Outrageous Info About Uses Of Trial Balance In The Accounting Process

Accountants use a trial balance to test the equality of their debits and credits.

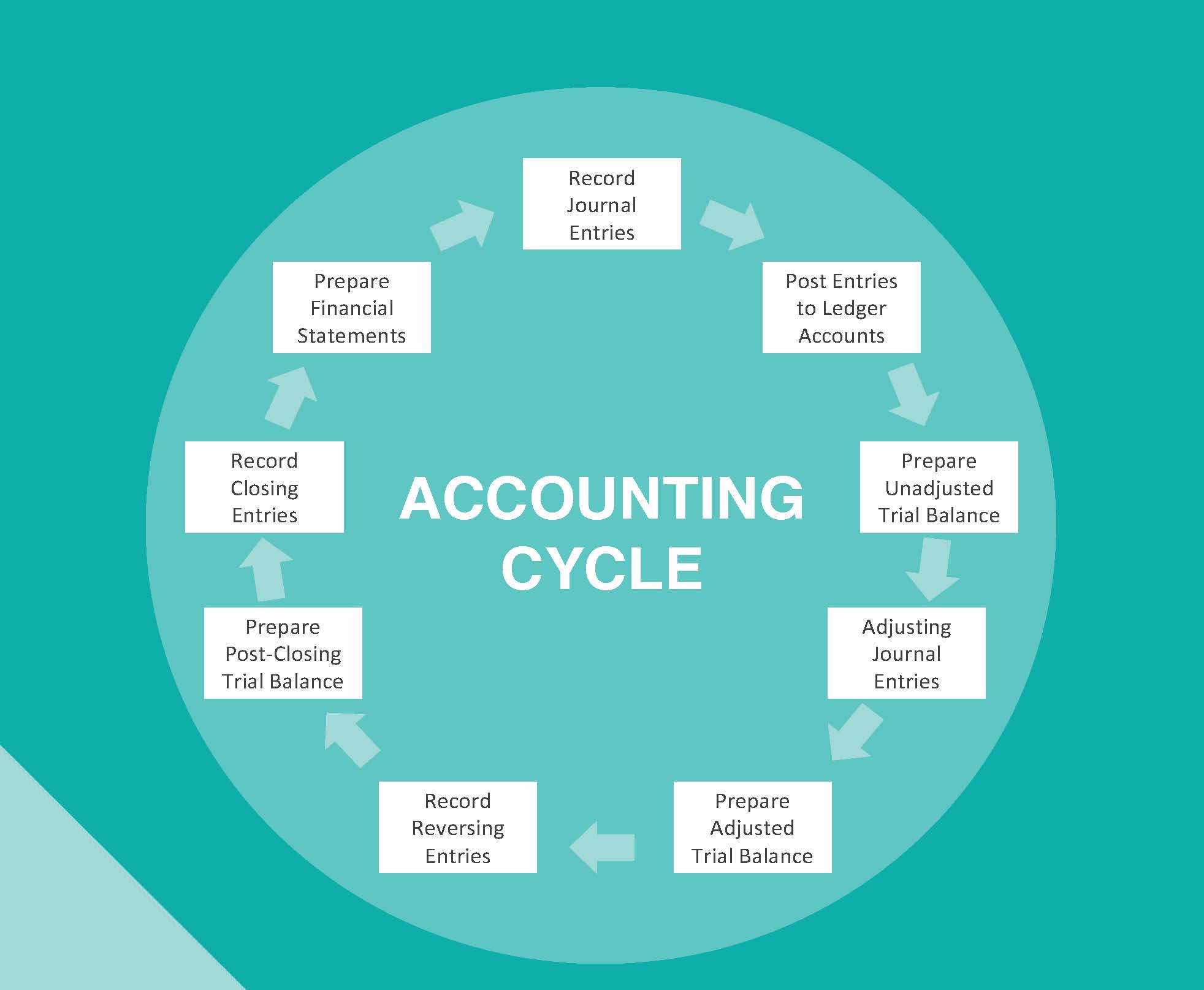

Uses of trial balance in the accounting process. At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. From the appearance of trump’s three adult children to his own time on the stand, here are five key moments from trump’s fraud trial. While it is not a financial statement, a trial balance acts as the first step in preparing one.

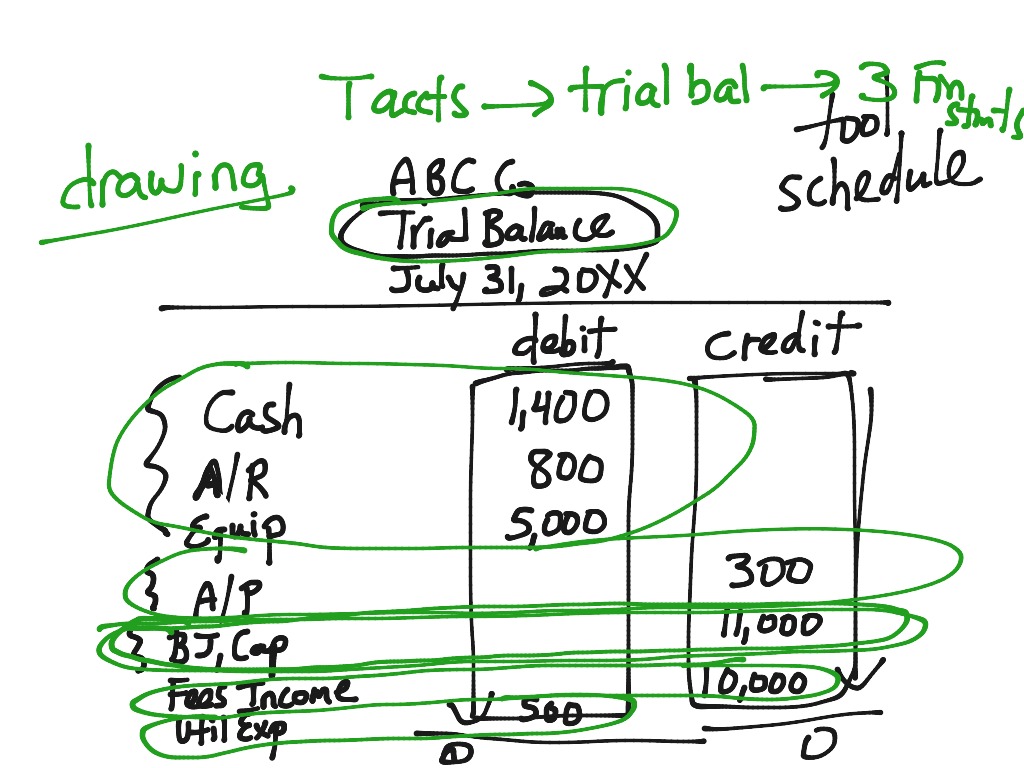

A trial balance tells the company its unadjusted balances in each account. Example of a trial balance document A trial balance is an internal report that includes all of the account balances in your general ledger.

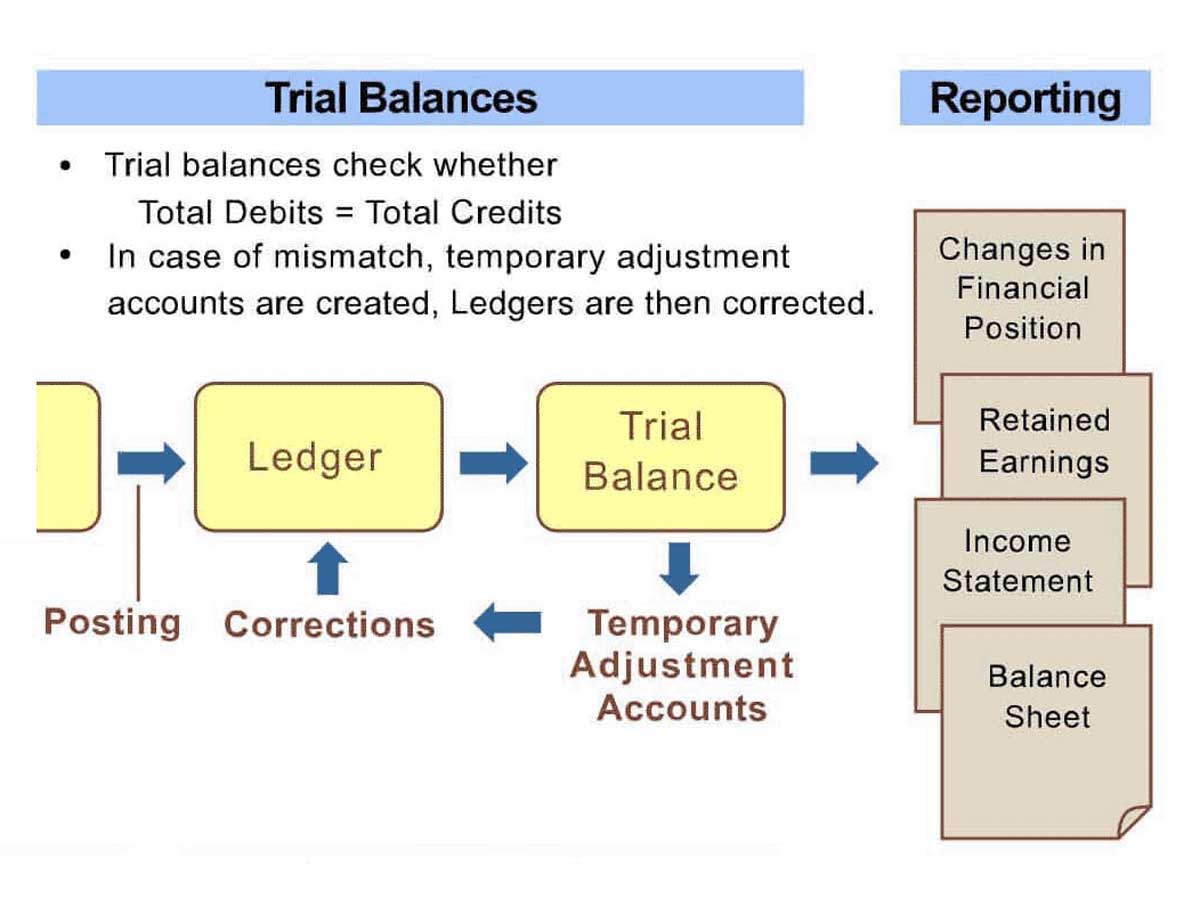

The role of a trial balance in accounting is to help accountants detect some errors when total debits don’t equal total credits for all balance sheet accounts and income statement accounts (including revenues, costs, expenses, gains, and losses). From this information, the company will begin constructing each of the statements, beginning with the income statement. A judge ordered the former president to fork over $355 million of his fortune, plus interest, finding he lied for years about.

Used to check initial accuracy before adjustments. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. A trial balance provides a snapshot of the assets, liabilities, and equity accounts for a business at any given time, and it must always be balanced before it can be used in further analysis and reporting.

A trial balance is a statement or report generated at the end of an accounting period, listing all the accounts and their balances. This means that for every entry.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Regularly preparing trial balances can help businesses evaluate their financial condition and ensure the accuracy of their accounting systems. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

Preparing and adjusting trial balances aid in the preparation of accurate financial statements. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other.

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their balances, where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. What’s the role of a trial balance in accounting?

New york (ap) — on the witness stand last year, donald trump proclaimed: A trial balance lists the ending balance in each general ledger account. A trial balance in accounting is a foundational tool that validates the accuracy of financial records.

To prepare the financial statements, a company will look at the adjusted trial balance for account information. It compiles all ledger accounts and details their balances as either debits or credits by following the core principle that. Despite the automation of accounting processes with modern software, trial balances still hold significance in certain situations.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)