Awe-Inspiring Examples Of Tips About Unrealized Gain On Balance Sheet

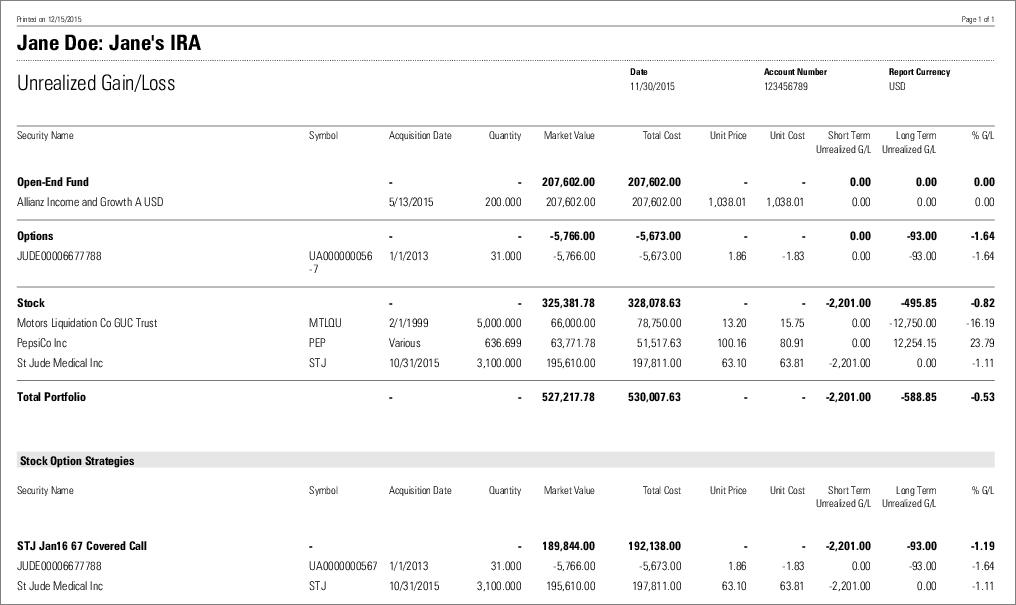

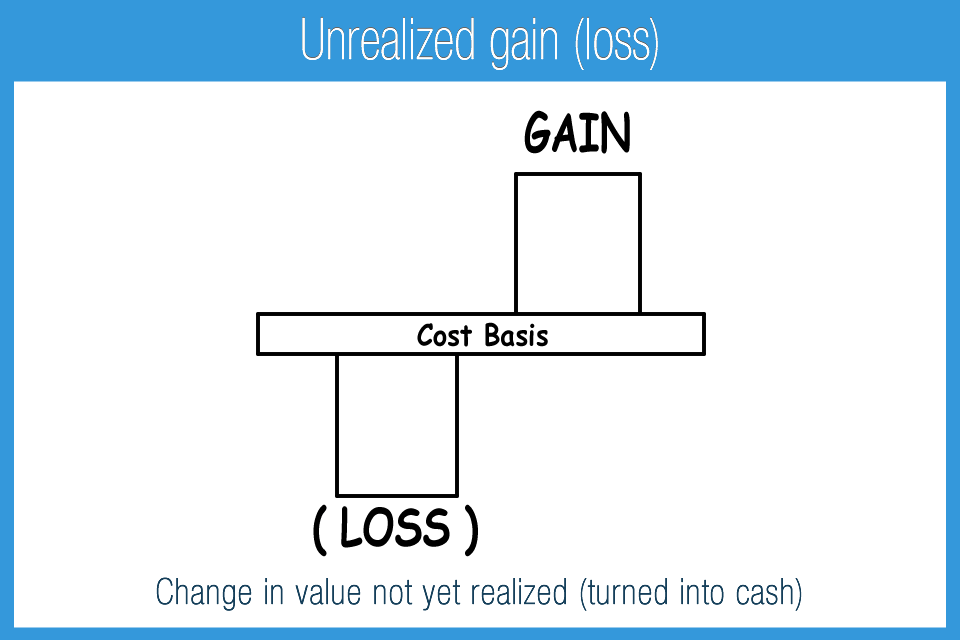

Unrealized gains/losses aren’t “locked in.” this means that if you’re holding onto assets with unrealized losses, it’s possible for them to become unrealized gains.

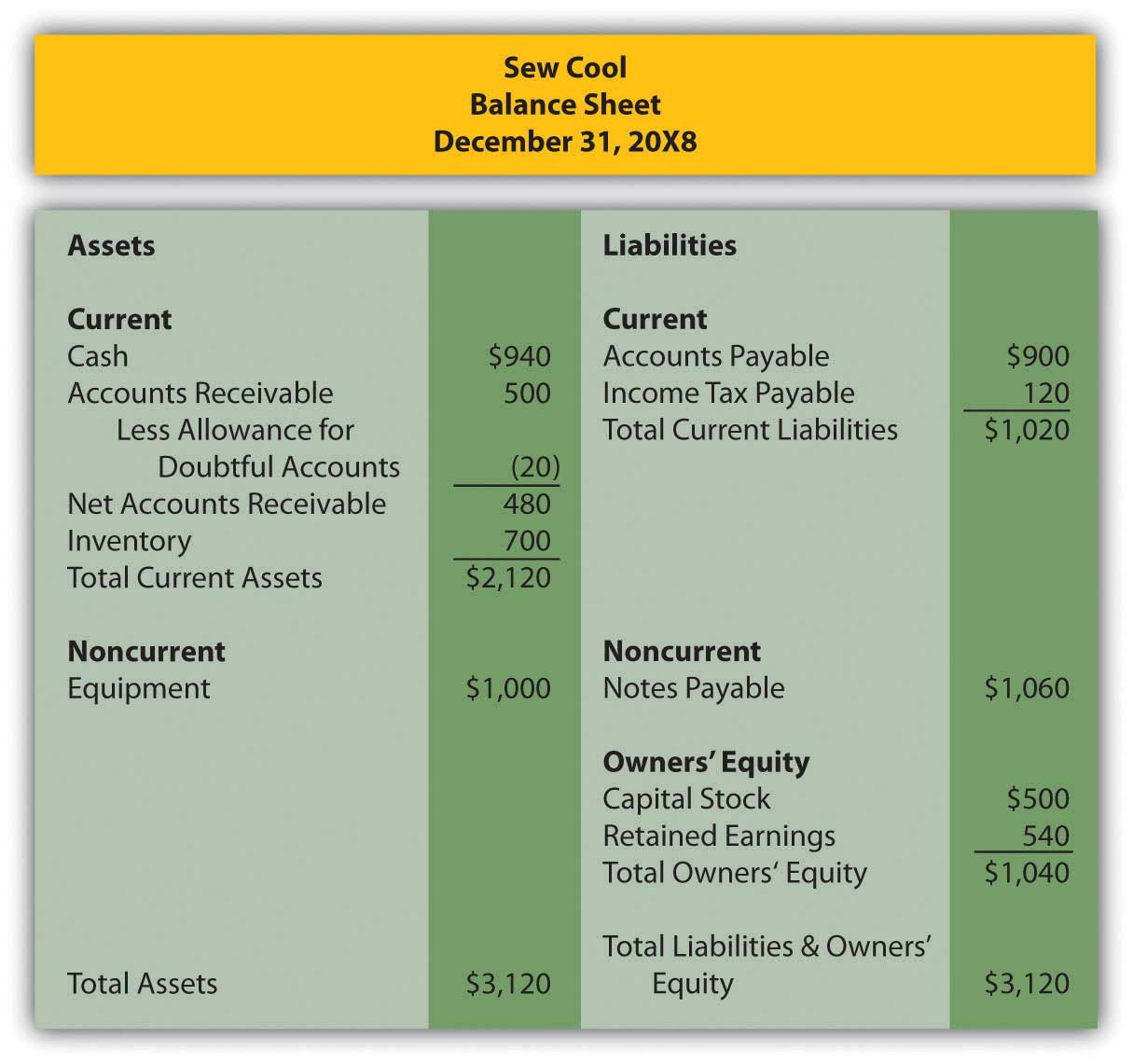

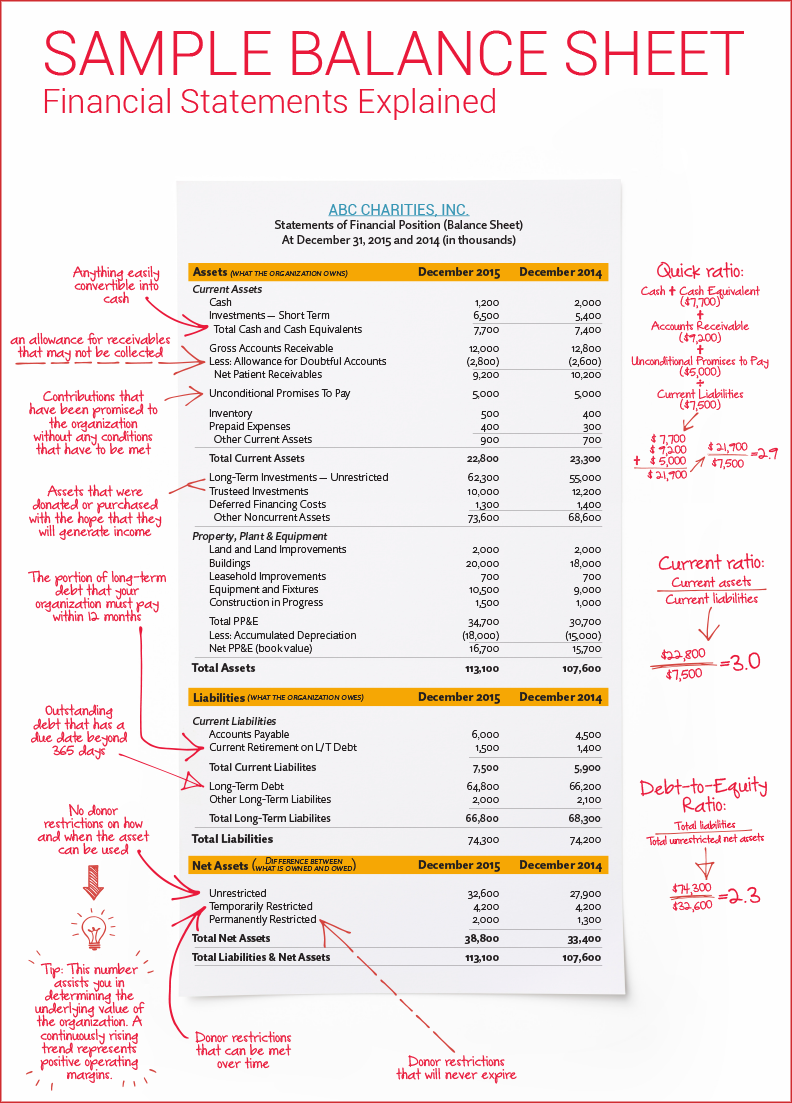

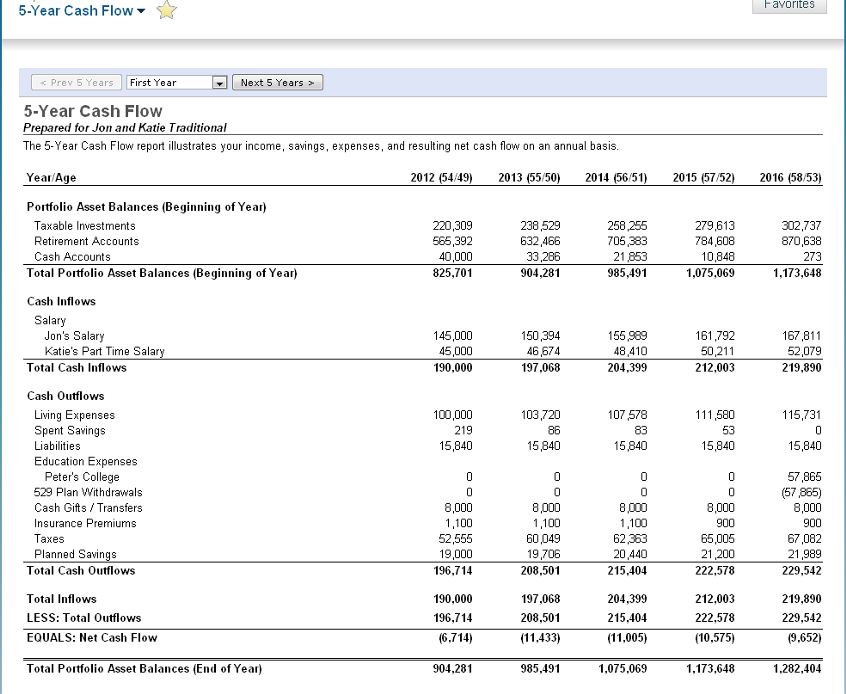

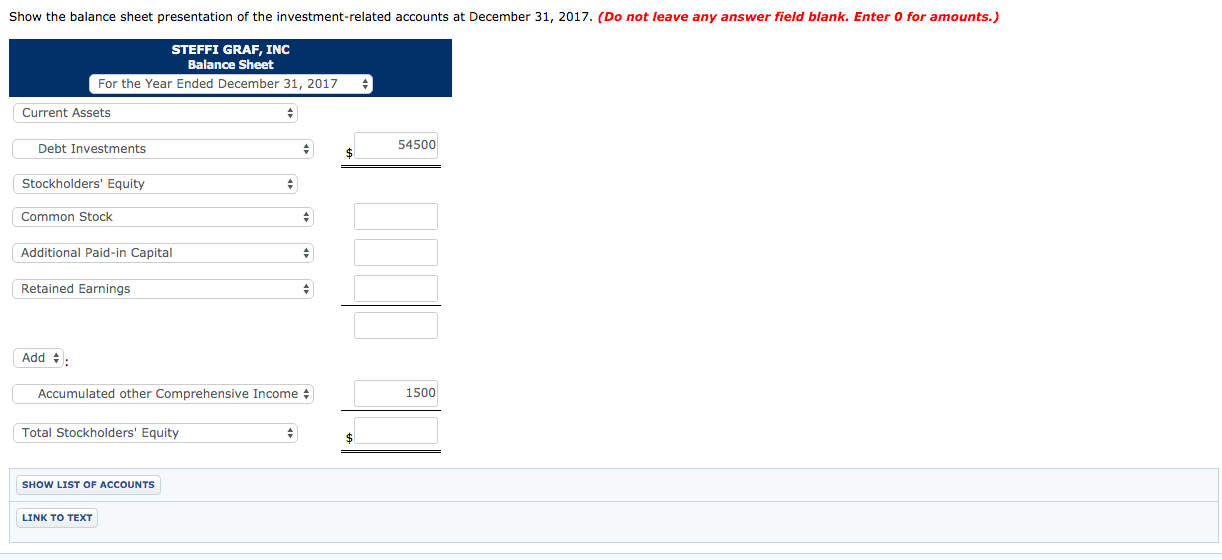

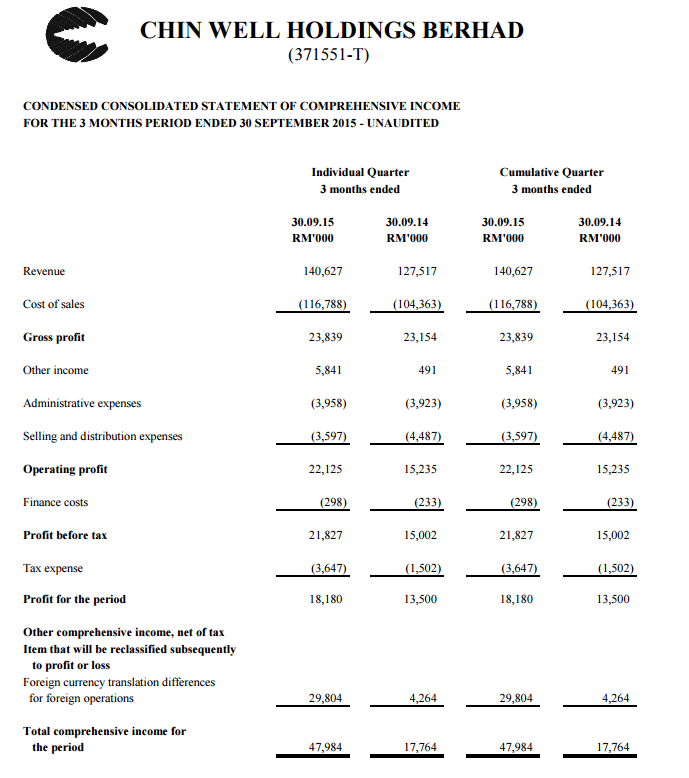

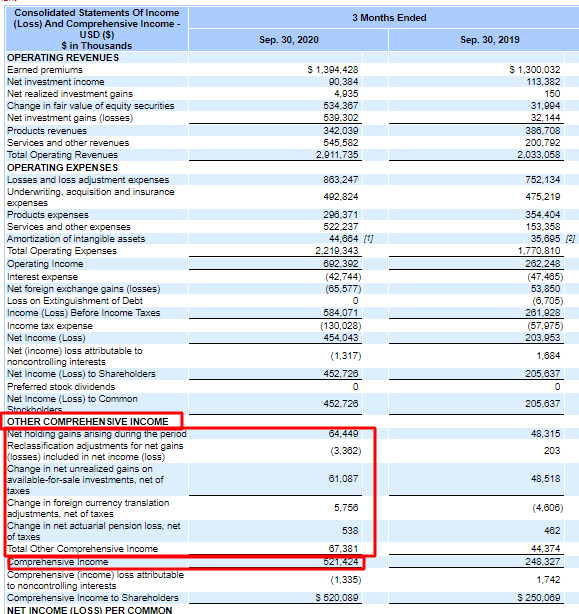

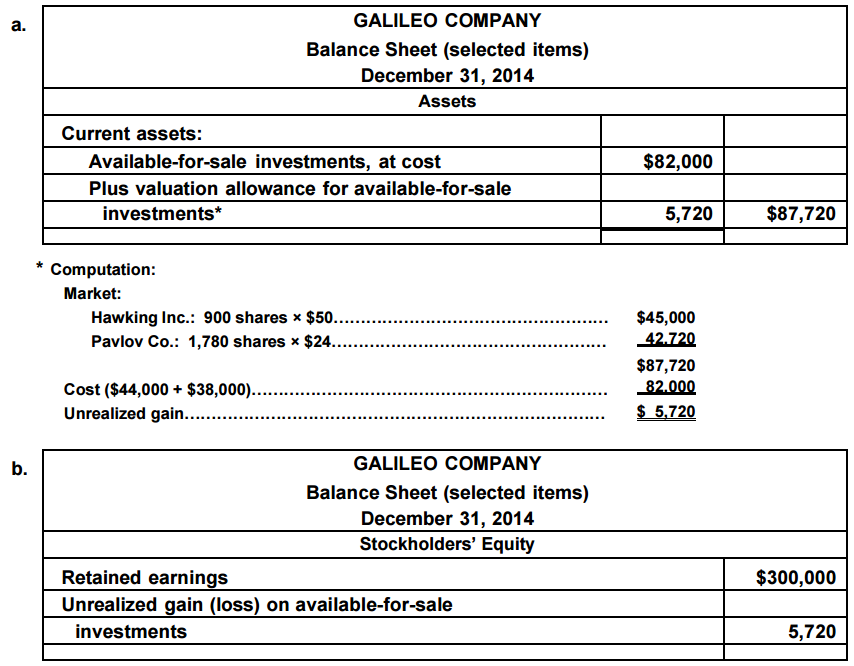

Unrealized gain on balance sheet. It is, in essence, a paper profit. when an. Unrealized income or losses are recorded in an account called accumulated other comprehensive income, which is found in the owner’s equity section of the balance. The unrealized gains and losses are.

If the market price is higher than the. In this video on unrealized gains (losses), here we discuss practical examples along with type of securities that result in unrealized gains or losses and we. Realized gains result in a taxable event, but unrealized gains are typically.

Realized and unrealized foreign exchange gain/loss. Once they are sold the gain or. An unrealized gain is an increase in the value of an asset that has not been sold.

Recording unrealized gains and losses. Unrealized gains refer to potential increase in value of unsold assets, and taxes on such gains are only payable upon sale. November 20, 2023 what is an unrealized gain?

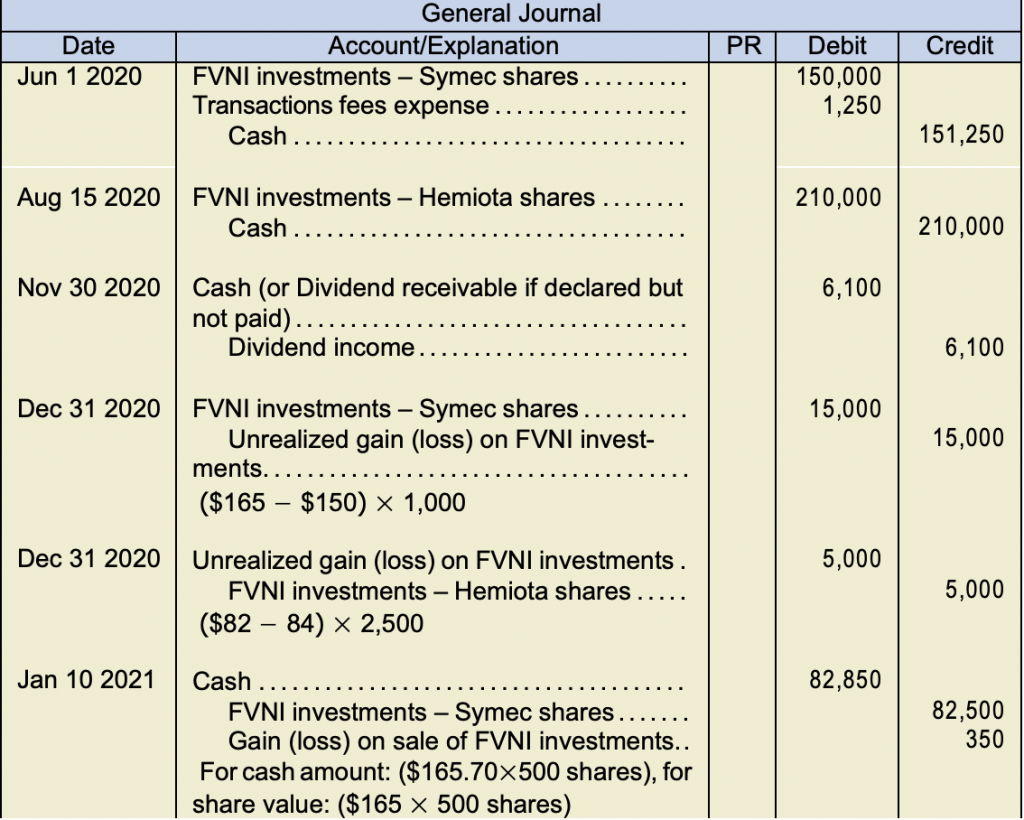

Transaction costs are defined as all costs directly attributable to the completed transaction. Unrealized gain or loss may occur when a subsidiary transfers an item to a related party, such as the parent or another subsidiary. There are other forms of unrealized income, but they are not labeled unrealized income on the balance sheet.

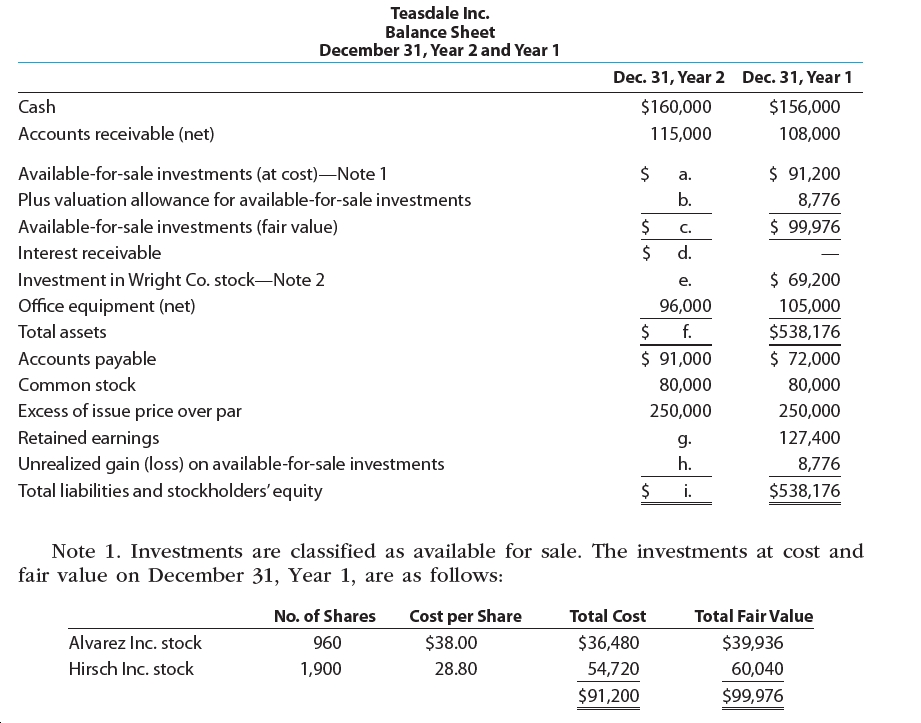

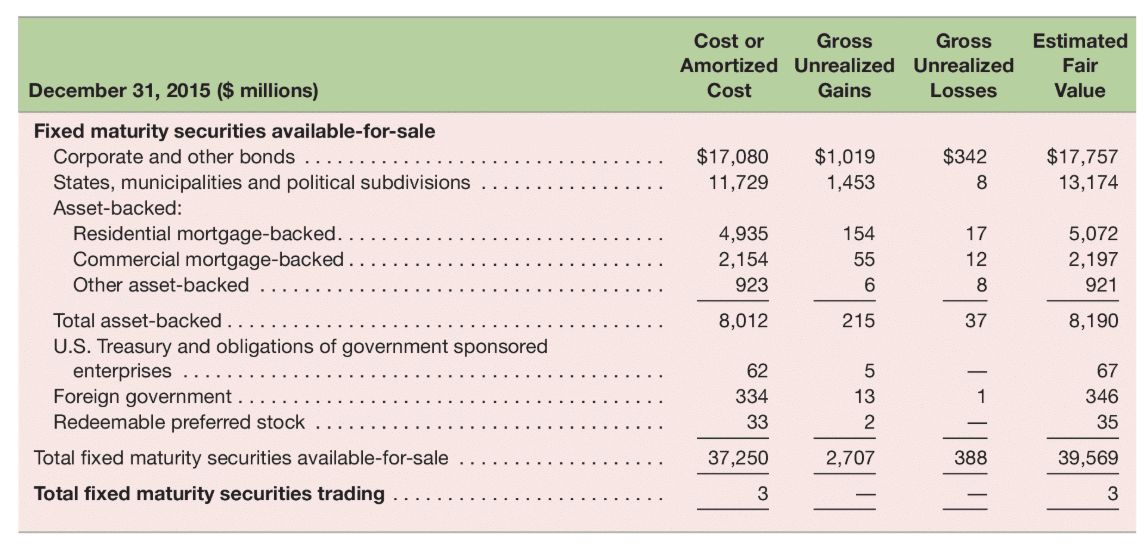

Cidrolin level 2 posted march 30, 2019 08:57 am last updated march 30, 2019 8:57 am how do i set up an equity account to track unrealized gains/losses on. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market. The accounting treatment depends on whether the securities are classified into three types, which are given below.

A central bank’s guide to international financial reporting standards / 116. Realized gain/loss includes transaction costs, which are expensed as incurred. An unrealized (paper) gain, on the other hand, is one that has not been realized yet.

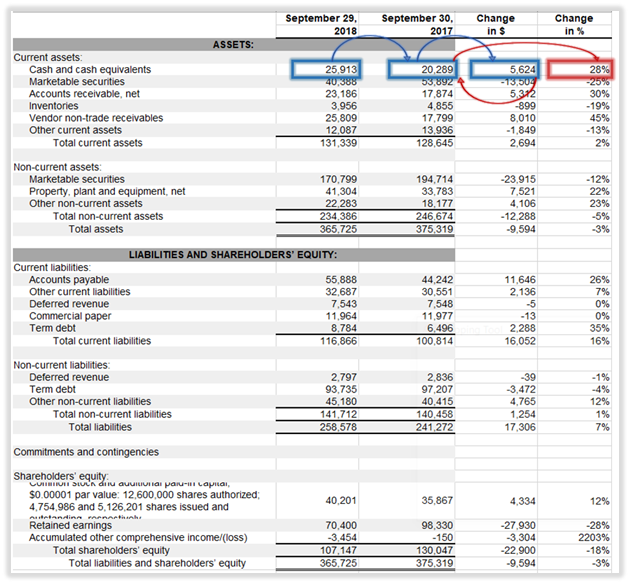

Realized and unrealized gains or losses from foreign currency transactions differ depending on whether or not the. Unrealized income or losses are recorded in an account called accumulated other comprehensive income, which is found in the owner’s equity section of the balance. Since the shares have not yet been sold, you now would have an unrealized gain of $8 per share.

You are free to use this image o your.