Neat Info About Firm Balance Sheet

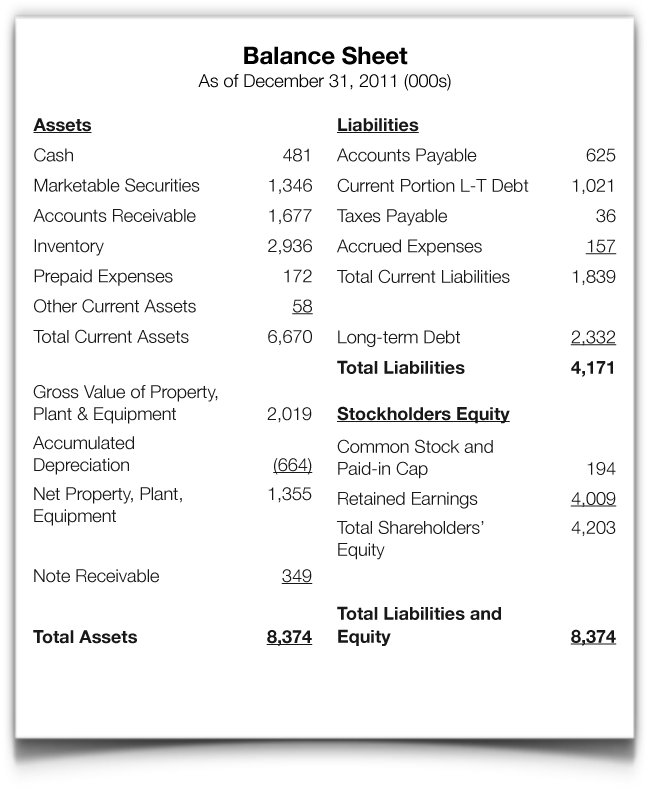

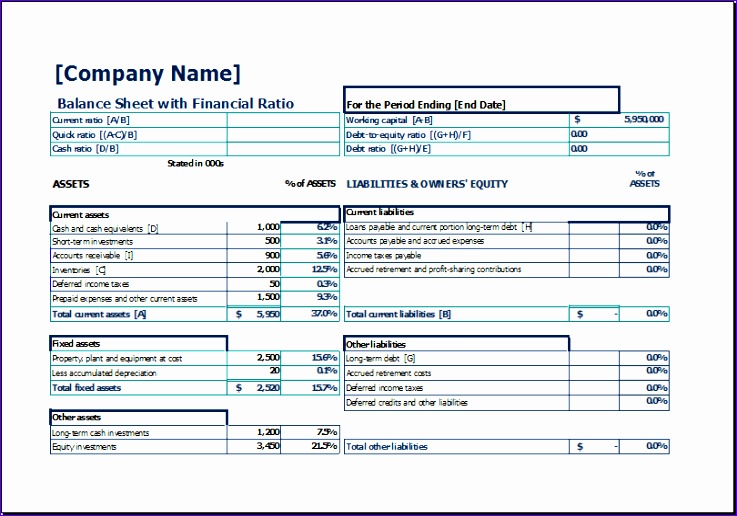

Add total liabilities to total shareholders’ equity and compare to assets.

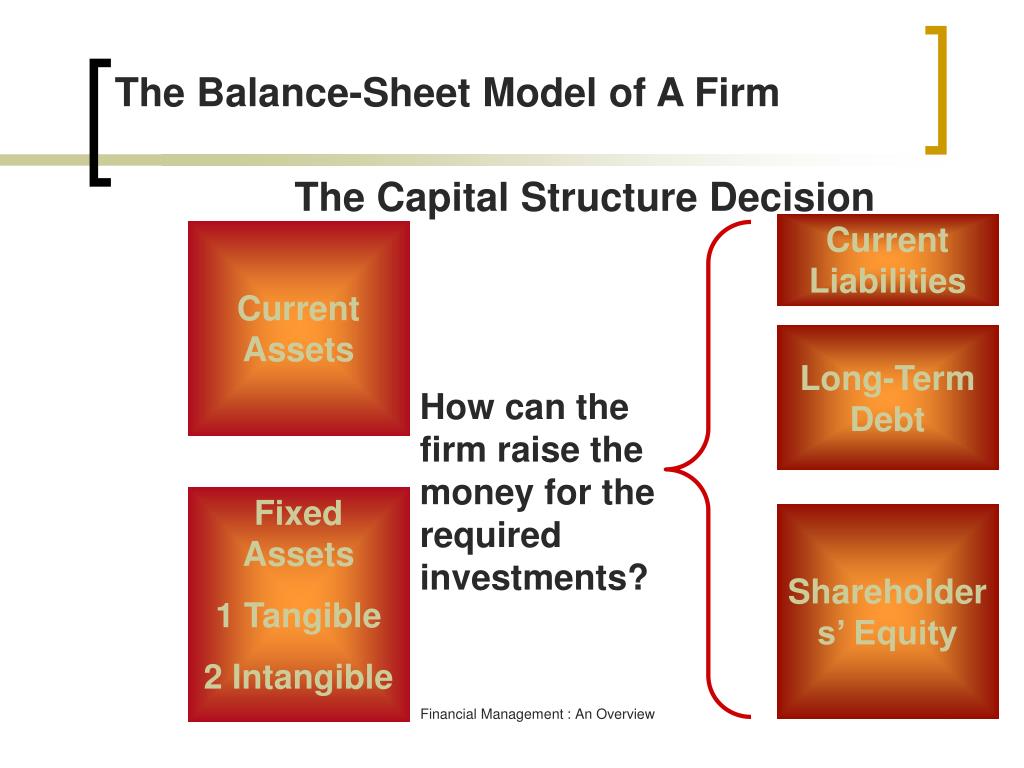

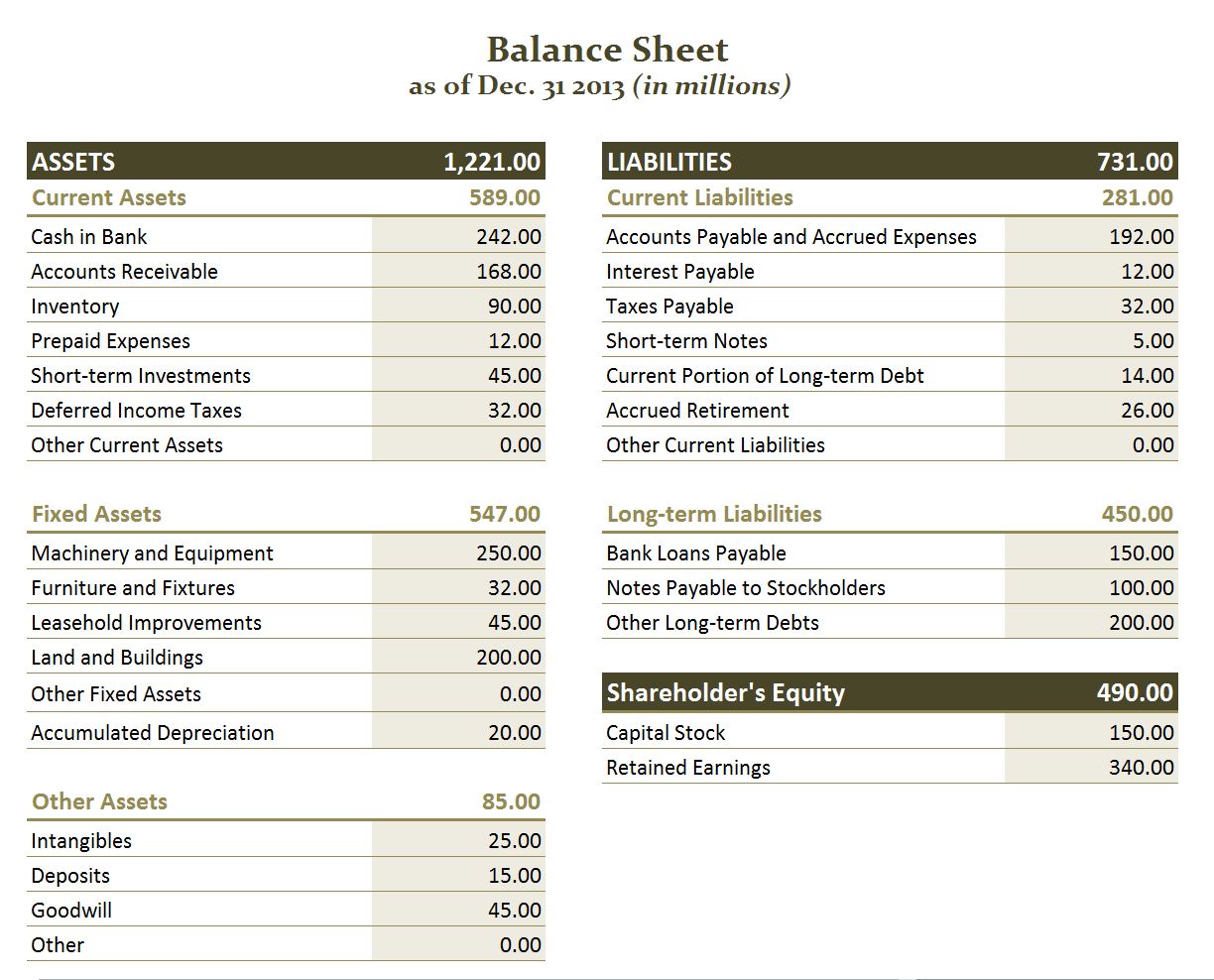

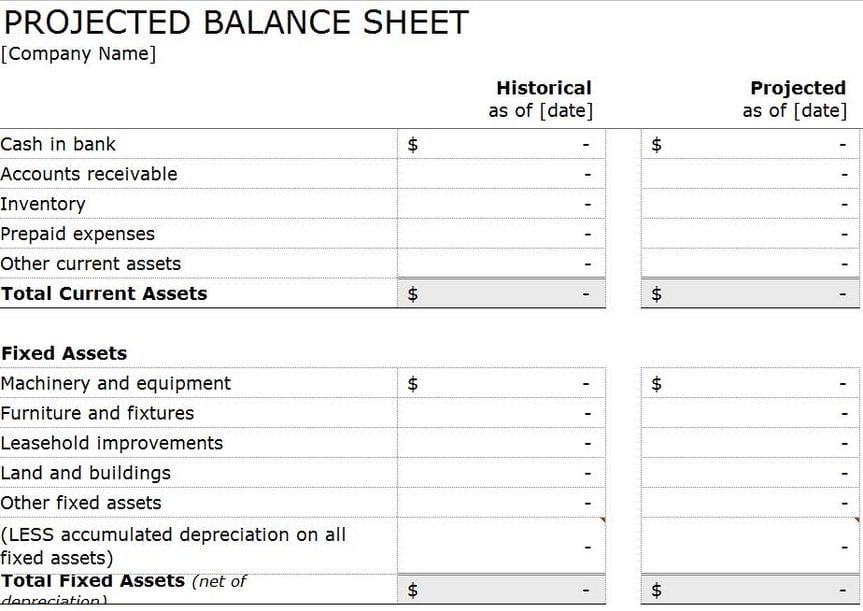

Firm balance sheet. Assets must equal liabilities plus equity. It helps evaluate a business’s capital structure and also calculates the rate of returns for its investors. Assets = liabilities + equity.

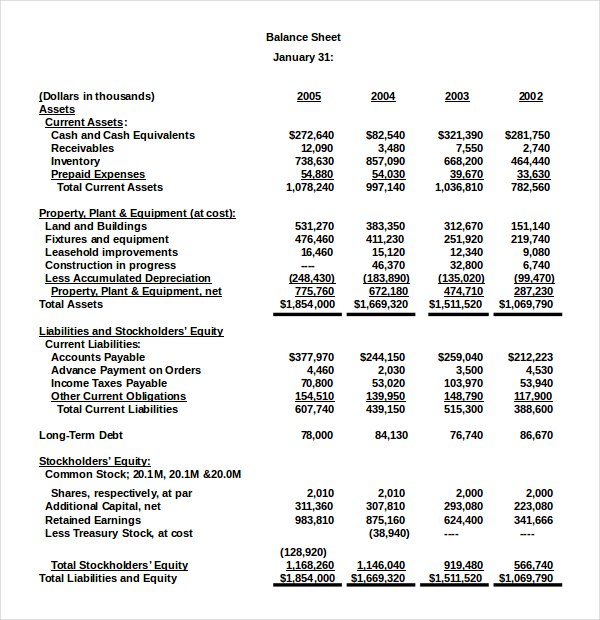

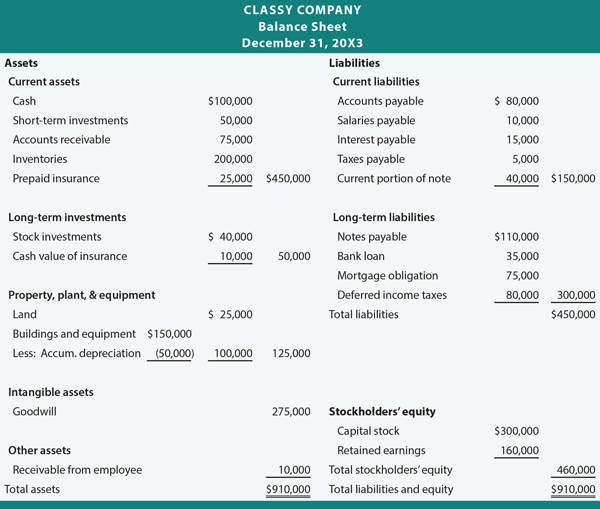

And its total liabilities amounting to $450. The two sides of the balance sheet must balance: The balance sheet represents the financial position of a business at any given point in time.

A balance sheet covers a company’s assets as defined by its liabilities and shareholder equity. This is the true worth of a business when its liabilities are net off from its assets. The strength of a company's balance sheet can be evaluated by three.

It shows the company’s assets along with how they are financed, which may be by debt, equity, or a combination of both. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Assets minus liabilities equals owners’ equity.

The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a certain point in time. The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. Assets are things that a company owns.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date. To do this, you’ll need to add liabilities and shareholders’ equity together.

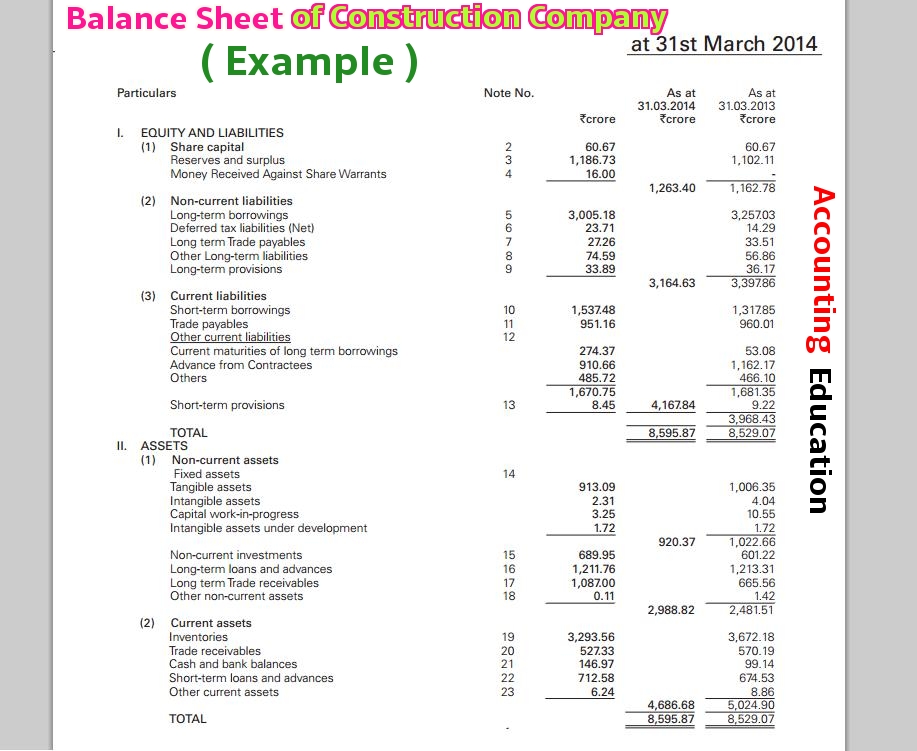

It summarizes a company’s financial position at a point in time. The first one is the balance sheet of partnership firm which is in heading 2. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

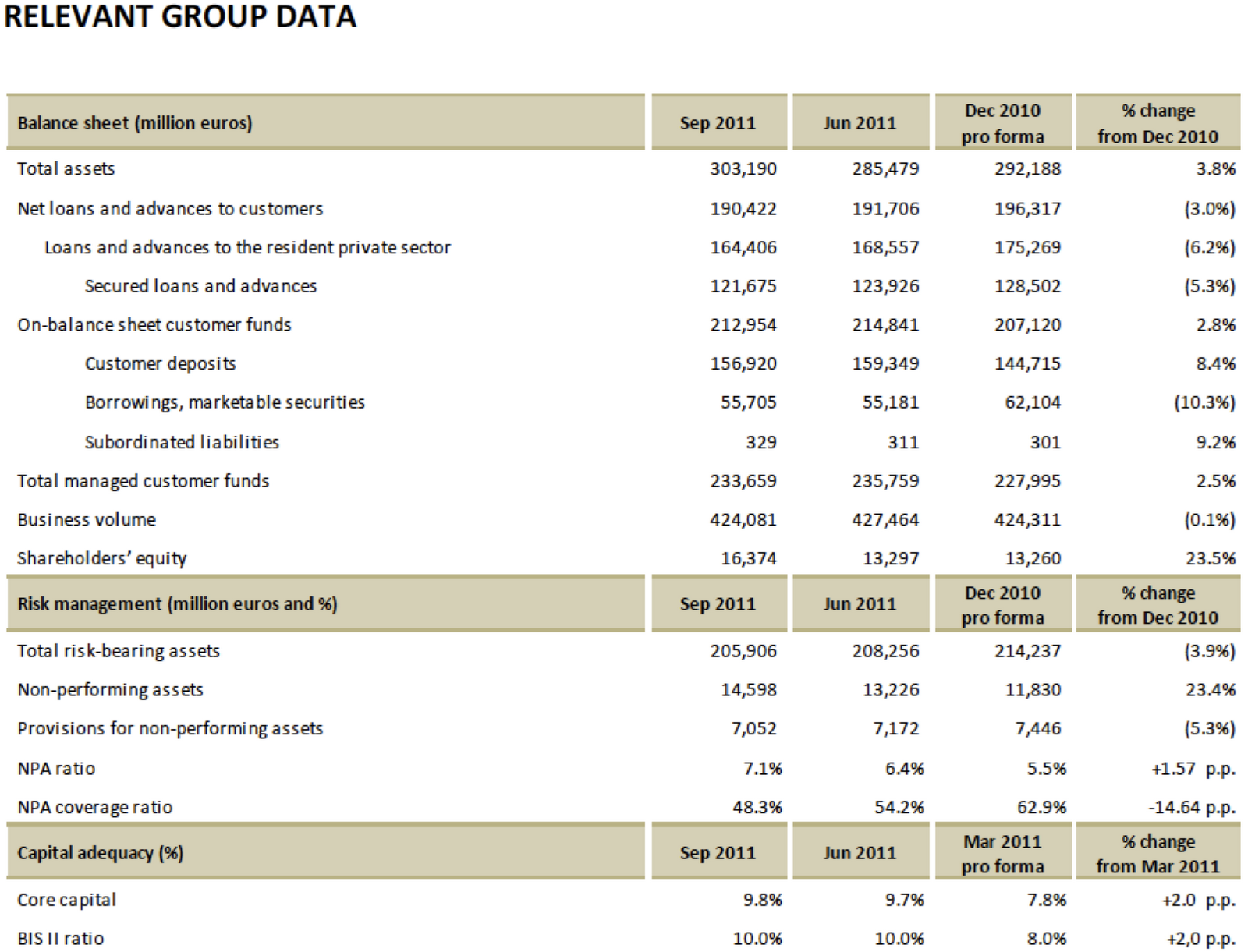

It is the shareholder’s equity in the balance sheet. Based on provisional unaudited data. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time.

March is the first time they'll do a deep dive into how to taper, said derek tang, an analyst at forecasting firm lh meyer. The balance sheet is based on the fundamental equation: Hence, the balance sheet is often used interchangeably with the term “statement of financial position”.

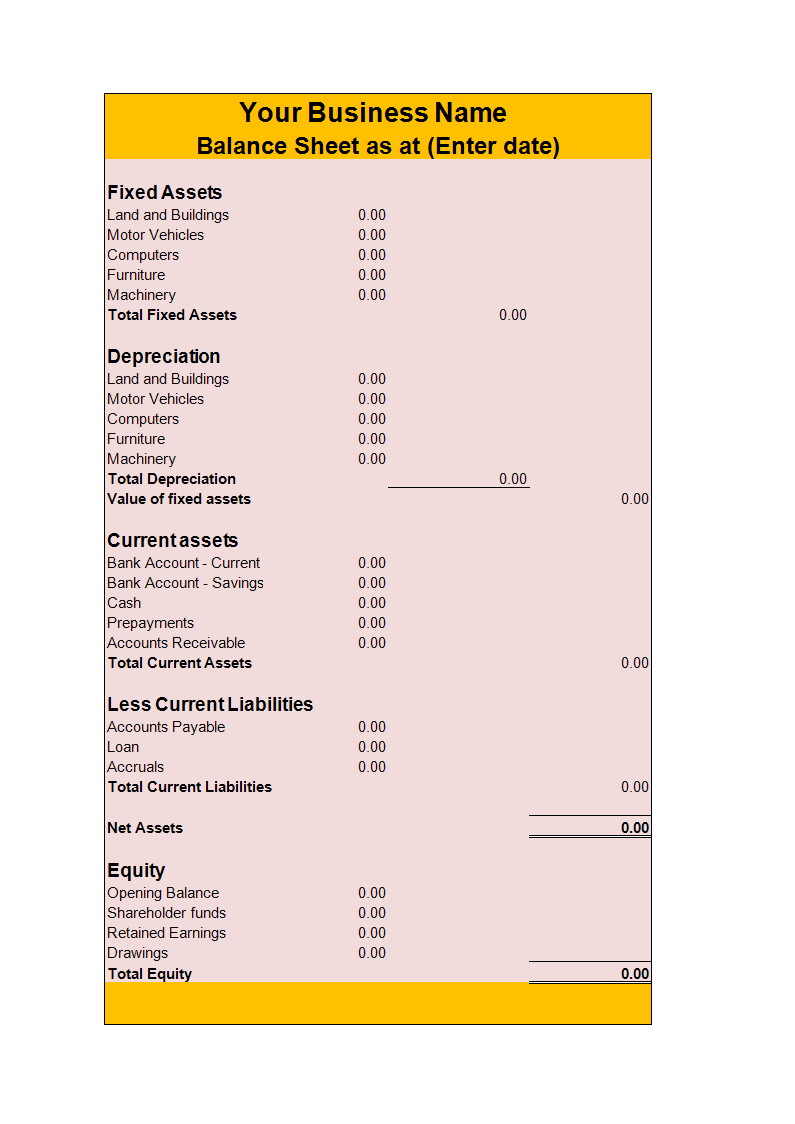

The second one is abc & company which is in heading 3. It can also be referred to as a statement of net worth or a statement of financial position. You can learn about the health of a business by looking at its balance sheet.