Inspirating Tips About Purpose Of Preparing Income Statement

Purpose of income statement.

Purpose of preparing income statement. Rent expense of offices used for administration and management purposes. This means it does not factor. An income statement presents the financial results of a business for a stated period of time.

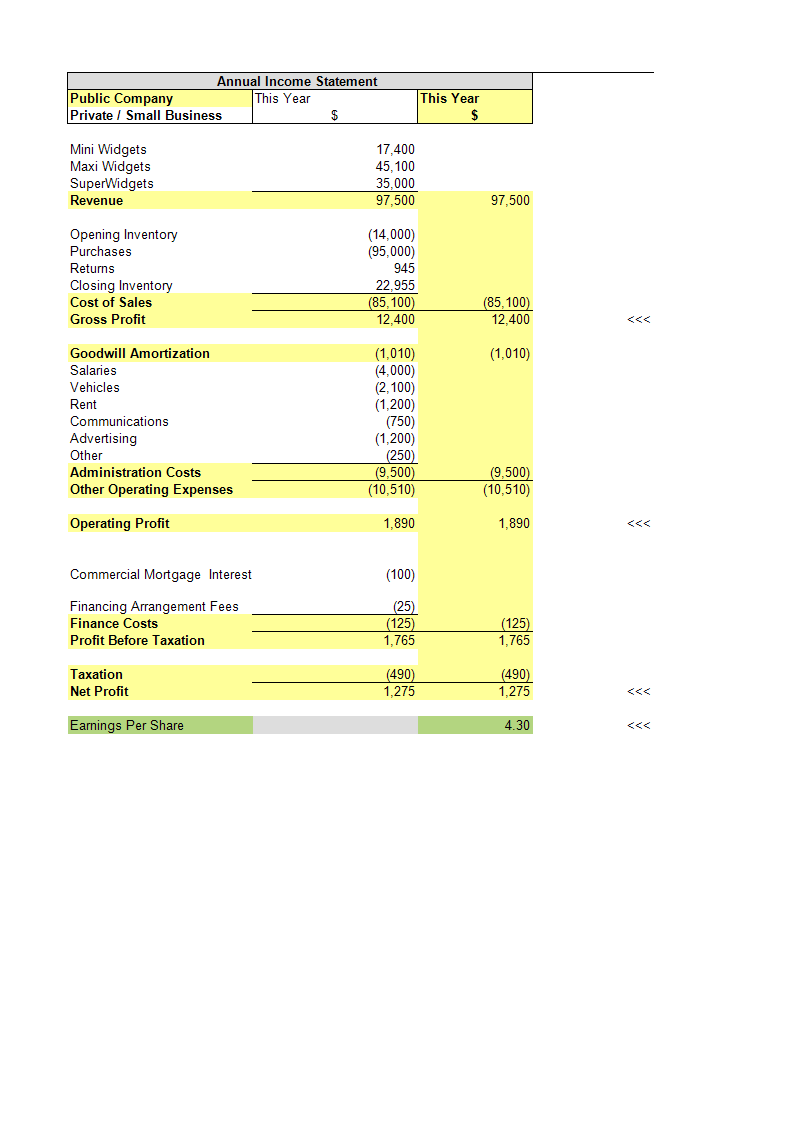

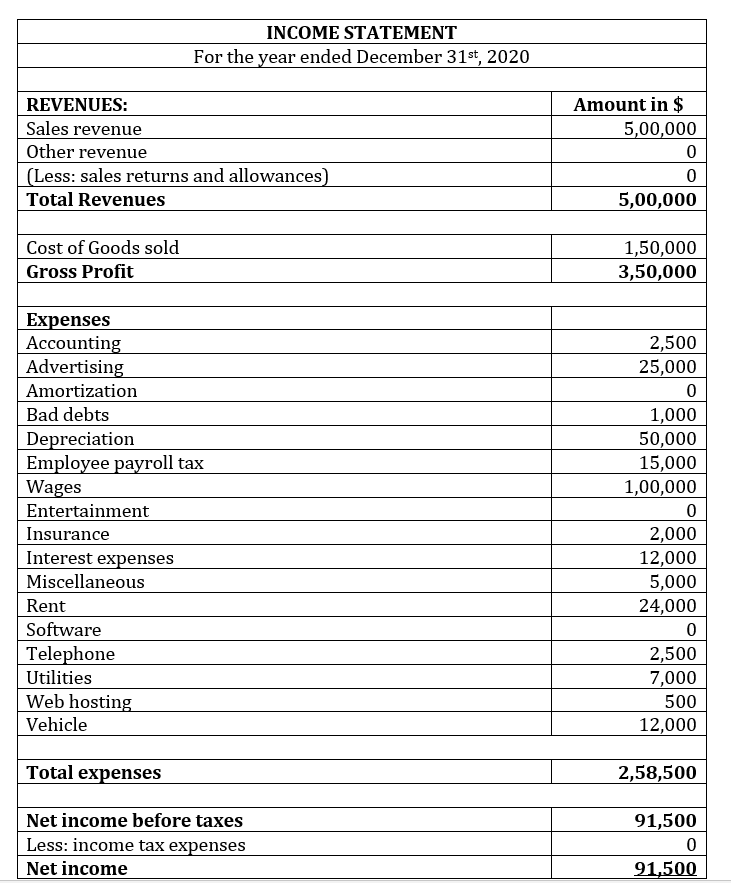

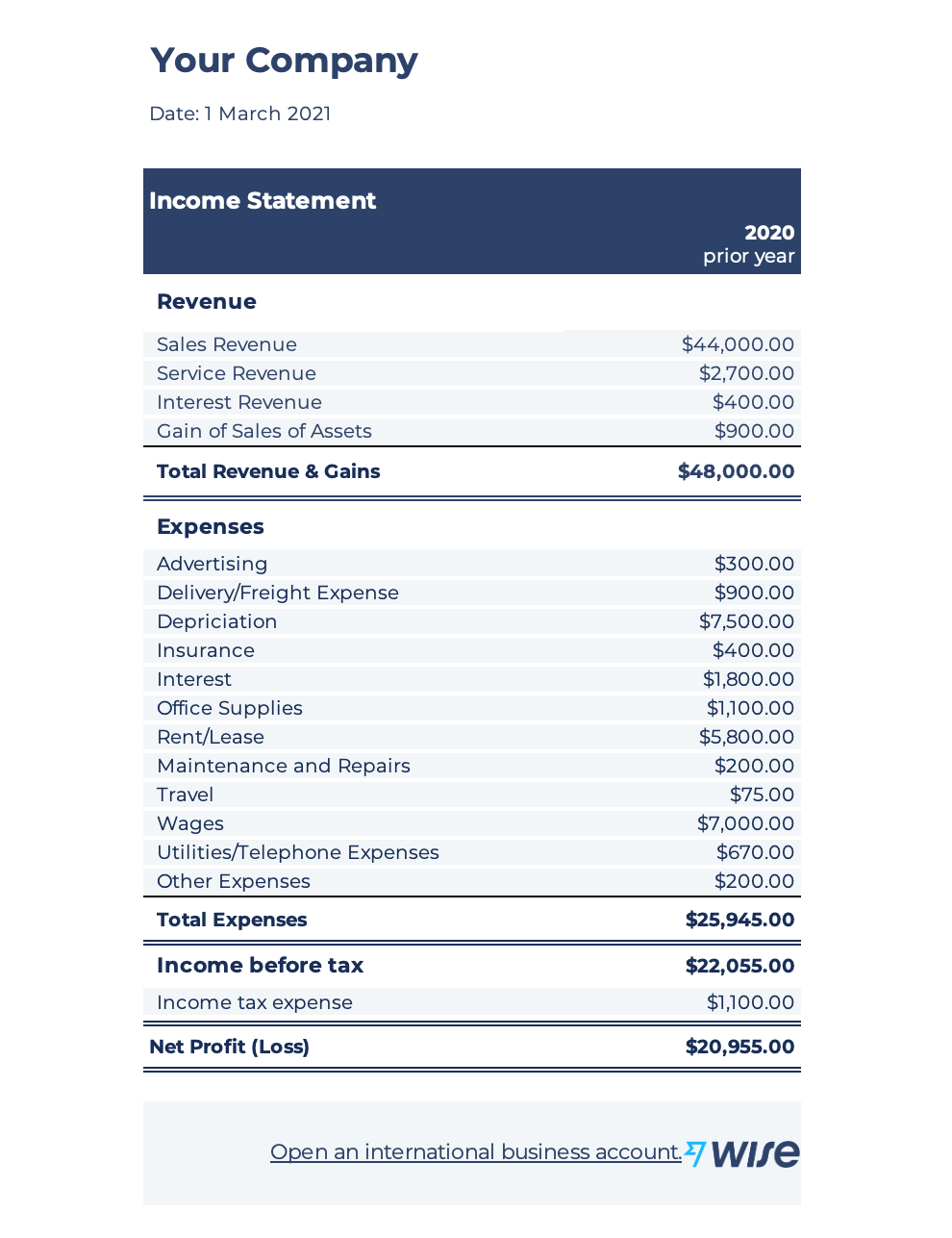

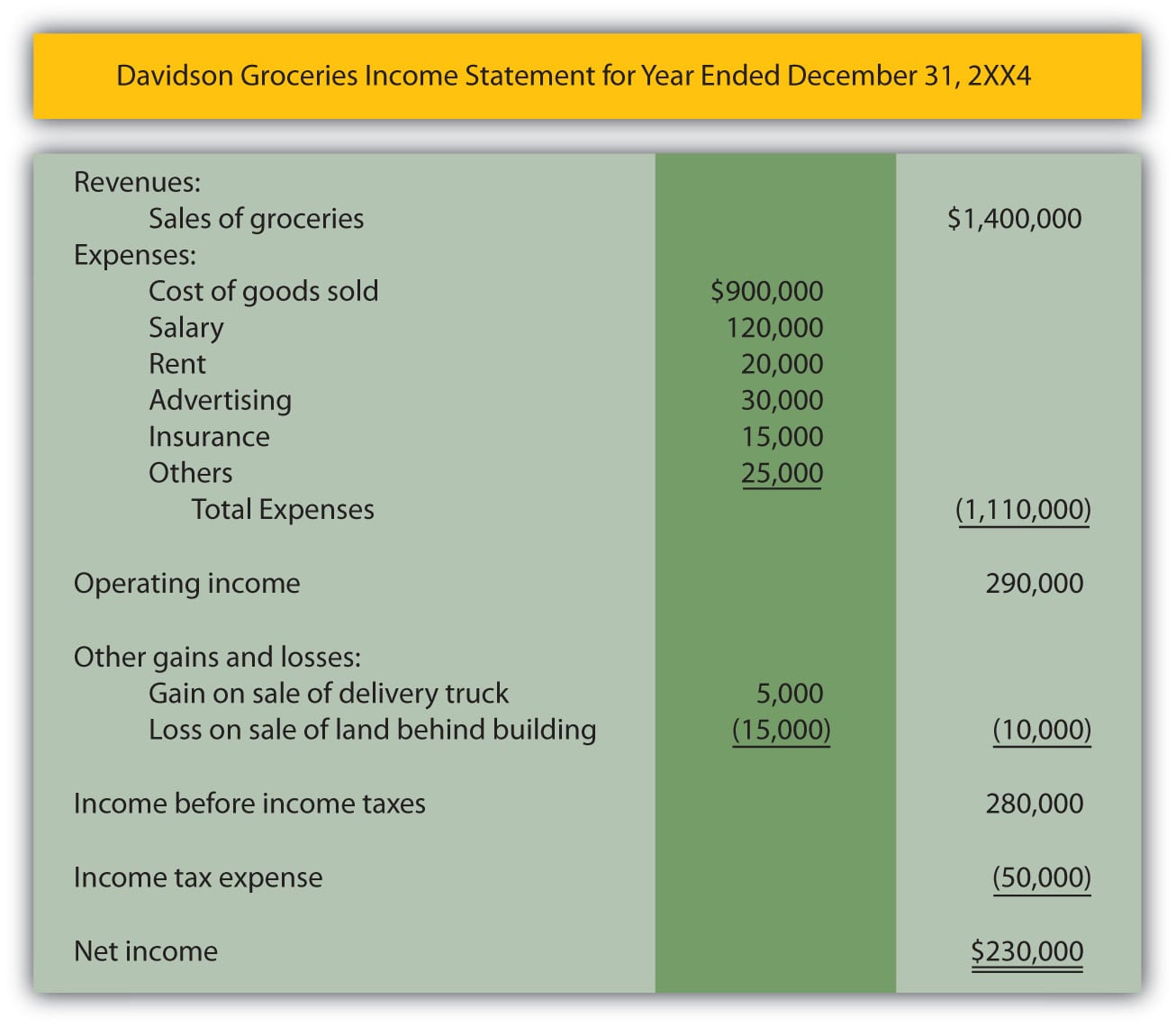

An income statement, otherwise known as a profit and loss (p&l) statement and profit and loss (p&l) account, is a record that measures and shows all the expenses and revenues a company incurred during a specific period of time. Steps to prepare an income statement 1. It reports net income by detailing a business’s revenues, gains, expenses, and losses.

Choose your reporting period your reporting period is the specific timeframe the income statement covers. The income statement helps determine a company’s financial health and the financial progress it made during a. The purpose of an income statement is to show a company’s financial performance over a given time period.

The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. However, monthly income statements are often extremely valuable for insights into your business’s financial progress. An income statement is an important financial statement that gives you a look into your business’s financial health and profitability for a specific period.

Figure out aspects of revenue, expenses and net income ; Within an income statement, you’ll find all revenue and expense accounts for a set period. Income statement purpose what is an income statement used for?

It’s important to note that there are several different types of income statements that are created for different reasons. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. Accountants create income statements using trial balances from any two.

In the context of corporate finance, the income statement is the record of the company's profit and loss over the financial year. Most companies create annual income statements, though you can prepare one for other periods of time, depending on your company's needs, like by month or by quarter. Calculate total revenue once you know the reporting period, calculate the total revenue your business generated.

For example, if an organization is preparing income statement for the six months ending 31 december. This guide explains how to prepare an income statement It is standard practice for businesses to present.

An income statement is a document that tracks a business's revenue and expenses over a set period of time. The income statement shows how much of a profit your business made — or that you assume you will make if it’s a projection — during a specific period of time. Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows.

Monthly, quarterly or annually, for example. The income statement, also known as a profit and loss statement, shows a business’s financial performance during a specific accounting period. It shows whether a company has made a profit or loss during that period.

/200452435-001-F-56a03f5e5f9b58eba4af8513.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)