Marvelous Tips About Difference Between Direct And Indirect Method Cash Flow Statement

One of the key differences between direct cash flow vs.

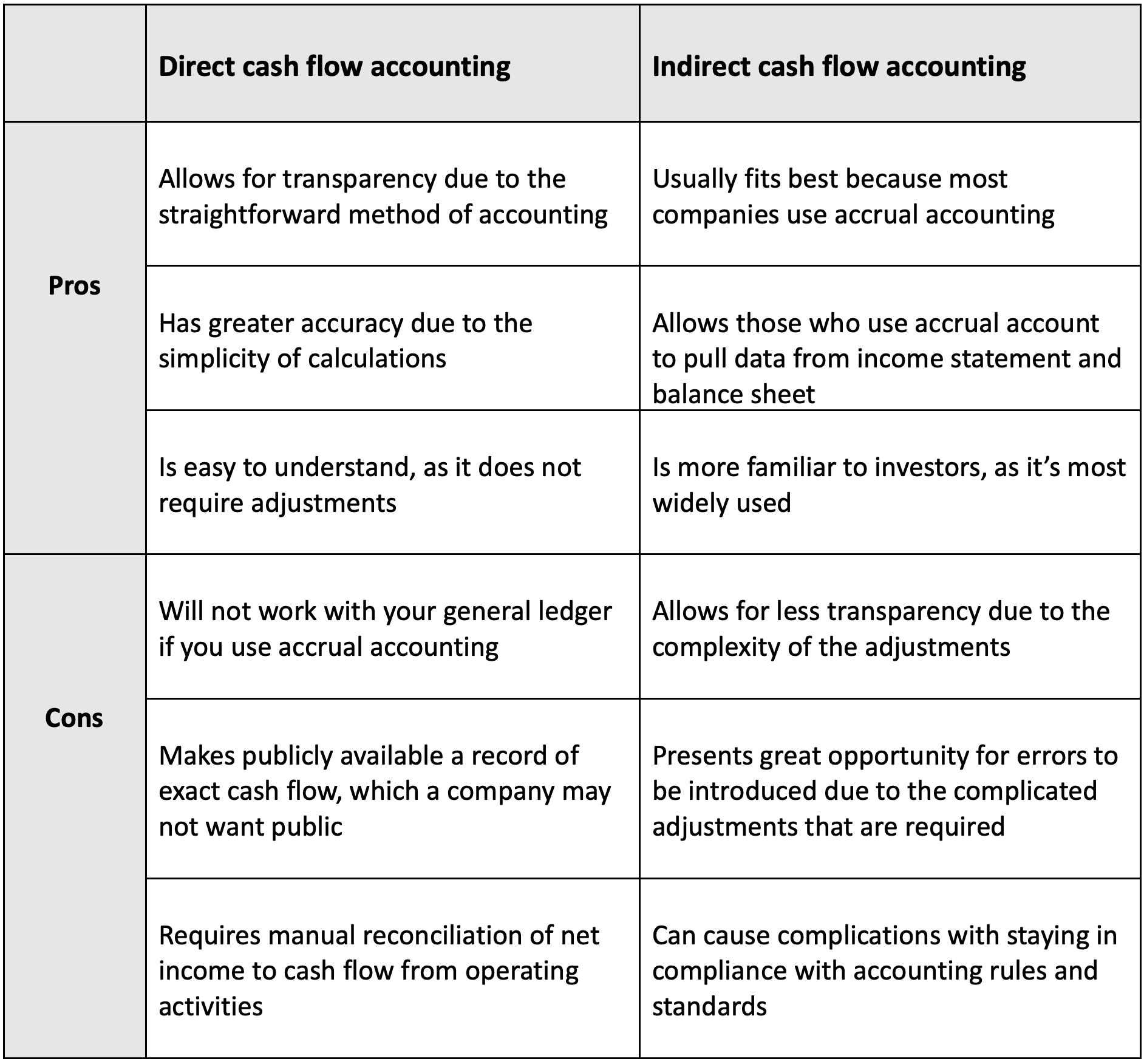

Difference between direct and indirect method cash flow statement. The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later. The american institute of certified public accountants reports that approximately 98% of all companies choose the indirect method of cash flows. One of the main differences between the direct and indirect method of presenting the financial statement of cash flows is the type of transactions that are used to produce the cash flow statement.

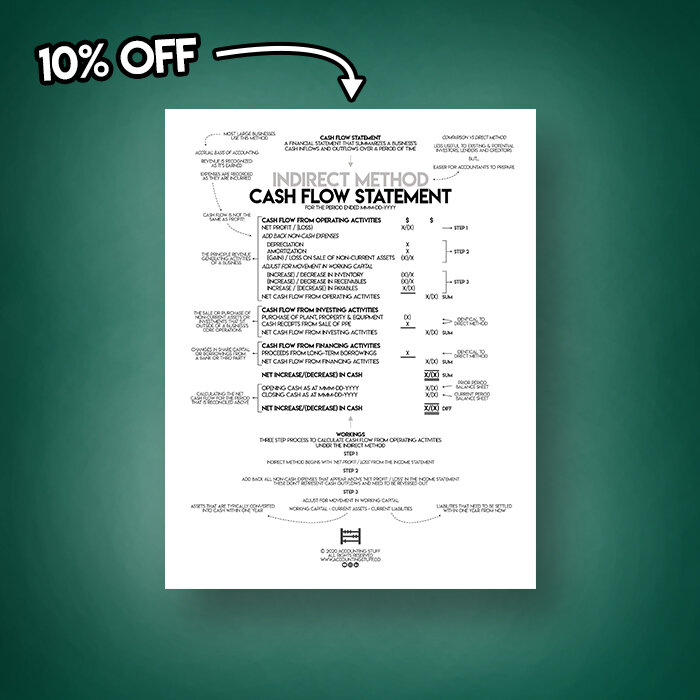

For both methods, the goal is to determine a company’s net cash flow. When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: For instance, assume that sales are stated at $100,000 on an accrual basis.

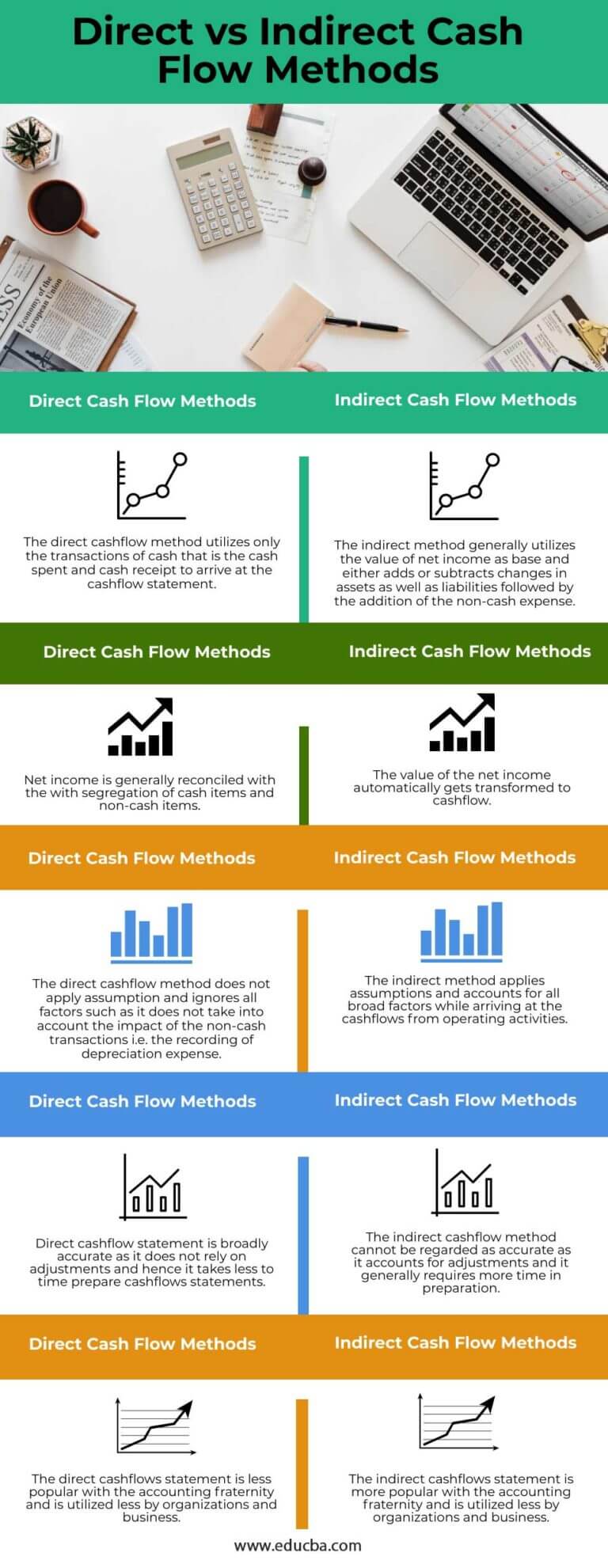

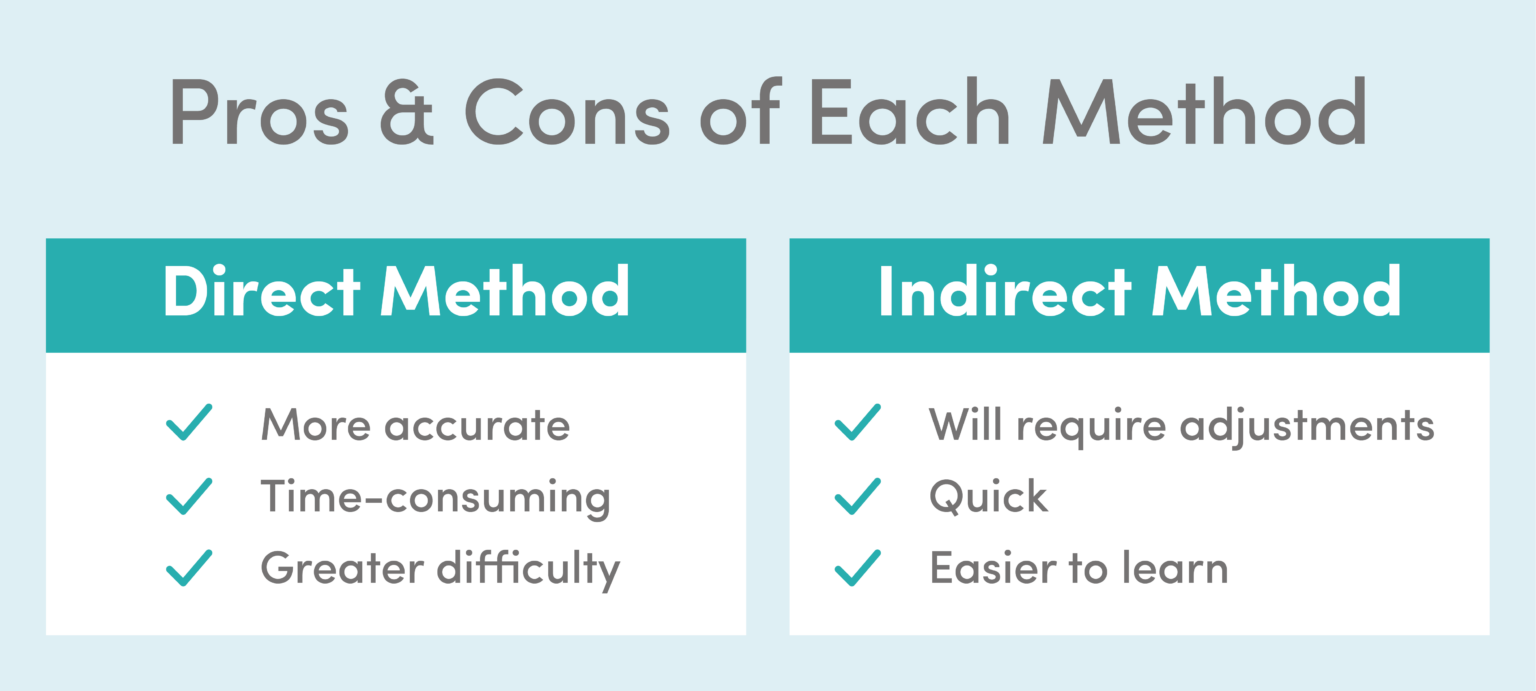

Since the method relies on the actual cash payments and receipts that occurred over the period, this method is highly accurate and exactly calculates the amount of cash that. When it comes to cash flows from operations, the standards allow us to choose between two distinct approaches. The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities.

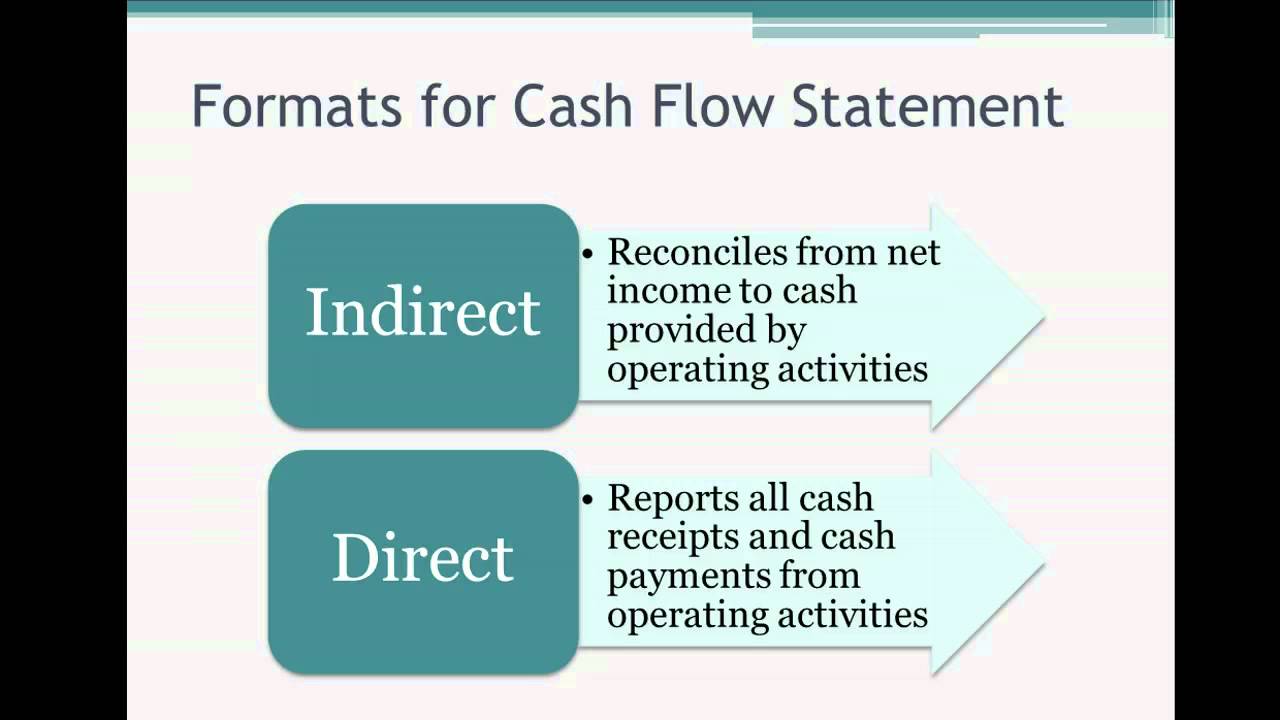

Direct and indirect cash flow forecasting differ in their methodologies and data sources. Cash flows are either receipts (ie cash inflows and so are represented as a positive number in a statement of cash flows) or payments (ie cash out flows and so are represented as a negative number using brackets in a statement of cash flows). There are two methods for building cash flow statements:

The indirect method always starts with the net income and makes adjustments. In reality, the only difference between direct and indirect cash flow resides in how the operating activities are calculated, as illustrated in this graphic. In this article, we explore direct and indirect cash flow, highlight their most notable differences and provide an example of a cash flow statement using both methods.

A company’s cash flow statement can be prepared with either the direct or indirect cash flow accounting method. The purpose of this is to identify changes in cash payments and company activity receipts. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

Although both cash flow reporting methods meet generally accepted accounting practices (gaap) and international financial reporting standards (ifrs), the guidelines encourage the. Direct cash flow statement. The direct method is an accounting treatment that nets cash inflow and outflow to deduce total cash flow.

The indirect cash flow method uses the same general classifications as the direct cash flow method. (there are no differences in the cash flows from investing activities and/or the cash flows from financing activities.) However, the indirect method is much easier for a finance team to assemble since it uses information obtained directly from the balance sheet and income statement.

Direct vs indirect method cash flow statement. For example, if a retailer sells an item on credit, the indirect method. The direct method converts each item on the income statement to a cash basis.

They are commonly known as direct and indirect methods. One of the main reasons you might prefer the direct method over the indirect method for building cash flow statements is that it can provide better accuracy. The indirect method considers accruals, so all receivable.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)