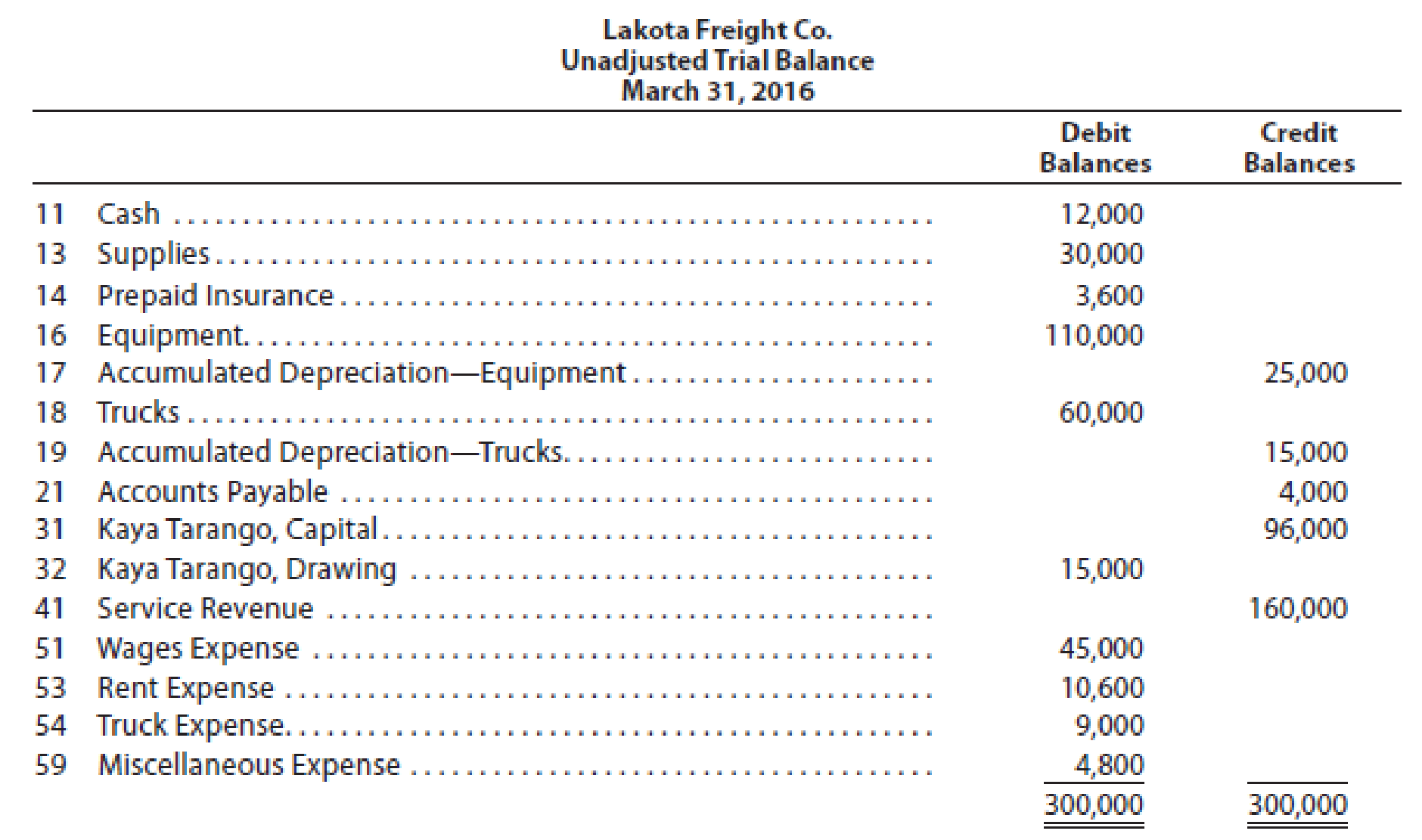

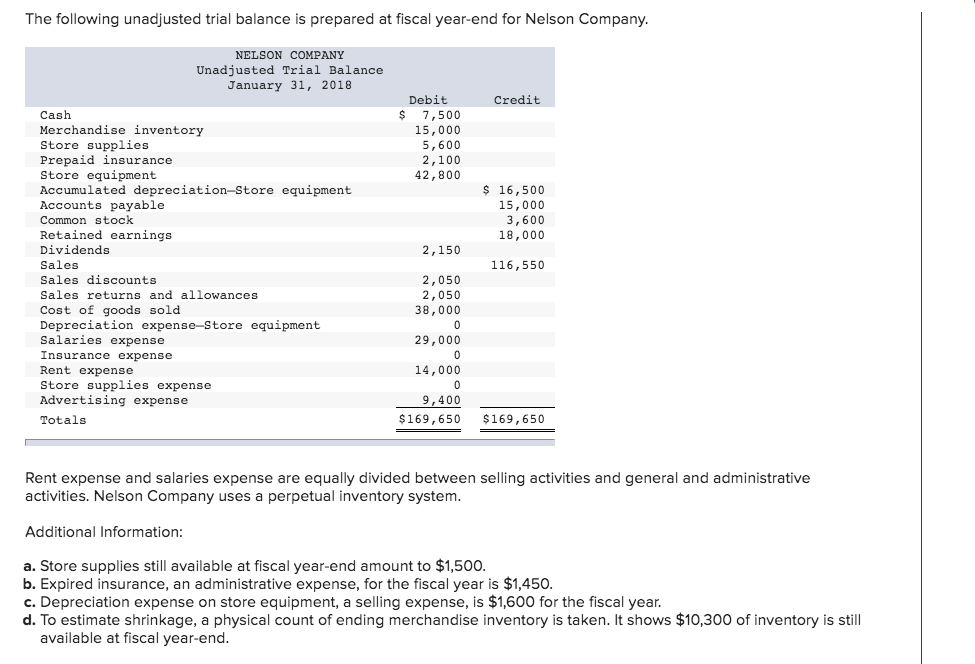

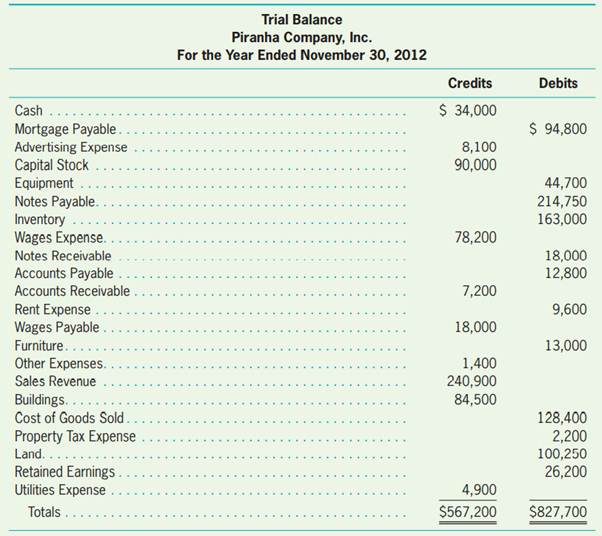

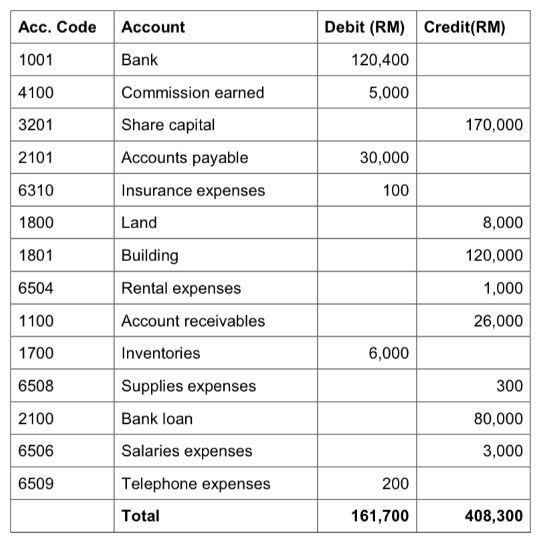

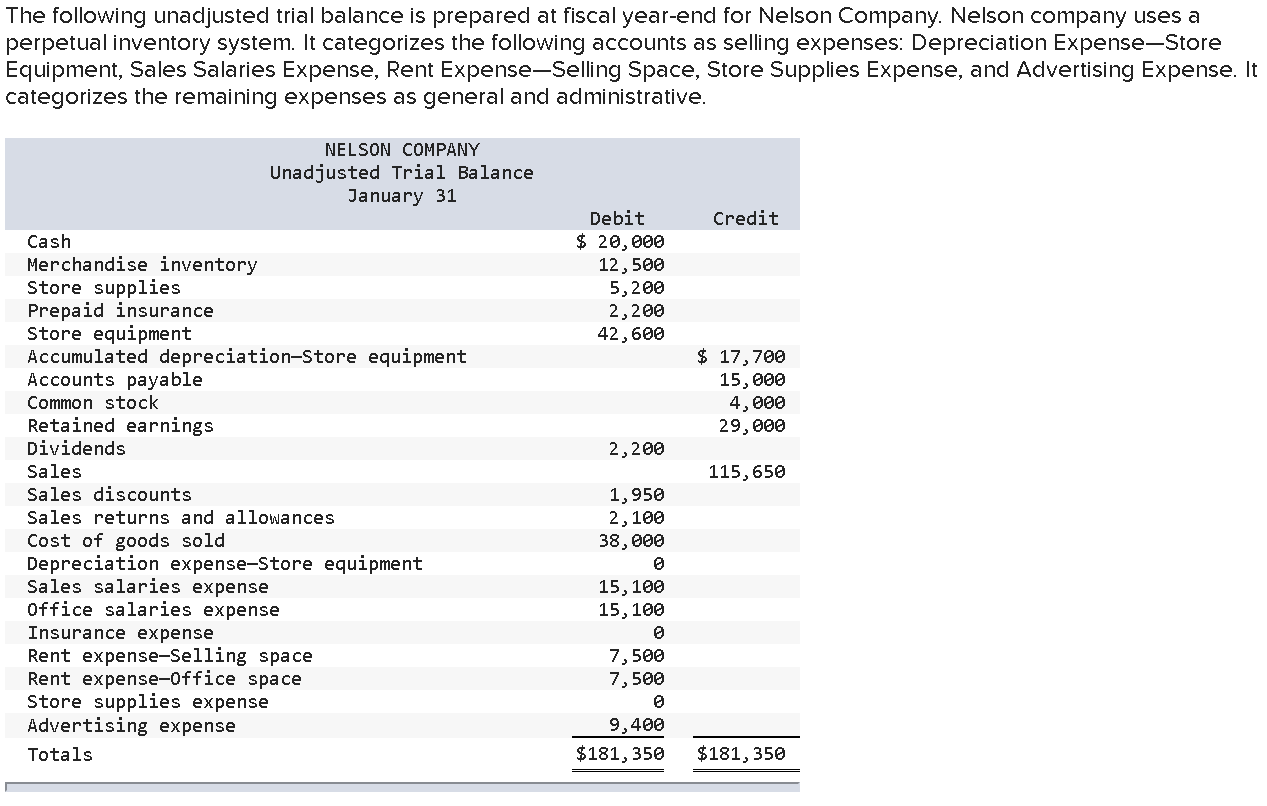

A trial balance is a bookkeeping worksheet in which the balances of all ledgers.

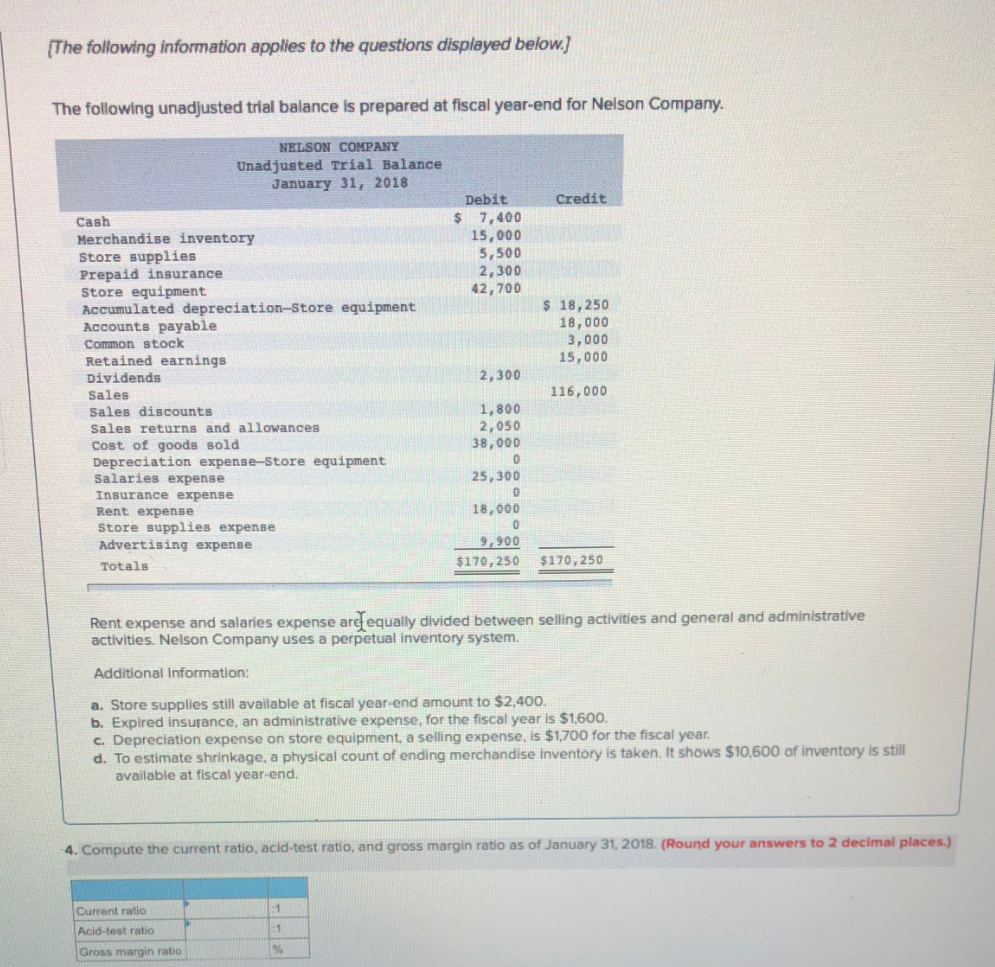

When is a trial balance prepared. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. An income statement shows the organization’s financial performance for a given period of time. However, a business may choose to prepare the trial balance at the end of any specific period.

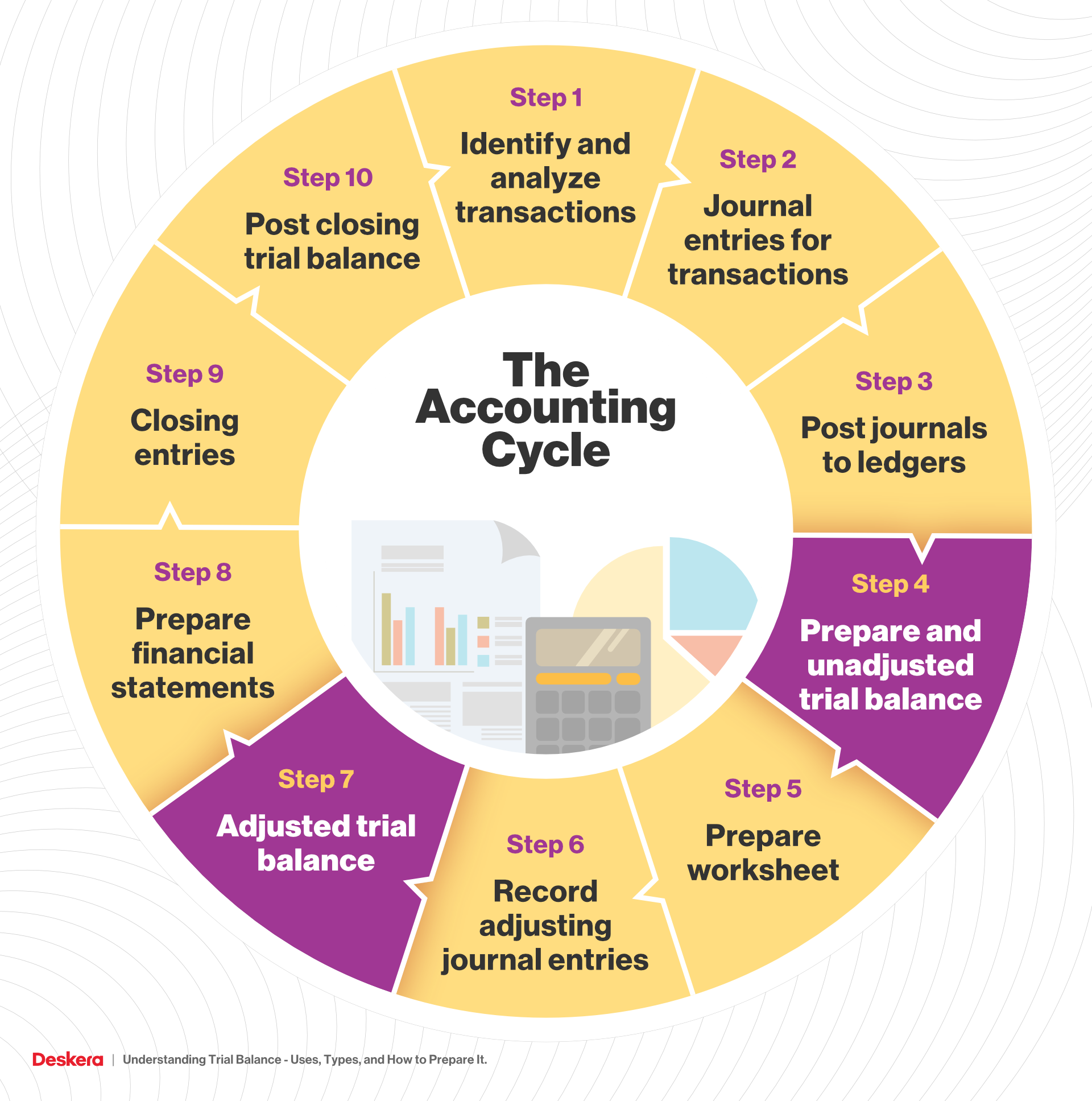

This is done in order to aggregate accounting information for inclusion in the financial statements. The entrepreneur/learner should recall that in the accounting cycle, once the ledger accounts have been established and balances extracted, the next step is to prepare a trial balance. All journal entries are posted in their respective ledger accounts.

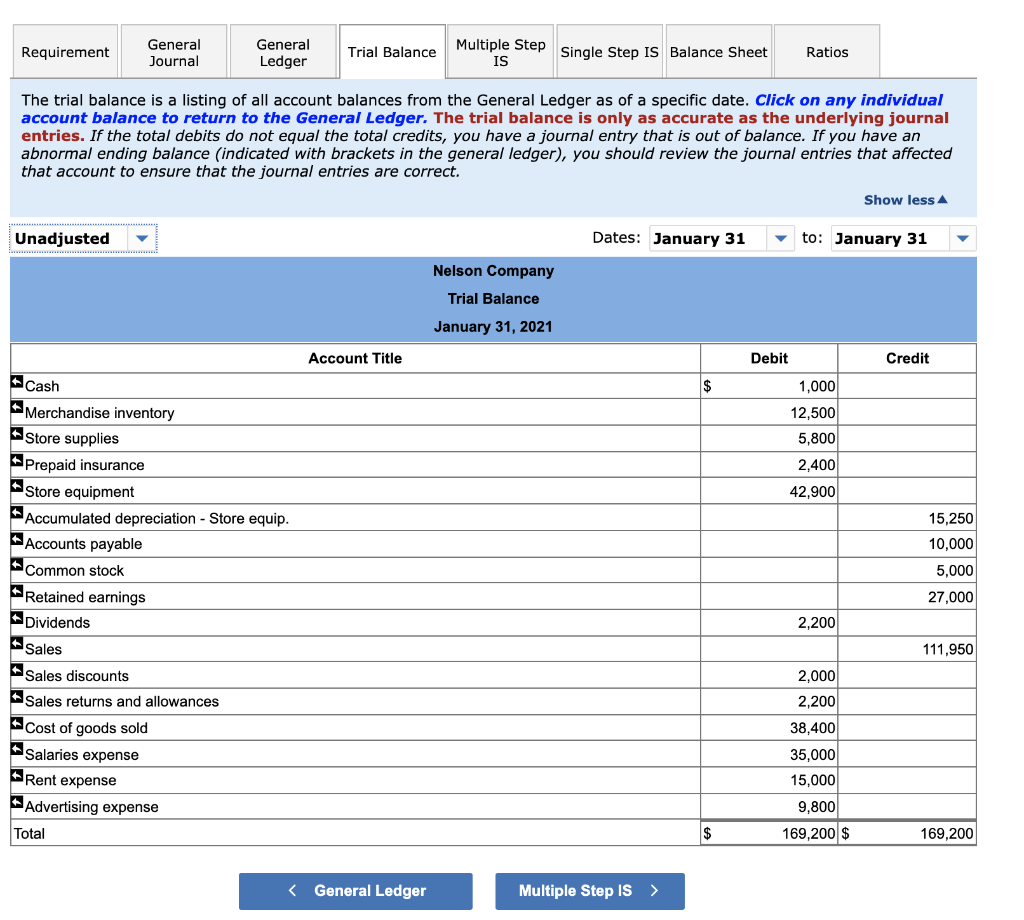

What is a trial balance? As a summary of all the ledger accounts closing balance, trial balance helps in determining the accuracy of journal and ledger posting. When a trial balance is tallied, i.e., when sum of all debit balances equals the sum of all credit balances, there is a prima facie evidence that ledger accounts are arithmetically correct.

The totalling of the accounts is done and all the accounts are balanced. Hub reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. A trial balance is usually prepared at the end of an accounting period, such as a month or a year.

Liabilities & incomes shall have a credit balance. The credit column with revenues. Typically, trial balance is prepared at the end of an accounting year.

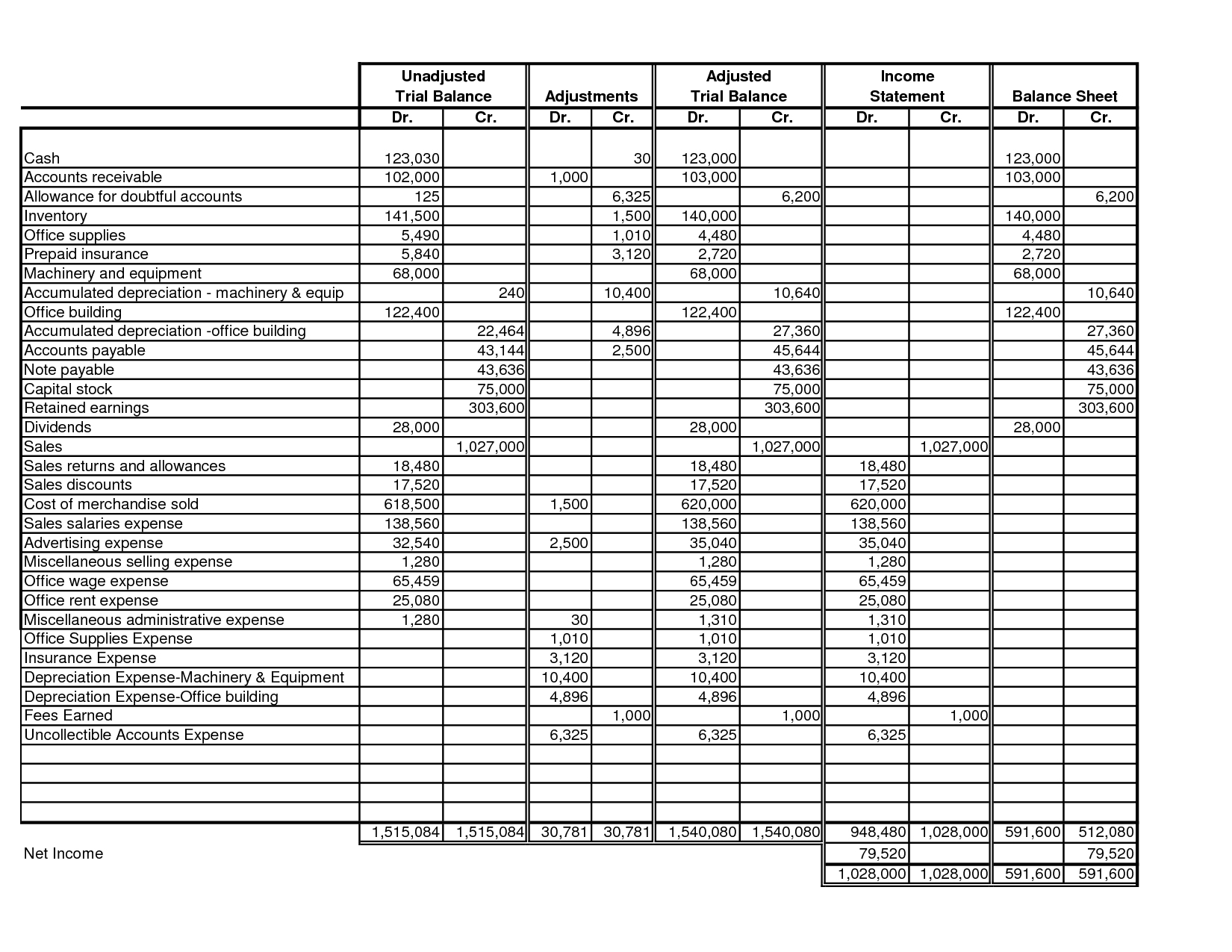

The balances of these ledgers are put into debit or credit account lists on the trial balance to have them be equal. The trial balance isn’t a financial statement itself, but all of the information that you need to create the three major financial statements—the balance sheet, the cash flow statement and the income statement—comes directly from the trial balance. How do you prepare a trial balance?

To check the arithmetic accuracy of ledger balances: A trial balance is a listing of the ledger accounts. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

The first step in the process of creating financial statements is to prepare a trial balance. How is the trial balance prepared? The trial balance is the edit phase of our story before we publish the results in financial statements.

To ascertain the arithmetical accuracy of ledger accounts: The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. It helps to record the income and expenditures of the business and easily complete the preparation of the balance sheet in the next step.

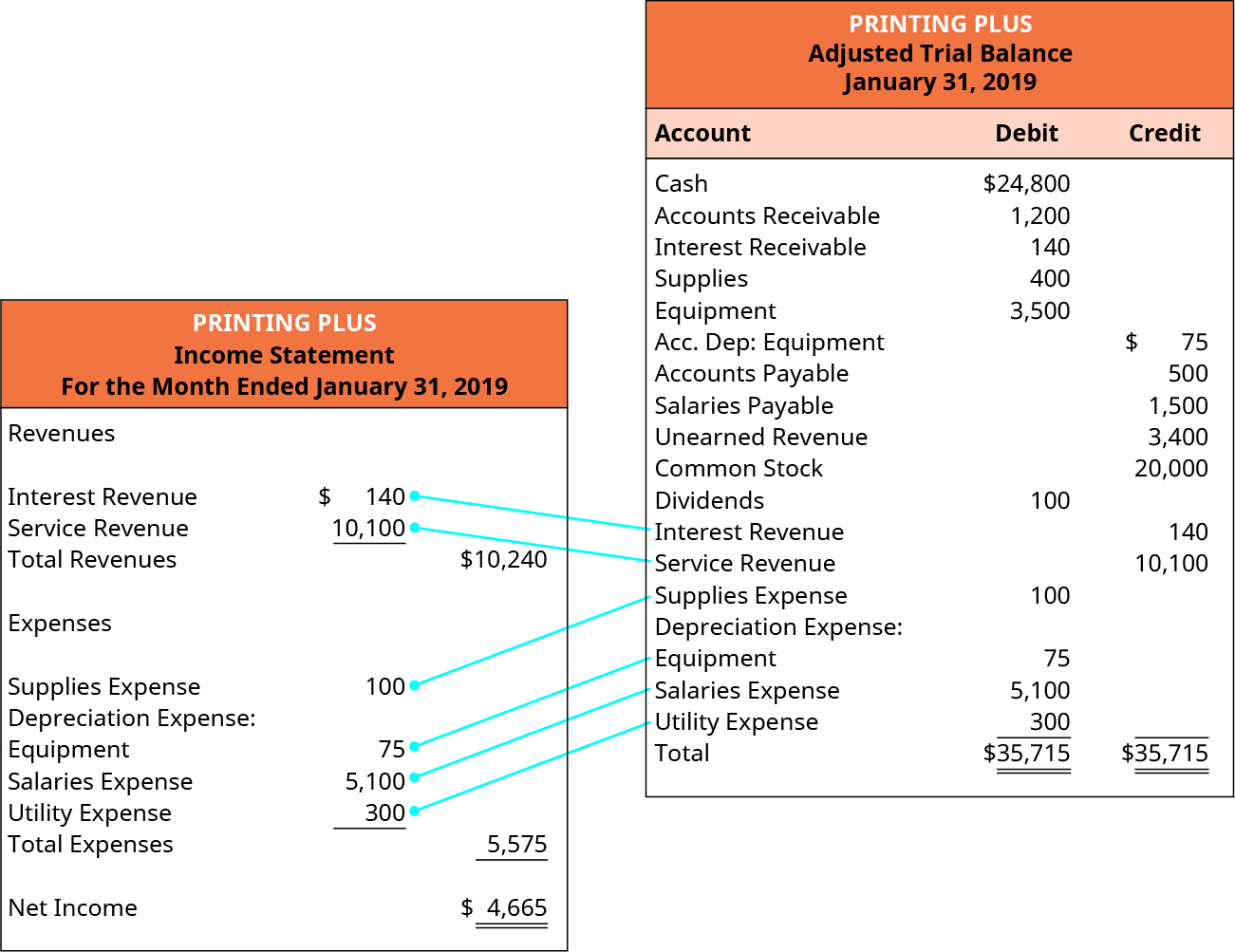

For printing plus, the following is its january 2019 income statement. In order to provide a summary statement view of the balances of various accounts, the trial balance is prepared. A trial balance contains three columns: