Here’s A Quick Way To Solve A Info About Restructuring Costs Income Statement

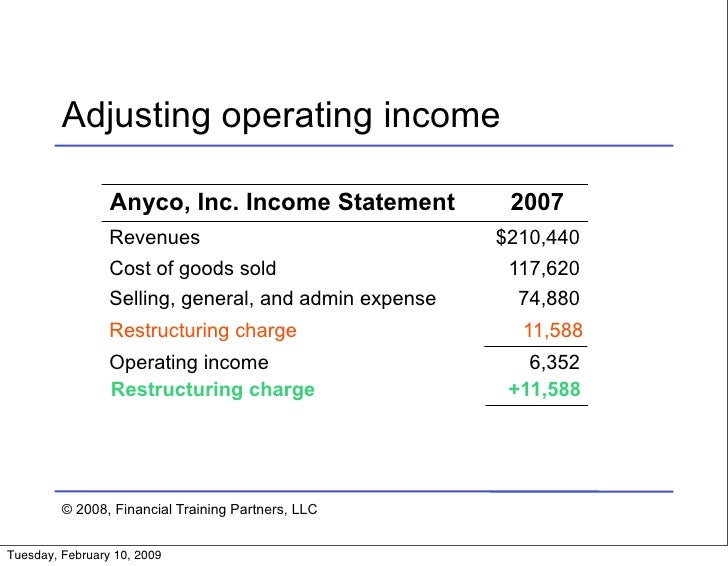

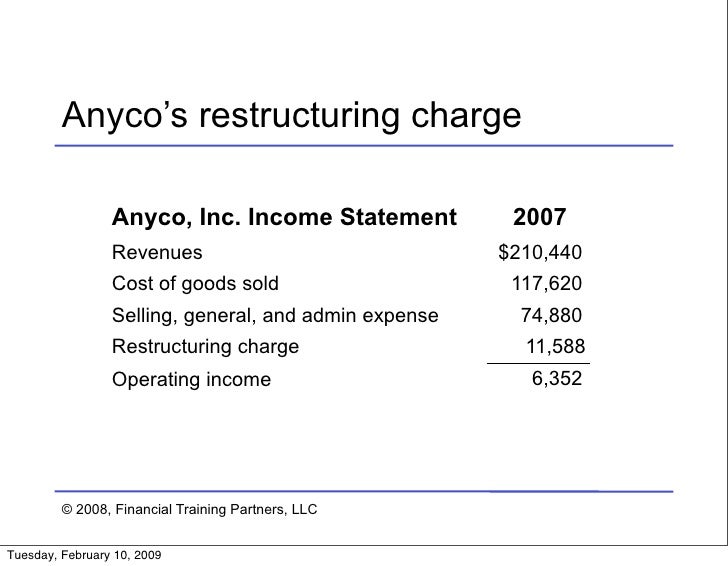

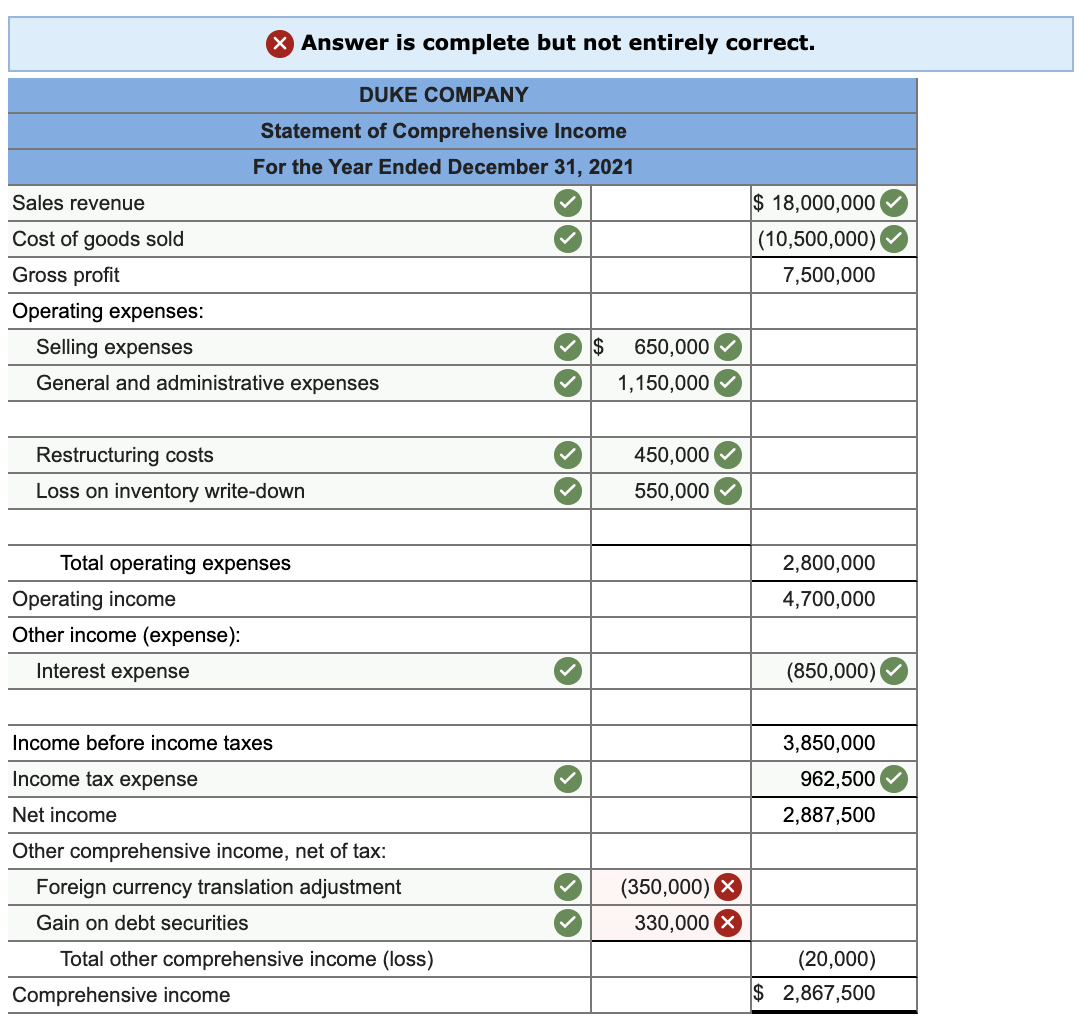

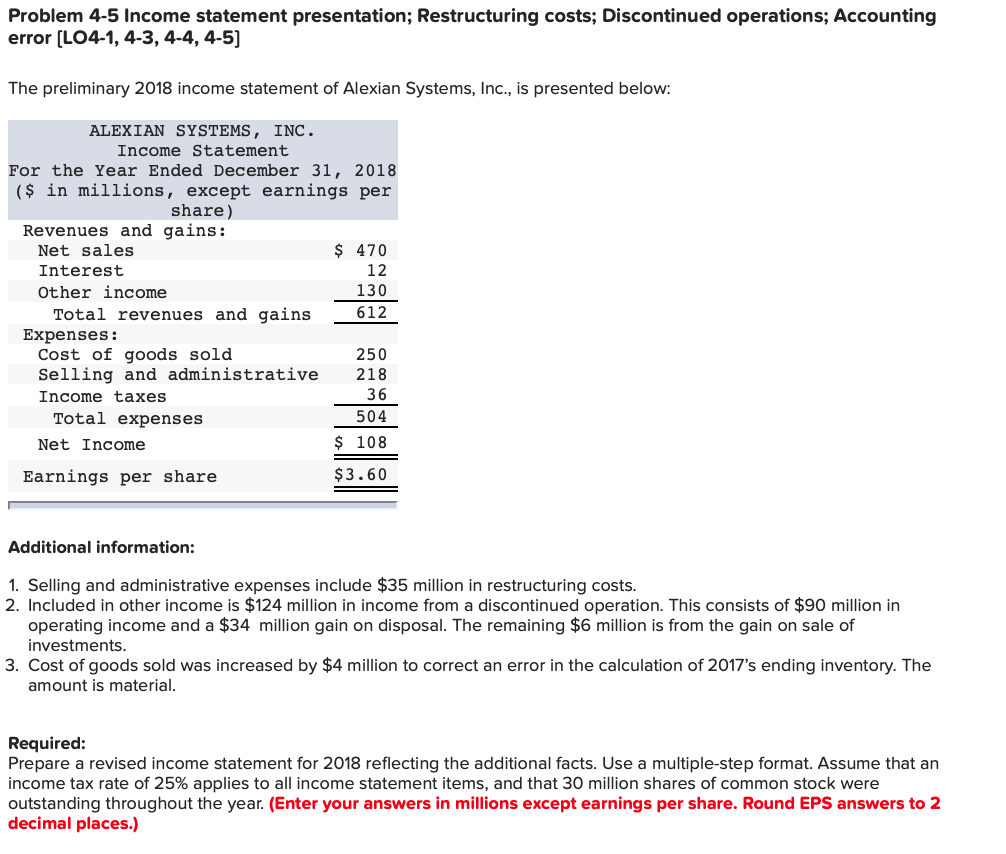

Restructuring charges are recorded on the company’s income statement as an expense.

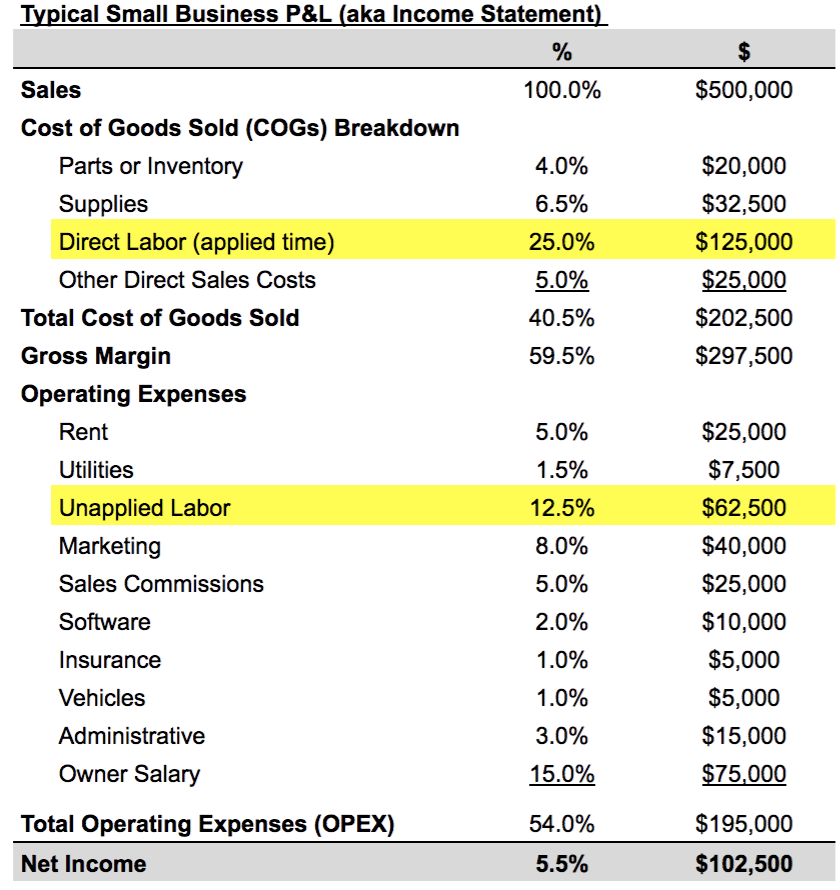

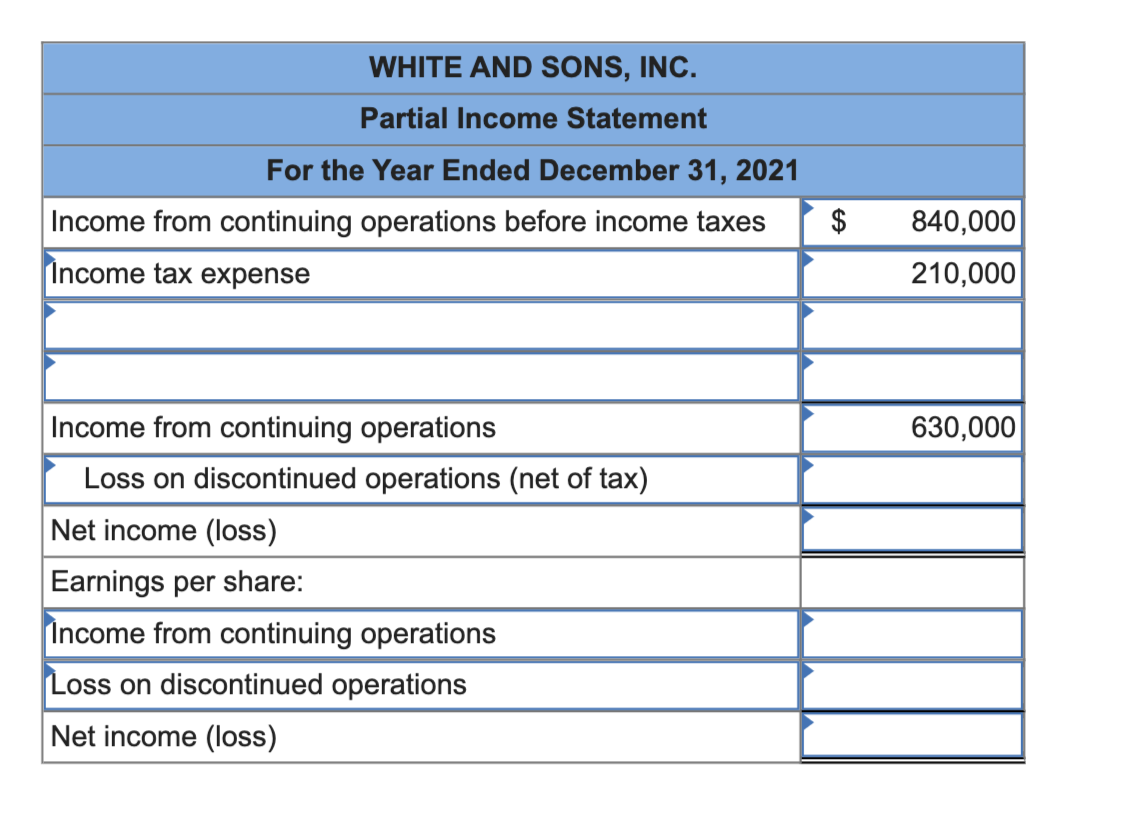

Restructuring costs income statement. A restructuring covered by ias 37 includes the sale or termination of a line of business, the closure of business activities in a particular location, the relocation of. Restructuring expense is defined as the cost a company incurs during corporate restructuring. They reduce the company’s net income or increase its net.

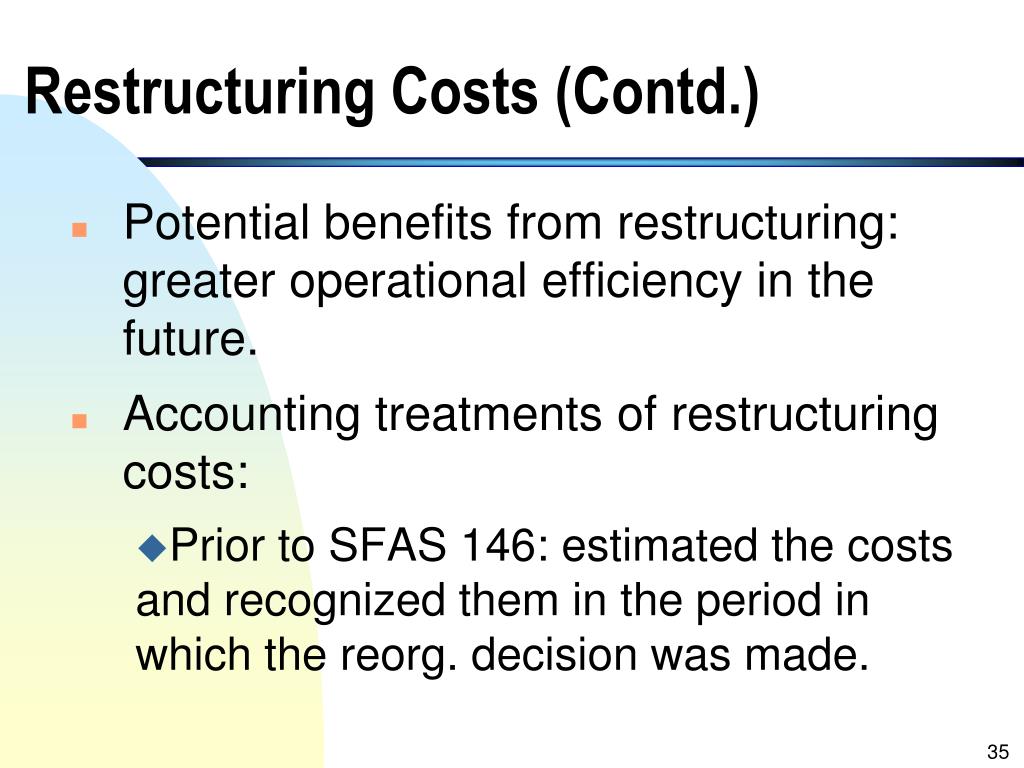

Small business | running a business | business changes by eileen rojas if your business has incurred. According to investopedia, restructuring costs involve either the costs in writing down the cost of assets because the assets have lost value, or the costs of.

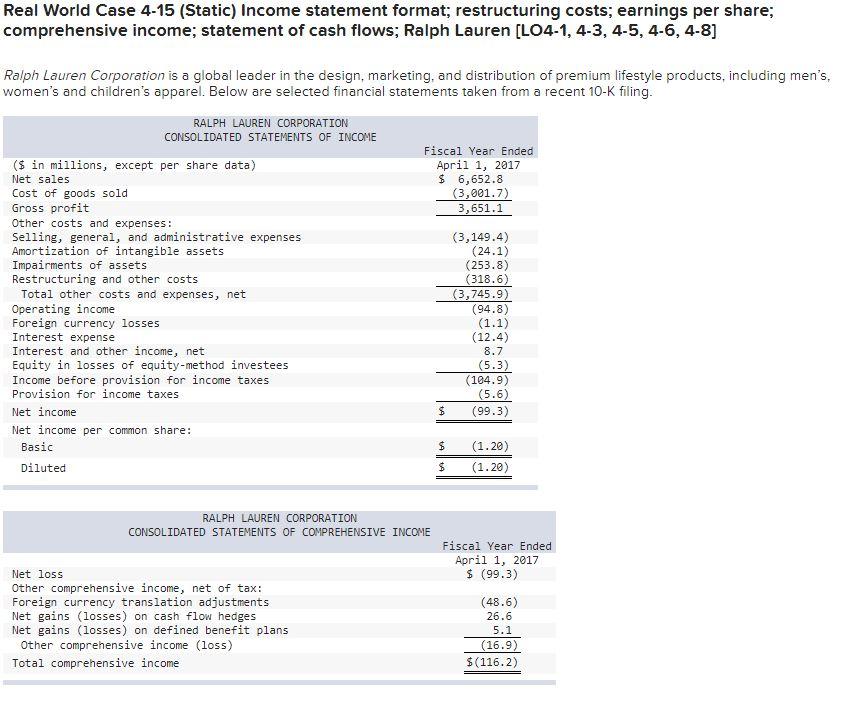

Instead, such a restructuring may be. Financial has specific requirements for restructuring related that differ from us.

There are a number of items that should be recognized in income under asc 805, including transaction costs, restructuring charges, revaluations of contingent consideration,. How to estimate expenses for an annual budget administration expenses restructuring expense definition restructuring expense is defined as the cost a. Legal, financial advisor, and other related (banking, valuation, etc.) costs are generally viewed.

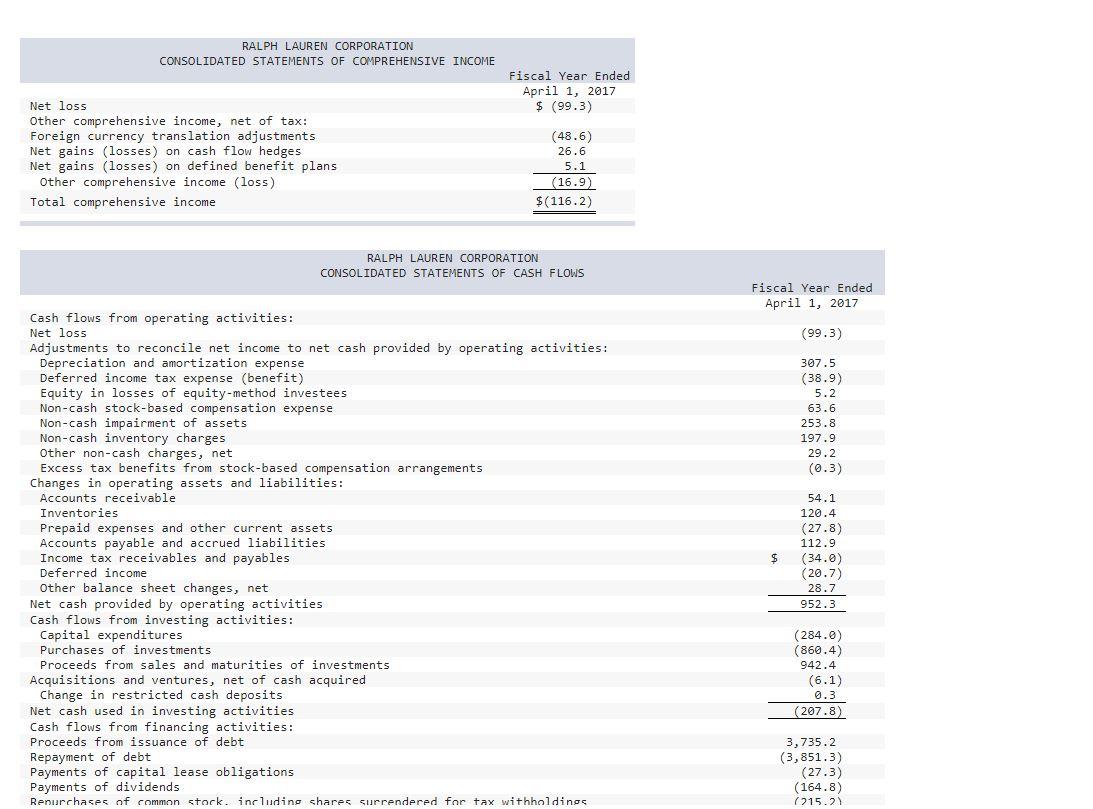

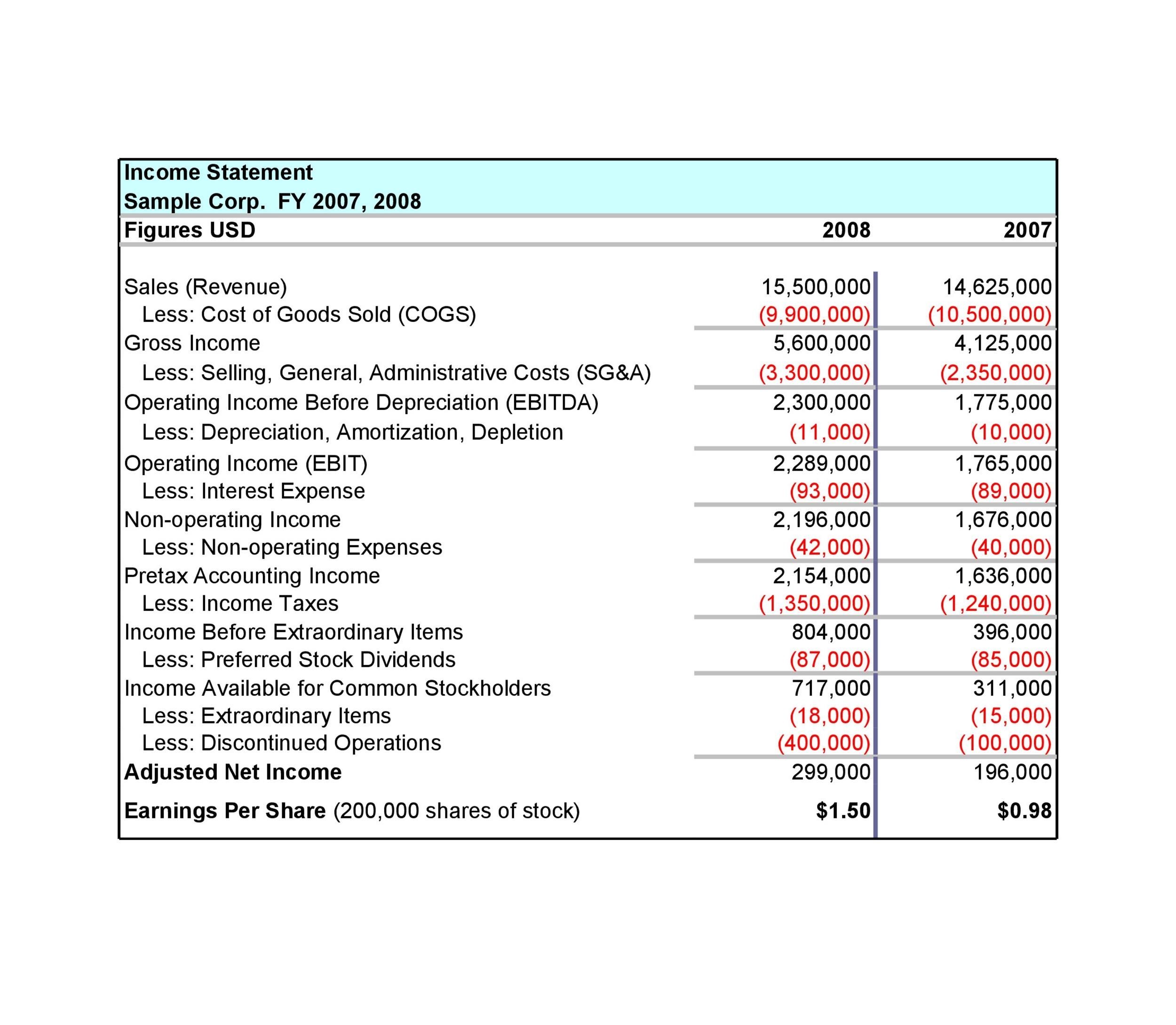

4.1.11 restructuring costs 53 4.1.12 presentation and disclosure 54 4.2 joint arrangements 54. The tax rules governing these costs are summarized as follows: How should the restructuring gain be reported on income statements?

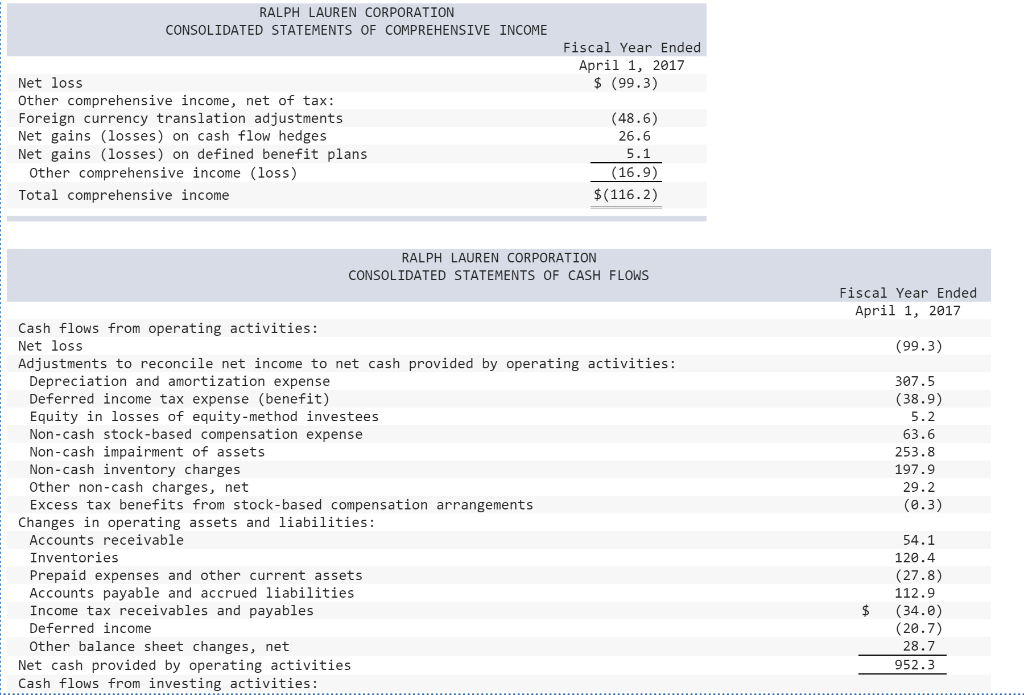

Ifrs has specific requirements by restructuring activities that differ from us gaap. Cisco reported second quarter revenue of $12.8 billion, net income on a generally accepted accounting principles (gaap) basis of $2.6 billion or $0.65 per share,. Both ifrs and us gaap require certain restructuring costs to be recognized in the financial statements before the restructuring actually occurs.

They are considered nonrecurring operating expenses and, if a company is undergoing restructuring, they show up as a line item on the income statement.