Best Tips About Trading Account Profit And Loss Balance Sheet

This account is prepared to arrive at the figure of.

Trading account profit and loss account and balance sheet. Balance sheet of ankit as at march 31, 2017. A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. Make a provision for bad debts @ 5 % on sundry debtors.4.

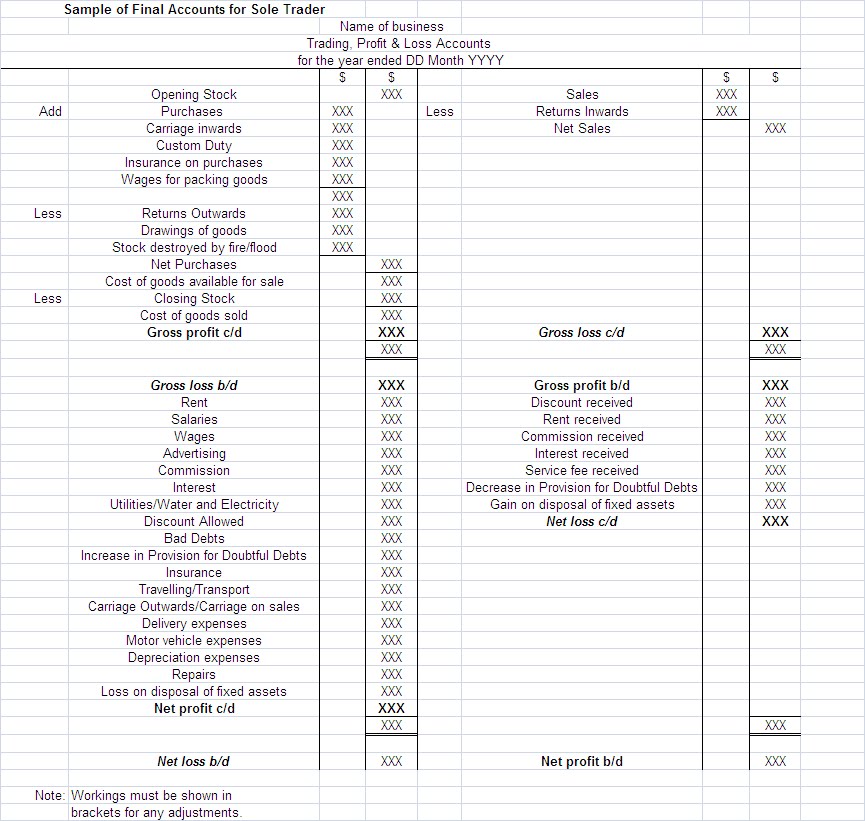

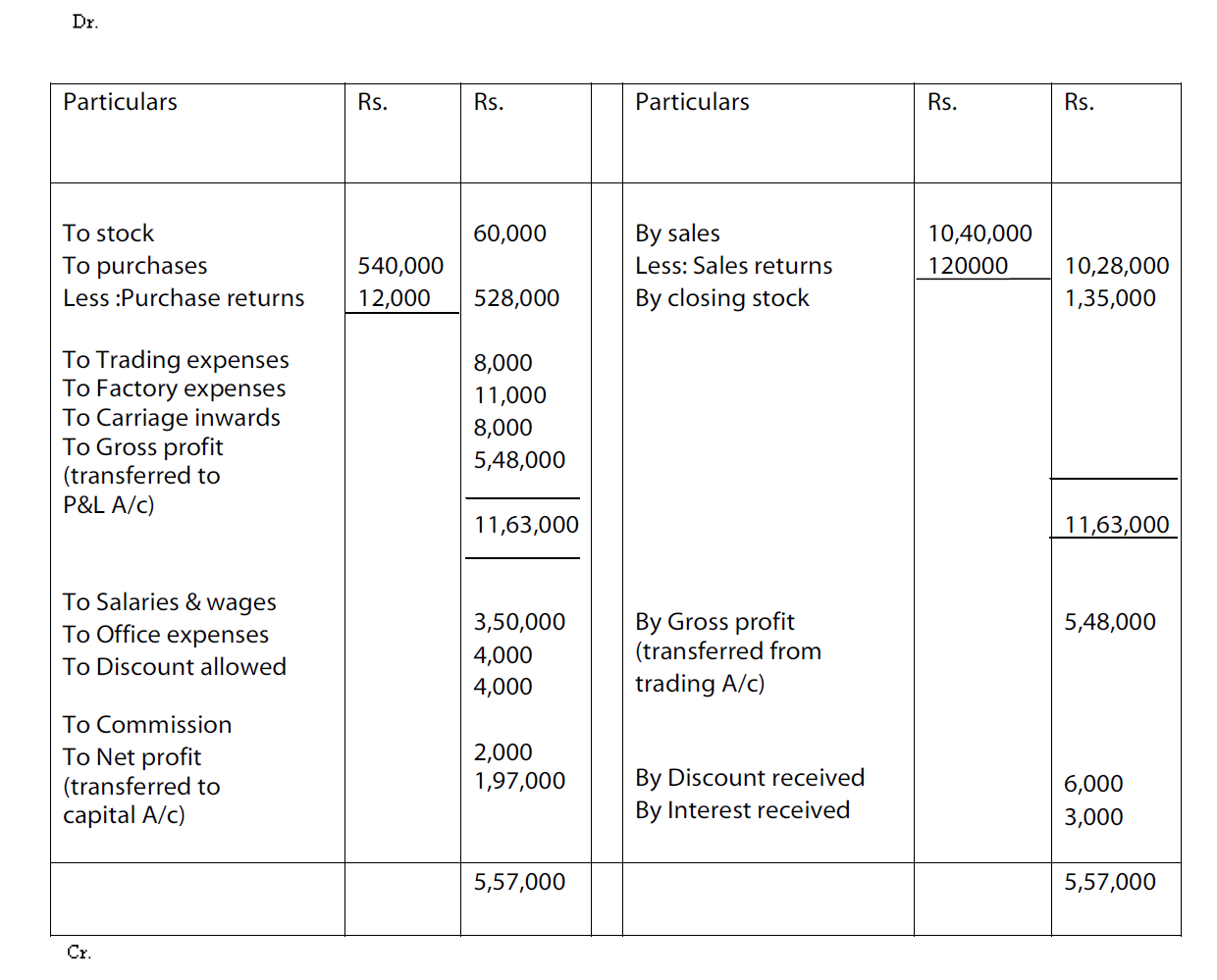

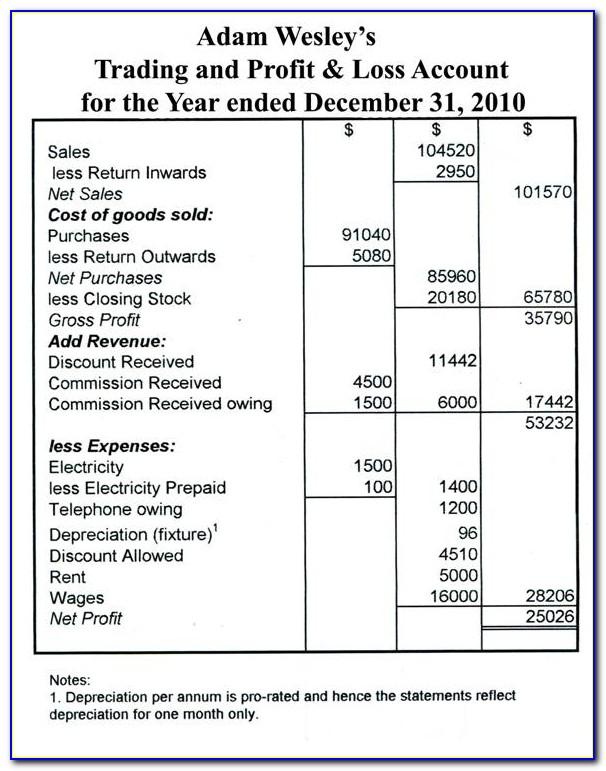

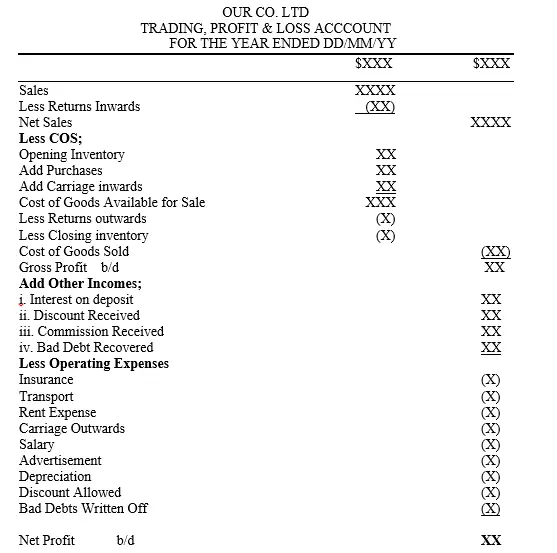

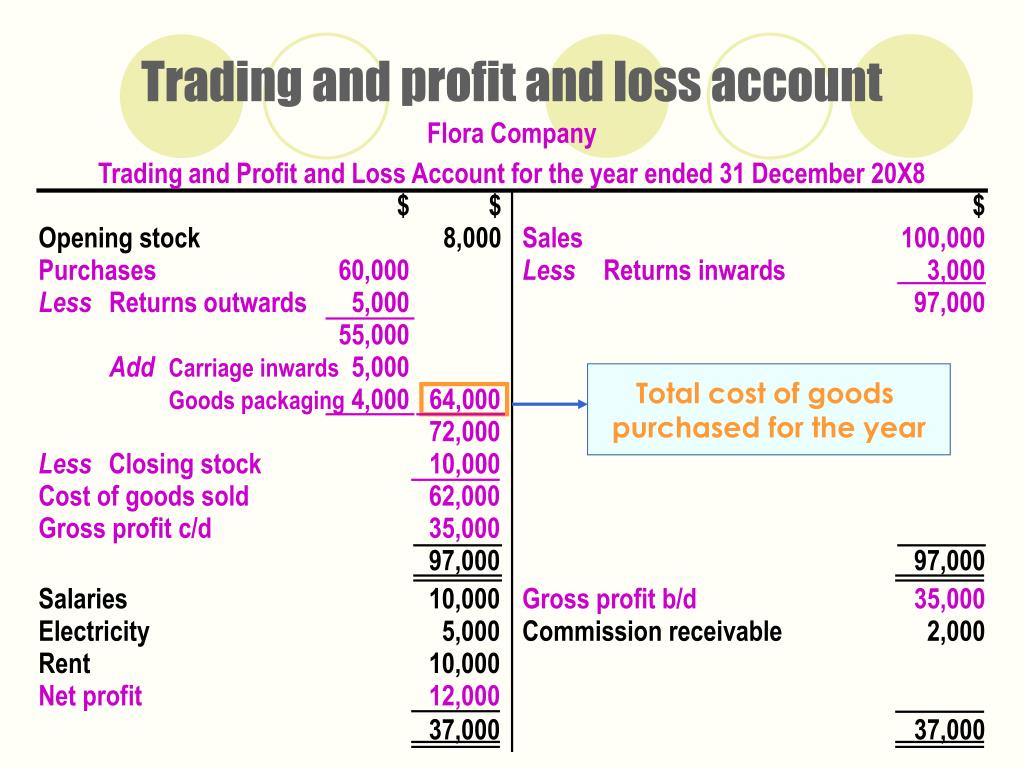

The trading and profit and loss account set out the trading activities of a trader. A p&l statement provides information about whether a company can. The trading account is the top part of the trading profit and loss account and is used to determine the gross profit.

The profit and loss account is the lower part of the trading profit and loss account and is used to. It is used to calculate the gross profit or loss of a business that is engaged in buying and selling goods. Trading account is a summary of all direct revenue and direct expenses.

For determining the true result or the net result of the business, preparing the trading and profit and loss. Prepare the trading and profit and loss account and a balance sheet of m / s shine ltd. Observe carefully the trading and profit and loss account of ankit.

Profit & loss account and balance sheet objectives this chapter will enable the business owner to develop an understanding of: The profit and loss account, in contrast, is an account that displays the period's revenues and expenses. Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business.

Trading and profit and loss account and balance sheet with adjustments explained in easy way lavish gupta 25.7k subscribers subscribe subscribed 24k 1.6m views 5 years ago accounting. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. The trading account is the first part of this final account, and this is used to determine the gross profit which is earned by the business.

The net result over the course of an accounting period are therefore shown in the profit and loss account. The following illustration will help demonstrate how to prepare the both trading, profit and loss account and the balance sheet at the end of the financial period. Record income & expenses and the template produces a trial balance, trading profit and loss accounts, cash flow statement and balance sheet.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Difference between trading account and profit and loss account. The profit and loss account the balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements.

July 14, 2021 by laxmi the compilation of these accounts from incomplete records notes makes students exam preparation simpler and organised. A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given period of time. The purpose of the p&l.

Difference between trial balance and balance sheet. For instance, a trader has cash in a bank account and securities in other accounts (if so, it must be mentioned). The item relating to outstanding wages will be shown in balance sheet as follows :