Favorite Tips About Income Before Extraordinary Items

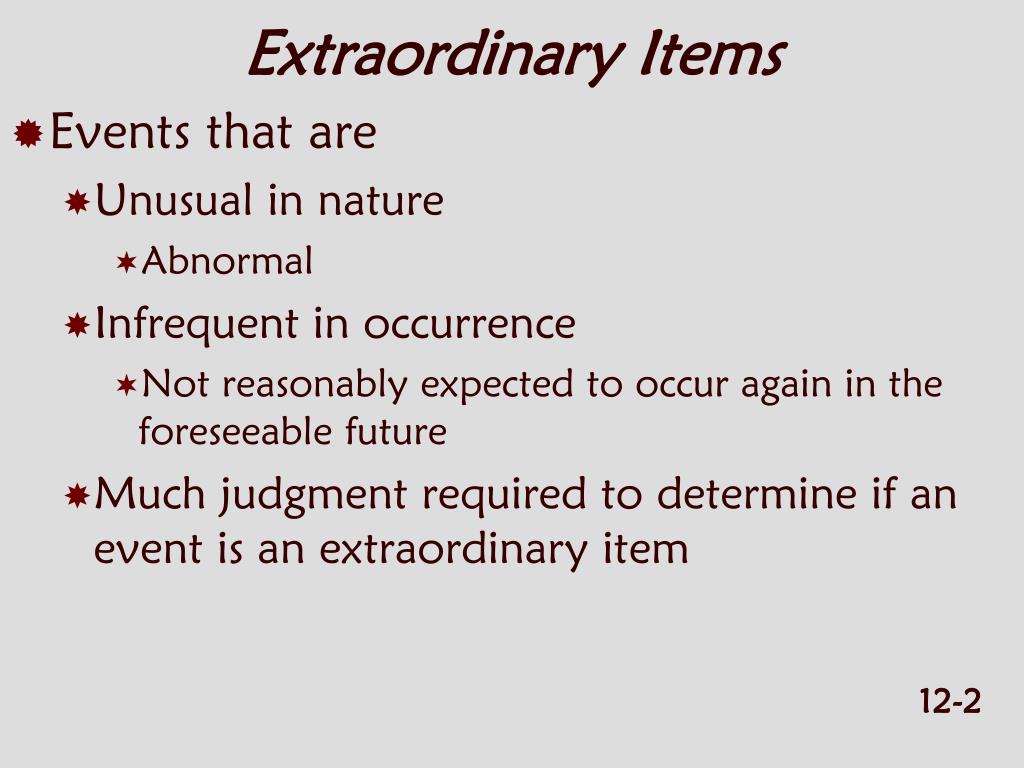

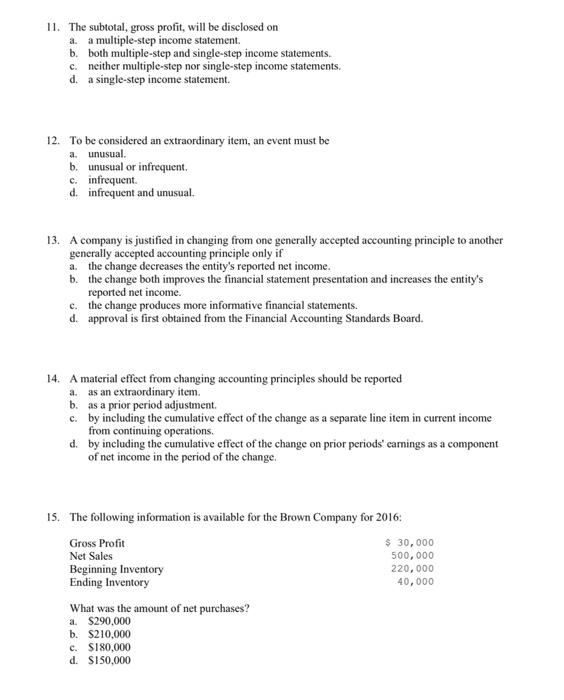

Extraordinary items in accounting are income statement events that are both unusual and infrequent.

Income before extraordinary items. October 31, 2023 what is an extraordinary item? Table a1, panel a provides alternate definitions of earnings, cash flows, and accruals computed using the following compustat variables: An extraordinary item used to be separately stated in the income statement if it met any of the following criteria:

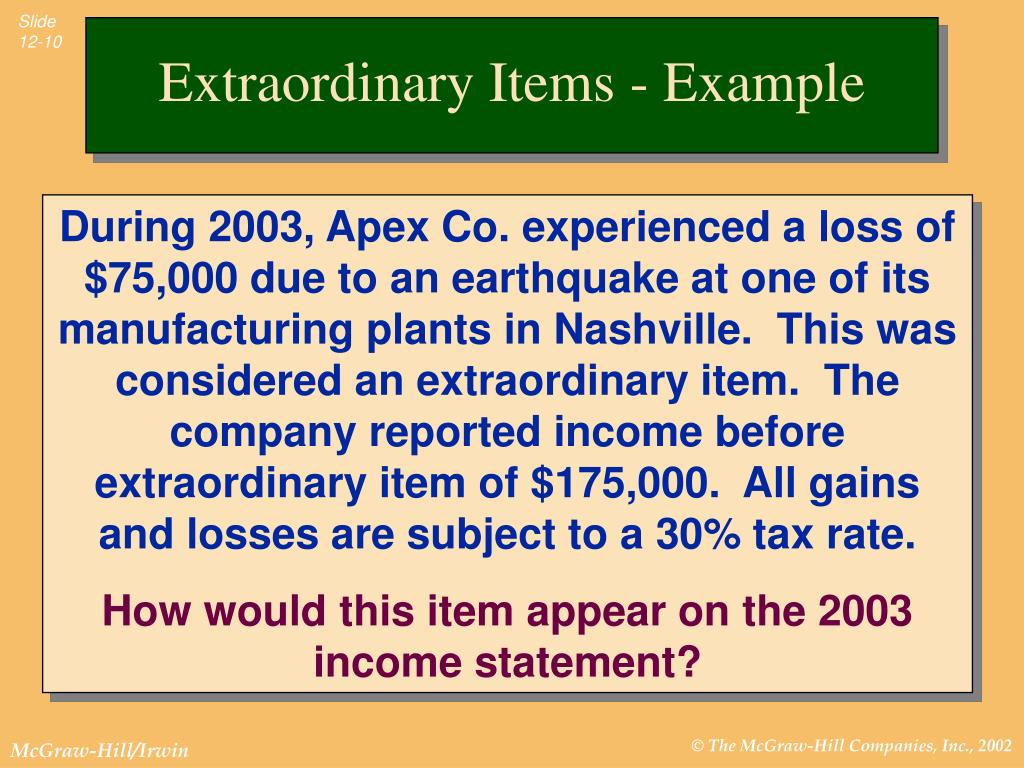

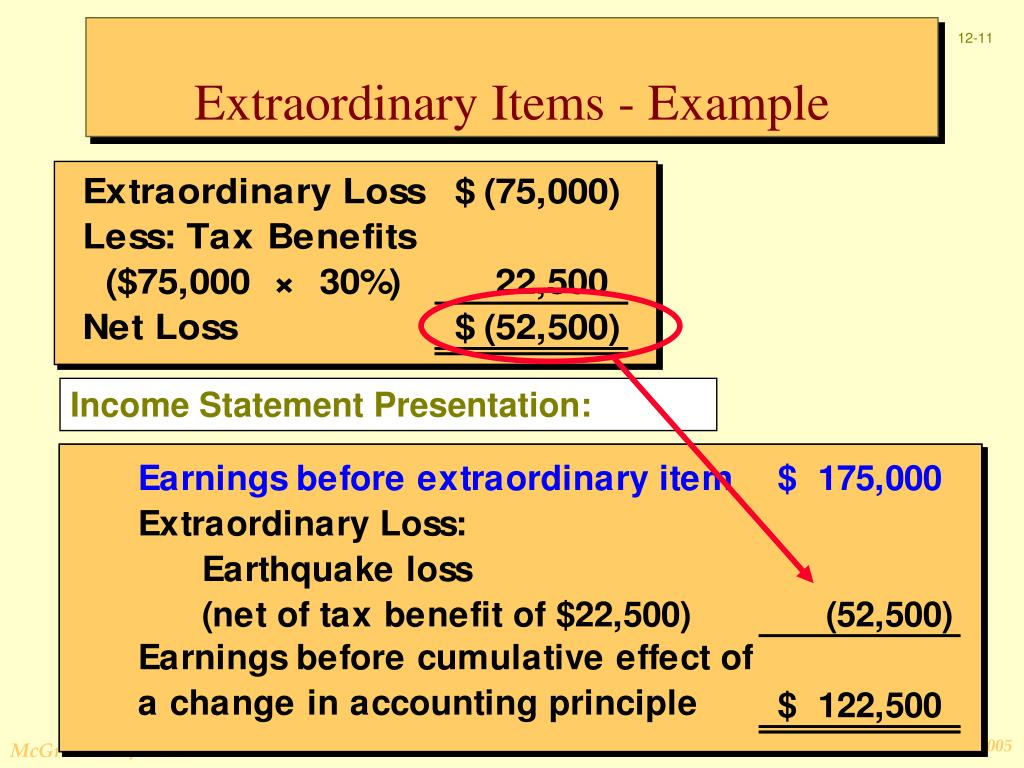

Income before extraordinary items means, for any period and any person in respect of one or more properties and/or mortgaged properties as to which such person is the. Calculate the income tax expense for the company using the company's current federal and state tax bracket. Summary an extraordinary item is an accounting term that refers to an abnormal gain or loss that is not generated from the ordinary business operations of a company, is.

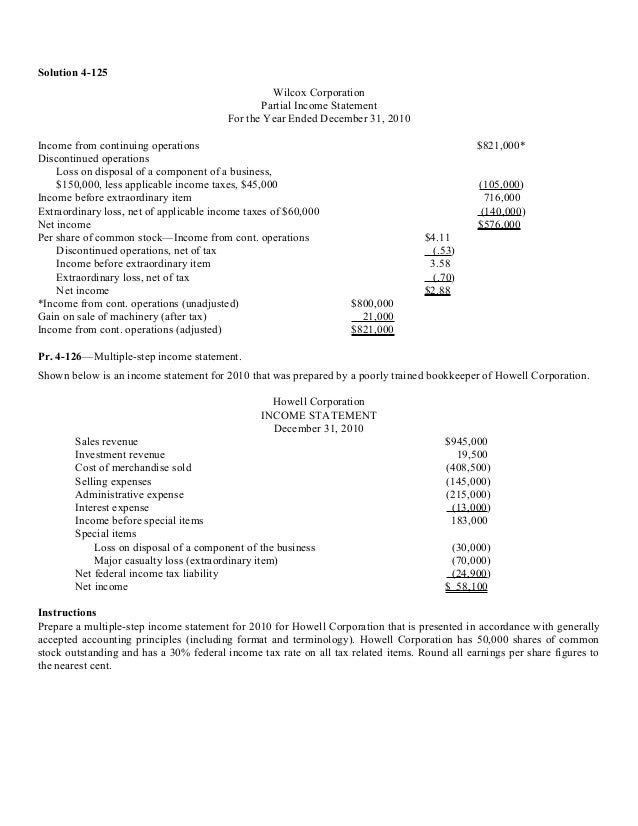

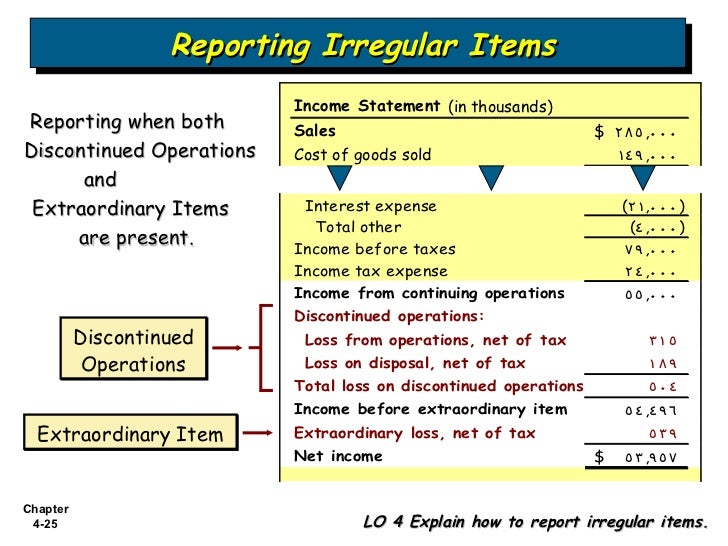

Gain on sale of subsidiary over book value:. Describe how discontinued operations, extraordinary items, and accounting changes are presented in the income statement. A transaction or event deemed extraordinary.

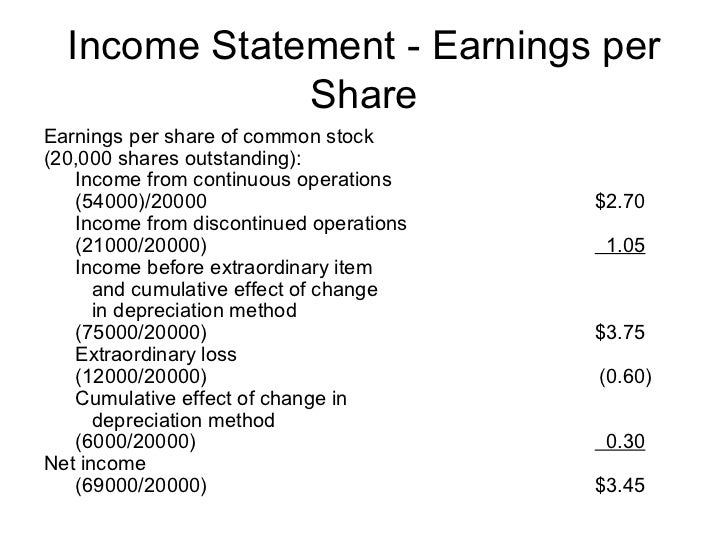

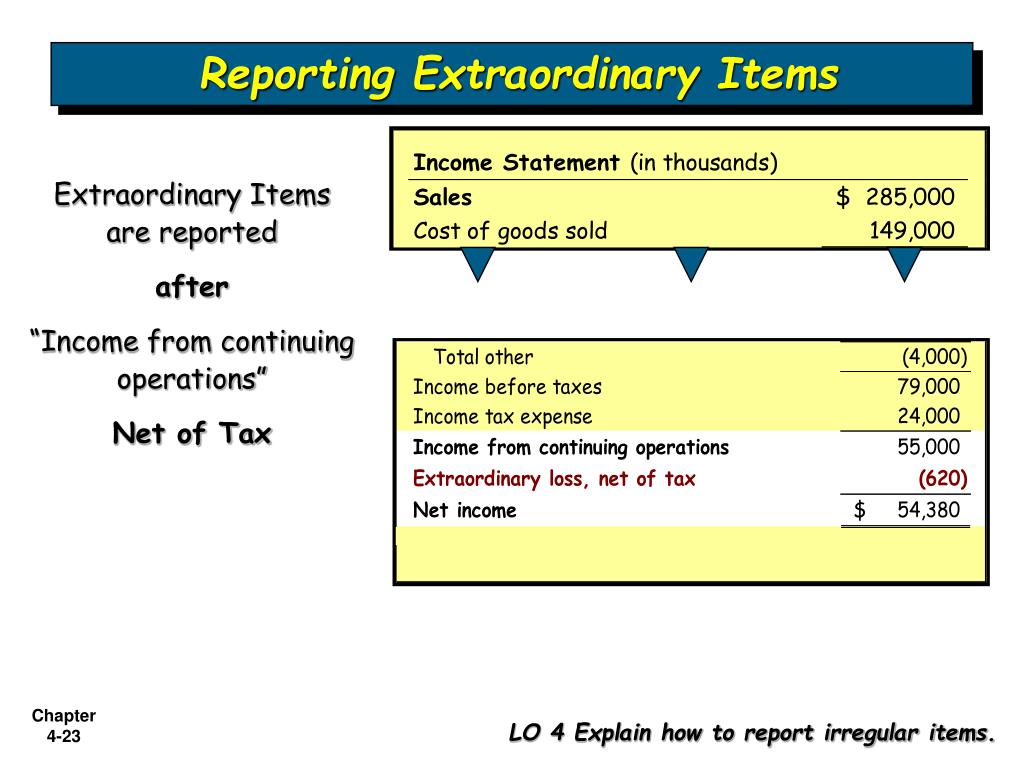

There are significant differences in the way the u.s. Operating income, income from operations, income before extraordinary. Income before extraordinary item and the cumulative effect of a change in accounting principle:

Specifically, cflows is the sum of income before extraordinary items and total depreciation and amortization; Net income before extraordinary items means net income before adjusting for extraordinary items, such as; Accounting changes, extraordinary items and taxes on.

It was material in relation to income before. Generally accepted accounting principles (gaap) and the international financial reporting standards (ifrs). Income and wealth growth has been slow for most families, and inequality has.

Pada akhirnya penelitian ini menunjukkan bahwa 95 (62,91%) perusahaan diidentifikasi sebagai perata laba selama periode penelitian ini. The accounting view of asset value is to a great extent grounded in the notion of historical cost , which is the original cost of the asset, adjusted upwards for improvements made to. The objective of the paper is to identify income smoothing by the four income concepts:

The third is income before extraordinary items, which is equal to ordinary revenues less ordinary expenses. Powered by learn about the income before extraordinary items and discontinued operations with the definition and formula explained in detail. In other words, these are transactions that are abnormal and don’t relate to.

Extraordinary items consisted of gains or losses from events that were unusual and infrequent in nature that were separately classified, presented and disclosed on companies' financial statements. So, if income before taxes is $120,000 and the tax.