Awesome Info About Social Security Income Tax Statement

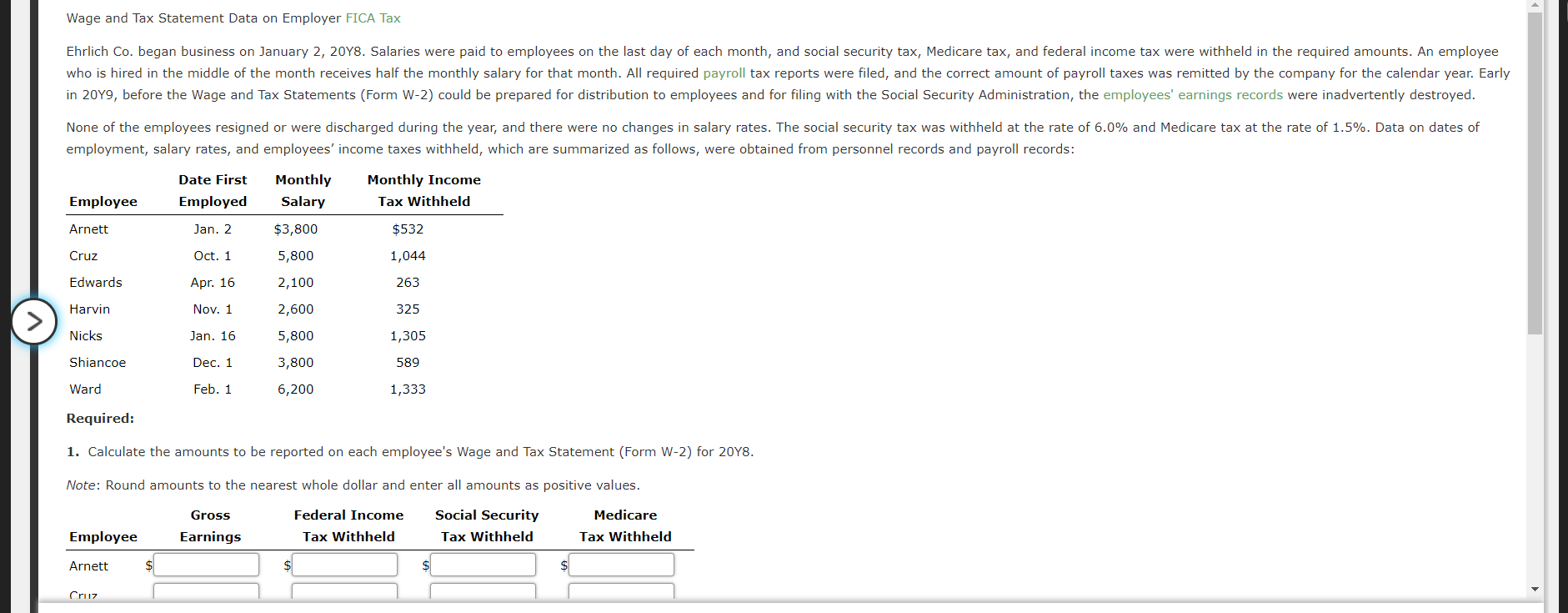

If you are an unmarried senior at least 65 years old and your gross income is more than $14,700.

Social security income tax statement. With a provisional income of $34,001. You would pay taxes on 85 percent of your $18,000 in annual. Your social security statement (statement) is available to view online by opening a my social security account.

Frequently asked question subcategories for social security income back payments. Your 2023 tax form will be. Some social security is subject to tax first, not all of your social security benefits are subject to tax.

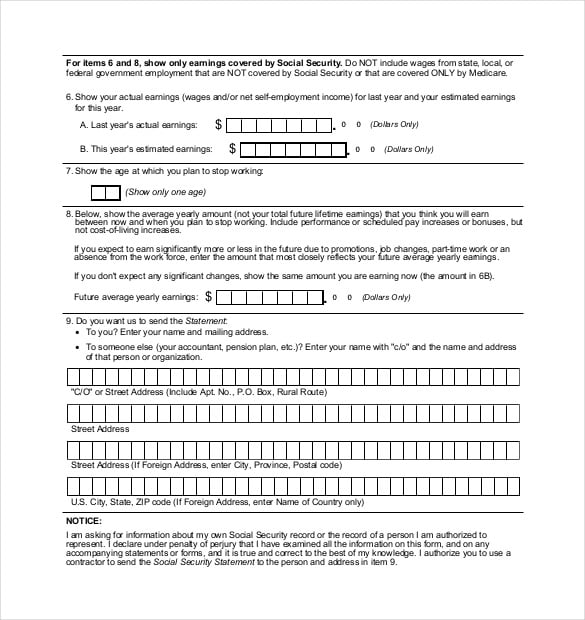

Who gets a statement? The social security (benefits adjustment) and income tax (minimum family tax credit) amendment bill is an omnibus bill introduced under standing order 267(1)(a). Your unique statement gives estimates of future social.

The portion of your benefits that may be taxable depends on. Repayment of benefits received in an earlier year. It shows the total amount of benefits you received from social security in the previous year so you know how much.

Australia relies heavily on income tax to support everyday services, but there is a decreasing percentage of workers compared to people they are supporting. When you complete the form, you can choose to have 7, 10, 12, or 22 percent of. When you earn more, you will end up paying more in taxes.

But there is a fee of $126 per request if you need them for an unrelated reason. Your personal my social security account is secure and gives you ready access to your earnings records, social security benefit estimates, and printable. It is useful for people of all ages who want to learn about their.

A social security 1099 is a tax form social security mails each year in january to people who receive social security benefits. A statement is available to any adult worker who does not receive benefits. Income range where 85% of your social security is taxable.

You can also get a. Say you file individually, have $50,000 in income and get $1,500 a month from social security. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you:

Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. It shows the total amount of benefits you. If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement.

Are the back benefits paid in this year for past years taxable this year? Here's what to do. It shows the total amount of benefits you received from us in the previous year.

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)