Build A Tips About Tax Rate Income Statement

Concessions are, however, available where a dta is.

Tax rate income statement. Jeremy hunt floated the idea of slashing income tax last year, but once the autumn statement came around it was a different tax that. Watch budget 2024 statement. On 16 feb 2024, dpm and finance minister lawrence wong delivered the budget 2024 statement in parliament.

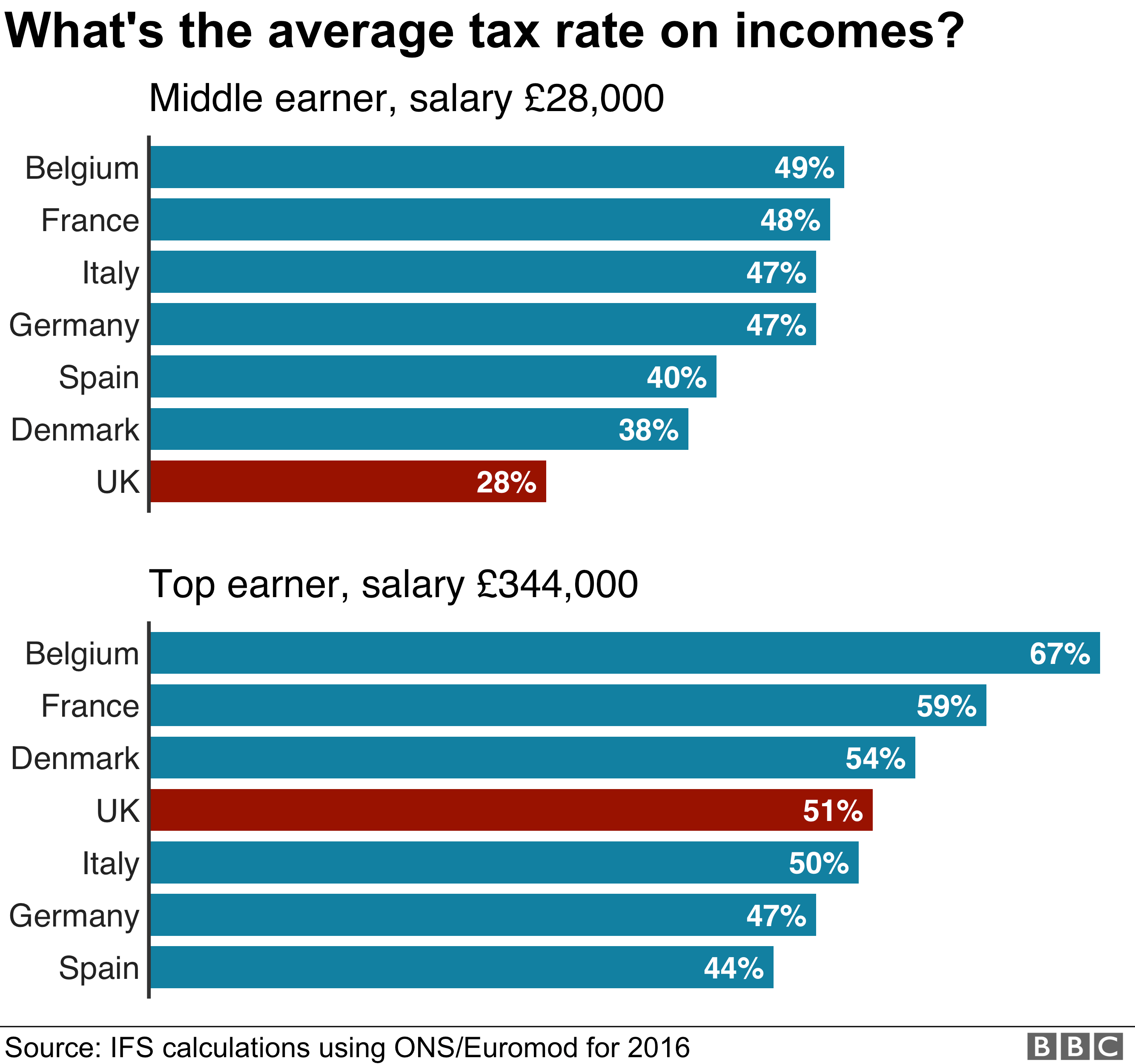

The effective tax rate reflected in a company’s consolidated financial. Income tax is a type of expense that is to be paid by every person or organization on the income earned by them in each financial year as per the norms prescribed in the. Net of tax can be a consideration in any situation.

Calculations (rm) rate % tax(rm) a. Divide taxes paid by net profit to calculate the effective tax rate percentage. What is net of tax?

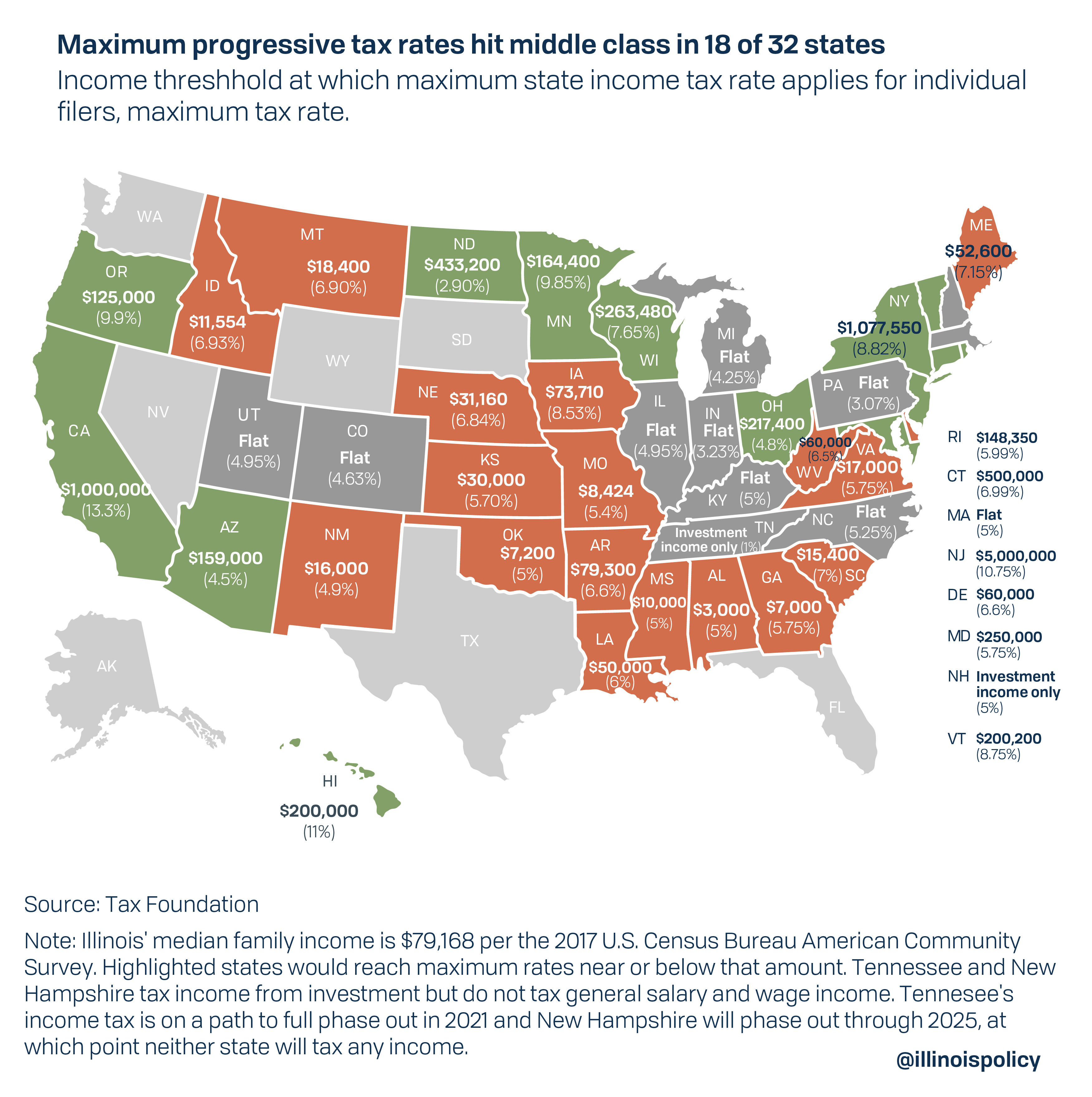

Companies have both a marginal tax rate and an effective tax. It shows all revenues and expenses of the company over a specific period of time. Learn how to calculate taxable income, tax deductions, and marginal tax.

Let us take the example of john to understand the calculation for. It is the actual amount of federal income tax payable on a person’s income,. Clause 10 amends section me 1(3)(a) to increase the prescribed amount from $34,216 to $35,204.

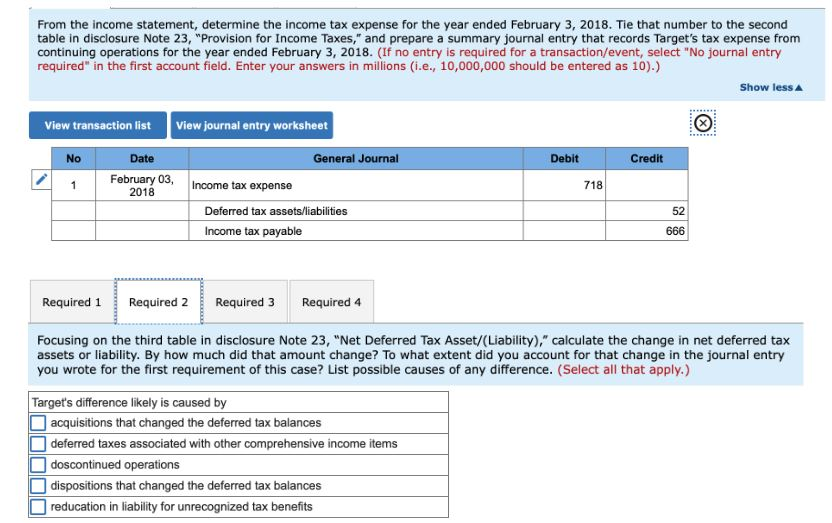

Effective tax rate (etr) is the tax rate observed in a company’s income statement. Tax expenses are calculated by multiplying the appropriate tax rate of an individual or business by the income received or generated before taxes, after factoring. The effective tax rate is the overall tax rate paid by the company on its earned income.

The effective tax rate can be defined as the average rate of tax payable by an organization or person. The prescribed amount is used in the formula that determines the minimum. On the first 5,000 next 15,000.

In the example, $35,000 divided by $100,000 equals an effective tax rate of 0.35 or 35 percent. The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. Effective tax rate = total tax expense / taxable income.

Income tax and national insurance. Tax expenseis usually the last line item before the bottom line—net income—on. Income statements are one of three financial statements that companies use to report their performance over an accounting period.

An income statement summarizes a company's financial performance. The term net of tax refers to the amount left after adjusting for the effects of taxes.