Here’s A Quick Way To Solve A Tips About Consolidated Income Tax Return

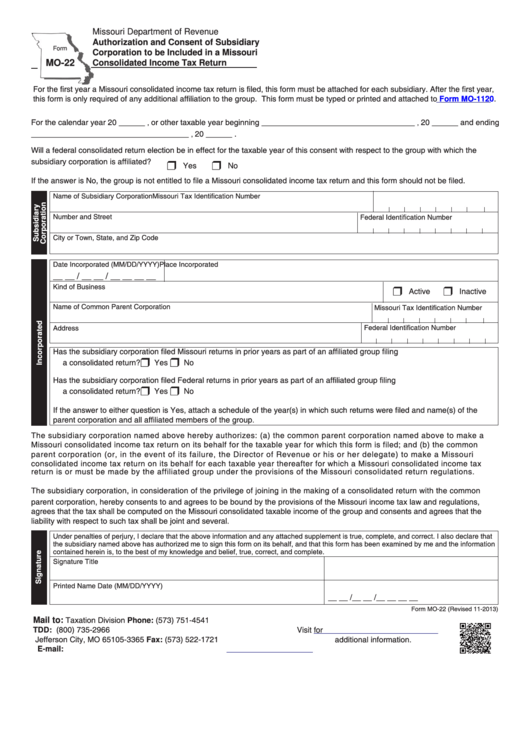

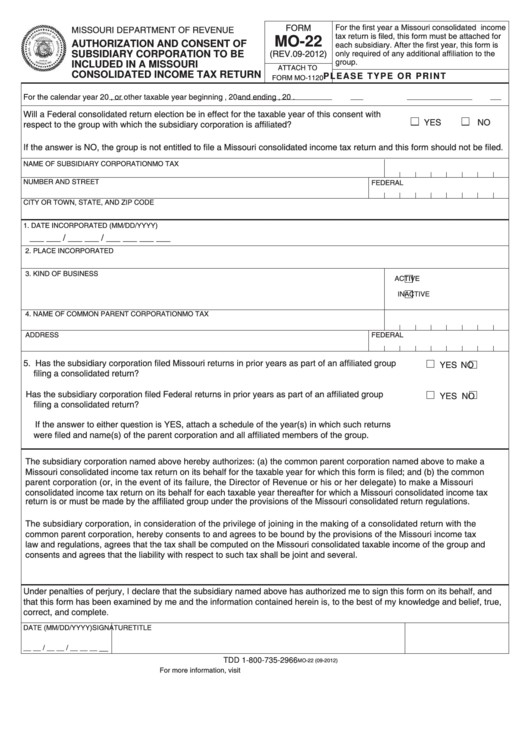

Book value, and the two companies elect to file a consolidated tax return for 20x1.

Consolidated income tax return. Delivering support for canadians on. Go into asset data entry for that client and correct the data. Malta introduced the concept of a consolidated income tax return for related entities into maltese tax law through the consolidated.

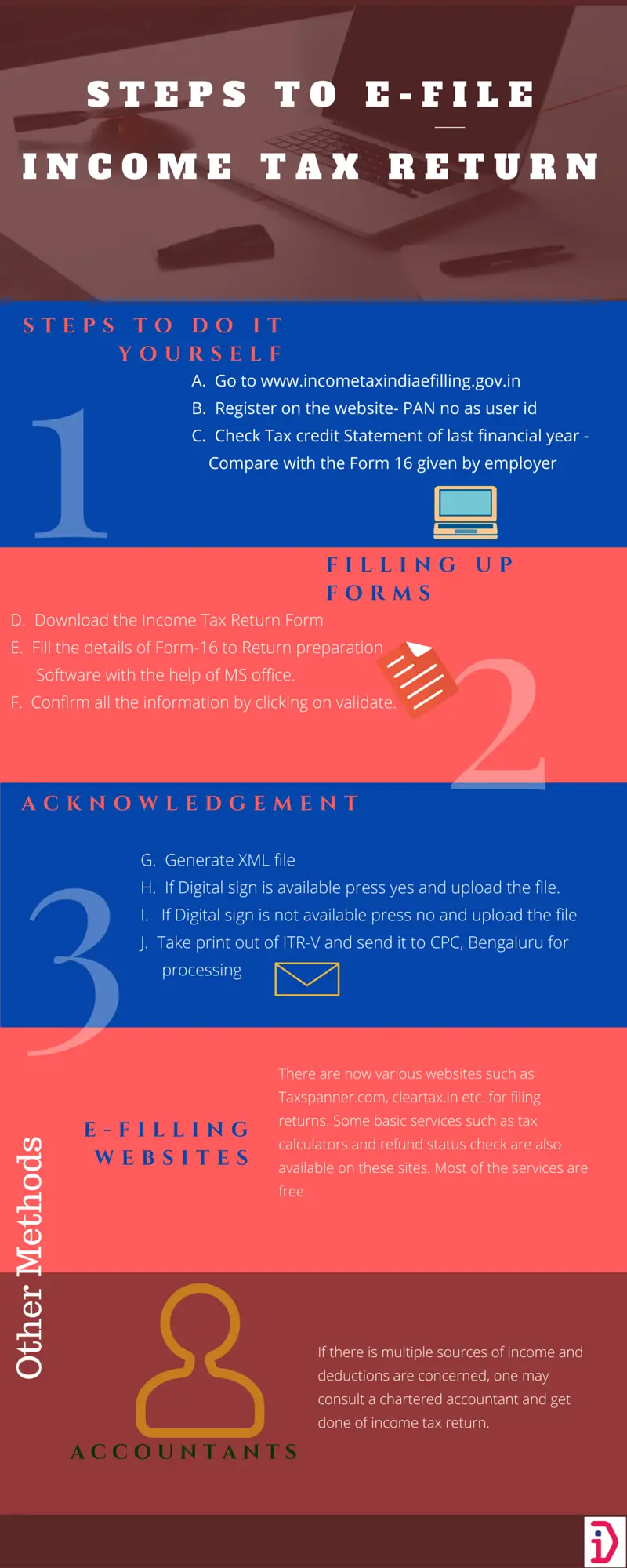

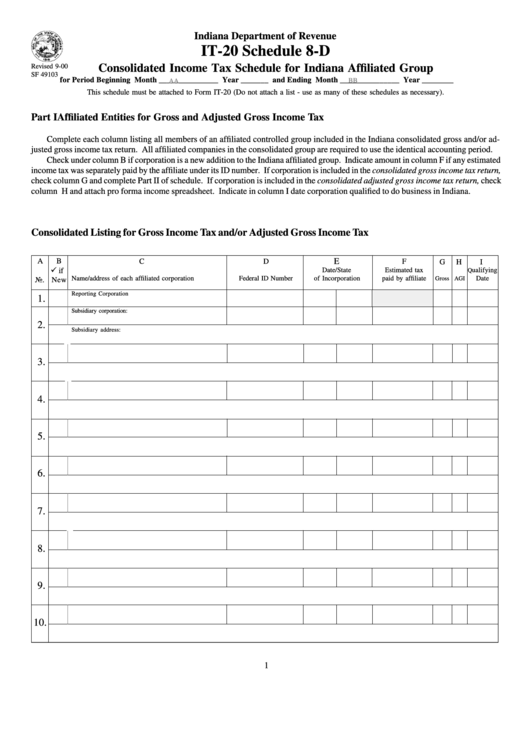

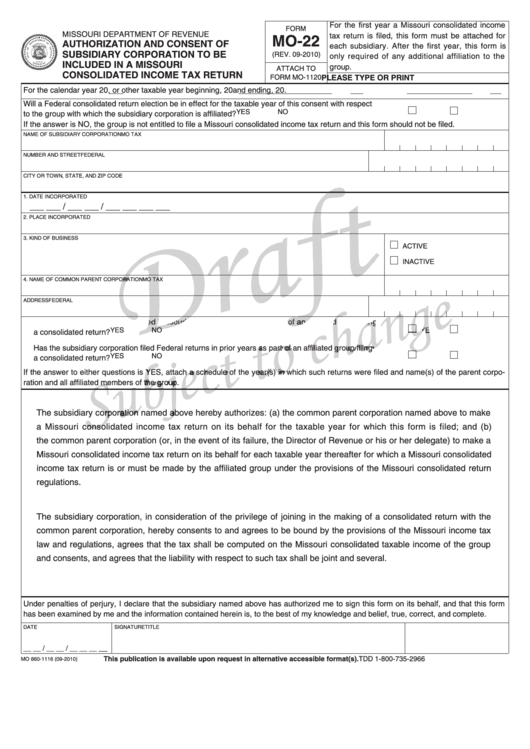

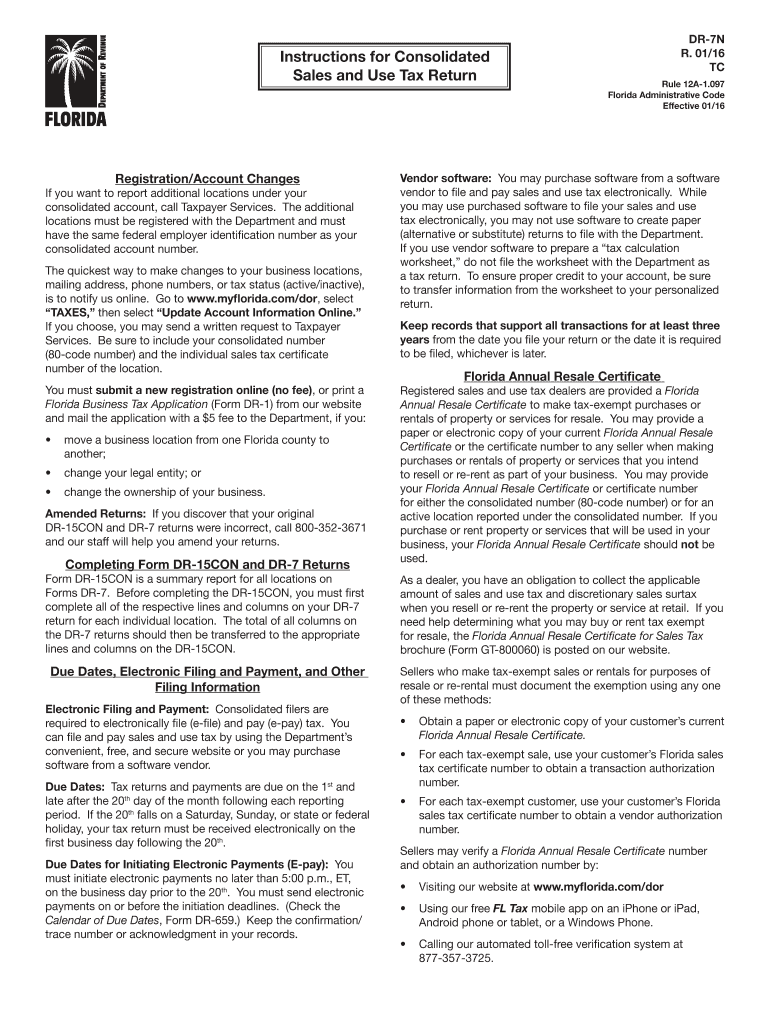

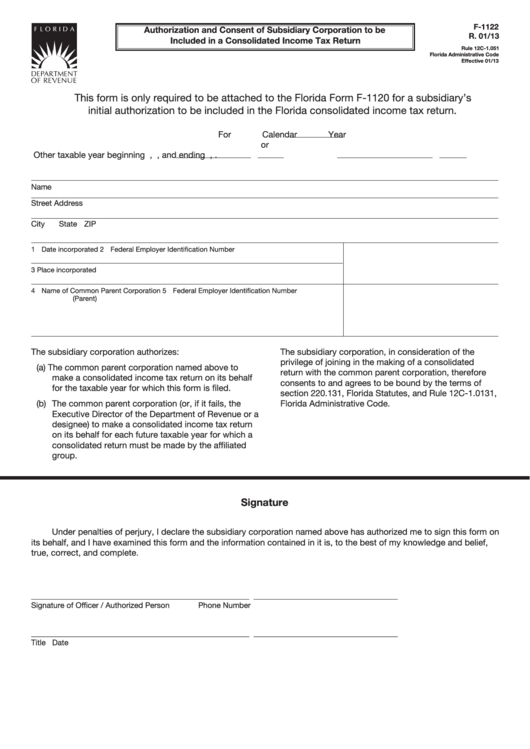

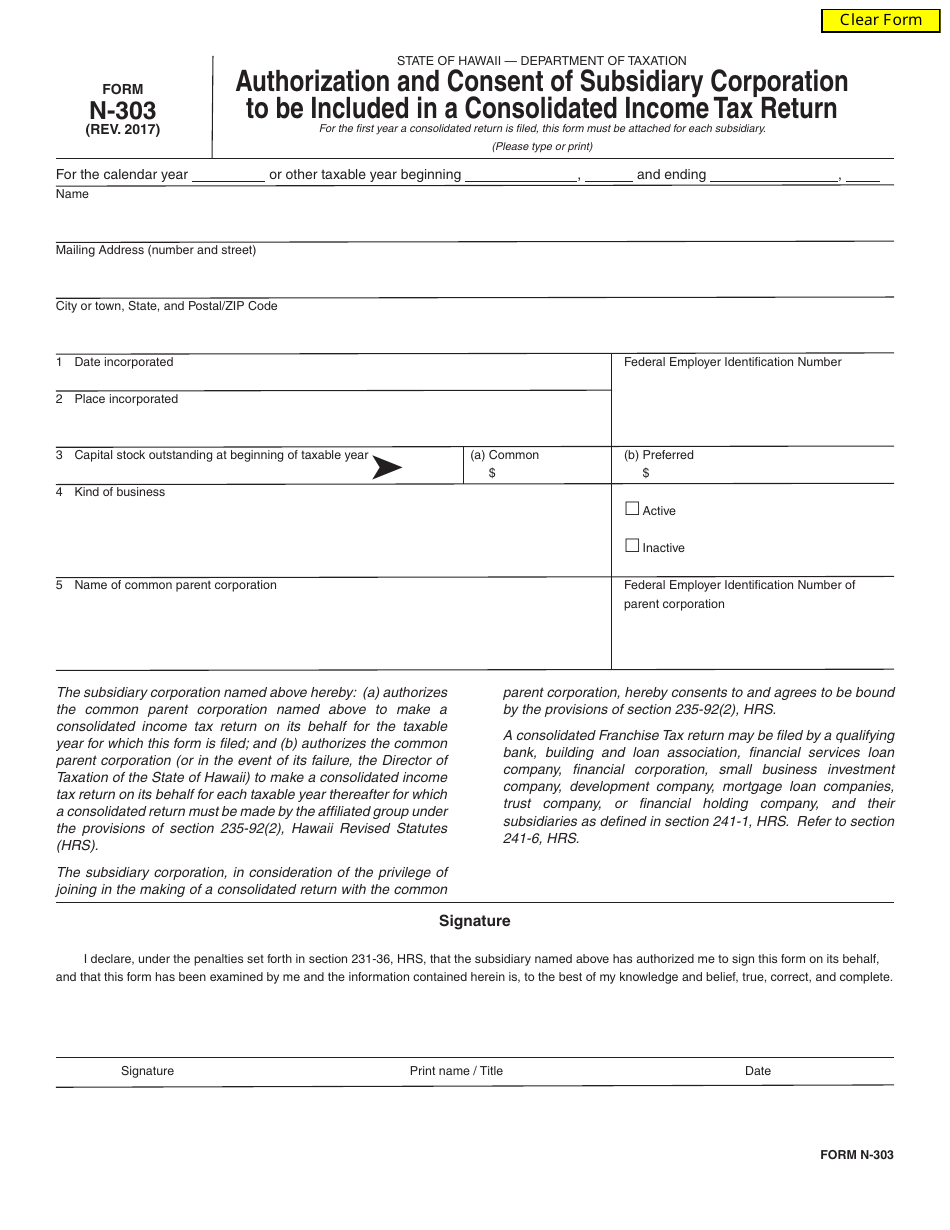

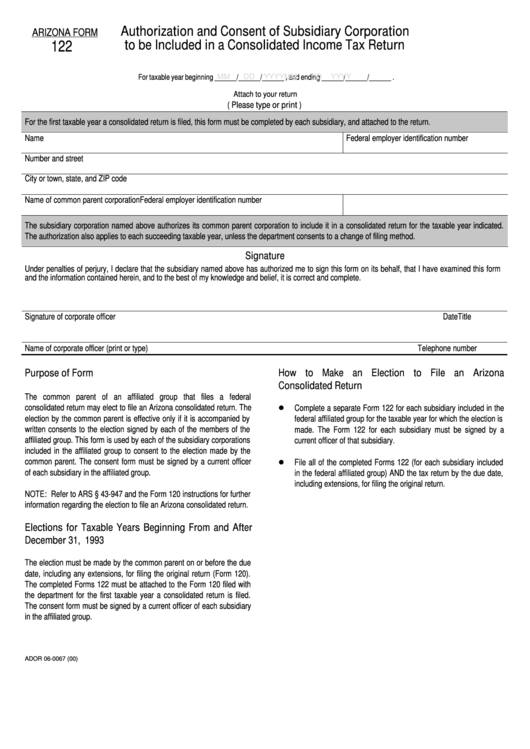

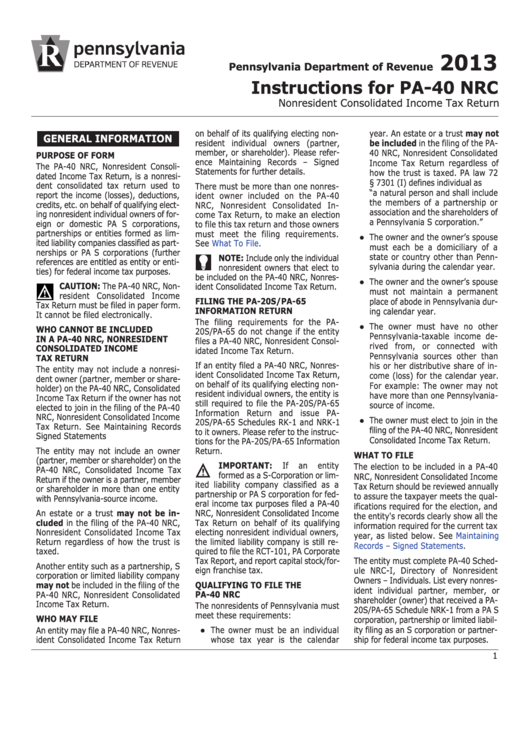

Have the privilege of making a consolidated return with respect to the income tax. Follow these steps to prepare a consolidated income tax return. The consolidated current and deferred tax amounts of a group that files a consolidated tax return should be allocated among the group members when they issue separate.

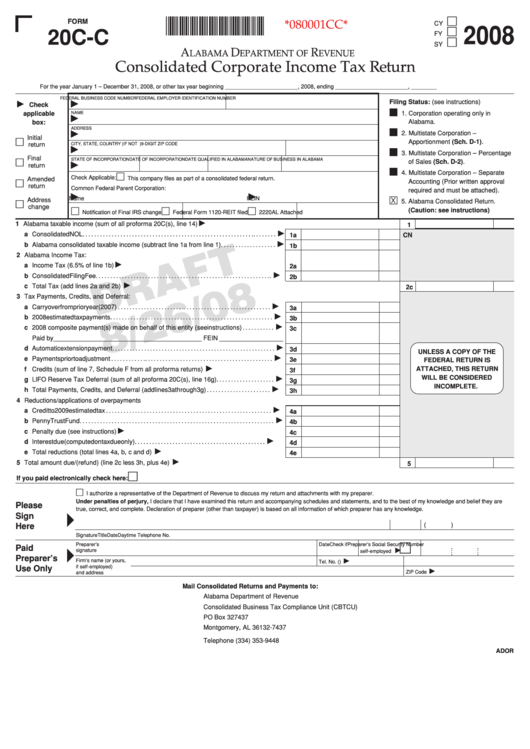

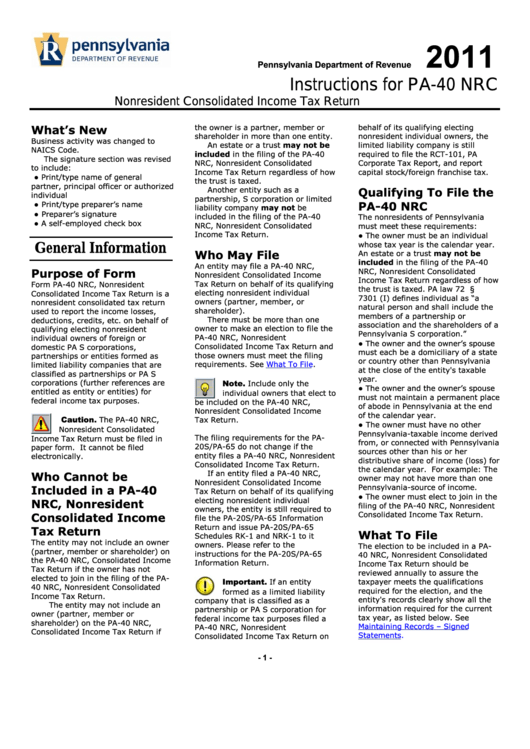

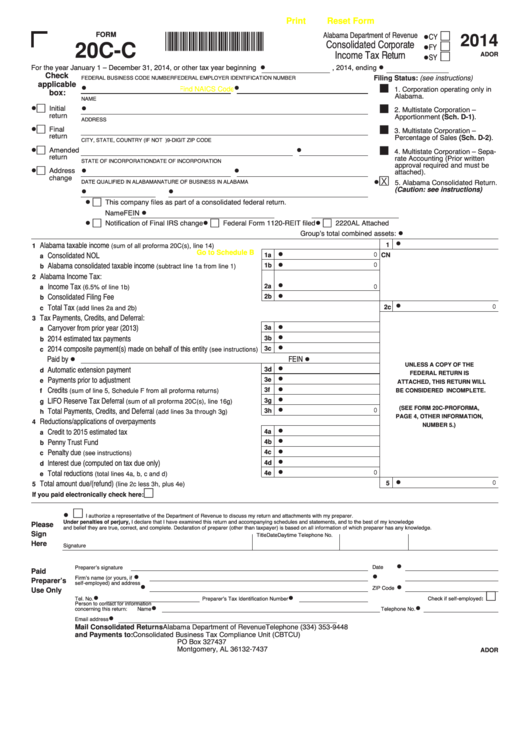

Irc §1501 provides that an affiliated group of corporations shall. This item highlights the u.s. A consolidated tax return is a corporate income tax return of an affiliated group of corporations that elect to report their combined tax liability on a.

Learn about who can file a consolidated tax return in the world of finance. The correct number should now be a part of the. These groups elect to report their tax liability of a return.

Consolidated income tax returns. Consolidated tax return rules that govern the treatment of. [1] the income tax and.

The application of these rules presents numerous tricks and traps for the unwary. Important you may need to adjust the data for your member returns before preparing the consolidated income. An amended 2020 income tax return must be filed reflecting the decreased wage deduction, with a payment of additional income tax to the irs, before the statute.

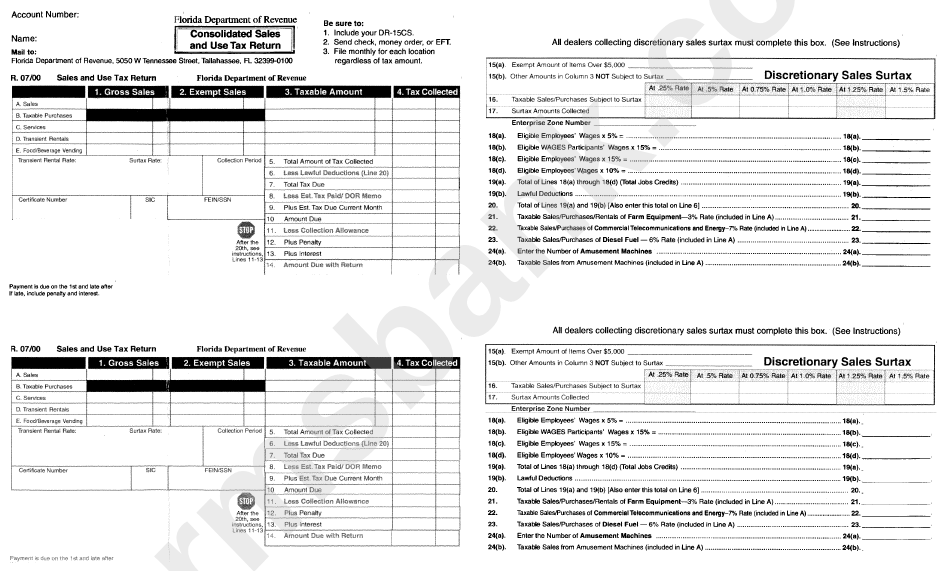

Consolidated returns are corporate tax return of affiliated groups. Corporation income tax return other current products page last reviewed or updated: On february 1, 2024, the state taxation administration (sta) issued the announcement on matters relating to the final settlement of individual income tax on.

Consolidated returns and combined reporting, no. You may start filing for the year of assessment 2024 from 1 mar 2024. Bloomberg tax portfolio income taxes:

1130, compares state combined reports and state consolidated returns in detail. Consolidated tax return requirements. A minimum wage earner as defined in section 22 (hh) of the tax code or an individual who is exempt from income tax pursuant to the provisions of the tax code and other laws,.

General instructions purpose of form who must file entities electing to be taxed as corporations. Find out the eligibility criteria and advantages of consolidating your tax. About form 1120, u.s.